TigerSoft News Service 3/9/2012

Visit our www.tigersoft.com

TigerSoft News Service 3/9/2012

Visit our www.tigersoft.com

Welcome

Preview Unsolicited

Testimonials About Us Contact Us

Peerless Stock Market Timing --- TigerSoft Insider Trading Software

-- Tiger Power Ranker

Be independent. Be your own

Guru. How To Get Started for Yourself with our Software.

--------------------------------------------------------------------------------------------------------------------------------------------------------[

PEERLESS RULES

Foreign ETFs' Performance Thus Far in 2012

and

Automatic Peerless Buys and Sells Applied to

All Non-US ETFs and Overseas'

Markets, 2011-2012

"Esperanto Prize" for Profitable

non-US ETF Trading

Like Esperanto, Peerless is an easy-to-learn

and easy-to-use artificial international language

that transcends political boundaries.

Esperanto , it was hoped, would grow in use and

thereby foster peace and better

international understanding. The rise of the

Common Market in Europe may be seen as a

movement in this direction, though

central banks now have an excessive

influence on government economic policies

there, Meanwhile, Peerless excels

at making traders profits internationally. We show

the results by country funds below for

2011-2012. Click on some of the country links

below and discover how profitable has

been the whole period since 1996. .

Australia United Kingdom Mexico

India

China

France

Germany Russia Brazil

South America

Peerless - A New Universal Language of

Profitable Stock Trading:

How is that Peerless has become so

profitable with non-US ETFS, when it was originally

designed for trading the DJI-30 and

the stock market generally?

The best answer I know of is that the Advent of non-US ETFs traded on the NYSE

in 1995 have made it easier and easier

for big money from Wall Street to flow in and

out of the most important non US markets

and companies. NYSE specialists now may

dominate and control prices for these

ETFs and thereby their underlying stocks

and the entire country markets they

represent. This is because of how easily big money

can now be moved quickly in and out fo

these smaller markets. This has created a condition

in which all the world's stock markets move up and down in tandem, not independenly.

Local news and the thinness of the

underlying stocks does make their Volatility

vary greatly,

The leverage of the NYSE specialists and

their banking affiliates has grown enormously.

To raise new money, Wall Street must now

be listened to and abided by.

As a populist, I can decry the loss

of Sovereignty to each ccountry's people, but

the truth remains that investors

using Peerless must see this as a big opportunity.

We can now trade foreign ETFs in their

relatively virgin markets more safely and

also make a lot more money than

trading US ETFs (Exchanged Traded Funds),

such as for the DJIA-30 (DIA),

SP-500 (SPY), NASDAQ-100 (QQQ) and Russell-2000 (IWM).

See the Blogs I wrote last year

about which countries' ETFs have performed best with

Peerless, thus moving in synch with

the DJI. .

http://tigersoftware.com/TigerBlogs/April-28-2011/index.html

April 27, 2011 Automatic Peerless

Trading of Latin American, Brazilian and Mexican Stocks

Using ETFs

Mexico - $1000

becomes $99,947 in 15 yrs.

Brazil - $1000 becomes $47,094 in 10

years.

Latin America $1000 becomes $25,042 in 9 years

PEERLESS RULES

The

results is that the Peerless Rules which dates back to 1981, that

produce automatic Buys and Sells

andhave been carefully back-tested

to 1915 on the DJI-30, now work

wonderfully with nearly every countries'

stock market and their ETFs which

are traded on the NYSE. This

becomes clearer and clearer, each

new year. The 2011-2012 Peerless/TigerSoft charts

make this very clear. Click

on any of the country links below and on tigersoft.com

to learn more. I would also

suggest that Peerless Rules most of the biggest

companies that the non-US ETFs

invest in. TigerSoft is building a special DATA

download that includes the ADRs

(American Depository Receipts) for all the biggest

stocks positions held by the the

non-US ETFs. Yahoo makes it easy to discover

the biggest positions of each ETF.

