SELL S8s

Low Volatility Peaks When the DJI Is Not at

ALL-Time High

(C) 2/29/2012 www.tigersoft.com

LOW VOLATILITY SELL SIGNAL - Sell "S8"

Sell S8s are based on unusually low volatility

after a 3-month rally of more than 10%

by the

DJIA, provided that index is not in

all-time high territory where the path of least

resistance

is often up. The rate of daily change in closing

prices must have stayed under

its 10-day

ma for 6 straight days. This signal seems to work particularly well after

there has

been a substantial jump up from a bear market low.

There have been 12 such earlier cases when the DJI

was not in all-time high territory.

In 8 cases

the DJI fell more than 8%. There were only 2 cases

where the paper loss

was a

significant 8%.

Here are the cases since 1928 when the DJI was not

in all-time high territory.

DATE What DJI did subsequently

(Key values: last/21-dma, OBVPct., IP21

(Current AI), annualized rate of change of 21-dma)

(1) 8/30/1932 DJI moved up for

a week from 74.30 to 80

and then fell to 58 in 2 months

Key values: la/ma

= 1.098 OBVPct= .246 ip21=.01

roc=3.46

This

was on a recovery from a bear market low.

8% paper loss before a profit.

More

than 20% decline.

(2) 9/29/1932 DJI fell

from 71.50 to 59 in 2 weeks.

Key values: la/ma =.988 OBVPct=-.107

ip21=-.069 roc=.46

This

was just after a recovery from a bear market low.

More

than 15% decline.

(3) 10/31/1932 DJI fell from 61.90 to 58 in a week, rallied to 67 and then fell steadily to 50

4

months later..

Key values: la/ma

=. .97 OBVPct= -.087 ip21=-.139 roc=1.779

This

was just after a recovery from a bear market low.

8% paper loss

before a big profit.

More

than an 18% decline.

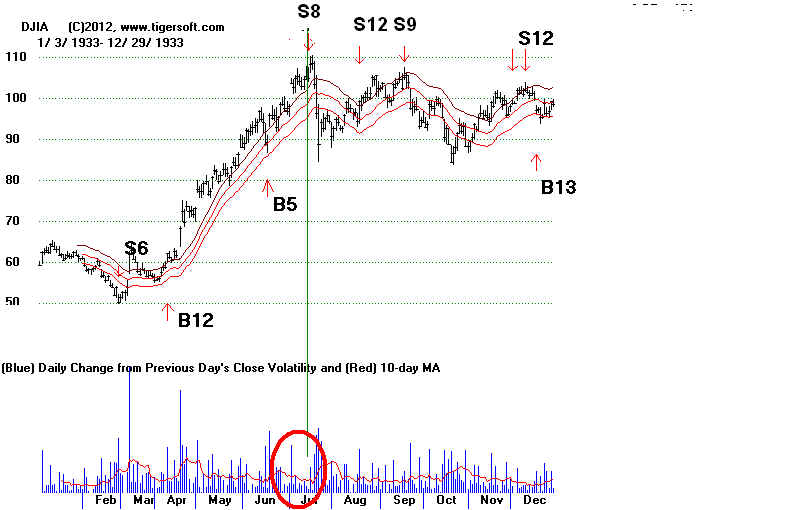

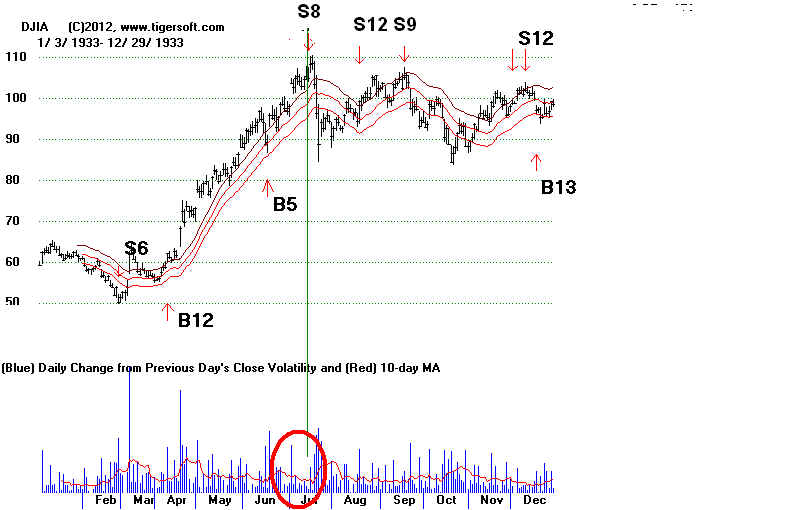

(4) 7/14/1933 DJI rose

from 105 to 109 in 3 days and then fell to 89 a week later.

