TIGER HOTLINE

TIGER HOTLINE

IMPORTANT:

The location of this Hotline will change Wednesday

night.

You should have received the new location by email. To renew... $350-$370/Yr Order Here.

The location of this Hotline will change Wednesday

night.

You should have received the new location by email. To renew... $350-$370/Yr Order Here.

Email me if you have not received the notice. william_schmidt@hotmail.com

November

San Diego Tiger User Group Meeting

A

Guide To Profitably Using The Tiger Nightly HOTLINE

A

Guide To Profitably Using The Tiger Nightly HOTLINE

TigerSoft and

Peerless Daily Hotline

(C)

1985-2011 William Schmidt, Ph.D. www.tigersoft.com

All rights

strictly reserved.

Background Studies

10/24/2011 2011's Super Stocks - 90%

Showed Insider Buying as Tiger measures it,

early on and before

their biggest moves

9/30/2011

Key Support failures in

DJI since 1929

Weekly DJI and A/D

Line charts since 1928

6/14/2011

- Tiger Charts of

SPY's Closing, Opening Powers and IDOSC: 1994-2011 Peerless

Buys and Sells applied to DIA, SPY, QQQ and Canadian ETF (EWC)

See New blogs about the

profitability of Peerless Buys and Sells applied to DIA,

SPY, QQQ and EWC

(Canada) and other country ETFs, Brazil, South America

and Mexico. Also

see the study just done of the industry groups that Peerless

Buys and Sells worked

best with since 1986.

http://tigersoftware.com/TigerBlogs/April-28-2011/index.html

http://www.tigersoftware.com/TigerBlogs/April27-2011/Index.html

http://tigersoftware.com/TigerBlogs/4-23-2011/index.html

4/15/2011 Surging Biotech's

- A Wave of Good Hope

3/11/2011 NASDAQ Charts:

1990-2011 Show Reliability of Head/Shoulders

3/8/2011

Compare Grain Tops Now

with Those They Made in 2008:

Rice, Wheat, Oats,

Soybeans

>SPY: TigerSoft

Charts: 1993-2011: Study them to improve your technical analysis skills.

>Head/Shoulders,

CP trends, NC's, zig-zags, Flagrant Accum. Index NNCs and PNCs.

>Use

TigerSoft's Insider Trading Charts To Look Beneath A Stock's Surface

2/23/2011 SPY Candle Stock

Charts: 1993-2011

2/12/2011 Trading Gold and Silver Stocks with

TigerSoft's Key Indicators Measuring Insider

and Professional Buying and Selling.

2/8/2011 Trading The EURO since

1999 Using TigerSoft's Closing Power and Accumulation Index.

This sets out a convenient list of trading rules that should be helpful.

TigerSoft Blogs

11/16/2010 30-Treas.-BONDS and

The DJIA since 1980

11/4/2010 TRADING RESULTS FOR

BULLISH and BEARISH SPECIAL SITUATIONS

What we can learn from

the Picks from Late July - September 2010

10/16/2010 New Research for

Trading with Closing Power

Overnight Market Action:

Bloomberg Futures around

the world before the US Markets open.

CNN Futures before the Opening in NY

24-hour Spot

Chart - Gold 24-hour Spot Chart - Silver

Dollar and

Currencies

Daily NYSE and NASDAQ New Highs.

Earlier Hotlines

2011 8/31/3011 - 10/4/2011 8/12/3011

- 8/31/2011

8/11/2011 - 7/5/2001

7/5/2011 - 6/2/2011

3/31/2011-6/1/2011

1/9/2011 - 3/31/2011

2010

12/9/2010 - 1/8/2011

11/1/2010 - 12/9/2010

10/13/2010 - 10/31/2010

9/28/2010 - 10/13/2010

8/31/2010 - 9/28/2010

6/14/2010-

8/31/2010 5/14/2010 - 7/26/2010

3/23/2010 - 5/14/2010

2/12/2010 - 3/22/2010

1/15/2010 - 2/11/2010

2009 10/21/2009-1/14/2010

8/30/2009-10/20/2009

7/31/2009-8/28/2009

7/1/2009-7/31/2009

6/14/2009-6/30/2009

5/1/2009 -

6/11/2009

3/31/2009-4/30/2009 |

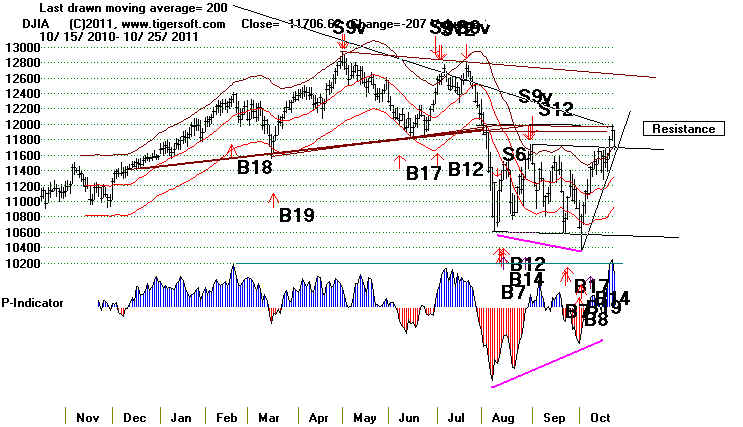

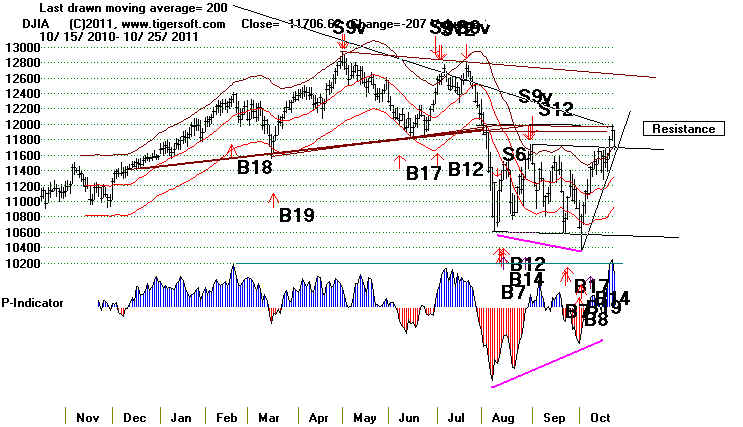

10/25/2011

DJI = 11706.62 la/ma=1.034

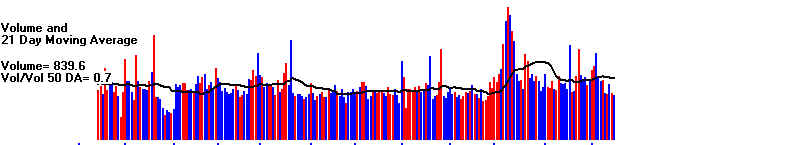

21-dma ROC=+-.699 P= +356 (-161) IP21=+.065 V= +38 OP= .162

BREADTH

STATISTICS:

117(-136)

MAXCP stocks Bullish

MAXCP Stocks

34 (-3)

MINCP stocks Bearish

MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

5 (-37) new highs on NASDAQ. 19 (+8) new lows on NASDAQ

10 (-28) new

highs NYSE 4

(-7) new lows on NYSE

10/25/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

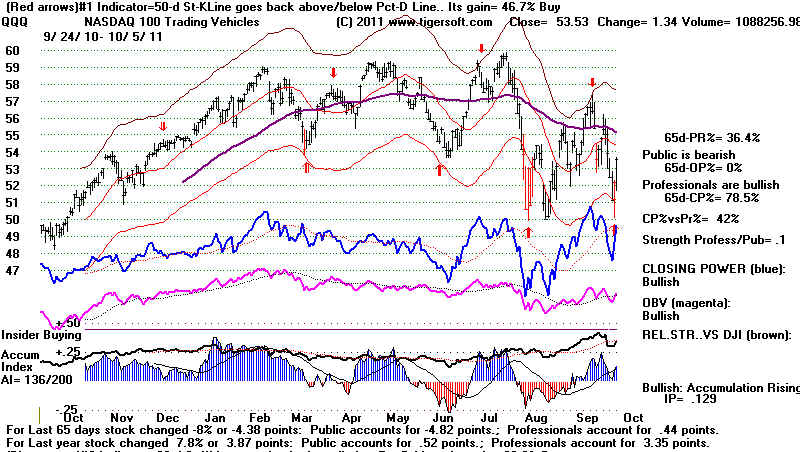

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

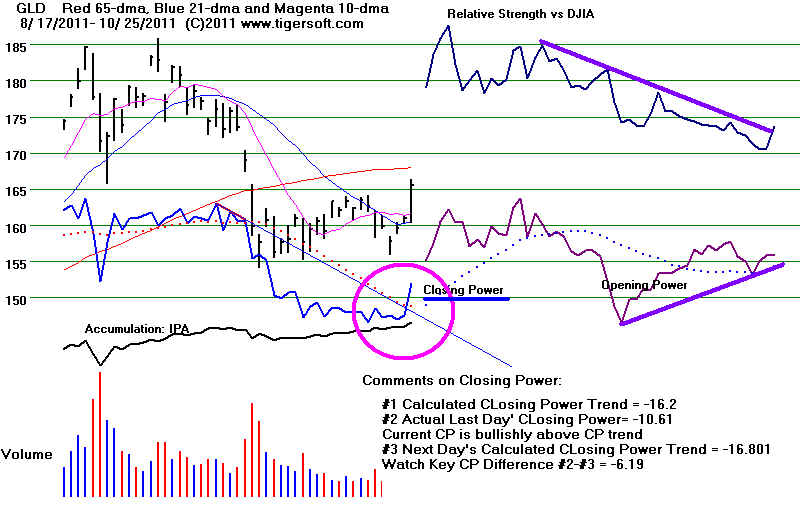

TigerQQQ GLD SLV

Crude

10/25/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) All on Buys now.

This will updated each night for a while to show new users how one might trade

some volatile precious metals' stocks simply using Closing Power.

Near Term:

updated last: 10/25/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

The 3 major market ETF Closing Powers

broke their uptrend-lines. This is short-term

BEARISH.

The ETFs' Opening Powers are still rising.

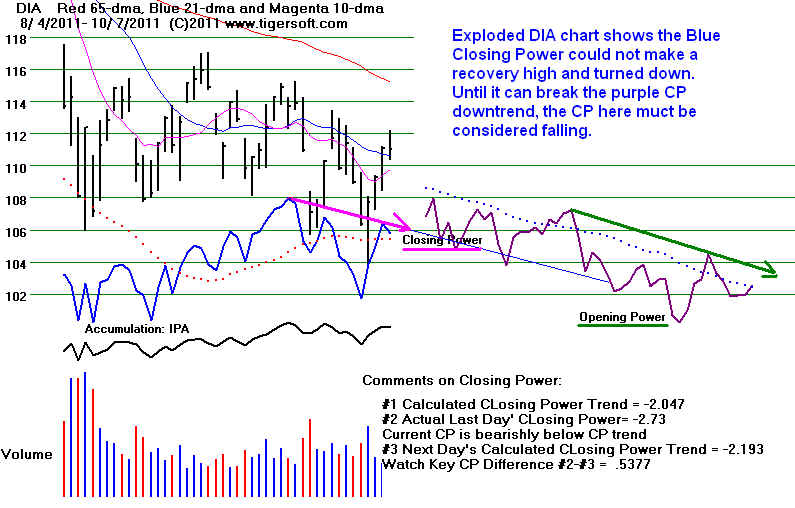

DIA BROKE

BELOW its CP UPtrendline -

It will take a close of more than 1.752 ABOVE the Opening

to restore the CP uptrend. The Opening Power is still rising.