See Germany's ETF (EWG) for

example here.

|

|

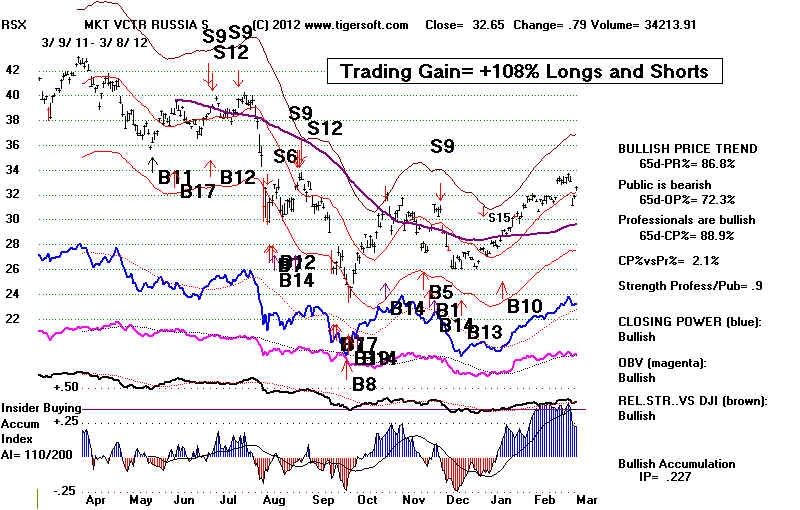

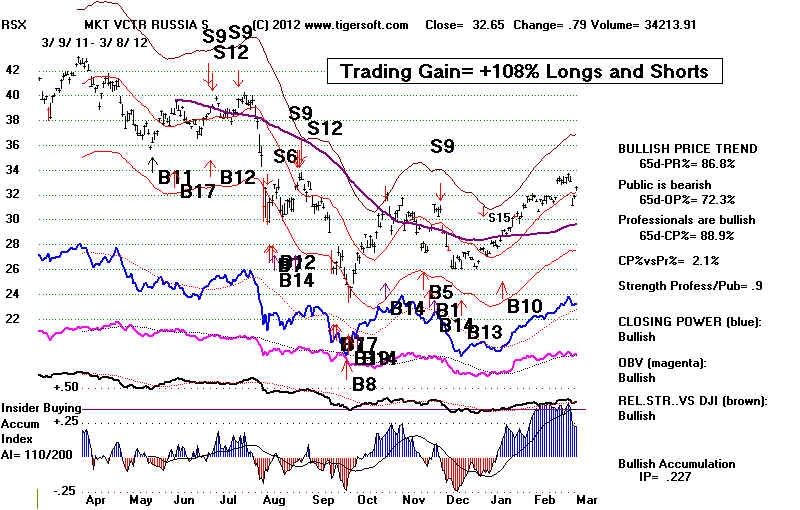

RSX (NYSE) ETF for Russian stocks show a Trading Gain of +108%

for last 10 months buying on autmatic Peerless Buys

and Selling on reversing

Peerless Sells. Short sales were also taken on

Sells and Buys.

The ETF itself actually declined in this period.

See the holdings below:

See

the quandry of investing in RSX without Peerless. The Peerless gain of +108% with RSX

was the highest of any of the ETFs. Past results do

not guarantee futures success.

But the consistency of

profitability by Peerless for many years should get your

attention and inspire a lot of confidence.

| Top 10 Holdings of RSX (57.64% of Total Assets) |

|

RSX

- ETF for Russia and Peerless Automatic Buys and Sells

(The numbers are our classification system for back-testing. They do not

measure the strength of the signal. Short sales are taken, too. In some cases,

Year-end Dividends are not factored in.)

Non-US

ETFs are Hot

96% of foreign ETFs are above their 65-day ma.

This ranks Foreing ETFs' stocks now #1

among the 28 industry groups TigerSoft

tracks each night on the Peerless/TigerSoft Hotline.

Peerless Is Hotter

See the

Performance of the non-US ETFs in the table below. The second column

allows you to compare the results

of trading the Peerless reversing Buys and Sell signals

with the various NON-US ETFs and DIA,

SPY, QQQ and IWM. It suggests that instead

of buying DIA or SPY when Peerless

gives a reversing Buy, consider a set of the best

performing ETFs that also trade well

with Peerless. TRE-Russia and RSX

stand out in

Peerless-Profitability. I have no custiomers in Russia presently. So

this is a virgin field

for us "tigers".