(See above.)

Key values: la/ma = 1.059 OBVPct= .17 ip21=-.103

roc=1.316

This

was on a recovery from a bear market low.

4% paper loss before a profit.

More

than 15% decline.

(5) 9/17/1935 DJI fell

from 133.10 to 128 in a week and two mo later hit 148.

Key values: la/ma

= 1.027 OBVPct= .316 ip21=.04

roc=506

Only

3% profit before rally.

(6) 3/25/1936 DJI rose

from 157.90 to 162 in a week and fell, a month later hit to

143

Key values: la/ma

= 1.017 OBVPct= .221 ip21=.016

roc=.546|

3% paper loss before a profit.

More

than 8% decline.

(7) 7/31/1939 DJI

fell from 143.30 to 131 in 3 weeks and then rallied to

156 2 weeks later.

Key values: la/ma

= 1.03 OBVPct= .328 ip21 =.099

roc=1.03

This

was on a recovery from a bear market low.

More

than 8% decline.

(8) 9/27/1939 DJI

from 150 went sidewise for 7 months and then fell to 114.

Key values:

la/ma = 1.028 OBVPct= .27 ip21=.068

roc=1.479

More

than 22% decline.

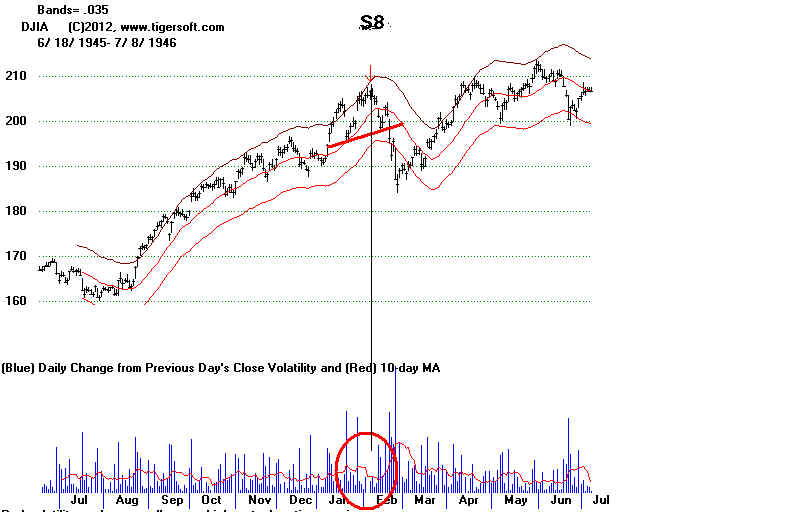

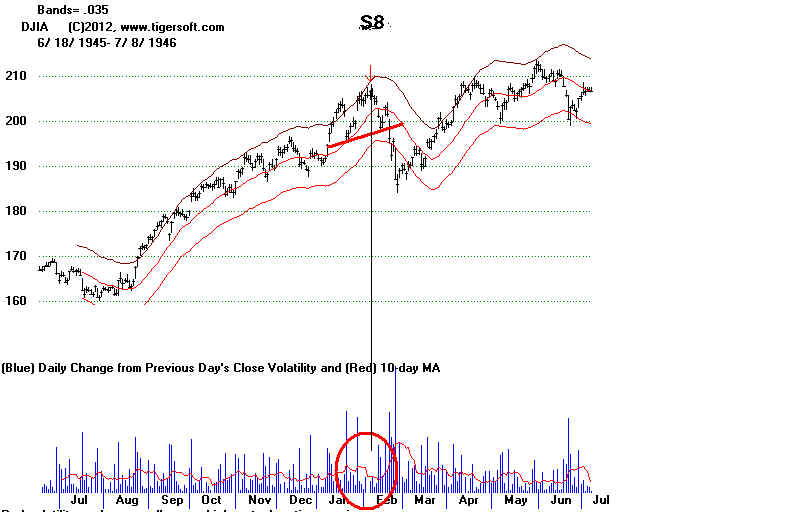

(9) 2/25/1946 DJI

fell from 206.60 to 186 in 2 weeks and 5 weeks after that.

rose to 208

Key values:

la/ma = 1.024 OBVPct= .43 ip21=.268

roc=.877

More

than 9% decline.

(10) 10/25/1950 DJI fell from 231.50 to LB at 221 in 8 trading days and two weeks later hit 236.

Key values:

la/ma = 1.011 OBVPct= .286 ip21=.049

roc=.281

More

than 5% decline.

(11) 7/1/1975 DJI fell from

877.42 to 784, 10 weeks later.

