TIGER

HOTLINE

TIGER

HOTLINE

william_schmidt@hotmail.com

A

Guide To Profitably Using The Tiger Nightly HOTLINE

A

Guide To Profitably Using The Tiger Nightly HOTLINE

TIGER

HOTLINE

TIGER

HOTLINE

william_schmidt@hotmail.com

A

Guide To Profitably Using The Tiger Nightly HOTLINE

A

Guide To Profitably Using The Tiger Nightly HOTLINE

TigerSoft and

Peerless Daily Hotline

(C)

1985-2011 William Schmidt, Ph.D. www.tigersoft.com

All rights

strictly reserved.

IMPORTANT: Please notice The

Hotline's Address will change Monday night.

Subscribers should have gottem an email this weekend giving new address.

If you did not get it, send an email to william_schmidt@hotmail or

Renew the Hotline, order here

350 (check) - 360(Visa/MC)

====================================================================================

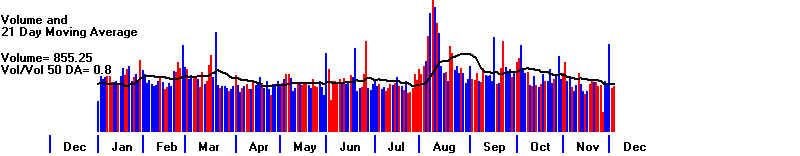

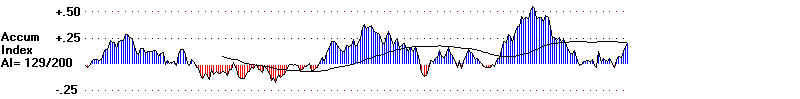

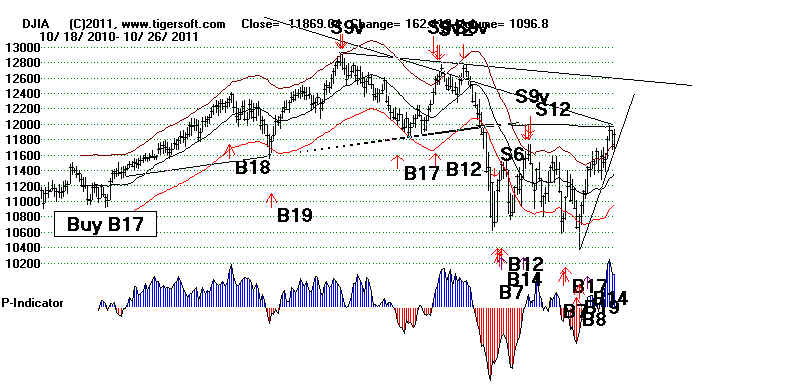

1216/2011 DJI = 11867 =2 la/ma=1 .003 21-dma ROC-

-.039 P= -174 ( +110 ) IP21=

-.116 V=

-104 OP=

-.106

12/16/2011 BREADTH STATISTICS:

37 +4 MAXCP stocks Bullish MAXCP Stocks

312

-18 MINCP stocks Bearish MINCP Stocks Bearish Plurality

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

18 new highs on NASDAQ. 77 new lows on NASDAQ BEARISH

33 new

highs NYSE

36- new lows on NYSE BEARISH

12/16//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

Most groups still have a plurality of stocks below their 65-dma. Defensive groups are still favored. BEARISH