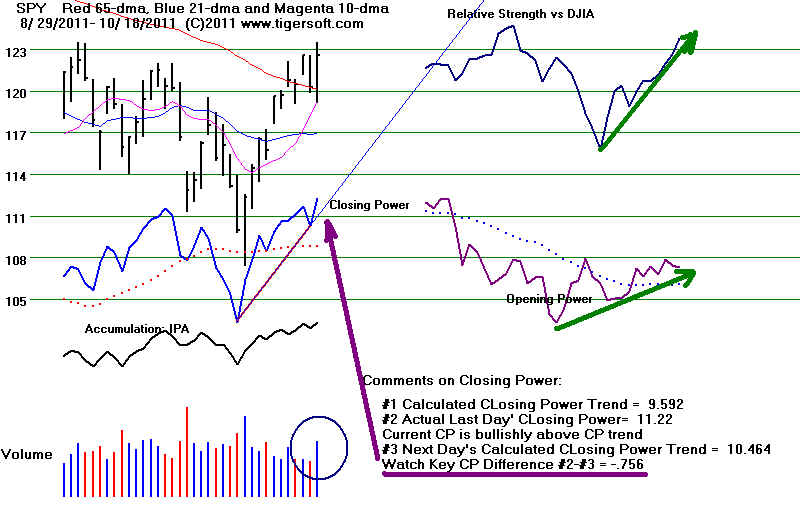

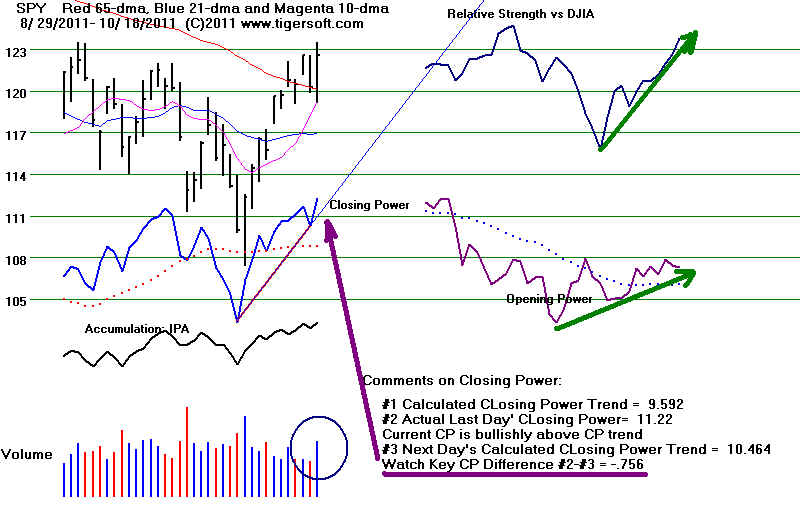

SPY

BROKE BELOW its CP Uptrendline - It will take a close of more than 2.7754 ABOVE the Opening

to restore the CP uptrend. The Opening Power is still rising.

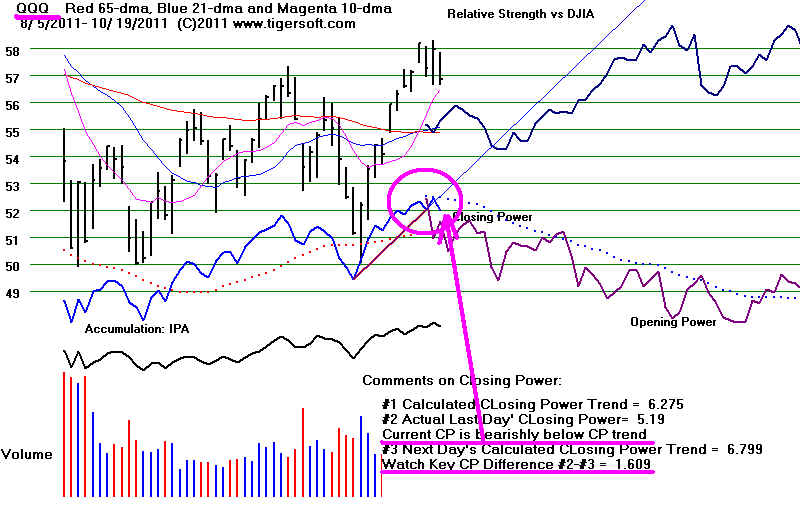

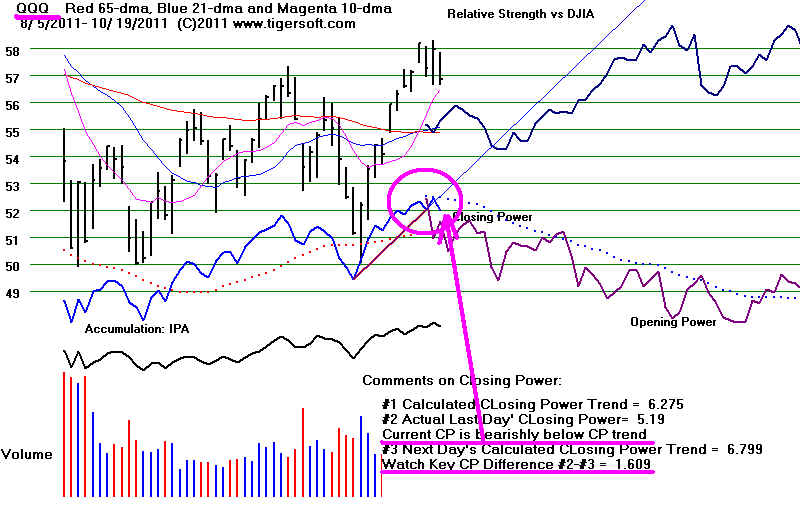

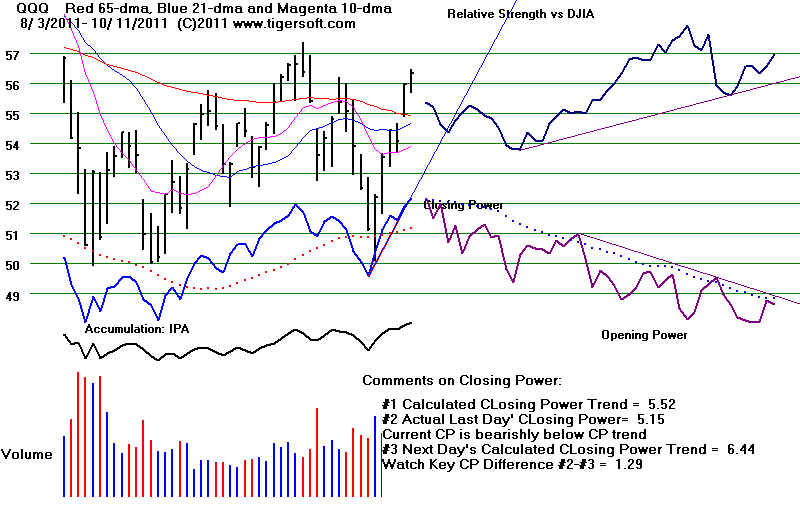

QQQ BROKE BELOW

its CP Uptrendline - - It will take a close of more than 1.0829 ABOVE the Opening

to restore the CP uptrend. The Opening Power is still rising.

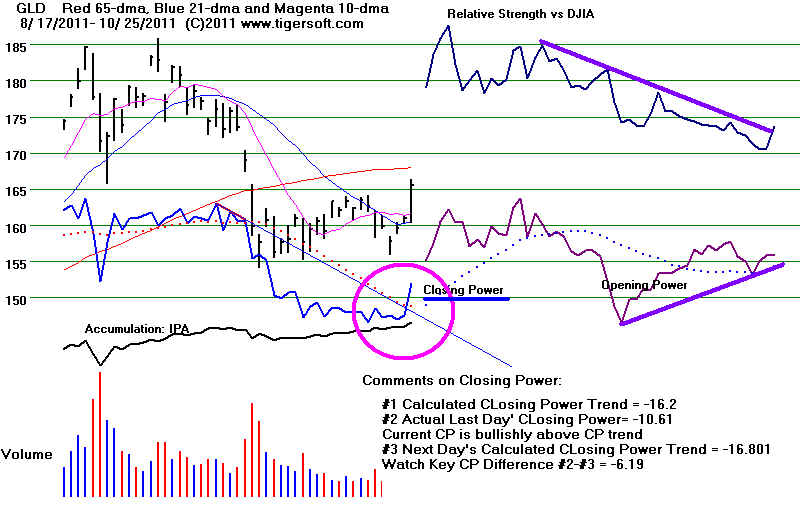

GLD BROKE

ABOVE its CP Uptrendline - It will take a close of more than 6.19 BELOW the Opening

to restore the CP downtrend. The Opening Power is still rising.

PEERLESS REMAINS ON BUYS

PEERLESS

BUYS SHOULD KEEP US MOSTLY LONG

The urge to take

profits after a 12% DJI rally in 15 trading days was too much for the

Professionals and

others who sold with the DJI tagging the 200-day ma yesterday. As

a result, the major

market ETFs' CLosing Power uptrends were all broken and Gold turned

up sharply. A short-term retreat is now most likely. But, because Peerless has

not given a Sell

signal, the decline

should be shallow, though even a retreat now back to

the 21-day ma would

be by 3.4%. So

some profit-taking is justified in ETFs and stocks whose Closing Power

has been penetrated.

But, I would respect the very unusual size of the advance and still look

for higher prices into

early November. Gold has just started to rise again. The market

tends to top out only

after it has advanced a few weeks, I have observed.

SEASONALITY STATS:

Top in early November?

Then after Thanksgiving, a Rally to New Highs in December...

Money typically comes

into the market during the last few days of the month and the

first week of the new

month. That might help prop the market up despite the grabbing of

quick profits by the

nimblest here. Since 1965, the DJI has risen 67% of the time over

the next week and the

next two weeks after October 25th. These statistics are much less

rosy if we look at all

the years before a Presidential Election since 1931. In

these years, there

were 9 UPs and 11

DOWNs. Since 1967, late Octobers rose 7 times and fell only 4. But

Novembers fell 6 times

and only rose 5.

The

most imortant thing to appreciate from the data below is that in the years before a

Presidential

Election, the stock

market is nearly always higher at the end of December than it is on October 25th

(or the end of

October). A +3% to +4% would be an average gain in this period. The market

was higher in 16 of 20

cases. The only recent exceptions were 1987 and 2007. Late Octobers and

Novembers are a

problem. They are both more likely to see a decline than a gain. Strong

Decembers

do more than make up

for weakness in the late-October to Thanksgiving period.