Key values:

la/ma = 1.036 OBVPct= .01 ip21=.04

roc=.434

This

marked the recovery high after the 73-74 bear market for 6 months.

More

than 9% decline.

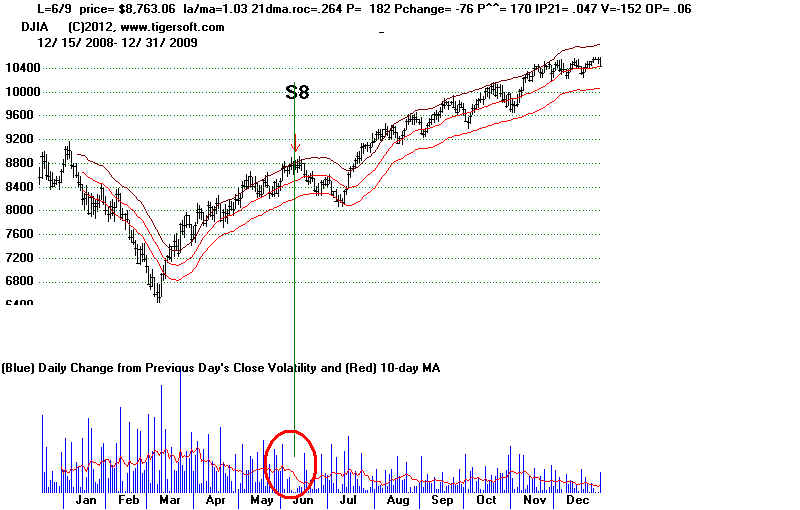

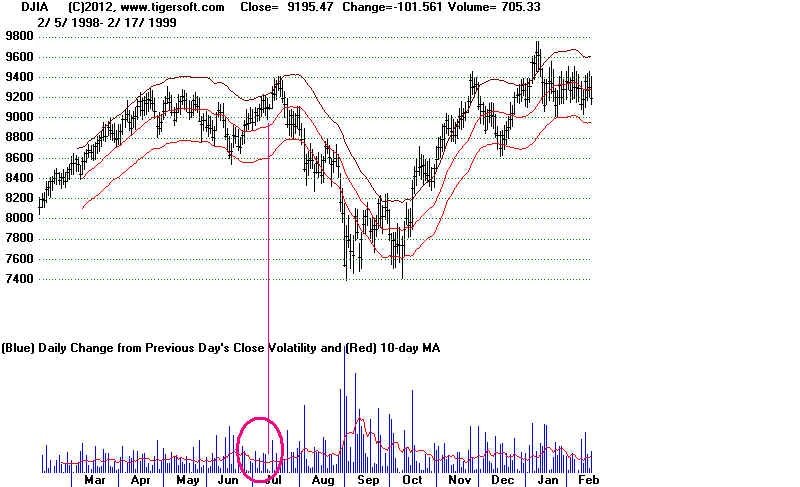

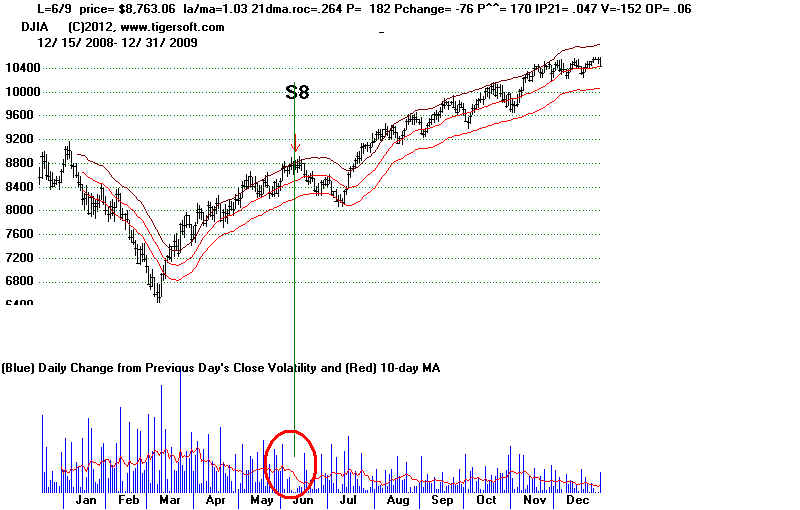

(12) 6/9/2009 No Paper Loss Gain on

Short=+5%

DJI fell from 8763.06 to 8146.52, 4 weeks later. 7% decline to lows

Key values:

la/ma = 1.03 AnnRoc=.264 P=182 IP21=.047 V=-152

OBVPct= .057

Note false head/shoulders and take-off when right shoulder exceeded.

