TigerSoft and Peerless Daily

Hotline

(C) 1985-2015 William Schmidt,

Ph.D. www.tigersoft.com

All rights

strictly reserved.

Tiger Software

858-273-5900 PO Box 22784 San Diego, CA 92192 Email

william_schmidt@hotmail.com

------------------------------------------------------------------------------------------------------------------

7/21/2014 Add more short sales

from the Bearish MINCPs and take

profits in stocks breaking their CP uptrends. Also sell

stocks closing clearly below their 65-dma if they also

show negative Accum. Index readings. Hold IBB, however.

The stock market appears quite dangerous, much more so

than I thought last night. I say this because of the new study done

tonight on the cases where the DJI went 4 months in a

row with very heavy and steadily Red Distribution. See the

charts of 1929, 1930, 1937, 1965-1966 and 1974 below

to appreciate this.

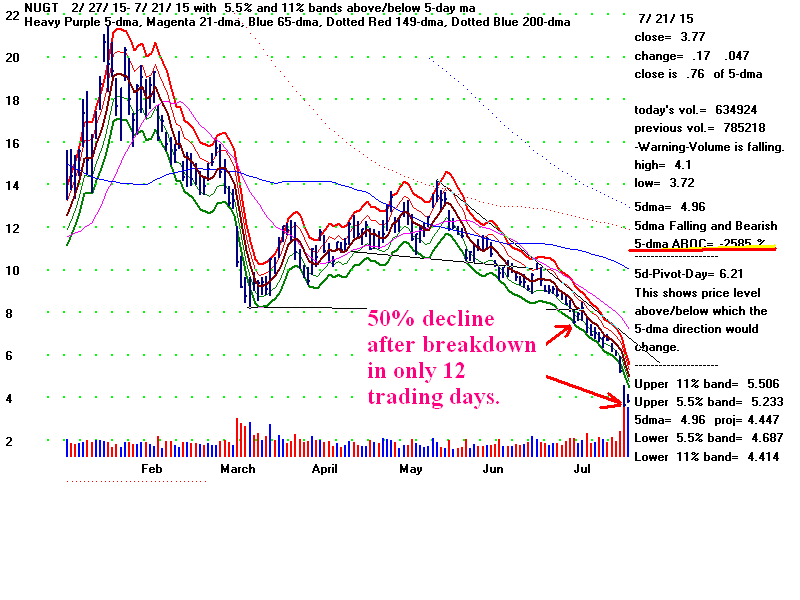

In addition, I am struck by how fast gold and oil stocks and their ETFs are

falling. This not only creates margin calls that affect other stocks'

prices, it also shows an utter absence of liquidity. Look at how

NUGT, the leveraged ETF for gold mining shares has plunged

in the last two weeks. Until a few years ago, Gold was considered

a haven and protection against disasters, bear markets and inflation.

Not any more. I think this is telling us that Deflation is now a very

real threat.

There was no Liquidity for Gold When Key Support Was

Broken.

What Might Happen if the DJI's 17500 Is Violated?

Differences from 1929

More and more, I see similarities with 1929. But I've mentioned

them already and quite a few times, too.

Fortunately, there are three or four differences between now and 1929.

So as not to sound too bearish, let me point out the key differences as

I see them. They should prevent the DJI from plunging more than 15%

in what would be the first correction since 2011.

1) Economists now understand, even if politicians do not,

the principles behind using deliberate deficit spending to create

jobs to prevent a Depression. Moreover, Bernanke has shown

that if you give trillions to the Big Banks, at least, you can get

the stock market to go up;

2) The broad Public is not in this market and Rand Paul regularly

appears on TV warning the Public about how dangerous the stock

market is;

3) The Fed has not yet raised rates to 5% to try to stop stock

speculation, as was done in 1929 and

4) The NYSE Stock Exchange A/D Line is not yet seriously diverging

from prices, as was true in1929.

But a severe correction seems to be shaping up.

4 Months of Heavy Red Distribution

The current Peerless signal is a Red Sell S12 (or Sell S12*).

This is the same signal that occurred two weeks ago. Both

signified that the DJI has reached the +1.1% to +2% band

over 21day ma with Accum negative or nearly so for last

50

trading days.

