TigerSoft's

Peerless Stock Market Timing 1915-2009:

+96% GAIN: April 2008 - March 2009 Trading Gain DJIA-30 ETFs (DIA and DOG)

(C) 2009 William Schmidt, Ph.D. All rights reserved.

Our Products/Services - Order Forms More Reading To Help You Beat The Pros

TigerSoft Links: See also www.tigersoft.com

Welcome Testimonials What We Offer Insider Trading Predictions Cassandra's Curse About Us

Tiger Blog Tiger's Books on Investing Automatic Buys/Sells on Stocks Explosive Super Stocks

Killer Short Sales Techniques Gold and Silver Stocks Crude Oil Calling All Tops

Longer-Term Investing Blue Chip Stocks Different Trading Applications of TigerSoft

858-273-5900 -- PO Box 9491 -- San Diego, CA 92169 william_schmidt@hotmail.com

Peerless Stock Market Timing: 1915-2009

NOW is the perfect time to start using TigerSoft and Peerless.

Is this the start of a new bull market or a bear market rally?

What signs must we see to call a new Bull Market, based on market

history since 1915?

Thanks for visiting ... Yes, there's a lot to read here. But this site may

well offer the most valuable reading you can do now as an investor.

Using Peerless can make an enormous difference to your retirement.

Correct timing the stock market makes a huge difference to profitable

investing. At the very least, seeing when to get out of the stock market

would have saved many readers a lot of anguish and dimmed retirement

hopes. See if you don't think so.... Thanks for visiting.

By studying the past, very often we can predict the future and understand

the present's potential. Examples. In 1981, I found a pattern in the stock

market's technical data that would have predicted the 1973-1974 bear market

and the 1978, 1979 and 1980 mini-market massacres. Early in October 1987,

the same pattern appeared. Sure enough, the stock market fell 34% in

three weeks. In July 2007, the same bearish pattern appeared. To disregard

this pattern seems highly unwise. As James Bond said, "Once in chance,

twice is coincidence, but thrice is enemy action." (Ian Fleming)

For more details, see: "Calling All Tops": Peerless Stock Market Timing:

Many Stock Market Tops Show The Same Technical Signature: 1929,

1937. 1957, 1959, 1973, 1978, 1979. 1980, 1987, 2000 and 2007.

Automatic Buy and Sell Signals

TigerSoft's Peerless Software produces red arrowed Buy and Sell signals.

They have numbers like "B5" (Buy) and "S9" (Sell) so that you can look

up the technical conditions that generated the Buy or Sell and see its

track record in our on-Line Help Section. When I say "technical" I mean

that the Buys and Sells are generated based on the market's own statistics,

not news or earnings. The DJIA's opening, high, low, close, NYSE advances,

NYSE declines, NYSE Advancing Stocks' volume and NYSE Declining

Stocks's daily volume are the only information the Peerless system uses.

We have derived from this data, a number of original indicators of internal

strength (insider and professional buying) and internal weakness

(insider and professional selling.) We have a series of rules for each signal.

The signals' trading results of each rule since 1928, and sometimes 1915,

have been closely studied. When the market, for example, falls 10% over

the following 3 months on average in, say, 15 cases, we look closely

at the rules for the potential Sell signal. If we can then see a solid

rationale for the re-occurring pattern of behavior following the occurence

of conditions meeting the rule, we make it a Buy or Sell. Come to our

San Diego User group meeting or call us - 858-273-5900, and we will

give you some examples of valid Peerless rules that we use.

New to the stock market?

San Diego Tiger Users meet once a month. Join us. Upon purchase,

we walk you through the installation of our Windows-based software

and give you personalized instruction on using the programs. It takes

about 30 minutes to get operational. We provide all the data you need,

though you can use our Ascii converter if you already have a data feed.