DJI Performance in Years before Presidential Election Year

Red shows DJI lower than previous level.

Blue show DJI higher than previous level.

DJI

DJI

DJI

DJI last 2 mo

Up/Down from 10/25-Dec 31

Year Oct.25 Oct.31

Nov.30

Dec.31 Up/Down

----------------------------------------------------------------------------------------------------------------------

1931 108.90 103.90 99.90 77.90

D DOWN 28.5%

1935 140.70 139.70 142.30 144.10 U

UP +2.4%

1939 155.50 151.50 145.70 149.90

D DOWN 3.6%

1943 138.20 138.30 129.60 136.20 U

DOWN 1.4%

1947 182.50 181.80

179.50 180.60

D DOWN 1.0%

1951 264.20 262.40

261.30 269.20

U UP +1.9%

1955 458.40 454.90 483.30

488.40 U

UP

+6.5%

1959 633.00 646.60

659.10 679.30

U UP +7.3%

1963 755.60 755.20 750.50 763.00 U

UP

+1.0%

1967 886.73 879.74

875.81 905.11 U UP +2.0%

1971 848.50 839.00

831.34 890.20 U UP +4.9%

1975 840.52 836.04

860.7 852.41

U UP +1.4%

1979 805.46 815.70 822.35 838.91

U UP +4.2%

1983 1252.44 1225.20 1276.02 1258.64 U

UP +0.5%

1987 1950.76 1993.53 1883.55 1938.83 D

Down 0.6%

1991 3004.92 3069.10 2894.68 3163.91 U

UP +5.3%

1995 4753.68 4755.48 5074.49 5117.12 U

UP

+7.6%

1999 10349.92 10729.85

10877.81 11497.12 U UP +3.7%

2003 9582.46 9801.12 9782.46 10453.92

U UP +9.1%

2007 13672.92 13930.01 13371.72 13262.82 D

Down 3.0% Crash Followed.

2011

--------------------------------------------------

9/11

9/11

8/12

15/5 15/5 16/4 from Oct25-Dec31

=====================================================================================

OLDER HOTLINES

=====================================================================================

10/24/2011

DJI = 11914 +105 la/ma=1.055 21-dma

ROC=+1.21 P= +516 (+56) IP21=+.138 V= +115 OP= .243

BREADTH

STATISTICS:

252(+116)

MAXCP stocks Bullish

MAXCP Stocks

37 (-6)

MINCP stocks Bearish

MINCP Stocks Mostly

leveraged Bearish m.m. ETFs

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

42 (+18) new highs on NASDAQ. 11 (+1) new lows on NASDAQ

38 (+15) new

highs NYSE 11

(+9) new lows on NYSE

10/24/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

10/24/2001 ===> DAILY Trading 3 Sample Stocks using Closing

Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) This will updated each night for a

while to show new users how one might trade some volatile precious

metals' stocks simply using Closing Power.

Near Term:

updated last: 10/24/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

The 3 major market ETF Closing Powers

are in an uptrend. The ETFs' Opening Powers are also still rising.

This is the Bullish BOTH-UP condition.

DIA is

above CP UPtrendline -

It will take a close of more than 0.314 BELOW the Opening

to break the CP uptrend. The Opening Power is rising.

SPY is

above CP Uprendline - It will take a close of more than 0.1315 BELOW the Opening

to break the CP uptrend. The Opening Power is still rising.

QQQ is above CP

Uptrendline - - It will take a close of more than 0.2514 BELOW the Opening

to break the CP uptrend. The Opening Power is rising.

GLD Below CP

Downtrendline - It will take a close of more than 0.05 ABOVE the

Opening

to break the CP downtrend. The Opening Power is rising.

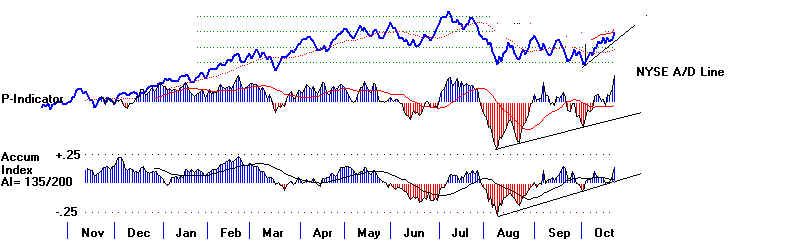

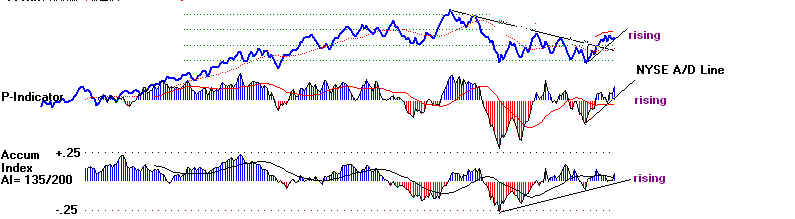

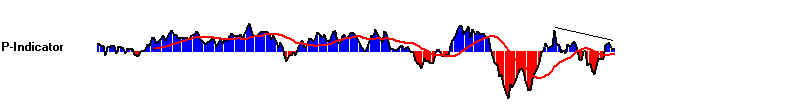

PEERLESS BUYS SHOULD KEEP US LONG

The Closing

Powers are all in rising uptrends. Internal strength indicators are rising. The

Peerless

P-Indicator has even made a yearly high. Many more stock groups show a plurality

of their stocks

above the 65-dma. I think the rally has taken a lot of people and professionals

by surprise.

Don't sell too quickly, even though the DJI has now rallied back to the slightly

falling 200-day

ma. (If it were angling downward more steeply, it would act as better resistance.)

It may bring some

selling, but more likely DJI-12000 will be reached. The SP-500, now at

1274.61, is

expected to face stiffest resistance at 1270, its 200-day ma. Today the NASDAQ

closed

slightly above

its 200-day ma.

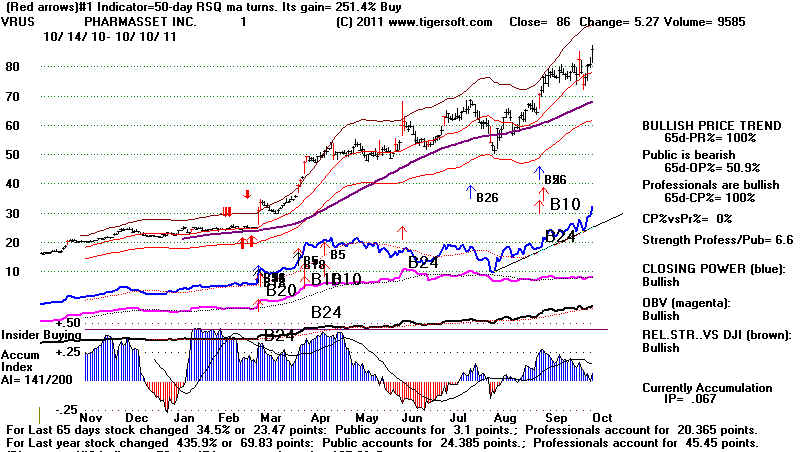

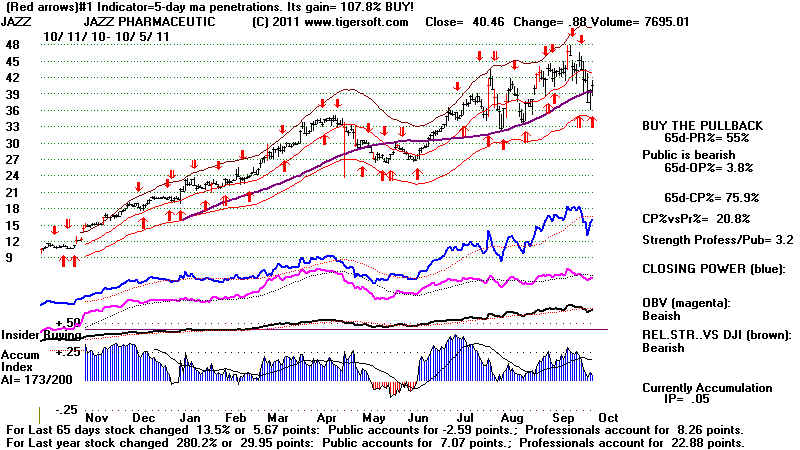

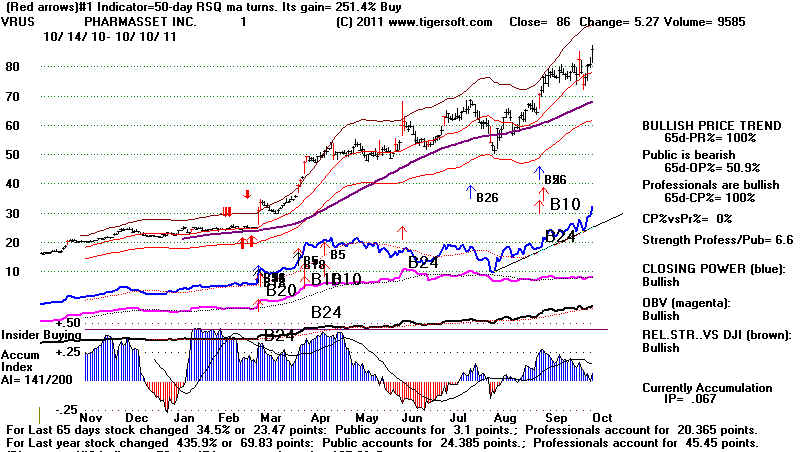

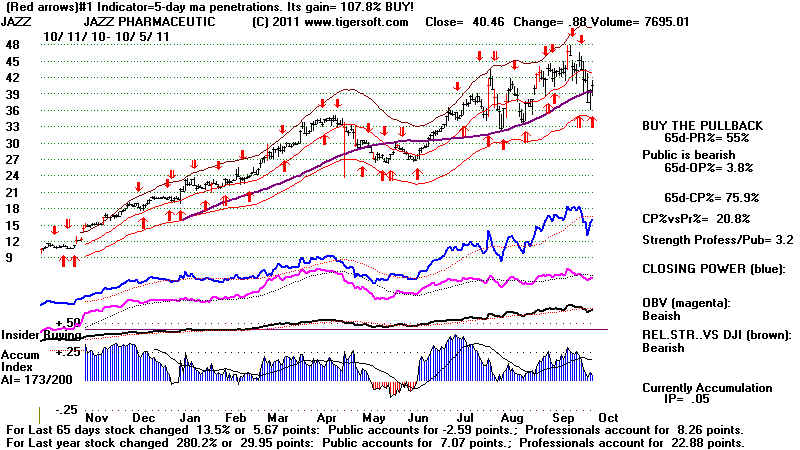

BULLISH SUPER STOCKS FOR 2011

See our 10/24/2011 new study:

2011's Super Stocks - 90%

Showed Insider Buying as Tiger measures it,

early on and before

their biggest moves.

If the CLosing Power uptrends are violated, take profits in major market

ETFs. With stocks

believe in the

Closing Power uptrends, too. And also the importance of

high Accumulation.

