TigerSoft and Peerless Daily

Hotline

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2013 William Schmidt, Ph.D. www.tigersoft.com

All

rights strictly reserved.

Tiger Software 858-273-5900

PO Box 22784 San Diego, CA

92192

Email william_schmidt@hotmail.com

----------------------------------------------------------------------------------------------------------------------

Important - This

site's addres will change Monday night.

Important - This

site's addres will change Monday night.

Look for an email from us giving the new address,

----------------------------------------------------------------------------------------------------------------------

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline,

order here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

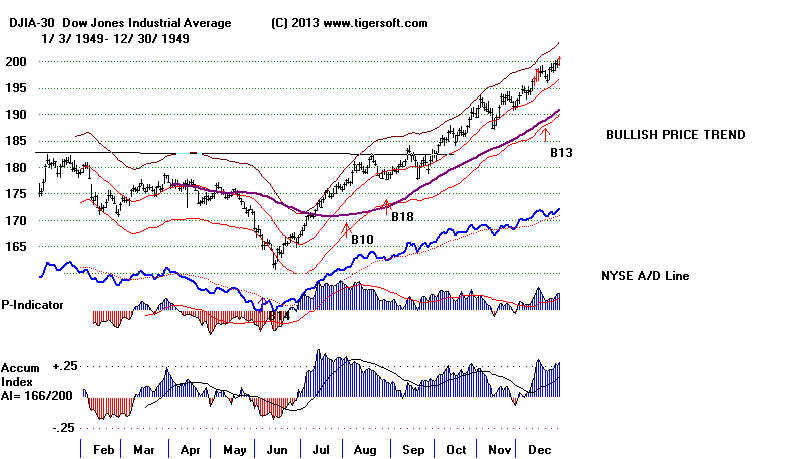

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

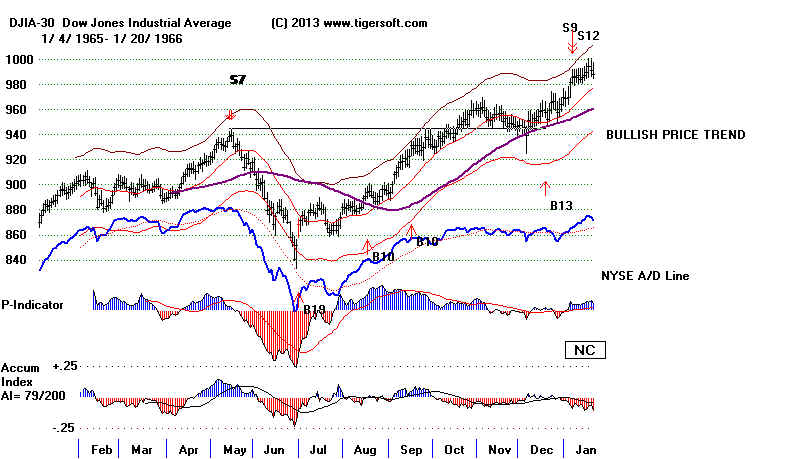

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969 1969-70

1970

1970-1 1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977 1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

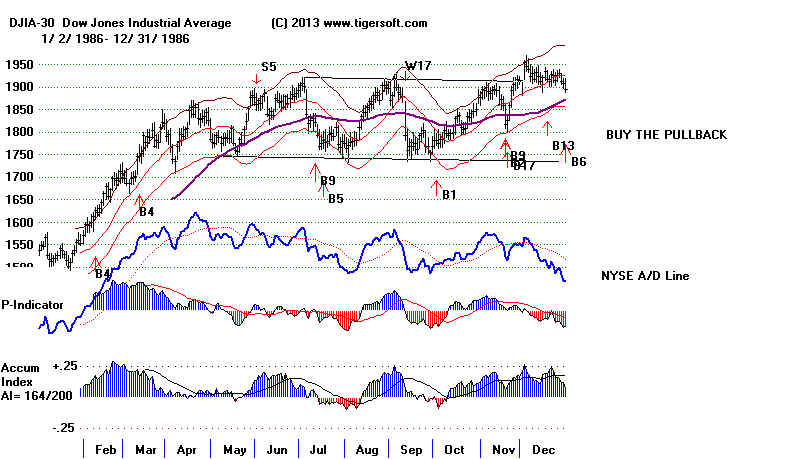

1986

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7 1997 1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009 2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

New 9/23/2013

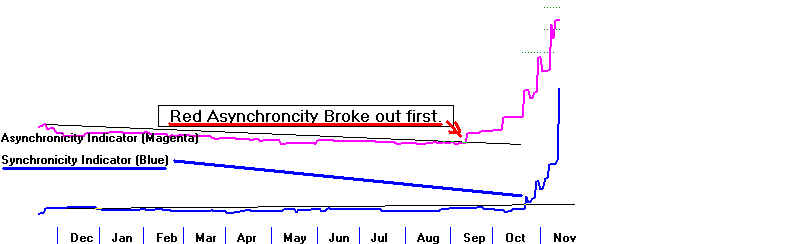

It's Usually Quite Bearish

When The Tiger IPA Makes A New Low ahead of The DJIA.

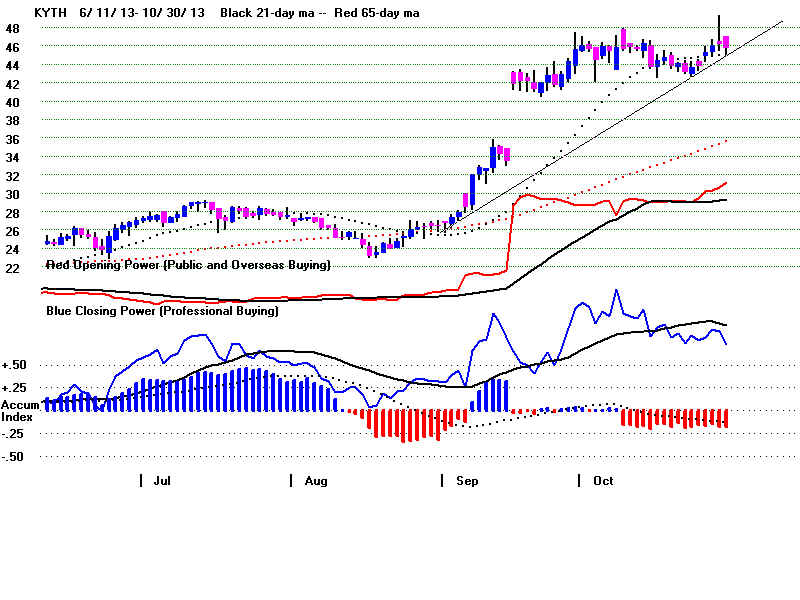

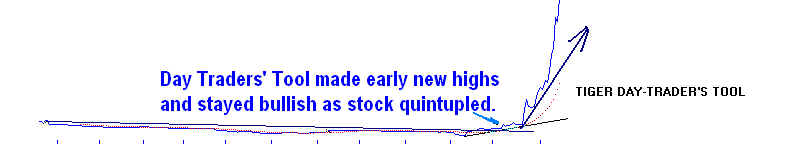

New 9/16/2013 Trading Low Priced Stocks Using

TigerSoft

New Introduction to

Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Documentation for TigerSoft

Automatic and Optimized Signals.

------------------------------------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------

11/22/2013

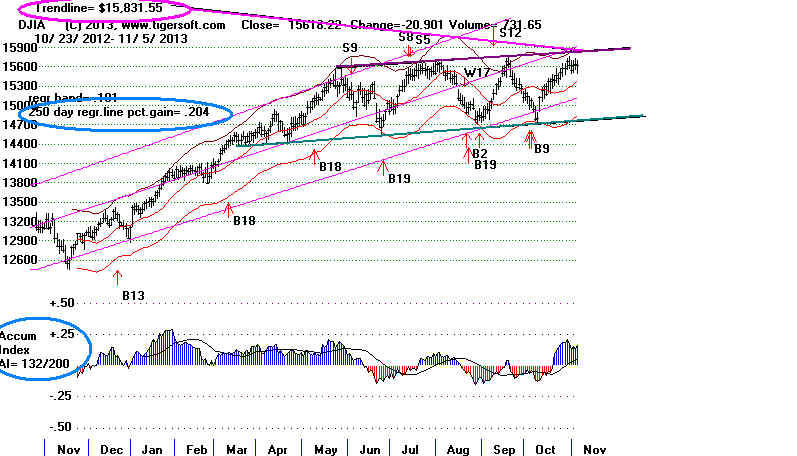

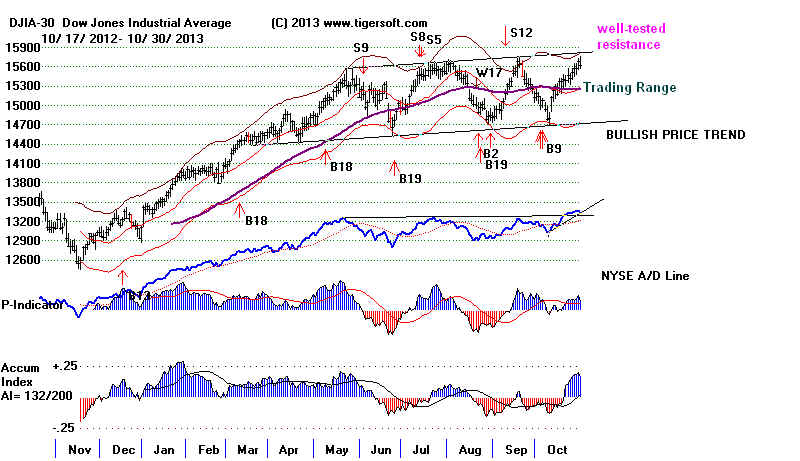

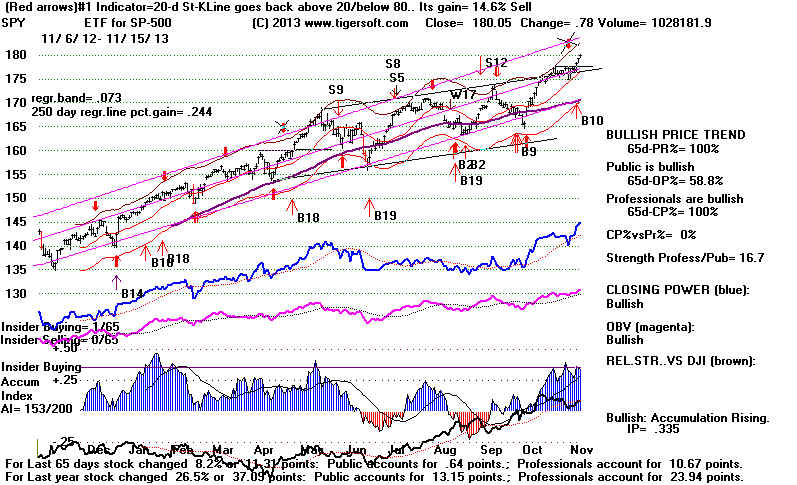

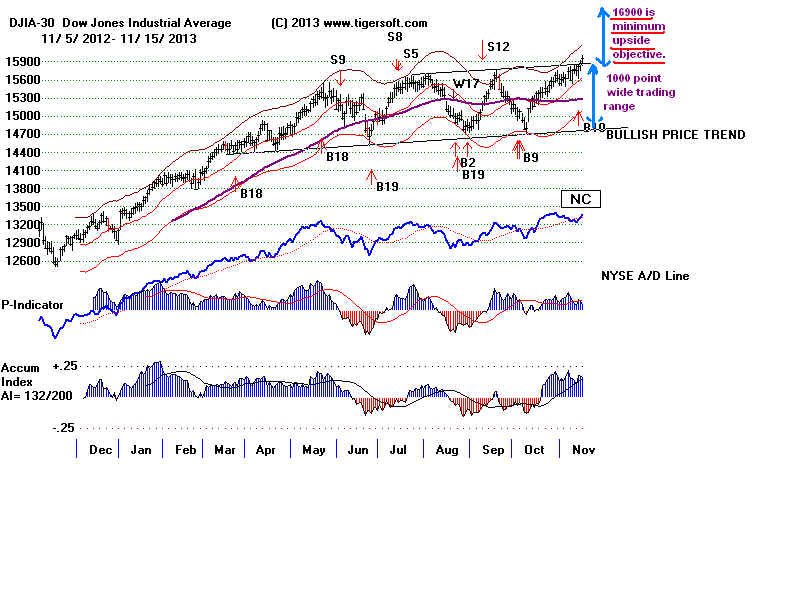

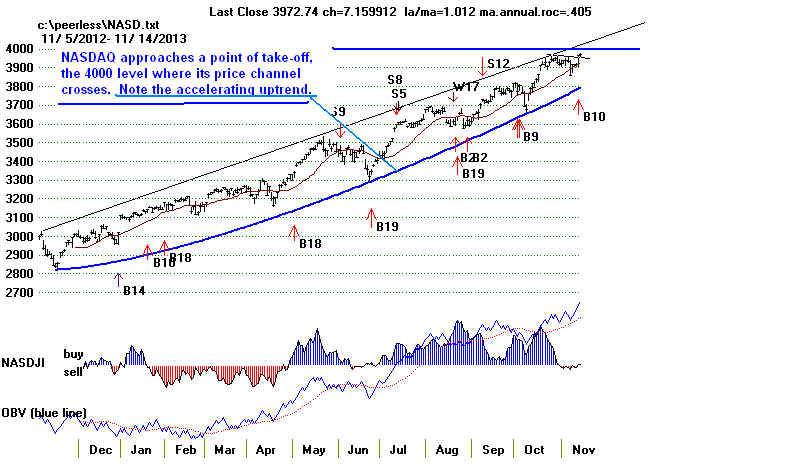

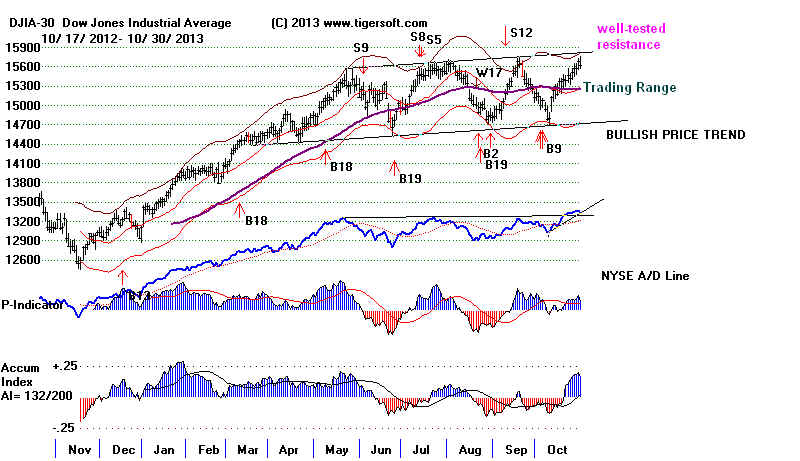

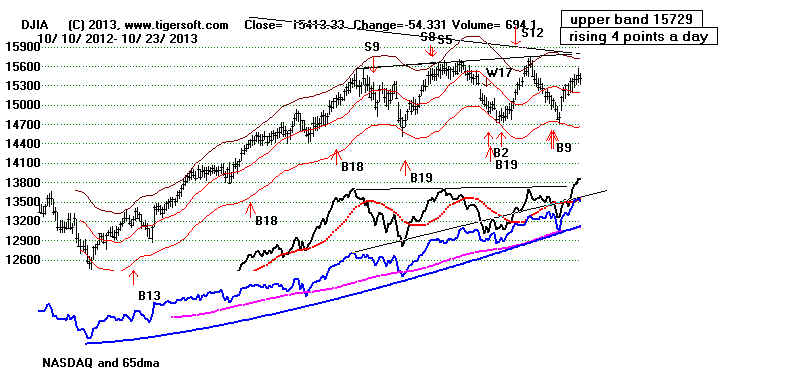

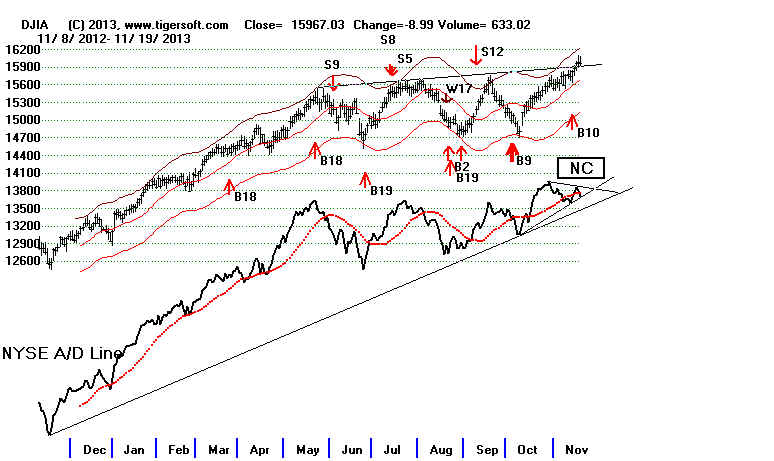

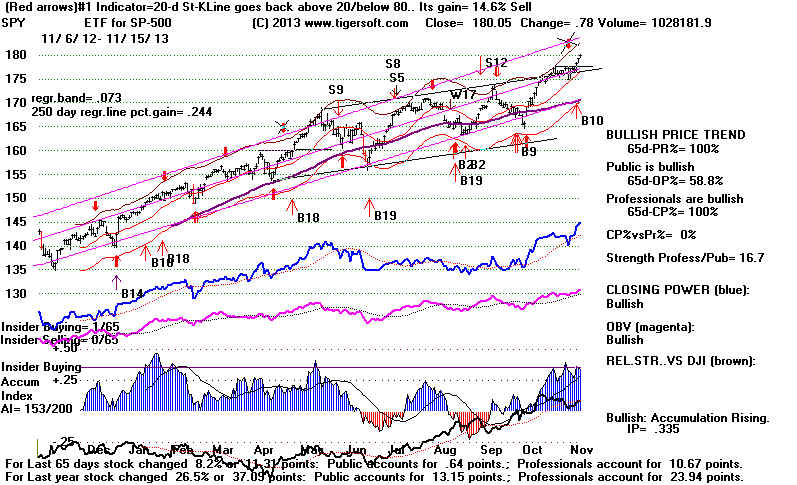

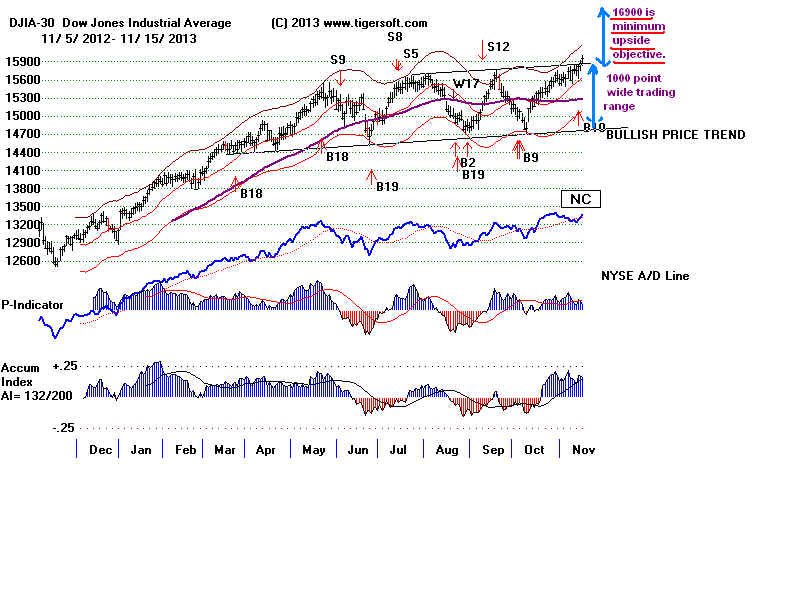

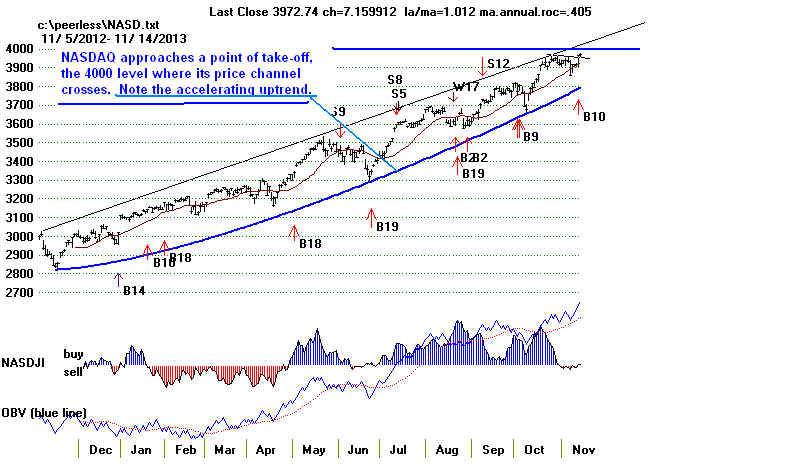

The Peerless Buy B10 sets

up an average Peerless goal of 16676.

