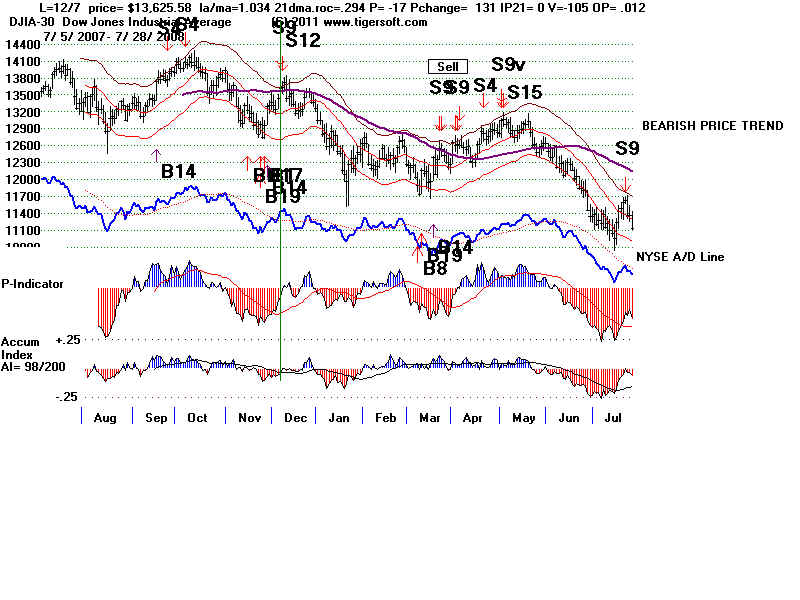

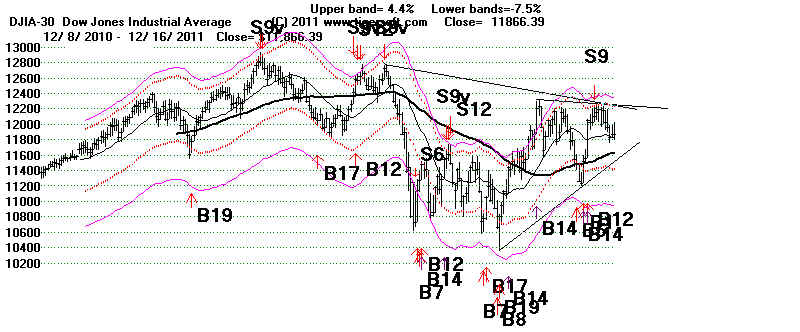

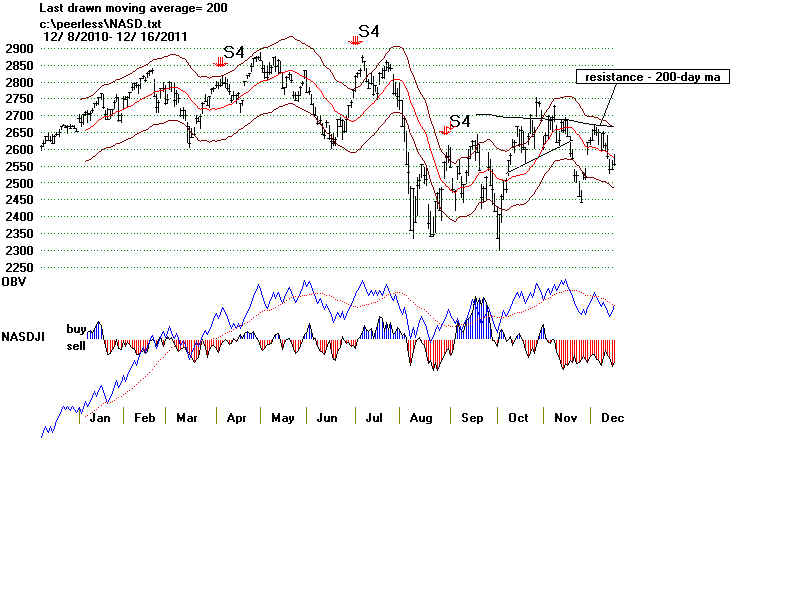

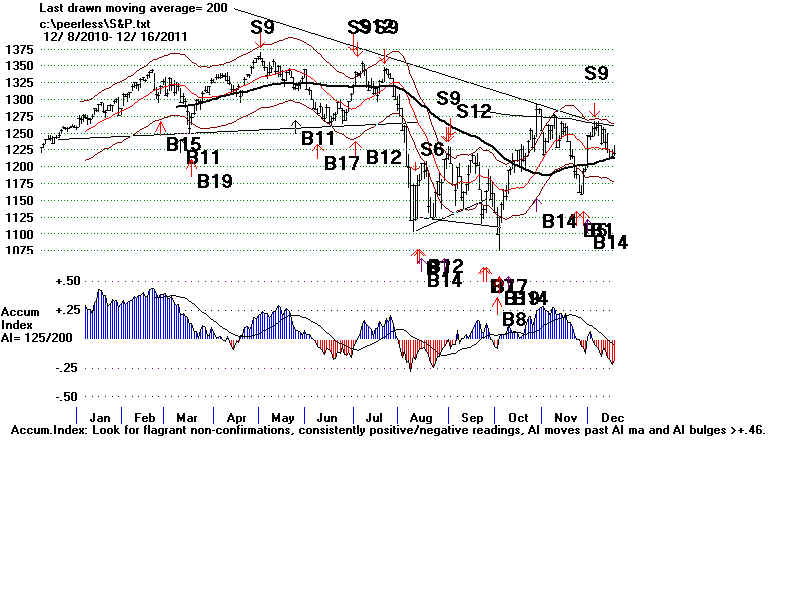

DJIA - PEERLESS - 12/16/2011

IWM - Candle Stick Chart - 12/16/ 2011

======= 12/16/2011 =======

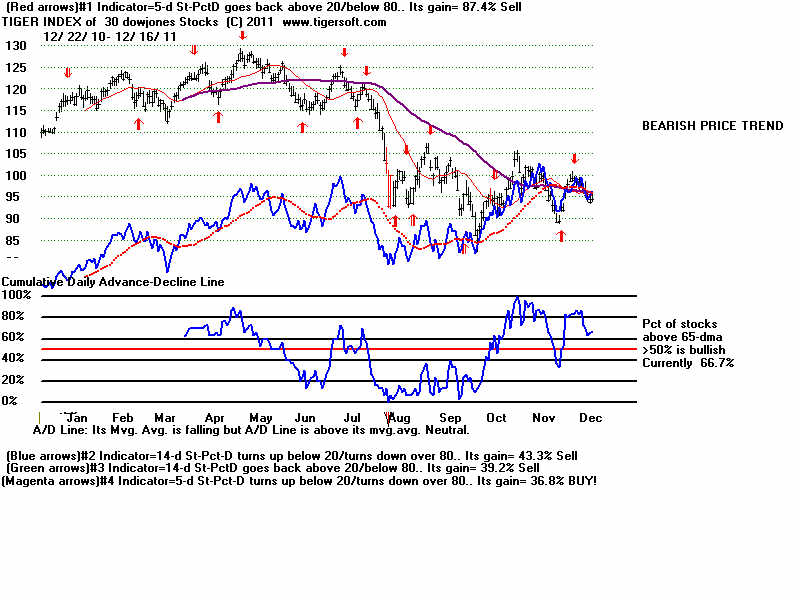

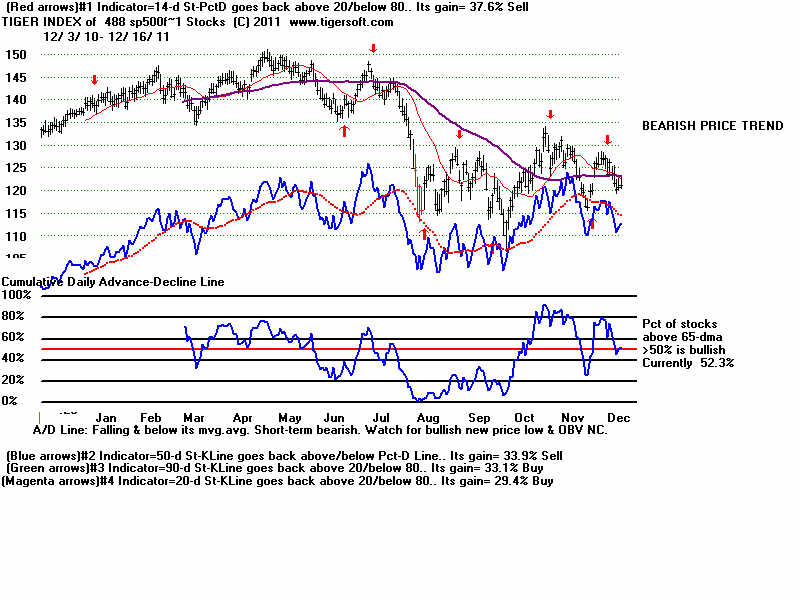

9 groups show >50% over 65-dma

15 groups show <50% over 65dma

Pct of Stocks over 65-dma - Daily Change

12/16//2011 12/9//2011 12/1//2011 11/22//2011 11/4//2011 10/24//2011 10/14//2011

--------------------------------------------------------------------------------------------------------------------------------------------------------------