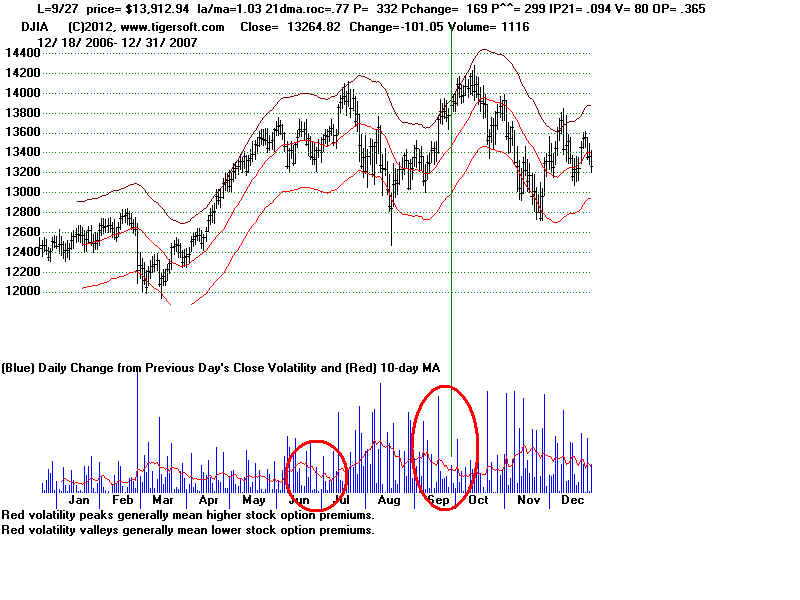

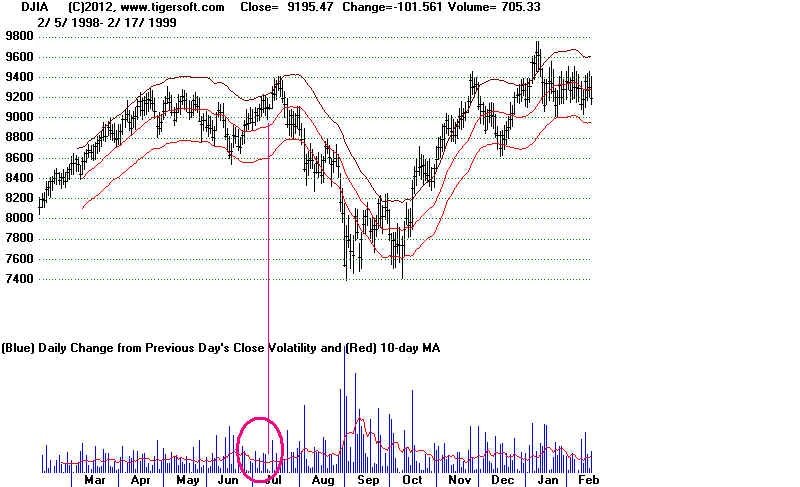

ALL TIME HIGH LOW VOLATILITY

IS

LESS RELIABLY A GOOD SHORT SALE

1996-1997

1998

1999

2003-2004

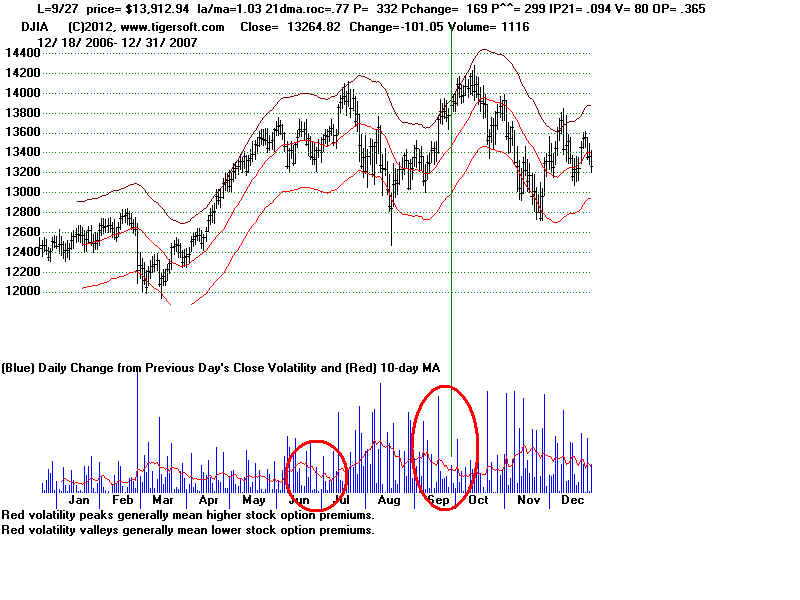

2007