TigerSoft and Peerless Daily

Hotline

(C)

1985-2013 William Schmidt, Ph.D. www.tigersoft.com

All rights strictly reserved.

Sharing this hotline address with non-subscribers is a violation of our contract with you

and a violation of copyright laws. I work hard for you. Respect that effort!

Important ===> Look for an email sent you giving the

new IP address for our Hotline

This HOTLINE Address will

change Monday night.

If you did not get an email, we may have made a mistake. But it may also

mean that your subscription has expired. To renew please

---> To

renew this Hotline,

order here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

For earlier hotlines this year, please go to

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

=====================================================================================

4/19/2013

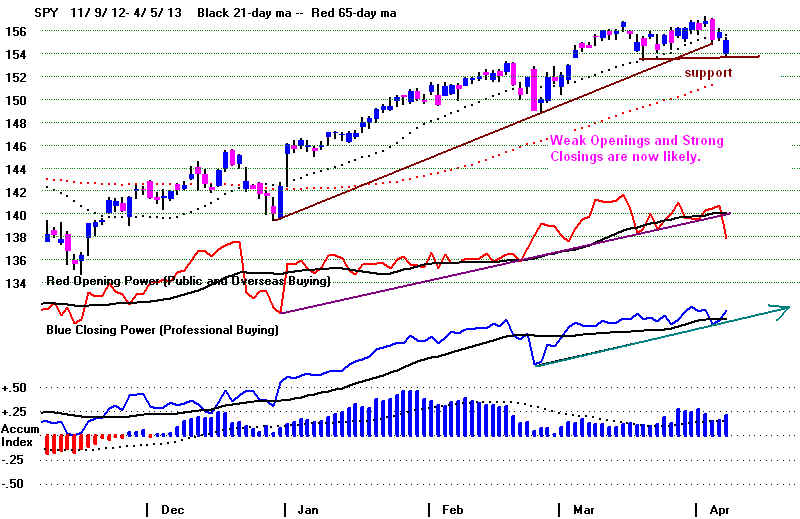

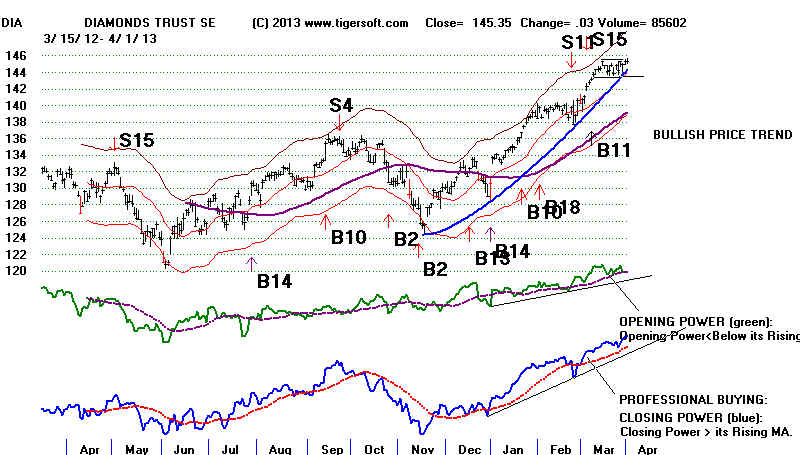

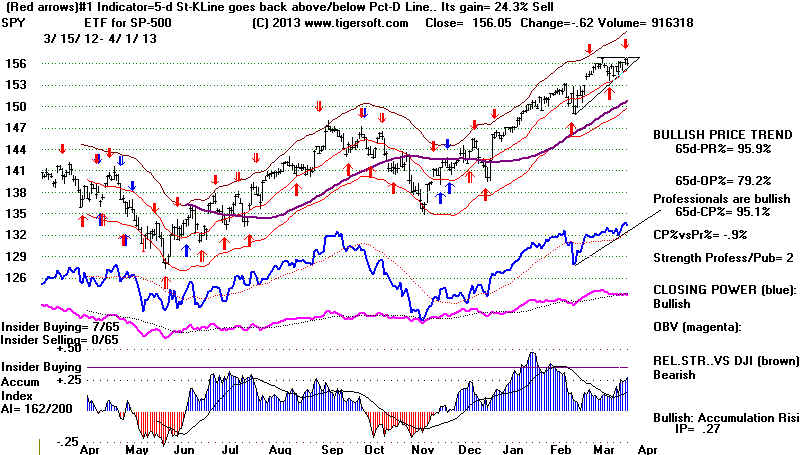

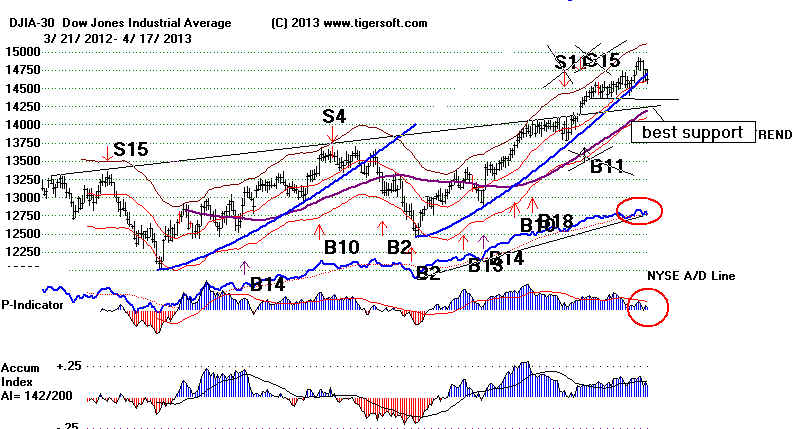

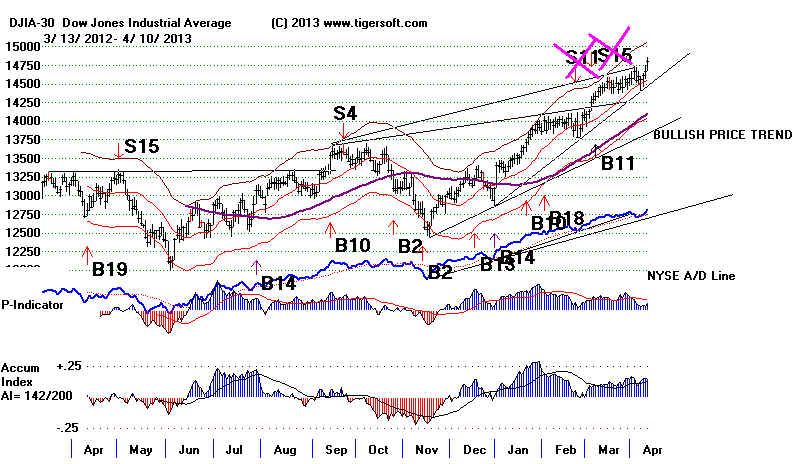

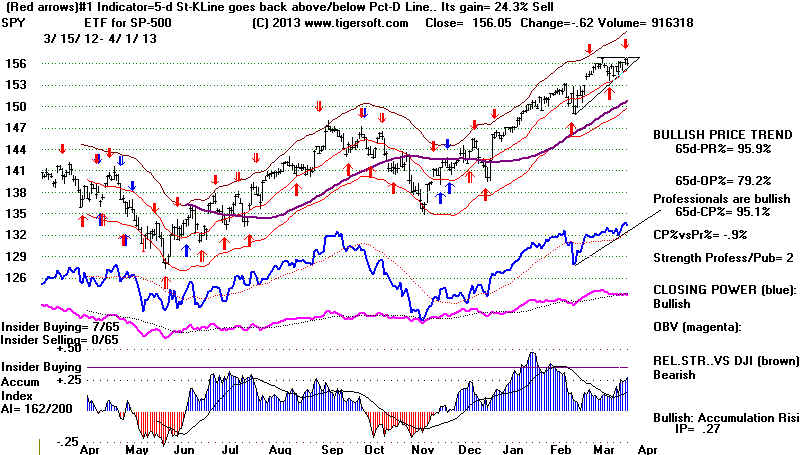

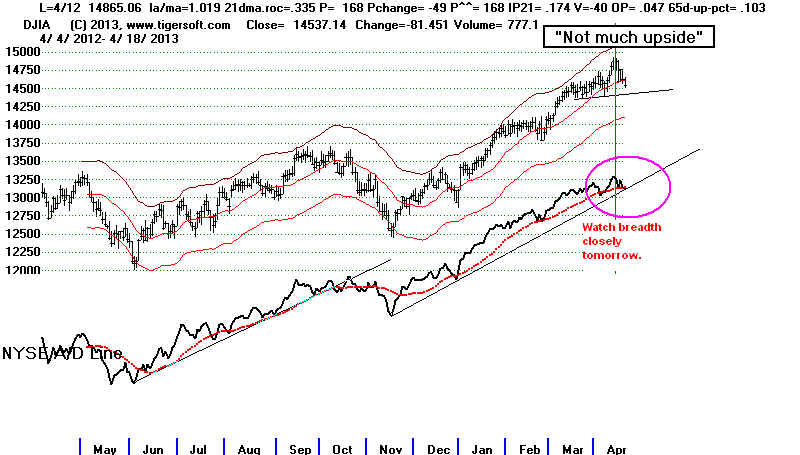

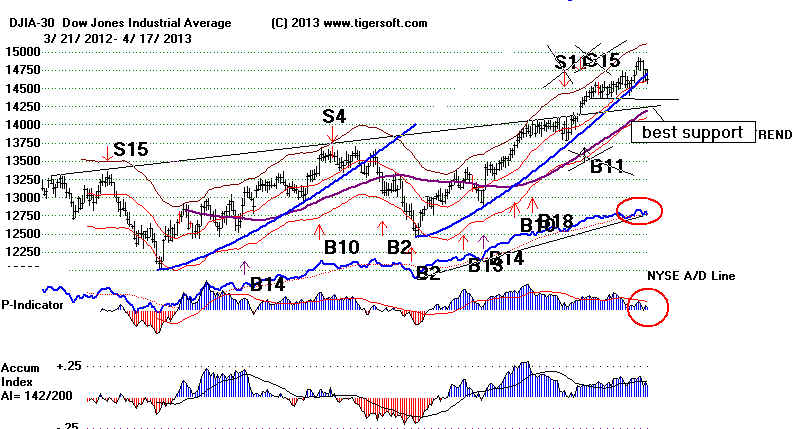

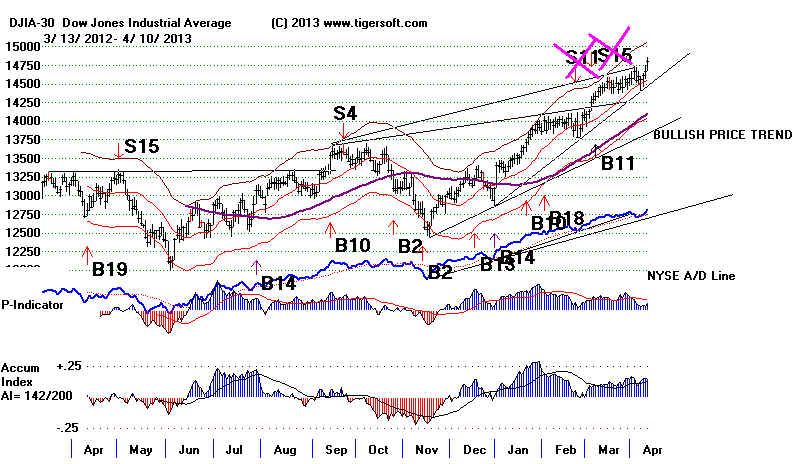

A/D Line Uptrend Is Intact. The Test of It Looks Successful.

Usually, this brings a good recovery. Technically minded Traders will now

be

watching this line even more closely. With such a reference point for selling,

short-term traders are expected to move aggressively into in strong, high Accumulation

stocks.

The problem

for now is that the DJI's current chart pattern could become a problem

and limit

the rally.

The margin

calls in Gold and Silver stocks are probably over for the time-being.

Watch to

see if Professionals switch to the long side with a strong closing.

Gold

futures are up 5%..

We have no

Peerless Sell. But the round number 15000 is likely to be resistance.

The market

is too defensive. It is led by Biotechs, Utilities, Reits and Food Stocks.

Such

leadership often occurs late in a long advance when economic growth conditions are

absent.

(This ascertained by

looking at the most bullish of the high

Accumulation new highs now.)

Perhaps,

the market will enter a narrow trading range like in 1984 and 1991

while the

necessary base is built for further gains. Industry selection will continue

to be very

important.

The

upside would seem to be limited for most stocks. Unless you are willing to sell out

quickly if the new Closing Power uptrends are violated, I would wait for a further

decline

to

buy where there will be more head-room. If there is a rally, I expect to do a lot of

selling

at

15000. As I keep saying, May is more likely to bring a tradable top than April.

But unless,

the

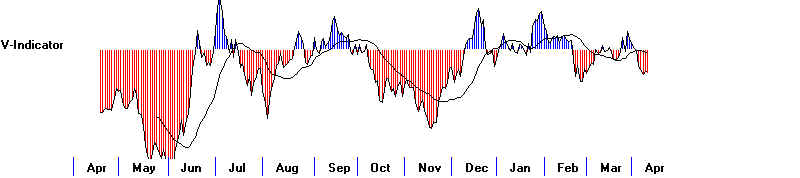

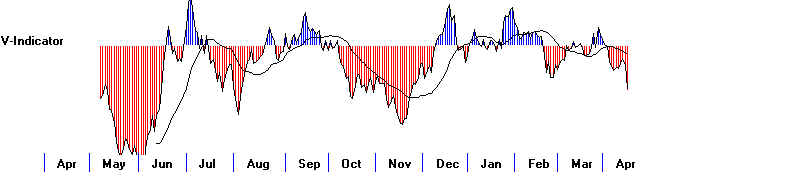

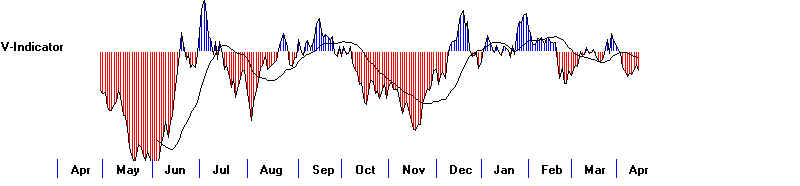

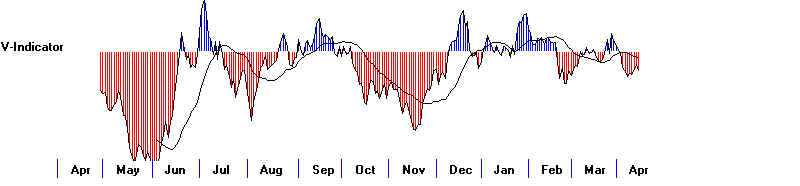

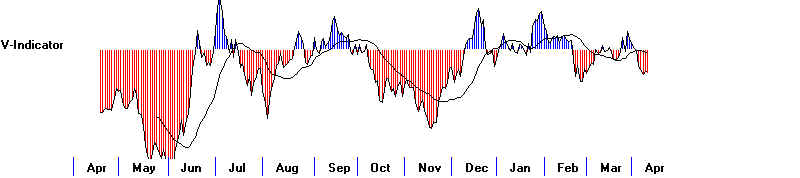

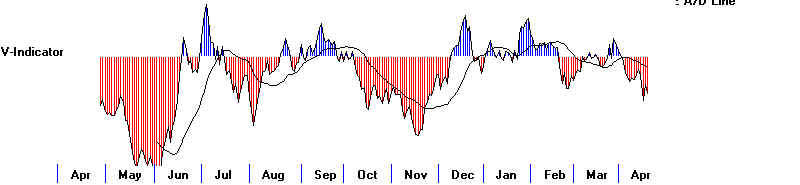

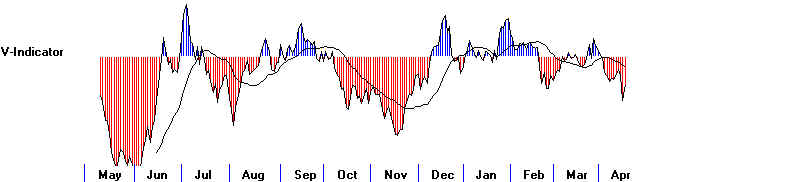

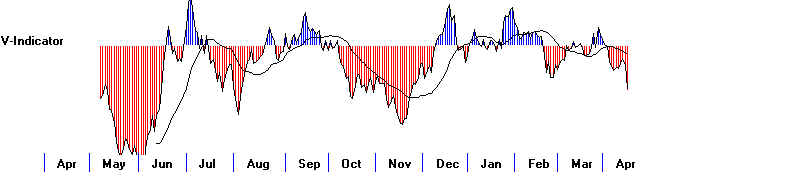

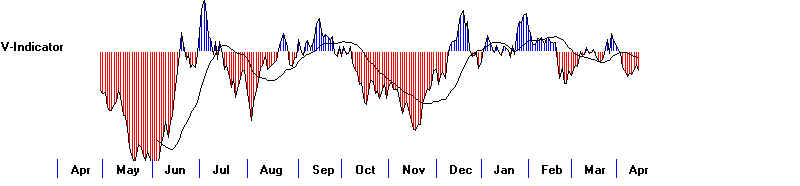

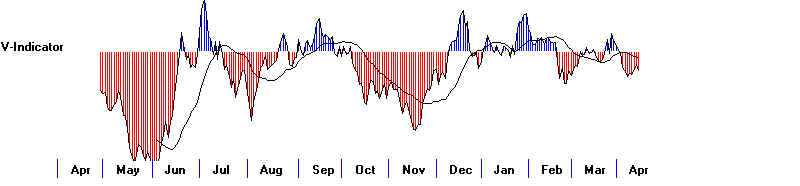

V-Indicator turns up sharply, we will probably get a Sell S15 or S9V at the upper band

because the V-Indicator is now quite negative.