The 1000 points' height

of the previous trading range gives technicians a classic way to

caclulate a minimum DJI upside target now of 16900. More

interesting to watch

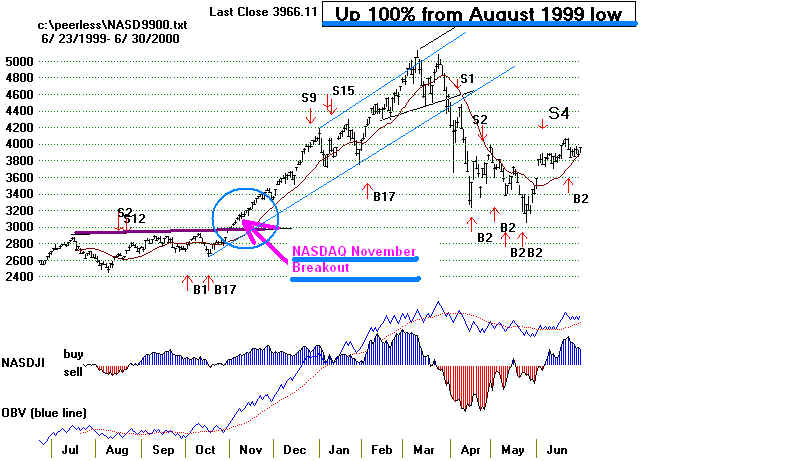

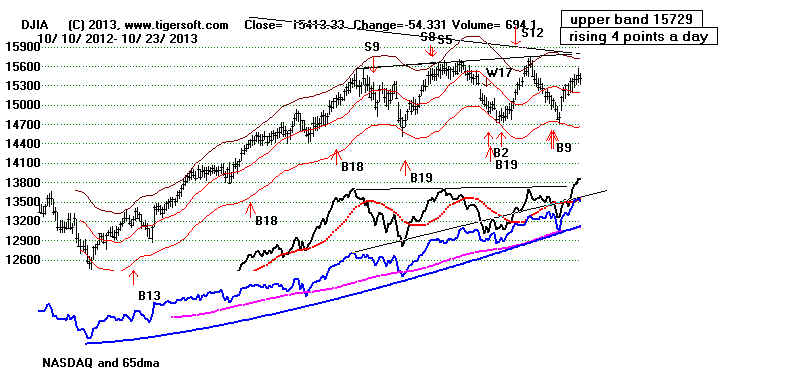

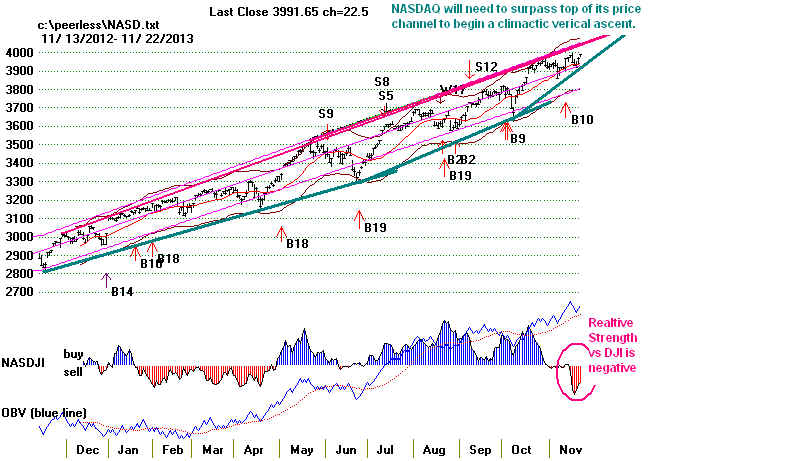

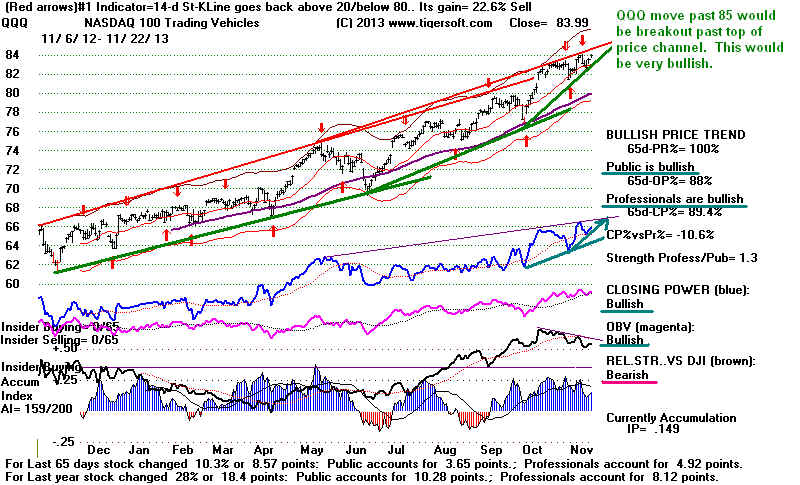

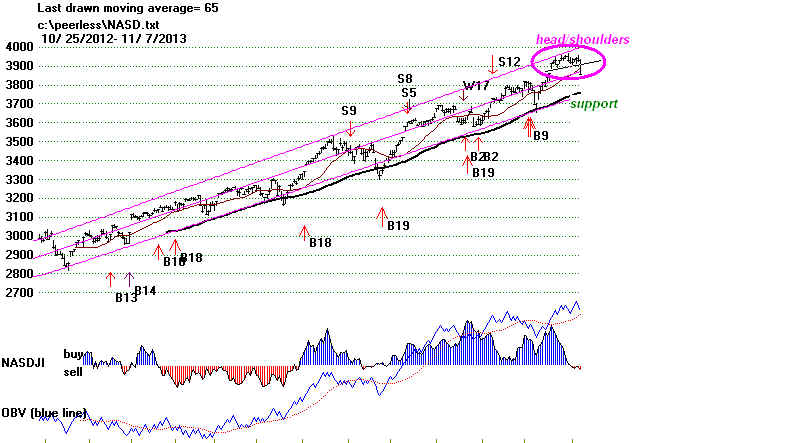

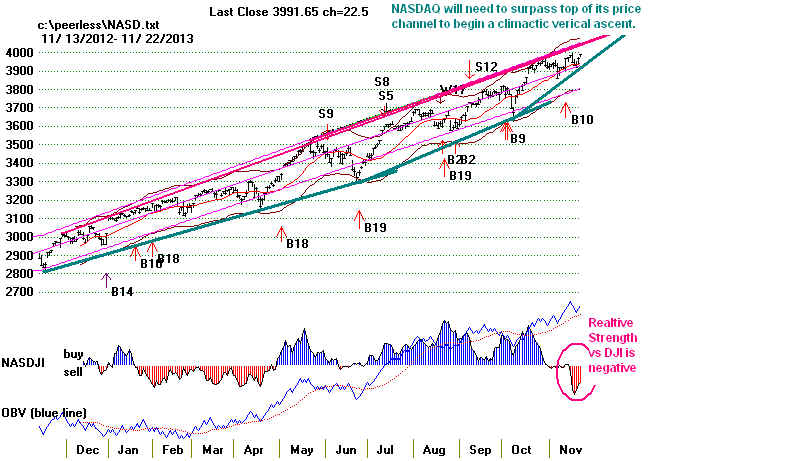

will be the NASDAQ and

QQQ. They may still breakout out above the top of their

well-tested price

channels. This could re-establish the"bubble" 1999-2000 scenario.

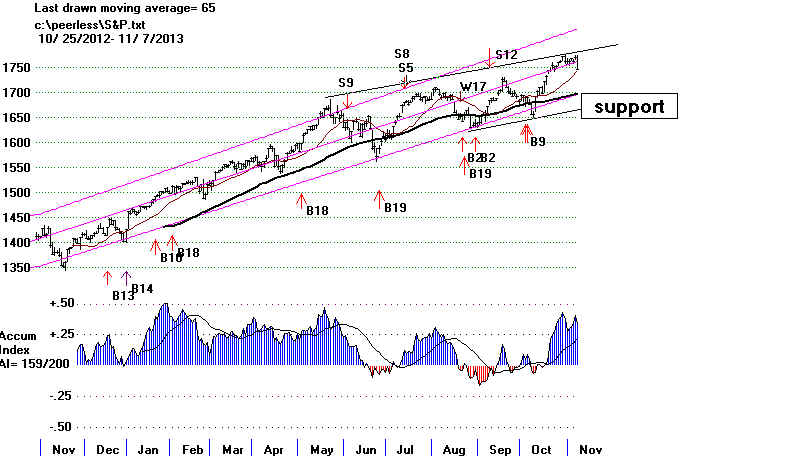

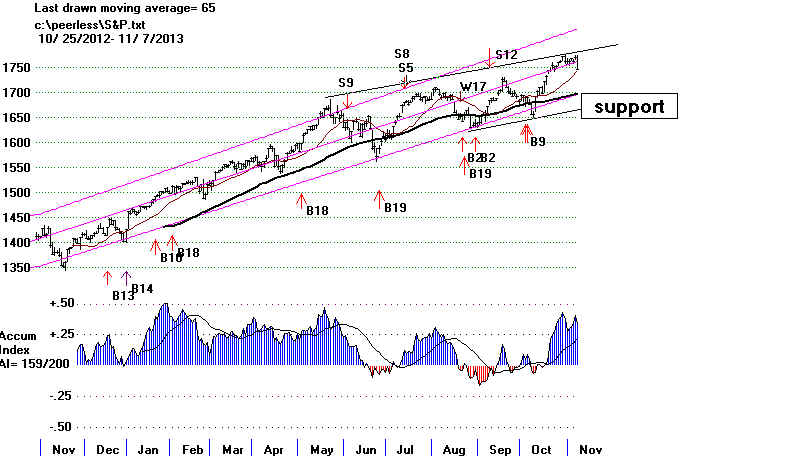

Peerless Signals and DJI

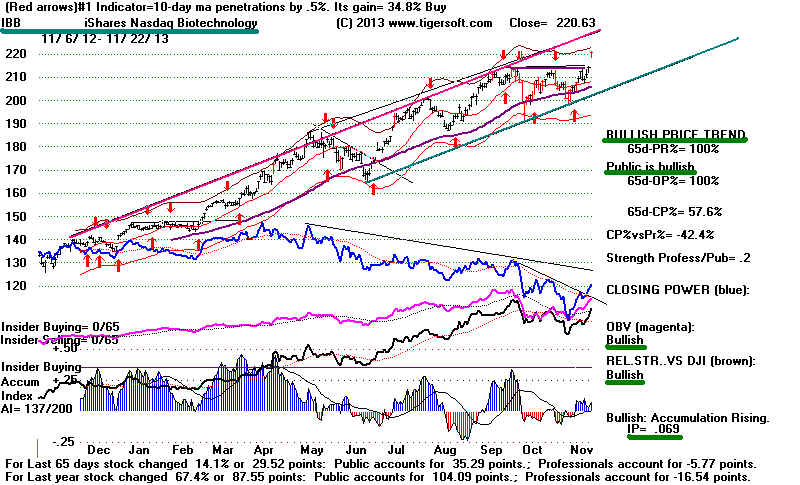

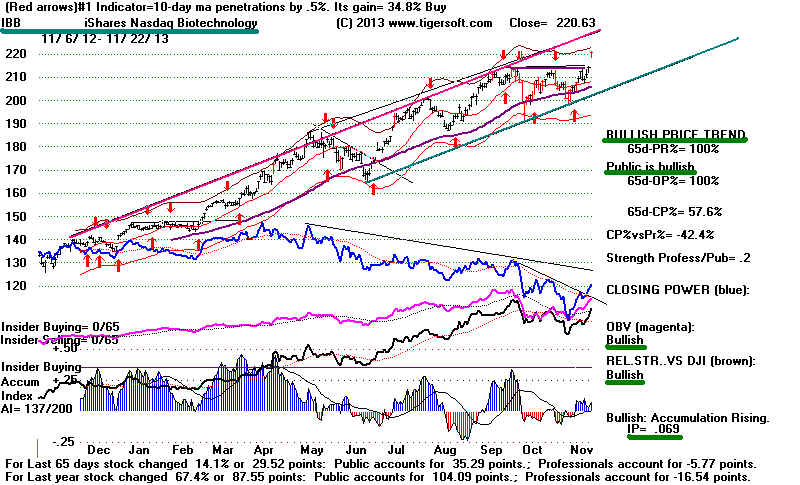

Friday, the

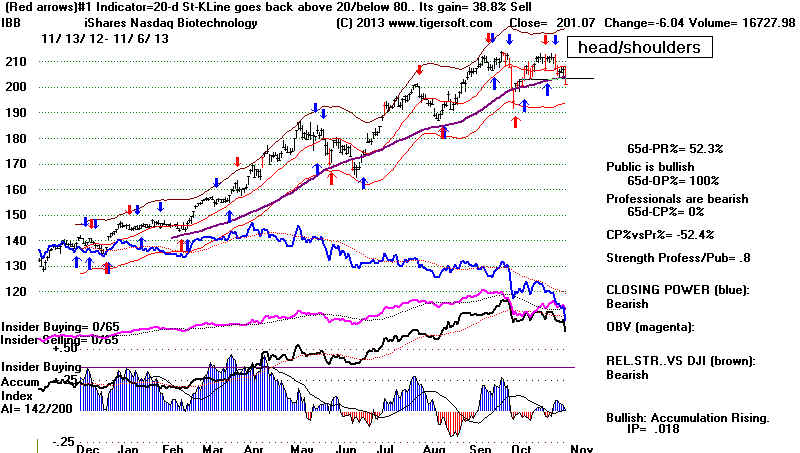

Biotechs broke out above their flat resistance levels. See BBH

and IBB below

NASDAQ IBB Biotech Flat-Topped Breakout

Momentum players

will probably push these higher and that will boost the NASDAQ

and QQQ. It

remains to be seen if the NASDAQ can recapture market leadership

from the DJI.

The TigerSoft RELDJI Indicator is still negative. It measures the

strength of the

NASDAQ versus the DJI. Right now it is quite negative. This

fact argues

against a climactic advance now in the NASDAQ and QQQ, which

is actually

bullish for the present, since very often the market does something

spectacular to

draw in unwary public investors near the end of a long advance.

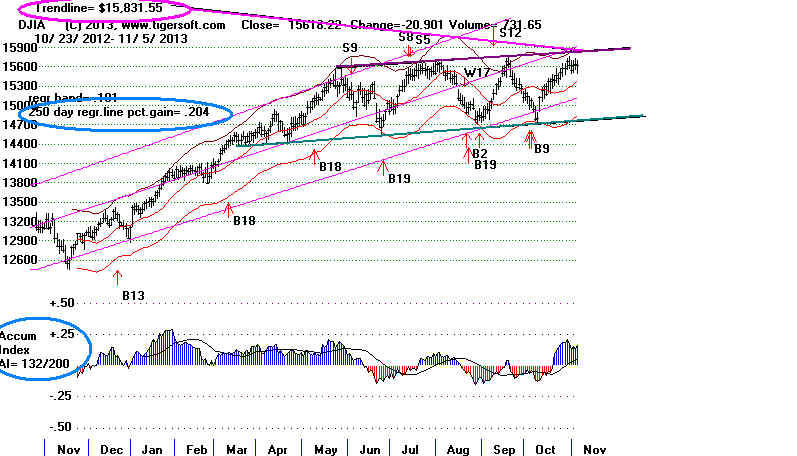

Peerless Signals and NASDAQ Trendlines

Will There Be A Sell S9?

The DJI stands 1.9% over the

21-day ma with the P-Indicator still negative. P-I is

now -32.

Because the Accumulation Index is quite positive (>.10) and it is November,

we won't easily

get a Sell S9 with Peerless as it stands now. Earlier in the year, a Sell S9

would probably

have occurred if the DJI were to reach the 3% upper band. Seasonality

is too bullish

now. The programs have been written tot ake that into account. The DJI

rises 70.2% of

the time over the next month and typically gains 1.8%. With a Democrat

in the White

House going into the year of the mid-term Elections, we do have to be

watchful of a top

between December and February.

I know there are

some bears out there. So, here are the results if one got a Sell S9

in November or

December in the years 1929, 1933, 1937, 1941...2001, 2005, 2009,

2013 when the

DJI, as now, was simply 1.9% or more over the 21-dma with the P-Indicator

negative. In a rising market, all four of the "Sell S9s" based on these

simple parameters

would have

brought losses. In a declining market, the signals did much better, though

in 2 of the 9

cases, they were significantly premature bring paper losses of more than 4%.

Sell S9 based on only

LA/MA >1.018 and P-I<0

la/ma PI

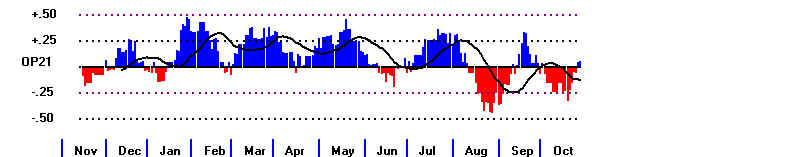

IP21 Gain

-----------------------------------------------------------------------------------------------

bear mkt 12/2/1929 1.024 -62 .002 +3.7%

DJI rallied 3% before falling to lower band.

bear mkt 12/3/1929 1.053 -.9 .049 +6.8%

bear mkt 11/8/1933 1.038 -12 .006 95.5 DJI reached 102 before falling to lower band (95.5) on

12/21/1933

bear mkt 11/24/1933 1.046 -8 -.005 98.1 DJI reached 102 before falling to lower band (95.5) on

12/21/1933

bear mkt 12/3/1937 1.025 -109 -.125 127.6 DJI fell to lower band 118.9 on 12/28/1937

bear mkt 12/8/1937 1.044 -58 -.041

129.8 DJI fell to lower band 118.9 on

12/28/1937

bear mkt 12/26/1973 1.02 -148 -.041 +1.1% DJI rose from 837.36 and reached 855.32 and then fell to 828.46

bear mkt 12/27/1973 1.034 -84 .016 +2.6% DJI rose from 851.01 and reached 855.32 and then fell

to 828.46

bear mkt 11/10/1977 1.023 -2

.128 +3.1% DJI rose from 832.55 and reached 845.89 and then fell to

828.46

11/24/1989 1.019 -28 .046 -.008%

DJI rose from 2676 to 2751 before falling back to a Buy signal.

11/20/1997 1.031 -106 -.014 -1.7% DJI rose from

7827 to 8111 befroe falling to 7660.

11/3/2005 1.019 -101-.03 -2.8%

DJI rallied and broke out...

11/9/2009 1.029 -47 .051. -0.8%

DJI rallied and then gave Buy B13

11/22/2013 ---> To Key Index and

Leading Stock Charts: DJI, SP-500, etc.

---->

288 +164 MAXCP stocks Bullish

MAXCP Stocks (11/22`/2013) Bullish

plurality

---> 68 -22 MINCP stocks

Bearish MINCP Stocks (11/22/2013)

---> 172

New Highs on NASDAQ 14

new lows. Bullish plurality

---> 158 New Highs on NYSE 29 new lows.

Bullish

plurality

DJI

la/ma

annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

11/14/2013

15876 +54

1.017

.384 +187 .168

-4

.119

035

11/15/2013

15962 +85

1.021

.450 +136 NC .166

-10 .220 056

11/18/2013

15976 +14

1.020

.439 +38 NC .140

-31 .206 059

11/19/2013

15967 -9 1.018 .437

-11 .126 -36 .206

063

11/20/2013

15901 66

1.012

.329 -126

.102 -57 .117

059

11/21/2013

16010 +109

1.017

.452 -42 NNC .115 -31 .21 074

11/22/2013

16065 +55

1.019

.420 -32 NNC .124

-27 .203 073

************************************************************************************

===================================================================================

OLDER HOTLINES

===================================================================================

11/21/2013

The Peerless Buy B10 sets

up an average Peerless goal of 16676.

The DJI stands

1.7% over the 21-day ma with the P-Indicator still negative. P-I is

now -.42.

Because of November's normally bullish seasonality, it is harder to

produce a Sell

S9, based on the DJI 2.5% over the 21-dma with the P-Indicator

negative.

In part, this is because the program also looks at the level of the Accumulation

Index, which is

now +.115. If you study the S9s (not S9Bs or S9Vs) shown below

since 1928,

you will see all

the cases of S9s where the IP21 was positive. There were no cases where

this was true in

November. There were only 2 instances in December (1987 and 1999).

Both were

ineffectual. So, a positive IP21 mitigates the bearishness of the Sell S9 at

these times.

I think this is generally true, too, But more so at the ned of the year.

As a result, the

Peerless program should probably require the Accumulation Index

(IP21) to be, at

least, below +.065 in November and December. You will remember that

I have suggested

that DJI tests of a rising 21-day ma are more likely to be successful

(and not bring a

bigger decline) if the IP21 is above +.065.