I suggest looking

at the new study of the best performing stocks of 2011 above $5 that I

have just

finished. More than 90% of them show an IP21 bulge above +.35

early in or even

before their

biggest advance. Note that I will proabably be revising the software to place

the insider

trading threshold at +.35. The ACCUMVER stocks on the Tiger Data page

now all have had

+.35 or higher Ip21 readings in the last 3 months. We should probably look

each night at all

the new highs in this group. These will all show Buy B24s.

SIMO 16.59 IP21=.02 UU IPA% is lagging AI/200=only 132

DPZ 32.54 IP21=.16 UU Running AI/200=only 125

EP 25.35 IP21=.353 Take-over under

way.

TAYD 9.00 IP21=.121 NH and running. AI/200=only 103

OPNT 44.97 +2.29 IP21=.161 NH breakout - BUY even though AI/200 only

127

PSMT 75.81 +2.04 IP21=.04 (low) AI/200=113 (low)

In additon,

consider the best performing stocks of the year, which is now

downloadable as

SUPER11 from

the Tiger Data page. Below are the highest Power Ranked stocks in SUPER11.

ELAN is the only

one that meets the various IP21 and Closing Power criteria we like most. As happens

often, the first

stage of a very good intermediate-term rally (like ours now) see lots of short-covering.

Price breakouts

in these top performers often bring excellent rallies, as do Closing Power

downtrend-breakouts. I could not find much to buy among these stocks

presently. But one

of the lessons of

this and other Super Stocks' studies is too give them plenty of chance

to prove

themselves when they show tell-tale spikes of high accumulation "Insider

Buying"

HCCI 16.63 - below 65-dma

COG 70.62 - just above 65-dma but IP21= only +.101 Optimized red Sell.

QCOR 34.29 NH but IP21 only +.026

MITK 11.23 IP21<0 and on red Stochastic Sell.

GLNG 39.2 At previous high...IP21=.112 (modest)

DK 15.0 CP short-term flat and IP21=.116 (modest)

PCYC 13.36 NH but IP21= .027 (barely positive)

DPZ (Dominos Pizza) NH IP21=+.156 AI/200=125 (usually 147 or higher is favored)

CVI 25.58 backing off from recebt highs. red Sell CP declining short-term.

ELAN 11.18 IP21=.186 Look for CP breakout above 3 month downtrend to buy

WTW 71.63 IP21= only +.115 but there is a Buy B7 (CP bullish divergence)

CBST 39.6 IP21=+.233 CP lagged recently.

===================================================================================

OLDER HOTLINES

===================================================================================

10/21/2011

DJI = 11809

la/ma=1.051 21-dma ROC=+1.24 P= +459 (+221) IP21=+.145 V=

+101 OP= .265

10/21/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

NEW 10/21/2001 ===>

DAILY Trading 3 Sample Stocks using

Closing Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) This will updated each night for a

while to show new users how one might trade some volatile precious

metals' stocks simply using Closing Power.

Near Term:

updated last: 10/21/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

The 3 major market ETF Closing Powers

are in an uptrend. The ETFs' Opening Powers are also still rising.

DIA is

above CP UPtrendline -

It will take a close of more than 0.179 BELOW the Opening

to break the CP uptrend. The Opening Power is rising.

SPY is

above CP Uprendline - It will take a close of more than 0.678 BELOW the Opening

to break the CP uptrend. The Opening Power is still rising.

QQQ is above CP

Uptrendline - - It will take a close of more than 0.6877 ABOVE the

Opening

to restore the CP uptrend. The Opening Power is rising.

GLD Below CP

Downtrendline - It will take a close of more than 0.14 ABOVE the Opening

to break the CP downtrend. The Opening Power is rising

but broke its uptrend..

UPSIDE

BREAKOUT:

PEERLESS BUYS STILL SAY "THERE WILL BE MORE STRENGTH"

In the 13 trading days since the October 4th bottom, the SPY has boomed 10%

and DIA, IWM and QQQ have each jumped 9%. Short-term, I

would look for SPY

to face keen resistance at 126.50, 2.5 higher. This was the

low of June 16th that

was violated in July. Broken support is likely to become

resistance on the next rise

to that level.

But without a Peerless Sell signal, I cannot

advise much selling except to take

some trading profits in SPY if the SPY Closing Power breaks its

uptrend after reaching

that level. Why?

Because 1) all our key techinical indicators

are rising. See the charts here.

2) Peerless should be

trusted because of all the back-testing to 1928 I have done;

3) All the anxieties over the EURO, while important and a threat

to many big banks, still

works to strengthen the Dollar and, thereby, allows the Fed much

more easily to keep

interest rates low without worry about inflation. This is

part of the reason that the Dollar

has fallen against a collection of other currencies only about 4%

since 2009, despite the

FED's injection of hundreds of billions of freshly printed

Dollars.

4) Seasonality is bullish after the next 3 trading days. As

I showed Thursday night,

we are much more apt to see a November peak after a 3%+ rise in

the first 3 weeks.

A slight rereat is suggested early next week, in that

historically, since 1965, the DJI rallies only

44.4% of the time over the next 3 trading days. The DJI is,

however, up 57.8% over the

next week. Even better, the historical odds are 64.4% that

it will be above where it is

now a month from now.

5) There is a fifth factor. Last quarters of the year

before a Presidential Election are

usually up. The Administration, Republican and especially

Democrat, typically goes all out

trying to boost the economy. Our case is not so

exceptional, Republicans aside.

I have argued that the current political triumverate

(Wall Street banks, the Obama

Administration

and the Fed under Bernanke) have apparently each agreed to prop up the

market in the period before the 2012 Presidential Election, and

each will do whatever

it can to that end, for its own reasons..

"Marriage of Convenience"

The Fed will keep interest rates low and buy trillions of

US government debt with their newly

printed money. Equally important, Professional

short-selling will be limited and leveraged

major market vehicles (futures and ETFs) will be run upwards

repeatedly, so long as there is

be no real challenge by the Obama Administration of

Wall Street's power and privileges,

namely,

no move to break up of the big banks,

no re-instututing Glass Steagal,

no imposing restrictions on executive pay and power,

no reducing leverage used by banks,

no restricting computerized trading,

no imposing short-term trading taxes and

no curtailing of derivatives and leveraged trading.

It is further underderstood by Wall Street that the Obama

Administration will restrain

its investigations into the conduct of the big banks and their

executives in causing

the Crash of 2007-2009. In particular, no criminal charges will

be brought

against any of the big banks' CEOs for fraud or misrepresentation in the

mortgages

they bundled and sold. Rhetoric asside, Obama has stuck to this

agreement.

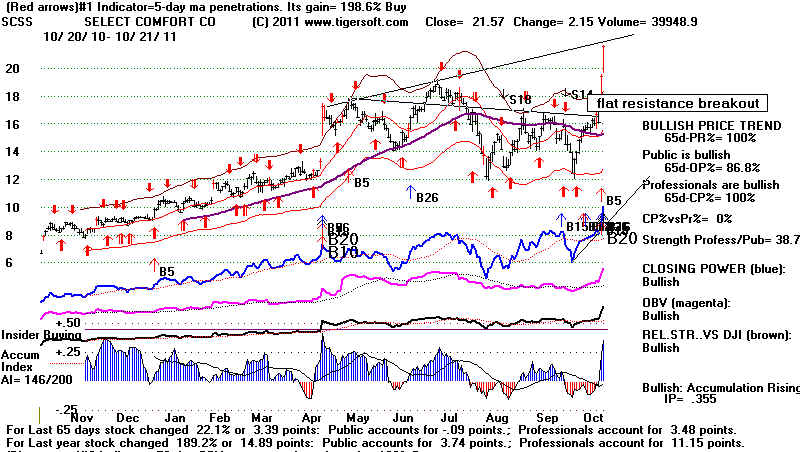

STOCKS TO PLAY NOW

Bulges of Accumulation (IP21) above .35 are commonly associated with 2011's

best gainers. I will show this tomorrow night. I will revise

ACCUMVER on the

Tiger Data page to provide data on stocks with this new parameter.

The rally since early October has allowed about 25 stocks over $20 to

advance more than 30%.

Consider buying those which are now above their 65-day ma and have

rising CLosing Powers

and have a current IP21 (Accumulation Index) over +.22.

Look also at the technical characteristics of these stocks as they

reversed and rose.

Many of these technical characteristics were common among a number of

these fine

performing new leaders. This is a study we will frequently refer

to in the future.

See http://tigersoftware.com/TigerBlogs/10-23-20111/index.html

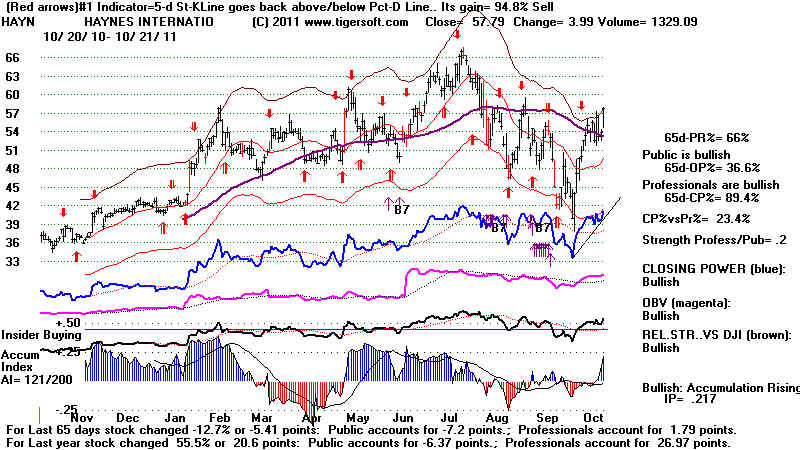

Biggest Gainers since Oct 4th

with IP21 over +.22

Stock price pct gain IP21

-------------------------------------------

SCSS 21.57 44%

.36 chasing is

risky here. check news...