Peerless Rules

These

"Peerless Stock Market Timing trading results are produced by TigerSoft and assume

1) long and short positions are being taken at the opening the day after the Buy or Sell

signal;

2) A reversing Buy causes shorts to be covered and long positions to be taken;

3) A reversing Sell causes long positions to be sold and shorts to be taken.

4) that $10,000 is the original investment;

5) all proceeds are fully reinvested in longs and shorts, on Buys and Sells;

4) $40 per round trip is allowed for commissions and slippage, too.

This seems conservative and

realistic.

Because of the success of Peerless over time with so many countries, I have translated

the story of Peerless into Russian,

German, French (France and Belgium), Spanish

(Spain as well as Mexico), Italian

and Portuguese (Brazil as well as Portugal). I used

a machine translator. If you

speak these languanges, have a look and feel free to

make suggestions. I would

also be interested in helping. for a small fee, other website

owners do what I have done.

Russian ETF - RSX - Automatic Peerless Signals: May 2011-March 2012

A buy and hold of RSX for the

period May 2011-March 2012 approach would have lost 10.5%.

On the other hand, using

Peerless would have gained you 107.8%. Peerless is the

difference between a loss and

a very big gain. The difference between using Peerless and

buying and holding was +

$11830.5. The TigerSoft/Peerless programs cost only $495.

A year of data from is only

$150, but you get the first 7 months FREE! It's time to

get the real story of

Peerless out there.

Signal

Price Value of Investment

5/24/2011

Buy B11 36.49

$10,000

6/30/2011

Sell S12 38.72

$10.611,13

7/1/2011

Buy B12 39.01

$10531.65

7/5/2011

Sell S9

38.95

$10515.46

8/11/2011

Buy B12 31.74

$12461.96

8/30/2011

Sell S9 33.44

$13129.43

9/23/2011

Buy B11 26.09

$16015.23

12/5/2011

Sell S9

29.44 $18021.61

12/19/2011

Buy B13 27.03

$19550.98

1/4/2012

Sell S15 27.38

$19804.14

1/18/2012

Buy B10 29.13

$18538.35

3/8/2012

end of study 32.65

$20778.00

8 winning trades, 3

losing trades

Biggest paper loss of

Long trade = 11%

Biggest paper loss on

short sale = 6.6%

To order Peerless and

TigerSoft for $495, please go to this link or give us a call

at 858-273-5900.

Peerless and

TigerSoft Special - Order here

$495

Peerless and

TigerSoft Special - Order here

$495

Safe Peerless Investing

in Foreign ETFs:

France (en France)

Germany (Auf Deutch)

Italy (Parliamo l'italiano)

Russia (po Russki)

Spain/Latin America/Mexico en Espanol)

Brazil (em portuguÍs) 3/8/2012.

Foreign ETFs' Performance Thus Far in 2012

and

Automatic Peerless Buys and Sells Applied to

All Non-US ETFs and Overseas'

