Welcome. Thanks for visiting.

Tiger Software Serving investors since 1981 Main Website

Introduction

Want to be your own stock market guru? Or just make a lot more money in the stock

market and reduce the

anxieties associated with investing in stocks and mutual funds?

Of course.

But how?

First, we teach folks how to

successfully predict the stock market,

what conditions have

repeatedly signaled a major change in the stock market's

direction since 1915 and how

to spot key insider and professional buying and selling.

Think of the peace of mind. Think of how you could be more aggressive if risk

is managed. And

think of how more profits could change your life. Peerless and

Tiger Soft are the choice of

hundreds of professionals. They can help you, too.

There is just no need to be forced to endure big losses from violent stock market

declines or miss great

opportunities for investing when the market advances. We

show you how to

recognize these trend changes in the general market, weeks

and months before the

average investor is aware of any change in the market's

direction.

Getting started? No

problem. Do you have an XP compatible lap top or

home computer?

We help you personally, making sure that you are up and running

with the software and

have a good grasp of how to use the programs. With

Windows7, you

will need the Professional version to download the free XP-Emulator.

Tiger Software - Stock Market

Charts and Analysis

"This is not rocket science." says William Schmidt,

Ph.D., author of TigerSoft.

Just watch the Tiger and Peerless charts.

Use Tiger's Internal

Strength Indicators

To Monitor What Insiders and Professionals Are

Doing

1) Believe the trend shown by the TigerSoft internal strength indicators even

more than the price action of the stock or commodity you are trading.

In the chart below,

> the Blue Accumulation turns into red Distribution at the top.

> the Blue Closing Power breaks its uptrend and goes into a Decline. This

shows that Professionals have switched from being net buyers to net sellers.

> the Automatic optimized Red

down-arrow sell signal appears.

> A fixed-technical-rule Sell S29 tells you the stock has broken its 50-day ma.

At the bottom, the Tiger Accumulation Index turns positive and the

Tiger Closing Power bullishly breaks its downtrend.

TigerSoft Chart of USO in 2008

Use PEERLESS Buys and Sellsi

To Allow The Overall

Market's Likely Trend

To Reinforce The Trend

in the Stock You Are Using.

2) Use the automatic Peerless Buy and Sell signals to tell you when

the general market is going to rise or fall. In the USO chart below, the

Peerless signals are superimposed on the USO Tiger chart. See the

many Peerless sells in the Summer of 2008. All that was needed to make

USO reverse was a change by Professionals from being new buyers ot

net sellers. The Tiger CLosing Power and Accumulation index above

show these changes of trend.

PEERLESS SIGNALS Superimposed on USO Chart

In the Summer of 2008, Peerless gave multiple Sells. They amplified and

reinforced the importance in the change in trend shown by USO's internal

strength indicators of USO. USO should have been sold and sold short

above $100. A short position should have been held as long as Peerless

was on a Sell and the TigerSoft Closing Power was still

declining.

When Peerless went to a Buy and the Closing Power for USO kept falling,

the stock might just have been avoided. Half the short position might have

been held as long as the Closing Power was falling as a hedge. Our research

demonstrates such stocks most often make good short sales as long as

the CLosing Power is falling.

OUR TIGER/PEERLESS RULES

ARE SIMPLE

1) Buy when Peerless Stock Market Timing says to buy and Sell when

it says to Sell. ETFs work well. But buying the highest Tiger "Power

Ranked

stocks usually works out better. On an automatic Peerless Sell for the general

market,

Sell Short the lowest ranked stocks and take some profits in the long positions.

2) On a Tiger chart, always note the Big bulges of Insider Buying above +.375

using ehe BLUE Accumulation or RED Distribution at the

bottom of our charts.

3) Heavily weight in your consideration, too, the "vector" of the Tiger

Blue CLosing Power Line" that appears just beneath the price bars. The blue

CP measures net Professional Buying and Selling, its direction and strength,

Trade as much as possible in the same

direction that Wall Street Professionals

are taking your stock. The Blue

line beneath the price chart is our Tiger Closing Power.

Its trend should be up in a bullish stock and down in a bearish stock. New highs

made by the stock should be confirmed by the Tiger blue Closing Power also

making a new high. When the CLosing Power, instead of confirming a new high,

fails and then breaks its uptrend, consider the Professionals to have switched

to a net bearish stance. You should, too.