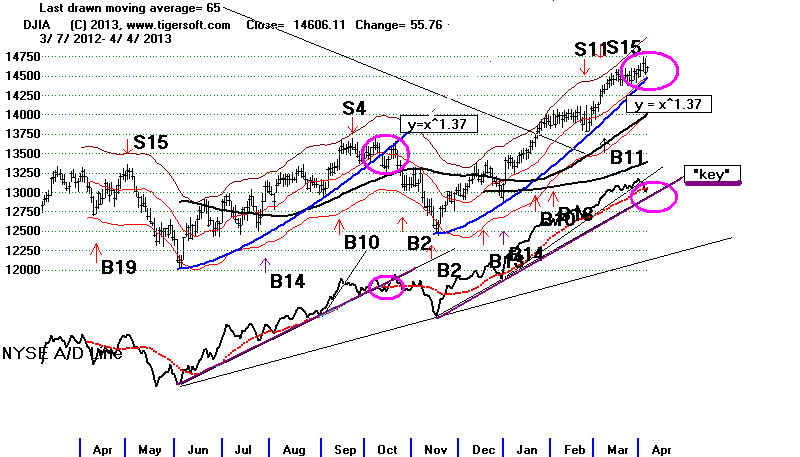

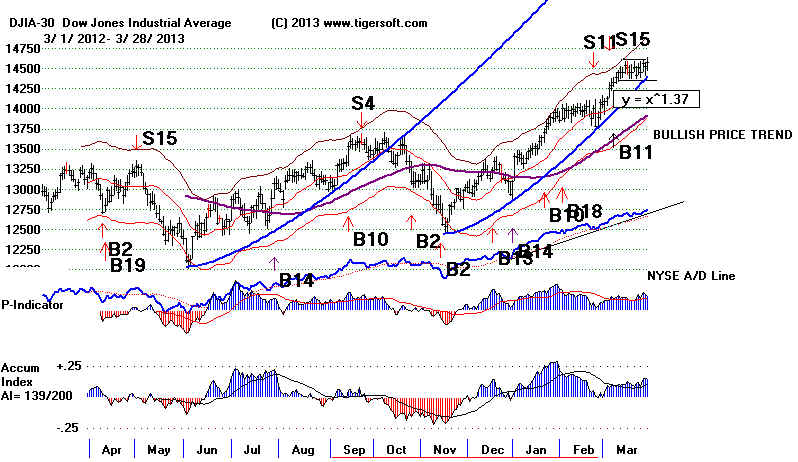

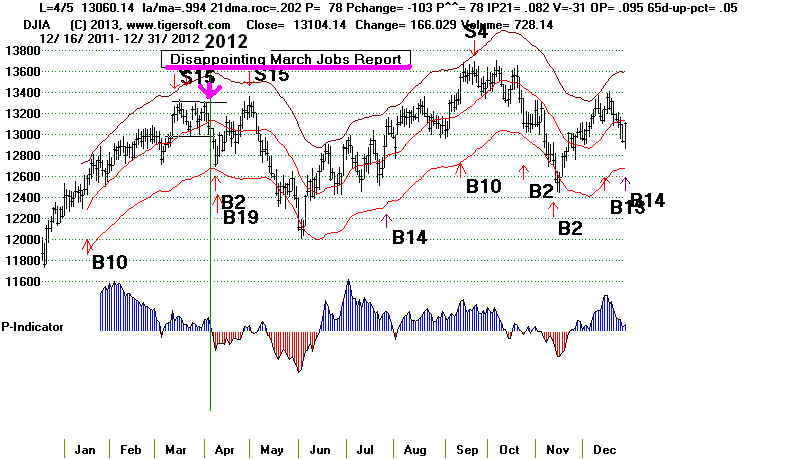

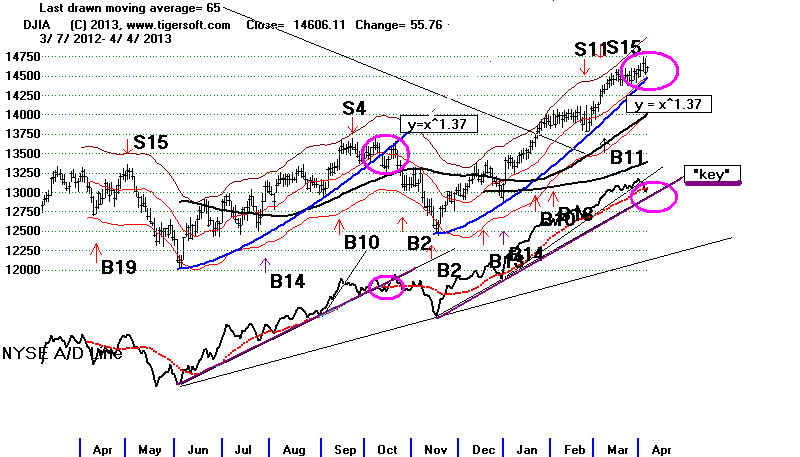

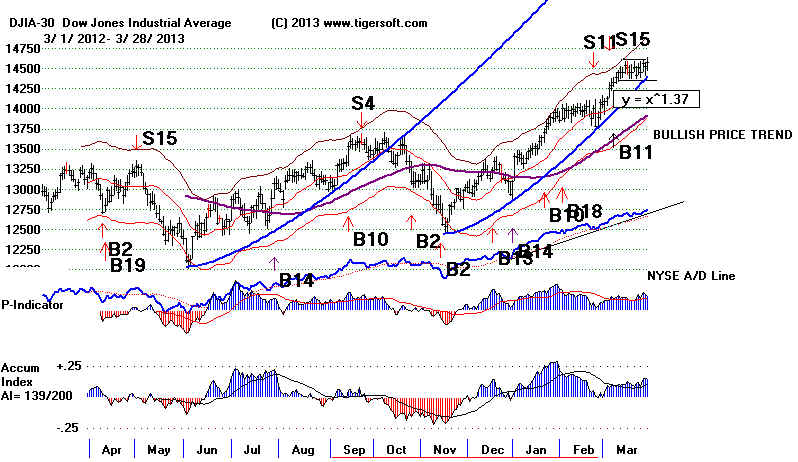

The DJI's pattern is taking on the appearance of a potential head/shoulders. This

The DJI's pattern is taking on the appearance of a potential head/shoulders. This

would

make a DJI breaking of the 65-dma more significant. The neckline

support is at 14415, The right shoulder apex resistance must be expected at 14750.

If

the pattern develops symmetrically, and they often do, it may be a month before we

see

whether the DJI can bullishly advance above the apex of the right shoulder or

breakdown. The standard measuring rule for this pattern if it breaks down, would

call for

a

minimum DJI decline to 14000.

That

the DJI helped up so well in the face of drops Friday by MCD (-2) and IBM (-17) of

has

to be seen as bullish short-term. By themselves, they would have put the DJI

down

158, but for strength elsewhere. Medium priced DJI stock with high

Accumulation

did

well. AXP (+2.19), BA (+1.84), HD (1.52), VZ (+1.34), JNJ (1.31), UTX

(1.67)

and

DIS (1.57. Together these rose 11.44. So, the fact that the DJI close +10.37

for

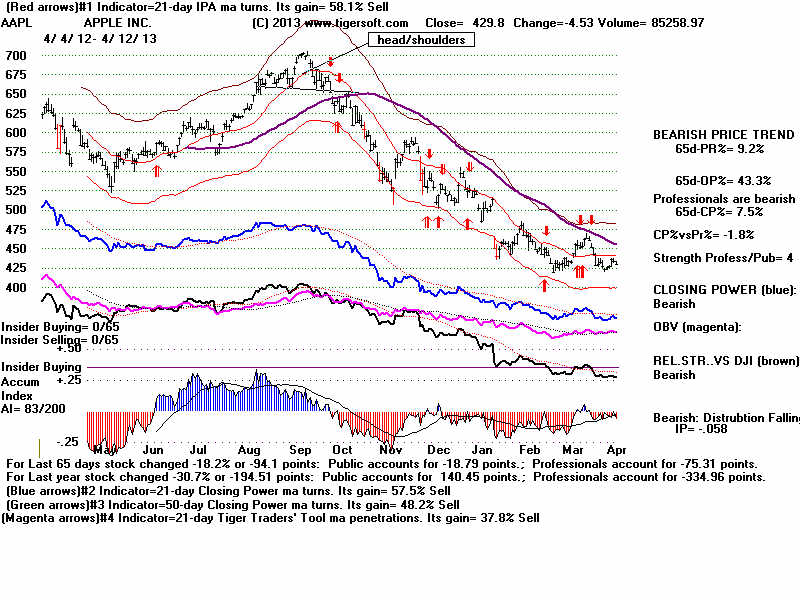

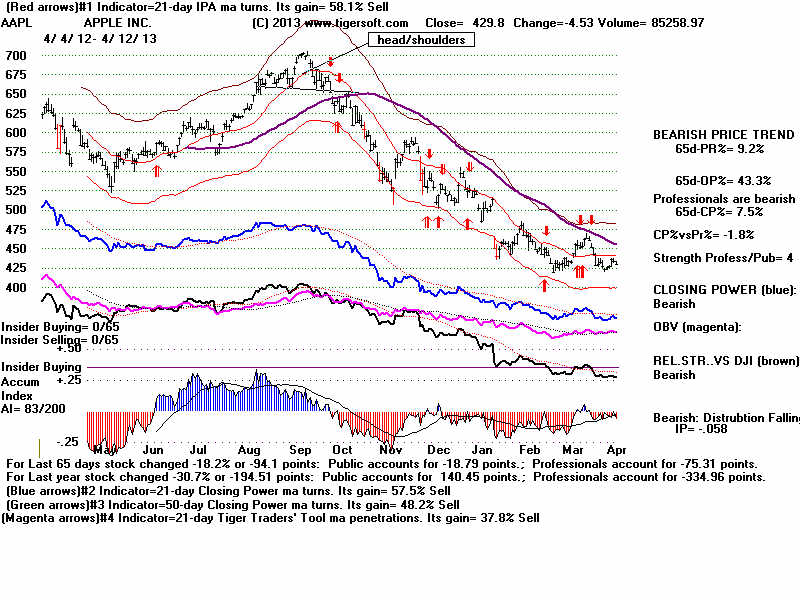

the day is remarkable. IBM's chart pattern shows a lot

more Accumulation

than AAPL did when it began its decline. See how AAPL's

Closing Power was already

falling before it completed a bearish head/shoulders pattern. Analysts apparently

think

much

more highly of IBM now. But this was IBM's

first earnings miss in 8 years. One can

not

help but wonder if there will be other earnings misses soon.

---> 164 MAXCP

stocks Bullish

MAXCP Stocks (4/19/2013) Bullish plurality

---> 94

MINCP stocks Bearish MINCP Stocks

(4/19/2013)

---> 36 New

Highs on NASDAQ 17 new lows. Bullish plurality

---> 117 New Highs on

NYSE 15 new lows. Bullish

plurality

Key Values: DJI

14547 +10

la/ma= 0.995 21dma-roc = 0.029 P=+ 61 Pch= -7

IP21 = +.096

(on 1/30/2013 IP21 was .293) V =

-72 Opct = .013 65

day-pct-up = .069

4/19/2013 ---> To

Key Index and Leading Stock Charts

Biotechs Are The Strongest Group

Is it too late to buy some of these rapidly rising high priced Biotechs or FBIOX?

The gain so far this year for FBIOX is like 1991 and 1987. In 1987, Peerless Sell

S9s

turned it down early in the year and it never recovered. In 1991, the DJI was stuck

in a flat trading range from March until December. In that environment and

without

a Sell S9 signal, FBIOX did very well. This suggests as long as Peerless does not

give

a Sell S9, FBIOX will be safe and biotechs should keep rallying. But keep in mind,

biotechs are not impervious to market weakness, once significant market weakness

is perceived to be imminent. They top out late, but they do drop in a bear market.

Right now, confidence is high enough to boost FBIOX and the bigger biotechs. As the

"main game in town now" for speculators, these biotechs are accelerating upwards

in a

way that can be traded short-term on the long side. But such trends bring bigger

declines

eventually. So, use the Closing Powers with them if you choose to chase them.

They'll be

safe until the CP uptrend is violated. Working with the highest AI/200 and positive IP21

stocks in the Biotech directory in uptrends will help. .

AI/200 IP21 Close change

RHHBY 199 .316

61.1 +.02 Running. CP is above its

21-dma.

INFI 178

.216 40.76 +.74

At 65-dma. CP is just below its 21-day ma.

IBB 174

.421 172.58 +7.63 High volume new

high.

CLDX 168 .162

13.03 +.50 Fresh breakout past 5 tops.

TSRO 167 .08

23.99 +.14 Move avove 25.20 would be

breakout.

LGND 163 .212

26.92 +2.52 27.34 is recent high.

ACOR 156 .369

40,44 +1.44 Up 8 points in last week.

REGN 147 .335

212/58 + 5.92 218 is recent high.

Is It Too Late To Buy FBIOX?

Splashy biotech gains often present problems for the market. Over-speculation in

a

small handful of stocks and panicking short covering are not good signs.

VRTX

rose 61% Friday on news of qualified efficacy in

stage 2 trials for its

treatment

of the most common form of cystic fibrosis. I rebuilt the BIOTECHs'

Tiger

data download so that it now has more than 200 biotechs. I eliminated the

specialty chemicals that had somehow populated that directory. VRTX chart.

The

higher priced Biotechs (especially AMGN, BIIB, CELG, GILD, REGN) are

getting much of the "hot", high performance money. The trend is still

up.

Heavy

institutional buying is very apparent. VRTX is 93% owned by institutions,

like

FBIOX. A vicious circle of hyper-speculation is building now. The better

the

Seclect Fidelity Biotech fund, FBIOX, does compared to

other funds, including

the

42 other Fidelity Select funds, the more its managers must keep buying more

of

its top stocks to meet the demands of the new investors that are flooding into it.

And

that just makes their funds' performance do even better and that brings in another

round

of public buying of FBIOX. FBIOX is up 28% so far this year. Its Utility

Fund,

FSUTX, is number 2, up 17%.

The

FED denies that a speculative bubble is being created by its stimulative efforts.

But

bubbles are an integral part of Wall Street and when you tell the world that

there

will not be any surprise increases in interest rates, which is one of the

reasons that speculators might hesitate to chase hot stocks, you get an even

bigger bubble in the top performing stocks.

| Top 10 Holdings of

FBIOX (59.73% of Total Assets) |

|

| Company |

Symbol |

% Assets |

YTD Return % |

| Amgen Inc. |

AMGN |

14.63 |

7.95 |

| Gilead Sciences, Inc. |

GILD |

10.72 |

18.31 |

| Celgene Corporation |

CELG |

7.22 |

34.60 |

| Biogen Idec Inc. |

BIIB |

5.96 |

15.26 |

| Regeneron Pharmaceuticals, Inc. |

REGN |

4.62 |

0.39 |

| Alexion Pharmaceuticals, Inc. |

ALXN |

4.09 |

-7.44 |

| BioMarin Pharmaceutical Inc. |

BMRN |

3.45 |

21.16 |

| Vertex Pharmaceuticals Incorpor |

VRTX |

3.09 |

10.19 |

| ONYX Pharmaceuticals, Inc. |

ONXX |

3.00 |

-0.37 |

| Medivation, Inc. |

MDVN |

2.95 |

-9. |

|

Do Big Gains from January to April 19th for FBIOX

mean strength for the rest of year?