BestREITs 93% +20% 67% +20% 47% -20% 20% -20% 73% 67% + 27% 7%

Bond Funds 90% 91% +1% 85% -1% 87% +2% 94% 82% -2% 77% +8%

Homebuilding 71% -8% 79% +22% 75% -4% 67% 75% 75% +17% 25%

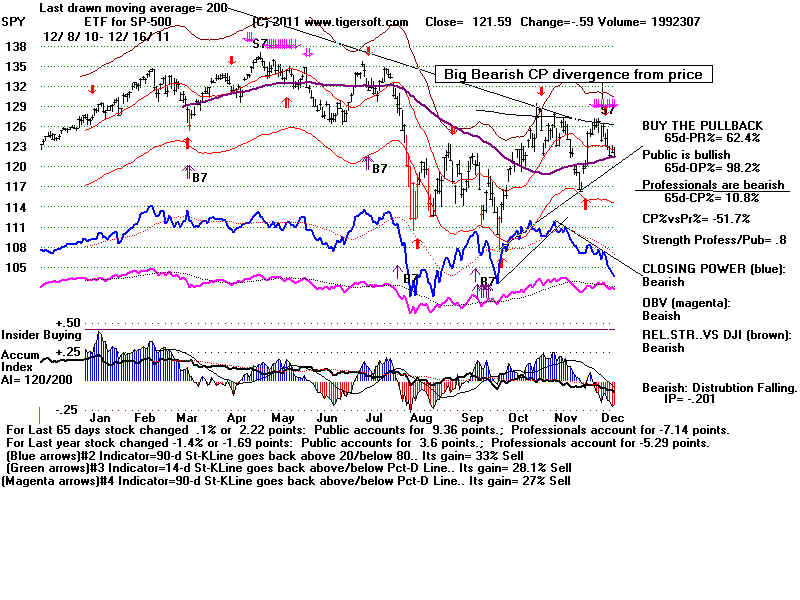

DJI-30 stocks 67% 87% +4% 80% -3% 50% -7% 91% -6% 87% +7% 53% +13%

Utility Stocks 63% -2% 81% +15% 79% 40% -23% 86% -3% 83% +13% 67% +6%

Transport Stocks 63% +2% 68% +8% 57% -6% 46% -7% 75% +1% 74% +4% 58% +20%

