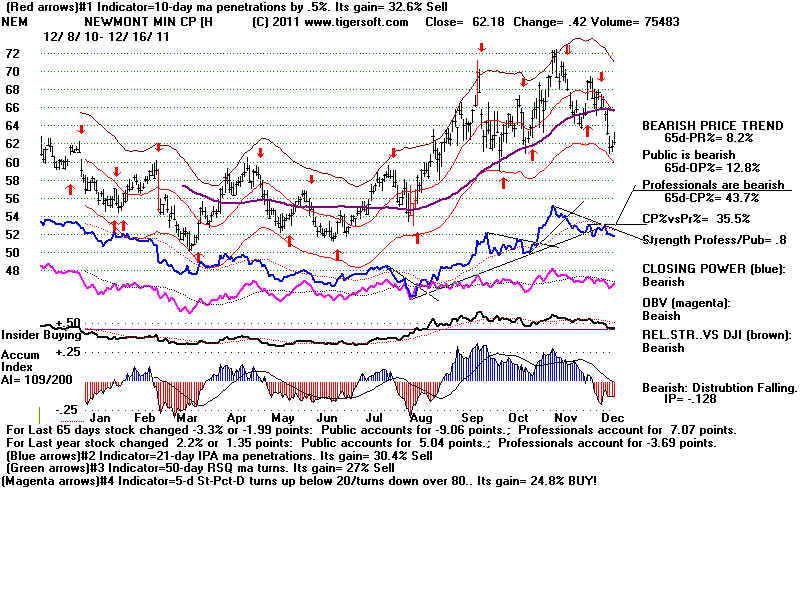

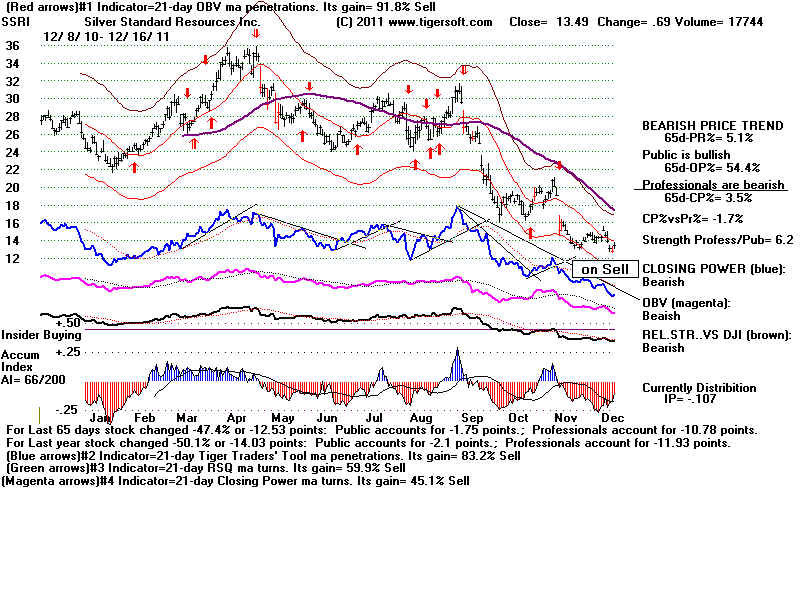

Daily: SSRI (silver), PAAS (silver) and NEM (gold).

(C) 2011 William Schmidt, Ph.D.

12 / 16 / 2011: STATUS (Charts shown below)

SSRI . on Sell CP downtrending

PAAS . on Sell CP downtrending

NEM . on Sell CP downtrending

Earlier Studies:

9/4/2008 TigerSoft New Service/Blog - How To Trade Silver (SLV) and SIlver ...

TigerSoft Blog - 8/6/2008 - Use TigerSoft's Unique Technical Tools ...

You can still make Big Money in the Stock Market. Watch for Insider

Always Look Beneath The Stocks Surface with TigerSoft Insider

TigerSoft's Closing Power Lets You Trade with The Market Makers ...

TigerSoft Blog - 8/16/2008 - Predicting The QQQ Using TigerSoft's Closing Power

2/11/2011 TigerSoft New Service/Blog - Trading Gold and Silver Stocks

INTRODUCTION.

Study the heavy BLUE Closing Power Line that appears immediately below the daily

price bars. A break in a CP downtrend is BULLISH. A break in a CP uptrend is BEARISH.

CP trend-breaks confirm the automatic oppoimized red signals. ..

Watching for and trading trend-changes of Tiger's Closing Power is a preferred tactic

for trading here. This works because the Closing Power represents Professional net

buying and selling. The "Pros" are not loyal to any stock. They drive it up and down

to turn a profit. We watch the CP trend-breaks to see when they switch from net

Buying to new Selling. Most of the time, trading in the direction they trade will make

us nice profits. Our website www.tigersoft.com has hundreds of examples. Google

"TigerSoft" "Closing Power". When the stock is very strong (or very weak), the rising

(or falling CP) often pulls back to its MA and then moves up (or down) again. The

first minor trend-breaks are then of only short-term importance in these cases unless

the CP has failed to confirm the new price high or low.

Blue Closing Power Trend-Changes Determine whether Tiger is Bullish or Bearish.

(The red Buys and Sells are hand-edited here for emphasis)

TigerSoft has many other indicators, but the simplest to use is to watch for Closing Power

trend-changes. See http://www.tigersoft.com/owners/

CP is not perfect. Perhaps 10% of the time, the biggest force behind a stock's moves is either

Public or Foreign net Buying or Selling and is not the trading by Professionals.. In these cases,

our Opening Power is more likely to predict stock prices. This situation occurs mostly in

highly speculative markets where public buying has been whipped up by lots of high publicity

promotion. Examples: Glen Beck and Silver 2011 or a long multi-year advance in stock prices,

e.g. Internet stocks in 1999-2000. Opening Power is not shown in the charts here, unless it

is more powerful than Closing Power. See the notes just below the Months on our charts,

where the relative importance of Public and Professional Buying is shown.

Sometimes determining which trendline to draw becomes important. In these cases,

rely on the trendline which goes through the most points with an emphasis on the

trend of the most important zigs and zags. We have assembled a list of rules that

rest on the core concept of a Closing Power trend-break.

CURRENT CHARTS

Watch for changes in trends of Closing Power