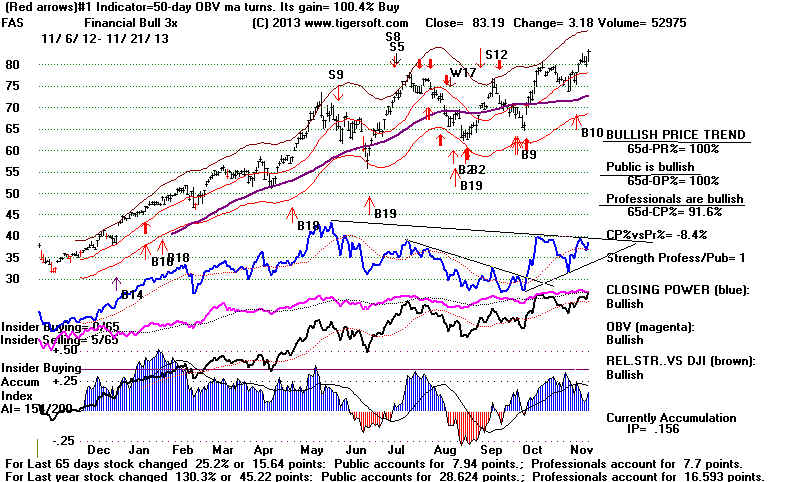

As for the

weakening A/D Line, price momentum like we have seen this year, usually

trumps such

non-confirmations. Tops usually take months to complete. Along with the

B10 breakout and

bullish seasonality, we have compelling reasons to play the market

mostly on the

long side. If you want to hedge, the BEARISH MINCP

stocks will

probably be under

heavy tax-loss selling right until the end of the year, as traders

close out their

losing positions to help balance their big gainers. I would mostly

play the high Accumulation breakouts. These are the stocks the

momentum buyers

keep favoring for

as long as the FED does not make rates move up sharply.

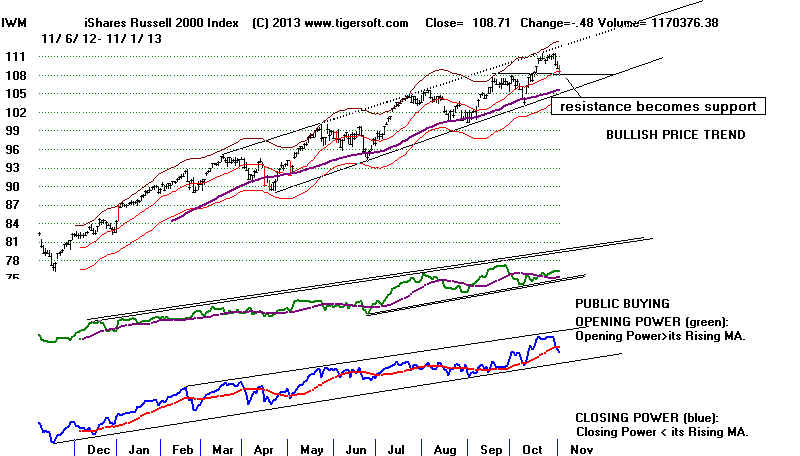

Watch to see if

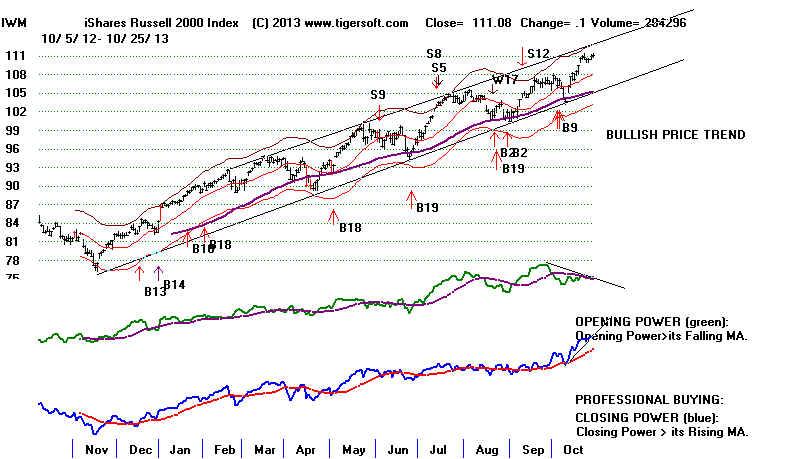

the IWM, NASDAQ and QQQ can regain the leadership role from the DJI-30.

Today they did

rise more than the DJI on a percentage basis. A biotech breakout by IBB

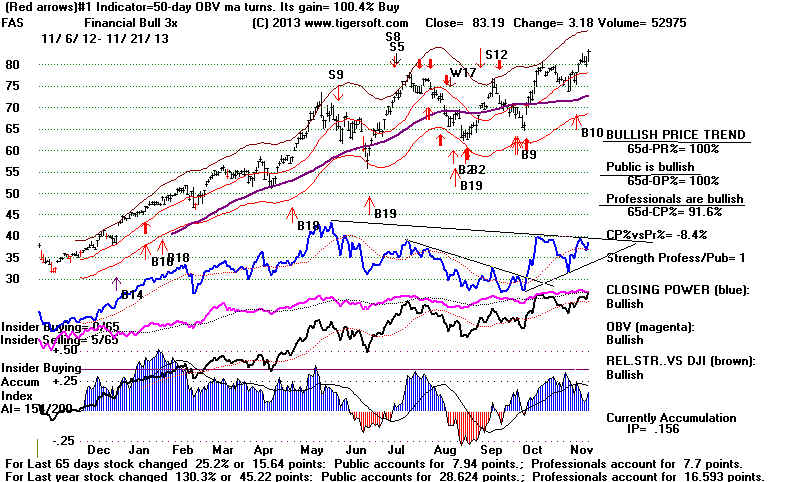

would certainly

help the NASDAQ. FAS, the leveraged Financials'

ETF, made a new high

today, as did JPM and BAC. If the bank

stocks cannot fall back when JPM is fined

$13 billion,

surely they must rise as Professionals expect much more help from the FED

for them under

the next FED Chairman who is considered even more of a "dove" than

Bernanke. .

S9 Signals with IP21>0 since 1929.

These are not

S9Bs or S9vs.

----------------------------------------------------------------------------------------------------------------

Date

la/ma

P-I IP21 Gain Paper

Loss Comments

----------------------------------------------------------------------------------------------------------------

8/27/1930

1.033 -36 .034 big gain

8/19/1931

1.022 -53 .038 big gain

9/18/1933

1.03 -17 .097 big

gain

4/11/1934

1.032 +33 .016 +4.5%

1%

2/11/1937

1.022 -11 .055 +13.0% 2%

3/3/1937

1.025 -6 .075

+14.2% 0%

9/13/1939

1.095 -43 .138

+3.2% 0% Way above upper band.

^^^^

1/6/1942

1.034 -59 .022

+5.6% 0%

6/2/1942

1.024 22 .12

-3.1% 3.1%

6/7/1943

1.016 -11

.012 1.7% 0%

1/10/1946

1.033 -14 .105 3.4%

3.7%

4/14/1950

1.026 -28 .022 3.5%

4.2%

4/30/1951

1.024 +26 .179 6.4% 1.5%

7/8/1957

1.022 -27 .038

10.3% 0%

8/3/1961

1.032 -8 .017

-1.7% 3%

7/16/1962

1.034 35 .082

1.0% 4%

4/30/1969

1.025 -30 .083 19.0% 1.3%

2/27/1970

1.03 61 .023

8.6% 1.9%

6/17/1990

1.026 -109 .001 5.0% 1.6%

8/17/1971

1.038 -93 .153

8.2% 2.3% head/shoulders

4/12/1972

1.023 -2 .087

5.7% 0%

8/10/1976

1.022 -5 .06

3.3% 1.8%

1/8/1973

1.022 -72 .052

9.0% 0.4%

4/11/1973

1.023 -158 .049

9.6% 0%

9/5/1973

1.016 -79

.013 -4.6% 4.6%

10/26/1973 1.021

-9 .163

20.1% 0% On-going-bear-market.

3/4/1974

1.024 40 .014

3.7% 4.5%

3/5/1977

1.024 26 .06

6.4% 0.3%

9/21/1979

1.017 -69 .049

10.9% 0.7%

10/9/1981

1.024 -12 .066

4.0% 0%

7/12/1982

1.026 -13 .07

5.8% 0.9%

7/26/1983

1.024 -73 .058

5.7% 0%

3/16/1984

1.024 +7 .001

5.7% 0%

5/28/1986

1.047 -19 .052

2.3% 1.6%

4/6/1987

1.039 -2 .187 6.3% 0%

This was 3.9% over 21-dma.

12/28/1987 1.021 -37 .132

1.6% 0%

10/4/1989

1.028 -49 .018

4.8% 0.1%

7/12/1990

1.025 -45 .052

17.4% 1.0%

4/15/1992

1.030 -56 .049

3.0% 1.8%

4/22/1998

1.03 -172 .075

-4.9% 4.9%

9/23/1998

1.026 -201 .018

6.4% 0%

12/10/1999 1.021 -391 .01

-0.3% 0.3%

(2/27/2002

1.027 93(!) .047

19.0% 5.1%

This should only be a Sell S15, not an S9.)

8/8/2002

1.039 -271 .063

4.6% 3.9%

5/5/2006

1.026 -10 .035

4.9% 0.6%

3/24/2008

1.024 -209 .116

9.3% 4.1%

4/2/2008

1.031 -75 .042

9.7% 0%

7/30/2008

1.023 -105 .058

5.8% 1.7%

-------------------------------------------------------------

11/21/2013 ---> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

---->

288 +164 MAXCP stocks Bullish

MAXCP Stocks (11/21/2013) Bullish

plurality

---> 68 -22 MINCP stocks Bearish MINCP Stocks (11/21/2013)

---> 140

New Highs on NASDAQ 16 -3 new lows. Bullish plurality

---> 105 New Highs on NYSE 22 new lows.

Bullish

plurality

DJI

la/ma

annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

11/14/2013

15876 +54

1.017

.384 +187 .168

-4

.119

035

11/15/2013

15962 +85

1.021

.450 +136 NC .166

-10 .220 056

11/18/2013

15976 +14

1.020

.439 +38 NC .140

-31 .206 059

11/19/2013

15967 -9 1.018 .437

-11 .126 -36 .206

063

11/20/2013

15901 66

1.012

.329 -126

.102 -57 .117

059

11/21/2013

16010 +109

1.017

.452 -42

.115 -31 .21 074

************************************************************************************

===================================================================================

OLDER HOTLINES

===================================================================================

11/20/2013

The Peerless Buy B10 sets

up an average Peerless goal of 16676.

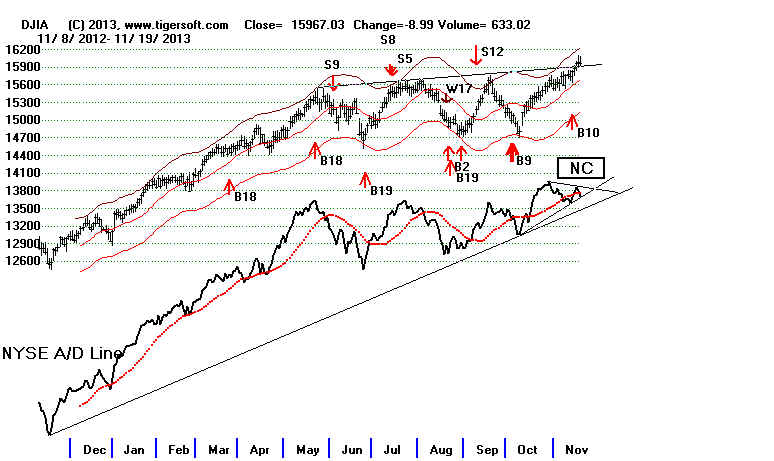

It's hard to turn

bearish with so much upward momentum, the bullish seasonality now

into December and the

Peerless Buy. But we always have to on guard when the NASDAQ

starts slipping away

from a rising DJI, the NYSE A/D Line fails to confirm the DJI

high

and the P-Indicator turns negative. These warnings could

lead to a Peerless Sell signal

on the next rally.

November S9s are rare. And as I showed two nights ago, they

don't immediately drop

the DJI.

11/20/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

---->

124 MAXCP stocks Bullish

MAXCP Stocks (11/20/2013) Bullish

plurality

---> 90 MINCP stocks

Bearish MINCP Stocks (11/20/2013)

---> 39

New Highs on NASDAQ 19 +1 new lows. Bullish plurality

---> 19 New Highs on NYSE 47 new lows.

Bearish plurality

DJI

la/ma

annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

11/14/2013

15876 +54

1.017

.384 +187 .168

-4

.119

035

11/15/2013

15962 +85

1.021

.450 +136 NC .166

-10 .220 056

11/18/2013

15976 +14

1.020

.439 +38 NC .140

-31 .206 059

11/19/2013

15967 -9 1.018 .437

-11 .126 -36 .206

063

11/20/2013

15901 66

1.012

.329 -126

.102 -57 .117

059

************************************************************************************

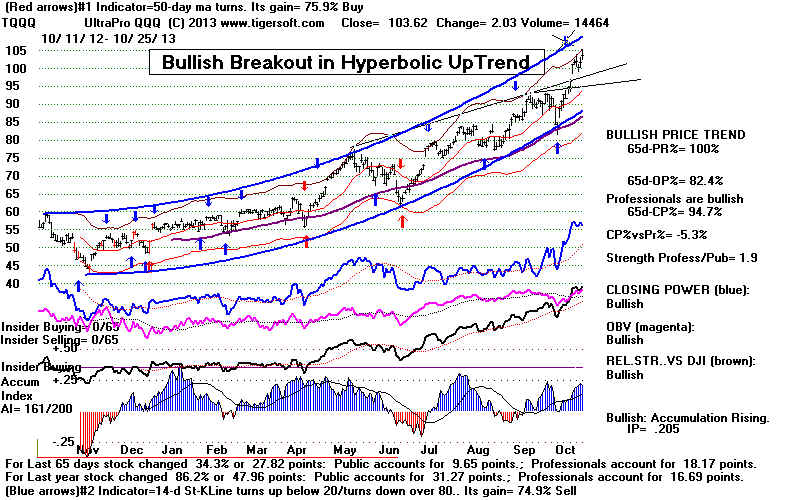

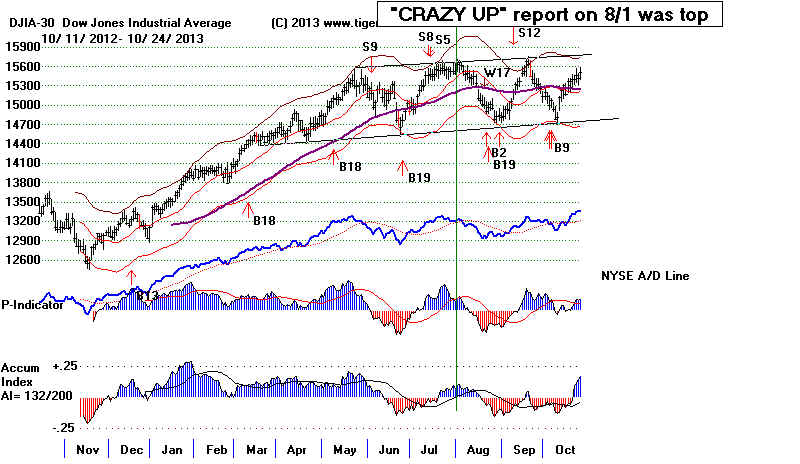

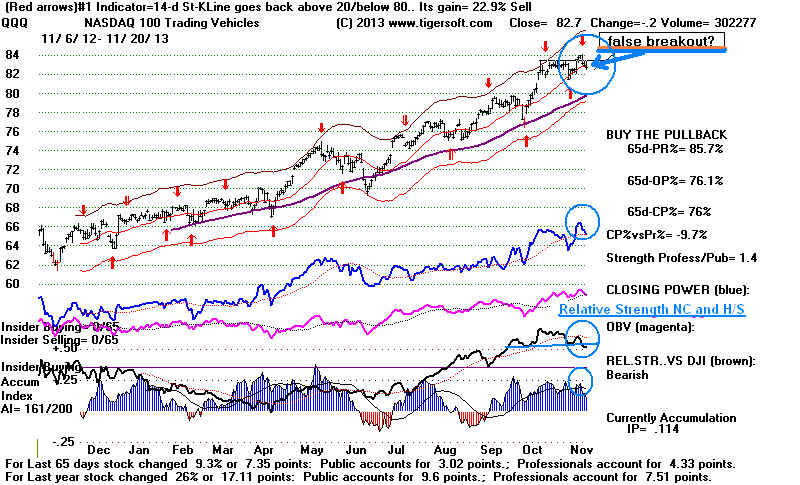

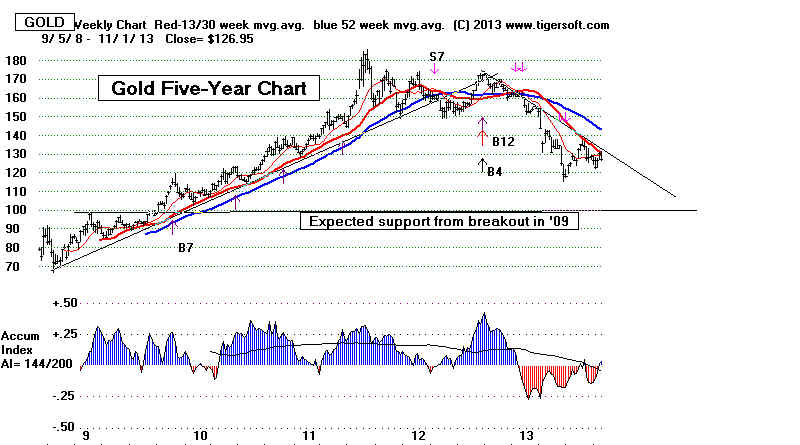

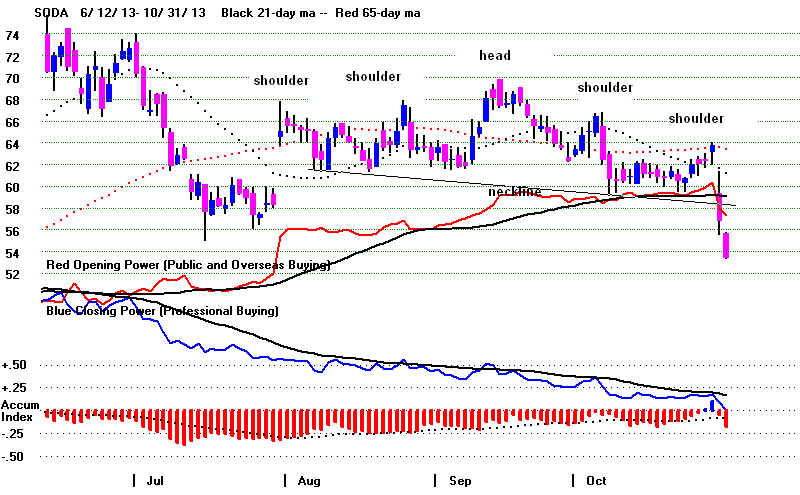

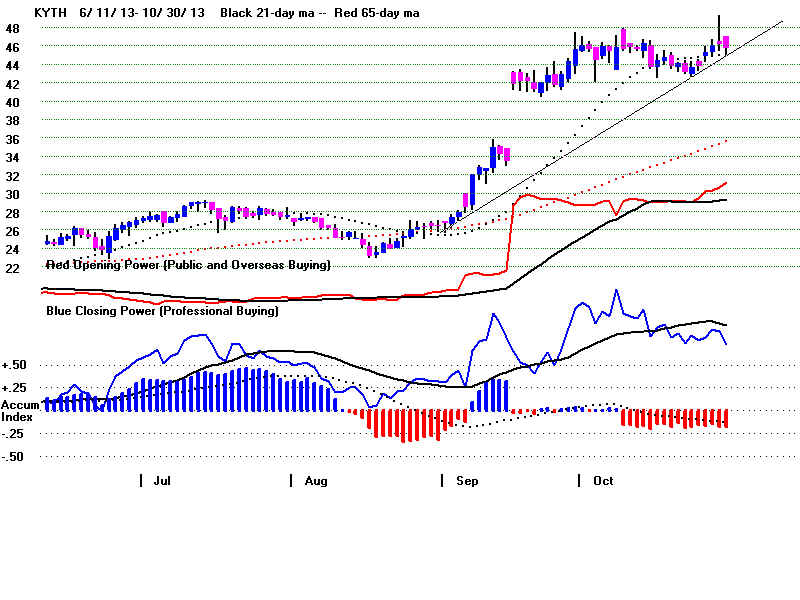

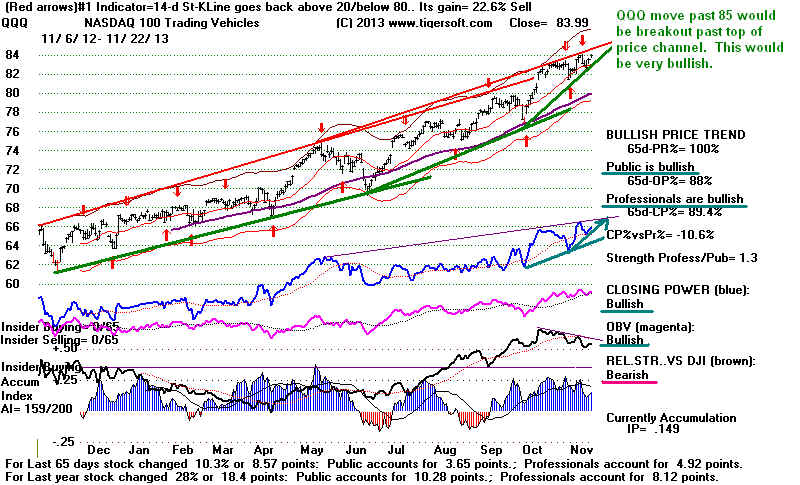

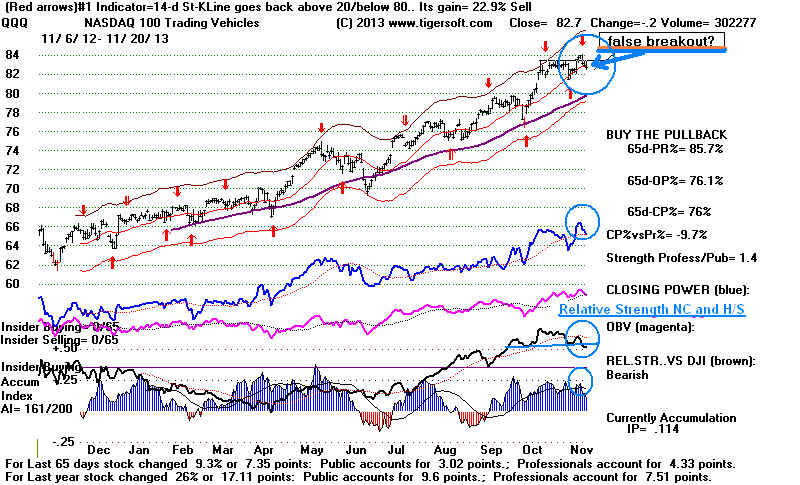

QQQ False Breakouts and RSQ Head/Shoulders

Consider also the just

failed QQQ breakout. Usually Buy B10s and valid breakouts

bring runaway moved.