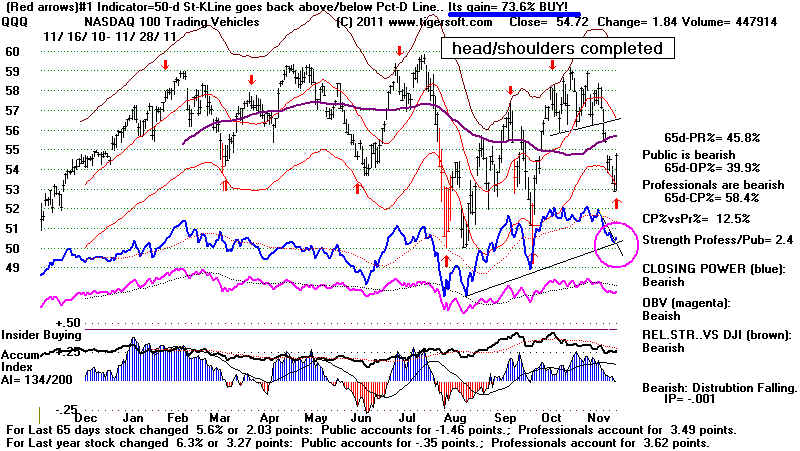

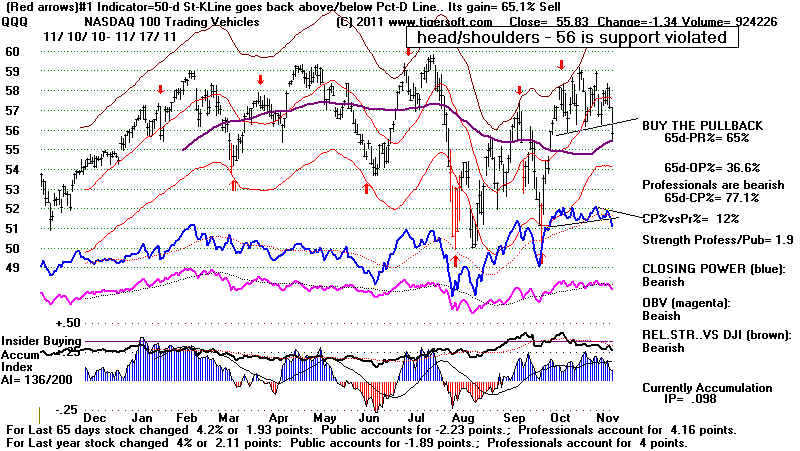

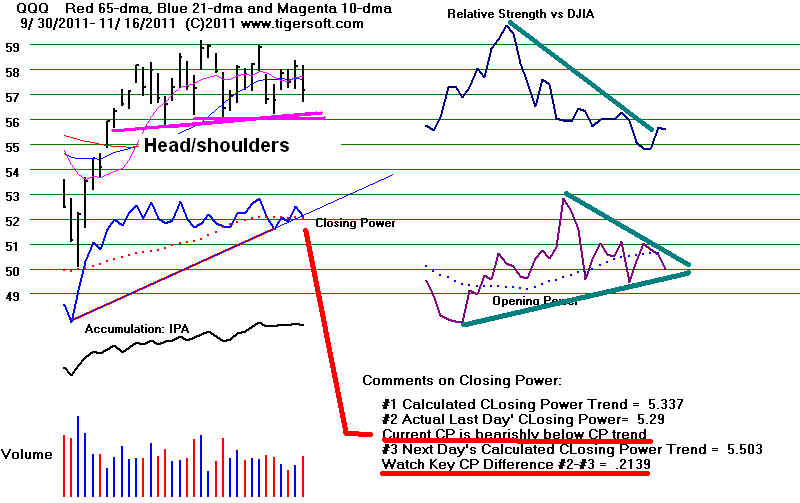

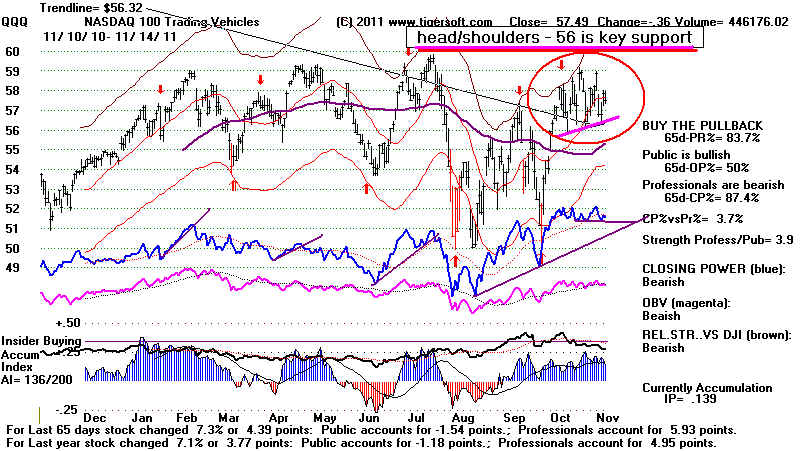

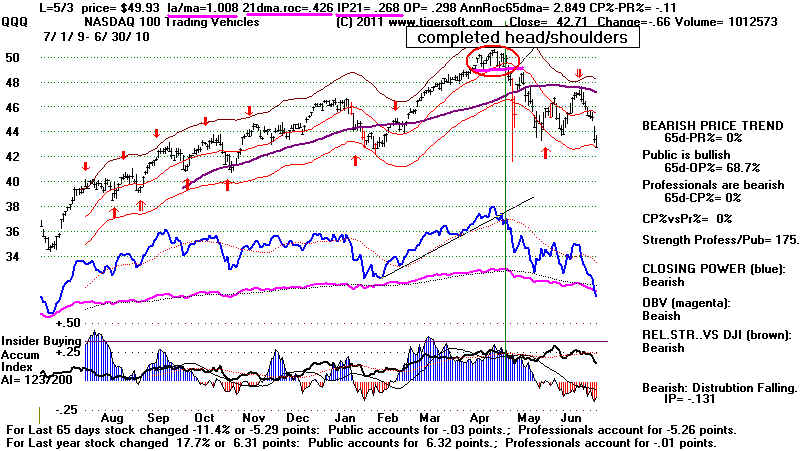

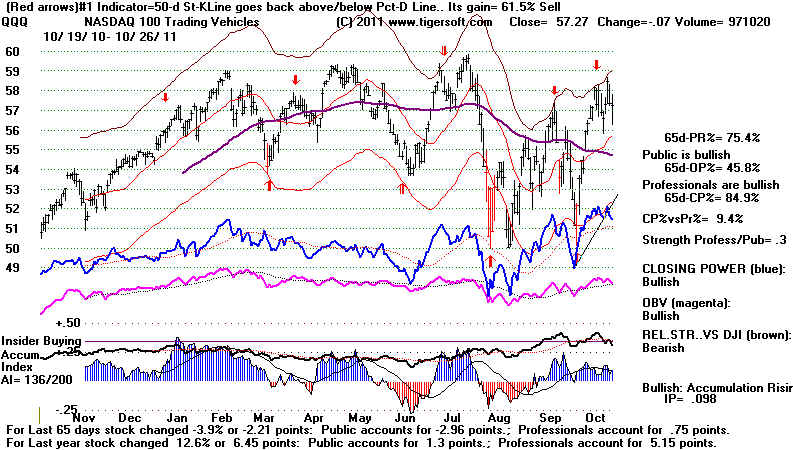

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

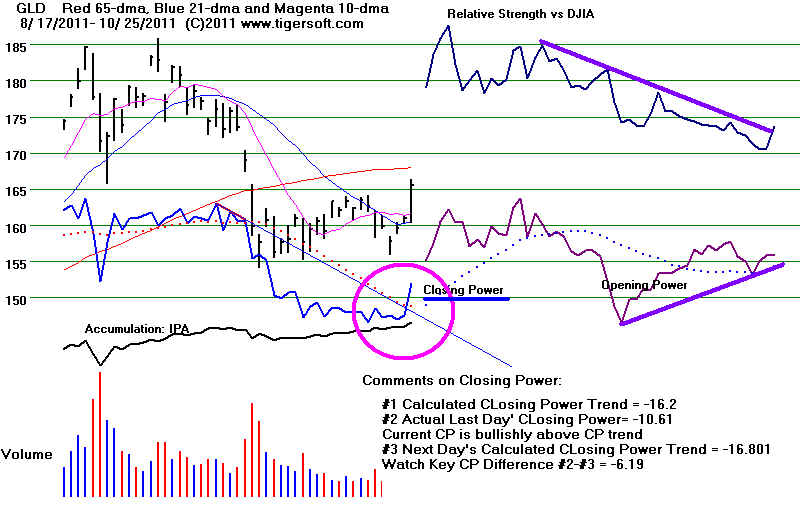

GLD SLV Crude

Precious Metal Stocks declining

CP BEARISH

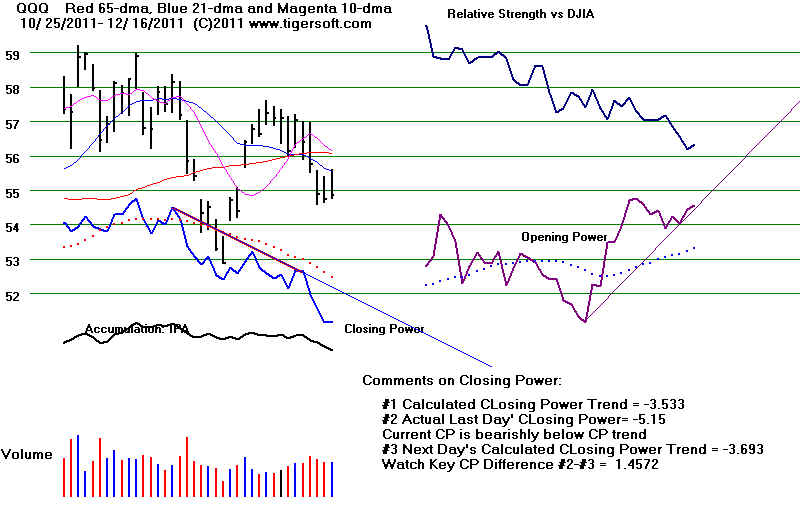

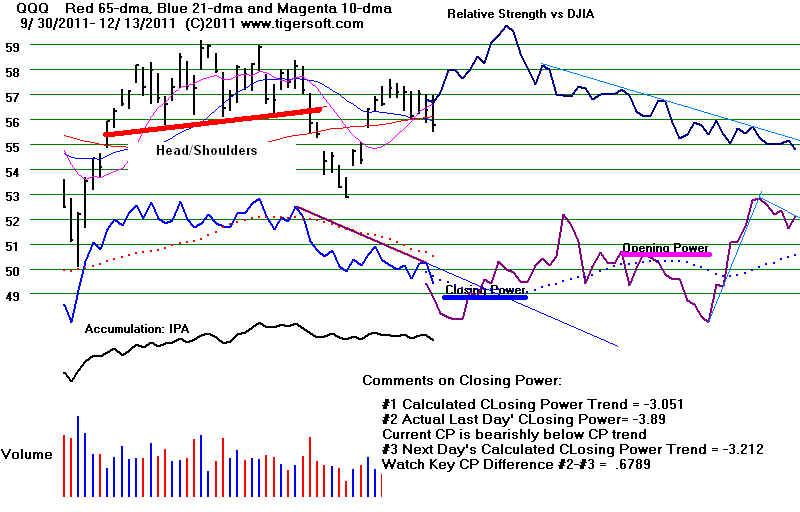

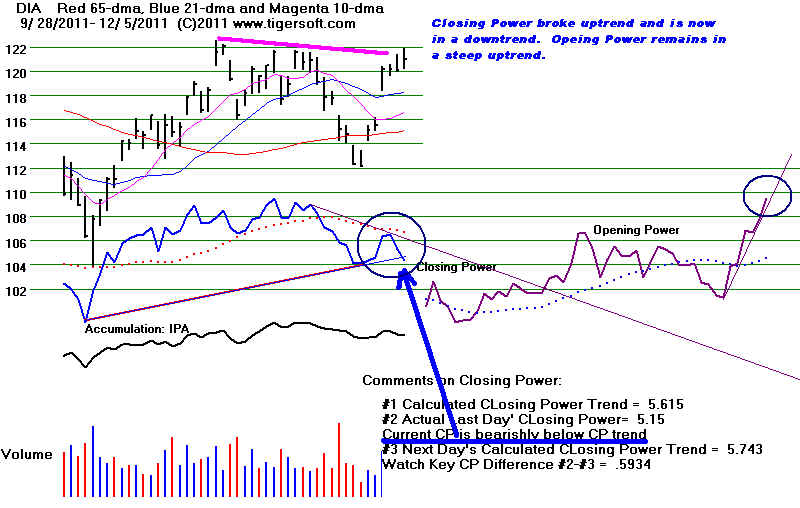

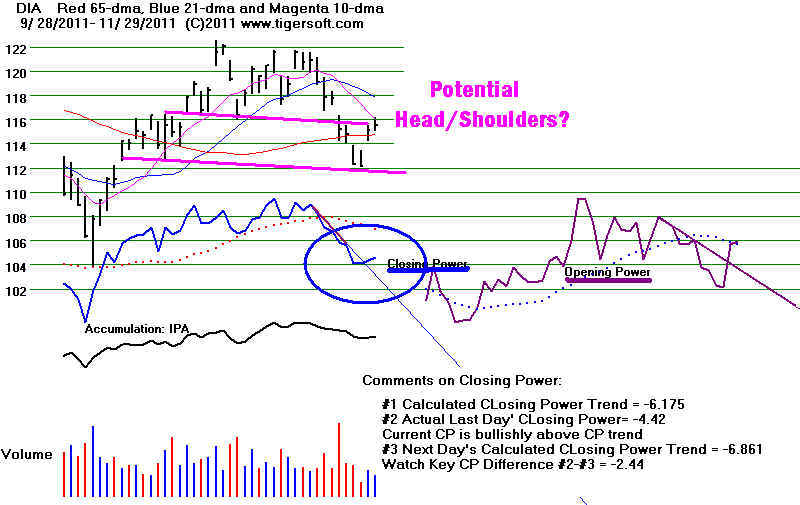

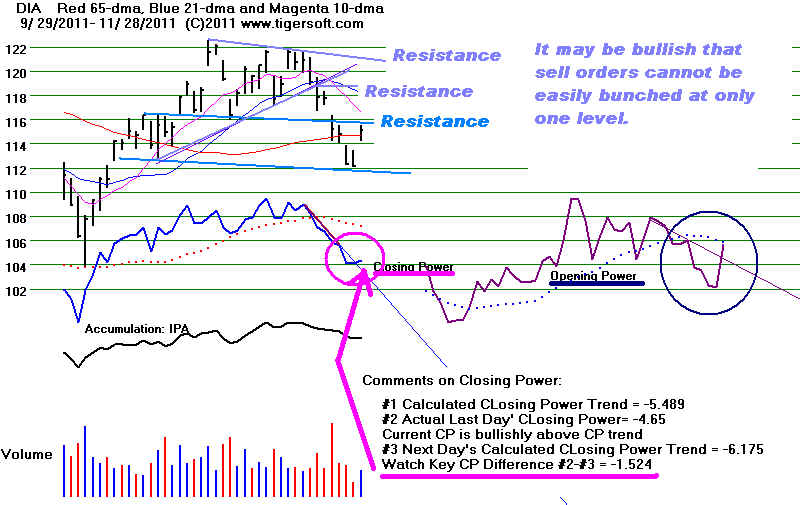

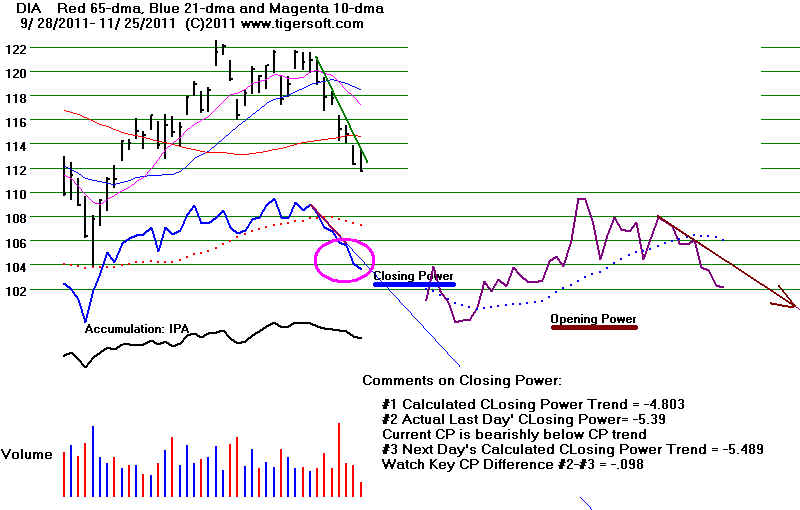

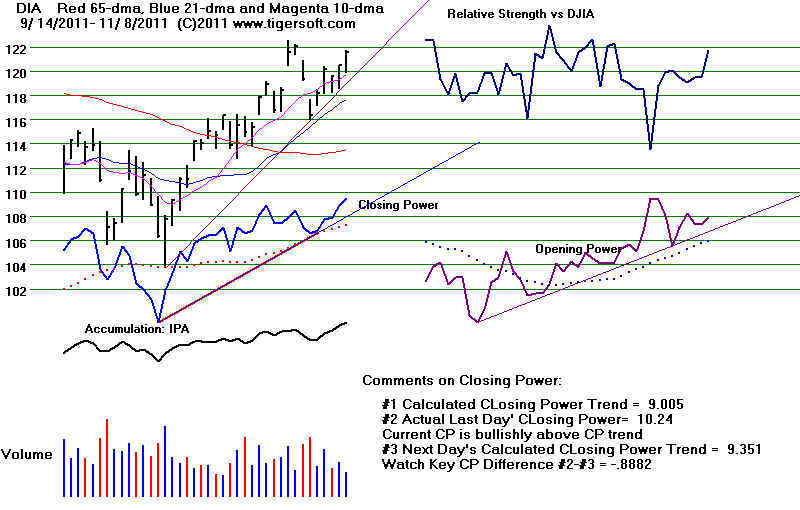

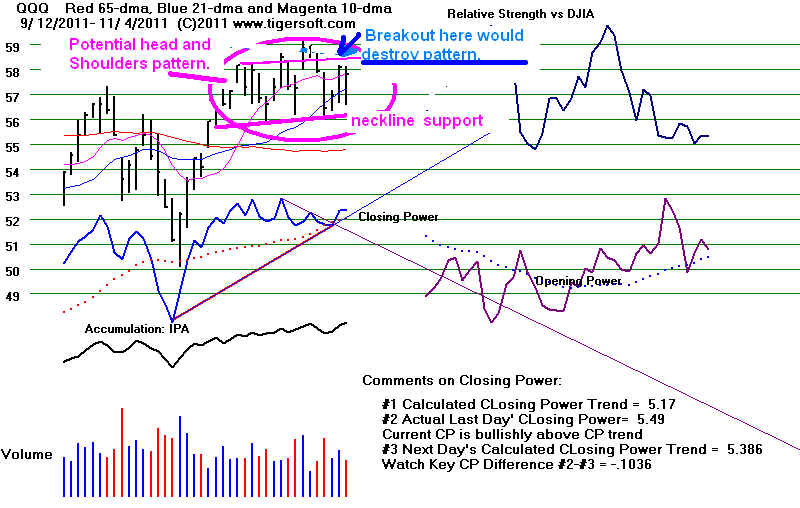

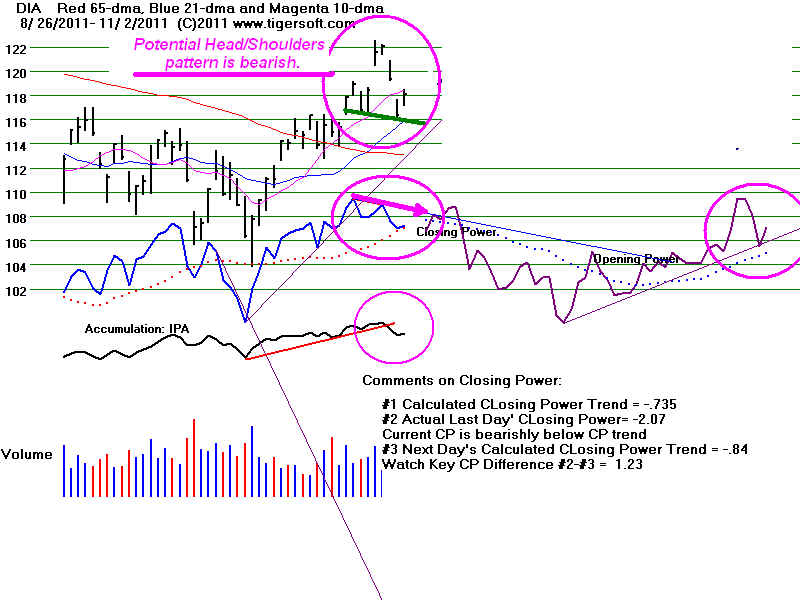

12/16/2001 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are all in

Down-trends. This is short-term

BEARISH

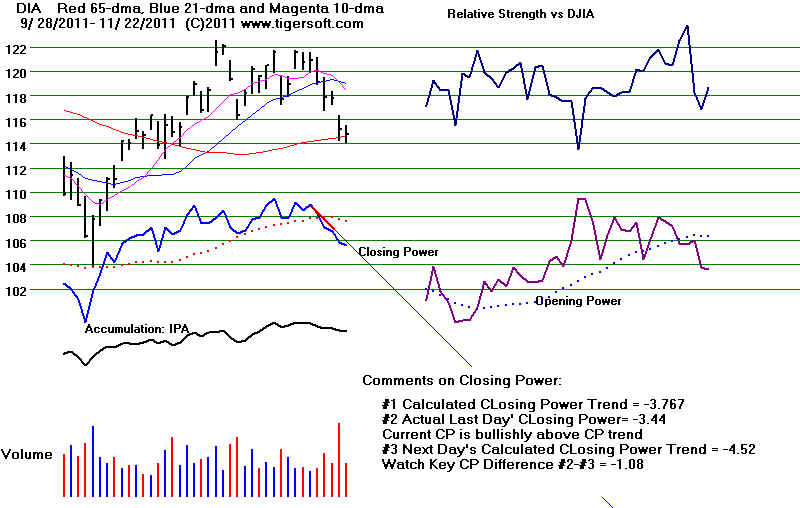

DIA' s CP iS in a

DOWNtrend

Any close of more than 3.39 ABOVE

the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

SPY's CP is in a DOWNtrend Any close of more than 3.27 ABOVE the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

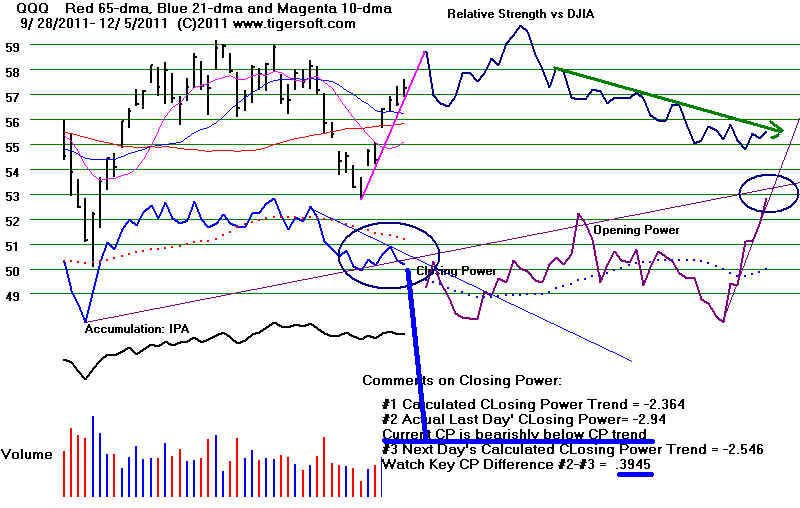

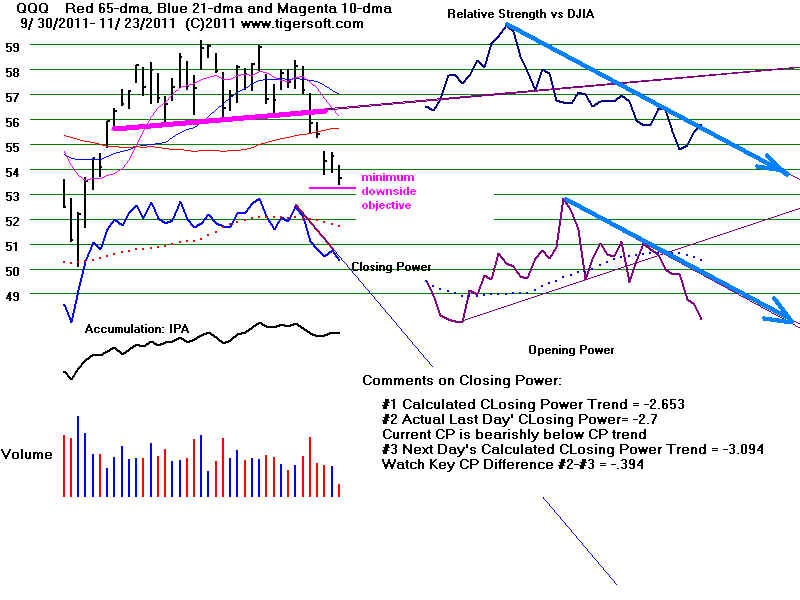

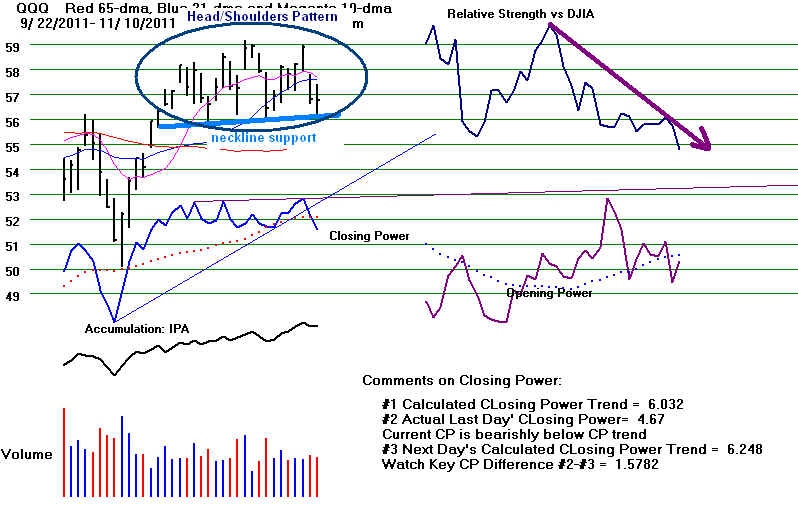

QQQ's CP is in a DOWN-trend Any close of more than 1.46 ABOVE the Opening

GLD's CP is in a DOWN-trendline- Any

close of more than 7.42 ABOVE

the Opening will break the CP DOWN-trendline. The CP is now below its rising

21-dma.

The Opening Power is short-term

risng.