Most important is good stock market timing. Look at the track record

of Peerless Stock Market Timing below.

|

TigerSoft's Peerless Stock Market Timing Software Back-Tested To 1915 Signal Date DJI Gain ------ ----- -------- ---- BUY 4/21/2005 10219 13.2% SELL 5/5/2006 11578 4.9% BUY 6/15/2006 11015 1.2% SELL 6/30/2006 11150 3.1% BUY 7/18/2006 10799 14.8% SELL 1/5/2007 12398 2.3% BUY 3/2/2007 12007 14.4% SELL 7/17/2007 13971 3.3% BUY 8/7/2007 13504 1.9% SELL 9/24/2007 13759 3.9% BUY 11/14/2007 13223 3.0% SELL 12/6/2007 13619 12.6% BEARISH BUY 3/7/2008 11900 5.5% SELL 3/24/2007 12549 13.0% BUY 9/15/2008 10918 0.9% SELL 9/22/2008 11016 16.0% BUY 10/8/2008 9258 0.1% SELL 10/14/2008 9311 2.6% BUY 10/28/2008 9065 0.8% SELL 11/5/2008 9139 12.0% BUY 11/21/2008 8046 1.3% SELL 1/29/2009 8149 Cover 3/9/2009 6547 19.7% BUY 3/10/2009 6926 12.3% as of 3/27/2009 7776 |

TigerSoft's Hotline answers the

most important questions you can ask now. 1. Should we buy, sell or sell short? 2. Are we in a Depression and will the stock market keep falling like it did in 1930, 1931 and 1932? 3. What is the key seasonality factor about to hit the market? 4. What is the safest hedging approach to use right now? 5. What is the single best short-seling technique to use in cave-in markets? 6. What would have been the very best way to have safely recognized all tradeable bottoms in the 1930s. 7. How can one distinguish bear market rallies from the next bull market's start? 8. Is Gold a satisfactory hedge? 9. What steps can the Obama Administration take to turn the stock market up? 10. How you can save a lot of money even if you are unemployed? Order Here - TigerSoft Buys/Sells/Insider Trading Detection Peerless Stock Market Timing (1915-2009) Nightly On-Line Hotline 200 Page Books Killer Short Selling Profits in Any Market: Using Tiger's Accumulation Index To Spot Insider Selling. Tiger-Power-Ranker Everything! $995 One year of all services, data, updates, Hotlines books. Peerless, TigerSoft and Power-Ranker software. |

Downside Volatility Can Be Profitably Tamed.

Use Peerless Stock Market Timing: 1915-2009

Who Let The Dogs Out?

For good or bad, the Bush Securities Exchange Commission permitted a

great

expansion in the number of trading vehicles that can be used to sell short

major

market indexes in a retirement account. Just before the Crash began,

in

June 2007, the Bush SEC also allowed short selling on down-ticks. These

changes have badly served most holders of stocks and Main Street and I have written

many

Blogs and Hotlines comdemning them. See my Blog -

7/18/2008

Wall Street's Dirty Little Secret. It Owns The SEC.

The SEC's Hand

in the 2007-2008 Bear Market

2007-2009 Big Losses, unless You Used

Peerless Stock Market Timing

These SEC changes have added greatly to the stock market's downward volatility.

Because Peerless predicted the declines, the extra volatility has actually helped

TigerSoft's Peerless traders make considerable profits in the extreme weakness

since mid-2007 Folks following Peerless and our Hotline have completely

avoided

the Bear Market because of the real-time Peerless major Sells. Others who did not

heed or did not know of our Peerless Sells on the general market are mostly down

50% or more. As you will see, I tried to warn anyone who visited my site.

I wrote Peerless in 1981 to avoid

exactly what has just happened. It is now

back-tested to 1915. I watch the stock market very closely every day and write

a

nightly on-line Hotline. The few hundred dollars a year I charge for it has saved my

customers millions and millions. As a trained political economist

with years of experience

writing about politics and economics from a populist's perspective, I wanted desperately

to

warn everyday people of the economic dangers I saw lying ahead. Put yourself

in my

position, How would you get the word out? How would you now? I wrote

and I

wrote about the troubles I foresaw. See My

Predictions

June

24, 2007 - The

1929 Crash: Could It Happen Again? Yes- Absolutely.

June

17, 2007 - June 23, 2007 Peerless gave major Sells to our people.

Major Peerless Sells in 2007 Warn of Coming Bear Market

Blogs - July 25, 2007 The Curse of Cassandra:

With Peerless You Will See The Future,

but Your Friends Will Not Believe You.