50 Super 2011 54% +4% 55% -2% 59% +2% 48% +2% 75%

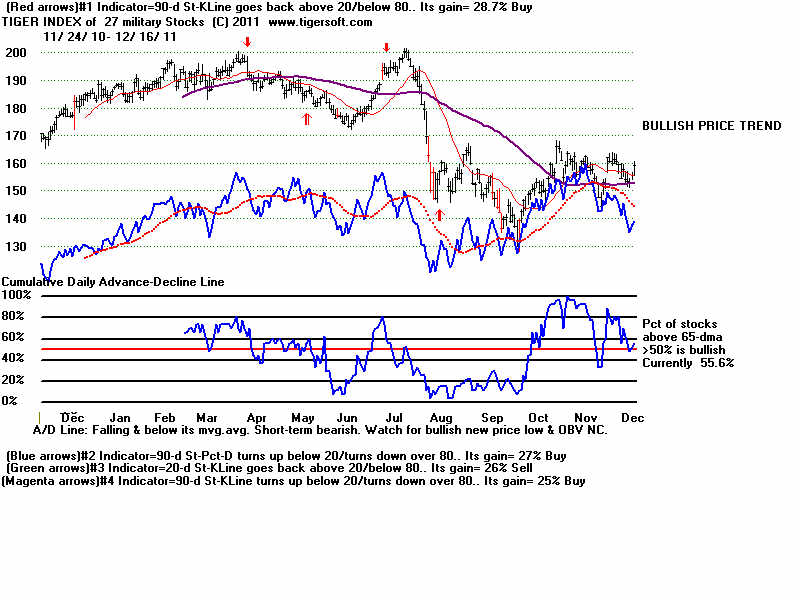

Military Stocks 52% +4% 70% +14% 82% -7% 48% -11% 100% 93% +3% 67% +11%

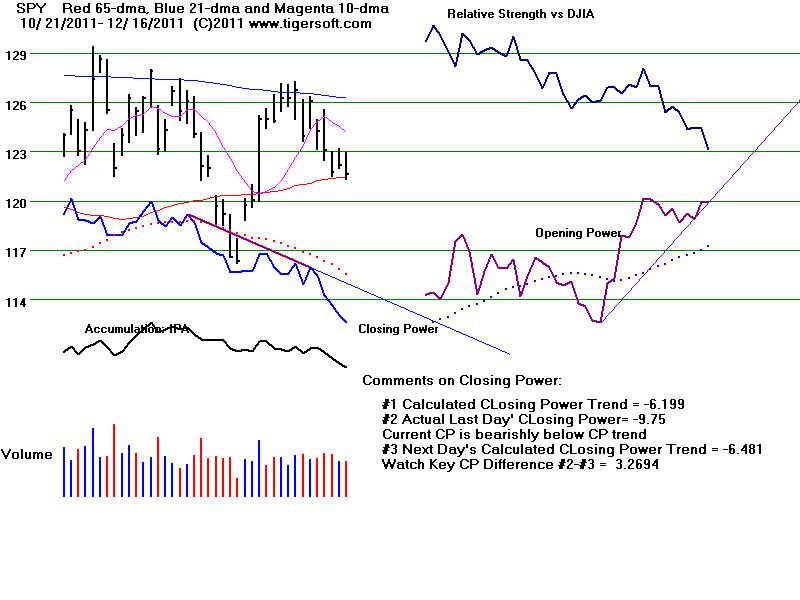

SP-500 stocks 52% +2% 74% +12% 73% -3% 42% -19% 86% -3% 87% +13% 57% +10%

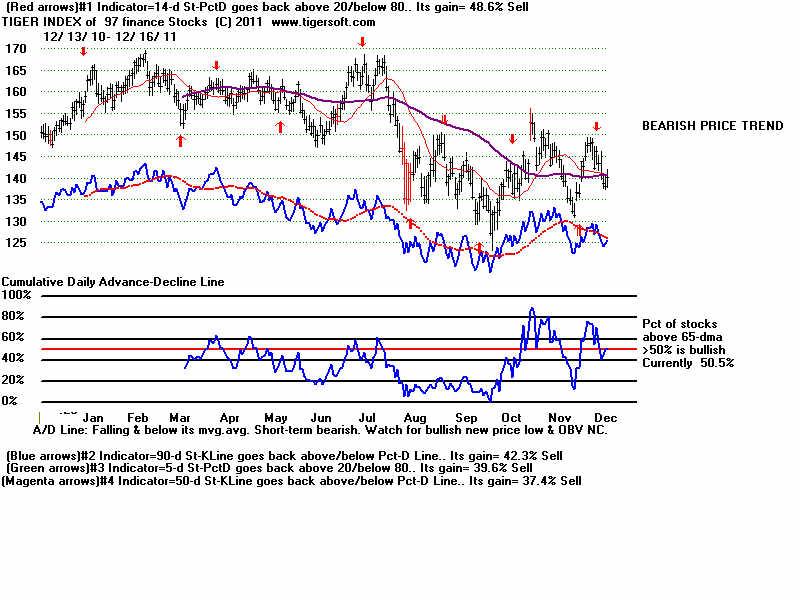

Finance Stocks 51% -5% 71% +16% 58% -2% 32% -5% 74% -4% 73% +13% 36%

============================================================================================