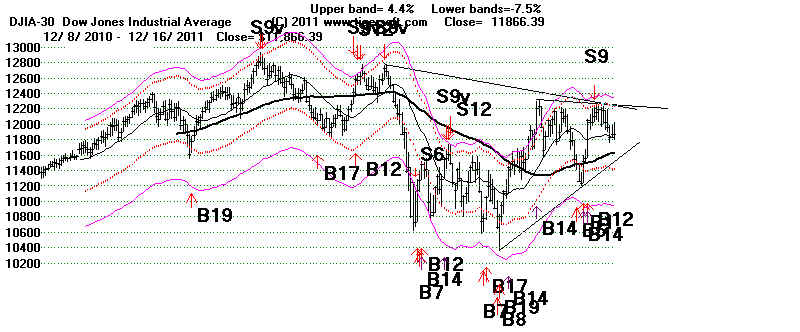

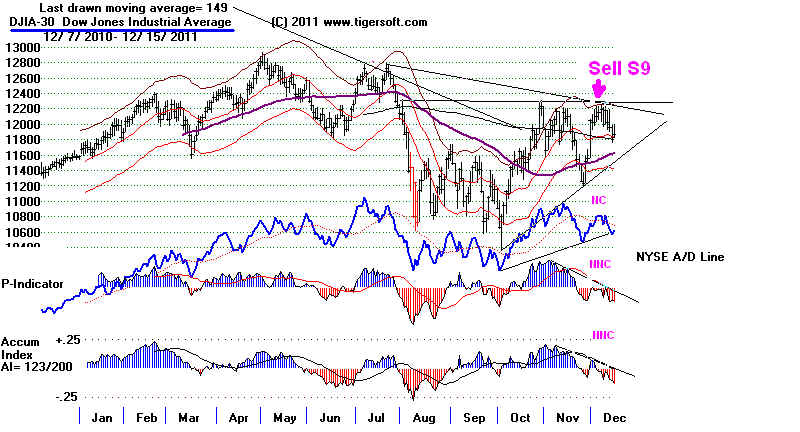

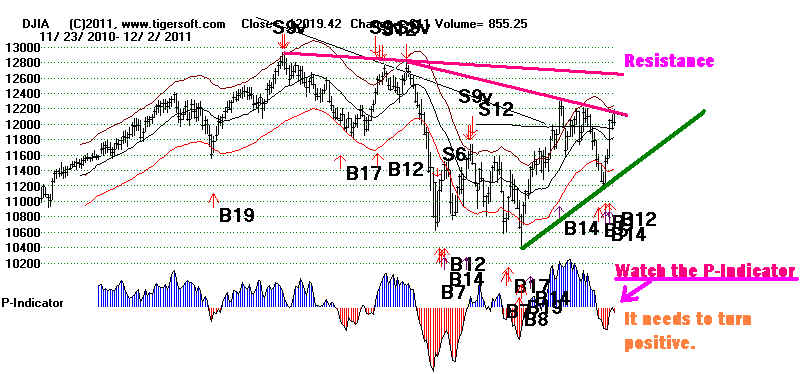

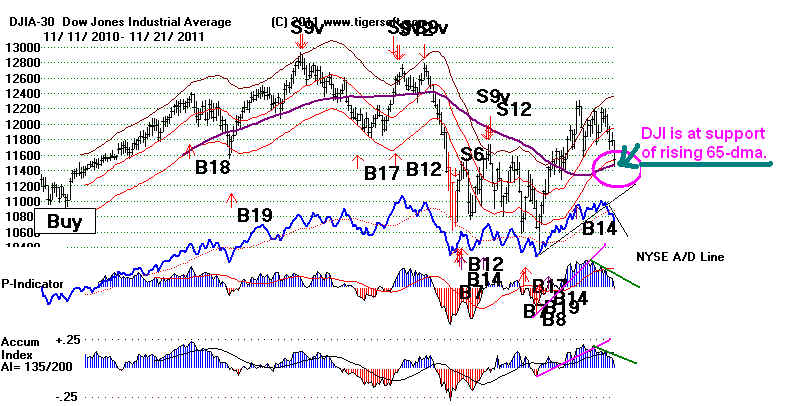

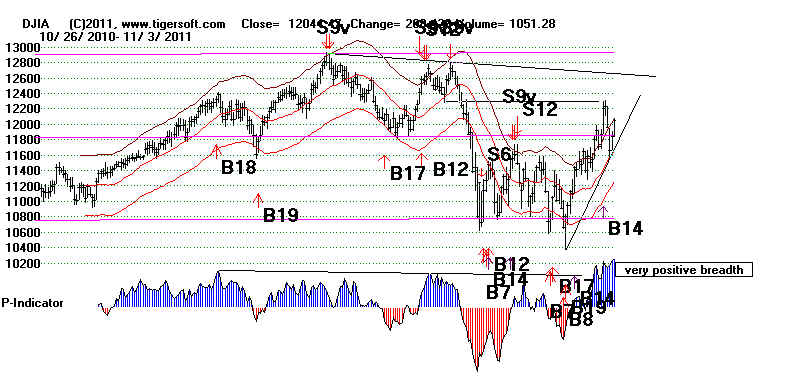

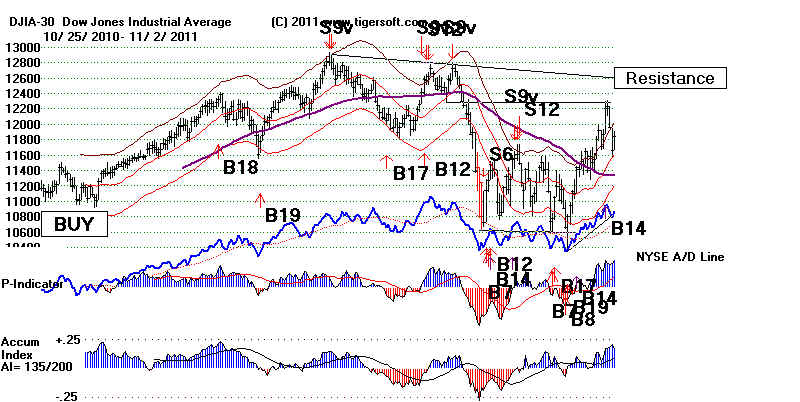

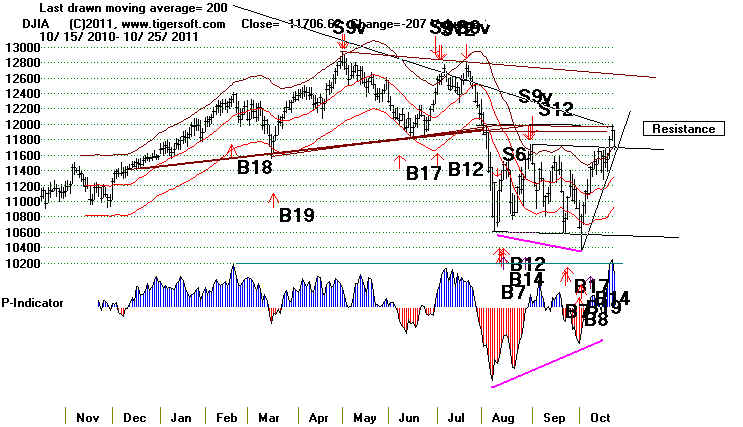

Clinched SELL S9 vs Santa Claus Rally

The futures have turned up at this point and no longer show a

weak opening. Weakness may still

break the recent support at 11760 on the DJI. Not many

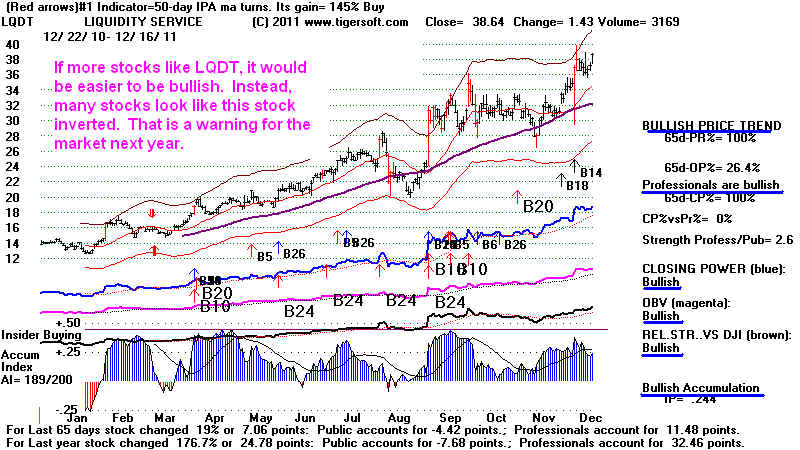

stocks look as bullish as LQDT below...

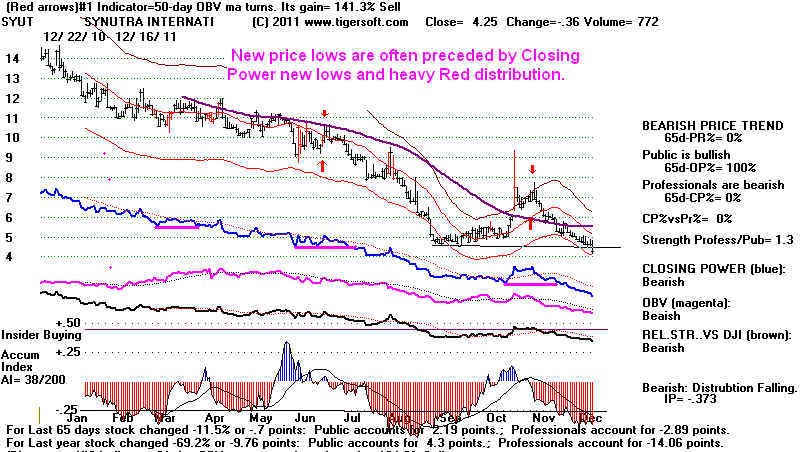

Instead, many MINCP stocks show heavy red distribution and

Closing Power new lows.

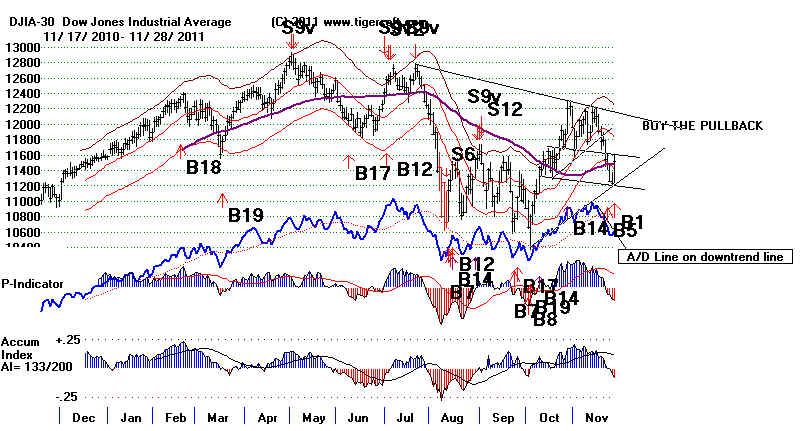

That suggests to me the odds are good the DJI will need to test its 10

week price uptrend-line

at 11539 in the next few trading days. I think we have to be

buyers of DIA there because of the bullish

Santa Claus period we are about to enter. On the buy side, I

would stick with defensive stocks or DIA.

If there is no more pullback on Monday, we will

be buyers on Turesday. What could spark a rally?

Successful peace

talks in Aghanistan, for one thing.

Not enough stocks loook like this.

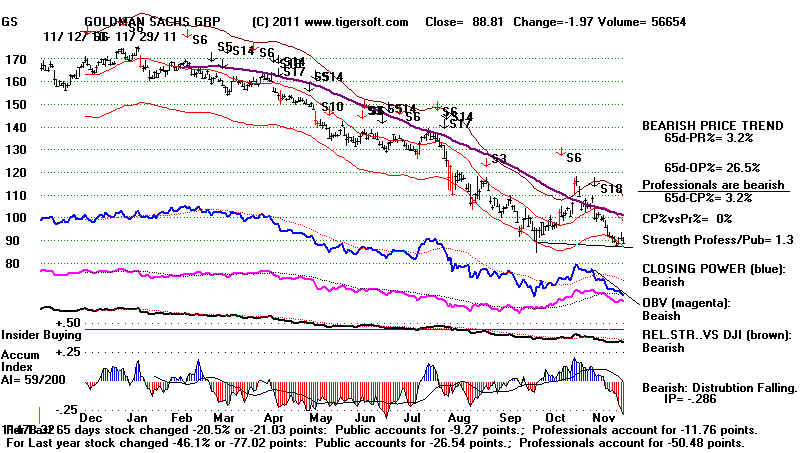

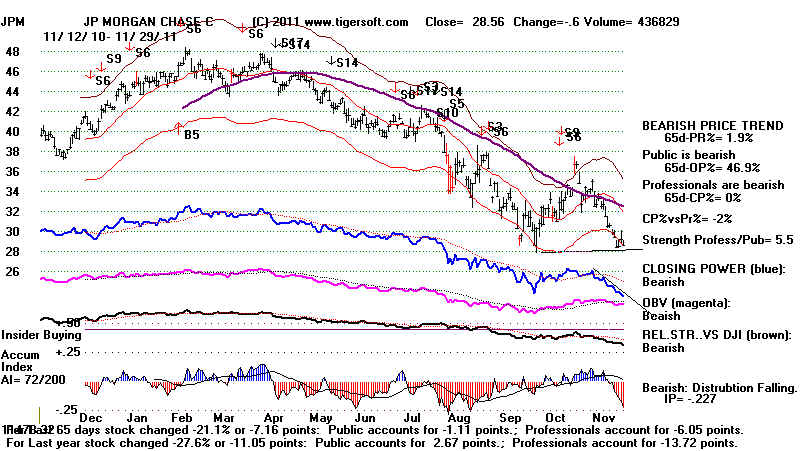

Too many stocks look like this.

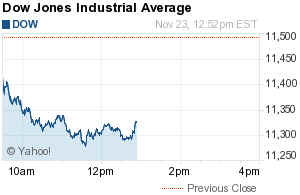

The DJI keeps selling off from its daily highs but refusing to close

below the 21-day ma

Clearly there are buyers who expect a Santa Claus rally. The

problem is the Sell S9

signal will not be satisfied until the lower band is reached. I

have found the best time to

buy based on the Santa Cluas rally's 89% probability of producing a

rally is at the close

of December 17th or the next trading day. Monday will be

the 19th. The avg gain for

the following 10 day is 1.7% going back to 1965. The odds as

better than 3:1 that the

DJI will be higher 10 trading days forward. What do we do?

Our Stocks Hotline is

hedged with 5 long positions and short 7. I think we have to

cover the general market ETF short

sales on Monday or Tuesday because of the 3:1 probability generally of

a rally until after

Christmas. Hopefully, we will see a DJI decline to 11600 to do

that.. That should be a good entry point for

buying DIA. Our Stocks' Hotline is still short more stocks than

we are long. Let's see what

Monday brings. Notice the Hotline will be at a new location

Monday night.

There have been 4 December Sell S9s.

December S9s' Aftermaths

1957 The DJI rallied to 12/31/1957 and then fell below the lower band

1982 The DJI fell immediately from the S9 on 12/7 to the lower band on

12/15/1982 and rallied.

1999 The

DJI fell only to the 21-day ma on 12/17/1999 and then rallied to the upper band

on 12/28/1999 for another Sell S9

and then declined quickly to the lower band on 1/4/2000

before rallying quickly again to

the upper band and beginning a big sell-off.

2007 The DJI fell from the

12/7 Sell S9 to just below the 21-day ma on 12/18 and rallied

2.5%

and formed a right shoulder on

12/26 in a head/shoulders pattern. It then sold off sharly, breaking the

lower band on 1/4/2000.

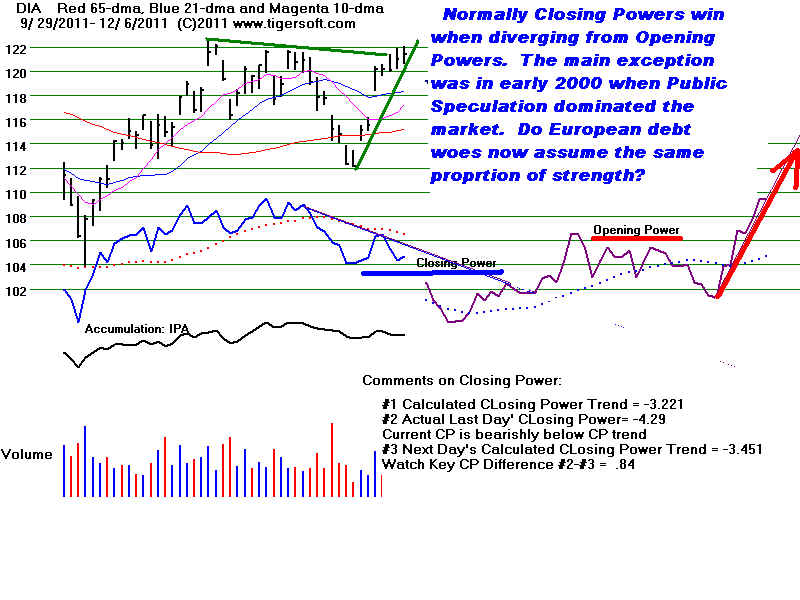

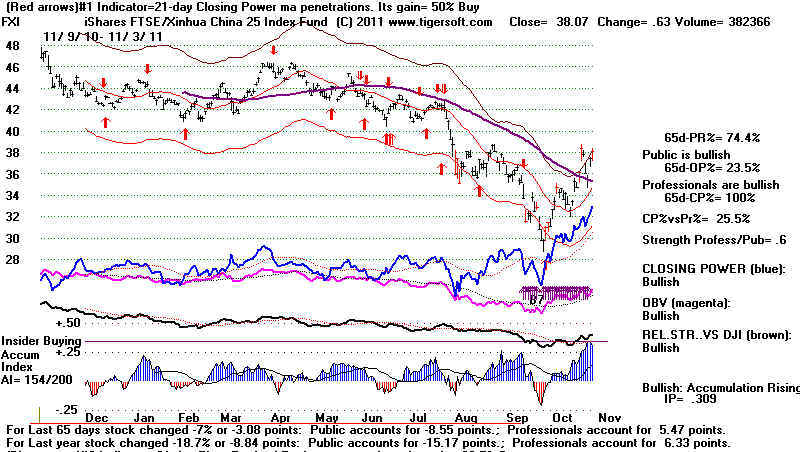

Which Side Will Win? US Professionals or the Overseas Buyers?