But new concerns about a Fed which may reduced its QE-III

program has brought on

a round of quick profit-taking. The QQQ's chart shows that

its prices are still

above its rising 21-day. In addition, its Closing Power confirmed the

last high and the

Accumulation Index was quite positive on the last rally. Still, we

should look back at

false breakouts by the QQQ since false breakouts often come

in bunches when the

market is topping out. Notice the date of the Tiger Blog when I wrote

about false breakouts.

Tiger

Blog - FALSE BREAKOUTS: How to Recognize Them and Trade Them

www.tigersoft.com/tiger-blogs/11-15-2007/index.html

QuickBreakout Failures since 1999.

There is only one case of a quick breakout failure on the QQQ. That was on 11/1/2007,

which proved a very good time to sell. Peerless had already given a Sell S4 signal

on 10/4/2007. The Closing Power turned very weak right after this. This is an

important

bearish sign. An exceptionally weak Closing Power on the QQQ also appeared

from March to April in 2000, in January-Feb 2001, in January-Feb 2002 and in September

2008.

Plunges soon followed. However, in all cases Peerless gave a classic Sell.

==================================================================================

OLDER HOTLINES

==================================================================================

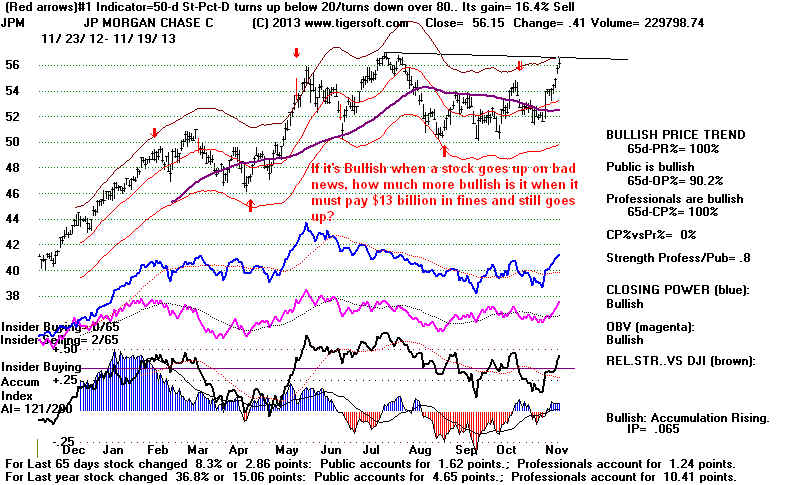

11/19/2013

The Peerless Buy B10 sets

up an average Peerless goal of 16676.

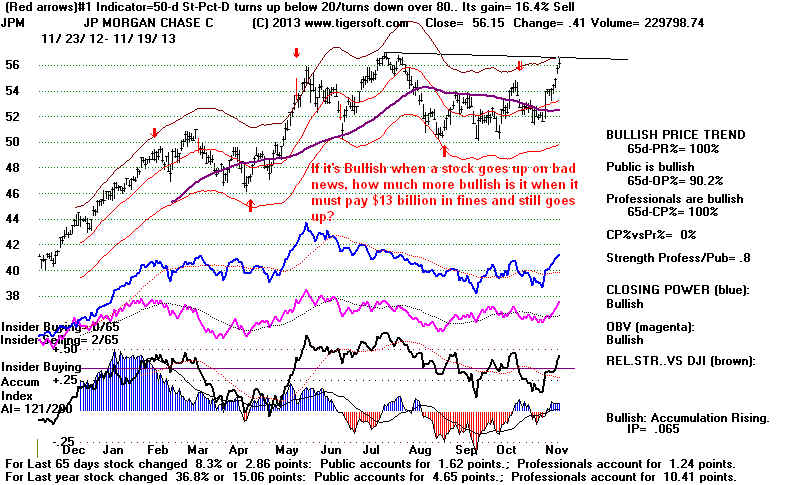

If it's usually true

that when a stock goes up on bad news, it's bullish, how must it

be when the stock rises

after being fined $13 billion. That's the case of JPM now.

Moreover, since bank

stocks's prices usually correlate very well with Peerless

Buys and Sells, such

"bullishness" should be noticed.

The momentum should also keep

the market rising here. More than 72% of the Russell-1000,

QQQ-100, SP-500 and DJI-30

(90%) stocks are above their 65-dma. But breadth has

weakened. Even though

the DJI is 1.8% over the 21-day ma, the P-Indicator has turned

negative. This could

lead to a Sell S9 signal if the DJI should rally. But November S9s

are rare. There was one

on 11/14/1980 with the DJI 4.2% over the 21-day ma and

the P-Indicator at -93.

In this case the DJI fell back to the lower band after forming

a head/shoulders. There

was also one on 11/13/2009 with the DJI 2.7% over the

21-day ma and the P-Indicator

a -110. It ended up losing 0.4% and suffering a

paper loss of 3.2%. The problem with November Sell S9s is that they confront a very

bullish seasonality.

The DJI rallies on average 0.9% over the next 5 trading days

and 1.3% over the next 10

trading days. The odds of it rising over the next two weeks

are 72.3%.

A/D Line NC of New High

A/D Line Uptrend still intact.

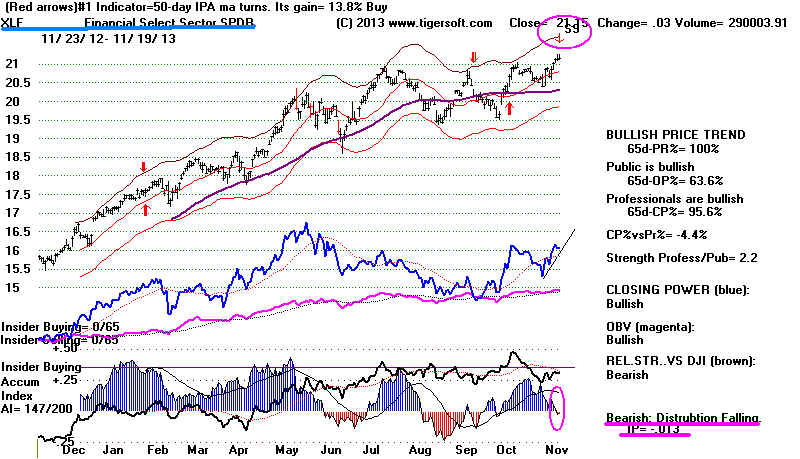

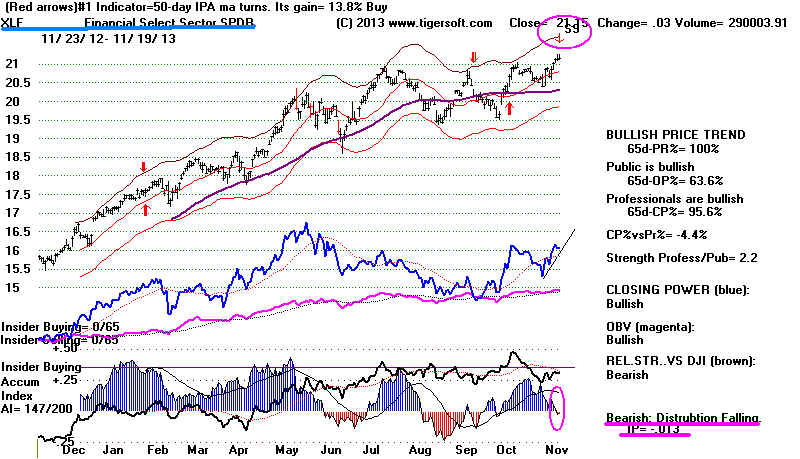

Finding Stocks Under Red Distribution as They Make New Highs

It's true that there is a

certain amount of red distribution now. See the weakest of

these stocks in our Bearish MINCP group again tonight. But distribution is not aggressive

selling. The

distribution can last for some time. We want to start watching the

percentage of new highs each

night that have an IP21 less zero. 31 of the 156 new hiighs

had negative IP21s tonight. (To get these results: Peercomm + Older

Charting + Run/Setups

+ Run New

Analysis/Ranking/Optimization + X(when finished). Then Peercomm + V iew

+ Tiger Spreadsheet.(

Then click top of "IP21 column" to reverse the display order so

it shows the negative IP21

new highs first. But shorts need to find stocks that traded

more than 1000 lots. The best

way to find these is to display the stocks showing new

Tiger Sell S9s. (Use the commands: Peercomm + Daily Stocks + S9 -218

Accum Index

-negative near the upper

band". ) The only Tiger Sell S9 of interest is XLF - the

Financial Select SPDR.

We will only watch it now. Its Closing Power is in an uptrend.

There is not much red

Distribution here.

Will This End The Law Suits against JPM?

Are Other Mortgage Lenders Next? JPM's stock

holders are optimistic. Of course, they know

the FED will "always be there to protect them.

JP Morgan today agreed

to pay $13.0 BILLION in fines to the FEDs for its

fraudulent mortgage

selling of a few years ago. This amounts to 1/2 of the banks

profits in the last

year. $7 billion of the settlement is tax-deductible.

"The breakdown

of the $13 billion settlement with JPMorgan includes a $2 billion fine

to prosecutors in

Sacramento and $4 billion in relief to struggling homeowners in hard-hit areas

like Detroit and

certain neighborhoods in New York. The government earmarked the other $7 billion

as compensation to

federal agencies and state attorneys general across the country, including those

in Illinois, New York

and California.... The Justice Department secured a range of other concessions,

including admitting to

the statement

of facts. JPMorgan also backed down from demands that

prosecutors drop a

related criminal investigation into the bank, and it forfeited the right to try later

to recoup any of the

$13 billion from the Federal

Deposit Insurance Corporation." (NY Times)

11/19/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

---->

157 MAXCP stocks Bullish

MAXCP Stocks (11/19/2013) Bullish

plurality

---> 74 +19

MINCP stocks Bearish

MINCP Stocks (11/19/2013)

---> 38

New Highs on NASDAQ 18

-2 new lows. Bullish plurality

---> 20 New Highs on NYSE 26 new lows.

Bearish plurality

DJI

la/ma

annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

11/14/2013

15876 +54

1.017

.384 +187 .168

-4

.119

035

11/15/2013

15962 +85

1.021

.450 +136 NC .166

-10 .220 056

11/18/2013

15976 +14

1.020

.439 +38 NC .140

-31 .206 059

11/19/2013

15967 -9 1.018 .437

-11 .126 -36 .206

063

********************************************************************************************

=====================================================================================

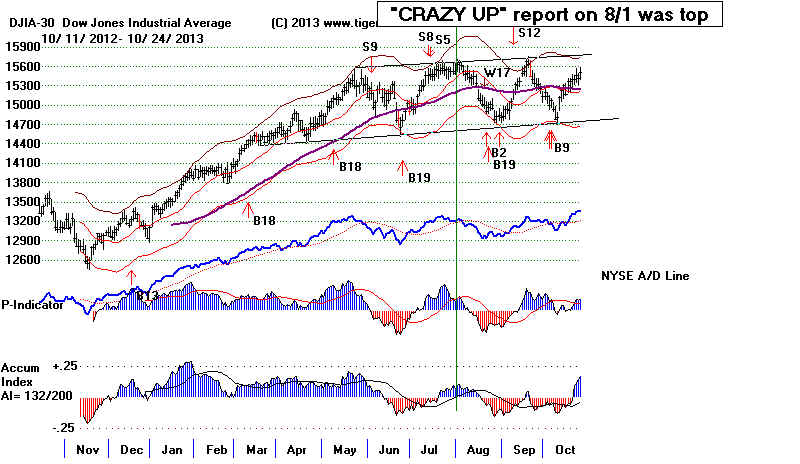

11/18/2013 Peerless Buy B10 sets

up an average Peerless goal of 16676.

But breadth is lagging. Given the Peerless Buy signal and the momentum

of all the the key indexes and major market ETFs, only a small retreat seems

in the making. Seasonality is bullish for a while longer. The main problem for

the market is political. Having a Democrat in the White House nearly always

set up

an important market top at the end of the year in the year after a Presidential Election

(1933, 1937, 1941, 1946, 1961, 1966, 1993, 1997, 2001, 2010)

There is only one exception to this rule since 1933. We should be alert

to the possibility of a Peerless Sell. The P-Indicator is not very positive anymore

and the DJI is 2% over the 21-day ma.

Democrats Bring Tops between December and February

With a Democrat in the White House, a bearish picture emerges at the end of the

year. Since 1934, a DJI top has always been made, with one

year excepted,

in December in the year after a Presidential Election (12/29/1983, 12/29/1977, 12/5/1997), or

the following January (1938, 1942, 2010) or February (1934, 1946, 1966,

1994 - only 5% drop).

The 1949-1950 was an exception when there was no peak at this time.

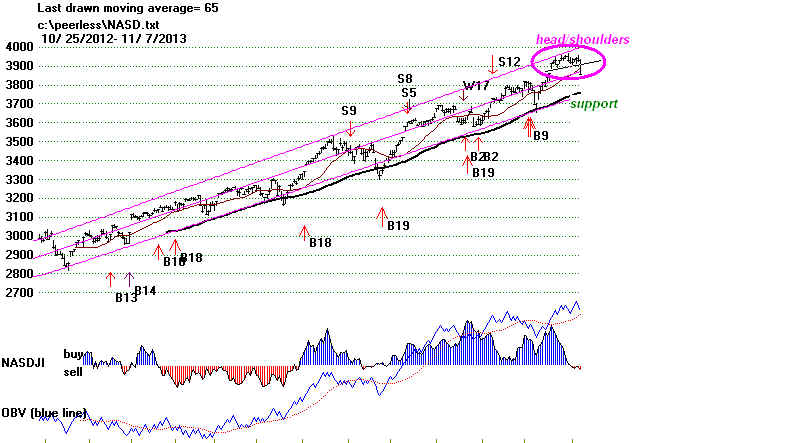

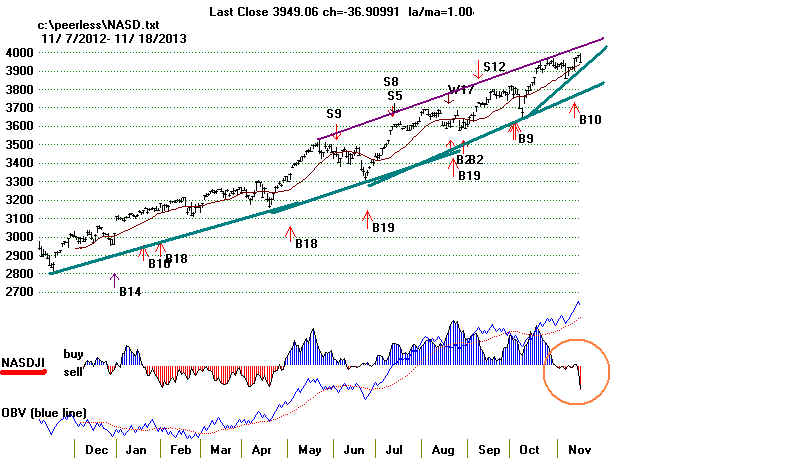

NASDAQ Profit-Taking...

Will It Worsen?

The 16000 pschological resistance has started a notable round of red Distribution

among some of the bigger NASDAQ-100 stocks. Most bigger NASDAQ stocks

do look over-extended. They are not close to a base. So, some are ripe for a

pullback. About 12% of the QQQ stocks show

increasing and very steady red Distribution:

AKAM, ALTR, CHKP, CTRX, CTXS, EQIX, FB, FFIV, NFLX, NUAN and SIRI.

In addition, some of the bigger biotech stocks show heavy Professional selling, judging

from the weakness in their blue Closing Powers.

This wave of distribution is mostly on strength. It is not

clear that the selling will

become aggressive or spread to the strongest stocks. The NASDAQ is still in an

accelerating uptrend. It will take a lot of selling to break the back of this

uptrend.

We have no Peerless Sell. Until Peerless gives a major Sell, it's best to expect

the DJI to keep making new highs. But if you

want to hedge, consider some of the

stocks showing very heavy Red Distribution,

Year-end selling in them will probably

continue to depress them.

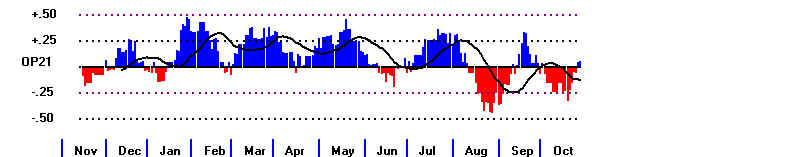

The key question now is will the NASDAQ keep following the DJI up? If it does not,

we will have a bearish warning. See the NASDAQ's Relative Strength

"NASDJI" Indicator

below. This compares the DJI's momentum to the NASDAQ's. It has turned

decisively

negative as the DJI rallies.

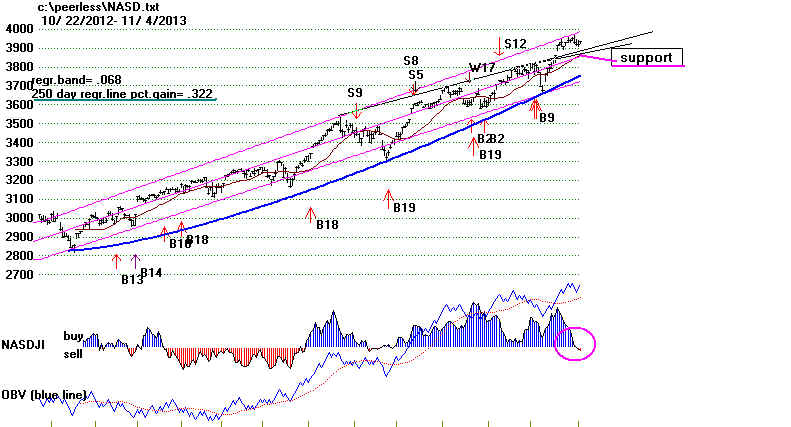

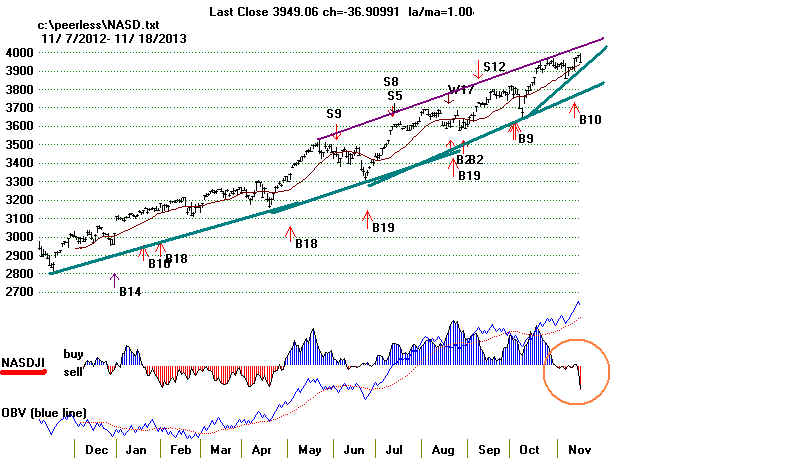

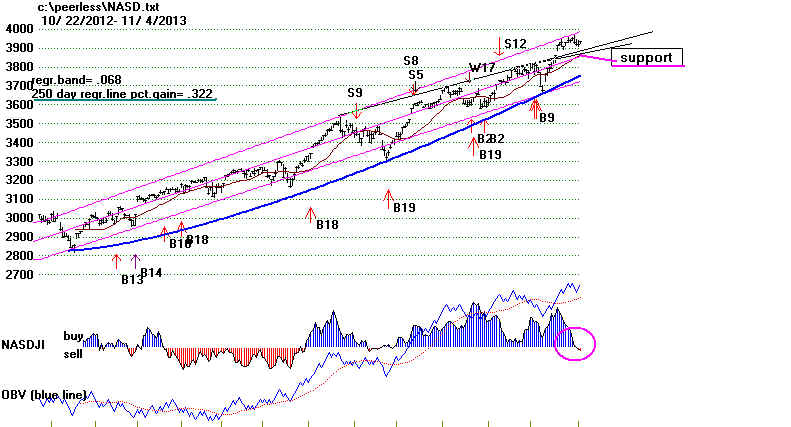

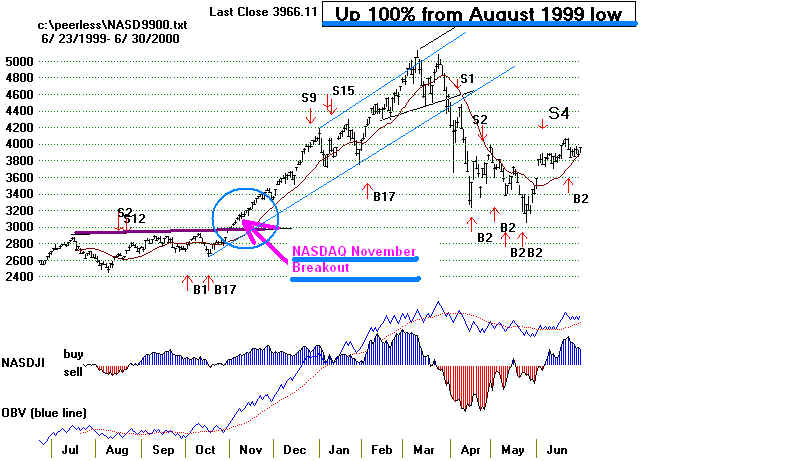

NASDAQ with PEERLESS SIGNALS

NASDJI Negative Non-Confirmations Usually Lead To DJI

Tops,

but not always immediately. Waiting for the Peerless Sell is Best.