Now the Accumulation Index has been negative or nearly

so

(below +.022) every day since March 25th, or for a

whopping 82 trading days. This has been repeated only

a few times since 1929, the year when the necessary DJI data became

available to compute the Tiger IP21-Accumulation Index.

80 straight Red days has always brought on a severe

sell-off

unless the market was extremely (!) oversold as it was in 1932

See the cases further below. .

1929: In this year,

there were never 82 straight days when the IP21 was below

+.023 until after the October stock market massacre. But you can see

how long the IP21-Accum. Index was negative for much of the year.

Right at the September top, the IP21 had been negative 50 straight days.

Making the situation more bearish, the NYSE A/D Line (not shown here)

|

had been falling throughout the whole year. In this way, the DJI's new

highs

in August and September made the stock market seem a lot stronger

than it really was.

1931 - 4 months of negative IP21

readings set up a renewal of the

on-going bear

market.

1937; The August peak and

the subsequent 47% sell-off was

forewarned by

months of heavy Red Distribution. Our situation now

is worse, as

there were never 82 straight days in 1937 with the IP21

| always below +.022.

1966: The 9 months' long bear

market in 1966 was first signaled by normal

Sell S12s in

January and February. After the head/shoulders top was completed,

the year

produced a period of 82 straight days with the IP21 under +.022.

The important

thing about the 1966 bear market is that it was only signaled

by S12s.

There were no Peerless S9s based on A/D Line bearish divergences.

1974 Final capitulation

followed an extended period of Red Distribution.

Conclusion

What the history of 80 straight days of Heavy Red Distribution shows

is that we are in a very dangerous stock market. In fact, these charts

show that 80 days of heavy Red Distribution is a lot more bearish

than I have previously suggested. The 17500 and 17800 support levels

are likely not to hold up. And if the 1966 bear market is revisited, we

will

see that the booming high techs will be overtaken by the bear very

abruptly if the 17500 support fails. I remember seeing charts of lots

of tech stocks for 1966. I got the James Dines P&F charts in the

Summer of 1967 while in London working on my dissertation.)

It was only after the DJI's head/shoulder pattern in 1966 was completed

|

that the booming high techs then sold off badly. After the bear

market

was over and in 1967, they came roaring back.

------------------------

Announcements

--------------------------------

E-Books

1

The On-Line Explosive Stocks

2

The On-Line Killer Short

Sales book

Purchase each all new book by CC for

$42.50 or send a check for $37.50 to me.

I call your

attention now to the many new concepts and

the considerable new research in them:

For example:

1) A very good New Tiger Buy B12 for Low

Priced Stocks

2) After Red high volume reversal days use CP

uptrend-breaks.

3) Buy the stocks the Federal Govt wants you

to buy.

4) 100-Day Power Rankings...

5) Using Closing Power Hooks after Buy B26s

and B20s.

6) How A Stock Reacts to Its Earnings Report

Is Very important.

7) TigerSoft Major Buy Signals' Combinations

Which are most Powerful? Reliable?

8) Augmented Buy B20s' Independent Success

Rate.

9) What factors warn a rising 65-dma will not

hold?

10) The classic cluster of technical

characteristics that commonly appear

in the 23 stocks falling 70% or more in

the deep pullback of 2011.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

PEERLESS STOCK MARKET TIMING:

A Guide To

Profitably Using The Tiger Nightly HOTLINE

New Peerless Signals and DJI Charts - version 7/4/2013

1965

1965-6 1966

1966-7 1967

1967-8 1968

1968-9 1969

1969-70

1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979 1979-80

1980 1980-1

1981 1981-2

1982 1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986 1986-1987

1987 1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2 1992

1992-3 1993

1993-4 1994

1994-5 1995

1995-1996

1996

1996-7 1997

1997-8 1998

1998-1999 1999

1999-2000 2000

2000-1

2001 2001-2

2002

2002-3 2003

2003-4 2004

2004-5

2005 2005-6

2006 2006-7

2007 2007-8

2008 2008-9

2009

2009-10

2010 2010-11

2011 2011-12

2012

2012-2013

2013 2013-4 2014

Introduction to Tiger/Peerless Buys and Sells.