The

market now is like a tug of war. The Europeans and the Public are busy

buying over-night and at the opening. But the

NY Professionals and US institutions

are selling the market off during the day. The

Sell S7 below shows this condition.

Usually Professionals win out. But they could

change their mind because of the

seasonality. A strong close would show the

Professionals are betting on a Santa

Claus rally. On the other hand, a very weak

opening would probably mean that

the Europeans have switched to the sell side and the

Santa rally will be postponed.

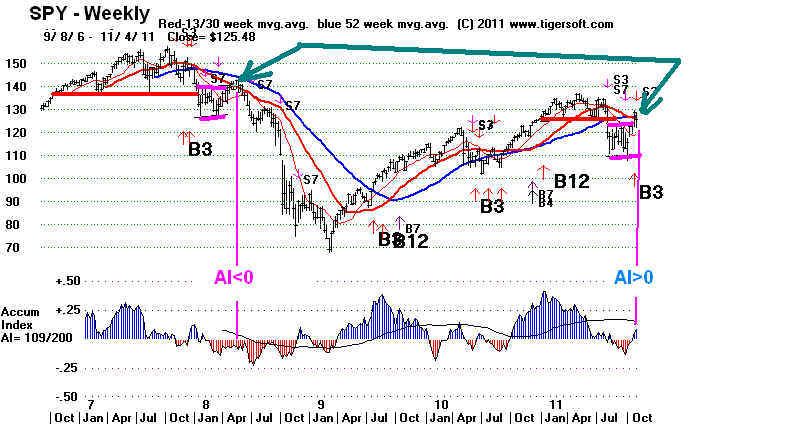

The SP-500 is trying to hold up at its rising 65-day

ma.

Which side is stronger depends on the circumstances.

though nornally it

is the Closing Power. But it does depend

on the times. Which slide blinks first?.

When there's a lot of Public speculation (as from

1997 to early 2000) or

when Europe is in grave trouble (as now), then

Opening Power is probably

stronger. When the Public is not in the

market and Europe is quiet, Closing Power

is much stronger and its trend will identify the real

price trend. What is important

now is to see that Professionals are not loyal to a rising or a falling market trend.

What differentiates their behavior from the public is

they are pragmatic "survivors", not

ideologues. They switch gears (as to the expected market direction) suddenly and

buy instead of sell because they believe there is

more potential on the upside.

This is apt to happen soon now because of the

exceptionally strong seasonality of the market

these coming two weeks, which they know to accept,

anticipate and not to fight.

at least until early January, when they can better

assess the influx of investment funds

for the new year.

====================================================================================

OLDER HOTLINES

====================================================================================

1215/2011 DJI = 11869 21-dmaRoc= -229

la/ma=1 .003 21-dma ROC- -.257 P= -285 ( =2 ) IP21= -.125 V= -154 OP= - .074

12/15/2011 BREADTH STATISTICS:

33 MAXCP stocks Bullish MAXCP Stocks

330 MINCP stocks Bearish MINCP Stocks Bearish Plurality

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

8 new highs on NASDAQ. 57new lows on NASDAQ BEARISH

23 new

highs NYSE

37- new lows on NYSE BEARISH

12/15//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

Most groups still have a plurality of stocks below their 65-dma. Defensive groups are still favored. BEARISH

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

Precious Metal Stocks declining

CP BEARISH

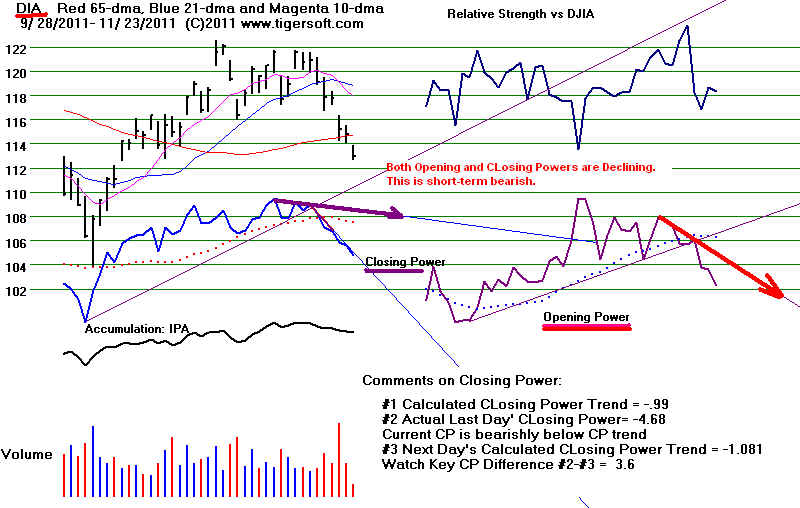

12/15/2001 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are all in

Down-trends. This is short-term

BULLISH

DIA' s CP iS in a

DOWNtrend

Any close of more than 2.70 ABOVE

the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

SPY's CP is in a DOWNtrend Any close of more than 2.93 ABOVE the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

QQQ's CP is in a DOWN-trend Any close of more than 1.61 ABOVE the Opening

GLD's CP is in a DOWN-trendline- Any

close of more than 8.70 ABOVE

the Opening will break the CP DOWN-trendline. The CP is now below its rising

21-dma.

The Opening Power is short-term

risng.

Clinched SELL S9 vs

Santa Claus Rally

There are few good technical signs now, but a Santa Claus Rally is

a very real factor now. See the studies in the last few Hotlines here.

The average gain for the DJI is 1.6% over the next 10 trading days,

going back to 1965. The DJI was up 77.8% of the time.

Saturday will be December 17th, the

day when Peerless

used to give a Santa Claus Buy signal. That signal was

dropped because some of the paper losses were too

great. Still, as you can see from our recent Hotline

studies, this is the time of the year when a rally usually

starts if the DJI is below its 21-day ma. The DJI is now

slightly above that ma. As the 17th falls on a Saturday this year

any additional decline would put the DJI in a zone where

below the 21-day ma, where we should probably do some

covering, including the recommended shorts on DIA, SPY and SDS.

In deference to the Santa Claus rally

traditition and how shallow

declines are from December 15th to December 31s, we will cover

many of our short sales on any further weakness by 1% or if their

CLosing Power downtrends are violated.

Three nights ago I showed the low points of the DJI relative to the 21-day

ma in the second half December. There were 27 cases where the DJI

dipped to or below the 21-day ma in mid to late December after 1940.

Buying 3% or more below the 21-day ma would have been possible in

only 8 cases. Buying 1.5% or more below the 21-dma would have been

possible in 13 cases. Buying 1% or more below the 21-day ma could have

been done in 18 cases. Another way of saying is that waiting for more

than a 2% decline would have worked out well in only 9 times: in 1972, 1975,

1980, 1983, 1991, 1996, 1997, 1998, 2000. That is just once in the last 10

years.

I conclude that we can't count such a deep decline. It will be most consistent

with past dips at this time of year to cover on any 1% weakness or on a close

below the 21-day ma next week.

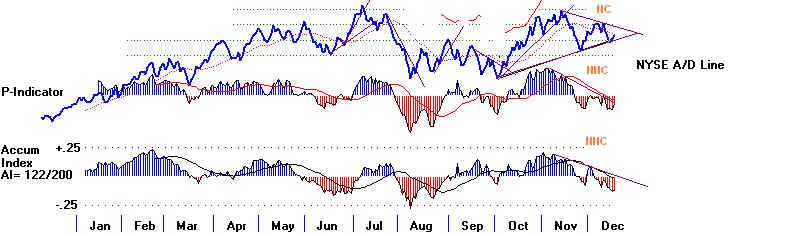

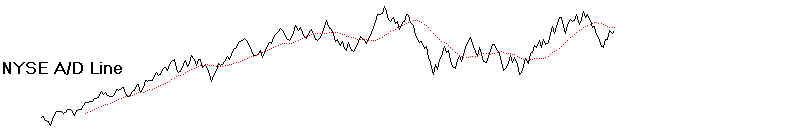

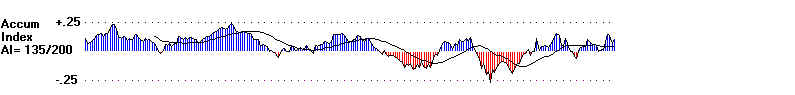

Breadth was good today. There were nearly 800 more up than

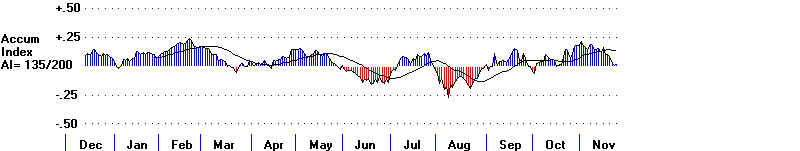

down on the NYESE. See the A/D Line chart below.

The A/D Line did turn up in vicinity of its 13-week uptrend.

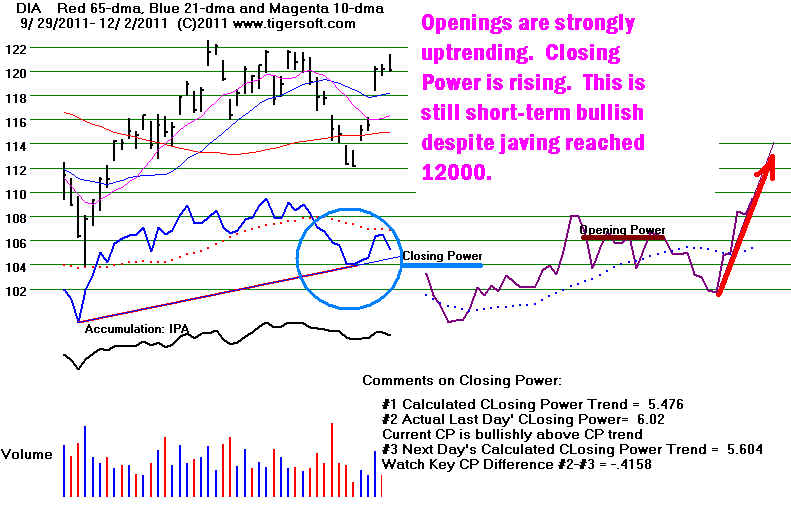

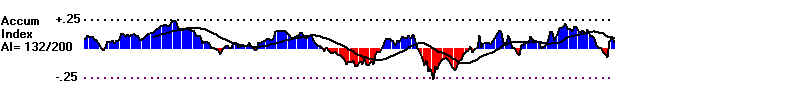

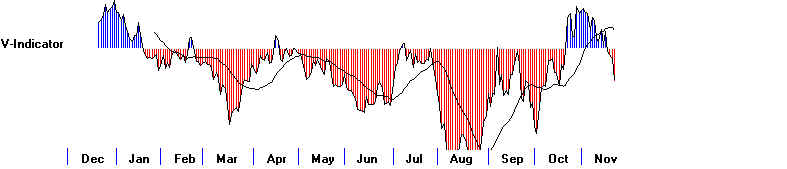

While the Tiger Closing Power remains in a downtrend, it looks

oversold (far below its 21-dma) and the Openings have been up

very strongly. See the second chart below. I would think that Openings

will remain strong as long as the EURO remains quiet. Remember:

politicians usually go away for the next two weeks. That also means

that Congress will likely agree to a compromise to keep the government

running.

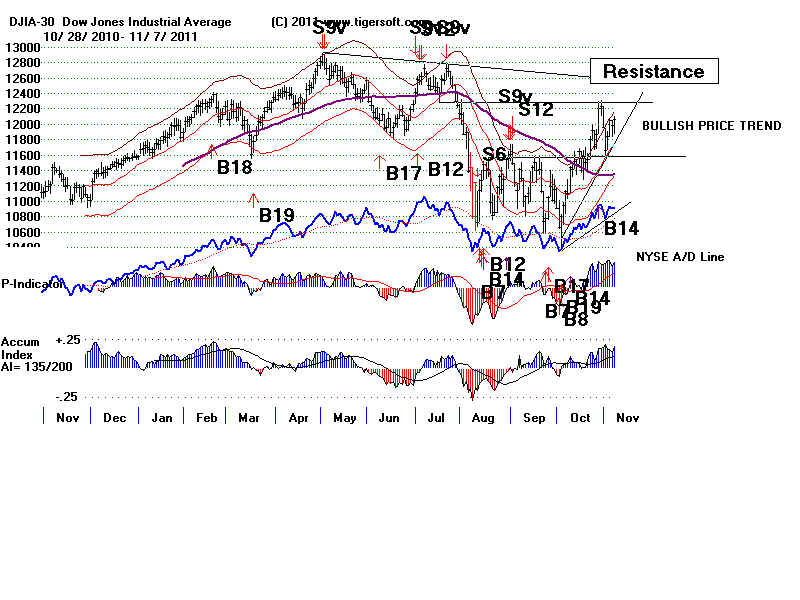

DJI

Sell S7

- Professionals are much more bearish than Public and Europeans.

Sell S21

- Both Opening and Closing Power are falling

====================================================================================

OLDER HOTLINE

====================================================================================

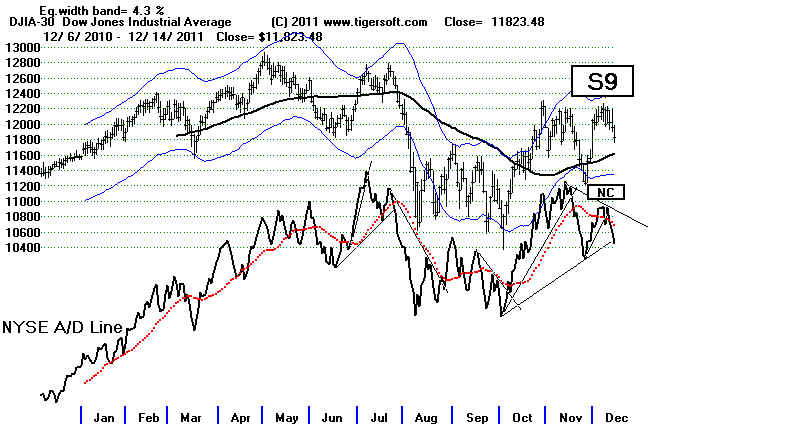

1214/2011 DJI = 11823 -131

la/ma= .998 21-dma ROC- -.257 P= -284 ( +11 ) IP21= -.102 V= -155 OP= - .079

Clinched SELL S9 vs

Santa Claus

BREADTH STATISTICS:

39 MAXCP stocks Bullish MAXCP Stocks

296 MINCP stocks Bearish MINCP Stocks Bearish Plurality

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

7 new highs on NASDAQ. 83 new lows on NASDAQ BEARISH

22 new

highs NYSE 71- new lows on NYSE

BEARISH

12/14//2011 ===>

See Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA

SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

12/14/2011 I see no reason to cover our short

sales yet. ASell S9 usually brings a decline

to the lower band. The A/D Line uptrendline going back to

Septmber was violated today

and the CLosing Powers are declining. The bearish MINCP stocks

have been weak, some

spectacularly. The decline seems likely to tag the price

uptrendline that now crosses at 11511.92.