4) Notice the buy and sell arrows produced by

the stock's own technical

action. The Buys have up-pointed arrows and are numbered so that

you can look up their meaning in the Help section. Buy B10s, B12s, B20s

and B24s usually appear at the start of the stocks about to rise significantly.

Trade in the same direction that Wall Street Professionals are taking

with the stock. The Blue line

beneath the price chart is our Tiger Closing Power.

Its trend should be up in a bullish stock and down in a bearish stock. New highs

made by the stock should be confirmed by the Tiger blue Closing Power also

making a new high. When the CLosing Power, instead of confirming a new high,

fails and then breaks its uptrend, consider the Professionals to have switched

to a net bearish stance. You should, too.

Example: DWCH Tiger chart below.

Peerless was on a Buy for most of the first quarter of

2012.

DWCH was a strong buy on the line formation breakout shown

below.

Note the insider buying bulges of Accumulation and major

Buys,

B10, B12, B24, B20. They are all there!

Example: FSLR

Contrast the

Bullish chart above with a stock

showing

particularly high Red Distribution.

We have been writing software and

thinking about how best to predict

stock prices for a long time. It is gratifying when one of our customers

writes something nice about our labors.

Read this unsolicited

testimonial from KJ in British Columbia, Canada.

.

"There are some exciting new

tools available for various plarforms nowadays

but the prize for the best overall package still has to go to

Tigersoft. Moreover

this toolbox pulls it all together in a cohesive fashion...With Tigersoft the computer

will do the heavy lifting for you and produce a short list of candidates each night.

Then it will allow you to futher investigate each one using every standard tool and

several unique ones. On top of that. the customer support is absolutely

first class. When you call the company. you speak directly to the programer and CEO

- a man who shares our passion for trading. I have followed Bill's work for 18 years

now. His methods work in up, down and sideways markets. And he keeps making

it better. The package will be the best investment you ever made.."

TigerSoft/Peerless Features:

Simple To Use. 4 mouse-clicks place Peerless signals on chart of your stock/ETF.

Highly Profitable. Recently +57.7% gain on DJI using Automatic Peerless signals,

long/short - as of 3/16/2012

Time-Tested Automatic Buy and Sell Signals.

Recently +158% gain on HPQ and

+127% on BAC using Optimized TigerSoft signals, long/short - as of 3/16/2012

Unique Tools To Spot Key

Insider Buying and Selling.

Discover the Power of

TigerSoft's own Accumulation Index to spot Inside Buying and Selling.

TigerSoft Closing Power lets you clearly see when Professionals are buying or selling your

stock.

Nightly Hotline Shows What's Hot, How To Use All Tools.

Get the latest TigerSoft/Closing Power research.

See the track record calculated back to 1928 for each new Peerless Buy and Sell as it

occurs.

Vuew daily all the key ETF charts, signals and indicators.

Trade long the sectors and stocks being heavily bought by Insders and Professionals.

Sell short the stocks and sectors that both Insiders and Professionals are selling.

Read the real news and see how it is shaping the market's outlook and direction.

Again, here are TigerSoft's BASIC RULES

#1 Believe the automatic Peerless Buys and Sells. Their track

record is far superior to most guesses, hunches and feeling.

Buy when the general market is safe becausePeerless is on a Buy.

Take profits or Sell Short when Peerless switches to a Sell.

#2 Buy the highest TigerSoft Power Ranked stocks showing very strong

Closing Power. These are the Bullish MAXCP Stocks.

They show both Insider Accumulation and rising Closing Power Professional Buying.

Take profits or hedge by simultaneously selling short the lowest Tiger Power

Ranked stocks that alss show very weak Closing Power.

#3 Sell Short outright or hedge using the lowest Tiger Power

Ranked Stocks. These are the Bearish MINCP stocks.

They show both Insider Disribution and Falling Closing Power Professional Selling.

Hedge or sell short outright these the the lowest Tiger Power

Ranked stocks that alss show very weak Closing Power.

How Tiger's Peerless Stock Market Timing Works

Peerless is a system of automatic Buys and Sells that have been back-tested

thoroughly to 1915. Any Peerless Buy reverses amy Peerless Sell and vice verse.

Many of the signals have remained essentially the same since 1981, especially the

Buy B9 and Sell S9. Each signal has its own track record. As a purchaser of Peerless

or new Hotline user, you will get access on the internet to all our Buys' and Sells'

documentation. (A newPeerless Stock market Timing book is being worked on.).