Different Types

of TigerSoft/Peerless CHARTS, Signals and Indicators

How reliable support is the DJI's rising 200-day ma?

-------------------------------------------------------------------------------------------------------------------

TIGERSOFT SIGNALS AND INDICATORS:

Documentation for TigerSoft

Automatic and Optimized Signals.

SPY Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma,

Optimized Signals.

"The

Jig Is Up": Calling September and October Tops.

A Keynesian's Warning Signs.

NUGT since 2012: A study of Tiger Technicals

Tiger Day

Traders Tool and most active Triple Leveraged ETFs

Advisory Pink Closing Power S7s at ETF at top since 1994

1994

1996

1997

1998

1999

2000 QQQ

SPY

DIA

2002

2007

2008

SPY 2011

2013-2014

Tiger Buy and Sell

Signals: New 2014 Research:

These are randomly chosen

groups.

but clearly we need to back-test them in more years.

You can replicate or do similar studies yourself

for other signals and/or other years.

9/1/2014 -

2014 Tiger

B19s - Steady rallying and no pullbacks below the 21-day ma.

9/2/2014 -

2014 Tiger

B17s on 14As taken alphabetically

9/3/2014 -

2014 Tiger B17s on 60

Biotechs taken alphabetically

9/4/2014 -

2014 Tiger

B18s on all "R" stocks taken alphabetically

* 9/8/2014 -

2014 Tiger

B20s - Conclusion: Use Closing Power trendbreaks in aftermath.

9/8/2014 -

2014 Tiger

B16s - Conclusion: Use mostly when

LA/MA under 1.05.

9/11/2014 -

2014 Tiger

B15s - Conclusion: Certain conditions

improved the results dramatically.

9/12/2014 -

2014 Tiger

B25s - Conclusion: 87.5% success rate

when other internals are positive.

9/15/2014 -

2014 Tiger B25s -

Best conditions for using B25s with somewhat

higher RSX capitalization stocks.

9/16/2014 -

New Tiger

Closing Power Take-Off Buy Signal in 2014: 14s, QQQ, DJI-30 and ETFs

9/17/2014 -

New Tiger

Closing Power Take-Off Buy Signal: 2009A-s

9/18/2014 -

New Tiger

Closing Power Take-Off Buy Signal: 2010A-s

9/21/2014 -

New Tiger

Augmented Sell S8s: DJI-30 - 2014

Requiring S8s to show

Negative CP%-Pr and IP21<+.15 produced a 70% success rate

in a rising market for

DJI-30 stocks and big ETFs.

9/24/2014 -

Tiger Sell

S14s: They make price breakdowns very bearish.

1/15/2015

-

Tiger Day

Traders' Tool Explained.

http://www.tigersoft.com/day-traders/index.html

http://www.tigersoft.com/Indicators/index.htm

http://www.tigersoftware.com/TigerBlogs/Aug-31-2009/index.html

NEW

2/16/2015

1) New -

Tiger Charts showing UP%, Opening-Up%, Closing-Up%

Note differences between bullish

and bearish stocks...

2) New -

UP%,

Opening-Up%, Closing-Up% Rankings of any directory.

3) New -

Display of what happens to a stock after various size openings up or down.

4) New -

6-month charts to better

show volume changes and 5-day ma with bands.

More profitable trading schemes coming...

Targeted Trading Opportunities:The Profits Quickly Add Up,

3/29/2015

Tiger CandleSticks:

IBB: 2001-2015

and

Recent Others.

====================================================================================

Earlier Hotlines

2-7-2014 to 3/19/2014

11-22-2014 to 2-6-2014

http://tigersoftware.com/555HL555/index.htm

10/9/2014 - 11/21/2014

http://tigersoftware.com/9933Hot/

9/2/2014 - 10/8/2014-

http://tigersoftware.com/2233HL/index.html

6/25/2013-9/1/2014

http://tigersoftware.com/112211-H/index.htm

11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

Past

Hotline Predictions

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

==============================================================================================================================

7/21/2015 200+ TigerSoft Charts

7/21/2015 200+ TigerSoft Charts