Updated 3/14/2011 (C) 2011 www.tigersoft.com

Professionals are usually right. Trade

in the

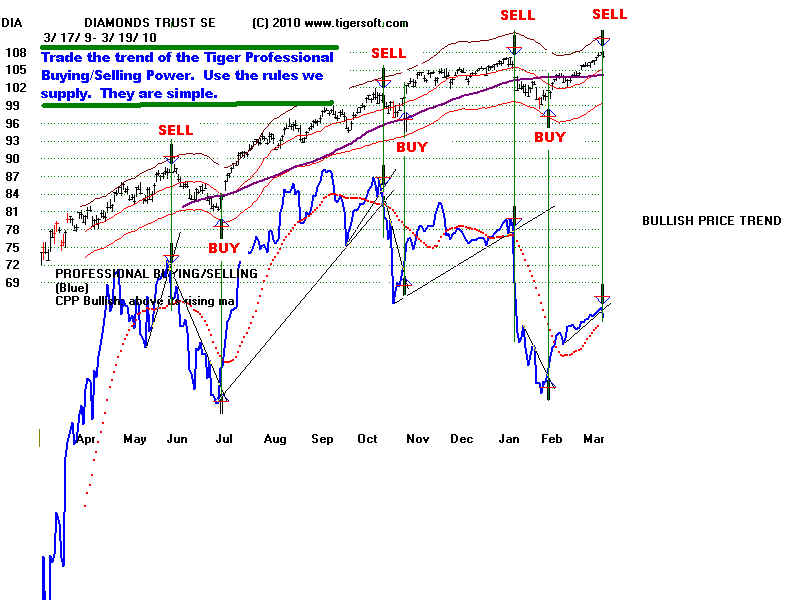

Professionals are usually right. Trade

in thedirection they are trading. The Tiger "Professional" Closing

Power is the key here. Trade its trends and you are trading

with the Wall Street Pros. Simply reverse positions when the

TigerSoft Closing Power trend is broken after it goes to an

extreme or after it fails to confirm a new high or low and

at key support levels. We show lots of examples on this

site. Closing Power virtually guarantees you'll consistently

make money.

These signals gained 29% from June 2009 to

March 2010.

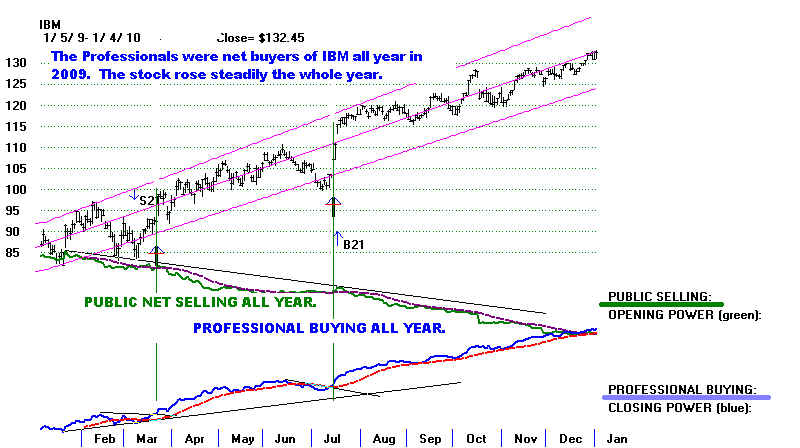

Public versus Professional Net Buying/Selling

3/20/2010 - (c) 2010-2011 www.tigersoft.com All rights strictly reserved.

With TigerSoft you can get a good idea if the

Public, as a general group, and/or the Professionals,

as a whole, are buying or selling. How we do this must

be kept proprietary unless you get the software.

The tools to make this distinction were created by

TigerSoft. This concept has many trading advantages.

Usually, we can assume that Professionals know more

than the Public. The stock market is their business.

They do it full-time. They cultivate contacts.

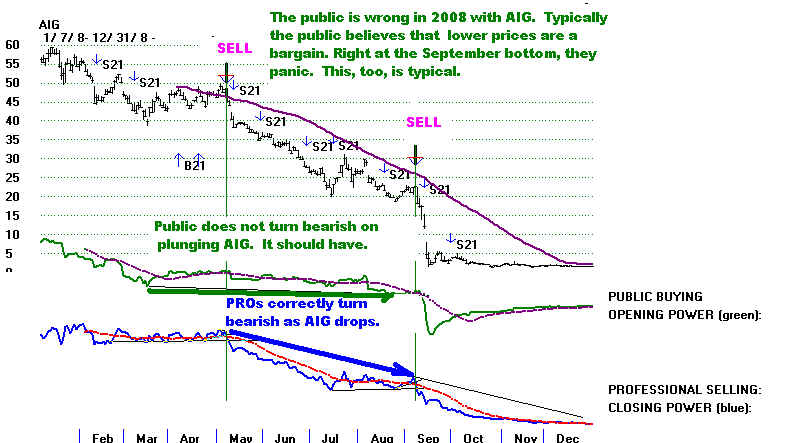

So, if the net buying (or selling) patterns of the two are

at odds, we generally expect the professionals' buying

or selling to be proved correct. This is not always true,

of course. Professionals can lose a lot of money, too.

But it pays generally to trade with their expectations.

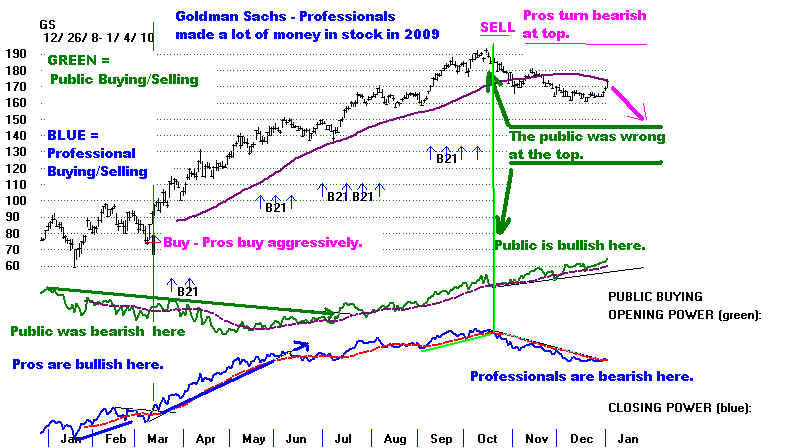

Look at GS. Goldman Sachs in 2009. At the beginning

of the year, Tiger's Professional Buying/Selling indicator was rising,

while Tiger's Public Buying/Selling indicator was flat to down, showing

skepticism. GS then ran up from 90 to 160. Then the Public became

net buyers. With both groups doing net buying GS rose to 190. But

starting in October 2009, while the Public kept buying as a whole, Pros

decided to shift to net selling. The Professionals decision was correct.

The stock fell from 190 to 150 ny early 2010.

RULES:

BUY - When Professionals shift to BUYING,

especially when Public Is Skeptical about Stock.

Shorter -Term Buy- When Public shifts to Buying if

Professionals Are Bullish and also Buying on Balance.

SELL - When Professionals shift to Net Selling after

a Long Advance and Public Is Buying.

SELL SHORT - When Public shifts to Selling and

Professionals Are Already Selling, as a whole.