- August 5, 2007 Don't Be A Deer in The Head

Lights. Timely!

- November 22, 2007 World Bull Market Is

Ending

- November 27, 2007 Chinese Stocks Show As

Much Insider Selling as The DJI Did in 1929!

- May 1, 2008 Overpaid CEOs Are

Destroying Their Companies,

- June 4,

2008 Far

from Over, The Credit Crunch Is Worsening.

- July 16, 2008 Investing in A

Perfect Financial Storm

- September 21, 2008 Wall Street Is

Dangerously Out of Control.

- October 28, 2008 The Biggest US

Stock Market Declines: 1915-2008

For years, I have explained to investors

that "long-term investing" carries enormous

risks. Most people in the stock market with portfolios now down 50% see how

right I was. But Wall Street had for years trained most people to "Buy and

Hold".

So, resistance was hard to overcome. People tend to "freeze with anxiety".

I wrote Don't Be A Deer in The Head

Lights right after the top in 2007. It was

timely!

But only 30 or 40 people bought my software in the Summer of 2007. Will it be

any different now, as we look for a bottom?

Here's how we

advise using Peerless.

Use a reversing Peerless Sell Signal on

the DJI-30 chart to decide when

the market is going to decline. When that happens, buy DOG even in a Retirement

Account to effectively go short the DJIA-30. Oppositely, when there is a

reversing

Peerless Buy signal, buy DIA, the ETF that matches the DJIA. Most everything

moves up and down with the DJIA-30.

Other

hedging vehicles of the major market indices can also be used:

DOG

Short 1.0 x Dow Jones Industrial

Average

DXD ultra

short 2 .0 x DJIA On a 1% market decline, this ETF will be up around 2.0%.

SH Short S&P 500

ProShares (AMEX:

SDS UltraShort 2.5 X S&P 500 ProShares .

PSQ Short NASDAQ-100 ProShares

QID UltraSort 2.0 X

NASDAQ-100 ProShares.

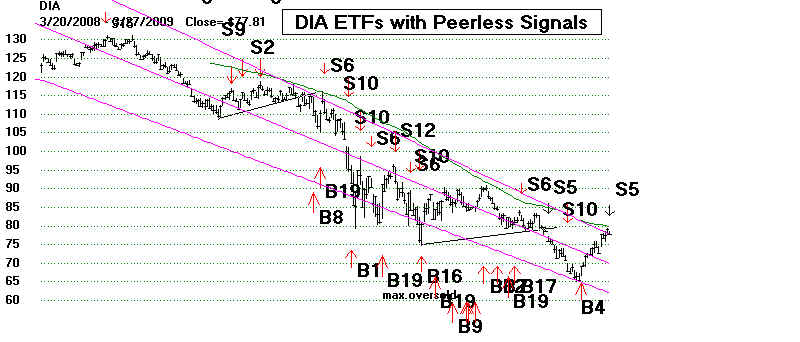

April 2008 - March 2009 Trading Gain on DIA

+96%

Using

Peerless'es Buys and Sells on the DJIA-30 would have gained a trader 113%

applied to

the DIA from April 2008 to March 2009. Here are the trades.

Our

software shows what would have happened starting with $10,000 and taking

each trade

for the last 12 months. Here we assume that each trade has a slippage

(commissions and differences between bid and ask) of $40 with each trade and that

the trades

are taken at the close the day of the signal. Had the trades been taken

at the next

day's opening, as is more likely, the gains would have been +96%. It

should be

noted that our Hotline actually improved on some of these trades, such

as covering

the short sale on DIA on 3/9/2009 at 6547.06, well below the next day's

Buy signal

at 6926.49.