Having the Peerless Software lets you superimpose our general market timing

signals on any chart you want. ETFs all around the world can be traded using Peerless.

So can 95% of all stocks. Commodities and precious metals are the most independent

trading vehicles. The Peerless/Tiger Software lets you back-test the Peerless signals

with any stock you like. Our Power Ranker software shows you a table of Peerless

results for any directory of stocks you are following.

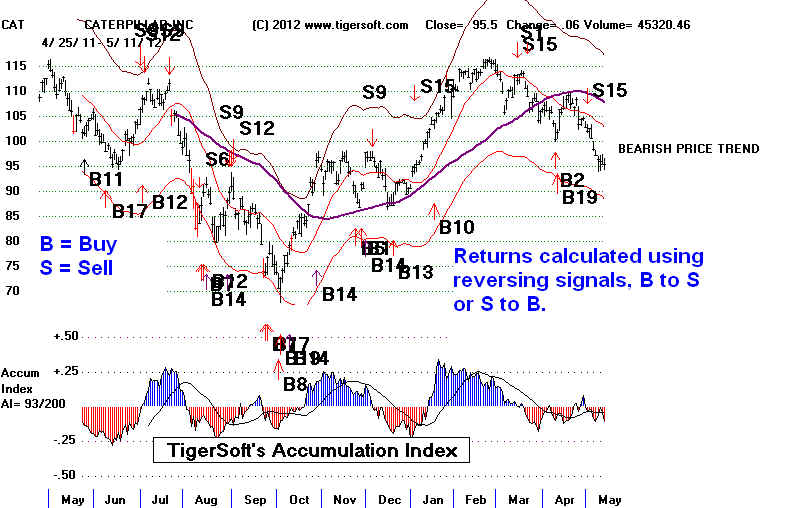

Take CAT, Caterpillar for example. Below is the current CAT chart with the

Peerless Buys and Sells superimposed on it. This stock is fairly typical of a stock

showing an average levels of Accumulation. The Tiger Accumulation Index in it here

has been positive 93 of the last 200 trading days.

CAT. Believe it or not, trading it long and also short according to the automatic

Peerless Buys and Sells at the next days' opening would have gained you

a whopping + 138%, +57% on the long side and 52% on the short side. From May 24th,

2011 until May 11th, 2012, there would have been 14 trades. $10,000 would have

become $23,974. The software shows you each trade. There would have been 11

winning trades and 3 losing trades. The biggest paper loss would have been 10.6%

on a short sale.

Had you merely held CAT for this same period, you would have lost 5.5%.

Our Software's cost is only $495. Meanwhile, you would have made $14,342 more

using our Peerless signals than just buying it and holding it..

Peerless, of course, won't always have such a good year. But its real

time record has been consistently very profitable. We have been studying the market

closely since 1981, when Peerless was first written. Revisions have only been made

when the evidence back to 1928 strongly supports a cahnge or a new signal.

Was CAT exceptional? Yes and no? We do not trade just one stock.

ETFs work well\, too. And we also \suggest buying the highest Tiger Power

Ranked stocks when Peerless gives a Buy and Selling short the weakest when it gives

a Sell. When Peerless gives a Buy Signal, we buy the stocks that show the most BLUE

Accumulation and Professional Buying. And when Peerless gives a Sell Signal,

we sell short the stocks showing the most RED Distribution and Professional Selling.

CAT shows average Accumulation

TIGER POWER RANKING

The highest Power Ranking stocks will have an AI/200 score above 150

and the lowest will have an AI/200 scrre below 50. Contrast below a high Accumulation

stocks LQDT with a very low Accumulation stock like RIMM. Going

long LQDT when Peerless gives a Buy and selling it when Peerless gives

a Sell is safe and very effective. Going short the lowest Power ranked stocks

on a Peerless Sell and covering on a Peerless Buy is recommended.

In extreme cases like this, once could simply stay hedged by being long the

high Accumulation stock (LQDT) and short the high Distribution stock (RIMM).

Our Nightly Hotline shows charts of the most bullish and bearish stocks

each night and often recommends hedging in this way.

| LQDT - Steadily High

Accumulationzz

Buying on the Peerless Buys and Taking Profits on the Peerless Sells would have gained you +81% this past year.  |

| RIMM - Steadily High

Distribution Shorting on the Peerless Sells and Covering ont he Peerless Buys would have netted a profit of 79% this past year.  |

THE TIGER POWER RANKING SHOWS

BUY SUCH STOCKS WHEN PEERLESS IS ON A "BUY".