Since

1996, the first 4 months of the year have tended to bring declines not rallies for FBIOX.

So

the FBIOX rally this year is unusual. There are only a few such cases:

2012, 2011, 2010, 2004, 1995, 1991, 1989 and 1987.

Half

the time FBIOX kept advancing. But half the time it fell back, sometimes a

long

ways when it was up between December 31st and April 19th.

This

year so far has seen the biggest percentage gain for FBIOX since

1991 and 1987.

Though 1991 saw FBIOX advance all year, there was a subsidence

from

4/17 (29.12) to 6/27 (25.77) before the advance resumed. In 1987s case,

FBIOX

peaked early in 3/24 two weeks before the first Sell S9 of 1987.

.

Dec 31st

April

19 Peak

Summer low

of year before

Rally continued.

---------------------------------------------------------------------------------------------------------------------[

2013

109.90

142.55

2012

86.19

93.44 116.16

(10/18) rallied from April to October.

2011

72.96

81.98 89.00 (7/22)

69.65 (8/8)

2010

65.49

74.43 75.10

(4/15) 59.53 (7/2)

2009

59.11

54.95 68.31 (9/21)

rallied from March to

September.

2008

66.68

63.48 74.39 (7/29) rallied from March low to Sept.

2007 64.96

66.18 73.44 (10/15)

63.16 (8/1)

2006

62.70

64.02 68.62 (3/2)

57.21 (8/14)

2005

57.65

51.34 63.02 (11/23)

rallied from March to November.

2004

51.48

59.62 62.64 (4/26)

47.35 (8/9)

2003

38.73

40.78 52.20 (9/10)

rallied from February to

September.

2002

65.12

51.74 none

fell steadily to 31.82 on 7/10

2001 86.80

64.56 75.03 (6/5)

51.04 (9/24)

2000

67.13

64.85 102.70 (11/2)

rallied from April to November.

1999

39.77

37.53 68.54 (12/30)

rallied from April to December

1998

31.89

32.51 36.35 (3/19)

27.01 (8/31)

1997

32.51

29.27 39.38 (10/8)

rallied from April to

October

1996

34.83

35.22 36.53 (3/8)

30.65 (7/16)

1995

23.41

26.03 34.83 (12/29)

rallied steadily the whole

year.

1994

28.61

23.26 25.40 (9/16)

22.70 (7/25)

1993

28.41

22.22 28.96 (10/15)

rallied from April to October

1992

36.42

27.34 24.88 (6/8)

went sidewise until October.

1991

19.94

27.92 36.42 (12/31)

rallied from June to December

1990 14.30

15.33

19.53 (7/16) 16.70 (8/23) then )rallied from August to

December

1989 10.10

11.81 15.12 (10/6) rallied steadily until October.

1988 9.70

10.25 10.86 (3/10) 9.48

(11/16)

1987 10.35

13.80 14.76 (3/23) 8.47 (10/27)

=====================================================================================

OLDER HOTLINES

====================================================================================

4/18/2013

Continue Holding

Some Bearish MINCPs Short and

Hold Mostly High Caps Showing High Accumulation.

These we may sell on a rally to 15000. Our "Rule of 7"

is still bullish.

Capture so quickly of Marathon Terrorist Is A Big

Boost for All of US.

A Rally To 15000 Suddenly Seems A Good Possibility.

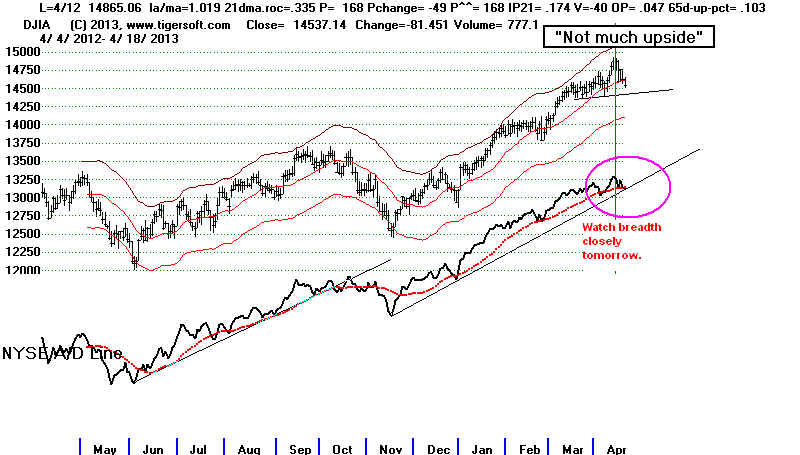

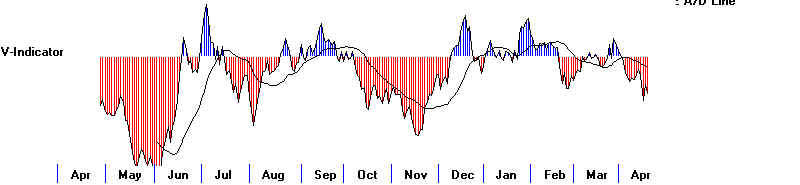

A lot depends on whether early gains are held. The A/D Line

Uptrend May Now Hold.

Key Values: DJI

14547 -81

la/ma= 0.995 21dma-roc = 0.066 P=+ 67 Pch= +5

IP21 = +.076

(on 1/30/2013 IP21 was .293) V =

-75 Opct = -.004 65

day-pct-up = .07

4/18/2013 ---> To Key Index and Leading Stock

Charts

The

Absence of A New Peerless Sell Signal Does Suggest A DJI Rally.

But

there would seem to be much more upside potential buying near 14200.

The

DJI's Accumulation Index remains positive. That should help hold up

the

DJI. But even if it succeeds any rally to 15000 will likely fail. Besides the

psychological

resistance there, the internal strength indicators have slipped a lot. The V-Indicator is

now

-75. In May a rally to the 2.7% upper band (around 15000) will bring a Sell S9V.

We

could even get a Sell S9 signal this month if the P-Indicator is 67 more points lower

on a

rally to a new high.

The

market has narrowed subtly. High caps are trying to hold up. The DJI, OEX and SP-500

are

still above their 65-day ma. But the smaller stocks are weakening

disproportionately.

The

NASDAQ, QQQ, MDY and NYSE broke below their 65-dma today while the IWM

and

Value Line broke below theirs previously. We saw this weakening process mainly in

the

declining tops of the P-Indicator. This was the primary reason we thought doing some

selling at the 1.9% upper band Sunday night was a good idea. There seemed little

upside potential and risk of a decline back to the 65-dma seemed high.

Note

that the NYSE A/D Line did not produce a non-confirmation on the last new high

because of how much the FED's low interest rates are boosting dividend paying NYSE stocks,

REITs, utilities, bond funds, etc. In this environment, we want to make use of

decisive

trend-breaks in the A/D Line. Today, the NYSE A/D Line fell back to its 5-month

uptrend.

A

decisive break would definitely be bearish and invite a lot more selling.

In this

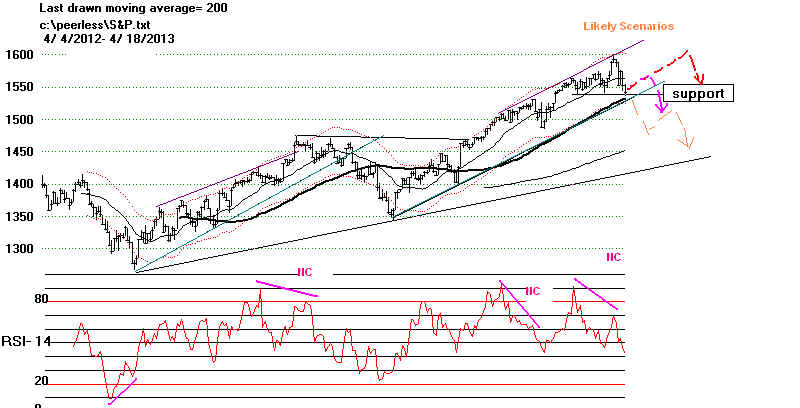

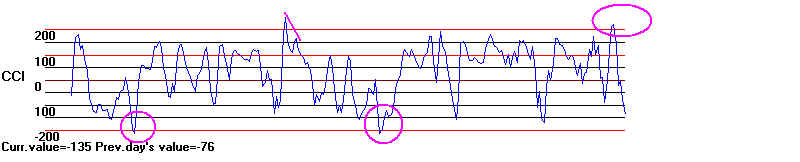

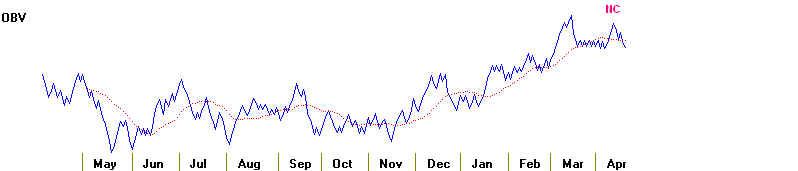

low-interest rate environment after a 10% advance, we should probably start heeding

the RSI and

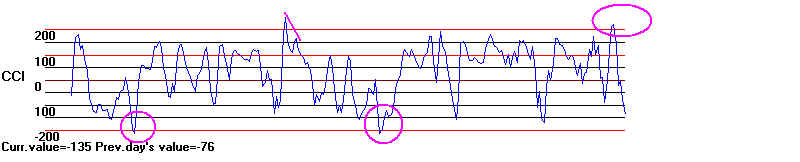

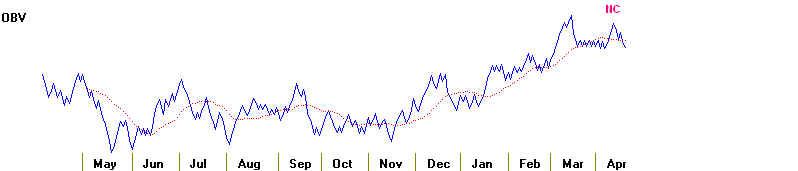

CCI momentum indicators. I wrote a brief electronic book a few years ago

for trading

index options. It emphasized the SP-500's 2.5% band, RSI's NC's, CCI NC's

and CCI

readings over/under 200. If anyone ones to get it, let me know. It's still

$38.50

and if you

give me a few days, I will bring its charts up to date. Below is the CCI

and RSI on

the SP-500. See how large the RSI NC (non-confirmation) was of the

last two

highs. And see how the CCI reversed from above +200. There was a wide

OBV NC at

the top, too.

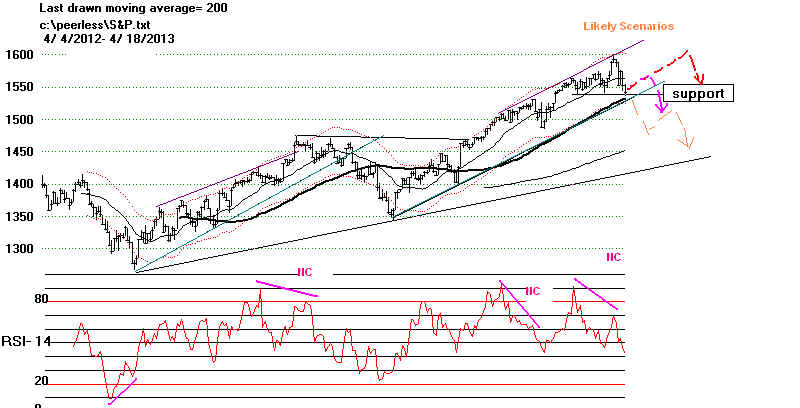

These are

all bearish signs. The most likely next paths (scenarios) for the SP-500

are shown

in the SP-500 chart below. Note that a weak right-shoulder rally for the next few

trading

days would set up a head/shoulders pattern in the DJI. That might be

more

bearish than a quicker and simpler re-test of the 65-dma.

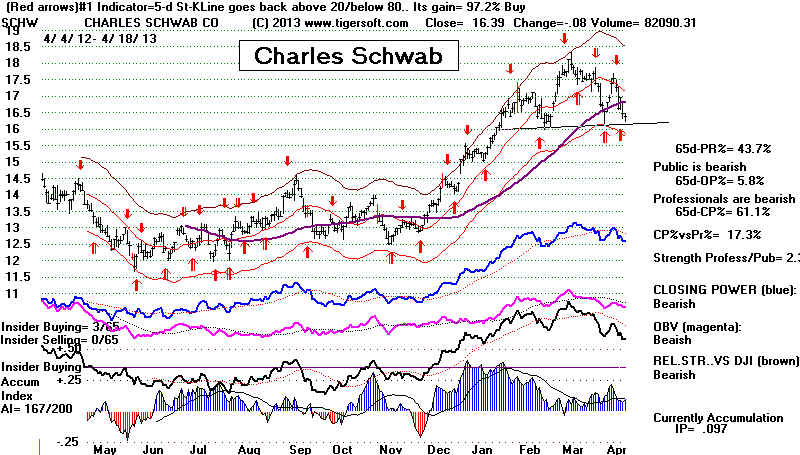

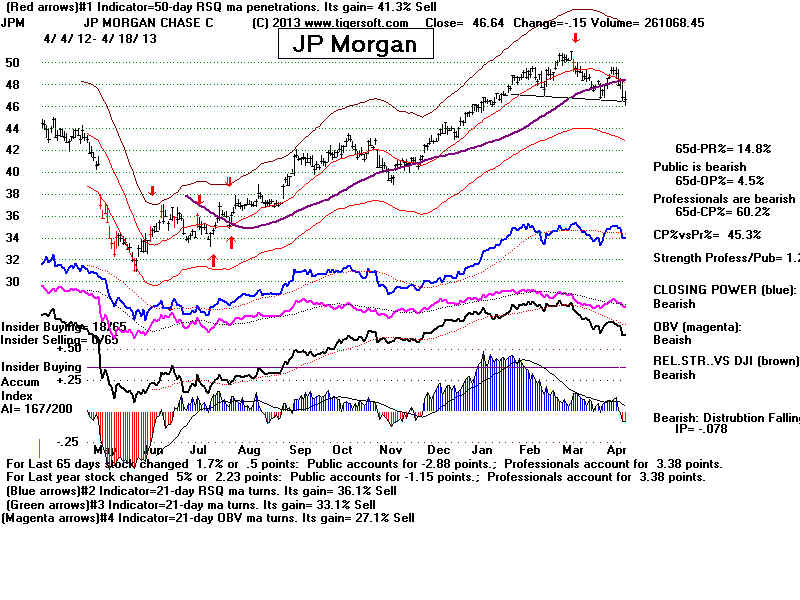

I also

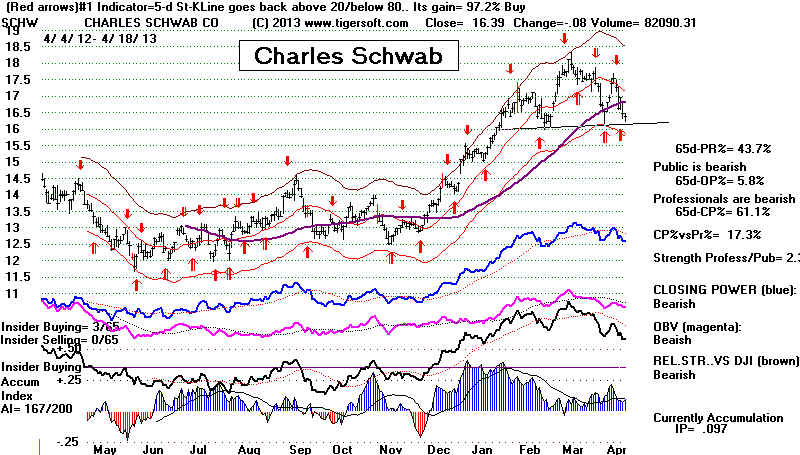

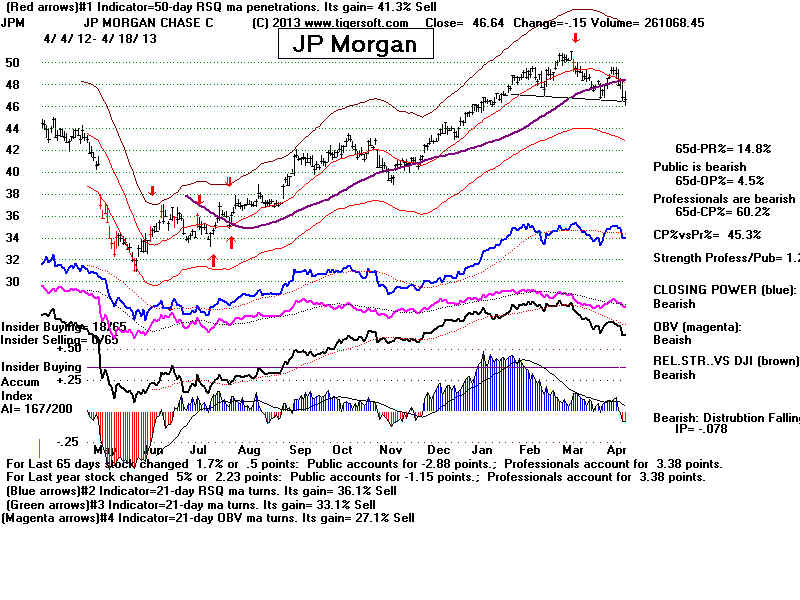

suggest watching key financial stocks like BAC, JPM and SCHW

to see if they

break

support and complete their head/shoulders patterns. SCHW and JPM show

considerable Accumulation and not enough red Distribution to seem bearish

enough to

short. However, a break in their necklines will be bearish, since

the stocks

are also below their 65-dma.