5/1/2008 Sell

Short DIA @ 129.96 using $10,000

9/15/2008 Cover Short DIA and buy DIA @109.8 using account's new

value of $11,551.25

9/22/2008 Sell DIA and Sell Short DIA @ 110.5 using account's new

value of $11624.89

10/8/2008 Cover Short DIA and buy DIA @91.4 using account's new

value of $13634.26

10/14/2008 Sell DIA and Sell Short DIA @ 93.67 using account's new value of

$13972.89

10/28/2008 Cover Short DIA and buy DIA @91.14 using account's new value of

$14350.28

11/5/2008 Sell DIA and Sell Short DIA @ 91.85 using account's new

value of $14462.07

11/21/2008 Cover Short DIA and buy DIA @80.54 using account's new value of

$16242.87

1/29/2009 Sell DIA and Sell Short DIA @ 81.53 using account's new

value of $16442.52

3/10/2009 Cover Short DIA and buy DIA @69.14 using account's new

value of $18941.27

3/27/2009 Sell DIA and Sell Short DIA @ 77.81 using account's new

value of $21316.46

open.....

Peerless Buys and Sells on the chart of the DIA.

Had these signals been used to trade the SPY for this period at the openings the next day,

the gain would

have been 118.52%. For the QQQQ, the gain would have been 110.45%.

The software

allows one to superimpose the Peerless signals on any other chart. When you

do this, you will

quickly see the enormous value of Peerless.

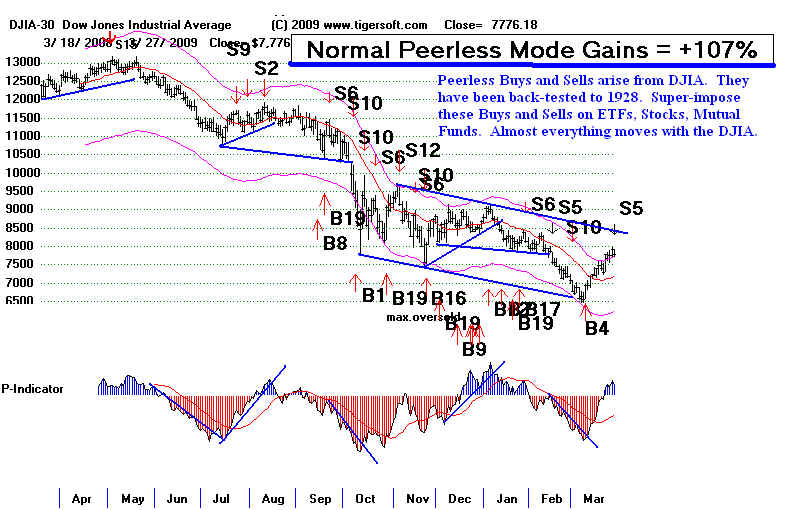

Below is the DJI chart on which the Peerless signals are based.

DJI and Peerless Signals: 2008-2009

More information? Call Us -

858-273-5900

Trade Like A Pro. Then

Profits Are Easy.

Some Basics:

"Tips" Are Unreliable.

"Buy and Hold" Is Proven Deadly..

Greed and Fear Bring Trouble. Be Objective.

Be Self-Reliant....Be Your Own Guru... Use TigerSoft Charts.

Perfection is not possible...Take small losses to avoid bigger ones...

Use The Best Trading Software.

Peerless has been back-tested carefully to 1915.

Always Inspect TigerSoft Charts for Insider Trading.

Buy What Insiders and Professionals Are Buying

Sell What Insiders and Professionals Are Selling Short.

Look for Historical Parallels. Learn from Market History.

It's easy...We can show you how in 30 minutes on your computer.

1. TigerSoft Automatic Buy

and Sells

And much more. All developed by us over

a 28 year period, since 1981. $295 or $49/mo

2. TigerSoft Insights into Key

Insider Trading $298

Use TigerSoft's Unique Tools To Spot Insider Trading

"Accumulation Index" and "Closing Power".

Don't trade without these tools.

Insider Buying

Insider

Selling.

"TigerSoft's

Closing Power is a game-changer"

3. Peerless Stock Market

Timing: 1915-2009 $398

4. Read our TigerBlog and Nightly Hotline ($298/yr).

5. Nightly Data and

Stock Trading Tutorials for TigerSoft

Data Users. $150/year

6. TigerSoft Books:

Explosive Super Stocks

Killer Short Sales in Any Market

Tiger's Tahiti Strategy for

Investing in DJI Blue Chips: 1970-2007

More about How We Can Help You:

Tiger Software's

#1 PEERLESS STOCK MARKET TIMING and TIGERSOFT. $495.00

<<<

Automatic Buy and Sell Signals:

Full History of All Reversing Buys and Sells since 1965

43 year Track Record .... 28+% per year!