Chem 48% +1% 60% +3% 64% -5% 48% -5% 77% -2%

Retails 48% +8% 52% 43% -1% 30% 65% -13% 70% +13% 57% +4

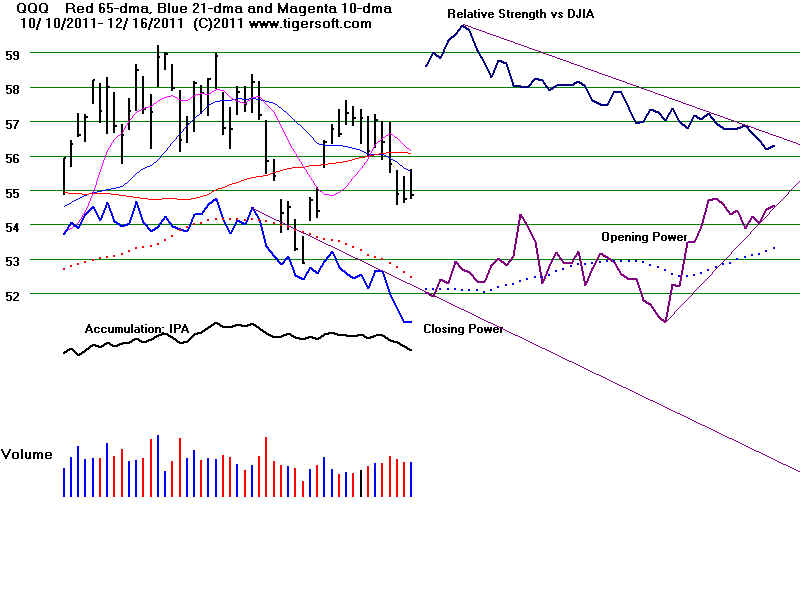

QQQ-100 stocks 43% +7% 68% +10% 71% +3% 35% -6% 84% -2% 84% +9% 69% +3%

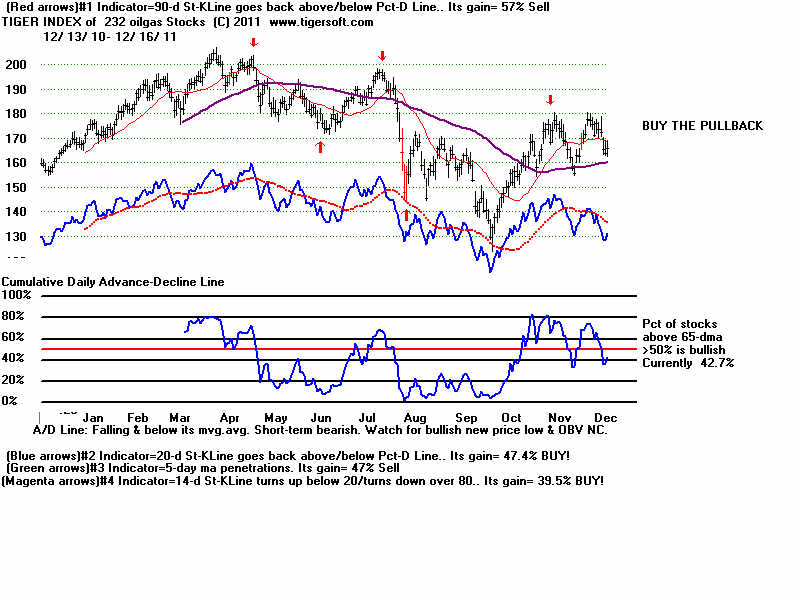

Oil stocks .. 43% +6% 66% +6% 69% -14% 49% -3% 79% +3% 64% +14% 37% +12%

Gaming 43% +14% 52% 64%