.

---> 65 -20 MAXCP stocks Bullish MAXCP Stocks (4/18/2013)

---> 139 +37 MINCP stocks Bearish MINCP Stocks (4/18/2013) Bearsh

plurality

---> 11 New

Highs on NASDAQ 48 new lows. Bearsh

plurality

---> 25 New Highs on

NYSE 79 new lows. Bearsh

plurality

-------------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

------------------------------------------------------------------------------------------------------------------------------------------------------

4/17/2013

THE ROLLER COASTER VOLATILITY

When confidence starts to crumble,

we have to expect wilder swings. And one of

the ways the market fools people is

to get them thinking that each decline is

a buying opportunity.

So, if the market rallies tomorrow, it will be conditioning

folks to buy on the next dip and

the dip after that. These dips may not bring recoveries

so nicely, especially after the

next Peerless Sell, perhaps in May.

Blame the big boys' computers, too.

Until their trading is regulated or taxed like it is

in Europe, we must expect wilder

and wilder daily volatility, which produces

no trend and where there is no

follow-through the next day. Such computerized trading

accounted for 75% of all trading on

the NYSE two years ago, when the Exchange

stopped reported it, for fear of

self-incrimination. Before 2010, there were very few

cases of mere 2-day whip-saws, up

and down. Before October 1987, there were none

for 50 years.

Here we have just seen 3 whip-saw days in a row. And tomorrow

could be another! The end result, whip-sawing aside, is that the DJI is back at the

support of its rising 21-day ma and

its 21-day ma momentum and IP21 are above .07.

This usually brings a rebound.

See the statistics further below.

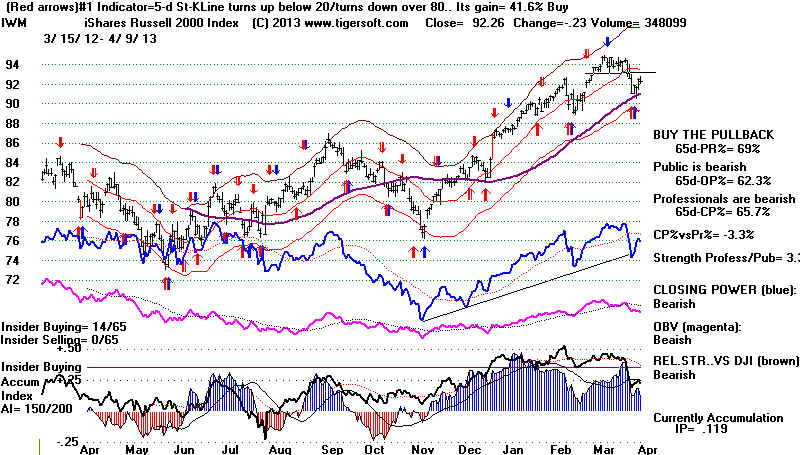

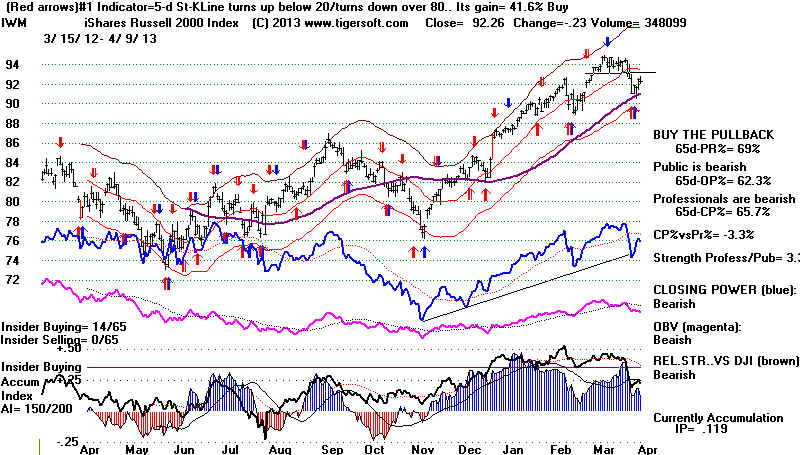

The broad-based Value Line and the Russell-2000 ETF

(IWM) dropped today below

their 65-dma.

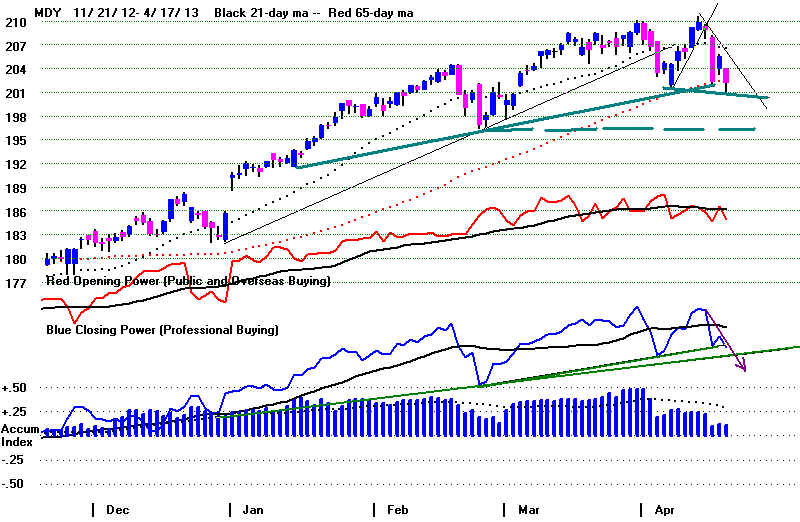

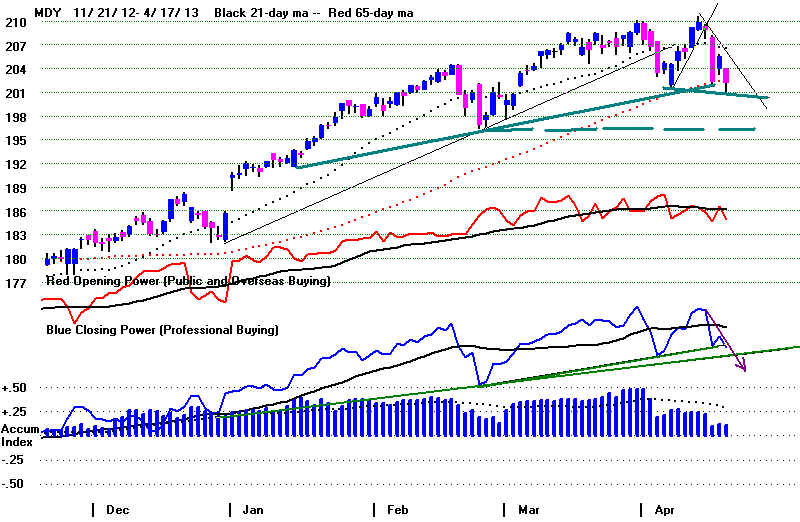

MDY, the ETF for MIDCAPS, closed right on its now flat 65-dma.

Besides, the DJI, watch MDY

tomorrow. Its Closing Power is in a steep short-term decline

which could be broken if the

closing is firm on Thursday..

What To Do.

On strength, consider more

selling of less seasoned stocks if they do not

show an AI/200 score above 175.

Short the stocks breaking below their 65-dma

if they have completed a

head/shoulders pattern and have negative Accumulation

on the right shoulder. Or just

hedge by shorting some of the Bearish MINCP stocks

and hold these short as long as

their Closing Powers are falling.

Completed Head/Shoulders

My concern now is that there are

more and more stocks and Tiger Sector Indexes

that have completed bearish

head/shoulders patterns or could easily break their necklines

in another day or two. AAPL (continuation H/S), Crude Oil,

USB, CMCSA, Computers,

Foreign

ETFs, High Priced Stocks, Home Builders, Ind Materials,

REITS, SEMI-Conductors.

Three particularly scary looking

key stock charts where the head/shoulders has not yet

been completed are JPM, SCHW and TWC. Schwab's neckline is only 26 cents below

today's close and JPM's is .43

lower. A closing below these would make the market look

a lot worse.

Go Away In May, Not April

It is normal for the broader market to start to fall behind the DJI in April even though

the DJI does not top out until May

or June. This is what makes the DJI and the A/D Line

start to diverge in April and then

much more critically in May and June. See the

A/D Line and DJI charts for 1959, 1965, 1972, 1986, 1998 and 2006.

"+ Double .07" (.0655, actually.) Usually Brings DJI

Rally up from 21-dma

The DJI-30 will now try to hold the

market up at its rising 21-day ma, only 11 points below

today's close. Usually if the

annualized rate of change of the DJI (Ann-Roc) is above +.065

and

the current Accum. Index (IP21) is above +.065, and they are

for the time being, the DJI

soon rebounds from the ma or from a

little below it. When one or both are below .065,

there is usually a decline to the

lower band. Below I checked the cases where the ratio

of down volume was more than 6:1

with the DJI just above the 21-day ma. You can

see my rule of

"double-07" has some merit in cases like ours now: 6/21/2012, 11/1/2011

,1/28/2011 and 10/29/2011.

la/ma AnnRoc

P-I P-I Ch

PI^^ IP21

V-I OPct 65-day Pct Ch.

4/17/2013

1.001 .136

61 -50

61 .101 -77

.094 .076

9/25/2012

DJI fell below lower band

1.009 .268

249 -109

249 -.029 -5

.119 .06

6/21/2012 DJI

moved upwards for 3 mo

1.006 .07

218

-96

218

.082

-17 -.04

-.047

11/1/2011 DJI rebounded to upper band.

1.008 1.037

511

17

509

.21

13 .264 -.04

9/2/2011 DJI fell to lower band

1.00 -.152

76 32

76

0.0

-150 .183 -.088

7/18/2011 DJI rose 2% and then collapsed

1.004 .409

272 -88

272

.047

-48 .107 .009

2/22/2011 DJI held up for two weeks and fell to lower band only when internals weakened.

1.007 .335

337 -120

335

.223

-12 .385 .097

3/9/2011 1.001 .05

197

-62

196

.10

-101 .052

.068

1/28/2011 DJI rose from 11824 to 12391 on 2/18

1.004 .241

78 -140

78 .07

-75 .129 .054

10/19/2011 DJI rose to upper band

1.006 .246

144 -185

140 .07

-38 .036 .073

4/16/2010 DJI fell below lower band after testing 21-dma

for 2 weeks.

1.009 .311 185

-151

180 .061 -65

.29 .035

5/4/2010 .988 -.05

142

-181

138 .056 -139

.329 .077

10/26/2010 DJI declined 2% and then rallied 9%.

1.002 .245

95

-62

88

.047

126 -.177

.077

6/15/2009 DJI fell slightly below

lower band .

1.005 .391

229

-166

213 .056 -83

.054 .163

Confidence Erodes Rather Than Collapsing

All At Once.

The way yesterday's rally was

totally snuffed out by today's decline has to

damage traders' confidence.

Whether or not the DJI can hold up, I have suggested selling

and hedging by shorting some

bearish MINCPs.

I think we still have to wait for a

fresh Peerless Sell signal before we may expect the DJI

to crumble badly.

Bigger declines do not usually start until May. A narrow DJI rally to

new highs could easily bring a Sell

signal.

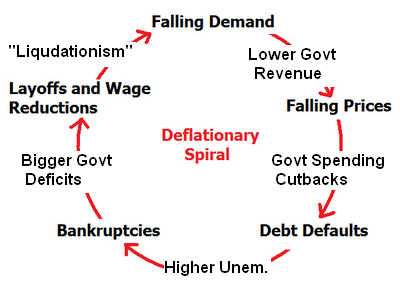

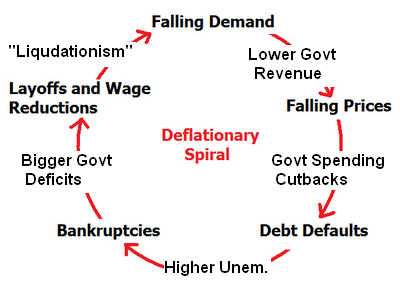

Deflation fears are mounting as

economists and market pundits see rapidly Gold, Silver,

Mining

Stocks and the entire Industrial Materials sector and

Crude Oil are falling.

This is a world-wide phenomenon.

As I feared, overseas ETFs dropped further

below

their 200-day ma. That should

put a limit on how far the DJI can rally. See yesterday's

remarks on the Deflationary Spiral

and how the blue chips ran out of steam in 1930

when they discovered that they

could no longer sell what they had produced.

Key Values: DJI 14619 -138 la/ma= 1.001 21dma-roc = 0.136

P=+ 61 Pch= -50

----------------------------------

IP21 = +.101

(on 1/30/2013 IP21 was .293) V =

-77 Opct = .10

65 day-pct-up = .076

-----------------

4/17/2013 ---> To Key Index and Leading Stock

Charts

---> 85 MAXCP stocks Bullish MAXCP Stocks (4/17/2013)

---> 112 MINCP stocks Bearish MINCP Stocks (4/17/2013) Bearsh

plurality

---> 11 New

Highs on NASDAQ 48 new lows. Bearsh

plurality

---> 25 New Highs on

NYSE 79 new lows. Bearsh

plurality

====================================================================================

OLDER HOTLINES

====================================================================================

4/16/2013

Let's See if We Can't Get A Better Place to

Buy

with A More Head-Room? If 15000 is the resistance,

we should not buy until we can see at least 5% upside potential.

That would mean buying at 14286. That's about where the

65-day ma will be in a week or two. There are also more

non-gold stocks tonight among the Bearish MINCP

stocks

that look like attractive short

sales.

Key

Values: DJI 14757 +158 la/ma= 1.011 21dma-roc = 0.198 P=+110 Pch= +102

IP21 = +.125

(on 1/30/2013 IP21 was .293) V =

-59 Opct = .109

65 day-pct-up = .088

4/16/2013 ---> To

Key Index and Leading Stock Charts

I suggested selling into strength in today's trading because of the market's

weakening internals and the

negative V-Indicator. These would seem to make it

difficult for the market to

escape a Peerless Sell signal on any rally to the

round number resistance at

15000.

I have to quickly add that a big decline is not expected. Without a

new Peerless Sell signal, the

odds favor only a retreat to the 65-day ma, now at 14400.

Dips to the lower band are

usually good buying opportunities in April, May and

late June.

DJIA and Peerless Signals as revised.

More revisions are being made, so there is no

Peerless.exe past the mid-March version.

See www.tigersoft.com/PeerInst-2012

Why No Buy B19?

The

DJI's reversal upwards raises the question "why did Peerless gave no

Buy B19 today. The

ratios of up and down volume yesterday and then today met the

requirements. The

answer is that the DJI closed above the 21-day ma today.

That makes it far less

reliable. But what about April reversals like this?

It is true that April

reversals like we saw today have in 7 of 7 cases brought

rallies of 3% in the DJI, at

least. But that may be because 6 of the 7 April Buy B19-like

reversals since 1945 occurred

with the DJI below the 21-day ma. Closing

below the ma gives the signal

more upside potential See the new

study

of uncontrolled B19-like reversals upwards between March and October.

And there is another problem

with more recent B19s. They are much more

numerous with the advent of

leveraged ETFs and computerized day trading. Two day swings

up and down are much more

common now than they were before 2000. Their intermediate-

term significance is less, as

a result. So, it is important for us to be more discriminating

in those reversals we do

trade on. Being below the 21-day ma seems like a good start.