BXUB 72.00 25%

.33

HAYN 57.79 37%

.22

|

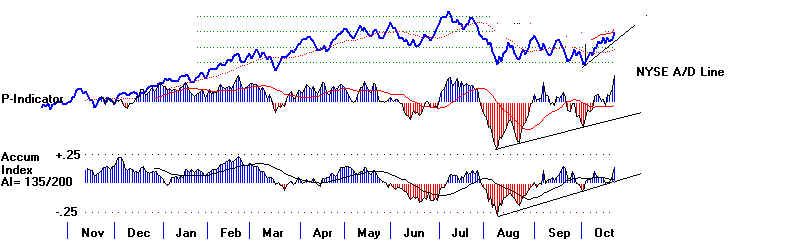

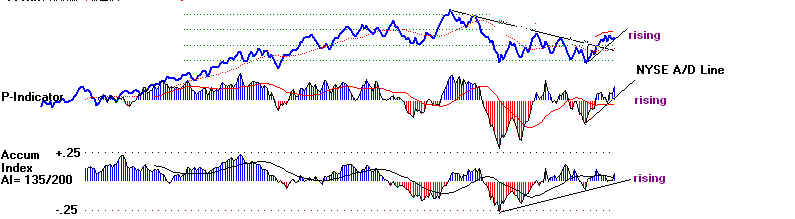

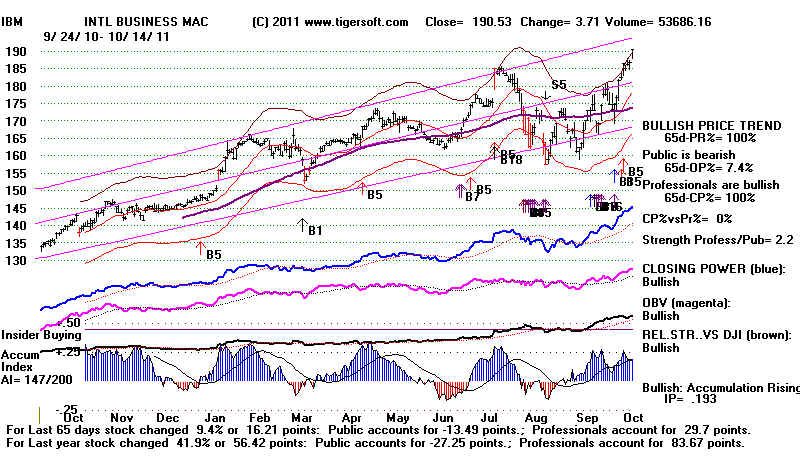

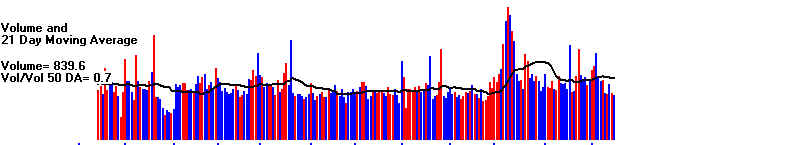

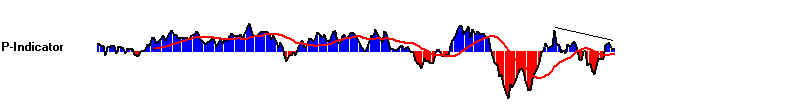

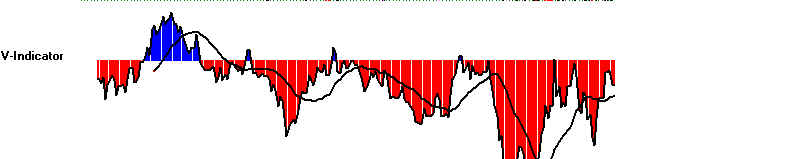

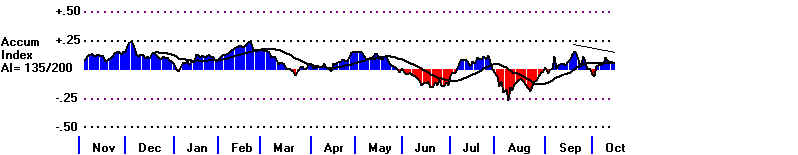

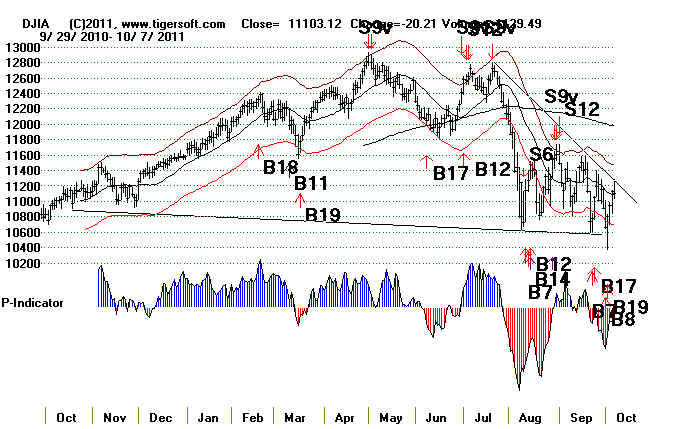

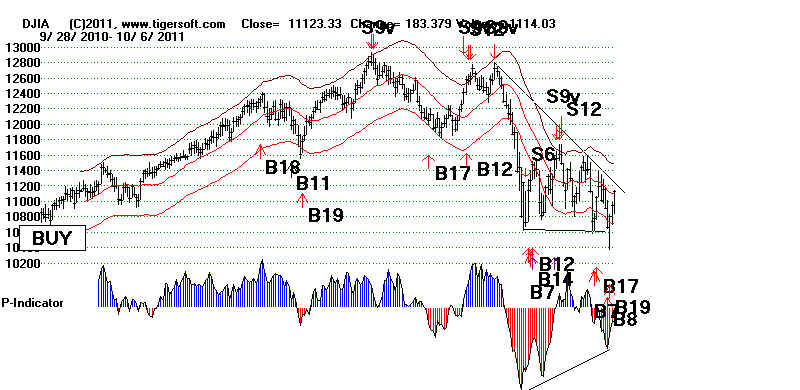

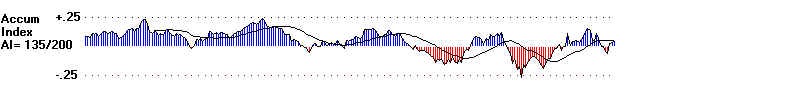

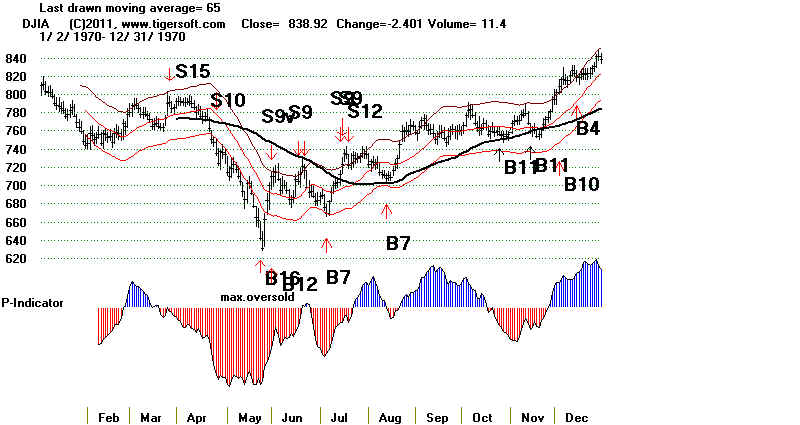

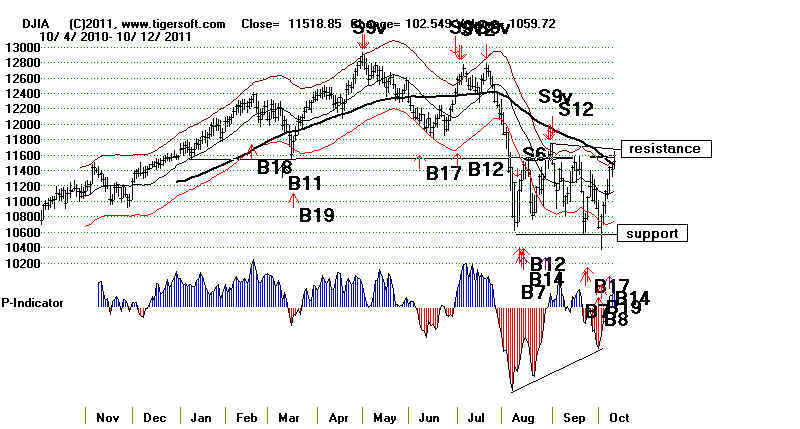

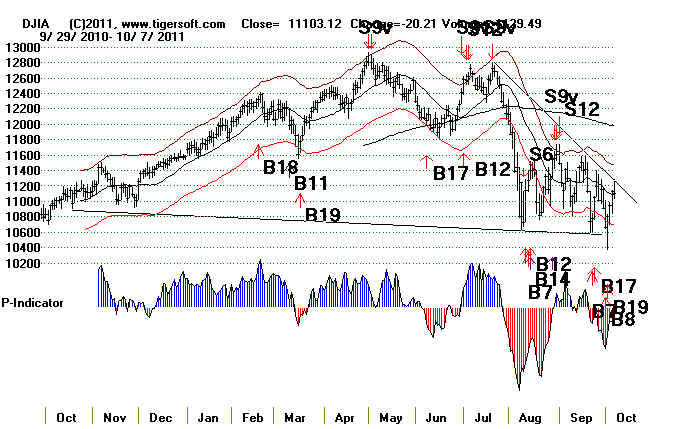

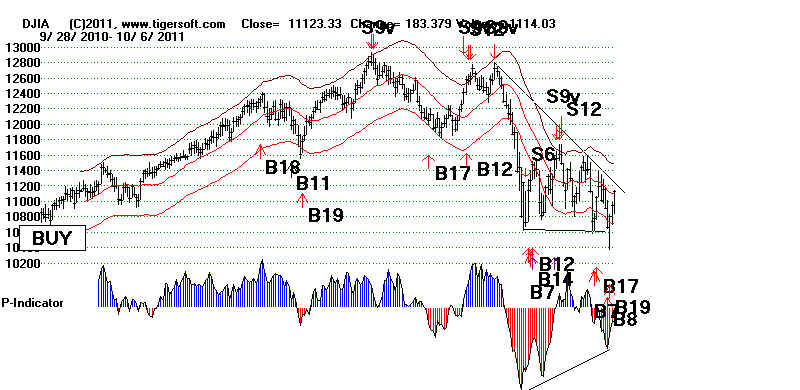

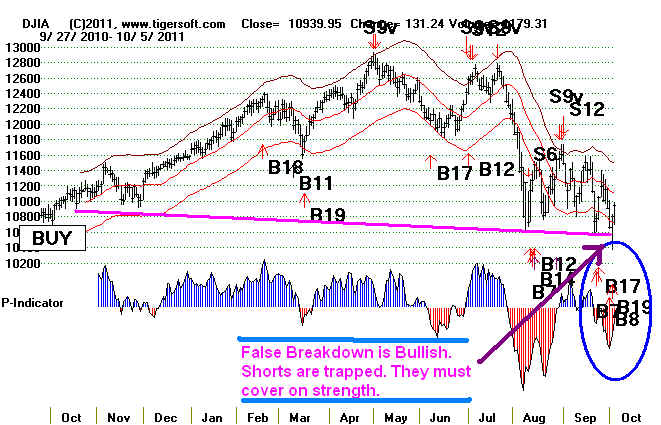

DJIA - Rising Internal

Strength Indicators/Major Buys

|

|

=================================================================================

OLDER HOTLINES

=================================================================================

10/20/2011

DJI = 11542 la/ma=1.032 21-dma ROC=+.444 P=

+238 (+130) IP21=+.073 V= -7 OP= .136

BREADTH

STATISTICS:

74(-5)

MAXCP stocks Bullish MAXCP

Stocks

35 (-1)

MINCP stocks Bearish

MINCP Stocks

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

19 new highs on NASDAQ. 25 new lows on NASDAQ

12 new

highs NYSE 17

new lows on NYSE

10/20/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

NEW 10/20/2001 ===>

DAILY Trading 3 Sample Stocks using

Closing Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) This will updated each night for a

while to show new users how one might trade some volatile precious

metals' stocks simply using Closing Power.