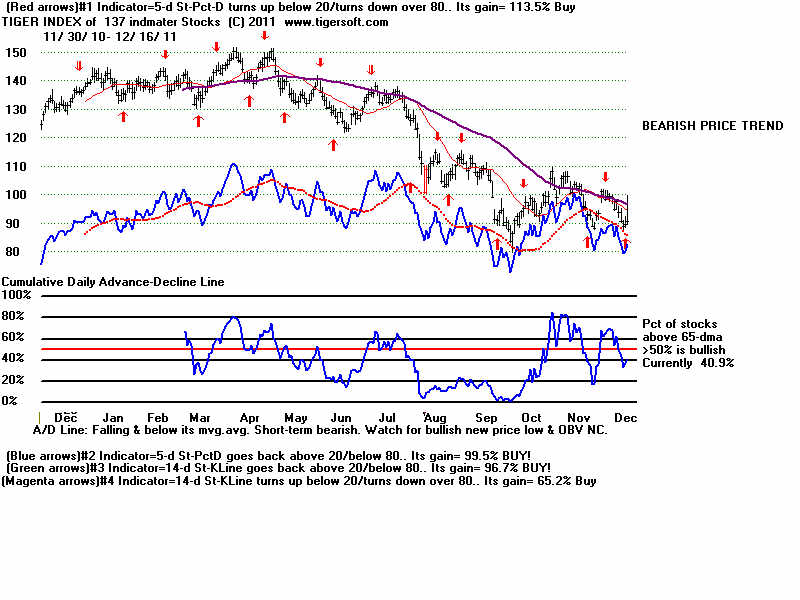

Ind. Materials 41% +4% 63% +9% 63% -5% 36% -4% 82% -2% 52% +11% 32% +10%

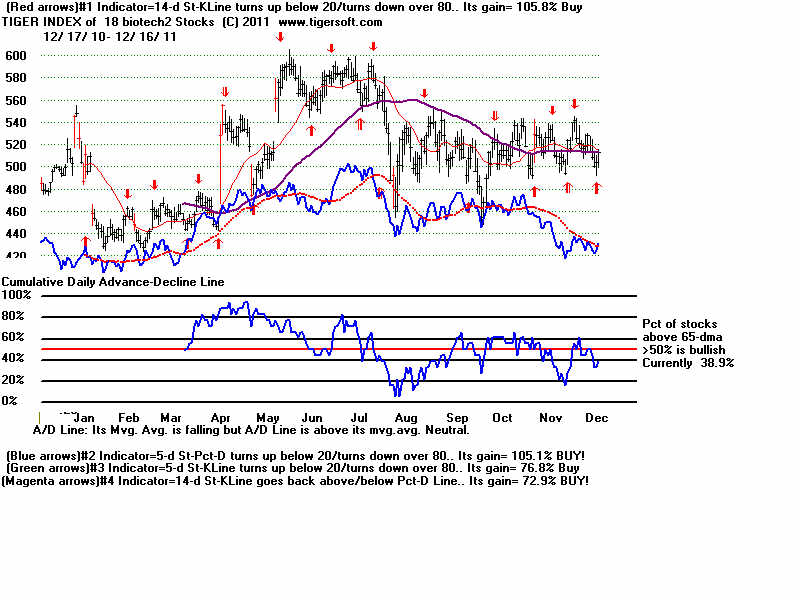

Biotech 18 39% +6% 50% +6 56% +2% 27% 47% -13%

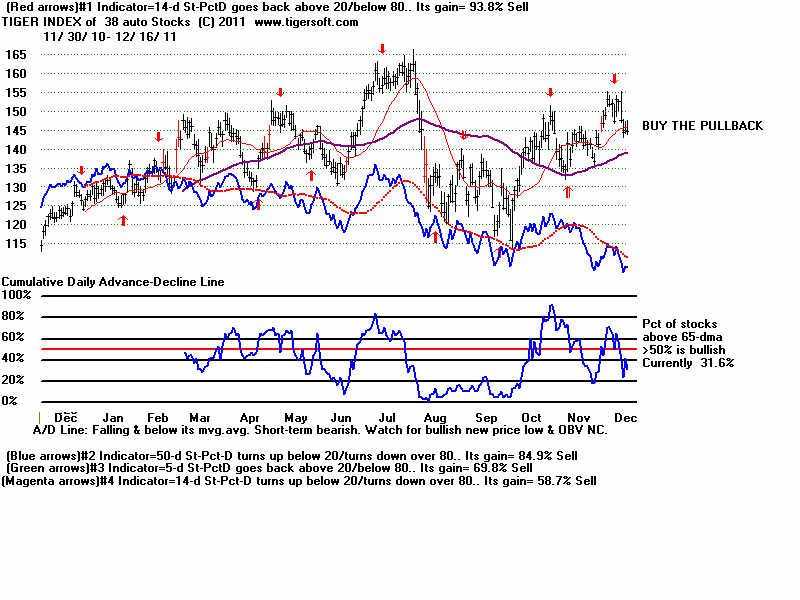

Auto Stocks 32% -10% 70% +20% 45% -8% 29% -5% 76% 69% +23% 61% +21%

Computer Eq 31% 44% +5% 45% -2% 33% -4% 67% -8% 71% +15%