The failure of the DJI to even reach its declining resistance line near

12600 on th elast rally

is bearish until the 11400-11500 is successfully tested. The

P-Indicator and V-Indicator are

clearly negative. The only buy signal we can get on this weakness

is an old, no longer used

Peerless Buy on December 17th. The Santa Claus Buy signal.

This, I should add is less trustworthy

after a Sell S9.

Can Santa Claus be counted on this year?

The B17 takes place on the first such occurrence between December 17th

and December 24th

where the DJI closes below its 21-day ma. (CL/MA <1.0 )

Below are the statistics of Santa Claus B17s. Cases where the DJI is in

a generally uptrending

markets avoid most of the serious losses, but not that of 2007.

If the presence of a recent Sell S9/S12

is factored in, the failed 2007 Santa Claus B17 would be over-ridden.

But using that rule would

mean we get no Buy B17 this year, because of the recent Sell S9.

Date LA/MA

Gain Reversing Signal

12/18/33

.974 12.0% 2/1/34 S4

12/17/34

.993 3.6% 1/2/35 S12

12/17/35

.980 9.1% 2/18/36 S15

12/17/36

.997 4.8% 2/10/27 S15

12/17/40

.993 2.4% 1/10/41 S12

12/17/41

.96 4.1%

1/6/42 S9 Bear market

12/17/45 .991

4.6% 1/10/46 S9

12/17/47 .999

-1.3%

1/14/48 S10 Bear market

12/22/53 .997

7.0% 3/9/54

S15

12/19/55 .997

7.6% 4/9/56

S2 3.9% Paper Loss...DJI fell from

481.80 to 462.40 and then rallied.

12/17/57 .966

29.2% 7/1/59 S12 A

perfect Buy at bottom

12/18/62 .997

-1.8% 1/5/62 S10

12/17/64 .989

8.7% 5/13/65

S8

12/17/68 .997

-3.6%

3/28/69 970.91 Bear market

6.7 % Paper Loss. DJI fell

to 905.77 on 2/26/69 and rallied

12/18/72

.997 3.4%

1/5/73 S15

12/17/73

.997 5.4%

1/2/74 S12

12/17/74

.992 46.9% 7/1/75 S8 Bear market

12/22/75

.998 20.3%

3/24/76 S15

12/19/77 .981

-1.8% 1/7/78 S10

12/17/80

.968 4.8%

1/2/81 S12

12/17/81

.968 -4.3% 4/1/82 S9 Bear market

8.6 % Paper Loss. DJI fell from 870.53 to 795.75

and then rallied.

12/17/82 .968

5.9% 1/6/83 S12

12/19/83

.985 3.4% 1/6/84 S12

12/17/84

.991 55.1% 4/29/86 S9

12/18/86

.999 25.8% 4/6/87 S9

12/18/89 .995

4.2% 1/2/90

S9

12/17/91 .998

13.9% 4/14/92 92

12/18/95 .993

9.3%

2/27/96 S1

12/17/96 .982

8.3% 4/23/97 S9

12/18/97 .98

17.1% 4/21/98 S15 DJI fell from 7846 to 7580 on 1/9/98 and

rallied.

3.3% Paper Loss.

12/17/98 .982

22.3% 6/18/99 S12

12/19/00 .999

1.2%

5/17/01 S4 Bear market? DJI next hit upper band, but no Sell, and

fell from 10584 to 9505 on 3/23/01 and rallied.

10.2% Paper Loss.

12/17/01 .999

2.3%

2/26/02 S9 Bear market 2% Paper Loss.

12/17/02 .985

2.3% 1/6/03

S12 Bear market

12/19/05 .999

6.8%

5/5/01 S9 1.5% Paper Loss.

12/17/07 .991

-4.7%.

3/24/08 S9

DJI fell from 13167.2 to 11740.15 and then rallied.

10.8% Paper Loss.

12/22/08 .992

5.8% 1/6/09

S12 Bear market

12/17/09 .991

1.0%

6/16/10 S12 DJI fell from 10308.26 to 9816.49 and then rallied.

4.7% Paper Loss.

Though this signal usally works out,

there are some very big paper losses. The biggest being

the 10%-11% losses in emerging bear

markets in 2000 and 2007. Where there have been

multiple Sells in a trading range after a

long advance, we have to be a bit leery of Santa Claus

B17s. That would seem to apply to

2011.

=================================================================================

OLDER HOTLINES

=================================================================================

1213/2011 DJI = 11955 -66 la/ma=

1.008 21-dma ROC- -.199 P= -296( -166 ) IP21=

-.094 V=

-152 OP=

- .068

Clinched SELL S9 vs Santa Claus

BREADTH STATISTICS:

33(-44) MAXCP stocks Bullish MAXCP Stocks

239 MINCP stocks Bearish MINCP Stocks Bearish Plurality

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

9 new highs on NASDAQ. 56 new lows on NASDAQ BEARISH

19 (-15)

new

highs NYSE 44 (+17) - new lows on NYSE BEARISH

12/13/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/13//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

12/12/2001 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs broke their

Down-trends. This is short-term

BULLISH

DIA'CP iS in a

DOWNtrend

Any close of more than 1.54 ABOVE

the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

SPY's CP is in a DOWNtrend Any close of more than 1.65 ABOVE the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

QQQ's CP is in a DOWN-trend Any close of more than 0.68 ABOVE the Opening

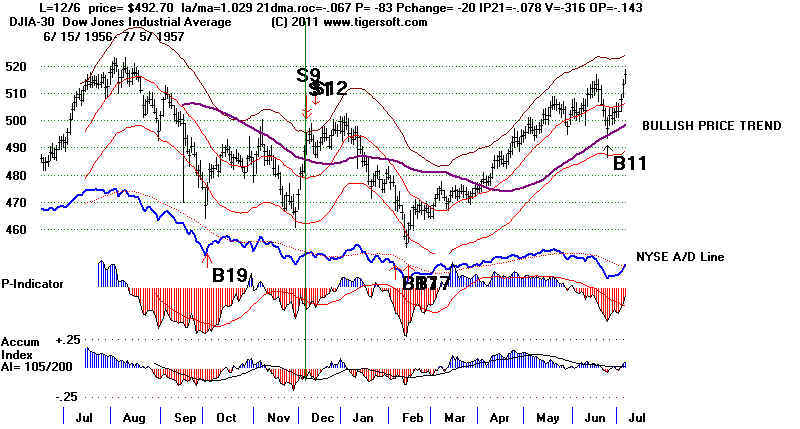

Sell S9s in December before 12/20

in Bull Market Environments

12/6/1956 492.7 +4.6% Reversed: 470.00 2/5/57 B4

LA/MA ANNROC P-I IP21 V-I Opct

1.029 -.067 -83 -.078 -316 .143

1% paper loss. Reversing.

DJI rallied to 496.00 and then fall below lower band in mid january.

1956-1957

12/7/1982 1056.94 +6.1% Reversed: 992.64 12/15/82 B6

LA/MA ANNROC P IP21 V-I Opct

1.028 .06 21 -.05 -4 -.048

No paper loss. Reversing.

DJI fell to lower band on 12/15 and reversed on Buy at rising 65-dmA.

1982-1983

12/7/1982 1056.94 +6.1% Reversed: 992.64 12/15/82 B6

LA/MA ANNROC P IP21 V-I Opct

1.028 .06 21 -.05 -4 -.048

No paper loss. Reversing.

DJI fell to lower band on 12/15 and reversed on Buy at rising 65-dmA.

1982-1983

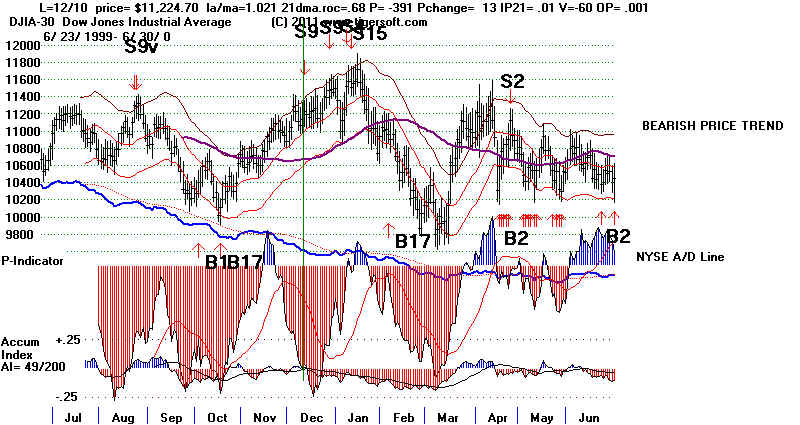

12/10/1999 11224.70 +2.3%

LA/MA ANNROC P IP21 V-I Opct

1.021 .68 -391 -.01 -60 .001

2% Paper Loss. Reversing.

DJI rose to 11484 on 12/29 and then fell in a week to the lower band.

There was no Buy signal there.

1999-2000

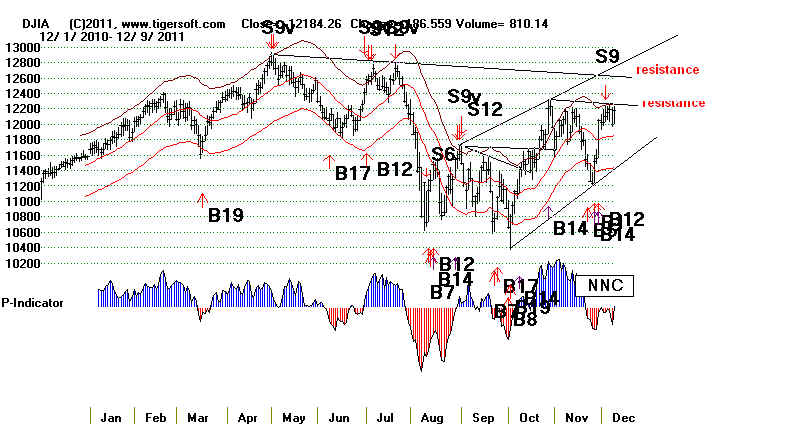

12/7/2007 13625.58 +3.4% Reversed: 11899.69 3/7/08 B8

LA/MA ANNROC P IP21 V-I Opct

1.034 .294 -17 0 -105 .012

1% Paper Loss. Reversing.

DJI rose one day more by 1% and then fell below the

on 1/4/2007 lower band. There was no Buy signal there.

2007-2008

12/7/2007 13625.58 +3.4% Reversed: 11899.69 3/7/08 B8

LA/MA ANNROC P IP21 V-I Opct

1.034 .294 -17 0 -105 .012

1% Paper Loss. Reversing.

DJI rose one day more by 1% and then fell below the

on 1/4/2007 lower band. There was no Buy signal there.

2007-2008

A Big Decline This Month Is NOT Expected.

Big declines below the lower band, another 3% down, very seldom happen

in December

unless there is already a bear market. Declines to or below

the lower 3.5% band

occurred only in 1933, 1980 and 1998. 3 times in 43 bull market

years.

>The Blue data *15 cases) below show the most common occurrence: a decline

around the 20th and before the 25th, below the 21-dma (LA/MA <1.)

and the a January rally to the upper band.

> Bottoms

after December 25th in December are unusual. 6 cases.

> A December

close more than 3.5% below the 21-day ma is most ununusal. (LA/MA<

.965)

Post December 11 Bull Market Bottoms

LA/MA

12/20/1933 .959 shot above upper

band on 1/15/1934

12/20/1934 .980 hit upper band on 1/3/1935

12/16/1935 .968 hit upper band on 1/13/1936

12/21/1938 .972 hit upper band on 1/21/1939

12/21/1939 1.003 hit upper band on 1/3/1940

12/23/1940 .983 peaked 2% over ma on 1/10/1941

12/14/1942 1.006 hit upper band on 12/18/1942 and kept rising...

12/15/1943 1.015 peaked 2% over ma on 1/6/1944

12/27/1944 .993

peaked 2.4% over ma on 1/10/1945

12/21/1945 .986 hit upper band

on 1/10/1946

12/21/1949 1.008 rose steadily for five months.

12/15/1950 .983 hit upper band on 12/29/1951 and kept

rising.

12/26/1951 .998 peaked 2.2% over ma on 1/22/1952

12/29/1953 .99

hit upper 2.5% band on 1/27/1954 and kept rising.

12/15/1954 1.007 hit upper band on 1/3/1959

12/14/1956 .993 only rose to

0.2%% over MA on 1/3/1957

12/12/1958 1.006 hit upper band on 1/5/1959

12/22/1962 .99 only rose to 0.5%% over MA on

12/28/1962

12/24/1963 1.002 rose steadily a long ways...

12/15/1964 .98

rose steadily for 4 months

12/20/1966 1.002 peaked 2.0% over ma on

1/18/1966

12/19/1968 1.00 peaked 1.8% over ma on 1/9/1966 and Sell

S12

12/21/1972 .978 peaked 2.4% over ma on 1/11/1966 and Sells

(12/8/1975) .973 broke out

above upper band on 1/5/1976 and went higher.

(12/11/1980) .936 rebounded to 5.9% above ma on 1/6/1981

12/15/1983 .971 hit upper 5.2% band on

1/10/1984

12/10/1984 .98 rebounded to 4.1% above ma on 1/21/1985

and moved higher.

12/24/1985 1.011 hit upper 2.2% band on 1/7/1986, fell back and

rebounded strongly.

12/31/1986

.985 rose above the upper band on 1/14/1987 and advanced strongly

12/21/1990 .99 Tagged upper band on

1/3/1990 and fell back on Sells.

(12/10/1991) .974 Shot back above upper

band on 12/23/1992 and kept rallying.

12/16/1992 .995 Rallied only to 1% over ma on 12/28/1962 and fell

back 3% before advancing..

12/15/1993

1.003 Rallied until 2/1/1994

(12/8/1994) .980 Rose steadily and kept

rallying.

12/19/1995 .999 Rose to upper band on

1/30/1996 and advanced further.

12/16/1996 .976 Rose past upper band on 1/14/1997

and advanced further.

12/26/1997

.971 Rallied to 1% over MA on 1/5/1998 and fell back in January before advancing.

12/14/1998

.96 Rose past upper band on

1/8/1998 and fell back to regroup.

12/21/1999 1.008 Rallied to upper band on 12/28/1999 and fell back to LB on

1/4/2000

12/20/2000 .975 Rallied to upper band on 1/3/2001

12/7/2004 .994 Rallied to a high 2.1%

over 21-dma and then fell back.

12/29/2005 .996 Rallied to 1.6% over MA on

1/11/2006 and fell back to regroup.

12/17/2009 .991 Rallied to 1.5% over MA on 1/13/2009

and fell back below LB to regroup.

A decline to near the DJI's lower band now would first require

the DJI closing more than

100 points lower to break its 21-dma. The DJI today closed

right at its 200-day ma.

Since that moving avererage is flat, I would not think it will act as

much support.