That the Futures are sharply

down right now despite the big reversal back upwards

today, makes this

refinement seem even more vital. .

Austerity, Deflation,

Liquidationism and Social

Darwinism

No political leader in the US or Europe is talking about the dangers of Deflation.

But there's no shortage of

"liquidationists" That's the problem as I see it.

There is mounting evidence of

world-wide Deflation, I think it will pay to be cautious regarding

how much more the Fed's low

interest rate and QE-3 policies can still boost stocks, especially

when it's very clear that

political elites in Europe and America are way too timid to

challenge exactly the same

financial austerity-orthodoxy that ruled England in the

high unemployment,

"locust" years from 1920 to 1939. (This was the subject of my Ph.D.

dissertation at Columbia.)

The

dismal American economic experience in the

early 1930s and again in

1937-1938 was a close parallel. It's important to appreciate

that years later, both

President Hoover and P.M. Churchill rued as their long career's

biggest political mistake,

the listening to orthodox advise from their big bank advisors,

Andrew Mellon at the US

Treasury and the Bank of England and the

Financial City of London.

Here's

the full quote from President Herbert Hoover on the advice given to him by Mellon:

"...The

“leave it alone liquidationists” headed by [my] Secretary of the Treasury

Mellon,

who felt that government must

keep its hands off and let the slump liquidate itself.

Mr. Mellon had only one

formula: “Liquidate labor, liquidate stocks,

liquidate the farmers,

liquidate real estate.”

He insisted that, when the people get an inflation brainstorm, the only way

to get it out of their blood

is to let it collapse. He held that even a panic was not altogether a bad thing.

He said: “It will purge the

rottenness out of the system. High costs of living and

high living will come

down. People will work harder, live

a more moral life. Values will be adjusted, and enterprising people

will pick up the wrecks from less

competent people”... (Source: U.C.

Berkeley Economist Brad

De Long).

---> 104 MAXCP stocks Bullish MAXCP Stocks (4/16/2013)

---> 112 MINCP stocks Bearish MINCP Stocks (4/16/2013) Bearsh

plurality

--->35 New

Highs on NASDAQ 20 new lows. Bearsh

plurality

---> 60 New Highs on NYSE 23

new lows. Bearsh plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

4/15/2013

Key Values: DJI

14599.2 -265

la/ma= 1.001 21dma-roc = 0.049 P= +9 Pch= -159

IP21 = +.088

(on 1/30/2013 IP21 was .293) V =

-93 Opct = -.059

65 day-pct-up = .081

No Peerless Sell, but

Take Some Profits On The Next Rally.

A Peerless Sell Signal in May Seems Likely.

There Does Not Seem to Be Much More Upside Right Now.

Gold Stocks Are So Beaten Down, I Would Not Short Them until They Rally.

Deflation Is The Threat Now.

Deflation Is The

Problem

For some time, gold stocks have been on our bearish radar. They have heavily

populated our "BEARISH MINCP" stocks.

Today's drop in gold and silver were

the worst since 1983. And that was not a good time to buy them long-term,

though Gold then rallied back to its falling 65-dma and Silver jumped 30% in 10

weeks.

Historically, Gold's long-term weakness portends one of three possibilities:

(1) a strong economy (as started for example in 1983 and 1995) or

(2) financial confidence (which started in 2011 with QE-II) or

a liquidity trap and World-wide Deflation.

I fear that the movement in the direction of Deflation has reached a point where it

cannot be stopped. Early in 1930, analysts predicted corporate profits would rise

sharply because of the drop in labor and producer prices. They failed to factor in

the drying up of demand. Consumers in the US and in Europe lacked the money and/or

confidence to keep buying what was produced. There was soon a glut of unsold

cars, radios, even grain... and the lay offs and bank failures began.

Half

of the Europe Power Elite still wants to pursue a Hoover-like Austerity now. So,

does

half of the US Congress. There is stalemate. But without Keynesian government

pump priming and massive public infrastructure rebuilding, the joblessness will rise

again.

From 1945 to 1965 there was widespread acceptance of Keynesianism. The Viet Nam

war unleashed deep-rooted inflationary forces and sparked the rise in oil prices.

That changed the consensus in favor of Keynes. Our military misadventures

in Iraq and Afghanistah have had the same effect. Keyesianism has given way to

libertarianism, austerity and now deflation. .

So, once again, as in 1930, there will not be enough global Demand for whatever

big corporations produce. Their profits may hold up for a while because their labor

and commodity prices are falling, but sooner or later, they will be left with big

inventories, and as in 1930, and there will be trouble. The Fed knows this. But

Obama

does not. A majority of Congress does not know this. There's the problem, as I

see it.

Eventually, the over-production will be eaten away. But that will take years.

But there is hope. In the 1930s the Solid South, because of the high unemployment

there,

was 100% behind FDR's public works. In fact, they were more behind them than was FDR

himself. (See Ira Katznelson,

Fear Itself: The New Deal.)

Meanwhile What Is To Be Done?

With the V-Indicator so negative, I do not see how a new high near the 15000

psychological resistance will not bring a Peerless S9v or Sell S15. A sizeable

P-Indicator non-confirmation would likely bring a Sell S7, even if the P-Indicator

is positive. Right now, it stands at an anemic +9. A 2.5% rally from here

could

even bring a Sell S9 this month.

Today it was the DowN Jones Average. Every one of its 30 components declined.

It was the biggest down day in six months. One has to wonder if any of the early

selling

was done by the terrorists themselves, as apparently occurred in the weeks before

the 9/11 attack on New York.

I said Sunday night that the upside seemed limited and I would certainly

approve of anyone taking profits and waiting for a pullback to buy back in.

Since the DJI has fallen to the support of its rising 21-day ma with its IP21 still

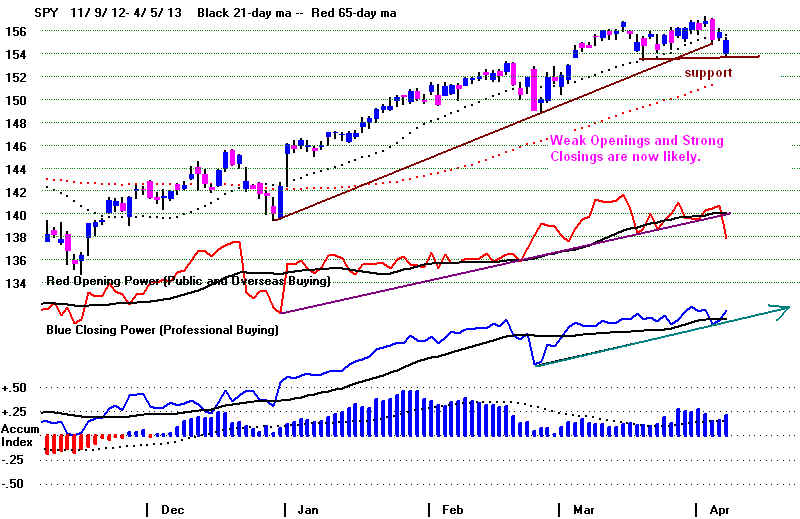

quite positive, + .088, a rebound is likely. But the Closing Power uptrends

for DIA, SPY, QQQ, IWM and MDY were very weak today. Professionals

may well use a higher opening to sell into. Watch for a resumption of weakness

tomorrow or the next day. Lightening up somewhat on this technical bounce would seem

reasonable. Note that the momentum of the 21-day ma has lost its strength.

It has fallen

back to +0.049. Below .07 it often does not have enough strength to turn back

upwards

a determined decline.

Sell short some of the Bearish MINCP stocks as

a hedge. Keep in mind that

new lows have suddenly outpaced new highs even though the DJI is only one

trading day from making a new high. This is a bearish "titanic syndrome".

(This seems aptly named. Our financial system rests on a collective disbelief

that it can not sink because the FED will always be able to save it, much like

the technologically new and powerful Titanic was thought to be unsinkable.).

The Insiders' Secret Sell Signal

I mentioned the absolutely flat trading in the DJI from Thursday to Friday. I

said that three such days of essentially zero change in the

DJIA might be a sign hoisted

by the "cognoscenti"

to tell each other that prices were about to drop sharply.

See the discussion on the newly revised Sell S8 page.

As it turns out, two such

days of zero change like we saw between Thursday and Friday are also good sell

points, but not in April. This signal is a perfect,

seven for seven from May to

October. As a Peerless Sell signal in these months, it would reinforce the validity

of other signals. So, I think it should be added. (Cognoscenti is my contribution to

the English language.)

When To Go Away in May

But as a Sell signal now, only two days unchanged cannot be reliably used.

The two April cases ahown below, 2011 and 1989, are warnings it can completely

fail in this month.

Here are the past cases since 1965 when the DJI changed less than 0.035% as on Friday and

the following conditions were also true, as on Friday: 1) The DJI was up more than

4% over

the last 65 trading days; 2) the DJI closed more than 1.7% above its 21-day ma and

3) the V-Indicator was negative.

2-Day Cognoscenti Sell S8s

November-April

May-October

-----------------------------------------------------------------------------------------------------------------------------

4/12/2013

3/19/2013 DJI continued to rally

3/12/2013 DJI continued to rally

1/5/2013 DJI continued to rally

12/21/2012 DJI continued to rally

May 2, 2011 Perfect sell before drop below LB

4/11/2011 DJI continued to rally

2/2/2011 DJI continued to rally

1/25/2011 DJI continued to rally

June 8, 2009 Perfect sell before drop below LB

May 10, 2006 Perfect sell before quick sell-off

1/4/1999 DJI rose and then fell only to lower band.

July 17, 1990 Perfect sell before bear market

4/17/1989 DJI continued to rally

October 5, 1987 Perfect sell before bear market

2/5/1986 DJI continued to rally.

1/9/1984 Excellent Sell before bear market.

11/23/1983 DJI fell to lower band.

September 21, 1979 Perfect sell before mini bear.

May 30, 1972 Perfect sell before quick decline.

12/9/1970 DJI continued to rally.

4/15/2013 ---> To

Key Index and Leading Stock Charts

---> 69 MAXCP stocks Bullish

MAXCP Stocks (4/15/2013) Bearsh plurality

---> 54 +16

MINCP stocks Bearish MINCP Stocks

(4/152013)

--->12 New

Highs on NASDAQ 39 new lows. Bearsh

plurality

--->133 New Highs on NYSE 81

new lows. Bearsh plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

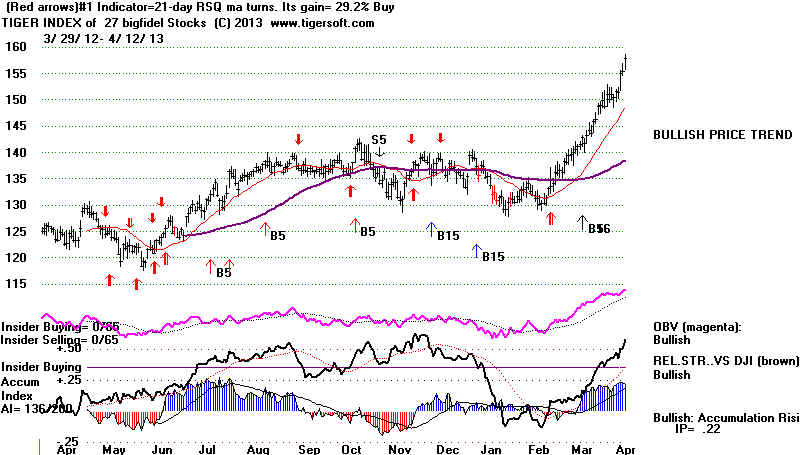

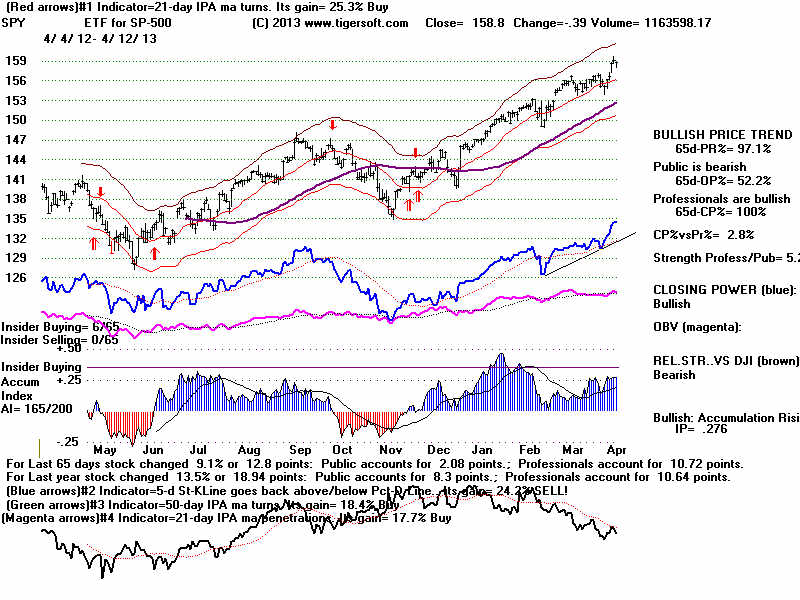

4/12/2013 The advance in the DJI-30

was stopped "cold" on Friday.

It was virtually unchanged for the day. This Is Not A Good Sign. A third

straight day without a .1% change would be bearish, if we judge from

the past tops when this occurred, most notably in early October 1987.

I have been working on an improved Sell S8 based on three straight days

where the DJI moves less than 0.1% after a long advance. The details

appear at the bottom of this hotline. For now, the rally in

high priced, high

caps will probably continue. That should boost DIA and SPY.

Will the DJI reach 12500 so Wall Street can celebrate?

It might be a hollow victory. I don't see how the DJI or SP-500 can rise

another 10% without a pause. The bullish MAXCP

stocks are already

up a long ways already. Mostly the safest, highest priced, institutional favorites

rose Friday. HD, our Tahiti stock, jumped 1.72.

The high-priced Biotech stocks

were the most bullish. AMGN, BIIB and REGN each added 3%. Is

this because

they

hope that the Supreme Court will grant patent rights to the human genome sequence?

See below how well Fidelity' biggest positions are rising. Clearly, the advance has

become

a defensive and blue-chip rally.

(Factors favoring big companies.)

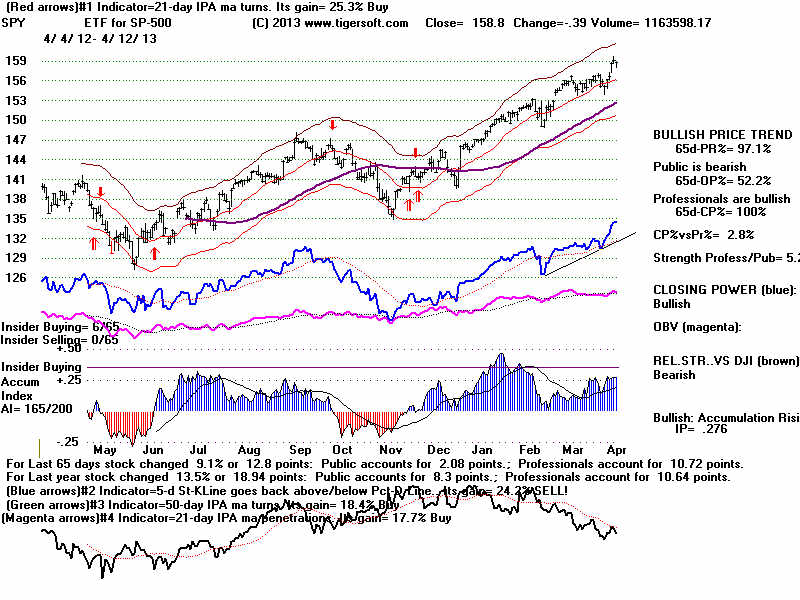

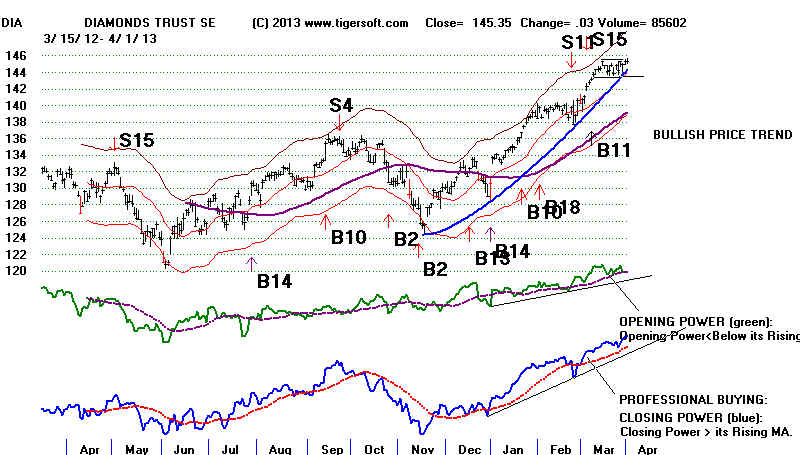

All this is normal in the late stages of a bull market. It is still bullish for DIA

and SPY.