43 year Track Record .... 28+% per year!

PEERLESS Provides Investors an Average Gain of

28+% per Year

on the DJIA. This is perfect for overall-market timing,

trading mutual funds,

index options and futures.

FACT: "Successful Stock Market

Timing Accounts

for 70% of A Typical Investor's Profits."

Our

Peerless Stocks Market Timing Has been back-tested as far as 1965.

Originally written in 1981, and tested with the Dow Jones Industrial Avg.,

it

has certainly stood the time. Look at the typical annual returns:

Avg.Annual Returns from Peerless Stock Market Timing and TigerSoft

25%-36%

per Year: DJIA

SP-500

NASDAQ

QQQQ

75%,

100+% per Year: Using Options Safer Blue Chips.

FACT: The SP-500 has not had a 10% correction

since January 2003.

This is the longest such period without a correction since 1965.

A correction is Over-Due. The market is now especially vulnerable!

FACT: Study after study shows that

historically most stock market profits

are

made between October lows and the end of April.

Want to read more about Peerless?

See Full Track Record?

Market Timers, See

also TigerSmart nearly 30%/year NASDAQ/QQQQ

Market Timing below.

Learn to compare current market conditions with those in the past.

For example, does the market right now bear the same characteristics of

other Summer

periods before a decline, or before a rally. History does repeat in the stock

market...

SIMPLE BUYING AND HOLDING

IS GETTING RISKIER and RISKIER!

The DJIA has now gone a record 50

months without a 10% correction.

It would be wise to get our Peerless Stock Market Timing to know

when the next correction is about to start. "The higher the diving board,

the bigger the splash!".

The long bull market from 1982 to 2000 is now a part of market history.

Market History shows long bull markets are often followed by 13-17

years of volatile trading markets. The year 2000 saw the

top in a long bull market that started in August 1982.

Despite the strength seen in 2007, as investors enjoy the world-wide bull market,

in the US we will probably see volatile swings up and down, for many years,

without a sustained run to multiple years' new highs.

Below, look at how well investors were alerted to the impending

Crash of 1987.

This was done real-time. The Peerless

Stock Market Timing system had been

written six years earlier. Hundreds of investors got out at the top

because

of Peerless. at the time! We teach you how to see these tops coming.

Learn from the past! Don't let the next "BIG ONE" hurt you.

Get Peerless!

Market Timing is Everything.

If you buy at a significant market bottom, you will almost

certainly make money. But if you buy near a major market

top, you will almost certainly lose a lot of money. The importance

of market timing is now the subject of a new book, by our

long-time friend David Rogers:

The 90% Solution,

(John Wiley & Sons, 2006.)

The long bull market from 1982 to 2000 is gone.

Market History for the 20th century shows long bull markets

are followed by 13-17 years of volatile trading markets. The year

2000 saw the top in a long bull market that started in August 1982.

We may well see volatile swings up and down, as

repeatedly occurred between 1966 and 1982 when war,

inflation, higher and higher interest rates and heightened

partisanship, including impeachment reigned supreme....

Review by William Schmidt of Tiger Software

So, don't just buy and hold, hoping for the best!

===> Here's our Special Offer in honor of the

May 10th, 2006 - Perfect Real-Time Major Sell

What are you waiting for? Pick up the phone

order Peerless today. 858-273-5900. We'll give

all the details needed to start trading these signals

right away.