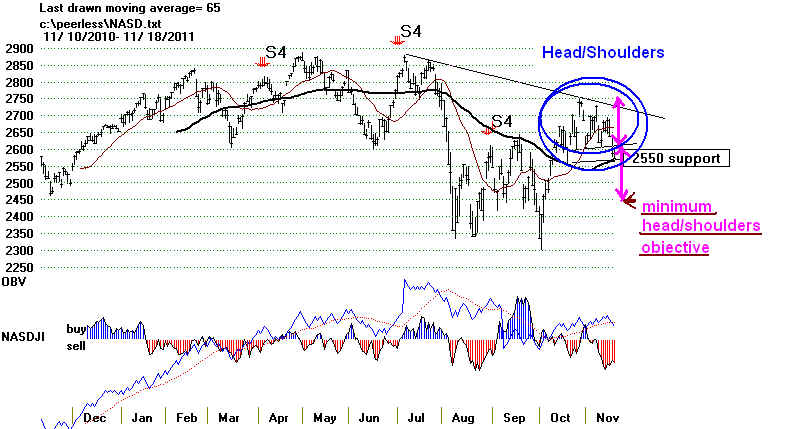

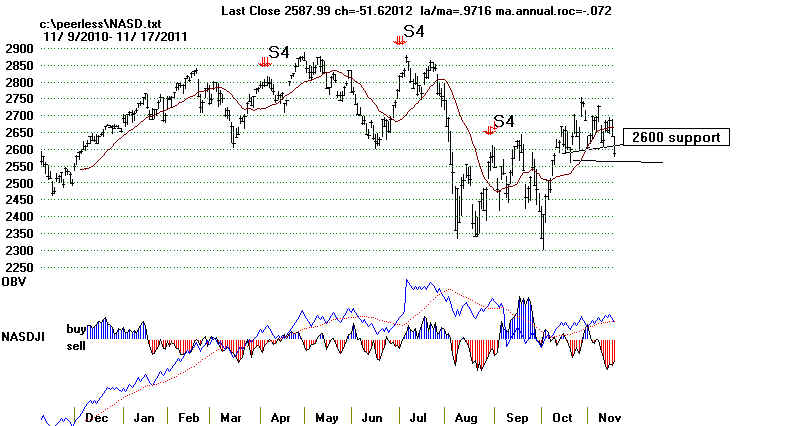

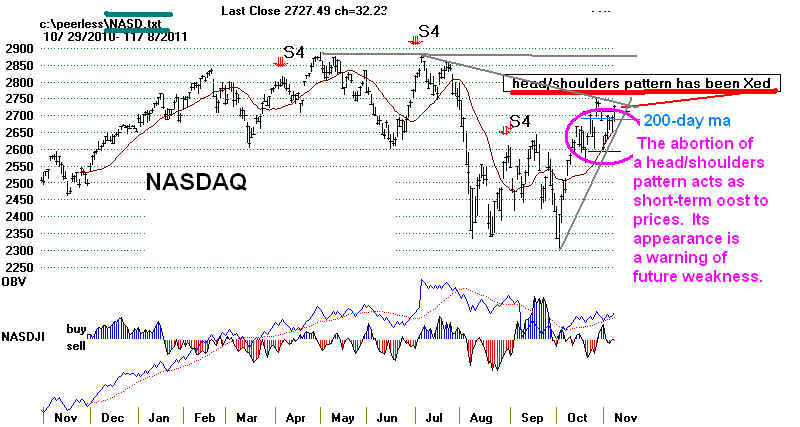

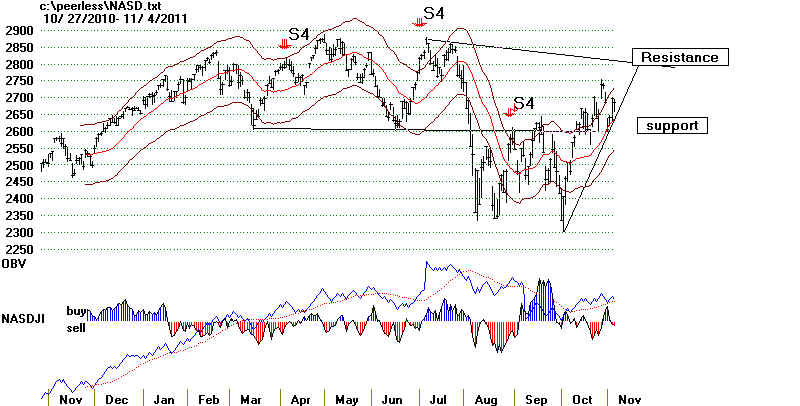

The NASDAQ is weaker. It broke its rising 65-day ma support

slightly today.

The NASDAQ will need to recover strongly tomorrow to convince bulls

that Santa

will save them from the Grinch S9.

For now, I would be mostly short,

including DIA or SPY, and wait for the key ETFs'

CLosing Powers to break their downtrends to cover in deference to

the seasonal Santa Claus rally,

which sometimes is delayed as late as the 23rd.

DJI for 12/12/2011

The DJI did nearly the worse thing it can do intra-day. It jumped

in the

first 30 monites and sold off considerably in the last two hours.

The

result was that the key ETFs Closing Power all made minor new lows

and set up Closing Power downtrends.

Most pundits blame this decline on Europe and American Bankers'

concerns

that Italy and Greece might not be able to pay back on its bonds,

especially with

Italy's present cost of borrowing now above 6%. Big US

banks have sold

large sums of Credit Default Swaps against this contingency.

Britain

has made matters worse for the banks by refusing to accept the

French-German demand that each EEC member accede to the Big EEC

Bankers effective control of each country's monetary and aggregate

fiscal

policies. The EEC bankers are essentially saying to each

countries'

voters, you can vote Conservative, Catholic or Socialist all you

want,

but we will fix your rate of interests and how much your

government

spends and taxes.

If there is a run on Euro, the consequences, though impossible

to predict

with any precision, might certainly include a freezing up of

credit and trade.

These are deflationary consequences. Gold and Silver declined sharply

today,

as a result. Food commodities

have been showing weakness for months.

Today showed that Bond holders

love deflation and a weak stock market.

There is a bullish aspect to all this, and that is your Dollars

are worth a little

bit more. The Dollar

broke out to the upside today, And interest rates

fell.

Although the FED did not do more at its meeting today to pump more

liquidity

into the market, the strong Dollar gives it more leeway in

the future to do that.

====================================================================================

OLDER HOTLINES

====================================================================================

1212/2011 DJI

= 12021 -163 la/ma= 1.013 21-dma ROC- +.128 P= -130( -141 ) IP21= -.04 V= -97 OP= .022

Clinched SELL S9 but will December bring a

breakout?

BREADTH STATISTICS:

77(+12)

MAXCP stocks Bullish

MAXCP Stocks

64(-43) MINCP stocks Bearish MINCP Stocks Bearish Plurality

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

8 new highs on NASDAQ. 31 new lows on NASDAQ BEARISH

34 (+15)

new

highs NYSE 27 (+22) - new lows on NYSE BULLISH

12/12/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

NEM's CP is uptrending. SSRI (Silver) and PAAS

(Silver) broke CP downtrends.

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/12//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

12/12/2001 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs broke their

Down-trends. This is short-term

BULLISH

Opening Powers are rising.

DIA restored its CP

DOWNtrend

But any close of more than 0.31

ABOVE the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

SPY's CP is below its

DOWNtrend-line Any

close of more than 0.13 ABOVE the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is short-term declining.

BREADTH STATISTICS:

65(+37)

MAXCP stocks Bullish

MAXCP Stocks

107(-93) MINCP stocks Bearish MINCP Stocks Bearish

Plurality

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

25 new highs on NASDAQ. 18 new lows on NASDAQ

BULLISH

19 (-11)

new

highs NYSE 5 - new lows on NYSE BULLISH

12/9/2001 ===> DAILY

Trading 3 Sample Stocks using Closing Power trend-changes:

NEM's CP is uptrending. SSRI (Silver) and PAAS

(Silver) broke CP downtrends.

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/9//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

12/9/2001 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs broke their

Down-trends. This is short-term

BULLISH

Opening Powers are rising.

DIA broke CP DOWNtrend But any close of

more than 0.44 BELOW the Opening

will restore the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The Opening Power is uptrendng.

SPY CP is at its

DOWNtrend-line Any

close of more than 0.46 BELOW the Opening

will restore the CP DOWN-trendline. The CP is now below its rising

21-dma.

Opening Power is in an Uptrend...

23 NATO fuel tankers set ablaze in Pakistan

23 NATO fuel tankers set ablaze in Pakistan But at least, Obama is not choosing to

escalate this incident into a causus belli. The stock market

is always spooked by a run-up to war. Obama's lack of response may

suggests that he DOES expect to

wind down his war in Afghanistan. This will be tricky.

Will There Be A Repeat of 1973-1974?

The stock market fell 45% in 1973-1974, partly because of the defeat of

the US in Vietnam.

History could repeat. Afghanistan

has cost 1732+ American soldiers'

lives and

$471+

billion, narrowly calculated. Adding in Iraq makes the scale of the war in

Vietnam comparable.

The Obama Administration has made tragic mistakes that even a casual reading

of Afghanistan

history and the failed imperial invasions by the British and Soviets should

have prevented.

Add to that, it's easy to see how much greater the benefits to America would

have been if even half

this money was spent domestically on education, health care, mass transit,

infrastructure repair.

Will Obama be challenged on this? Obama must think Republicans will

not. Hubris alone could

cause Obama to fail terribly, as Nixon did. But we see now also an even

stronger military-industrial

complex, unchecked corporate power and a thoroughly stalemated political

system. It's hard to be

optimistic this December. The Sell S9 will probably be profitable.

Sources: http://www.navytimes.com/news/2011/12/ap-nato-fuel-tankers-set-ablaze-in-pakistan-120811/

http://www.guardian.co.uk/world/2009/oct/18/afghan-war-soviet-invasion-mistakes

http://www.telegraph.co.uk/expat/expatnews/7070390/United-States-must-shift-strategies-in-Afghanistan.html

Afghanistan

Online: The Role of Afghanistan in the fall of the USSR

British

Empire: Forces: Campaigns: Afghanistan 1878 - 1880

Afghanistan

'will collapse into civil war when western troops fall out

http://topics.nytimes.com/top/news/international/countriesandterritories/afghanistan/index.html

================================================================================

12/8/2011 DJI = 11998 -199 la/ma=

1.013 21-dma ROC= - .173 P=

-210 ( -175

) IP21=-.095 V=

-132 OP= .008

Clinched SELL S9

BREADTH

STATISTICS:

28(-25) MAXCP stocks Bullish MAXCP Stocks

200(-133) MINCP stocks Bearish MINCP Stocks Bearish

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

3 new highs on NASDAQ. 54 new lows on NASDAQ

BEARISH

30

new

highs NYSE 10 - new lows on NYSE BULLISH

12/8/2001 ===> DAILY

Trading 3 Sample Stocks using Closing Power trend-changes:

NEM's CP is uptrending but , SSRI (Silver) and PAAS

(Silver) are in CP downtrends now.

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/8//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

12/8/2001 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are now in

Down-trends. This is short-term

BEARISH

Opening Powers are rising

steeply. When the Opening Power uptrend is

violated, a retreat should follow.

DIA shows a CP DOWNtrend Any close of more

than 1.13 ABOVE the Opening

will break the CP DOWN-trendline. Meanwhile, the CP is now below its

21-dma.

The steep Opening Power's uptrend has been violated.

SPY shows a CP DOWNtrend- Any close of more than 1.35 ABOVE the Opening

will break the CP DOWN-trendline. The CP is now below its rising

21-dma.

Opening Power broke its steep Uptrend...

| Lesson of the 1930s:

AUSTERITY IS DANGEROUS! Paul De Grauwe - Centre for European Policy Studies Incredibly, the same mistakes are being made today involving some of the same countries as during the Great Depression. This time it is the continental west European countries tied together in the eurozone that have seen their currency, the euro, become strongly overvalued. The two countries that in the 1930s responded to the crisis by devaluing their currencies, the US and the UK, have today also allowed their currencies to depreciate significantly. Since the start of the financial crisis, pound sterling has depreciated against the euro by about 30%. After having strengthened vis-à-vis the euro prior to the banking crisis of October 2008, the dollar depreciated against the euro by close to 20%. Thus, as in the 1930s, the dividing line is the same. The US and the UK have allowed their currencies to depreciate; the continental European countries tied into the euro area have allowed their currency to become significantly overvalued. Even the numbers are of the same order of magnitude. During the1930s, the overvaluation of the gold bloc currencies amounted to 20-30%. Today, the euro is overvalued by similar percentages against the dollar and the pound. So why are the euro area countries employing the same policies as the gold bloc countries did nearly eighty years ago? The answer is economic orthodoxy. In the 1930s it was the orthodoxy inspired by the last vestiges of the gold standard. Today the economic orthodoxy that inspires the ECB is very different, but no less constraining. It is the view that the foreign exchange market is better placed than the central bank to decide the appropriate level of the exchange rate. A central bank should be concerned with keeping inflation low and not with meddling in the foreign exchange market. As a result the ECB has not been willing to gear its monetary policy towards some exchange rate objective. As in the 1930s, the euro area countries will pay a heavy price for this orthodoxy. The price will be a slower and more protracted recovery from the recession. This will also make it more difficult to deal with the internal disequilibria within the eurozone between the deficit and the surplus countries. |

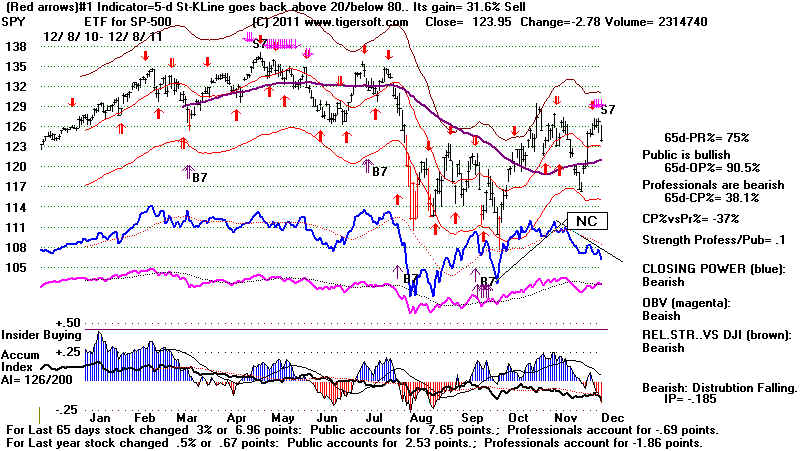

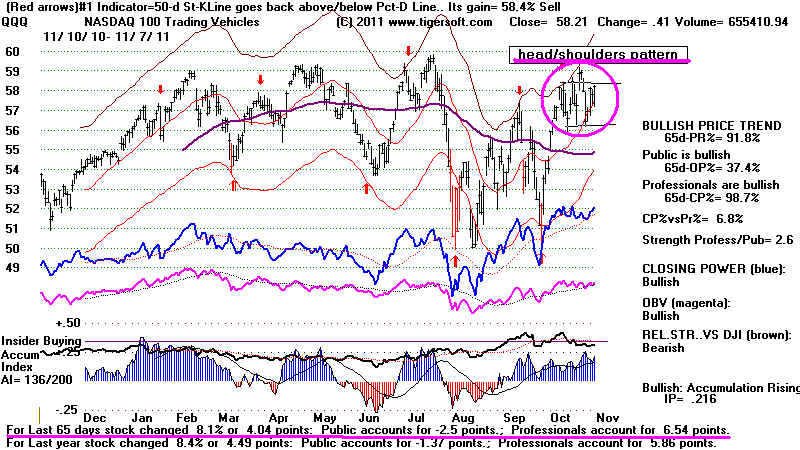

Technicals

The DIA could not

get past 122; it will likely have to test its rising 65-dma support at 115.

Note how the DIA marginally made a new CLosing

high but the Closing Power lagged

considerably and then broke it uptrend.

This is a reliable trading Sell.

SPY's

CLosing Power made a 2 month low far ahead of price. This yields a CLosing Power

Divergence Sell S7. (Signals(3) + Closing

Power Divergence Warnings). SPY should be

shorted.