But what will happen when even blue chips are not considered safe enough to still buy?

A lot depends on the whether Austerity wins out here in America. We have seen

what it did to Europe. Right now, the world' stock markets are stuggling to

stay

above their longer-term 200-day ma. Without a wealthy middle class in the US,

it's not clear who will buy what is made.

I

hope I'm pleasantly surprised by the DJI cracking through 15000.

Certainly, for now,

it's true that the A/D Line and the Closing Power are

rising. Another bullish sign for now,

Non-Confirmations of

new highs by the P-Indicator will not be reliably bearish until May.

See Sell-S5. The most

bullish sign now is that professional shorts are nervous. They

seem to have stopped

shorting stocks on weakness, apart from mining stocks. The result

is we have no new short

sale candidates among the Bearish MINCP Stocks.

But realistically how

much higher can stocks, as a whole, rise in three more weeks?

The P-Indicator is

weakening. We may even see a Sell S9 if the DJI is at the 2.5%

upper band and the

P-Indicator becomes negative. So, I can certainly understand if you

decide to take some profits

at 15000 and choose to wait for a pullback to buy.

2 Straight and 3 Straight Days When The DJI Is Unchanged.

There's another more

pressing, scary development. The DJI was essential unchanged

Friday from Thursday.

Rounded off, it closed at 14865 both days. Is this a secret sign

among professionals

that something significant is about to happen?

Paranoia aside, I

have found that an essentially unchanged DJI for two or three days

is often quite bearish.

Two days in a row with almost no change also can be an

important turning

points, too.

Examples:

2/21/1945

5/31/1946 perfect Sell before 24 % DJI decline.

2/10/1947, 7/16/1947, 4/30/1951, 11/16/1956, 3/16/1956, 11/20/1959, 7/8/1959,

8/8/1961, 10/21/1969 (a month before start of 1968-1970 bear market.

5/20/1972, 10/3/1979, 8/23/1984, 10/5/1989, 1/3/1989, 7/18/90... (to be studied more.)

But by itself, it is

not reliable enough to be a Peerless Sell signal. There are too many cases

where it fails.

Examples:

10/9/1945, 1/31/1946, 3/26/1946, 12/29/1951,

1/5/1951, 5/3/1954, 11/17/1955, 6/20/1955,

1/12/1959, 3/5/1959, 7/21/1967, 12/7/1971, 12/30/1971, 4/16/1975.

More important, a DJI that is unchanged for

three days is actually a very good sell signal.

I

first noticed that unusually low volatility can call a major top back in early October

1987.

Look how how close to

each other the three closings were just before the market fell 30%.

10/1/1987 2639.2

10/2/1987 2640.99 change +.000678

10/5/1987 2640.18 change - .000307

....

10/19/1987 1738.74

The 2007 top also showed a similar pattern:

7/17/2007

13971.55

7/18/2007 13918.22

7/19/2007 14000.41

Revised Sell S8

Three days in a row with such low volatility is unusual. Here

are the

cases going back to 1965 where the daily change is less than 0.1% and

the DJI is in a rising trend, along with the the outcomes. Red indicates a decline.

It seems best to not apply this rule in November, December, January or

February. As developed now, this signal would have been profitable in

11 of 13 cases, assuming that a paper loss of 3.4% would have been used.

This is much better than the current Sell S8 signal. There are more cases here

and this signal does not require the user to eliminate those cases where the

DJI is at an all-time high.

#1

9/28/2012 DJI fell from

13577.96 to 12588.31 on 11/16/2013 no paper loss

#2

5/3/2011 DJI fell from

12807.51 to 11879.27 on 6/15/2011 no

paper loss

#3

6/9/2009 DJI fell

from 8763.06 to 8146.52 on 7/10/2009 no

paper loss

(11/9/2004 DJI rose from 10386.37 to 10827.12 on 12/23/2005 )

(1/7/2004 DJI fell from 10529.03 to

10063.64 on 3/23/2004 2.0% paper loss)

#4

1/13/2003 DJI fell from

8785.98 to 7524.06 on 3/11/2003. no paper

loss

#5

7/28/1997 DJI fell from

8121.11 to 7161.15 on 10/2797 1.6% paper

loss

(2/25/1991 DJI went sidewise for 10 months.)

(The July 1990 top was close to this pattern: 2999.75, 2999.75, 2981.68)

#6

5/16/1990 DJI rose from 2819.68 to 2999.75 before

starting a bear market. 6.4% paper loss

#7

3/2/1988 DJI

fell from 2071.29 to 1941.48 on 5/23/1988. 1.7% paper loss

(2/24/1988 DJI fell from 2039.95 to 1941.48 on

5/23/1988. 3.3% paper loss)

#8

10/5/1987 DJI fell from 2640.18 to 1738.74

on 10/19/2007. no paper loss

#9

6/18/1987 reversed at a small

loss by Buy B4.

(2/5/1987

reversed at a small loss by Buy B4. )

(12/28/1986 reversed at a small loss by Buy B4.)

(12/20/1985 This fails, but Decembers are too bullish a month to use this signal.)

#10

8/22/1979 DJI fell from 885.84 to 796.67 on

11/7/1970. 1.7% paper loss

( 1/23/1967 Late Januaries are too bullish to apply the signal here.)

#11

4/17/1963 DJI fell to 687.8 on 7/23/1963. Paper

loss = 2.2%

#12

9/20/1955 DJI fell from 483.7 to 438.6 on

10/11/1955. Paper loss = 0.8%

#13

5/25/1948 DJI fell from 189.7 to 173.2 on 12/1/1948.

Paper loss = 1.8%

Key Values: DJI 14865 +0 la/ma= 1.019 21dma-roc = 0.335 P= +168 Pch= -49

IP21 = +.174

(on 1/30/2013 IP21 was .293) V =

-40 Opct = ..49

65 day-pct-up = .103

4/12/2013 ---> To Key Index and Leading Stock

Charts

---> 435 MAXCP stocks Bullish MAXCP

Stocks (4/12/2013) Bullish plurality

---> 54 +16

MINCP stocks Bearish MINCP Stocks (4/12/2013)

--->53 New

Highs on NASDAQ 15 new lows. Bullish plurality

--->103 New Highs on NYSE 26

new lows. Bullish plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

4/11/2013

Any Retreat Should Be Shallow. The Non-Confirmation of

the P-Indicator Is Not A Reliable Sell-S5 Signal in April

The odds favor higher prices by May. This is a run into

all-time high. The path of

least resistance is upwards. Sellers do not know where to bunch their

orders. The DJI, S&P-500, NYSE and now the QQQ have achieved bereakouts

above well-tested flat resistance. This is bullish and it also means support

must now be expected at the point of breakout. True, the round number 15000

could offer some resistance. But the NYSE A/D Line and Closing Powers have

confirmed the new highs. Seasonality now is good. The DJI advances70% of the

time over the next 21 trading days since 1965.

After 1945, market tops at this time in April bring only shallow declines of

4% to 5%

when there was a January take-off.

Here are the January take-offs since 1929:

1929, 1936, 1945, 1950,

1954, 1955, 1956, 1961, 1963, 1964, 1965, 1967, 1971, 1972,

1975, 1976, 1983, 1986, 1987, 1989, 1993, 1995, 1998, 1999, 2006, 2011, 2012

April peaks that bring declines of more than 4% following a January take-off

are not as common as those in May or June. But there are 9 cases. These

tops have occurred when the DJI was a low as 1.7% over the 21-dma while the

adjusted P-Indicator (P^^) was always below +203. We are far enough above the

21-day

ma now to match one of these peaks. But the current P-Indicator is +217 and the

current IP21 is +.16. The latter value is above all but one of the April tops below.

Two technical problems will be important in May. The first is the negative

V-Indicator,

The other is the P-Indicator is less than half what it was on its March peak. This

condition

could bring a Sell S5 from May to July, but not in April

See http://tigersoft.com/PeerInst-2012/-Sell-S5.htm

4/15/1929 Peak before longest,

deepest bear market in US history.

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.027 .795

+27

-17 +136

+.097. -175

.607 .149

--------------------------------------------------------------------------------------------------------------------------

4/6/1936 11%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.034 .236

-37

-1

-161 -.152

-249 .074

.107

--------------------------------------------------------------------------------------------------------------------------

4/26/1955 4%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.024 .448

+50

+8 +145

+.052 -75

.306 .081

--------------------------------------------------------------------------------------------------------------------------

4/6/1956

10%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.023 .669

+33

+4 +105

+.15

-98

.524 .071

--------------------------------------------------------------------------------------------------------------------------

4/29/1971

11%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.019 .574

+69

-14 +147

+.084

+1

.403 .085

--------------------------------------------------------------------------------------------------------------------------

4/18/1972 4%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.019 .327

-20

+4

-43 +.054

-1

.147 .064

--------------------------------------------------------------------------------------------------------------------------

4/21/1976 5%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.019 .345

-1

+15

-2 +.038

-1

.07 .067

--------------------------------------------------------------------------------------------------------------------------

4/18/1986 5%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.025 .348

`06

+8 +202

-.001

+2

.137 .168

--------------------------------------------------------------------------------------------------------------------------

4/6/1987

8%

la/ma

21dma-roc P-I

P-I ch.

P^^

IP21

V-I

Opct

65-pct change

1.039 .646

-2

+14

-3 +.187

+8

.524 .197

--------------------------------------------------------------------------------------------------------------------------

Key

Values: DJI 14865 +129 la/ma= 1.021 21dma-roc = 0.34 P= +217 Pch= +58

IP21 = +.15

(on 1/30/2013 IP21 was .293) V =

-27 Opct = .127

65 day-pct-up = .10

4/11/2013 ---> To Key Index and Leading Stock

Charts

---> 463 MAXCP stocks Bullish

MAXCP Stocks (4/11/2013) Bullish plurality

---> 38 +7

MINCP stocks Bearish MINCP Stocks

(4/11/2013)

--->111 New Highs on

NASDAQ 10new lows. Bullish plurality

--->235

New Highs on NYSE 4

new lows. Bullish plurality

====================================================================================

OLDER HOTLINES

====================================================================================

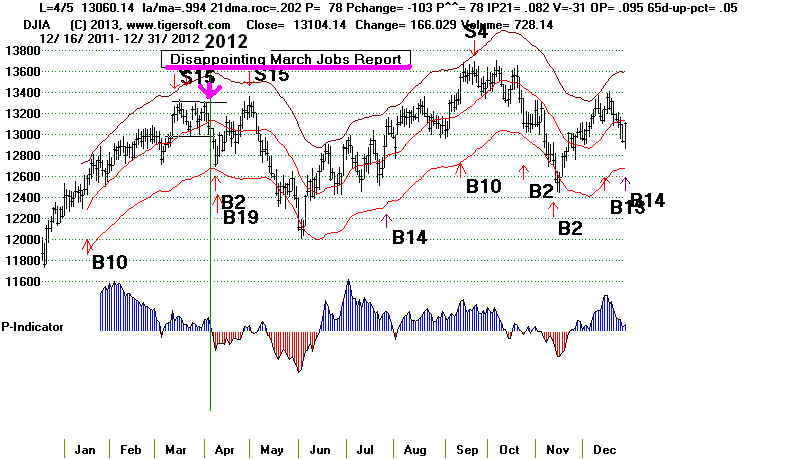

4/10/2013 There Were Good Reasons The Stock Market Was Not

Upset by Last Week's Jobs' Report and North Korean War Talk.

Key Values: DJI 14802 +129 la/ma= 1.018 21dma-roc = 0.291 P= 158 Pch= +64

IP21 = +.15 (on 1/30/2013 IP21 was .293) V = -38 Opct = .133 65 day-pct-up = .093

Important: The 3.8% paper loss on the Sell S15 of March 7th when the DJI was at 14329

would now be above the 3.4% stop loss limit suggested for S15s, as last edited on 3/17/2013.

We have already closed out nearly all our short positions on the Tiger Stocks' Hotline and

would hold long mostly "bullish: ranked high capitalization stocks showing AI/200 scores

above 165.

4/10/2013 ---> To Key Index and Leading Stock Charts

---> 390 +125 MAXCP stocks Bullish MAXCP Stocks (4/10/2013) Bullish plurality

---> 31 -6 MINCP stocks Bearish MINCP Stocks (4/10/2013)

--->132 New Highs on NASDAQ 8 new lows. Bullish plurality

--->216 New Highs on NYSE 3 new lows. Bullish plurality

Important: The 3.8% paper loss on the Sell S15 of March 7th when the DJI was at 14329

would now be above the 3.4% stop loss limit suggested for S15s, as last edited on 3/17/2013.

We have already closed out nearly all our short positions on the Tiger Stocks' Hotline and

would hold long mostly "bullish: ranked high capitalization stocks showing AI/200 scores

above 165.

4/10/2013 ---> To Key Index and Leading Stock Charts

---> 390 +125 MAXCP stocks Bullish MAXCP Stocks (4/10/2013) Bullish plurality

---> 31 -6 MINCP stocks Bearish MINCP Stocks (4/10/2013)