Near Term:

updated last: 10/20/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

Only the DIA's ETF Closing Powers is

still in an uptrend. The ETFs' Opening Powers are also still rising.

Backing and filling seems to be required now.

DIA is

very slightly beloiw CP UPtrendline -

It will take a close of more than 0.594 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

violate its

new CP uptrend-line to consider the DIA short-term bearish. The Opening Power is

rising.

SPY is

BELOW CP Uprendline - It will take a close of more than 1.88 ABOVE the Opening

to restore the CP uptrend. This is SPY short-term bearish. The Opening

Power is still rising.

QQQ is below CP

Uptrendline - - It will take a close of more than 2.402 ABOVE the

Opening

to restore the CP uptrend. Consider the QQQ short-term bearish. The Opening

Power is rising.

GLD Broke CP

Uptrendline - It will take a close of more than 0.14 ABOVE the Opening

to restore the CP uptrend. Consider the QQQ short-term bearish. The Opening

Power is rising

but broke its uptrend..

PEERLESS BUYS SAY THERE WILL BE MORE STRENGTH

The intenrals (P-I, A/D

Line and Accum. Index) are each improving. This is constructive. So is

the DJI current strength versus the

usual weakness at this time of year. Below are the cases when

Octobers advance by 3% by October

20th, as happened this month. I count 14 cases since 1950.

Always did the DJI reach a November

peak at least 1% higher. A peak 2% higher or more

in November occurred in 10 cases.

Only in 4 instances did the DJI peak 4% or more higher in November.

Bear market declines followed in 4

cases, after rallies of less than 3%: 1968, 1969, 1974 and 2002.

Strong Early Octobers: 1950-2011

9/30 10/20

Peak Nov

2011

10913.30 11541.78

2010

10788.05 11107.97

11444.08 (11/5) up 3% bull mkt followed

2009

9712.28 10041.48

10471.58 (12/1) up 5% bull mkt followed

2005

11679.07 12002.37

12342.56 (11/17) up 3.% bull mkt followed

2003

9275.06 9777.94

9858.46 (11/3) up 1% up more in Dec.

2002

7591.93 8538.24 (10/21)

8896.09 (11/29) up 4% bear mkt decline

followed.

2001

8847.56 9377.03 (10/22)

9959.64

up 7% up more in Dec.

1998

7842.62 8505.85

9374.27

up 10% up more in Dec.

1982

896.25 1034.12

1050.22

up 1% consolidation followed.

1975

793.88 842.25

860.67

up 2% consolidation followed.

1974

607.87 669.82 (10/21)

674.75

up 1% and

then down.

1969

813.09 839.27

860.48

up

2.5% and then down

1968

935.79 967.49

983.34

up 2% and then down.

1953

264.00 273.90

281.40 up

3% bull mkt followed

--------------------------------------------------------------------------------------------------------------------------------------------------

1948

178.30 186.5

189.80

up 1.5% and

then down.

1947

177.50 185.39

DOWN to 176.10 (12/5)

1942

109.10 115.20

117.30

up 2% bull mkt followed

=====================================================================================

OLDER HOTLINES

=====================================================================================

10/19/2011

DJI = 11505 -72 la/ma=1.03 21-dma ROC=+.102 P=

+107 (-27) IP21=+.014 V= -71 OP= .044

BREADTH

STATISTICS:

79 (-61)

MAXCP stocks Bullish MAXCP

Stocks

36 (-3)

MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

12 new highs on NASDAQ. 17 new lows on NASDAQ

8 new

highs NYSE 7

new lows on NYSE

10/19/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

NEW 10/19/2001 ===>

DAILY Trading 3 Sample Stocks using

Closing Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) This will updated each night for a

while to show new users how one might trade some volatile precious

metals' stocks simply using Closing Power.

Near Term:

updated last: 10/19/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

Only the DIA's ETF Closing Powers is

still in an uptrend. The ETFs' Opening Powers are also still rising.

Backing and filling seems to be required now.

DIA is

above less steep CP UPtrendline -

It will take a close of more than 0.288 BELOW the Opening

to violate the CP uptrend. In cases like this, we should probably wait for the CP to

violate its

new CP uptrend-line to consider the DIA short-term bearish. The Opening Power is

rising.

SPY is

BROKE BELOW CP Uprendline - It will take a close of more than 1.32 ABOVE the Opening

to restore the CP uptrend. This is SPY short-term bearish. The Opening

Power is still rising.

QQQ broke its blue

CP Uptrendline - - It will take a close of more than 1.61 ABOVE the

Opening

to restore the CP uptrend. Consider the QQQ short-term bearish. The Opening

Power is rising.

GLD Broke CP

Uptrendline - A close of .14 ABOVE the Opening is needed

tomorrow to break

the CP DOWNtrend. GLD Openings are above its 21-dma.

A bearish CP divergence is

present with

GLD.

PEERLESS BUYS SAY THERE WILL BE MORE STRENGTH

We have no new sell signals

yet to reverse the Buys. We have come close,

but each time the

DJI has recenly closed more than 2.7% above the 21-day ma,

the P-Indicator

and Accumulation Index are positive. So no S9 or S12 has occurred.

It might seem

that this could soon change, and we could get a sell signal tomorrow

or the next day.

In fact, this is unlikely, even though the P-Indicator is only +107 and

Accumulation

Index only +.014.

Remember that we

use a 21-day ma in creating the P-Indicator and the Accumulation Index.

This means that

tomorrow's construction of the P-Indicator and AI will have to replace the data we now

show with new

data that will not include the data for 9/21/2011 which was quite bearish. As a

consequence, it

will be hard for the P-Indictor or Accumulation Index to fall tomorrow.

We routinely use

the 21-day ma because of the reliable role of the monthly cycle in price

stock price

movements. We do not want to over-weight a bearish part of the month by

counting it

twice. The next 5 days is typically bearish. It rises only 35.6% of the time,

falling -0.8% on

everage since 1965. But then it typically reverses and two weeks from

now it is up 67%

of the time.

The break in the QQQ

and SPY CLosing Power uptrends also argues for some hestitation

here but then a

resumtption of the uptrend. A pullback now would make a later penetration

of the DJI's 11600 more

significant and powerful in a week, or so.

Being slightly

bearishly hedged with a few of the bearish MINCP stocks seems appropiraite and

reasonable.

====================================================================================

OLDER HOTLINES

====================================================================================

10/18/2011

DJI = 11577 +180 la/ma=1.037 21-dma ROC=+.185 P = +134

(+176) IP21=+.014 V= -54 OP= -.123

BREADTH

STATISTICS:

140

MAXCP stocks Bullish MAXCP

Stocks

39

MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

13 new highs on NASDAQ. 17 new lows on NASDAQ

19 new

highs NYSE 5

new lows on NYSE

10/18/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

NEW 10/18/2001 ===>

DAILY Trading 3 Sample Stocks using

Closing Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) This will updated each night for a

while to show new users how one might trade some volatile precious

metals' stocks simply using Closing Power.

Near Term:

updated last: 10/18/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

All 3 general market ETFs' Closing

Powers established new uptrends today. These CPs

are still above the support of their 21-dma. Opening Powers are also still

rising.

DIA is

above less steep CP UPtrendline -

It will take a close of more than 0.84 BELOW the Opening

to violate the CP uptrend. In cases like this, we should probably wait for the CP to

violate its

new CP uptrend-line to consider the DIA short-term bearish. The Opening Power is

rising.

SPY is

above less steep Uprendline - It will take a close of more than 0.756 BELOW the Opening

to violate the CP uptrend. In cases like this, we should probably wait for the CP to

violate its

new CP uptrend-line to consider the DIA short-term bearish. The Opening Power is

rising.

QQQ broke its steep CP Uptrendline - - It

will take a close of more than 0.246 BELOW the Opening

to violate the less steep CP uptrend. In cases like this, we should probably wait

for the CP to violate its

new CP uptrend-line to consider the DIA short-term bearish. The Opening Power is

rising.

GLD Broke CP

DOWNtrendline - A close of 2.716 BELOW the Opening is needed tomorrow

to restiore

the CP DOWNtrend. GLD CP is still

below its CP 21-dma but Openings are

above its 21-dma.

A bearish CP divergence is present

with GLD.

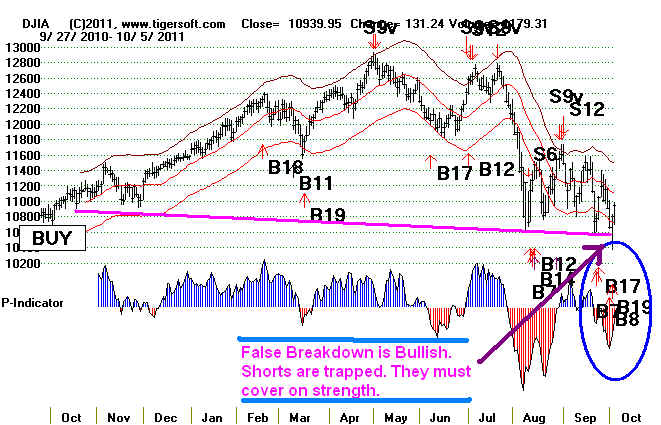

10/18/2011

Multiple Peerless Buys Still Operate. Looks Like a False

Breakdown

below Falling 65-Day MA. Many of these produce

excellent additional

rallies.

Cases of quick moves back above the broken 65-dma in October

and November since 1929 have all brought moves of more than 5%

higher. There were 7 cases. This condition would seem to qualify as a

legitimate Peerless signal, if a math based program confirms

the visual inspection that the testing shows that I have just

done.

Let's

see how this case turns out. The DJI is already at the upper

band and does not show a very positive Accumulation index.

The number of sectors with a plurality of their

stocks above a 65-dma

is expanding rapidly. This is bullish. But, we still have

to watch the Closing

Power uptrends and consider a penetration of them a short-term

sell.

The DJI is 3.7% over the 21-day ma with the current Accumulation

Index (IP21) standing at only .014. There is plenty of

selling being

done as the DJI nears 11600. Volume is still below its falling

21-dma. Usually it takes more volume to eat up overhead

supply.

RALLIES after DJI Closings Back below A Falling 65-DMA:

1929-1953

> 5 cases of a rally of

more than 5% 4 cases of allies to

peaks less than 5% higher.

+ 10/1/1934 90.40 False move. DJI immediately turned up and moved to 119.50 on

6/21/1935

la/ma annroc

P-I ch IP21 V-I Opct

.998 -.315 -46

-2 -.036 -80 -.112

+ 6/29/1939 130.10 False move. DJI immediately rose. to 144.20 pn 7/24/1939

la/ma annroc

P-I ch IP21 V-I Opct

.952 -.704

-84 -38 -.038 -96 -.071

3/15/1940 146.50

False move. DJI rose in two weeks back to 151.30 above 65 dma on 4/8/1940.

la/ma annroc P-I ch

IP21 V-I Opct

.993 -.145 -10

-20 -.117 -52 -.014

12/28/1943 135.00

False move. DJI rose in a week to 138.30

la/ma annroc P-I

ch IP21 V-I

Opct

1.006 .453

84

0 +.075 43 .228

2/7/1944 134.20 False move.

