TREASON, INSIDER TRADING and HENRY PAULSON

TigerSoft Blog - 11/29/2011 - Freedom News Service.

http://www.tigersoft.com/Tiger-Blogs/index.htm

See also http://www.tigersoftware.com/TigerBlogs/September-18-2008/index.htm

Henry Paulson Took

Washington Corruption and

Wall Street Cronyism To Dizzying New Highs!

PART II

The Axis of Crony Capitalism - Goldman Sachs and The US Treasury

Part 1 - http://www.tigersoft.com/tiger-blogs/September19-2008/index.html

http://www.tigersoft.com/Tiger-Blogs/index.htm

See also http://www.tigersoftware.com/TigerBlogs/September-18-2008/index.htm

Our TigerSoft's main themes are Insiders Always Know First on Wall Street and

If you want to make money there, you must Learn How to Spot Their Buying

and Selling.

Paulson's Secret Morning Meeting at Eton Park.

with Hedge Fund Managers and

5 Goldman Sachs Professional Traders

- July 21

Paulson's Tip To Sell Short

In the early Summer of 2008, now home prices were crashing and foreclosures were

at record levels. The economy was on the brink. Most vulnerable were the two government

backed home loan enterprises, Freddie Mac and Fannie Mae, which held more than $5 trillion

in mortgage backed securities. They had guaranteed 90% of American home loans. How could

they survive? In mid-July 2008, "Paulson had been pushing a plan in Congress to open lines of

credit to the two struggling firms and to grant authority for the Treasury Department to buy equity

in them... (He) had told reporters on July 13 that the firms must remain shareholder owned

and had testified at a Senate hearing two days later that giving the government new power to

intervene made actual intervention improbable...

This is not what he told the insiders. At Eton Park, till weeks before the Public was told how

grave the financial situations was at Fannie Mae and Freddie Mac, George Bush's Teasury

Secretary Henry Paulson secretly advised a dozen, or so, Wall Street insiders that Freddie

and Fannie would go bankrupt if Congress did not infuse them with huge sums. At the meeting

were some of the biggest short-selling hedge fund managers and trader friends of his from

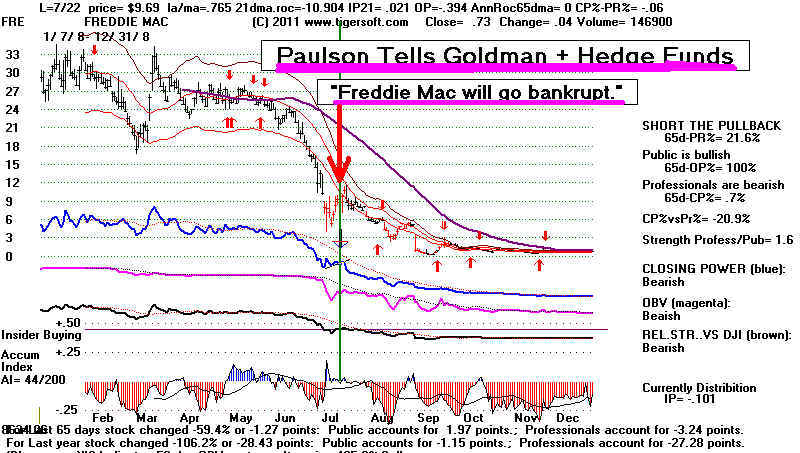

Goldman Sachs where he had been CEO from 1999 to 2006. At teh time, Freddie Mae was

over $11 and Feddie Max was over $7.

Paulson provided these Wall Street insiders a perfect opportunity to bet against America

at the expense of everyone else who did not have this information.... When news of his

massive bank bailout plans were made public, the Dow Jones average fell 3500 points lower.

That Fannie and Freddie Mae were in dire financial straits had not been said publicly

is very clear. To the contrary, the next day the NY Times reported that Paulson's

examination of Fanie and Freddie's books was expected to reassure the stock market.

"After a perfunctory discussion of the market turmoil ... the discussion turned

to Fannie Mae and Freddie Mac. Paulson said he had erred by not punishing Bear Stearns

shareholders more severely... (Paulson) went on to describe a possible scenario for

placing Fannie and Freddie into “conservatorship” — a government seizure designed

to allow the firms to continue operations despite heavy losses in the mortgage markets.

"Paulson explained that under this scenario, the common stock of the two government-sponsored

enterprises ... would be effectively wiped out. So too would the various classes of preferred stock,

he said. The fund manager (who disclosed this) says he was shocked that Paulson would furnish

such specific information — to his mind, leaving little doubt that the Treasury Department would

carry out the plan. The managers attending the meeting were thus given a choice opportunity to

trade (on the short side) on that information."

Besides those from Goldman Sachs, attending were:

1) Short seller James Chanos of Kynikos Associates Ltda $6 billion hedge fund.

2) GSO Capital Partners LP co-founder Bennett Goodman. Senior Managing Director Blackstone Group

3) Roger Altman, chairman and founder of investment bank Evercore Partners Inc.; and

4) Steven Rattner, a co-founder of private-equity firm Quadrangle Group

5) Michele Davis, then-assistant secretary for public affairs at the Treasury Department, who now

represents Paulson as a managing partner at public relations firm Brunswick Group Inc.

6) Eric Mindrich - founder of the Elton Park Hedge funds.

7) Stephen Mandel Pine Pine Capital

8) Dinakar Singh, Axon Capital Management

9) Daniel Och of Och-Ziff Capital Management

Below is the Tiger chart of Freddie Mac. ( I cannot locate the data now for Freddie Mac.)

Sources:

http://www.dailyreckoning.com.au/the-disturbing-facts-about-paulson-fannie-freddie-and-friends/2011/12/02/

http://4closurefraud.org/2011/11/29/insider-trading-how-paulson-gave-hedge-funds-advance-word-on-fannie-and-freddie/

http://thestockmarketwatch.com/stock-market-news/recent-events/business-news/insider-trading-scandal-hank-paulson-tips-goldman-gang-on-fannie-freddie/15928

|

REACTIONS: William Black, associate professor of economics and law at the University of Missouri-Kansas City, can’t understand why Paulson felt impelled to share the Treasury Department’s plan with the fund managers. “You just never ever do that as a government regulator — transmit nonpublic market information to market participants,” says Black, who’s a former general counsel at the Federal Home Loan Bank of San Francisco. “There were no legitimate reasons for those disclosures.” Janet Tavakoli, founder of Chicago-based financial consulting firm Tavakoli Structured

Finance Inc., says the meeting fits a pattern. |

Small wonder Goldman Sachs does so well

trading for its own account.

More reading about Paulson

Congressman Stearns Questions Hank Paulson How Do You HaVE ANY

CREDIBILITY

Hank

Paulson confronted on foreknowledge of 9/11 and Bailout

Hank

Paulson, Tim Geitner, Ben Bernanke should be tried for TREASON

1) Short seller James

Chanos of Kynikos Associates Ltda $6 billion

hedge fund.

1) Short seller James

Chanos of Kynikos Associates Ltda $6 billion

hedge fund.

Bennett Goodman.

Bennett Goodman.