--->132 New Highs on NASDAQ 8 new lows. Bullish plurality

--->216 New Highs on NYSE 3 new lows. Bullish plurality

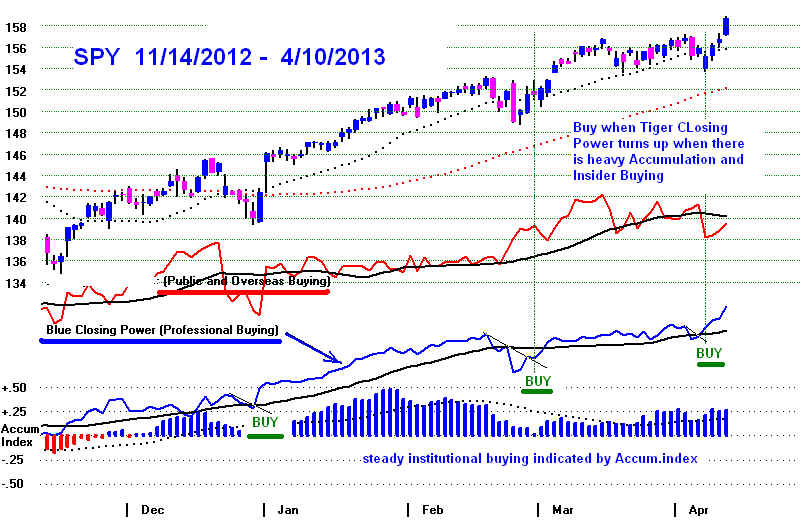

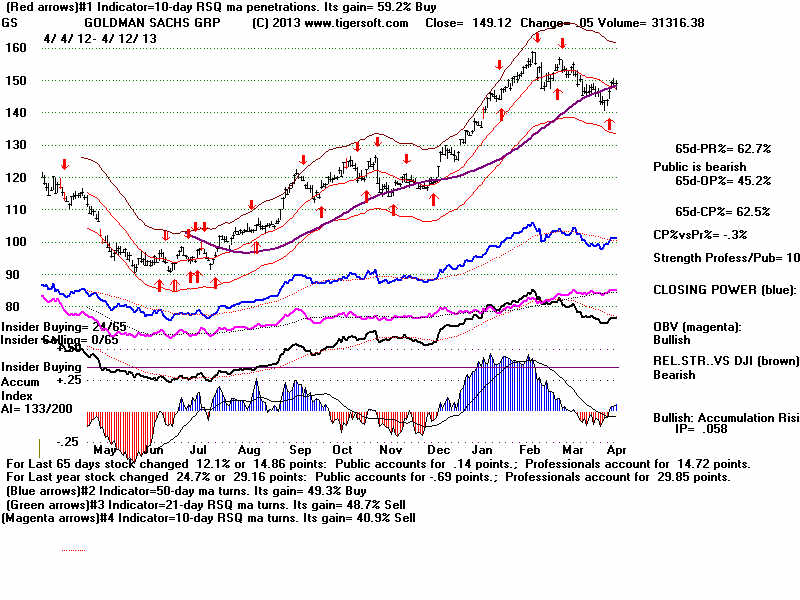

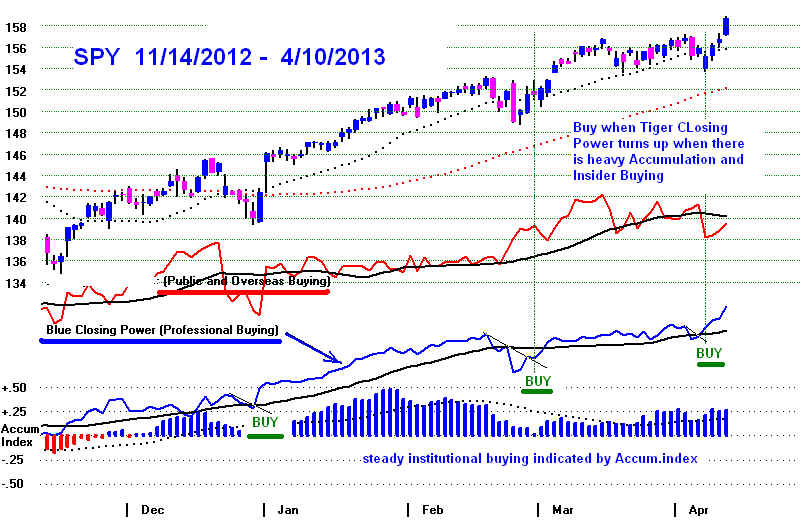

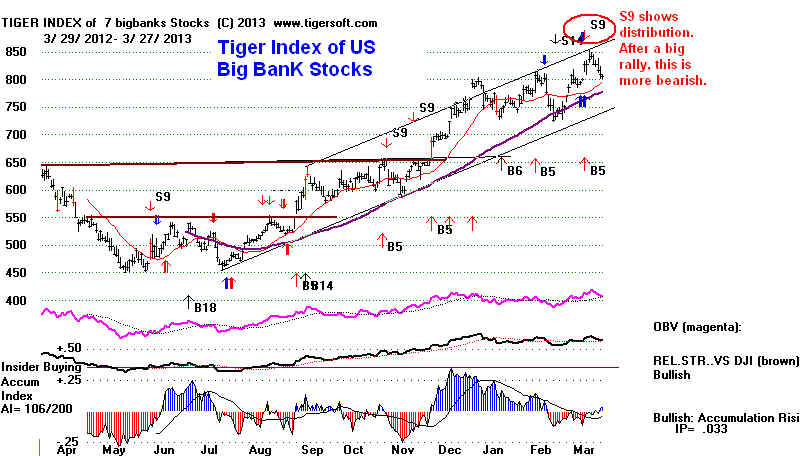

Surprise. Surprise. Big Banks got

the Bullish FED Minutes a day early.

That's why the Closing Power turned up! And they want to privatize

social security! They say they want to police insider trading!

Keep watching Tiger's Closing Power. With it you can trade as an equal.

Professionals Aren't Selling and We Shouldn't Either.

Breadth Expanded Nicely Today. Helped by soaring

high-priced

biotechs, like AMGN and CELG,

the NASDAQ made a new high today, too.

Clearly, the FED wants the Market up on April 15th so that tax payers will have lots of

money to send to Washington.

The high caps that Fidelity has the most confidence in are doing well

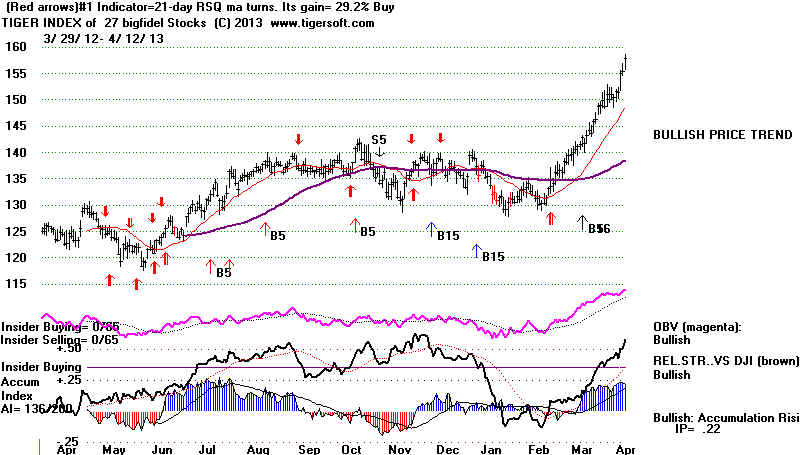

as a whole. These are the BIGFIDEL stocks. The "Tahiti" stocks in

this

group can be traded profitably using the Closing Power trends. The highest

AI/200 stocks in this group are:

AI/200 Opening Power Closing Power Price

MACD Signal

-----------------------------------------------------------------------------------------------------------

TM Toyota

174 Up

Up

108.8 Buy

HMC Honda

173

Down

Up

38.96 Buy

HD (Home Depot) 161

Down

Up

71.69 Buy

UTX (United Tech) 155

Up

Up

95.18 Buy

The DJI,

SP-500 and our BIGFIDEL Index accelerated their run in all-time high territory.

What was behind it?

Not so much earnings as the latest FED minutes showing that a

clear majority of

voting FED members are still in the Bernanke camp and do not see a

reduction in the QE-III

strategy for months. Professionals like this.

What's Behind The Rally?

The

Wall-Street-Washington Connection Has Grown Even Closer.

The stock market is up

127% since March 2009. But real, not official, unemployment is

probably 13%.

Most new jobs are low-paying. 14% of all Americans now rely on Food

Stamps.

Millions of young

people have no real way to pay back their expensive college loans.

Health insurance costs

and medical bankruptcies keep making new highs. Yet despite all this,

Obama and his advisers

still believe that creating a Wall Street boom is the best way

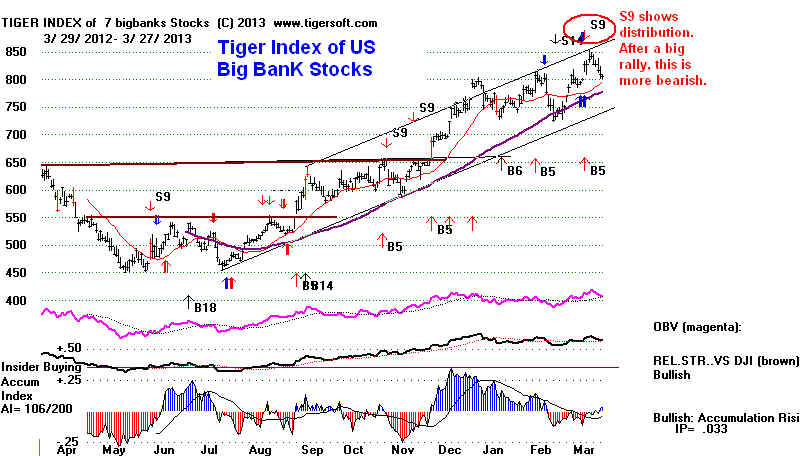

to fix what ails Main

Street. Wall Street is very grateful about Obama's loyalty to them

rather than his own

supporters.

Don't be fooled by

Obama being a Democrat. Wall Street has grown to love this man,

even if they dare not

say this in front of wealthy donors to Romney and other Republicans.

From

2009 to 2011, the top 1% got 121% of the entire income growth in the US. The

other

99% saw incomes decline. Obama has rekindled Wall Street's appreciation of

his Presidency by his

budgetary stance this week, It is clearly to the right of President

Nixon, who never

attempted to take away seniors' Social Security or Medicare. It is

to the right of Paul

Ryan's budget. Both Progressives

and many Republicans

expressed "shock"

that Obama would take

away future Social Security and Medicare benefits from seniors.

Defenders, of course,

say that Obama is just being "pragmatic" in the new age of

"austerity",

something which

he has wholly embraced, just when Europe is starting to wake up to how

horrible this policy is when

unemployment is already high.

Progressive critics suggest

that Obama will once again demoralize his base just in time for the

2014 mid-term elections, much as he

did in 2010; that he is a lot more"Ivy League" than

community organizer, way too

academic and hopelessly out of touch with the economics

of the lives of most working and

retired people.

Whatever you think, Wall

Street, I want to emphasize, is extremely happy with his swing

to the right on this and on the

Keystone Pipeline. Rhetoric aside, he is their ally.

He is no FDR. He and

his advisors are "trickle-downers", free marketers

and definitely not fervent

supporters of financial regulation. Real unemployment

is probably more than 13% but Obama and

his advisers still believes that a Wall Street

boom will benefit Main

Street. This has been the hidden message of our rising

Closing Power since March

2009. Now the DJI seems headed for 15000, and all the

splashy headlines it can get, to

draw in more new investors.

Smaller Social Security Payments Would Increase

The Public's Playing of Wall Street

Some take Obama's

betrayal of seniors a step further. Listen

to Bill Black

"The

Grand Betrayal Has Arrived". Is this the start of a new effort to privatize

Social Security?

Wall Street would love that!

Bullish Technicals

Bullish Seasonality,

powerful momentum, steadily positive Accumulation and excellent breadth

have all done in our

Peerless March, volume-based Sell S15. The Hotline and our write-up

on Sell S15s soon

afterwards have tried to prepare readers for this development. The next

version of Peerless

will disallow Sell S15s when

the P-Indicator is above +175 and the 65 day

percent change is above

.0875. The research I am doing now on Sell S1s, S2s, S3s, S4s

and Sell S5 all point to the

importance of not making too much of Sell signals in February,

March or even April

after a January take-off. Most of the time, the first intermediate-term

top comes in May or

early June.

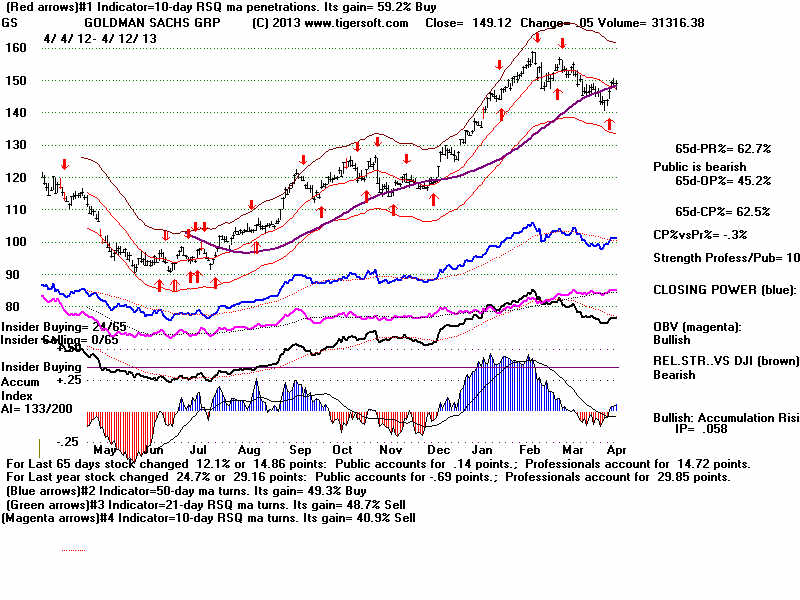

So Many Bearish-Looking Leveraged

Short ETFS

I learned another thing

from the market of the last few weeks: that the appearance among

the Bearish MINCP

stocks of so many leveraged short ETFs must be considered very bearish.

Tonight 7 of the 10

bearish MINCP stocks are leveraged short ETFS:

SKF, SH, SPXU, SRS, DXD, DUG, DOG

Two of the remaining 3

were counter-cyclical ABX ( the world's biggest

gold stock)

and FXY (the ETF for the falling Japanese Yen. So,

Professionals are closing out

many of their shorts,

apart from Gold. Goldman Sachs

predicted further declines

in

gold and silver.

We also see

Professional Short Covering in the rebound from well-tested price support

in the Tiger Index of

the Most Heavily Shorted Stocks.

I will start showing

them and report this bullish situation, instead of discarding their charts

as an annoying

interference in my quest for the perfect stock to sell short. Look and

see if you don't agree

that many of the leveraged Short ETFs now come close to our

view of what the ideal

short sale looks like.

====================================================================================

OLDER HOTLINES

====================================================================================

4/9/2013 Key Values: DJI 14673 +60 la/ma= 1.01 21dma-roc = 0.227 P= 94 Pch= -25

IP21 = +.157 (on 1/30/2013 IP21 was .293) V = -49 Opct = .127 65 day-pct-up = .087

4/9/2013 ---> To All Key Index and Leading Stock Charts

---> 265 -24 MAXCP stocks Bullish MAXCP Stocks (4/9/2013) Bullish plurality

---> 37 +2 MINCP stocks Bearish MINCP Stocks (4/9/2013)

--->43 -2 New Highs on NASDAQ 13 new lows. Bullish plurality

--->90 -50 New Highs on NYSE 5 new lows. Bullish plurality

4/9/2013 It's

Still Too Early To Sell Out.

Flat top breakouts from patterns like the DJI and SP-500 show

reliably bring runs upward. They are at the top of their patterns.

But watch the P-Indicator now. It has been positive now 91 straight days.

If that positive streak reaches 105, then its turning negative would

bring a Special Peerless Sell S9.

See http://tigersoft.com/PeerInst-2012/SellS9.htm

The P-Indicator is now +94. It fell by 25 today. So, weak breadth

in the next two weeks will make the P-It decline more. It is possible that the

it might be negative when the DJI next closes above the 2.3%

upper band. That would probably bring a Sell S9. The DJI now

stands 1.1% over the 21-dma.

The advance is clearly narrowing. See how the NYSE A/D Line did not confirm

the DJI's nominal new closing high today. The P-Indicator is less than

half its level on the previous peak. At the upper 2.7%-3.5% band this type of

non-confirmation from May to August would likely bring a Sell

S5. But

usually, apart from S9s, we do not see tops this early in the year. See

the evidence I presented recently here about this.

The narrowing of the market may reach the point where the DJI

could soon run up to the 3%-3.5% upper band and still find the P-Indicator

negative or nearly so. That would bring a normal Sell S9. Both

normal and

Special Sell S9s can occur in April. There have been 9 April Sell S9s.

In 4

of these 9 cases, the paper loss was between 3% and 4.9%. So, even

a Sell S9 might not immediately stop the market from rallying. We have

enough cases of April Sell S9s to make it worth while to list and study them.

April Sell S9s

Peerless Date DJI Pct. Reversing Date DJI Pct.

Signal Gain Signal Gain

--------------------------------------------------------------------------

Sell S9 4/18/1929 311.9 27.0% *Buy B16 11/13/1929 198.7 35.1%

4% paper loss Gain = +2.5%

LA/MA ANNROC P-I IP21 V-I Opct

1.024 -.219 -60 +.01 -710 -.131

------------------------------------------------------------------------

Sell S9 4/11/1934 105.2 4.5% Buy B9 4/30/1934 100.5 -1.5%

1% paper loss Gain = +4.5%

LA/MA ANNROC P-I IP21 V-I Opct

1.020 +.117 +33 +.016 -17 +.208

------------------------------------------------------------------------

Sell S9 4/14/50 215.38 -1.6% Buy B4 8/9/50 216.9 6.2%

4.2% paper loss Gain = +6.4%

LA/MA ANNROC P-I IP21 V-I Opct

1.026 .443 -28 -43 .022 -189 .404

------------------------------------------------------------------------

Sell S9 4/30/69 950.18 24.4% Buy B8 1/27/70 763.99 1.8%

1.9% paper loss Gain = +19.0%

LA/MA ANNROC P-I IP21 V-I Opct 65day Pct Change

1.025 .189 -30 +11 -66 .083 -1 .138

------------------------------------------------------------------------

Sell S9 4/6/72 959.44 2.5% Buy B2 5/2/72 935.2 3.2%

No Paper Loss Gain = +5.7%

LA/MA ANNROC P-I IP21 V-I Opct

1.023 .483 -2 .087 0 .237

------------------------------------------------------------------------

Sell S9 4/1/82 833.24 6.7% Buy B8 8/11/82 777.21 36.0%

3.4% paper loss Gain = +6.7%

LA/MA ANNROC P-I IP21 V-I Opct

1.026 .265 45 .004 0 .135

------------------------------------------------------------------------

Special Sell S9 4/29/86 (P-I turns negative after being positive 100 days.)

1825.89 -0.1% Buy B9 7/9/86 1826.07 0.5%

No Paper Loss Gain = +3.6%

LA/MA ANNROC P-I IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

------------------------------------------------------------------------

Sell S9 4/6/87 2405.54 7.7% Buy B17 5/19/87 2221.28 5.9%

No Paper Loss Gain = +5.2%

LA/MA ANNROC P-I IP21 V-I Opct

1.039 .646 -2 .187 +8 .27

------------------------------------------------------------------------

Sell S9 4/22/97 6833.59 -4.9% Buy B4 5/9/97 7169.53 10.5%

4.9% paper loss Loss = 4.9%

LA/MA ANNROC P-I IP21 V-I Opct

1.03 .141 + 2 -.025 -17 .058

------------------------------------------------------------------------

High Cap Strength

For now, the Closing Powers for DIA and SPY

are still rising . The Accumulation levels

with these ETFs suggest there is ample

underlying support tohold the market up,

barring a sudden outbreak of fighting in Korea.