DJI rose in a week to 140.90 on 3/16/1944

la/ma annroc

P-I ch IP21

V-I Opct

.977 -.338

-33 -8 -.063

-73 -.293

+

4/18/1944 135.10 False

move. DJI rose steeply moving to

159 in June.

la/ma annroc P-I

ch IP21

V-I Opct

.976 -.489

-102 -34 -.223

-176 -.228

+ 10/26/1944 145.00 False move. DJI rose steeply moving to 168.20 on 5/28/1945.

la/ma annroc P-I

ch IP21 V-I

Opct

.988 -.056

13 -20 +.13 -28

-.114

12/26/1951 264.10 False move. DJI rose to 275.40

on 1/22/1952.

la/ma annroc P-I

ch IP21

V-I Opct

.998 .302

37 -29 +.017 -30

-.158

+

5/29/1952 262.90 False move. DJI rose to 279.80 on

8/8/1952.

la/ma

annroc P-I

ch IP21

V-I Opct

1.005 .241

67 +19 +.086

90 -.201

Octobers and Novembers only: 1929-2011

> 7 cases

of a rally of more than 5% 0

cases of allies to peaks less than 5% higher.

+ 10/1/1934 90.40 False move. DJI immediately turned up and moved to 119.50 on

6/21/35

la/ma annroc

P-I ch IP21

V-I Opct

.998 -.315

-46 -2 -.036 -80 -.112

+ 10/26/1944 145.00 False

move. DJI rose big to 168.20 on

5/28/1945.

la/ma annroc P-I

ch IP21 V-I

Opct

.988 -.056

13 -20 +.13 -28 -.114

+ 11/16/1959 634.50 False Move

DJI rose big to 685.50 on 1/5/1959.

la/ma annroc P-I

ch IP21

V-I Opct

.999 -.418

-152 +36 -.035

-498 -.233

+ 11/7/1980 932.42 False Move DJI

rose to 989.30 on 11/21/1980

la/ma annroc

P-I ch IP21

V-I Opct

.986 -.397 -182 -28 -.289

-5 -.11

+ 10/7/1985 1324.37 False Move DJI rose big to1544.50 on 12/17/1985.

la/ma annroc P-I

ch IP21 V-I

Opct

1.003 -.021 -156 --4 -.038

- 9 -.098

+ 11/24/1997 7768 False Move

DJI rose to 8149.13 on 12/5/1998

la/ma annroc P-I

ch IP21

V-I Opct

1.023 .082 -65 --60 +.021 - 16

.287

+ 11/2/1999 10581 False Move DJI rose big to 11582 on 1/13/2000

la/ma annroc

P-I ch IP21

V-I Opct

1.023 .082 -65 --60 +.021 - 16

.287

====================================================================================

OLDER HOTLINES

====================================================================================

10/17/2011

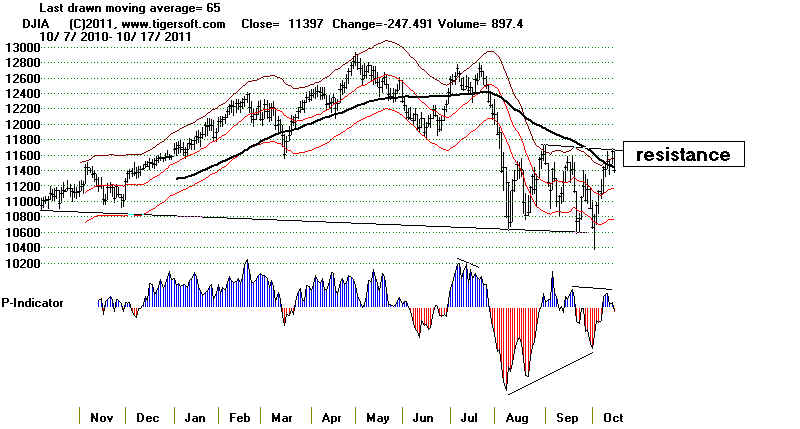

DJI = 11397 -247 la/ma=1.022 21-dma ROC=-.12 P = -43 (-93) IP21=-.001 V= -123

OP= +.04

BREADTH

STATISTICS:

39

MAXCP stocks Bullish MAXCP

Stocks

27

MINCP stocks Bearish

MINCP Stocks

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

20 new highs on NASDAQ. 7 new lows on NASDAQ

15 new

highs NYSE 6

new lows on NYSE

10/17/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

NEW 10/17/2001 ===>

DAILY Trading 3 Sample Stocks using

Closing Power trend-changes:

SSRI (Silver), PAAS (Silver), NEM

(Gold) This will updated each night for a

while to show new users how one might trade some volatile precious

metals' stocks simply using Closing Power.

Near Term: updated last: 10/17/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

All 3 general market ETFs' Closing

Powers broke their steep uptrends today. These CPs

are still above the support of their 21-dma. Opening Powers are also still

rising. A CP retreat

to test the rising 21-dma seems likely.

DIA broke

its steep CP UPtrendline -

It would take a close of more than 4.205 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

test its

21-dma and consider the DIA short-term bearish.

SPY broke

itst steep Uprendline - It would take a close of more than 4.714 ABOVE

the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

test its

21-dma and consider the DIA short-term bearish.

QQQ broke its steep CP Uptrendline - - It

would take a close of more than 1.913 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

test its

21-dma and consider the DIA short-term bearish.

GLD BELOW CP

DOWNtrendline - A close of -.125 ABOVE the Opening is needed tomorrow to

break

the CP DOWNtrend. GLD CP is still

below its CP 21-dma but Openings are

above its 21-dma.

A bearish CP divergence is present

with GLD.

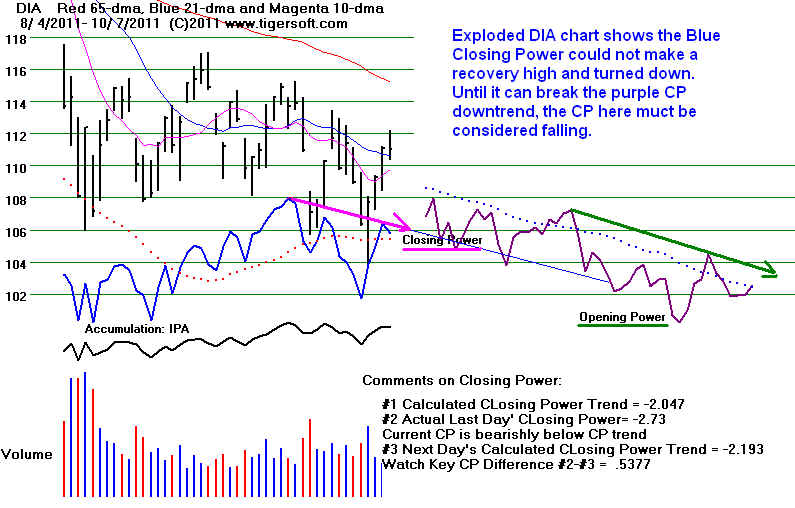

New TigerSoft Exploded Charts shows

exactly how much of a move from the Opening

to the Close is needed to break the Closing Power trendline. Note that a visual break will require,

at least .25 more of a penetration of the calculated uptrend. We have been using

visual

CP trend-breaks. http://tigersoft.com/CP-Trendbreaks/index.html

-----------------------------------------------------------------------------------------------------------------

10/17/2011

Multiple Peerless Buys Still Operate. But A More Decisive

Close

by The DJI back below its Falling 65-Day MA Will Be Bearish and

Call for a Decline back to The Support of 10800. A New Study suggests

the odds of a retreat to the lower band are 2:1

if tomorrow brings a more decisive

close by the DJI below the 65-day ma.

Sell Short a Few of The Bearish MINCP Stocks.

Yesterday's overbought condition (CL/MA = 1.043)

showed multiple non-confirmations.

An automatic 50-day Stochastic Sell has

appeared on the DIA tonight. The steep

Closing Power uptrends have clearly been

violated. A pullback by DIA by 2 more points

to its rising 21-day ma lis next. Most

likely, the DJI will not hold there and the dynamics of the

broad trading range, 10800-11600, will play

out, namely, that with resistance having

been found, now support must be sought by a

test of support. The middle of such

a trading range is usually not very good

support. In addition, the AnnROC and IP21

are both below .07. This warns that the

21-day ma will probably not hold.

After the close, IBM's quarterly earnings

and revenues were announced. Revenues

did not meet expectations, we are

told. This should induce more selling by the public.

But I believe that computer stocks are in

strong hands and the dip over the next few

days will give a good re-buying

opportunity. See the discussion a night ago here.

A deeper general market decline cannot be

predicted now because Peerless remains

on multiple Buys. However, a

weak close tomorrow would cause the DJI to decisively break

back below its falling 65-day ma. This is

bearish. See the study further below. So is

the way the Russell-2000 (IWM) reached

and now has fallen back from its 65-day ma.

DJI Closings Back below A Falling 65-DMA:

1929-1953

In 9 of these 30 cases the break below the declining 65-dma was

false and a

rally of 5% or more ensued within a week.

In 21 instances, it would have paid

to have sold short. False moves were often bear traps, in which the DJI

quickly

turned around and sped up substantially. It is not clear that the standard Peerless

key values would have helped increase the

chances of correctly playing these

moves. More work might be done, but

21 successes and 9 failures is not good enough

to make this a Peerless Sell.

October-November breakdowns proved to be traps

in 6/15 of the 15 cases between 1929 and

2011.

DJI Closings Back below A

Falling 65-DMA: 1929-1953

21 declines 9 rallies

9/19/1930 229 Last chance to sell. Severe Bear

Market followed.

7/8/1931 143.8 Market slipped gradually for 8

weeks and then fell sharply.

7/24/1931 139 Market slipped gradually for 5 weeks and

then fell sharply.

3/24/1932 77.90 Steep decline followed immediately.

1/18/1933 60.40 DJI fell to 51.40 bottom on 2/28/1933

4/26/1934 103.60 DJI fell to 93.20 bottom on 5/11/1934

6/21/1934 97.50 DJI fell to 87.80 on 7/27/1934

8/29/1934 93.70 DJI fell to 86.70 on 9/17/1934

10/1/1934 90.40 False move. DJI immediately turned up

and moved far above 65-dma

.998 -.315 -46

-2 -.036 -80 -.112

1/26/1938 123.20

DJI declined to 118.50 on 2/3/1938 and

then rallied back above upper band.

5/16/1938 115.40

DJI declined to 107.90 on 5/27/1938 and

then rallied back above upper band.

3/17/1939 143.90 DJI

fell sharply to 124..00 on 4/101939

6/29/1939 130.10 False move. DJI immediately rose. to 144.20 pn

7/24/1939

.952 -.704 -84

-38 -.038 -96 -.071

1/9/1940 149.80

DJI declined to 144.70 on 1/15/1940 and

then rallied slightly back above ma

3/15/1940 146.50 False move. DJI rose in two weeks back to

151.30 above 65 dma on 4/8/1940.