Since 1972, I counted 7 cases where it was clearly bearish when the NASDAQ's

Relative Strength NASDJI Indicator turned negative as the DJI rallied to new highs.

Only in one case, January 1987, did the lagging NASDAQ play "catchup" and take

back

the leadership from the DJI. The divergence now, thus, puts the NASDAQ on notice.

I had hoped we would see a NASDAQ take-off in the next 3 months like occurred

in 1999-2000. But the NASDAQ has turned down and is much weaker than the

DJI. Today the NASDAQ fell 36.90 (-0.93%) while the DJI rose +14 (0.09%).

One day is not especially important, but the current Peerless

"NASDJI" Indicator

has turned quite negative on this rally to new highs by the DJI. This did not occur

in 1999-2000. Just the opposite was seen then. The NASDAQ stayed very positive

throughout the period from November 1999 to March 2000. Some of the more

important market tops saw the NASDJI Indicator turn negative despite the

DJI rally to new highs: namely:

1

1972-January 1973 DJI top - S9/S12,

2

Oct. 1979 - NASDAQ breakout but NASDJI was only slighlty

positive.

3

January 1984 - NASDAQ had been falling for 6 months when DJI

finally topped out.

4

August 1987 - NASDAQ had been negative for 5 months despite

the DJI rally.

5

July 1990 - July DJI top saw NASDJI turn negative at the same

time.

6

February 1994 - NASDJI turned negative just as DJI

topped out.

7

May 2011 - NASDJI turned negative just as DJI reached a peak

from which it fell 15% by Sept.

NASDAQ weakness does not always pave the way to a January market top.

Just the opposite was true in January 1987, when a lagging

NASDAQ suddenly jumped

from 350 to 440 in March. But even in this

case, from March to August 1987, the

NASDJI indicator was below zero. Only in August 1987 did the DJI finally top

out.

But that top led to a 35% plunge in two months. The lengthy period of NASDAQ

weakness vis-a-vis the DJI was a significantly bearish divergence. It is much better

when the DJI and the NASDAQ are moving up together.

11/18/2013 ---> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

---->

285 MAXCP stocks Bullish MAXCP Stocks

(11/18/2013) Bullish plurality

---> 55 +6

MINCP stocks Bearish

MINCP Stocks (11/18/2013)

---> 63

New Highs on NASDAQ

20 new lows. Bullish plurality

---> 79 New Highs on NYSE 13 new lows.

Bullish

plurality

DJI

la/ma

annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

11/14/2013

15876 +54

1.017

.384 +187 .168

-4

.119

035

11/15/2013

15962 +85

1.021

.450 +136 NC .166

-10 .220 056

11/18/2013

15976 +14

1.020

.439 +38 NC .140

-31 .206 059

********************************************************************************************

================================================================================

OLDER HOTLINES

================================================================================

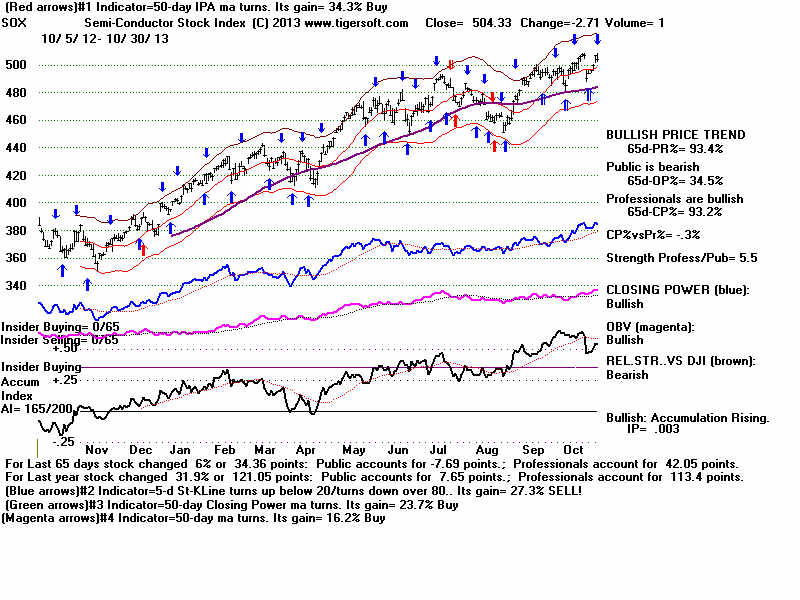

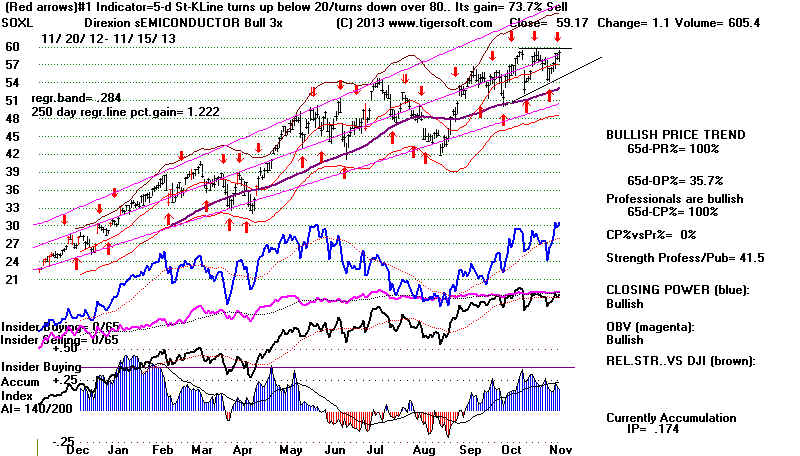

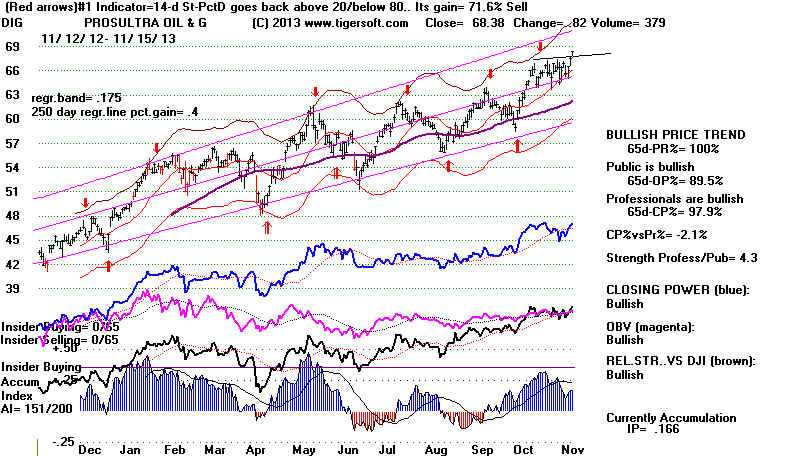

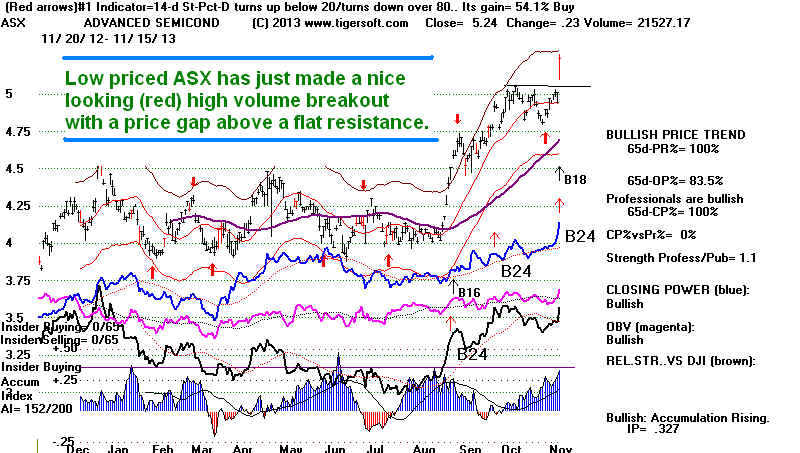

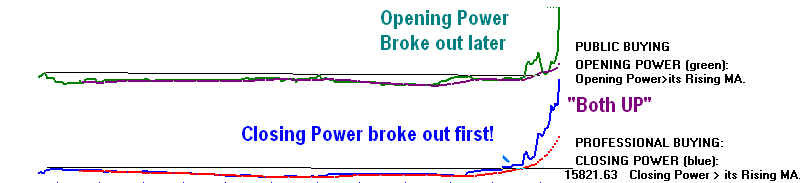

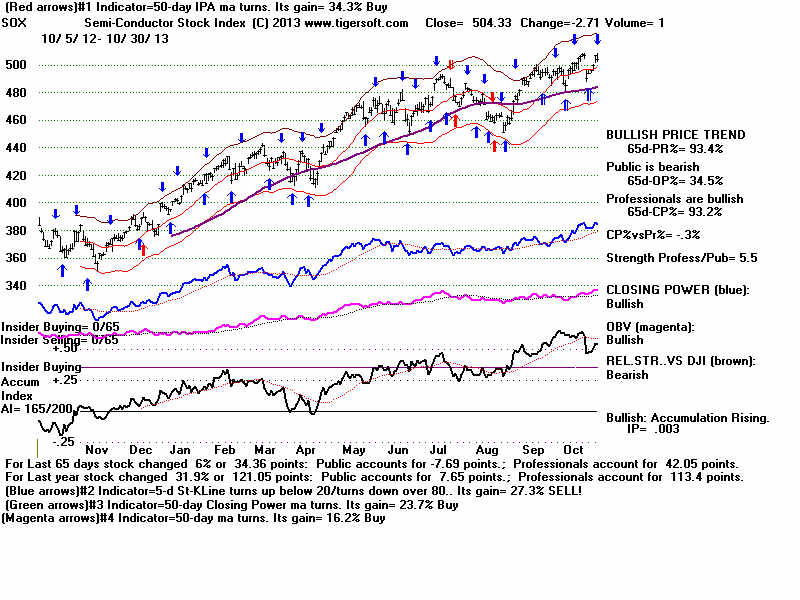

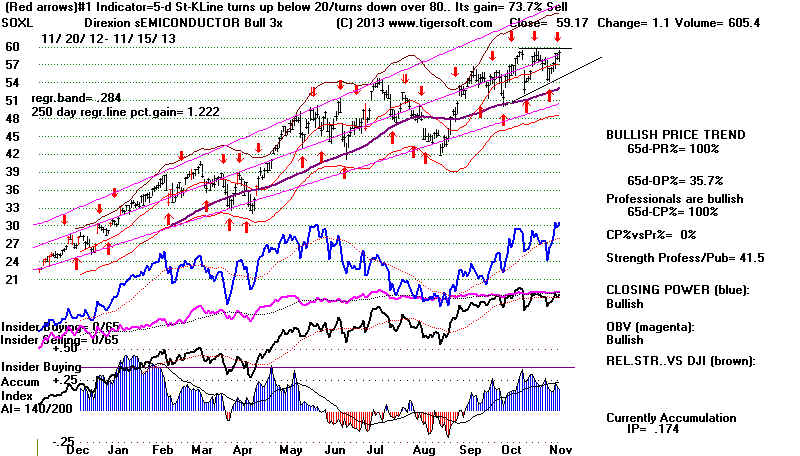

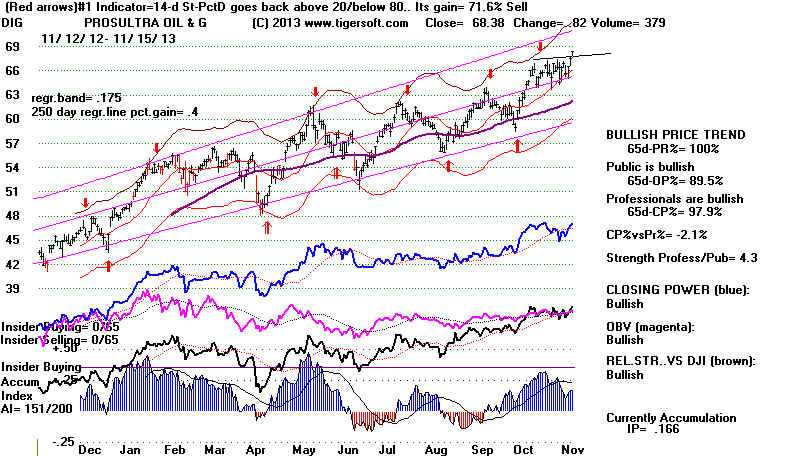

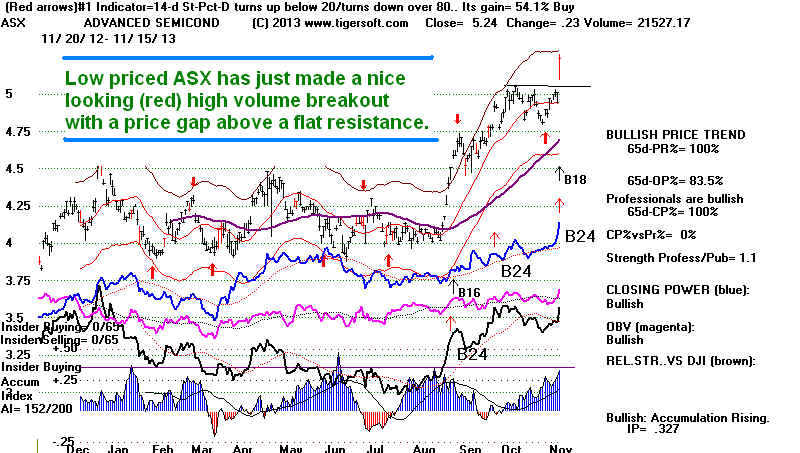

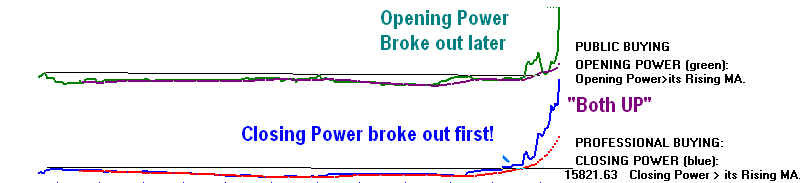

11/15/2013 Peerless Buy B10 sets

up an average Peerless goal of 16676.

The Opening and Closing Powers are both rising for the key ETFs. This

"both-up" condition often brings the quickest advances. There is some

weakness in the next two or three days if seasonality rules. But two weeks

after November 17th, the DJI is up on average 0.8% and rallies 68.1% of the time

since 1965.

More significantly, near all the BEARISH MINCP stocks

again tonight are

leveraged major market short ETFs. If these were stocks, we would want to

short them aggressively. If the market really is ready to "melt up", I

would

think that the 3x leveraged Semiconductor ETF, SOXL, will

make a good breakout

soon. Watch also the Oil ETF, DIG, which did breakout

Friday. The low-priced

ASX in the semi-conductor group looks like a good speculation

now, too.

Charts for these are shown at bottom of tonight's Hotline.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218 +37

.226 014

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

11/14/2013

15876 +54

1.017

.384 +187 .168

-4

.119

035

11/15/2013

15962 +85

1.021

.450 +136 NC .166

-10 .220 056

********************************************************************************************

11/15/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

---->

524 +11 MAXCP stocks

Bullish

MAXCP Stocks (11/15/2013) Bullish

plurality

---> 49 +4

MINCP stocks Bearish

MINCP Stocks (11/15/2013)

---> 105

New Highs on NASDAQ

21 new lows. Bullish plurality

---> 152 New Highs on NYSE 11 new lows.

Bullish

plurality

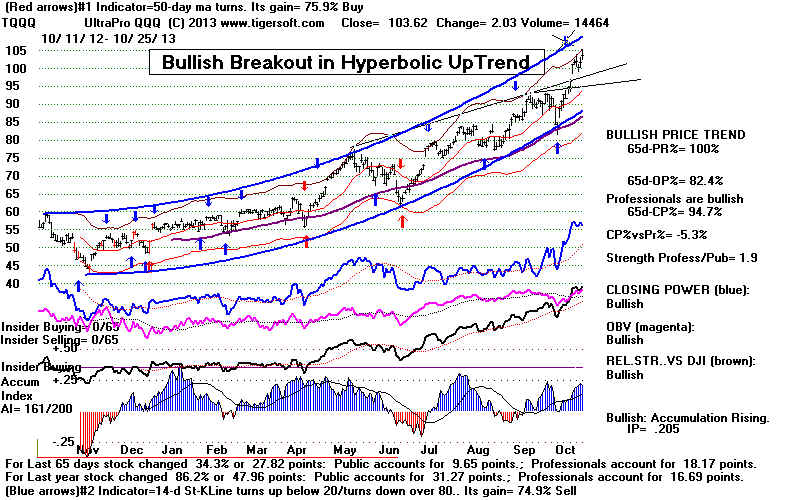

The breakout from the top of

the 1000 point-wide trading range at 15900 sets up a

minimum downside objective of

16900. With the DJI moving in all-time high territory

sellers do not no where to

concentrate their sell orders except at round numbers.

That means 16000 is the

immediate goal. Bullishly, the A/D Line for the DJI

stocks,

the NASDAQ-100 stocks, the SP-500

stocks and Russell-1000 stocks are making

new highs. Let's

let the rising tide and the Peerless Buy B10 do their jobs. Continue

to watch the NASDAQ and QQQ to see if they can

break out past their rising resistance

lines. This could

set up quick, vertical ascents, which may let them reach their March

2000 highs. Back

in the 1999-2000 tech bubble, the last 6 months saw very steep rises.

Back then, Fed Chairman

Greenspan, like Yellen now, did not acknowledge that a

speculative bubble was

developing. Instead of, tightening margin requirements as

the Fed did in the 1968

bubble, he flooded the markets with more liquidity to avert any

possible trouble in the

roll-over to the year 2000. The result was from 11/1/1999 to

2/10/2000, only 14

weeks' time, the NASDAQ jumped from 2968 to 5048 and the

QQQ advanced from 65.41

to 117.56. This represented a rise of more than 65%.