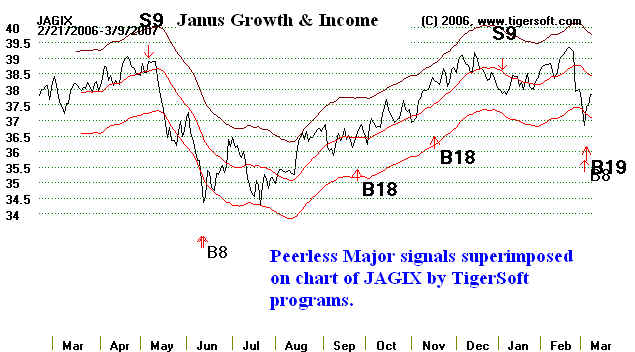

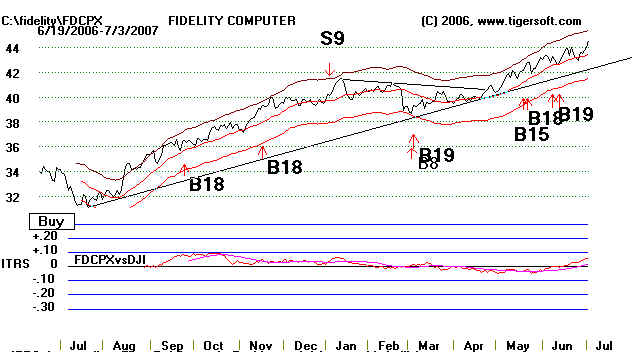

Peerless-Tiger Soft combine to give very profitable signals

on mutual funds like those of Janus and Fidelity funds...

More information.

Recent chart of Janus Fund:

Here is the recent chart of

Here is the recent chart of Fidelity's FDCPX - Computer

Select Fund.

..........................................................................................................................................................................

PEERLESS STOCK MARKET TIMING

BUY & SELL SIGNALS

Detailed Track Record

Peerless Gained +28.5% per year from 1965-2007 on DJI-30

LEARN WHEN TO INVEST & WHEN TO WAIT!

BUYING AND SIMPLY BLINDLY HOLDING IS RISKY AND RESULTS

IN DEMONSTRATABLY INFERIOR RESULTS!

Nearly everything goes up when the DJI-30 rises.

And nearly everything falls sharply when the DJI-30 plunges.

So, Peerless will help you no matter what you trade.

Nearly All Stocks

DIAMONDS - DJI-30 Equivalent.

Spiders (SPY)

NASDAQ-100 (QQQQ)

RYDEX Nova and Ursa Funds

Fidelity Select Funds.

Non-ETFs and Overseas Stocks.

Index Options

Index Futures

Use the major reversing Peerless Buys and Sells from charts the DJI-30 and

the NASDAQ. They have been back-tested to 1915. The results here have been

carefully computed for the 42-year period 1965-2007.

Peerless has been bringing big profits to its users since 1981. Its core concepts

and initial signals have remain unchanged. Over the years since 1981, a few more

major Buys and Sells have been added, but only after careful back-testing.

There have been 67 times since 1965 when a long position was taken and 66

occasions when a Peerless user should have gone short the DJI-30 or its equivalent.

RESULTS YOU CAN BACK-TEST YOURSELF

We provide you all the back-data to 1965, so you can readily back-test

and better understand the dependability and power of Peerless.

The Automatic major Buy and Sell Signals for Peerless have averaged

a yearly gain of more than 28% on the DJI since 1965. They give a big boost to

the performance to nearly all portfolios, because of how inter-twined and

inter-dependent global markets now are. The reversing major Peerless

signals are powerful and last long enough to affect nearly all markets.

Which Sectors benefir most from Peerless Stock Market Timing?

Peerless improved the profits of those holding Fidelity Select funds by 11.6% per year

from 2000-2004 . Especially fine results are seen in Technology, Consumer Services,

Cyclical and Banking for the entire period 1987-2005. Anyone owning stocks in these

areas would have been aided enormously by employing the Peerless automatic

Buy and Sell signals.

Make 28.4% per Year on DJI-30 if you are willing to Sell Short

Make nearly 20%/year Buying the DJI-30 and Selling only

Using Peerless would have turned $100 in 1965 into $89,600 in 2007

.This is the equivalent of 17.5 %/year.

By comparison, buying and holding the DJI-30 from 1965 to 2007

would have only increased the value of the original $100 investment to $1437.

61 of the 67 trades (91.0%) would have been profitable.

On average 1.6 trades per year.

Avg. Trade's Gain = +11.2%

The Peerless gains of simply buying and selling on the reversing major Peerless signals

are understated, in that no consideration is given the interest received while in cash.