Green Stks 25% 48% +12% 45% -3% 24% +1% 45% -4% 41% -+13% 26% +6%

Chinese Stocks 20% -1% 32% 32% -4% 25% -2% 49% -2% 33% +8% 20% +6%

Gold/Silver Stks 16% +4% 45% +9% 44% - -2% 23% +4% 60% +3% 16% +12% 10% -1% ====

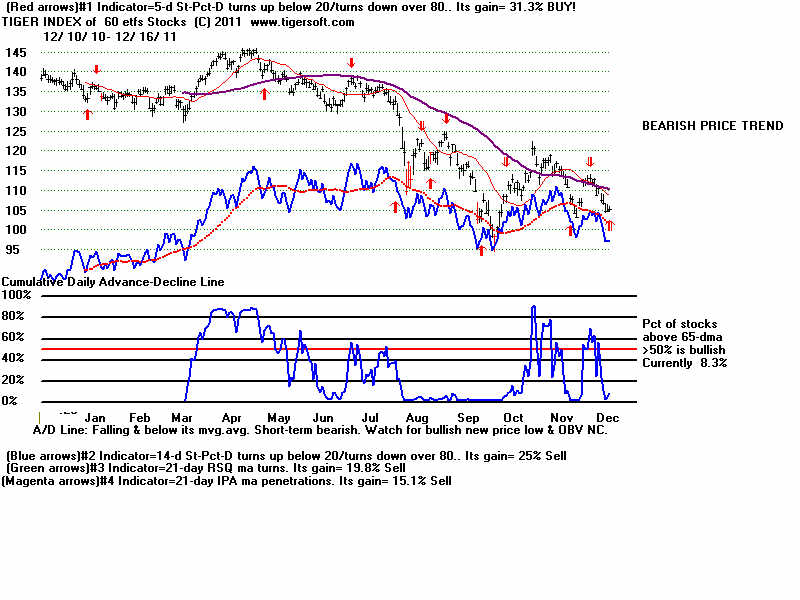

Foreign ETFs 8% +3%

Food Commodities 0% - 10% 30% 30% 20% 40% +10% 30%