I think the bears

should be worried now and we should let our long profits run.

|

|

===================================================================================

OLDER HOTLINES

===================================================================================

Janet Yellen - "There

is no Speculative Bubble"

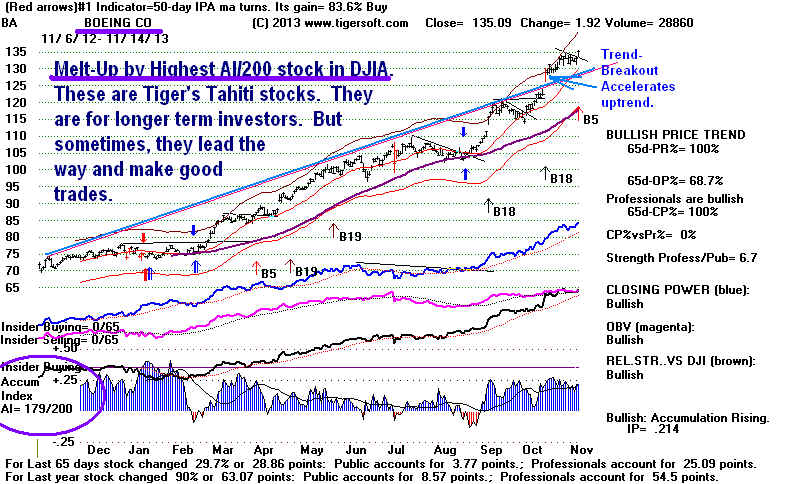

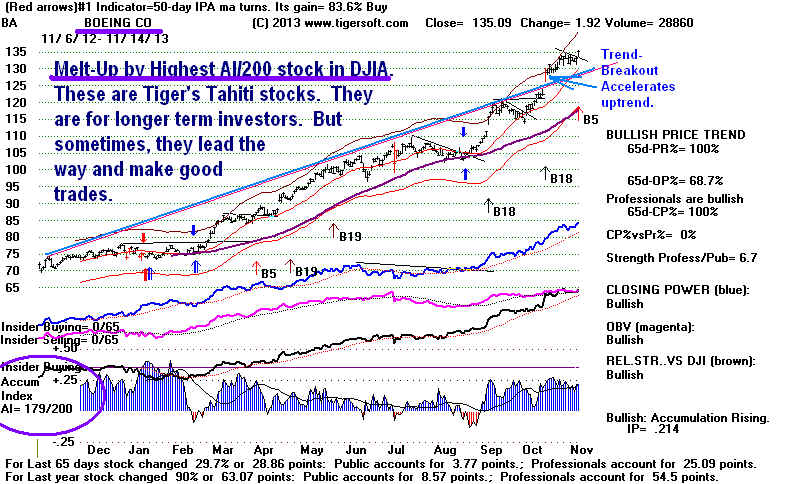

11/14/2013 The new

Peerless Buy B10 is

apt to bring a rise in the DJI by

1000 points. At least, that is projectione can make from its trading range breakout.

Stay long the major market ETFs making breakouts. They should rally higher

by Thanksgiving. Our highest AI/200 stock in the DJI, Boeing, shows what a

"meltup"

is like. There is now more chance of this than a serious decline. I

would stick

with the very highest Accumulation stocks showing strong Relative Strength and

a rising Closing Power.

While

Janet Yellen's words could come back to haunt her,

While

Janet Yellen's words could come back to haunt her,

for now, they are very bullish.

The Fed is not going to "taper". It wants higher

stock prices! See the Senate's confirmation hearings' report in NY

Times. She

insisted that Main Street has gained as much from the ripple effects of Fed policies

as Wall Street.

"Lookout above...."

November Peerless B10s in rising markets have been reliable bullish, but not wildly so.

November Buy B10s

The average November Peerless Buy signal is a rising market brings a DJI gain

of 5.4%. Compared to earlier B10s, ours shows a high IP21 and low volume

(V-I and OPct). A 5.4% gain from 15821.63 would put the DJI at 16676.

Date DJIA Gain LA/MA ROC P-I P-chan. IP21 V-I OPCT

--------------------------------------------------------------------

11/28/1952 283.70 +2.9% 1.034 .774 186 13 .19 217 .47

11/3/1972 984.12 +6.4% 1.039 .539 120 55 .083 1 .259

11/21/2005 10820.28 +7.0% 1.026 .685 227 -10 .108 108 .316

11/13/2013 15821.63 1.015 .500 228 +130 .179 6 .124

A more impressive gain main be made by the NASDAQ if the speculative energies

return to levels like this Summer.

The number of stocks making big daily and 10-day gains is not as high as it was this

Summer.

Instead, speculative money is going into a handful of super-performers. This

focusing on

fewer very hot stocks if it continues will be a sign of trouble ahead. As I

showed, when

a Democrat is in the White House the market usually does not make it past mid February

without a significant decline. But, a decline does not look imminent. Instead,

there is

chance of a "MELT-UP". Seasonality, momentum, the Breakout B10 are all

amply bullish

now. There is no hint from Janet Yellen, the heir apparent to Bernanke, that the

FED

will reduce its Quantiative Easing.

Will The NASDAQ and QQQ Breakout

above the top of their Channel Resistance Lines?

This could start a wild veritical ascent, as

occurred between October 1999 and March 2000.

11/14/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

---->

513 MAXCP stocks Bullish MAXCP

Stocks (11/14/2013) Bullish

plurality

---> 45 -3

MINCP stocks Bearish

MINCP Stocks (11/14/2013)

---> 102 -4

New Highs on NASDAQ 24

+5 new lows. Bullish plurality

---> 163 New Highs on NYSE 13 -4 new lows.

Bullish

plurality

====================================================================================

OLDER HOTLINES

====================================================================================

If you liked what Ben Bernanke did for you in the

stock market, wait until you meet his friend, Janet Yellen....

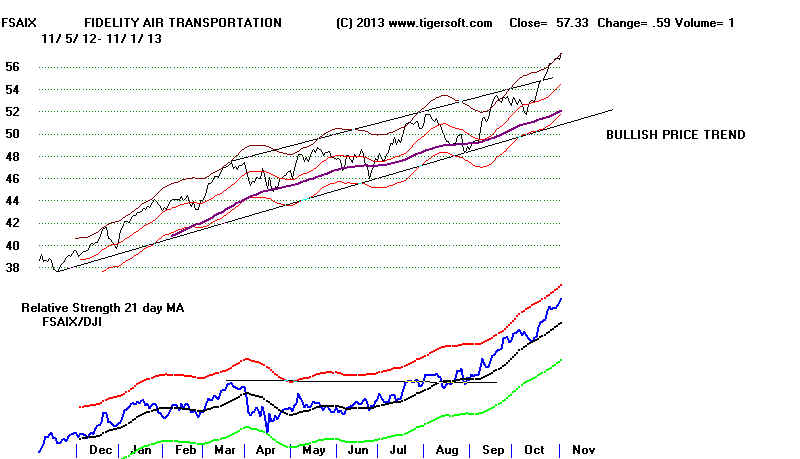

11/13/2013 Peerless added a Buy B10 to help

convince us the market will keep rising.

Janet

Yellen's words today that the Fed's job of improving the US economy using

Quantitative Easing has "more work to do" sent the DJI up to another new

all-time

high closing. It marginally surpassed the set of

recent high closings and thereby gave a Buy

B10. We should probably wait for a clearer DJI breakout past the well-tested

resistance

line, before according the breakout "decisive" status. But the internals

are generally positive enough to be optimistic, as is seasonality now. Wall

Street

loves how compliant the Obama Justice Deptartment is. Today they approved

the merger of airlines' giants, American and US Airways. They are also very pleased

that Obama

is doing so much to have international trade agreements be reached in total secrecy.

All the fuss about the Affordable Care Act will probably disappear once the Fed's

websites work. Lana here at Tiger has signed up with a California health insurance

plan

on-line tonight that will bring her much more care with a far lower deductible at very

affordable price.

11/13/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

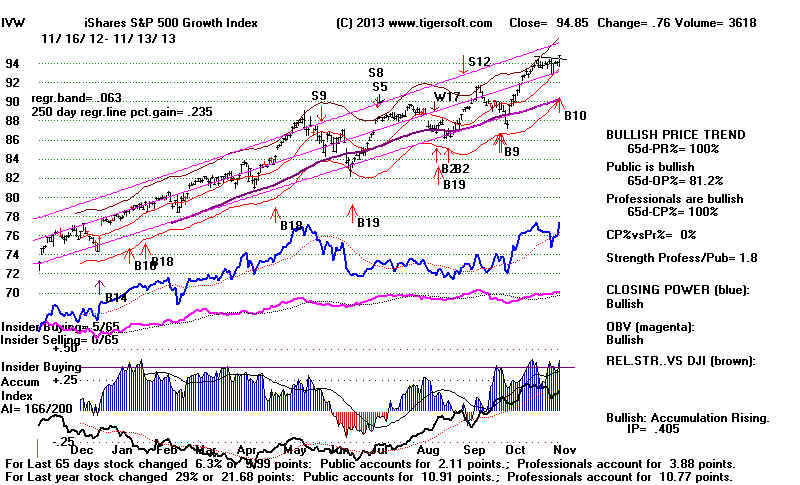

I would cover most of the short sales taken to hedge

against a decline down

from resistance. You can see there are very few Bearish

MINCP stocks now.

There are lots of Bullish MAXCP stocks to choose

from. I prefer the ones

that have not advanced more than 10% in their last breakout and show very high

Accumulation. Among the major market ETFs, consider

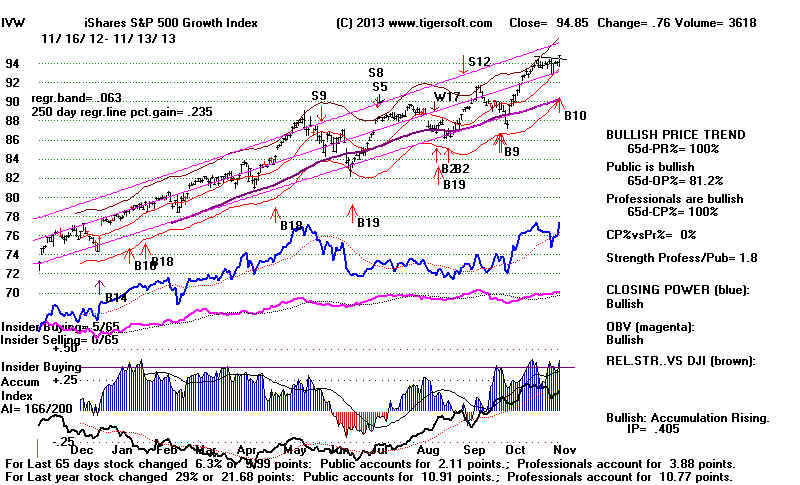

buying IVW or SPY,

also leveraged TQQQ and MVV. The last two show up when

the Power Ranker is run

against the Leveraged stocks. Avoid the Biotech stocks for now. They

have recently been underperforming.

Promising No "Sneak Attacks", the Fed Guarantees

That There Will Be Many More Speculative Bubble Stocks

The Fed has taken away much of the risk element in the market

by telling us in

advance rates will be kept low for a long time. In other markets in the past, there

was

always the risk that the Fed would suddenly surprise investors by raising the

Fed Funds' Rates or the Discount Rate. This seems not true now. As a result,

speculators are having a great time, reminiscent of 1967-1968, 2009-2010 and

oil stocks briefly in 2008. Before a bear market ruined the excitement and good

times in these memorable periods, Peerless gave multiple Sell Signals, especially

including

Sell S9s. These occurred because the DJI reached the upper band with the

P-Indicator negative. The May-2013 S9 was actually a Sell S9-B, not a regular Sell

S9.

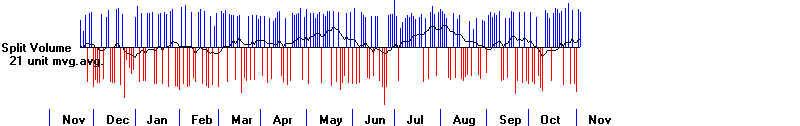

The Number of "Big-Up Stocks" (>20% in 10-trading days, over $5/share)

We will keep watching this chart. It is a measure of

the speculative energy.

Let's watch to see if the number of "big-ups" increases some more because

of the DJI breakout. Right now, this indicator is lagging. I think it will

keep rising.

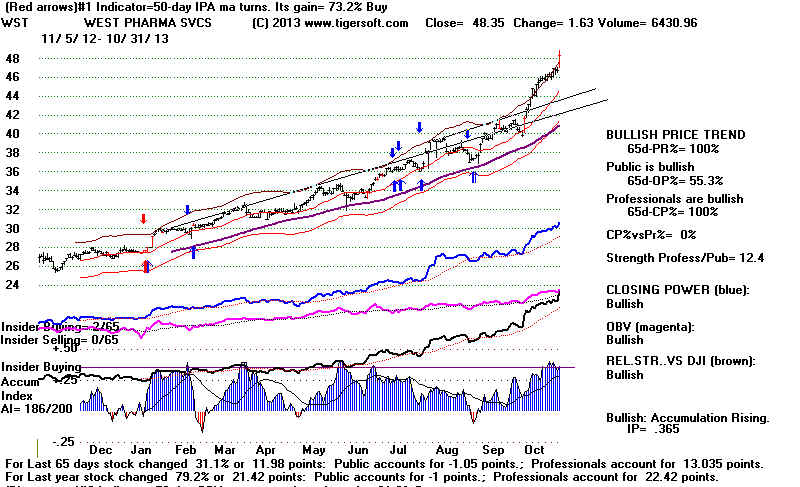

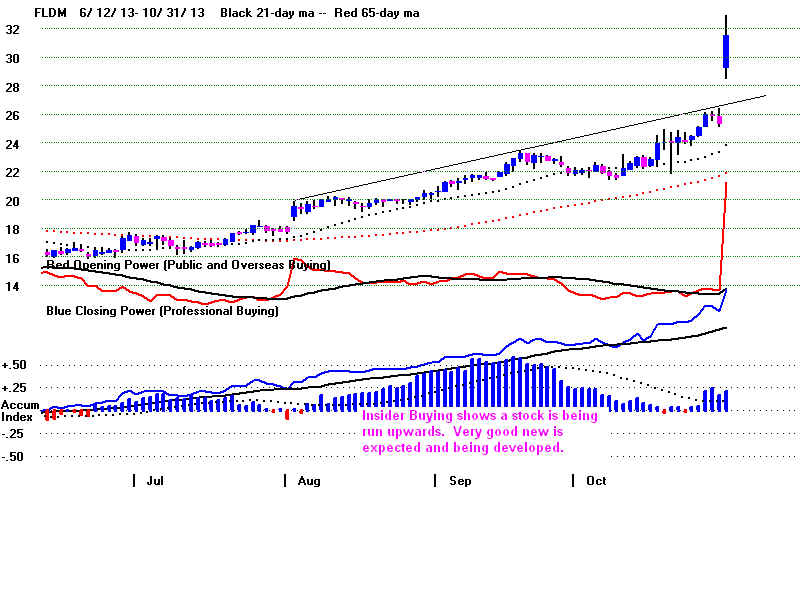

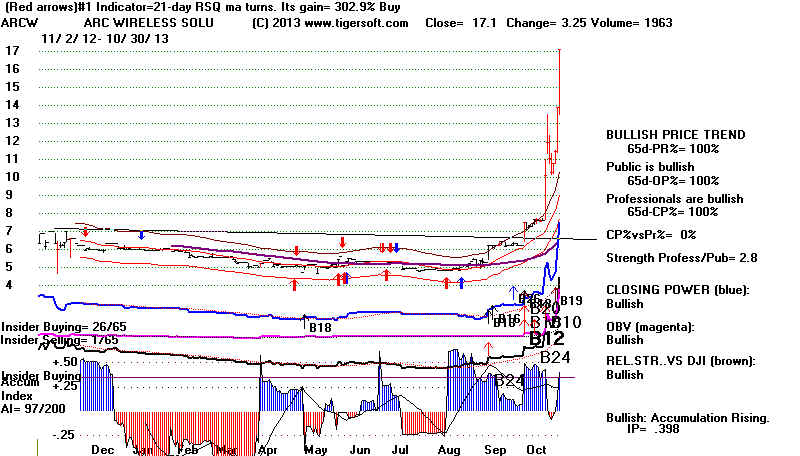

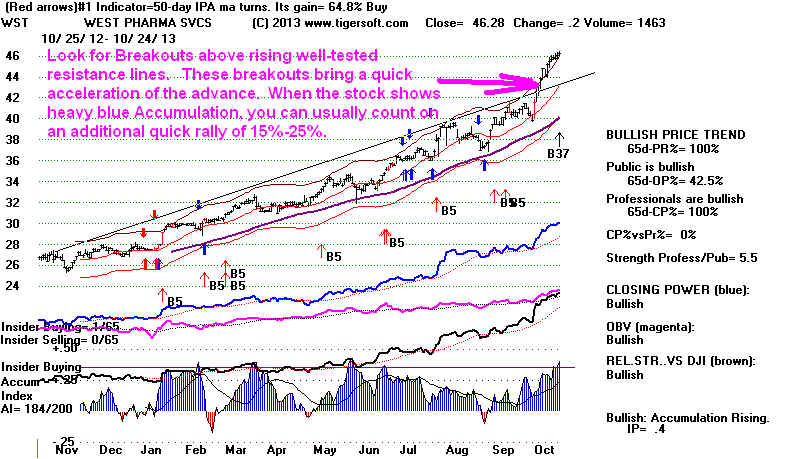

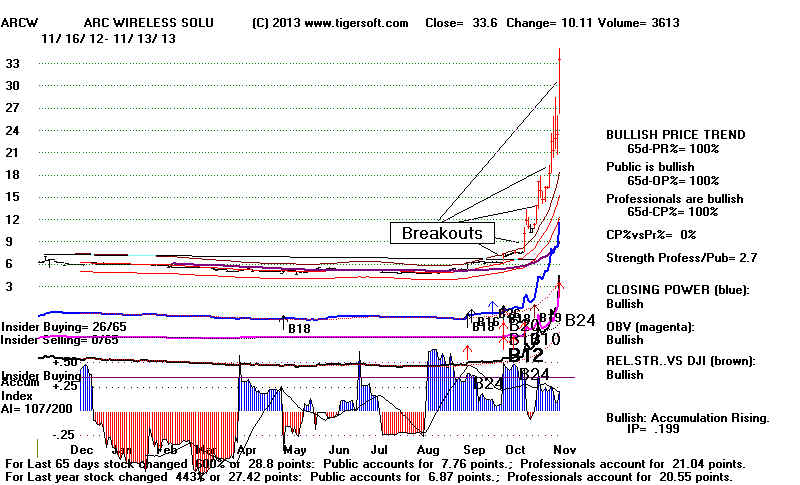

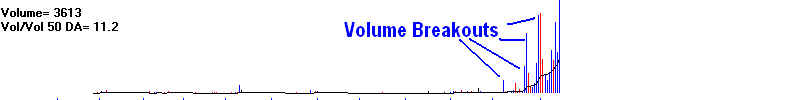

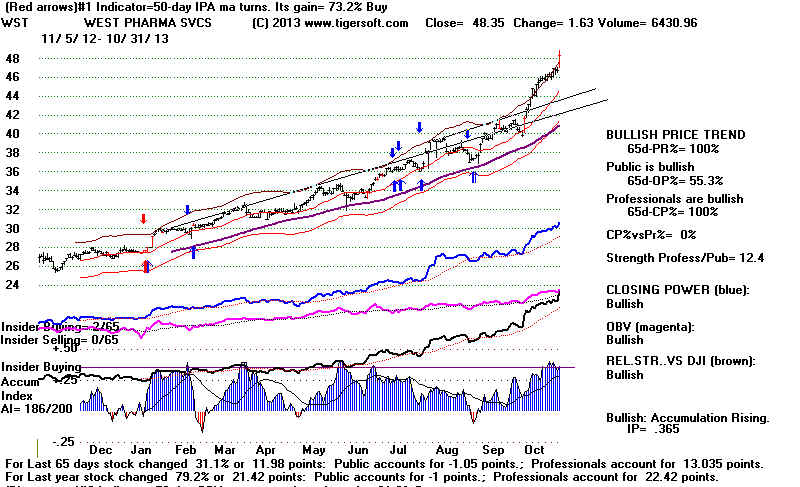

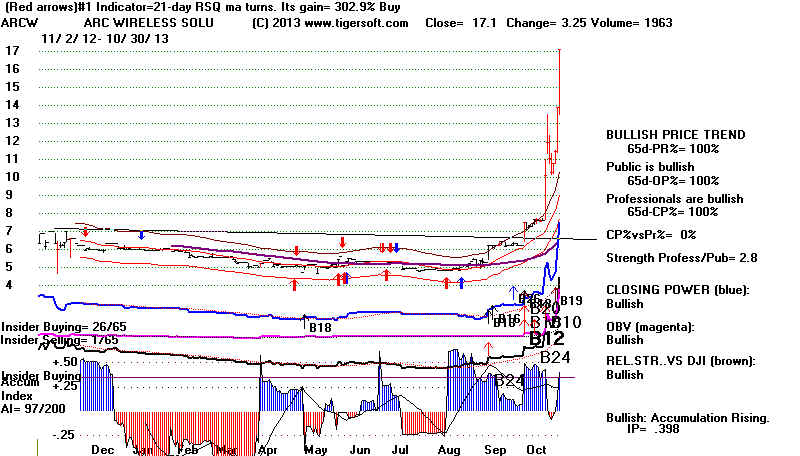

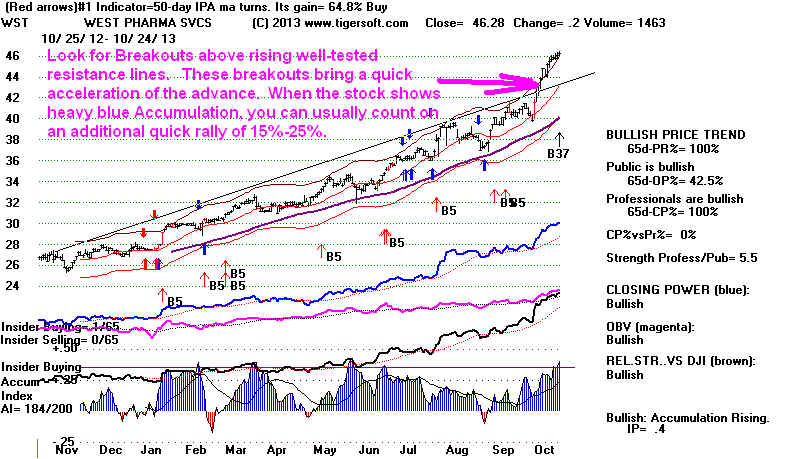

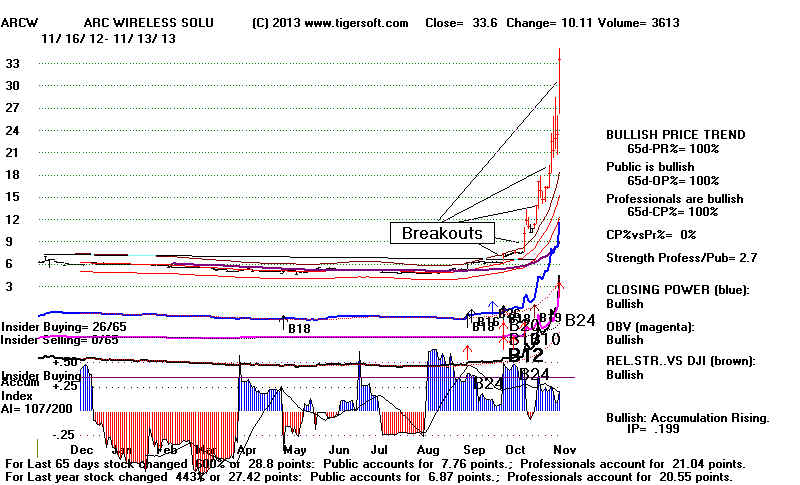

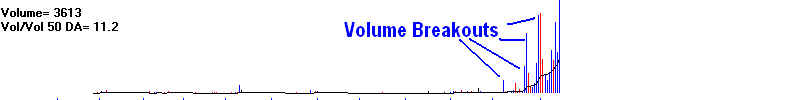

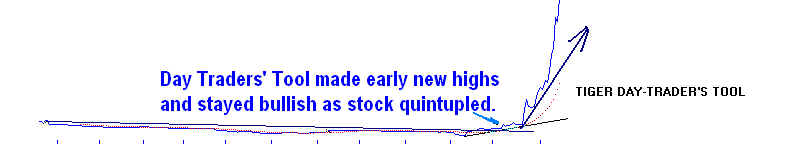

A Perfect Explosive Super Stock

When we look at the Bullish MAXCP stocks, we keep seeing

lots of stocks surging

to new highs that show very high Accumulation, red high volume, Closing Power

and Relative Strength new highs. The best in this market are the ones with good

stories

and new products, like "3-D printing". That's what's behond ARCW.