This would probably have increased the average annual return by more than 2.5%,

making the average annual return 20%. It is assumed that dividends received cancel

out commissions..

83% of the reversing major Peerless Sells brought a decline to at least the

lower band in our charts. And that was in a market environment that rose

from 1000 to 13500. Calling All Tops!

In 50% of the cases of a Peerless major Sell, the DJIA went well below

the lower band and down anywhere from 8% to 33%.

What Value Do You Place on Peace of Mind?

Know when the stock market is safe and know when it is dangerous.

We have spent 25 years researching market history. It repeats and repeats.

Don't resign yourself to a cruel financial fate. You do not have to suffer bear

markets. Sell when Peerless tells you to and use the time until the next Buy

to relax and to prepare for the next Buy signal. You peace of mind and

confidence will soar, along wth your investments.

With Peerless You Can Afford To Be More Aggressive.

Keep in mind the returns below are for conservative Dow Jones Industrial

Average. Because of the added safety our Peerless system offers, you may

well want to be more aggressive.

"Calling

All Tops "

19 Reversing Major PEERLESS SELLS

brought Dow Declines of 6.2% to 34.1%, 1965-2005

Date of Major Reversing Sell

Next Subsequent Reversal to BUY

------------------------------------------------------

-------------------------------------------------------------------------------

1/6/1966 Peerless Major Sell

"S12" 7

months later after 21.3% decline in DJI

9/14/1967 Peerless Major Sell "S12"

4 months later after 6.2%

decline in DJI

1/7/1969 Peerless Major Sell

"S10" 16 months

later after 28.4% decline in DJI

8/17/1971 Peerless Major Sell "S9"

3 months

later after 7.6% decline in DJI

1/3/1973 Peerless Major Sell

"S9"

8

months later after 9.9% decline in DJI

10/26/1973

Peerless Major Sell "S9"

4 months later after 16.1% decline in DJI

4/19/1974 Peerless Major Sell

"S9"

6 months later after 29.8% decline in DJI

5/25/1977 Peerless Major Sell "S10"

7 months later

after 10.7% decline in DJI

10/10/1978 Peerless Major Sell

"S12" 1 month later after

7.2% decline in DJI

9/21/1979 Peerless Major Sell "S9"

2 months

later after 9.7% decline in DJI

1/16/1980 Peerless Major Sell "S12"

2 months later

after 10.1% decline in DJI

2/26/1981 Peerless Major Sell "S12"

7 months later

after 12.9% decline in DJI

Real Time Signals: Peerless Users Saw These

Signals at The Time.

10/1/1987 Peerless Major Sell

"S9"

3 weeks later after 34.1% decline in DJI

1/3/1990 Peerless Major Sell "S9"

3 weeks later after 8.9% decline in DJI

7/13/1990 Peerless Major Sell "S9"

3 months

later after 17.7% decline in DJI

10/1/1997 Peerless Major Sell "S9"

3 weeks

later after 6.5% decline in DJI

4/23/1998 Peerless Major Sell "S9"

5 months

later after 16.5% decline in DJI

1/4/1999 Peerless Major Sell "S9"

32 months

later after 10.3% decline in DJI

5/15/2002 Peerless Major Sell "S12"

3 months later after

20.0% decline in DJI

"Calling All Bottoms, too"

35 Reversing Major PEERLESS Buys

brought Dow Advances of 6.0% to 35.6%, 1965-2005

Date of Major Reversing Buy

Next Subsequent Reversal to Sell

-------------------------------------------------

-------------------------------------------------------------------------------

9/24/1965 Peerless Major

Buy "B18"

4 months later

after 6.0% advance in DJI

11/22/1966 Peerless Major Buy "B9"

4 months later

after 9.4% advance in DJI

5/19/1967 Peerless Major Buy "B9"

4

months later after 6.3% advance in DJI

1/22/1968 Peerless Major Buy "B9"

12 months later after

6.2% advance in DJI

5/27/1970 Peerless Major Buy "B19"

2 months later

after 9.1% advance in DJI

8/11/1970 Peerless Major Buy "B9"