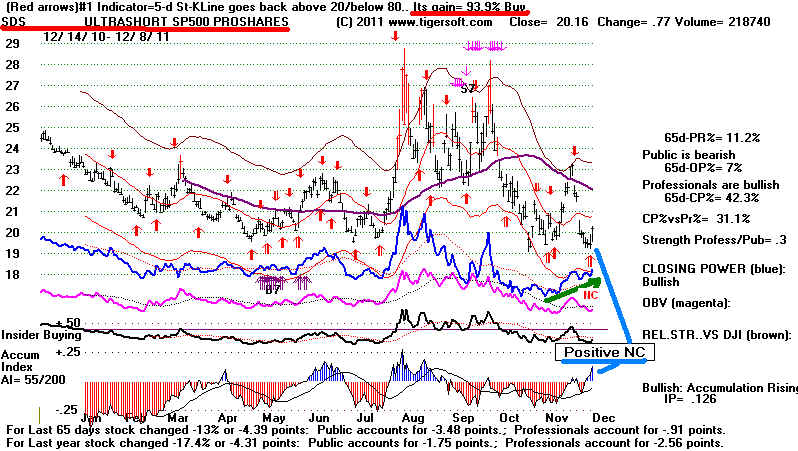

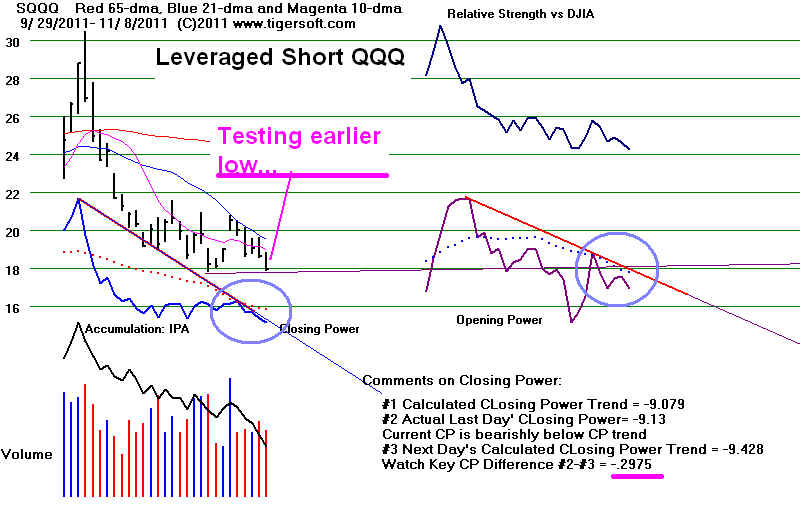

LEVERAGED SHORT SPY - SDS

Watch tomorrow to see if QQQ

breaks below the ususal support of its rising 65-dma.

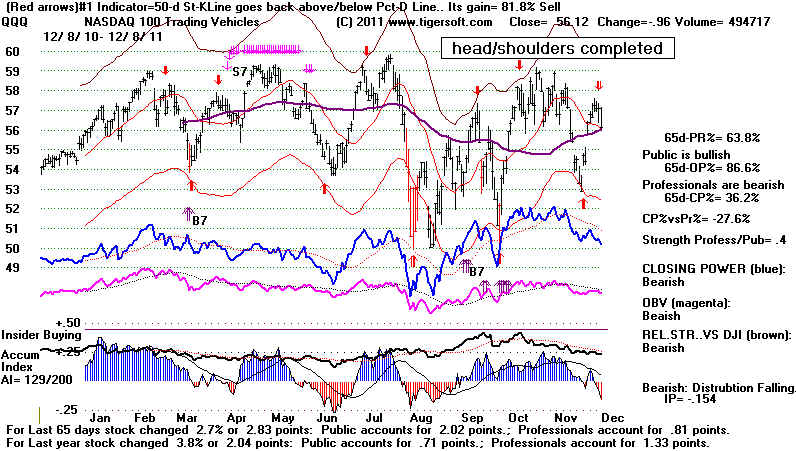

That the optimized best trading system has

gained a whopping 81.% on the QQQ this

year should give us more confidence of a

breakdown.

The Stock Market Does Not Like Uncertainty

Unanswered Questions about the Fate of the Euro:

Will the EURO survive? Goldman says "No". Morgan Stanley

says 20% probability.

Zero Hedge reports 50% chance by end of 2012.

What would be the consequences if it does

collapse? Would

loans dry up 50%? Would we see another liquidity crisis, as in 2008?

How would

that be resolved? What

central bank would guarantee banks or big loans soon again?

Would trade barriers

suddenly go up? Would

inter-nation European commerce dropsharply?

The Wall Street Journal downplays the dangers

now.

"A number of investors and bankers have

indicated that companies are hoarding liquidity and refraining

from making acquisitions to strengthen their

internal financing, rather than turning to banks....

In late November, Lufthansa said it would halt

all non-essential investment for six months to combat rising

financing costs, and on Wednesday Tognum’s

CEO told the Financial Times Deutschland the company

is increasing liquidity and hedging activity as

a preventive measure, to avoid the consequences of a potential

collapse of the euro zone." Source

How will America be

affected? The Dollar would soar? That

would badly hurt American exports.

Will America's biggest banks be hurt badly because

they have sold massive amounts of credit default swaps

on Italian, Greek, Spanish and Portuguese

government bonds.

Clinched SELL S9

Date

DJI on Gain

Adv

Dec

Date

DJI

Adv Dec

Plurality

date of S9

of Clinching:

1. 9/14/1966

806.23 +6.0% 691 467 9/19/1966 810.85

460 677

--------------------------------------------------------------------------------------

2. 10/25/1966 793.09 +0.4% 596 549 11/3/1966 804.34 467 664

-----------------------------------------------------------------------------------

3. 3/28/1969 935.48 +17.8% 804 518 4/1/1969 933.08 638 720

----------------------------------------------------------------------------------

4. 4/30/1969 950.18 +19.0% 942 419 5/7/1969 959.60 587 779

---------------------------------------------------------------------------------

5. 1/5/1970 811.31 +5.8% 1021 426 1/6/1970 803.66 488 890

-----------------------------------------------------------------------------------

6. 6/17/1970 704.68 +5.0% 639 643 6/22/1970 669.36 412 820

----------------------------------------------------------------------------------

7. 6/22/1970 716.11 +6.5% 412 820 6/22/1970 716.11 412 820

---------------------------------------------------------------------------------

8 7/15/1970 711.66 +0.6% 837 412 7/21/70 722.07 398 900

---------------------------------------------------------------------------------

9 7/21/1970 722.07 +2.0% 398 900 7/21/1970 722.07 398 900

--------------------------------------------------------------------------------

10 5/6/1971 937.39 +3.7% 463 947 5/6/1971 937.39 463 947

--------------------------------------------------------------------------------

11 8/23/1971 892.38 +7.4% 917 474 8/30/1971 901.43 494 894

-----------------------------------------------------------------------------

12 4/12/1972 966.96 +5.7% 865 649 4/13/1972 965.53 569 890

--------------------------------------------------------------------------------

13 5/22/1972 965.31 +5.6% 823 644 5/23/1972 962.3 649 762

-------------------------------------------------------------------------------

14 5/30/1972 971.18 +6.1% 636 783 5/30/1972 971.18 636 783

------------------------------------------------------------------------------

15 8/3/1972 947.7 +2.7% 828 586 8/8/1972 952.44 682 746

-----------------------------------------------------------------------------

16 8/10/1972 952.89 +3.3% 783 588 8/15/1972 969.97 783 588

-------------------------------------------------------------------------------

17 1/5/1973 1047.49 +16.5% 745 687 1/8/1973 1047.86 676 771

-------------------------------------------------------------------------------

18 4/11/1973 967.41 +9.6%

4/12/1973 964.03 703 717 -14

4/13/1973 959.36 592 788

---------------------------------------------------------------------------

19 7/11/1973 908.19 +3.7% 1294 224 7/13/1973 895.99 504 881

---------------------------------------------------------------------------

20 9/4/1973 895.39 -5.0% 1010 439

9/10/1973 891.33 574 836

------------------------------------------------------------------------------

21 10/26/1973 987.06 +20.1% 915 532 10/29/73 984.8 655 822

------------------------------------------------------------------------

22 2/22/1974 855.99 +27.3% 988 439 2/28/1974 860.53 658 746

----------------------------------------------------------------------

23 2/28/1974 860.53 +27.7% 658 746 2/28/1974 860.53 658 746

----------------------------------------------------------------------

24 3/4/1974 853.18 +27.1% 706 707 3/7/1974

869.06 521 924

----------------------------------------------------------------------

25 6/6/1974 845.35 +26.4% 1007 386 6/11/1974 852.08 490 905

----------------------------------------------------------------------

26 6/13/1974 852.08 +27.0% 648 671 6/14/1974 843.09 370 953

------------------------------------------------------------------------

27 8/29/1975 835.34 +4.8% 1051 352 9/2/1975 823.69 399 992

------------------------------------------------------------------------

28 9/5/1975 835.97 +4.9% 491 811 9/8/1975

840.11 649 659

9/9/1975 827.75 478 884

-----------------------------------------------------------------------

29 3/24/1976 1009.21 +4.2% 1081 452 3/25/1976 1002.13 514 933

---------------------------------------------------------------------------------

30 3/15/1977 965.01 +6.4% 954 514 3/17/1977 964.84 676 709 -33

3/19/1977 961.02 650 729

------------------------------------------------------------------------------------

31 10/10/1978 891.63 +11.7% 720 752 10/10/1978 891.63 720 752 -32

10/12/1978 896.74 663 811

---------------------------------------------------------------------------------

32 9/21/1979 893.94 +10.9% 529 803 9/21/1979 893.94 529 803

-------------------------------------------------------------------------------------

33 2/13/1980 903.84 +14.0% 799 759 2/14/1980 893.77 415 1104

----------------------------------------------------------------------------------

34 11/14/1980 986.35 +5.3% 869 696 11/17/1980 968.94 638 941

-------------------------------------------------------------------------------------

35 1/2/1981 972.78 +3.5% 1061 495 1/7/1981

980.89 219 1552

-----------------------------------------------------------------------------------

36 10/9/1981 873 +4.0% 783 749

10/13/81 865.58 729 744 -15

10/14/81 850.81 384 1116

----------------------------------------------------------------------------------

37 4/1/1982 833.24 +6.7% 1061 377 4/9/82

842.94 669 767

----------------------------------------------------------------------------

38 7/12/1982 824.87 +5.8% 1061 456 7/13/1982 824.2 664 752

----------------------------------------------------------------------------

39 12/7/1982 1056.94 +6.1% 1017 628 12/8/1982 1047.09 796 826 -30

-----------------------------------------------------------------------------

40 7/26/1983 1243.69 +6.1% 1030 592 7/27/1983 1230.47 477 1189

-------------------------------------------------------------------------------

41 3/16/1984 1184.36 +5.7% 1141 438 3/19/1984 1171.38 394 1215

------------------------------------------------------------------------------- 42

10/ 14/ 1985 1354.73 -6.3% 987 462

10/18/1985

1368.84

740 770 -30

-----------------------------------------------------------------------------

43 4/ 29/ 1986 1825.89

0.0%

499

1153 4/ 29/

1986 1825.89

499 1153

-----------------------------------------------------------------------------

44 8/12/1986 1835.49 +2.3% 1171

494 8/18/1986 1869.42 786

828 -42

-----------------------------------------------------------------------------

45 4/6/1987 2405.54 +7.7%

877 734 4/7/1987 2362.94

527 1121

-----------------------------------------------------------------------------

46 5/6/1987 2342.19 +5.2% 771 798 5/6/1987 2342.19 771 798 -27

-----------------------------------------------------------------------------

Never Clinched.

47 6/8/1987 2351.64 -4.0% BUY B4

6/22/1988

2445.51 907 692

-----------------------------------------------------------------------------

48 10/1/1987 2639.2 +30.2%

1029 526 10/5/1987 2640.18 688

855

-----------------------------------------------------------------------------

49 12/28/1987 1942.97 +1.6% 283

1392 12/28/1987 1942.97

283 1392

-----------------------------------------------------------------------------

50 9/6/1988 2065.26 -0.1% 807 625 9/12/1988 2072.37 606 788

-----------------------------------------------------------------------------

51 10/4/1989 2771.09 +4.8%

831 656 10/10/1989

2785.33

652 831

-----------------------------------------------------------------------------

52 10/11/1989 2773.36 +4.9%

458 1021 10/11/1989 2773.36

458 102

-----------------------------------------------------------------------------

53 7/12/1990 2969.8

+17.4% 973 540 7/17/1990 2999.75 643

877

-----------------------------------------------------------------------------

54 4/15/1992 3353.76 +3.0% 1111 651 4/16/1992 3366.50 805 898

----------------------------------------------------------------------------

55 4/21/1992 3343.25

+2.7% 782 937 4/21/1992 3343.25

782 937

-----------------------------------------------------------------------------

56 10/17/1994 3923.93 +5.5%

1057 1129 10/17/1994 3923.93 1057 1129

-----------------------------------------------------------------------------

57 4/22/1997 6833.59 -4.9% 1536 971 4/23/1997 6812.72

1149 1359

-----------------------------------------------------------------------------

58 7/8/1998

9174.97 +16.8% 1759 1240 7/9/1998 9089.78 1217 1716

-----------------------------------------------------------------------------

59 9/23/1998 8154.41

+6.4% 2377 800 9/24/1998 8001.99 1093 2042

-----------------------------------------------------------------------------

60 8/17/1999 11117.07 +6.4%

1845 1150 8/18/1999 10991.37 1195 1799

-----------------------------------------------------------------------------

61 12/10/1999 11224.70 +2.3%

1554 1482 12/13/1999 11192.59 1230 1847

----------------------------------------------------------------------------

62 12/28/1999 11476.71 +4.5% 1557 1522 1/3/2000 11257.51 1079 2140

---------------------------------------------------------------------------

63 4/11/2001 10013.46 +12.5% 1160 1917 4/11/2001 10013.46 1160 1917

-----------------------------------------------------------------------------

64 10/10/2001 9240.86 -0.2% 2259 876 10/12/2001 9344.16 1275 1996

-----------------------------------------------------------------------------

65 2/26/2002 10115.26 +19.0%

1799 1334 3/12/2002 10632.35 1539 1616

5% higher

-----------------------------------------------------------------------------

66 5/17/2002 10353.08 +20.9%

1735 1424 5/20/2002 10229.50 1197 1942

-----------------------------------------------------------------------------

67 2/20/2004 10619.03 +6.1%

1170 2089 2/20/2004 10619.03 1170 2089

-----------------------------------------------------------------------------

68 5/5/2006 11577.74 +4.9%

2449 853 5/9/2006 11639.77

1639 1683

-----------------------------------------------------------------------------

69 7/17/2007 13971.55 +4.9%

1369 1898 7/17/2007 13971.55

1369 1898

-----------------------------------------------------------------------------

70 12/7/2007 13625.58 +3.4%

1649 1615 12/11/2007 13432.77

534 2759

-----------------------------------------------------------------------------

71 3/24/2008 12548.64 +9.3%

2604 628 3/26/2008 12422.86

1346 1826

-----------------------------------------------------------------------------

72 4/2/2008 12608.92 +9.7% 1859 1236 4/8/2008 12576.44 1325 1816

-----------------------------------------------------------------------------

73 7/23/2008 11632.38

+6.1% 1997 1214 7/24/2008 11349.28

609 2600

-----------------------------------------------------------------------------

74 7/30/2008 11583.69 +5.8%

2112 1065 7/31/2008 11378.02 1206 1960

-----------------------------------------------------------------------------

75 11/13/2009

10270.47 +0.9% 2206 813 11/17/2009 10437.42

1374 1660

-----------------------------------------------------------------------------

76 6/17/2010 10434.17 +6.3%

1525 1545 6/17/2010 10434.17

1525 1545 -20

-----------------------------------------------------------------------------

77 7/26/2010 10542.43 +2.6%

2472 602 7/27/2010 10537.69 1355 1716

-----------------------------------------------------------------------------

78 8/9/2010

10698.75 +4.0% 2215 859 8/10/2010 10644.25 841 2237

-----------------------------------------------------------------------------

79 12/5/2011 12097.83

????

====================================================================================

OLDER HOTLINES

====================================================================================

12/7/1941 - Remember

This Day of Infamy and Terrible Sacrifice

12/7/2011 DJI = 12196 +46 la/ma=

1.029 21-dma ROC= .129 P= -35 ( -6 ) IP21=-.027 V= -

68 OP= .103

SELL S9 versus Santa Claus

A January Top Is Most Likely

The Sell S9 Still Has Not Been Clinched.

The QQQ has been acting much weaker than the

DJI.

The cases of December S9s are too few to be super-confident of the Sell S9 right now..

Decembers tend (2 of 3) to bring support

and make bigger declines wait until the next year.

But 2007 showed we can't count on that.

Breaks in the A/D Line uptrend

and Opening Power uptrend, as well as

"clinching", have not yet occurred.