Print

its chart out below. Put it up where you can see it and be reminded of the

conditions that

come as the stock begins its take-off. Then Google "TigerSoft"

"Explosive Super

Stocks". You'll see ARCW was one in a long line of "explosive super

stocks", as

we define them.

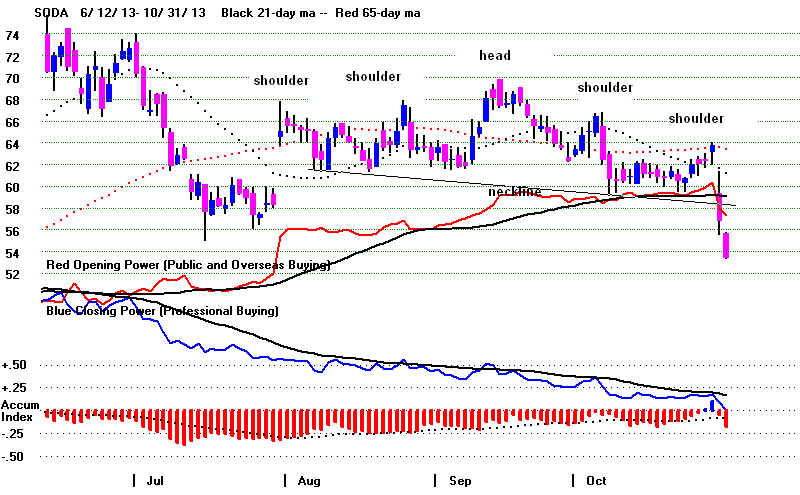

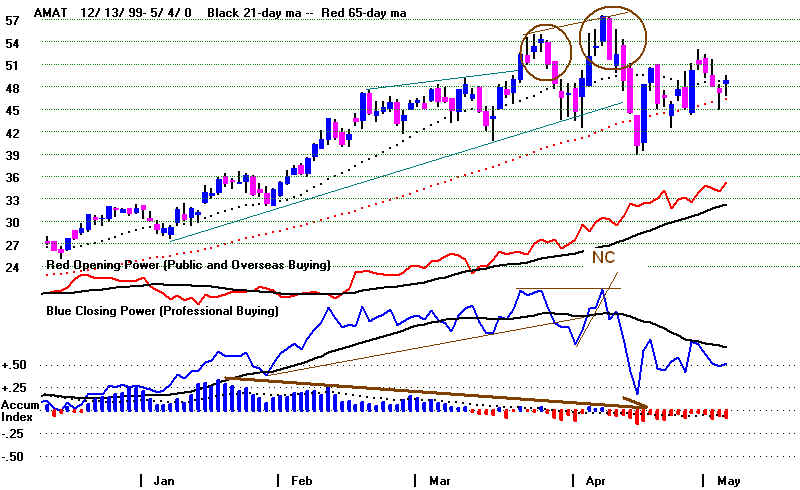

I have to note now that the P-Indicators uptrends have been broken. Additional

weakness would now likely be see in a rise in the 10-year rates,

IBM's falling back from the 65-dma overhead, the QQQ breaking

its new head/shoulders' neckline and IBB (Biotech) turning

back down in accord

with its weak Closing Power.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218 +37

.226 014

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/201

15751 -32

1.013

.344 +97 .109

-28 .035

021

11/13/2013

15822 +71

1.015

.500 +228 .179

+6 .124 024

********************************************************************************************

---->

480 MAXCP stocks Bullish MAXCP Stocks

(11/13/2013) Bullish plurality

---> 48 -8

MINCP stocks Bearish MINCP Stocks (11/13/2013)

---> 106

New Highs on NASDAQ

19 new lows. Bullish plurality

---> 126

New Highs on NYSE 17 new lows.

Bullish

plurality

=====================================================================================

OLDER HOTLINES

=====================================================================================

11/12/2013 Peerless remains on a Buy. Fears

of a decrease in the Quantitative Easing

were said to be responsible for today's DJI decline in increased volume. The decline

was minor. So, most fund managers are more afraid to be out of the market than

seriously

think QE will be soon curtailed. They are probably right. Just like the big

banks are

too big to be allowed to fail, so too, at $4 trillion now QE-III is too big to be

allowed to fail.

Some hedging seems advisable. Our Stocks' Hotline has a few

more longs than

shorts now. The shorts will protect us if the DJI does retreat 5%-6% from its

well-tested resistance line.

.

At the same time, look at the Bullish MAXCP stocks to

see continuing evidence

that speculative optimism is alive and well. The number of "big jumpers",

those

up 30% in the last 10 trading days IS falling, though. Tomorrow night, I'll try

to show a yearly chart of this number.

Momentum and seasonality should give the market more upside

time,

as should the positive P-Indicator, V-Indicator and active Buy.

But it is

a warning that the Peerless Indicators' uptrends have been broken.

Sneak Attacks and Market Tops.

The DJI has again failed to get past the well-tested resistance. This is

automatically bearish for traders, because they know that the market must now

go searching for support. We can't let down our guard.

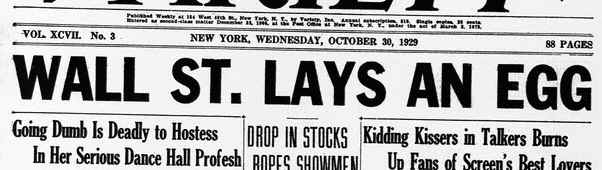

In history, one side's

"sneak" attack is the other side's lack of readiness and failure to allow for

the enemy's treachery and cruelty. Bear market, it is said, come in like a

thief in the night. That was the way the December 1968 top occurred after 2 years

of increasingly wild and wooly over-speculation.

I have to note now that the P-Indicators uptrends have been broken. Additional

weakness would now likely be see in a rise in the 10-year rates,

IBM's falling back from the 65-dma overhead, the QQQ breaking

its new head/shoulders' neckline and IBB (Biotech) turning

back down in accord

with its weak Closing Power.

11/12/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218 +37

.226 014

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

11/12/2013

15751 -32

1.013

.344 +97 .109

-28 .035

021

********************************************************************************************

---->217 -12 MAXCP stocks Bullish MAXCP Stocks (11/12/2013) Bullish plurality

---> 56 -2

MINCP stocks Bearish MINCP Stocks (11/12/2013)

---> 58 (-36)

New Highs on NASDAQ 11

new lows. Bullish plurality

---> 73

New Highs on NYSE 20 new lows.

Bullish

plurality

===================================================================================

OLDER HOTLINES

===================================================================================

11/11/2013 Peerless remains on A Buy. It sure looks the DJI wants

to

breakout. I think the FED will sit on its policy-changing hands this

Christmas

retail season.

The DJI's price pattern is so precise, one has to think that

a clear penetration

of its resistance would be significant for it. With a volume increase, a decisive

DJI breakout close past 15840 should bring a new minimum DJI target of 17,000.

Since the DJI is watched by a lot of people, expect quite a few to be drawn in from

the sidelines. I suspect the speculative energies we are seeing in less

welll-known

stocks will heat up more if the DJI breaks out.

The Fed Is Still

The Key

The Fed Is Still

The Key

Unfortunately for the bulls, investors are looking ahead into 2014 and

seeing trouble. That's why 10-Year rates are

at the apex of a right shoulder,

thereby poised to go higher, and several housing stocks are now in the Bearish MINCPs,

as is an Emerging markets' bond fund. As a result, the NYSE A/D Line is

lagging

noticeably, though it usually takes a much wider non-confirmation by the A/D Line

of the DJI new highs to stop momentum like we see now. Dissension

within the Fed

is building. The head

of the Fed's whole bond buying program is now talking openly

about

how little the Fed's massive buying of bonds has helped Main Street. I doubt

if he would speak out so publicly if this was not now the accepted wisdom within

the Fed. But as I suggested two weeks ago, there is no easy QE Exit-Plan.

The market

appears hooked on artificial stimulus. The real US economy is widely lagging the

market. So, the Fed needs to support Wall Street stock prices to prevent a

Financial

Collpase-caused deep recession.

"QE" Has Become "too big to fail"!

"Over five years, its bond purchases have come to more than $4 trillion.

Amazingly, in a supposedly free-market nation, QE has become the largest

financial-markets intervention by any government in world history. And the impact?

Even by the Fed's sunniest calculations, aggressive QE over five years has generated

only a few percentage points of U.S. growth....Having racked up hundreds of billions of

dollars in opaque Fed subsidies, U.S. banks have seen their collective stock price triple

since March 2009. The biggest ones have only become more of a cartel:

0.2% of them

now control more than 70% of the U.S. bank assets...As for the rest of America, good luck.

Because QE was relentlessly pumping money into the financial markets during the

past five years, it killed the urgency for Washington to confront a real crisis:

that of a

structurally unsound U.S. economy. Yes, those financial markets have rallied

spectacularly,

breathing much-needed life back into 401(k)s, but for how long? "

( Andrew Huszar -

Head of Fed's Bond Buying Program)

For Now, Momentum Should Rule

and Seasonality is Bullish, too.

The upward trend of the rest of the market is very steadily up. And any

decline, if

it still happens, is likely to be shallow and limited to 5% to 6%. Seasonality is

neutral for

the next week, but the DJI rises 70.2% of the time in the 10 trading days after

November 11th and 80..9% over the next two months. That, at least, is what happened

between 1965 and 2011. The Accumulation Index and P-Indicator on the DJI now

are quite positive. That makes a rare November or December Peerless Sell unlikely. i

Democrats in The

White House Bring Tops At The

Beginning of The Second Year in The Presidential Cycle

But what we have to worry about, I think, is the typical market top and decline

with a Democrat in the White House. See below how often this occurred after 1945

between late December and February in the year of the mid-term Elections.

Feb 1946-March 1946 10% decline - Truman

Feb 1950-March 1951 5% decline - Truman

12/28/1961 was a major top. DJI fell 26% by June.

Kennedy

1/18/1966 top before 9 mo 20% bear market Johnsom

Carter's Presidency was an exception. His first year

was a bear market.

2/1/1994 - top and 10% DJI decline. Clinton.

Earlier sell-off

-/12/5/1997-1/9/1998 DJI 10% decline. Clinton

1/14/2010 - 2/8/2010 7% decline. Obama

Momentum Is Up

The DJI-30 has struggled in isolation to get past its well-tested resistance.

The

NASDAQ, SP-500, the Tiger Index of the Dow-30 stocks themselves,

the Tiger Index of SP-500 stocks and the Tiger Index of the Russell-1000 stocks

are in unusually well-defined up-channels.

Having studied the relationship between the other indexes when the DJI makes

breakouts after the NASDAQ and the SP-500, it's hard to

believe that an official

DJI breakout would do immediate harm to what is already a powerful up-market

that is shared by most sectors. The real risk is that it will speed up a buying

climax,

where the NASDAQ jumps 25% as it did in the October 1999-March 2000 period

and the Fed then decides to start raising rates to prevent a bigger stocks' bubble

not backed up realistically by earnings' potential.

11/11/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218 +37

.226 014

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

11/11/2013

15783 +21 1.016 .419 +159 .139

-13 .115 023

********************************************************************************************

---->229 MAXCP stocks Bullish MAXCP Stocks (11/11/2013) Bullish plurality

---> 58

MINCP stocks Bearish MINCP Stocks (11/11/2013)

---> 58 (-36)

New Highs on NASDAQ 11

new lows. Bullish plurality

---> 73

New Highs on NYSE 20 new lows.

Bullish

plurality

********************************************************************************************

=================================================================================

OLDER HOTLINES

=================================================================================

11/8/2013 Peerless Remains on A Buy. Though breadth was somewhat

impaired

because interest rates rose, many of the week's weakest NASDAQ and Biotechs

stocks fought their way back above the 65-dma. IBB's

Closing Power is still in

a falling trend. Even though many high priced biotechs were up, their Closing

Powers are is steep declines, showing continued Professional selling. See their

charts here:

11/8/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

The DJI is at the top of its trading range. Until it breakouts, there is more

downside

potential than usual when Peerless is on a Buy signal.

2-Day Reversals Up

I examined today the cases since 1980 where the DJI fell 1.75% one day and then

rose by that much the next day with the DJI between 1.5% and 2.5% over the

21-day ma. The first thing that emerges is how many more cases there are in the

last 6 years due to computerized trading. The conclusion I draw from this is that

such reversals are less important. Still, there are two cases where such 2-day

reversals were soon followed by flat-topped breakouts.

la/ma Outcome

--------------------------------------------------------------------------------------------------------

11/8/2013 1.017

12/29/2011 1.018 Breakout

followed with January take-off.

7/22/2010 1.022 DJI

rallied 3% and then droped to lower band.

10/20/2010 1.016 DJI rallied

2.5% and then droped close to lower band.

10/22/2009 1.026 DJI fell 3%

and then rallied.

12/5/2008 1.02 Sidewise for 3

weeks.

4/28/2003 1.022 Up

strongly.

2/5/2001 1.025 DJI fell below lower band.

4/17/1998 1.025 DJI fell lower band.

4/14/1989 1.02 A valid FLAT TOPPED BREAKOUT followed..

6/28/1988 1.015 DJI

declined to lower band.

4/28/1983 1.022 BREAKOUT

followed.

Flat-Topped Breakouts

Momentum, as I keep saying favors an upside breakout by the DJI above the

well-tested 15800 resistance. But when? I

re-did the study of DJI trading ranges,

> 5%-6% DJI pullbacks above flat resistance occured without Sells

in 1984 three times: September, October and November)

and in 1986 (November).

> Novembers brought reversals down, not breakouts, in 1980. However,

1972 did yield a successful November breakout, as Nixon's re-election was

celeberated.

>Breakouts are more common in late December or January. Valid late

December/January flat topped breakouts occurred in 1985, 1987 and 1991.

The breakout in January 2000 was quite false. The Peerless Sells in January

2000 were unmistakably bearish.

>The NYSE A/D Line is lagging the DJI now. Flat topped breakouts can still

work out in these circumstances, but the advances are more likely to be limited

than bring big advances that last more than 3 months.

Flat

Topped DJI Breakouts with Peerless Buys and A/D Line NCs.

DJI Breakout

Result

----------------------------------------------------------------------------

9/26/1968

11 weeks advance

11/14/1972

7 weeks advance

Dec 1986

much higher later in 1986

May 1990

7 weeks advance

9/17/1996

much higher...

11/8/2013 ---> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

Links corrected. Some items added.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218 +37

.226 014

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

11/8/2013

15762 +167 1.017 .489 +222 .158

-5 .120

016

********************************************************************************************

---->183 MAXCP stocks Bullish MAXCP Stocks (11/8/2013) Bullish plurality

---> 78

MINCP stocks Bearish MINCP Stocks (11/8/2013)

Low Priced High Accum Stocks (11/8/2013)

---> 94

New Highs on NASDAQ 20 new lows. Bullish plurality

---> 92

New Highs on NYSE 30 new lows.

Bullish

plurality

===================================================================================

OLDER HOTLINES

===================================================================================

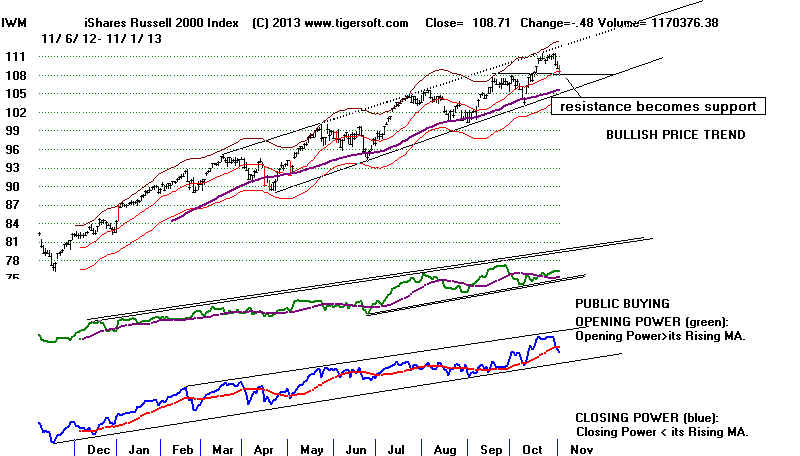

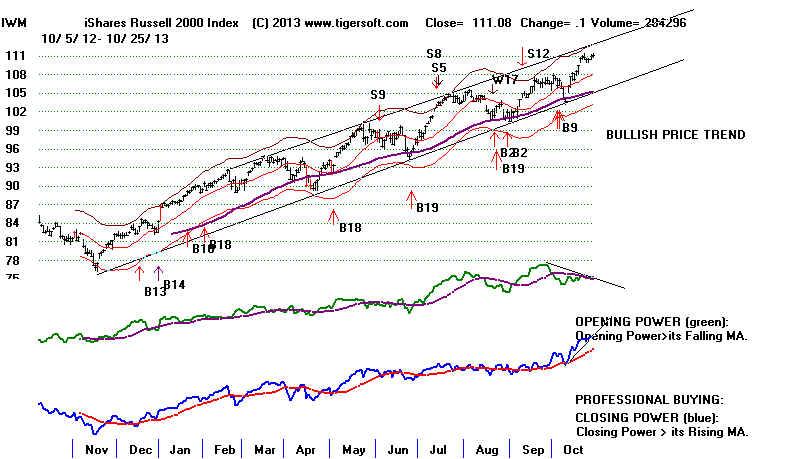

11/6/013 Still No Peerless Sell. The

DJI approaches 15800, its pivot point.

If it breaks out above that level, it should boost IWM and the rest of the

market. But if it fails to stay above 17700, a DJI retreat of 5%-6% would

seem to become more probable.

The DJI scored a new all-time high today, but its high has all but tagged

the well-tested resistance-line over-head. Bearishly its move was not confirmed

by the NYSE A/D Line, the NASDAQ, SP-500,

QQQ or IWM. Such

non-confirmations a

re not good. A DJI retreat would probably be healthier than a breakout. Our

IWM long position actually fell today. It should not have done

this. IWM's

a close call, but I think simple prudence requires it to be sold tomorrow if the DJI

cannot stay above 15700. There is the possibility that it will breakout

past 15800...

But a DJI 5% to 6% retreat from the well-tested resistance is also possible, too,

even without a Peerless sell. The 1986-1987

case shows this.

Biotechs are a problem for the market now. In 2000, they peaked 2-3

weeks

before the QQQQ and NASDAQ did. Will that happen again here? Their very

weak Closing Power shows that Professionals are not ruling that out! Sell short IBB

on the strength tomorrow after the DJI's higher opening..