3 months

later after 9.4% advance in DJI

12/15/1970 Peerless Major Buy

"B4" 9

months later after 9.8% advance in DJI

11/30/1971 Peerless Major Buy "B12"

5 months later after 15.4% advance

in DJI

10/7/1974 Peerless Major Buy "B19"

11 months later after 35.6%

advance in DJI

12/4/1975 Peerless Major Buy "B9"

4 months

later after 19.9% advance in DJI

2/23/1978 Peerless Major Buy "B9"

5 months

later after 11.7% advance in DJI

11/1/1978 Peerless Major Buy "B19"

10 months later after 8.0%

advance in DJI

11/21/1979 Peerless Major Buy "B9"

2 months later after 7.2%

advance in DJI

3/28/1980 Peerless Major Buy "B19"

7 months later

after 26.3% advance in DJI

Real Time Signals: Peerless

Users Saw These Signals at The Time.

8/17/1982

Peerless Major Buy "B19" 4

months later after 29.5% advance in DJI

1/24/1983 Peerless Major Buy "B9"

6 months later after

20.7% advance in DJI

1/14/1985 Peerless Major

Buy "B9" 9

months later after 20.7% advance in DJI

11/18/1985 Peerless Major Buy "B4"

3 months later after 10.6% advance

in DJI

2/10/1986 Peerless Major

Buy "B4" 4

months later after 14.6% advance in DJI

9/11/1986 Peerless Major

Buy "B17" 7 months

later after 33.3% advance in DJI

6/22/1987 Peerless Major Buy "B4"

3 months later

after 7.9% advance in DJI

10/19/1987 Peerless

Major Buy "B16" 2 months later

after 18.8% advance in DJI

11/2/1988 Peerless Major

Buy "B15" 2 months

later after 27.7% advance in DJI

1/25/1990 Peerless

Major Buy "B17" 6 months

later after 16.4% advance in DJI

9/24/1990 Peerless

Major Buy "B17" 19 months

later after 16.4% advance in DJI

12/28/1992 Peerless Major Buy "B15"

22 months later after 18.1% advance in DJI.

3/27/1995 Peerless

Major Buy "B15" 8

months later after 17.2% advance in DJI.

9/13/1996 Peerless Major Buy

"B10" 4 months later after

14.8% advance in DJI.

5/5/1997 Peerless Major Buy "B14"

4 months later after 11.1%

advance in DJI.

10/28/97 Peerless

Major Buy "B19"

3 months later after

8.1% advance in DJI.

2/10/98 Peerless

Major Buy "B4"

2 months later after 10.2% advance in DJI.

10/1/98 Peerless

Major Buy "B17"

3 months

later after 20.3% advance in DJI.

9/21/01 Peerless Major

Buy "B16"

3 months

later after 23.8% advance in DJI.

7/24/02 Peerless

Major Buy

"B19" 19

months later after 29.1% advance in DJI.

THE PEERLESS DJI/SP500 SYSTEM OF BUY AND SELL SIGNALS

CAN BE YOURS

TOMMORROW FOR ONLY $495. Order here.

(See also TigerSmart nearly 30%/year

NASDAQ/QQQQ Market Timing below, under #2)

These signals on the DJIA have been

helping investors and traders since 1981!

They have been back-tested to 1965. These signals

gained 28% in 2004.

The yearly average gain is more than 28% on the DJI, sometimes a lot more.

Reduce your risk and trade the DJI and its equivalents. Theoretically, someone

putting $500 into this system in 1965, would now have a nest egg of $3,000,000.

Superimpose these Peerless DJI signals on your SP-500

and OEX charts and

see your money grow. Peerless DJI signals are great for trading Rydex Index

funds that mirror SP-500. Someone

investing $100 into the SP-500 in 1970

would have seen their funds grow to $89,687. The system is simple and

automatic. And there were only an average of 3 trades a year. This improves

an investors'| gains by a factor of 74.6 over buying and holding.

|

You will want to superimpose the Peerless Major Buys and Sells on your stock charts. Most stocks advance when Peerless gives a Buy and most fall when it gives a Sell. Here are current signals on IBM.  |

Track Record: DJI

1965-2007 Major Signals |