Most importantly, we show you what insiders AND professionals are buying or selling.

Insiders are associated with the company.

They may or may not have to file insider

transactions's report. Professionals are

the market makers, hedge fund "gunslingers"

and mutual fund managers that move a stock up

or down, because they have been given

inside information and want to capitalize on

it, besed on their expectations for the general

market. They are discreet and circumspect

and the SEC hardly ever bothers them.

Profitable investing and trading is quite easy when you focus your buying

on the stocks both professionals and insiders are

buying for your long positions

and short-selling on stocks insiders and

professionals are heavily selling. Our charts

and the Tiger Power Ranker let you find these easily.

When Peerless is on a Buy, we emphasize buying. So you should buy and sell the

best stocks (and sell short and cover) the worst

stocks according to the Peerless signals.

This is simple and works well. Our website has

many examples.

The best and worst stocks very often continue their moves past the market turning

points predicted by TigerSoft. We encourage users to follow some basic rules for

Using Tiger's Closing Power and Accumulation Index, which track the buying and

selling by Wall Street Professionals and Corporate Insiders. It is easy to find the

best and worst stocks. We apply the Power Ranker to the strongest Closing Power

stocks to get the best. These are the BULLISH MAXCP stocks. The lowest Power

Ranking weakest CLosing Power stocks are the BEARISH MINCP stocks.

A simple to follow rule is to buy the most powerful (Bullish MAXCP) and highest

Power Ranked stocks when they successfully test support or their rising 65-day ma.

TOP Tiger Power Ranked Stock at end of 2009.

Background:

Tiger Software now serves several thousand active investors and traders world-wide,

in Europe, Asia, Australia, Africa, Canada and the U.S. Our first customers back in 1981

ran early versions of our market timing and stock selection software on Apple II+s.

Most are still customers. That's an important testimonial. We have hosted monthly

Tiger User-Group meetings in San Diego since 1985. And now have national meetings

once a year in Las Vegas.

Tiger Soft and Peerless Keep Getting Better

TigerSoft does not rest on what it has accomplished. We contiunue to back-test

and refine. Example: When the DJIA in 2008 fell by an amount that had not been seen

since the 1930s, we intensively studied the extreme bear markets of 1929-1932, 1937

and 1939-1942 to discover how bottoms were made in these conditions. The result was

a modification of the software in early 2009 which produced a perfect real-time Buy signal

on March 10th, 2009 with the DJIA at 6914, The previous day, our nightly on-Line Hotline

said to cover all short sales. This was at the DJIA's exact bottom.

.

So Cost-Effective:

Even a casual study of what we offer, will prove that TigerSoft and our

Peerless Stock Market Timing would probably have saved you, like most

other investors, many thousands of dollars in 2008 and made them many thousands

more in 2009.

We will make that clear below. But here are some key questions for you.

What do you now base your stock market investments on? Insider Tips,

"hunches", "Buying and Holding until you have a profit"? Emotional binges of Greed

and Fear? We hope not. We hope not. These are poor long-term substitutes for the serious,

empirical back-testing we have done for 28 years, with data now back to 1915.

It will help you a lot to become very cynical about what Wall Street says.

The fraudulent misrepresentations by Wall Street of the safety of the bundled

mortgages they sold as "AAA" are not isolated events. The bailouts they received

and the way they used this public money to pay exorbitant - no strike that, to

pay obscenely high bonuses in the millions to some individuals, should show

Wall Street is not to be trusted. Instead, you must rely on other sources of

information to guard your investments. We want to earn your trust and confidence.

This website is entended to show you how very valuable it is to use our TigerSoft

and Peerless, thereby discovering real-time what insiders and Wall Street

professionals expect of the market and particular stocks. Watch and do what they

do. Pay no attention to what they say.

If you are open to new ideas and ready to listen to some unconventional thinking,

you have come to the right place. No longer do you have to be a victim of Wall Street

stock manipulation, self-serving news reports and recommendations followed by

insider selling before the bad news comes out.

We will pleased to share with you what we learned about calling market tops

and bottoms as they occur and spotting insider buying and selling just before the

biggest moves in individual stocks or commodities. We can help you a lot.

We have helped thousands of other, too.