===================================================================================

OLDER HOTLINES

===================================================================================

11/7/013 Still No Peerless Sell. The DJI, however, has fallen back

from the

15800 pivot point. A 5% or 6% decline would be consistent with the dictates

of its well-established trading range. So we have to take some profits and

should do some short-term hedging. I have suggested selling IWM,

which

is still in an uptrend, shorting IBB (Nasdaq biotechs) and

some of our "Piffle"

and bearish MINCP stocks, while we await developments

regarding Fed intentions.

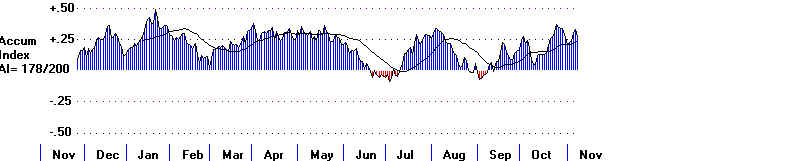

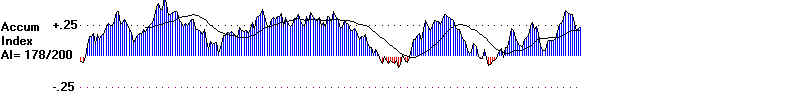

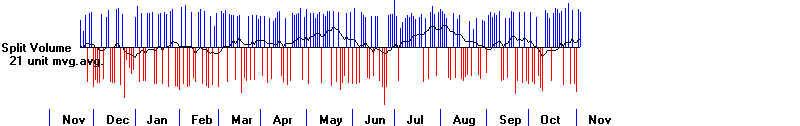

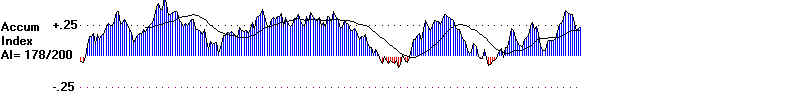

The SP-500 and NASDAQ charts below show high and steady Accumulation. This

means that any decline by them to their uptrends and their rising 65-dma may

good support. But it is no guaranee. The NASDAQ's high

AI/200 score may not forestall

or prevent a year-end decline. Looking back when the AI/200 was consistently positive

and above 150, we still see a 10% retreat by the NASDAQ in 1989, a 30% decline in

mid 1990,a 15% decline in the first half of 1992, a 14% sell-off in the first hald of 1994

and a 18% free-fall in 2010. In these cases, there was either a Peerless Sell or a

completed head/shoulders in the NASDAQ. We have no Peerless Sell, but the NASDAQ

has completed a small head/shoulders pattern. Caution now is warranted.

11/7/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

Links corrected. Some items added.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218 +37

.226 014

11/7/2013

15594 -153

1.000

.61 +301 .159

+6

.115 007

********************************************************************************************

----> 53 MAXCP stocks Bullish MAXCP Stocks (11/7/2013)

---> 136

MINCP stocks

Bearish MINCP Stocks (11/7/2013) Bearish

plurality

Bearish-Looking

Crazy-Up Stocks. 11/7/2013

---> 28

New Highs on NASDAQ 39 new lows. Bearish plurality

---> 22

New Highs on NYSE 29 new lows.

Bearish plurality

===================================================================================

OLDER HOTLINES

===================================================================================

11/6/013 Still No Peerless Sell. The

DJI approaches 15800, its pivot point.

If it breaks out above that level, it should boost IWM and the rest of the

market. But if it fails to stay above 17700, a DJI retreat of 5%-6% would

seem to become more probable.

The DJI scored a new all-time high today, but its high has all but tagged

the well-tested resistance-line over-head. Bearishly its move was not confirmed

by the NYSE A/D Line, the NASDAQ, SP-500,

QQQ or IWM. Such

non-confirmations a

re not good. A DJI retreat would probably be healthier than a breakout. Our

IWM long position actually fell today. It should not have done

this. IWM's

a close call, but I think simple prudence requires it to be sold tomorrow if the DJI

cannot stay above 15700. There is the possibility that it will breakout

past 15800...

But a DJI 5% to 6% retreat from the well-tested resistance is also possible, too,

even without a Peerless sell. The 1986-1987

case shows this.

Biotechs are a problem for the market now. In 2000, they peaked 2-3

weeks

before the QQQQ and NASDAQ did. Will that happen again here? Their very

weak Closing Power shows that Professionals are not ruling that out! Sell short IBB

on the strength tomorrow after the DJI's higher opening..

11/6/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

Links corrected. Some items added.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

11/6/2013

15747 +129

1.020

.751 +378 .218

+37

.226

014

********************************************************************************************

----> 196 -48 MAXCP stocks Bullish MAXCP Stocks (11/6/2013) Bullish plurality

High

Accumulation Low Priced Stocks 11/5/2013)

---> 71 +12

MINCP stocks

Bearish MINCP Stocks (11/6/2013)

Bearish-Looking

Crazy-Up Stocks. 11/6/2013

---> 57

New Highs on NASDAQ 34new lows. Bullish plurality

---> 65

New Highs on NYSE 13 new lows.

Bullish

plurality

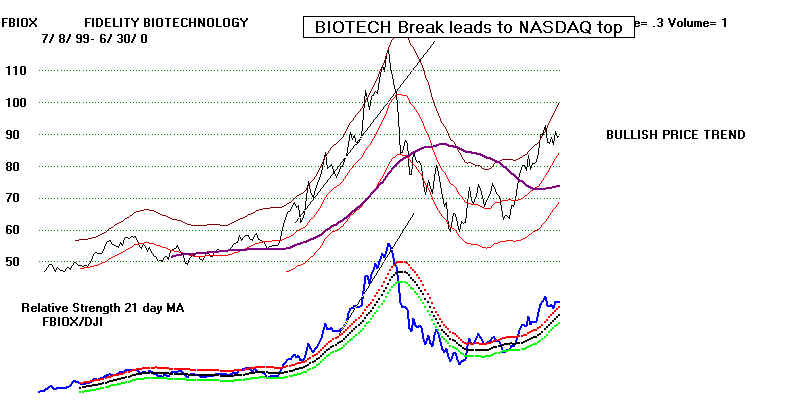

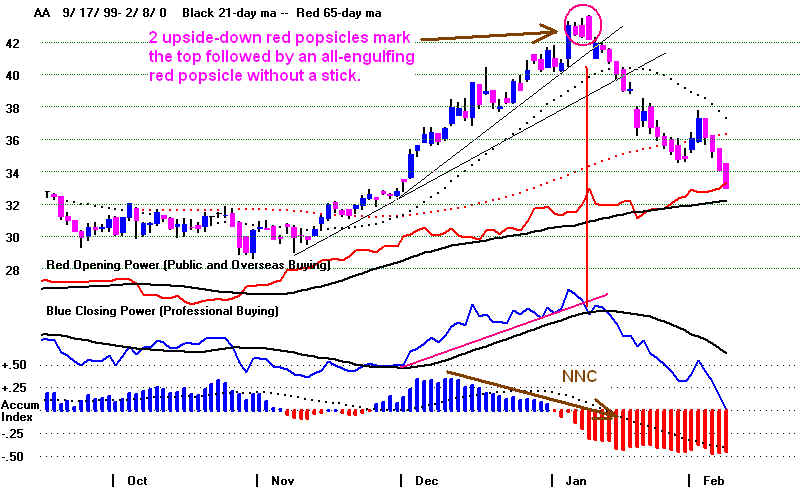

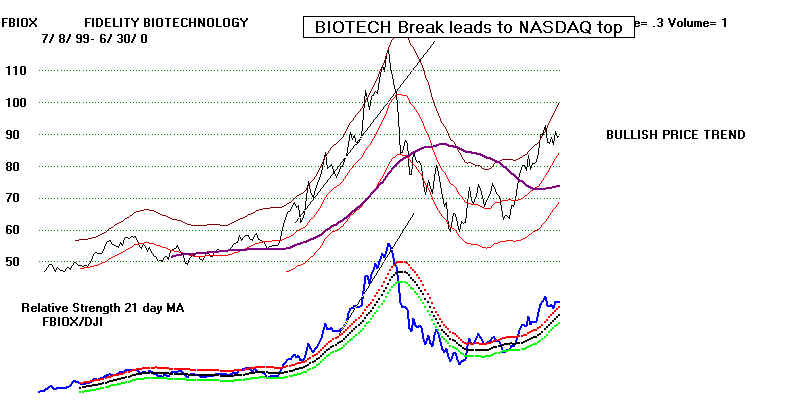

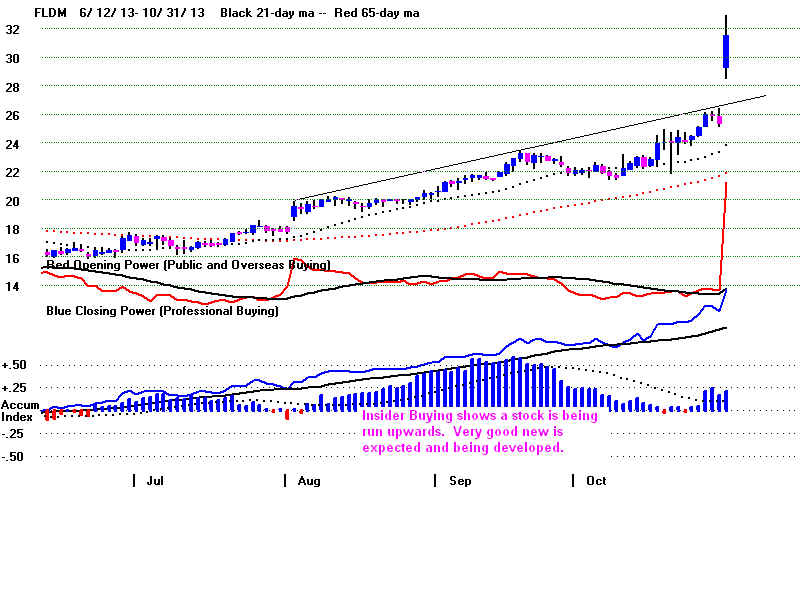

Biotech Weakness Will Hurt NASDAQ

It was the breaking of the biotech bubble in 2000 just as the mapping of the

human genome was accomplished that played a big role in the NASDAQ

collapse. See an article from 2000. QQQQ topped out two weaks later.

It was the way QQQQ' Closing Power fell and fell to new 12 month

lows in 2000 that is the parallel I fear now looking at a number of Biotechs

that are up a long ways.

Biotech

Sell-Off Ignites Rout of Tech Stocks - Los Angeles Times

"Mar 15, 2000 - A vicious morning sell-off

in biotechnology stocks spilled over to other techs"

QQQQ 2000 Top

The research I have presented here suggests that any retreat will

probably

be limited, especially given the DJI's upward momentum. But the weakness

in Biotechs could easily worsen. Sell short IBB with the idea that we may

have to cover it quickly if it aborts its head/shoulders pattern by moving

above its right shoulder. The biggest biotechs are getting too far ahead

of their rank and file brethern. They also are breaking the 65-dma. With

heavy Professional selling (falling Closing Power), we will see how bullish

the broad Public still is. Very often, distribution occurs mostly on the way

down. In other words, prices decline on falling Closing Power even though

there may be higher Openings. Many have risen a very long ways. PCYC,

for example, has risen more than 75x its level 4 years ago.

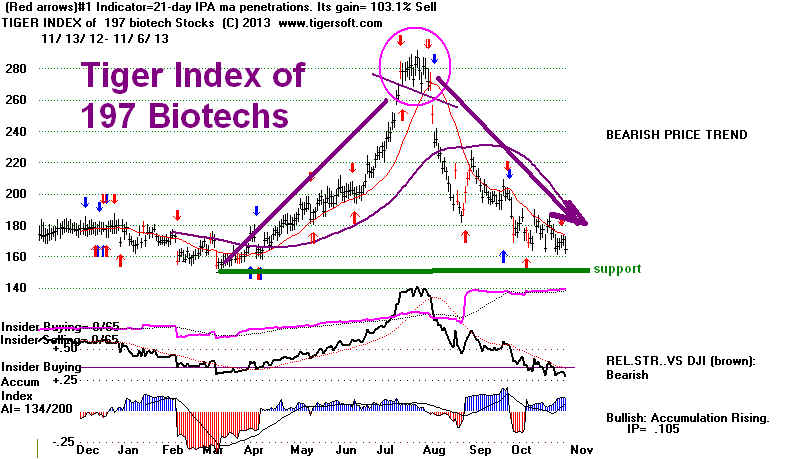

I am concerned about the growing weakness in the Biotech group. An awful

lot of profit-taking could occur. With profits so big, there will likely be a lot

of hasty, clumsy dumping as prices drop much further. The leaders are

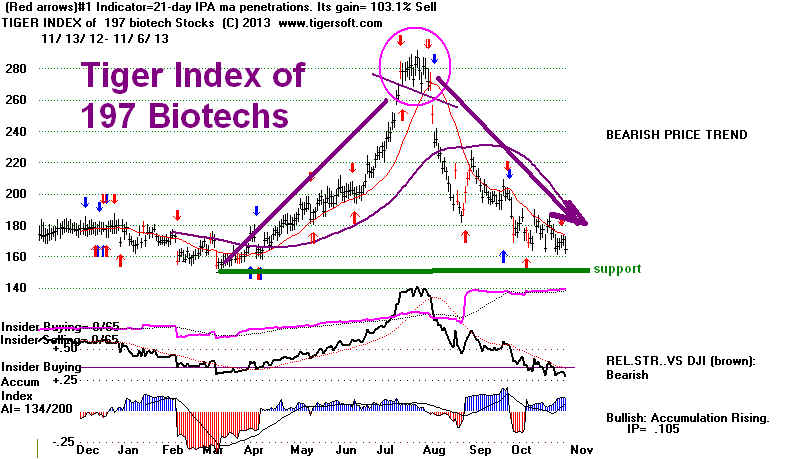

too far ahead of the rank and file, I would say. The Tiger Biotech Index of 197 |

such stocks is looking much, much weaker.

Now the Fidelity Biotech Index (FBIOX ) and IBB (Nasdaq

Biotechs)

have just violated their 65-dma. This will force institutions to either add to

their positions or lighten up. My guess is that they will lighten up.

And if they

start to do that, it may turn into a selling rout.

See how a number of biotechs have already badly fallen through trap-doors:

ARIA, AVEO, BIOF, CCXI, CRIS, GTXI, HWAY, IMGN. A lot more

seem likely.

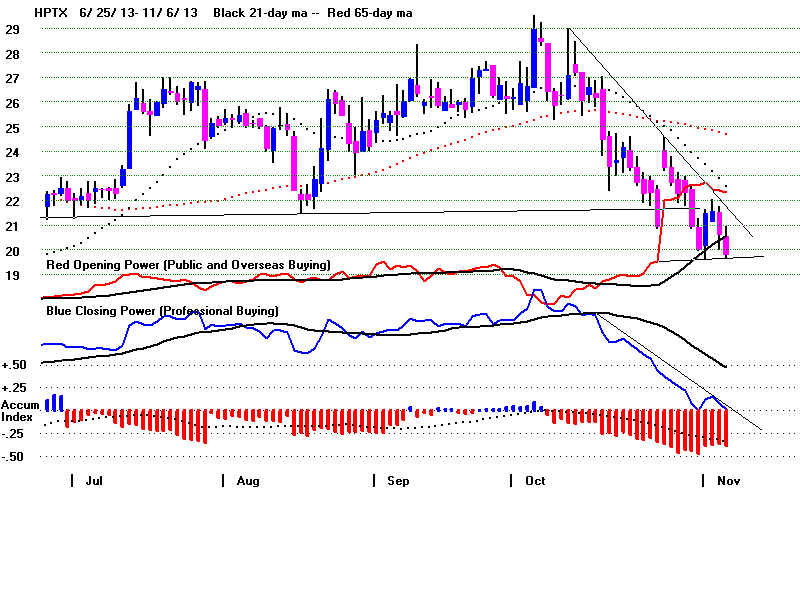

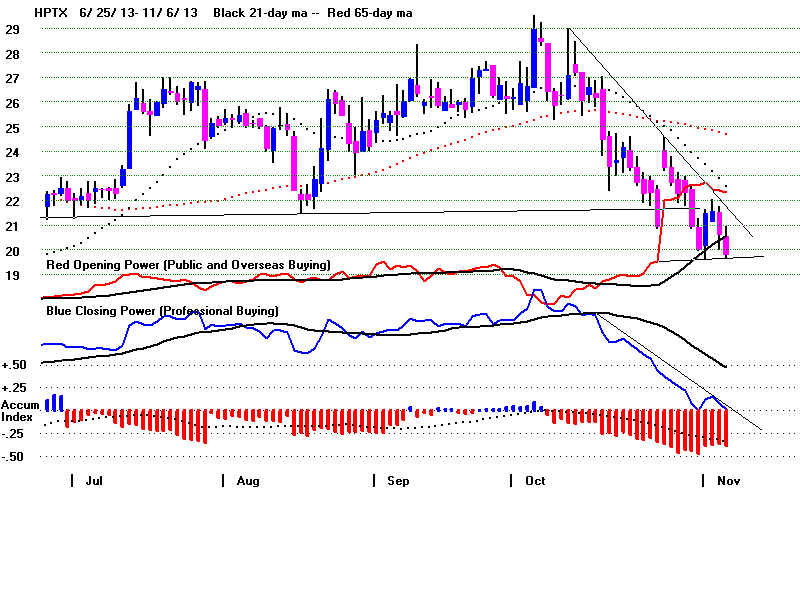

I would sell short IBB. PCYC, RPRX and HPTX should also be considered.

|

===================================================================================

OLDER HOTLINES

===================================================================================

11/5/013 Still No Peerless Sell. I take the strength in the Futures

(now +77) as a sign

that Wall Street is much relieved that the Republican Tea Party candidate in

Virginia lost and that the "moderate" Republican Christie won handily in New

Jersey.

The Tea Party represents uncontrollable, wild unpredicatability to Wall Street.

Establishment Democrats are much easier to influence and work with.

We are long IWM and did not go short IBB. Because of the DJI's trading range

and the frequent cases where there is a pullback of 5% to 6% from its well-tested

resistance even when there is no Peerless Sell, I have suggested hedging with

some BEARISH MINCP or CRAXY-UP/PIFFLE

stocks.

Many of our high Accumulation BULLISH MAXCPs keep advancing

to new highs.

Now with the DJI futures up so much, it looks like the pivot point of 15831 will be

tested soon. Understand that breakouts into all-time high territory truly terrify

the shorts

because there is often no good technical price level where they can take a stand

against the stampeding bulls. That is why the market may breakout and advance

a quick 5% or 10%, even, in these circumstances.

The closest parallel I can find for the market right now is seen in the

1986

and 1986-1987

charts. If the market were to follow the pattern here, there would be a 6%

retreat in November from 15800 and then a powerful surge early next year.

Another way to look for parallels is to find the cases since 1945 where the upwards

momentum of the DJI (using the annualized rate of change of the Least Squares Line)

and the AI/200 were roughlty similar. Using this approach, we should not expect a

top until January unless Peerless gives a Sell Signal.

I came across an article in Yahoo that reflects my own bullishness. It talked

about

one of my favorite themes: how the stock market can keep rising while Main Street,

employment and wages languish.

http://finance.yahoo.com/news/us-economy-plods-pay-lags-184103537.html

Bears are mostly basing their case now on sentiment indicators showing excessive

bullishness

on the part of individual investors. Many of the individual stock gains

have been "frothy", I agree. Some hedging may be justified, but Peerless

has not

given a Sell and the research tonight would tend to make us think that the next

top may not be until January unless we get a Peerless Sell, a head/shoulders top

or some other clearly bearish development.

Watch the Biotechs tomorrow. If they fail to participate in a strong DJI advance,

it will show the NASDAQ and the QQQ will have to retrace some of their gains

and consolidate before they can hope to repeat the November 1999 to March 2000

climactic advance.

DJI-15800 is where resistance line now crosses.

11/5/2013 ---> To Key Index and Leading

Stock Charts: DJI, SP-500, etc.

Links corrected. Some items added.

DJI

la/ma annroc P-I

IP21 V-I

Opct 65-day Pct Change

-----------------------------------------------------------------------------------------------------------------------------------

10/29/2013 15680 +111 1.027 .430 +312 .210 +27

.149 01

Top?

10/30/2013 15618 -62 1.022 .333 +188 .175

-1 .054

006

10/31/2013 15546 -73 1.016 .321 +175

.13 -18

.038

006

11/1/2013

15615 +70

1.019 .482

+245 .153 +4 .138 - 001

11/4/2013

15639 +24

1.018

.44

+248

.134 +6 .141 - 002

11/5/2013

15618 -20 1.015

.529

+279 .161 +7

.130 - 000

********************************************************************************************

----> 244 MAXCP stocks Bullish MAXCP Stocks (11/5/2013) Bullish plurality

High

Accumulation Low Priced Stocks 11/5/2013)

---> 59

MINCP stocks

Bearish MINCP Stocks (11/5/2013)

Bearish-Looking

Crazy-Up Stocks. 11/5/2013

---> 66

New Highs on NASDAQ 25 new lows. Bullish plurality

---> 58

New Highs on NYSE 14 new lows.