I suspect another big 8% to 12% decline

will not start in earnest until January.

After the new year starts, be very

careful. With Democrats in the White House,

the stock market most often shows first

quarter weakness.

Though waiting for the clinching (more than 15

down than up on NYSE at the close on the

day of the Sell S9 or on subsequent closes

until there is a reversing Buy) achieves

a higher price only 40% of the time compared to

selling on the S9, it is still possible

now for a price breakout above the flat 11250

resistance to occur. That would send prices

up smartly. Similar breakouts occurred in

June 1987 and February 2002 while S9s were

waiting for clinching. In 1987 prices

went 5% higher. In 2002 they rose 5% higher before

clinching.

Though the Opening Powers broke their steep

uptrends Wednesday, the Closing

Powers for the DIA and SPY rose slightly above

their declining downtrends and appear

to be at key pivot (or inflection) points where

they could spring either way. While we

wait, our Stocks' Hotline has taken twice as many short positions as long

ones among

the extreme and "bullish" CLosing Power

MAXCP and MINCP stocks.

Historically, the DJI tends to turn strongly up near

December 17th, by the end of next week.

It might seem that the Sell S9 is running out of

time. But in 2007, the DJI peaked on December 10th

and quickly formed a head/shooulders pattern in the

rest of December and then sold off badly.

BREADTH

STATISTICS:

53(+15) MAXCP stocks Bullish MAXCP Stocks

67(-60) MINCP stocks Bearish MINCP Stocks Bearish

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

13 new highs on NASDAQ. 22 new lows on NASDAQ

BEARISH

52

new

highs NYSE 4 new lows on NYSE BULLISH

12/7//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY

QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD SLV Crude

12/7/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

BREADTH STATISTICS:

12/6/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

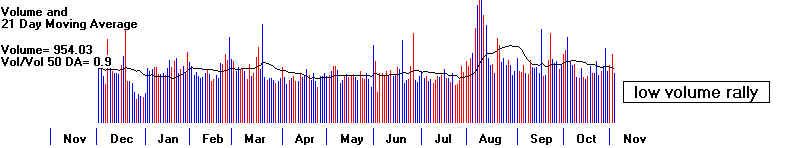

There is another negative factor. That is the extent to which computerized

trading has produced the rally.

When you look at the SP-500 stock, you see how uniformly high all their tradin volumes

seem to be.

Computers are now tending to rush the stock market up a lot one day and then drive it down

the next.

This weakens the argument that breadth today was so good that we should wait.

All in all, we might want to wait for the Sell S9 to be clinched. But the case for

this is not so clear

or one-sided. Accordingly, we will take five or six Bearish MINCP Stocks short positions tomorrow

and sell most of the long positions in the Bullish MAXCP Stocks we own.

The shadows from

the December 2007 experience are still too dark. It may be that the decline will be

only a short-term

one, perhaps just to the rising 21-day ma of the DJI. But we have CLosing Power on

our side. And that

the CP downtrends now suggest Professionals have turned bearish, as does the relatively

high number

of MINCP stocks and low number of MAXCP stocks. .

BREADTH STATISTICS:

36(-14) MAXCP stocks Bullish MAXCP Stocks

145(+25) MINCP stocks Bearish MINCP Stocks

Bearish

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

34 new highs on NASDAQ. 18 new lows on NASDAQ

BULLISH

48 new

highs NYSE 6 new lows on NYSE BULLISH

12/5//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude

12/5/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

NEM, SSRI (Silver) and PAAS (Silver) are in CP

downtrends now.

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/ 5 / 2001 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are now in

Down-trends. This is short-term

BEARISH

Opening Powers are rising steeply. When

the Opening Power uptrend is

violated, a retreat should follow.

DIA broke CP UPtrend - Any close of

more than 0.60 ABOVE the Opening

to restore the CP UPtrendline. Meanwhile, the CP is now bwlow its

21-dma

and shows a falling CP trend.

SPY has a CP DOWNtrend- Any close of more than 0.98 ABOVE the Opening

will break the CP DOWNtrendline. The CP is now below its rising 21-dma.

Opening Power is in a steep Uptrend...

QQQ has a CP DOWN-trend Any close of more than 0.40 ABOVE the Opening

will break the CP UPtrendline. The CP is now below its rising 21-dma.

Opening Power is tising steeply.

GLD

has a CP UPtrend - Any close of more than 0.11 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising

21-dma.

NEW SELL S9 TODAY.

Only 3 December S9s since 1933

Other than the fact that in our cases

the ratio of NYSE advances to declines

is a very positive 3.5 to 1, the key values now fall within the ranges of the

3 earlier December S9s.

S9/S12 12/6/1956 492.7 +4.6% 4700 2/5/57 B4

NYSE advances 524 declines 428

This would have been clinched with NYSE declines being greater than"

advances two trading days later with the DJI at 493.2

LA/MA ANNROC P IP21 V-I Opct

1.029 -.067 -83 -.078 -316 .143 1% paper loss. Reversing.

DJI rallied to 496.00 at end of December and then fall below

the lower band. Santa Claus Rally delayed the decline to the lower band.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

S7 S9 12/ 28/ 1987 1942.97 +1.6% 1942.97 12/28/87 B9

NYSE advances 283 declines 1392

This would have been clinched with NYSE declines being greater than"

advances the same day.

LA/MA ANNROC P IP21 V-I Opct

1.021 -.025 -37 .132 -8 .157

This was a dubious Sell because of cross-currents from tax loss

selling at the end of the year and because the Accum.Index readings

were a very positive +.132 on this day. The DJI did not peak

until early January.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

S9 12/ 7/ 2007 13625.58 +12.6% 11899.69 3/7/08 B8

NYSE advances 1649 declines 1615

This would have been clinched with NYSE declines being greater than"

advances the two trading days later with the DJI at 13432.77

LA/MA ANNROC P IP21 V-I Opct

1.034 .295 -15 -.035 -105 .032

DJI fell below the lower band. Santa Claus Rally had little delaying effect

on the decline.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

S9 12/ 5/ 2011 12097.83

NYSE advances 2377 declines 685

LA/MA ANNROC P IP21 V-I Opct

1.022 .054 -62 -.006 -77 .006

DJI fell below the lower band. Santa Claus Rally had little delaying effect

on the decline.

===============================================================================

OLDER HOTLINES

===============================================================================

12/2/2011 DJI = 12019 -1 la/ma= 1.016 21-dma

ROC= .185 P= -62 (-65) IP21=+.048 V=

- 74 OP= .014

BREADTH STATISTICS:

50(-37) MAXCP stocks Bullish MAXCP Stocks

NGLS, TMF, PCYS, SPPI,

120(+39) MINCP stocks Bearish

MINCP Stocks Bearish

TBT SYUT AIXG NUVA TZOO NAT GES HSP RWT

FTR SKX

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

14 new highs on NASDAQ. 22 new lows on NASDAQ

BEARISH

37 new

highs NYSE 8 new lows on NYSE BULLISH

12/1//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude

12/1/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

NEM, SSRI (Silver) and PAAS (Silver) are in CP

downtrends now.

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/ 1 / 2001 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are in

shallow uptrends. This is short-term

slightly BULLISH

DIA has a CP UPtrend - Any close of

more than 1.61 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

SPY has a CP UPtrend- Any close of more than 1.16 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

QQQ has a CP UPtrend Any close of more than 3.31 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

GLD

has a CP UPtrend - Any close of more than 0.11 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising

21-dma.

Peerless Multiple Buy

Signals versus 12000-12200 Resistance

December is Reliably Bullish, especially before a Presidential

Year. But first, a pullback seems likely when the CLosing

Power uptrends are broken....

Before the month is out I would expect a challenge of the 12800 high. I do not expect

Obama to do anything to rock the

financial establishment to cause him to be the first

Democrat ever to bring a December marlet

decline in the year before the start of a

Presidential Election year. But

first, there may have to be a retreat when the Closing

Power uptrend (above) is

violated.... The Big Banks and Military stocks have done well

in this rally. Home repairs and

eating inexpensively have helped HD and MCD make

new highs. Seasonality is neutral

for the next two weeks and is then very bullish.

DJIA is at resistance and near the upper band.

The P-Indicator has turned negative

as the DJI approaches the upper band. The

NYSE A/D Line has slipped back from

its falling 21-day ma. The number of stocks

that Professionals are

pushing to new highs has fallen considerably below the

number they are forcing down.

Year-end tax loss selling works against these stocks.

In the chart above, you can see Peerless recently gave a Buy B12. More volume

is

probably needed to get the DJI past the

12000-12000 resistance. But the selling is not

aggressive. Watch IBM. As the

highest priced DJI stock by far, it has much more

power tp move the DJI. Right now ,

at the old highs its Accumulation Index is negative

(showing institutional distribution) and

it shows much more Public than Professional

Buying.

A B12 is at this stage in a 30 month

advance (as opposed to when it is ending a bear market)

considered much less powerful. In

the present case, it is based on only two really good

breadth days. which is something the

ubiquitous computerized buying can easily

produce in an era of Fed guaranteed low

intrest rates. What is less sure is that

this buying will be sufficient to reverse

the many downtrends in non-dovident,

secondary stocks and get the DJI past all

the resistance overhead. Add to that,

B12s have not been very powerful

recently. The Buy B12 does make it harder to get

a Peerless sell signal for the next two

weeks, after which point a bullish Santa

Claus rally usually occurs. We will

tell you if a Sell Signal would be given here if the

B12 is taken out of the picture.

Foreign, Chinese and Financial stocks

have been among the weakest groups until the recent

rally. I would still prefer to buy

selected Biotechs because their trend has been up all year.

The 18 stocks that make my BIO2 group

which is charted below are ACOR, ALXN, AMGN, BIIB, CELG,

CPHD, GILD, ILMN, JAZZ, MYL, XVNT,

TEVA, VRTX, CRUS/ I recently added BMRN, ITMN

and REGN because the Fidelity Biotech

Fund (FBIOX) has been positions in them. A

new high in this

group would certainly be bullish.

====================================================================================

OLDER HOTLINES

====================================================================================

12/1/2011 DJI = 12020 la/ma= 1.017 21-dma ROC= .365

P= 2 (+72) IP21=+.093 V= -47 OP= .104

BREADTH STATISTICS:

87(-10) MAXCP stocks Bullish MAXCP Stocks BULLISH

81(-12) MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

14 new highs on NASDAQ. 22 new lows on NASDAQ

BEARISH

37 new

highs NYSE 8 new lows on NYSE BULLISH

12/1//2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude

12/1/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

NEM, SSRI (Silver) and PAAS (Silver) are in CP

downtrends now.

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

12/ 1 / 2001 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are in

shallow uptrends. This is short-term

slightly BULLISH

DIA has a CP UPtrend - Any close of

more than 1.61 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

SPY has a CP UPtrend- Any close of more than 1.16 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

QQQ has a CP UPtrend Any close of more than 3.31 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

GLD

has a CP UPtrend - Any close of more than 0.11 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising

21-dma.

Peerless Show Multiple Buy Signals

in the Bullish Month of December!

Expect a breakout above 12200 and a challenge of the 12800 high.

Do not expect Obama to do anything to

rock the financial establishment.

====================================================================================

12/1/2011

====================================================================================

11/30/2011 DJI = 12045.68 la/ma= 1.02 21-dma ROC=

.091 P= 71 (+201) IP21=+.056 V=

-93 OP= .082

BREADTH STATISTICS:

97(+56) MAXCP stocks Bullish MAXCP Stocks BULLISH

93(-61) MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

38 new highs on NASDAQ. 32 new lows on NASDAQ

BULLISH

52 new

highs NYSE 11 new lows on NYSE BULLISH

11/30/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude

11/30/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

NEM is on a New Buy...

SSRI (Silver) and PAAS (Silver) broke their CP downtrends today,

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'

stocks simply using Closing Power.

11/30/2001 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS:

The ETFs CPs are in

shallow uptrends. This is short-term

slightly BULLISH

DIA has a CP UPtrend - Any close of

more than 1.2 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

SPY has a CP UPtrend- Any close of more than 1.19 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

QQQ has a CP UPtrend Any close of more than 0.55 BELOW the Opening

will break the CP UPtrendline. The CP is now above its rising 21-dma.

GLD

has a CP UPtrend - Any close of more than 0.20 ABOVE the Opening

will break the CP UPtrendline. The CP is now above its rising

21-dma.

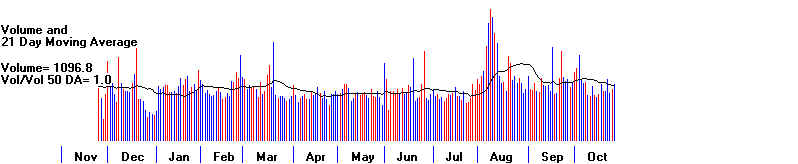

Hooray!

I think we still have to believe

the Peerless Buys, the bullish seasonality and the breaks in

the steep Closing Power downtrend,

The DJI's downtrending resistance line is at 12200s.

This is also where the 3.5% upper

band is. Today's volume rose sharply. It will need to stay

high to eat up the overhead supply

of stock up to 12800 on the DJI. But the good news is

breadth was so good it brought a

Buy B12. In on-going bull markets, B12s average aboout

8% gains in the DJI before being

reversed. Here that would mean a run to 13000. Buy B12s

do suppress some Peerless Sell

signals at the upper band for two weeks. So 13000 is a

possibility. Do not

underestimate how many stops the Administration and the Fed will

pull out to ramp the market up

before the 2012 Presidential Election Season begins.

Decembers in the Year were up 69%

of the time since 1966. How strongly up depends in

part on whether it was the Year

just before A Presidential Election Year. As we political

cynics might expect, Decembers in

the year before a Presidential Election rose 20 times

since 1915 and fell only 4 times,

each while a Republican was President. Obama would become

the first Democratic President

since before 1900 to allow the DJI to fall in December if he

did not do all he can to keep the

current rally rising.

December Average

DJI Gain since 1915

Years before

The Presid. Election Year

2.0%

-------------------------------------------------------------------

Mid-Term Year

1.4%

-------------------------------------------------------------------

Year after

The Presidential Year

1.15%

-------------------------------------------------------------------

The Presidential Year

1.0%

-------------------------------------------------------------------

Republicans controlled the

White House in Decembers before a Presidential Election

in the 4 cases when the DJI

declined in the December before a Presidential Election

Year.

December DJI

2007

13371.72 to 13264.82

2003

9782.46 to 10425.04

1991

2894.68 to 3168.83

1987

1833.55 to 1938.83

1983

1276.02 to 1258.64

1975

860.67 to 852.41

1971

831.34 to 890.20

1959

659.10 to 679.30

1955

483.30 to 488.40

1931

93.90 to 77.90

1927

198.20 to 200.70

1923

92.30 to 95.50

Democrats

1999

10877.81 to 11497.12

1995

5074.49 to 5117.12

1979

822.35 to 838.74

1967

875.81 to 905.11

1963

750.50 to 763.00

1951

261.30 to 269.20

1947

179.50 to 181.20

1943

129.60 to 136.20

1939

145.70 to 149.90

1935

142.30 to 144.10

1919

103.70 to 107.20

1915

96.70 to 99.20

.

====================================================================================

OLDER HOTLINES

====================================================================================

11/29/2011 DJI = 11556 +33 la/ma= .979 21-dma ROC= -.68 P= -269 (-11) IP21=-.052 V= -199 OP= -.058

BREADTH STATISTICS:

41 (-1) MAXCP stocks Bullish MAXCP Stocks

158 (-5) MINCP stocks

Bearish MINCP Stocks

BEARISH

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

11 new highs on NASDAQ. 41 new lows on NASDAQ

BEARISH

12 new

highs NYSE 22 new lows on NYSE

BEARISH

11/29/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA

SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ

GLD

SLV

Crude

11/29/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

NEM is on a Sell but is testing its 65-day ma

SSRI (Silver) and PAAS (Silver) broke their CP downtrends today,

This is updated each night for a

while to show new users how one might trade

some volatile precious metals'