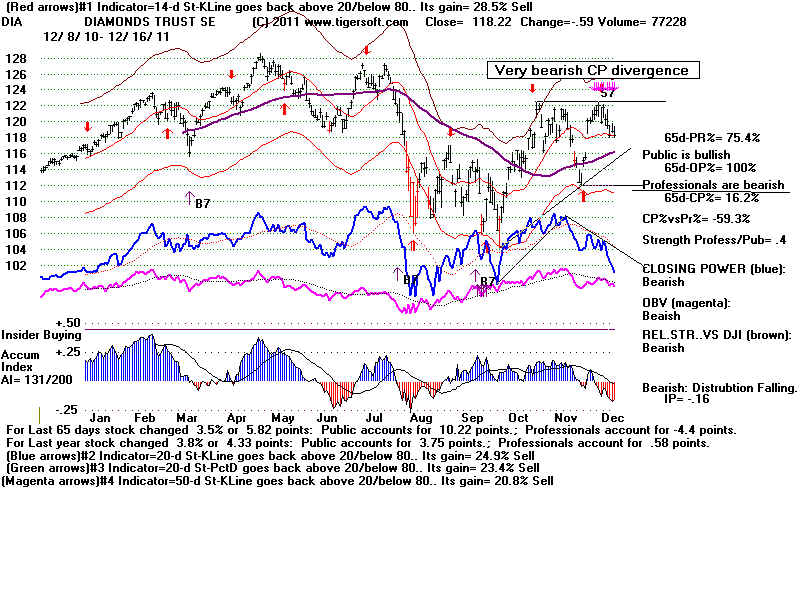

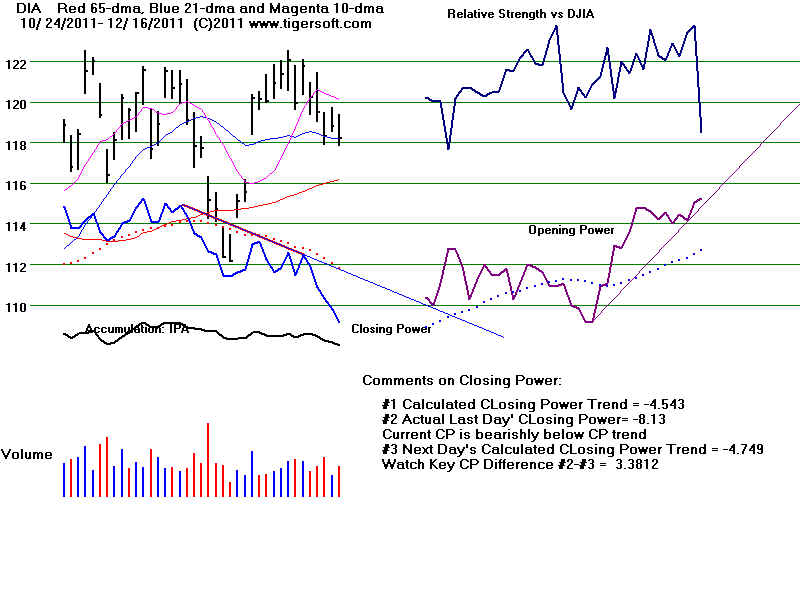

DOW STOCKS

SP500 STOCKS

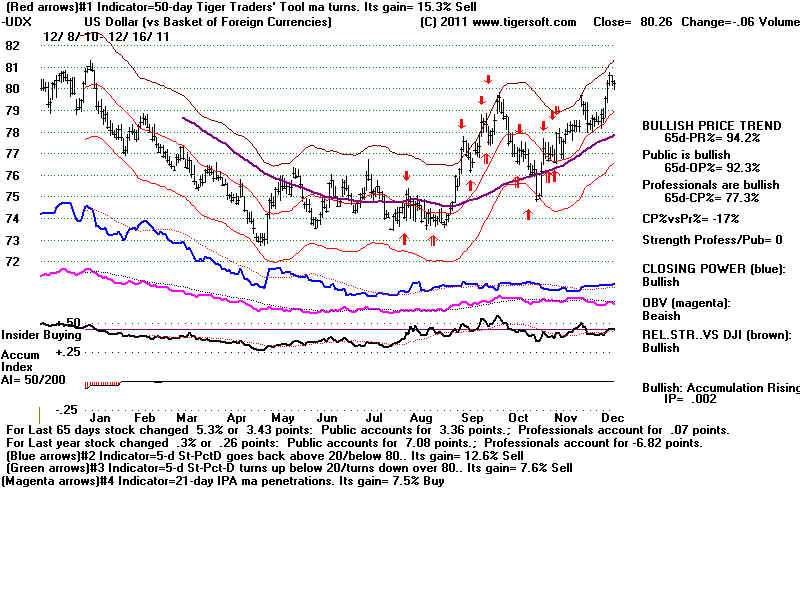

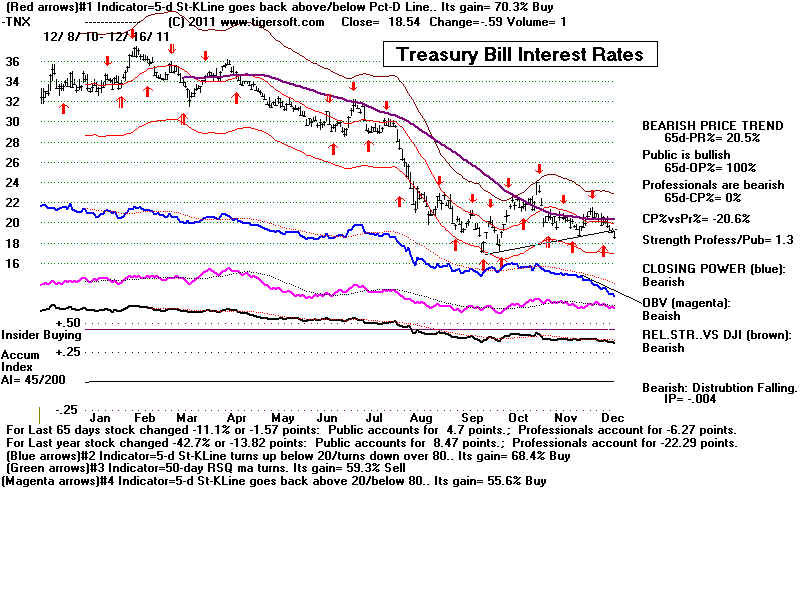

INTEREST RATES

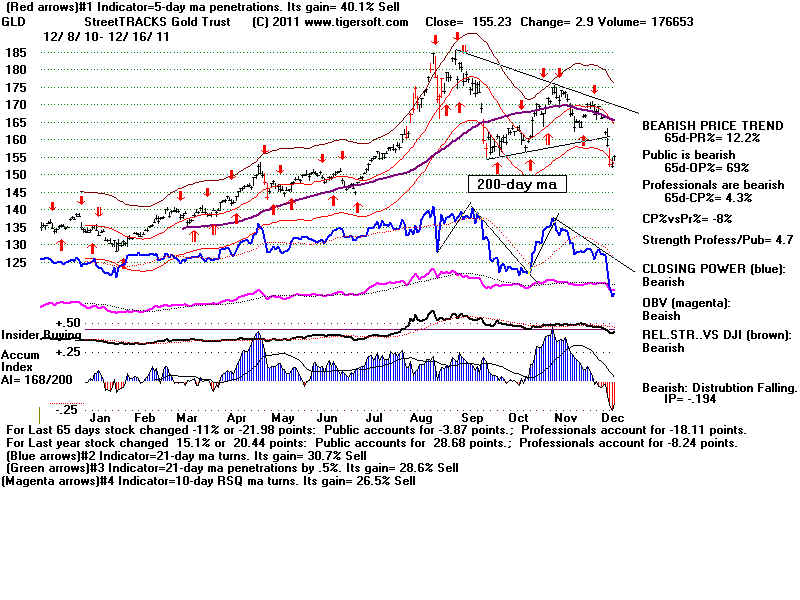

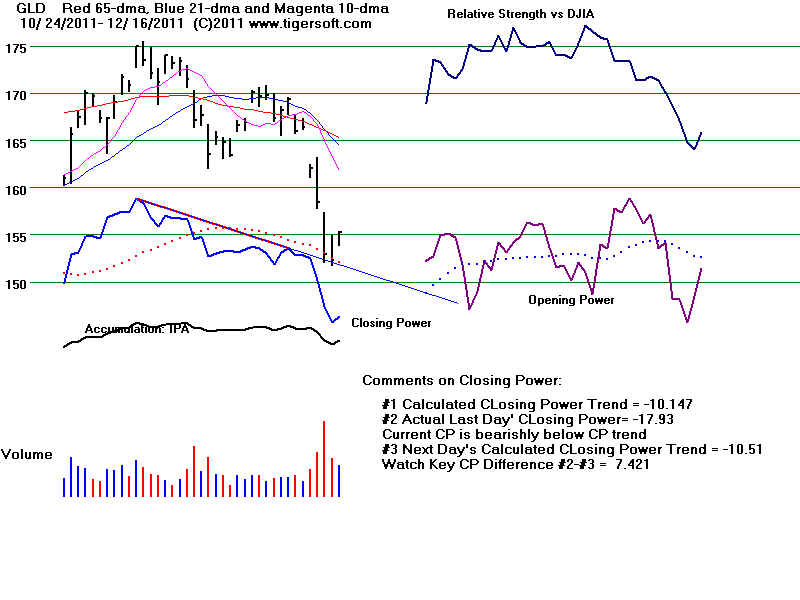

GOLD ETF

GOLD STOCKS,

SILVER

Index of Oil Stocks

BONDS |