I take the lagging IWN and Value Line to be signs

that public speculation in more unseasoned stocks

has been put in a holding pattern presently.

Dividend-paying high caps are favored even

though many look over-bought. This is now

a defensive rally. Considering CNN's scary war talk

and the weakness in the economy here and overseas,

the DJI's strength keeps surprising the many

pundits who say a Crash is near.

=====================================================================================

OLDER HOTLINES

=====================================================================================

4/8/2013

The A/D Line and Closing Power Uptrends are

bullishly rising.

So is seasonality. Usually intermediate-term declines of more than 5%

do not start until late April at the earliest after a January take-off like

we have just seen. It is normal for the blue chip DJIA to keep making

new highs even after the A/D Line starts to visibly lag. The A/D Line's

non-confirmations seem minor so far. And NYSE breadth was quite good

today.

Another thing: the market seems to be holding well despite a lot of bad

economic news. That is a good sign, too. Here are some stock trading

concepts and specific ideas for this environment.

One of the tricks now is to focus more on the highest Accumulation (AI/200)

institutional favorites as long as their Closing Powers are rising or turn up

after the stocks test price support, preferably the rising 65-day ma. The longer

term positive Accumulation lends hope to the idea that these stocks will

find ready buyers if they should fall back to support.

I applied the Power Ranker to the FIDSTKS (Those that Fidelity Sector funds

have the biggest positions in.) and the best performing sectors now:

Home-Builders, Reits

and now Pipelines.

See the stocks I found in this pursuit. As

always, flat topped breakouts in these

stocks make excellent short-term trades. Watch FSP

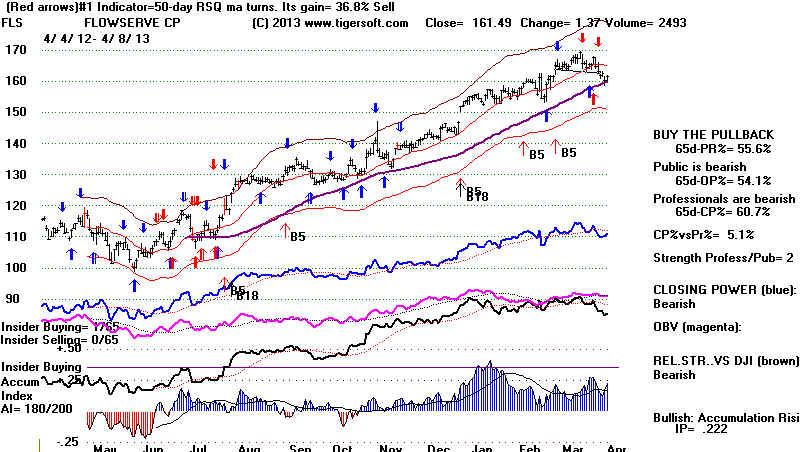

and COR

in this connection. Two of the high Accumulation stocks that seem to

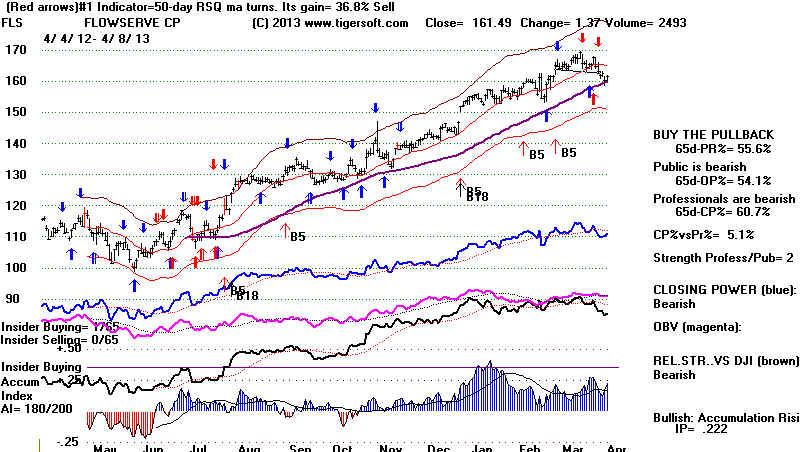

have successfully tested their 65-day ma are FLS (below) and NBL.

I have been suggesting selling short as hedges the

weakest stocks whose

Closing Powers show Professionals are aggressively selling. Consider

sector weakness, too, when selling short. Private Education and Gold stocks

have been among the weakest sectors for some time. Until their Closing

Powers break their downtrendlines, I would keep shorting them. But at some

point, Professionals will start covering them and we should, too. APOL

look like a good short sale now, having just broken below another minor

support level.

AAPL shows the bad things that can happen when the outlook clouds

up for

a heavy instititional favorite. In this vein, we might want to look at the weakest

stocks in BIGFIDEL, the 27 biggest Fidelity long positions. Right now, except

for AAPL, none are below their 65-day ma support and also show an AI/200

score below 100 and bearish Closing Power Sell S7s divergences from price.

QCOM (below) does show a head/sh0ulders pattern like

AAPL did at the top.

but QCOM's support at 64 recently held. With these Tiger Sell S7 divergence

stocks, we have to wait for a violation of the 65-day ma support to become

bearish enough to actually short them. Often they are heavily shorted already,

so that weakness to price support invites short-covering.

Another trick is to use my "rule

of 10" with stocks that fall steadily for 6

months

and then drop quickly from 14 below 10. This often brings a short-term selling

climax

which then allows a stock bought immediately between 8 and 9 to rally in days back

to 12, for a very nice trading profit. I would not hold the stock long in

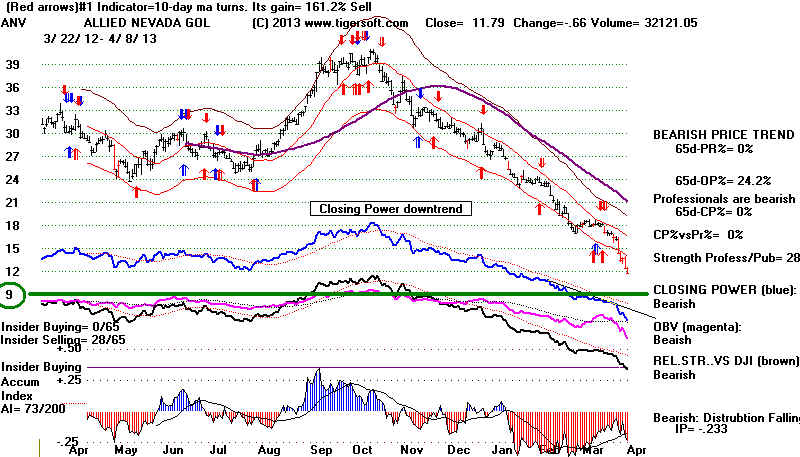

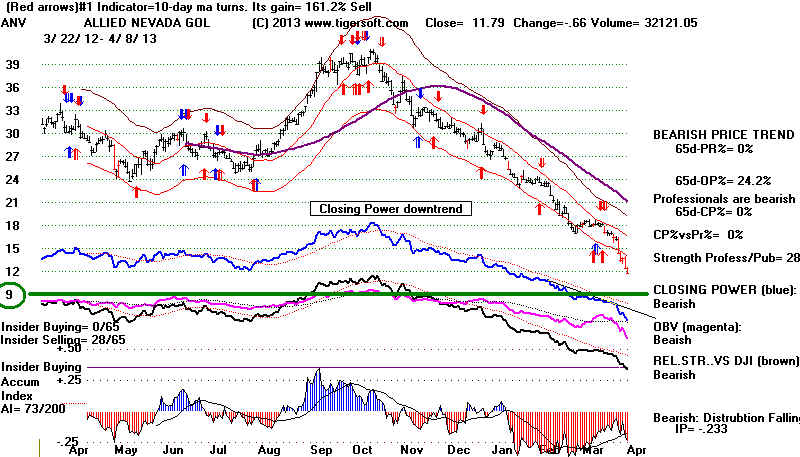

expectation

of a bounce, if the stock closes below 7.5. ANV is the stock I'm watching now to

apply my "rule of 10" too. You might recall that I mentioned ANV as the

domestic

gold producer that I would watch for a reversal which would be a sign that other golds

might also be good to buy. Only the first dip to 8-9 should be used for buying.

4/8/2013

Key Values: DJI 14613 +48 la/ma= 1.007 21dma-roc = 0.223 P= 117 Pch= +30

IP21 = +.195 (on 1/30/2013 IP21 was .293) V = -56 Opct = .147 65 day-pct-up = .082

4/8/2013

---> To All Key Index and Leading Stock Charts

---> 289 +91 MAXCP stocks Bullish

MAXCP Stocks (4/5/2013) Bullish plurality

---> 35 +2 MINCP stocks Bearish MINCP Stocks (4/5/2013)

--->45 New Highs on

NASDAQ 14 new lows. Bullish plurality

--->140

New Highs on NYSE 7 new

lows. Bullish plurality

====================================================================================

4/5/2013

Until There Is A New Peerless Sell, Seasonality Argues That

The DJI Will Hold Up and A Bigger Decline Will Be Averted.

That

Would Change if The NYSE A/D Line Uptrend and Closing

Power

Uptrends Are Violated.

4/5/2013 Key Values: DJI 14565 -41

la/ma= 1.004

21dma-roc = 0.221 P= 87 Pch= -24

IP21 = +.131 (on 1/30/2013 IP21 was .293) V = -53 Opct = .136 65 day-pct-up = .10

4/5/2013

---> To All Key Index and Leading Stock Charts

---> 198 +110 MAXCP stocks Bullish

MAXCP Stocks (4/5/2013) Bullish plurality

---> 33 -142 MINCP stocks Bearish MINCP Stocks (4/5/2013)

--->22 +4 New Highs on

NASDAQ 15 new lows. Bullish plurality

--->64 -4

New Highs on NYSE 20 new

lows. Bullish plurality

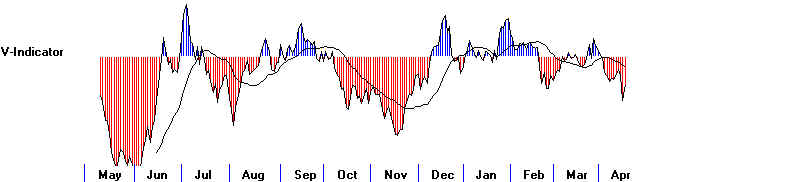

Is the decline over? Will there be a bigger market decline this month?

The A/D Line NCs show the advance is narrowing. This is normal as the

DJI approaches an intermediate-term top.

The NYSE A/D Line and Closing Power uptrends are still

intact. This is

bullish. If the Openings are not too weak, the markets should rally. SPY's

156-156.5 will be resistance. 153.5 is support.

Peerless is ambivalent, I admit On the hand, it gave a Sell S15 a month

ago.

That signal has not been reversed by a new Peerless Buy signal. And the paper

loss so far is still under 3.5%, the point where the paper loss is bigger than past S15s.

So orthodox Peerless users are happy with the decline and may still expect a test

of 14000, the rising 65-dma or the lower band.

But, as I have emphasized, momentum and breadth were unusually strong when

the signal occurred, thereby casting doubts about the Sell S15. Major Sells

usually must wait until May or later following a January take-off.

How about the A/D Line Non-Confirmation? Isn 't that bearish? After the Sell

S15,

the DJI rallied to a closing high of 14662 on April 2nd. That DJI closing high was

widely unconfirmed by the other indexes and the NYSE A/D Line. Studying old

charts, I have to conclude that A/D Line NC's by themselves do not reliably produce

a decline to the lower band. This can be shown here.

This weekend I put into the programs a way to show the 40-day A/D NCs. Study them

below.

I suggest that the best way to use the A/D Line NCs for an intermediate-term investor

would be to wait for a Peerless Sell. There are just too many insignificant A/D Line

NCs,

at least, until May. (The next Peerless Update will let you display A/D Line NCs.

I have

recently made a number of improvements to B17s, S1s, S2s, S3s and S4s. More on this

later. )

Looking at the old charts, I would expect the A/D Line to start to lag much more

noticeably

before a major top. This is what happens typically happens after a January take-off

starting

in late April, May or later. There are only 3 exceptions, 1976, 1986, and 1987.

That makes the odds one in eight that there will be a 5% or more decline. (A

5%

drop by the DJI peak would take to about 13800.)

Here are the January take-offs since 1945.:

1945, 1950, 1954, 1955, 1956, 1961, 1963, 1964, 1965, 1967, 1971, 1972, 1975, 1976,

1983, 1986, 1987, 1989, 1993, 1995, 1998, 1999, 2006, 2011, 2012

Late March or early April peaks that bring declines of more than 5% when the the

market has been uptrending are rare.

4/6/1956

10%

3/24/1976

4%

3/27/1986

5%

4/7/1987

8%

Scary Unemployment Numbers

As if US austerity, falling overseas markets, rising imports from Japan and

North Korean threats of war were not enough tests of the stock market,

on Friday the market got a blast of very cold air about the real economy to wake

it up and bring it back for a few hours to, at least, a distant awareness of how

the rest of countryis faring.

The private sector is not creating enough jobs and the government sector is laying

off people. Yet the Unemployment number dropped .1%. Clearly, a lot of people

have given up finding regular work. Yet the stock market recovered from its lows

on Friday. For now, it seems the weak Labor Depratment's Unemployment data

is causing the FED to intensify its QE-III program to keep interest rates low.

See how rapidly the interest rate on the 10-year bonds has dropped in the last two

weeks. The view of many bond investors is that over-bought stocks are unsafe in

a weak economy and that the Fed will not be abandoning its program of buying

long-term mortgages anytime soon.

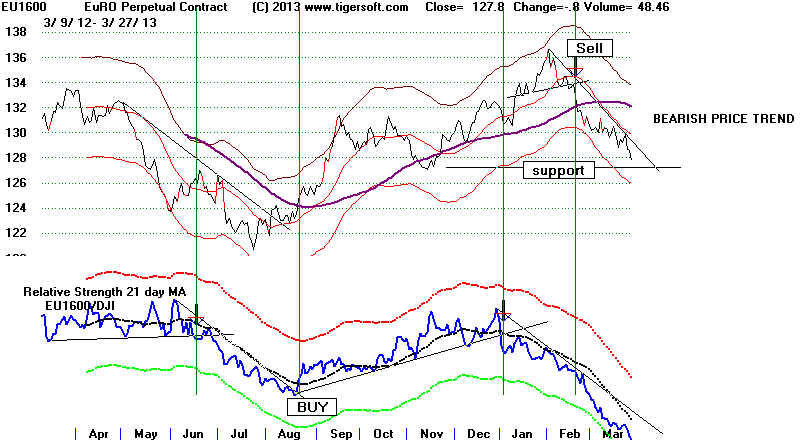

Falling Non-US Stock Markets

Falling Interest Rates

Japanese Yen free-Fall

I have doubts that interest rates can stay this low. The Tiger Index of Bond

Fund still show months and months of big money selling,

red Distribution

and a very weak Closing Power.

===================================================================================

OLDER HOTLINES

===================================================================================

4/4/2013

The Bull Market Is Straining To Stay

Up.

Watch how the Stock Market Reacts to the Unemployment

Numbers. Watch not just the changes in the Indexes,

watch:

1) The A/D Line,

2) the well-tested Parabolic Uptrendline,

3) SPY's Closing Power uptrendline,

4) NASDAQ New Lows versus New Highs

5) the Peerless key values: P-I, IP21 and the 21-dayma ROC.

4/4/2013 Key Values: DJI 14606 +56 la/ma= 1.008 21dma-roc = 0.290 P= 110 Pch= -34

IP21 = +.11 (on 1/30/2013 IP21 was .293) V = -42 Opct = .23 65 day-pct-up = .114

4/4/2013

---> To All Key Index and Leading Stock Charts

---> 84 MAXCP

stocks Bullish

MAXCP Stocks (4/4/2013)

---> 175 +12 MINCP stocks Bearish MINCP Stocks (4/4/2013) Bearish plurality

--->19 -1 New Highs

on NASDAQ 14 -15 new lows.

Bullish plurality

--->68

New Highs on NYSE 9 new

lows. Bullish plurality