Markets, 2011-2012C:\etfs Days back= 46

----------- RANKED BY 2012 PERFORMANCE --------------------------------------------

12/30/2011 - 3/8/2012

Rank Peerless ETF Name Price Pct.Gain

Pct Gain SYMBOL

since

April

2011

---- -------- --------------------------------- ---------- ------------

1 +32.1% TGA TRANSGLOBE ENERGY 11.76 48%

2 +84.5% TRF TEMPLETON RUSSIA FUND 17.39 27%

3 +83.9% CEE CENTRAL EUROPEAN EQUITY FUND 35.2

4 +36.6% INP PACIFIC-ASIA ex Japan 57.65 23%

5 +107.8% RSX MKT VCTR RUSSIA S 32.65 22%

6 +49.2% SGF SINGAPORE FUND 13.33 22%

7 -3.4% TF THAI CAPITAL FUND 10.44 21%

8 +75.6 HAO CLAYMORE/ALPHASHA 23.33 20%

9 +25.0% IIF MS INDIA INVESTMT FUND 16.82 20%

10 +66.1% GF NEW GERMANY FUND 14.59 19%

11 +21.4% IFN INDIA FUND 22.71 19% 3.3%

12 +73.8% EWG ISHARES MSCI GERMANY INDEX 22.87 18%

13 +72.9 EWZ ISHARES MSCI BRAZIL INDEX 68.02 18%

14 +58.5% JFC J FLEMING CHINA REGION FUND 13.03

15 +37.2% TWN TAIWAN FUND 17.12 18%

16 +40.4 EWS ISHAR SINGAPORE INDEX 12.76 17%

17 +45.0% CH CHILE FUND 17.47 16%

18 +22.7% CAF MORGAN STANLEY CHINA 22.27 15%

19 +55.0% ECH ISHARES MSCI CHILE 66.66 15%

20 +69.1% EEM ISHARES MSCI EMERGING MKTS 43.81 15%

21 +43.8% EWH ISHARES MSCI HONG KONG INDEX 17.86 15%

22 +55.9% EWT ISHARES MSCI TAIWAN INDEX 13.48 15%

23 +48.7% GCH GREATER CHINA FUND 11.59 15%

24 +63.8% VWO Vanguard Emerging Markets 44.2 15%

---- +32.0% QQQ ETF for NASDAQ-100 64.75 15%

25 +57.6% EWD ISHARES MSCI SWEDEN INDEX 28.77 14%

26 +75.8% EWO ISHARES MSCI AUSTRIA INDEX 16.27 14%

27 +98.0% EWY ISHARES MSCI SO KOREA INDEX 59.71 14%

28 +55.5% GMF ST SP EM AS PACIFIC E 75.7 14%

29 +58.3% GXC STRK SPDR S&P CH 71.16 14%

30 +38.5% IXN ISHARES S&P GLOBAL TECHN. 67.45 14%

31 +62.7% EWI ISHARES MSCI ITALY INDEX 13.6 13%

32 +81.0% EWQ IShares MSCI France 22.25 13%

33 +66.5% ILF ISHARES S&P LATIN AMERICA 40 48.16 13%

34 +39.1% JEQ JAPAN EQUITY FUND 5.65 13%

35 +46.3% PGJ Gldn Dragon USX China 22.22 13%

36 +45.8% EWK ISHARES MSCI BELGIUM INDEX 11.9 12%

37 +66.6% EWW ISHARES MSCI MEXICO 60.25 12%

38 +23.0% MXF MEXICO FUND 24.57 12%

39 +32.4% CHN CHINA FUND 22.94 11%

40 +73.0% FEZ FRESCO DOW JONES EURO 50 32.88 11%

41 +57.2% FXI iShares FTSE/Xinhua China 25 38.81 11%

42 +10.8% GRR ASIA TIGERS FUNDS 13.43 11%

43 +37.0% ITF ISHARES S&P-TOPIX 150 INDEX 43.06 11%

44 +31.8% EWJ ISHARES MSCI JAPAN INDEX 10.03 10%

45 +68.6% EWM ISHARES MSCI MALAYSIA 14.76 10%

46 +56.2% IEV ISHARES S&P EUROPE 350 FUND 37.25 10%

47 +50.5% VGK Vanguard European Stock 45.92 10%

48 +36.2% VPL Vanguard Pacific Stock 52.61 10%

-- +43.7% SPY ETF for SP-500 137.04 9%

-- +57.5% IWM ETF for Russell-2000 80.51 9%

50 +74.1% EWA ISHARES MSCI AUSTRALIA 23.2 8%

51 +28.2% EWL ISHARES MSCI SWITZERLAND 24.56 8%

52 +30.7% IF INDONESIA FUND 12.74 8%

53 +28.0% JOF JAPAN OTC EQUITY FUND 7.78 8%

54 +48.5% EWC ISHARES MSCI CANADA INDEX 28.48 7%

55 +46.6% EWU ISHARES MSCI UK INDEX 17.32 7%

56 +59.9% KEF KOREA EQUITY FUND 9.72 7%

-- +42.5% DIA DJI-30 ETF 128.91 5%

57 +42.6% IDX Vectors INDONESIA 29.18 2%

58 +53.3% EWP ISHARES MSCI SPAIN INDEX 30.4 0% 59 IXP ISHARES S&P GLOBAL TELECOMM 56.14 0%

|

TigerSoft News Service 3/9/2012

Visit our www.tigersoft.com

TigerSoft News Service 3/9/2012

Visit our www.tigersoft.com

Peerless and

TigerSoft Special -

Peerless and

TigerSoft Special -