.993 -.145 -10

-20 -.117 -52 -.014

5/10/1940 144.80 DJI

fell sharply to 118.80 on 6/101940

1/15/1941 131.50 DJI

fell sharply to 117.90 on 2/191941

12/28/1943 135.00 False move. DJI rose in a week to 138.30

1.006 .453

84 0

+.075 43 .228

2/7/1944 134.20 False move. DJI rose in a week to 140.90 on

3/16/1944

.977 -.338

-33 -8 -.063 -73 -.293

4/18/1944 135.10 False move. DJI rose steeply moving to 159 in

June.

.976 -.489

-102 -34 -.223

-176 -.228

10/26/1944 145.00 False move. DJI rose steeply moving to 168.20

on 5/28/1945.

.988 -.056

13 -20 +.13 -28 -.114

7/11/1946 206.30

DJI fell sharply to 163.10 on 10/91946

3/31/1947 177.200 DJI

fell to 163.60 on 5/191947

2/7/1949 174.40 DJI fell to 171.10 on 2/251949 and then rose to 178.40 on 3/29/1949.

4/20/1949 175.70

DJI fell sharply to 161.60 on 6/131949

5/18/1951 250.10 DJI fell only to

247.00 on 5/23/1951 and then went

sidewise for a month.

12/26/1951 264.10 False move. DJI rose to 275.40 on 1/22/1952.

4/4/1952 265.60 DJI fell to

256.40 on 5/1/1952

5/29/1952 262.90 False move. DJI rose to 279.80 on 8/8/1952.

3/30/1953 283.10 DJI fell to 263.40 on 6/9/1953

==============================================================================

October-November Breakdowns

below A Falling 65-dma

16 cases: 9 (60%) declines 6 (40%) rallies

--------------------------------------------------------------------------------------

10/1/1934 90.40 False move. DJI immediately turned up and

moved far above 65-dma

10/26/1944 145.00 False move. DJI rose steeply moving to 168.20

on 5/28/1945.

11/16/1959 634.50 False Move

11/20/1969 831.18 DJI fell to 783.79 on 12/18/1969 and

then resumed bear market.

10/14/1971 878.36 DJI fell to 797.97 on 11/23/1971

11/15/1974 647.61 DJI fell to 577.60 on 12/6/1974

10/1/1976 979.69 DJI fell to 924.04 on 11/10/1976

11/29/1977 931.86 DJI fell to 807.43 on 12/7/1977

11/7/1980 932.42 False Move

11/14/1984 1206.93 DJI fell to1170.49 on 12/6/1984

10/7/1985 1324.37 False Move

10/17/1997 7847 DJI fell to 7161 on 10/27/1997

11/24/1997 7768 False Move

11/2/1999 10581 False Move

11/15/2000 10708 DJI fell to 10374 on 12/1/2000

10/8/2004 10055 DJI fell to 10374 on 10/25/2004

Taking some new short sales in the BEARISH

MINCP stocks, many of which look

very vulnerable, is now recommended.

====================================================================================

OLDER HOTLINES

====================================================================================

10/14/2011

DJI = 11644-41 la/ma=1.043 21-dma ROC= .226 P =

+50 (+19) IP21= .047 V= -84 OP= +.148

BREADTH

STATISTICS:

146 +5

MAXCP stocks Bullish MAXCP Stocks

24

-2 MINCP stocks Bearish

MINCP Stocks

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

20 new highs on NASDAQ. 7 new lows on NASDAQ

15 new

highs NYSE 6

new lows on NYSE

10/14/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

Near Term: updated last: 10/14/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

All 3 general market ETFs' Closing

Powers are rising but at a rate that seems unsustainable.

Opening Powers sre rising. This is the bullish "BOTHUP"

condition. Momentum now is clearly upwards.

DIA is at

steep CP UPtrendline -

It would take a close of more than 0.87 ABOVE the Opening

to sustain the CP uptrend. In cases like this, we should probably wait for the CP to

fall to

become short-term bearish.

SPY is at

steep Uprendline - It would take a close of more than 1.16 ABOVE the Opening

to sustain the CP uptrend. In cases like this, we should probably wait for the CP to

fall to

become short-term bearish.

QQQ is at steep CP Uptrendline - - It would

take a close of more than 0.654 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

also fall to

become short-term bearish.

GLD ABOVE CP

DOWNtrendline - A close of 0.13 BELOW the Opening is needed tomorrow to

restore

the CP DOWNtrend. GLD CP is still

below its CP 21-dma but Openings are

above its 21-dma.

New TigerSoft Exploded Charts shows

exactly how much of a move from the Opening

to the Close is needed to break the Closing Power trendline. Note that a visual break will require,

at least .25 more of a penetration of the calculated uptrend. We have been using

visual

CP trend-breaks. http://tigersoft.com/CP-Trendbreaks/index.html

-----------------------------------------------------------------------------------------------------------------

10/14/2011

Multiple Peerless Buys Have Overcome 65-Day MA

>But DJI is now 4% over 21-day ma and Volume is low.

>Also bearish: P-Indicator and Accum. Indicator do not confirm

Friday's

recovery and V-Indicator remains negative.

>Watch

the CLosing Power. A Close below the Opening will be

short-term

bearish and Call for a Retest of 65-dma.

>Seasonaility: DJI rises only 44% of

the time in the week after 10/16/2011,

based on

DJI from 1966-2010... but rallies 60% over the next month from

today's

level.

>There

are more than 5x more stocks being bought agressively by the Pros

and being

aggessively sold.

>NASDAQ new

highs exceed new lows.

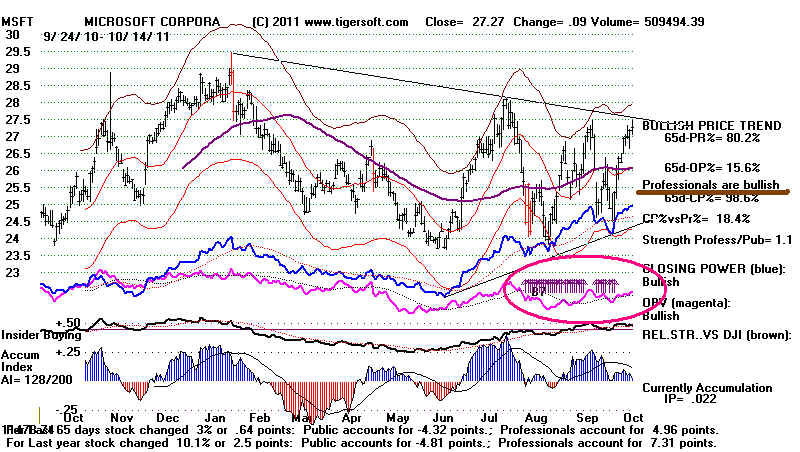

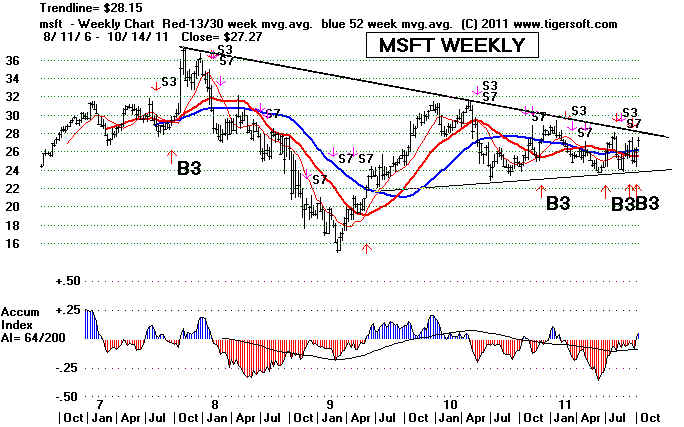

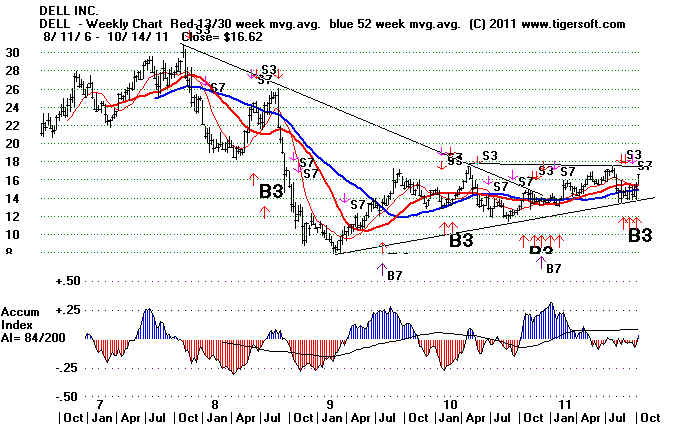

The rally is being fueled, more than anything else, by computers and

specific software

companies. IBM and AAPL are soaring. You knew that, of

course, but did you know

that MSFT and DELL are showing multiple Buy B7s, which indicate that

Professionals

are much more eager to buy than the Public is? I suspect

breakouts will occur on their

weekly charts above their long downtrendlines: MSFT over 28 and SELL

over 18.

Let's see if the market can keep bring amazed disbelief to the majority

who scoff at it.

Manipulation? Quite possibly. But the point is, given all the bad

news, the Pros find it

more profitable to make it rise, knowing that the probability is good

that many of the

bears can be induced to buy at much higher prices when the news gets

better or they

must throw in the towel.

As Keynes said: “The

market can stay irrational longer than you can stay solvent.”

|

Keynes The Speculator

"Keynes traded on high leverage - his broker granted him a margin account to

trade positions of £40,000 with just £4,000 equity...

Easter 1920 found Keynes

vacationing in Rome. He learned that his open currency trades had made him a profit of

£22,000 on francs and a loss of £8,000 on U.S. dollars. A jubilant Keynes wrote to his

mother from Italy on April 16 to say that he was, “indulging in an orgy of shopping.

. . I think we have bought about a ton so far. . .”

Keynes soon learned that

short-term currency trading on high margin, using only his long-term economic predictions

as a guide, was foolhardy. By late May, despite his belief that the U.S. dollar should

rise, it didn’t. And the Deutschmark, which Keynes had bet against, refused to fall.

To Keynes’s dismay, the Deutschmark began a three-month rally.

Keynes was wiped out. Whereas

in April he had been sitting on net profits of £14,000, by the end of May these had

reversed into losses of £13,125. His brokers asked Keynes for £7,000 to keep his account

open. A well known, but anonymous, financier provided him with a loan of £5,000. Sales of

Keynes’s recently published book The Economic Consequences of Peace had turned out to

be healthy and a letter to his publisher asking for an advance elicited a cheque for

£1,500."

(Source: http://www.maynardkeynes.org/keynes-the-speculator.html

) |

DJIA next faces 11800 resistance.

====================================================================================

OLDER HOTLINES

====================================================================================

10/13/2011

DJI = 11478 -41 la/ma=1.029 21-dma ROC= .247 P =

+31 (-102) IP21= .054 V= -80 OP= +.147

BREADTH

STATISTICS:

141 +14

MAXCP stocks Bullish MAXCP Stocks 10/13/2011

26

+3 MINCP stocks Bearish

MINCP Stocks

10/13/2011

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

9 new highs on NASDAQ. 9 new lows on NASDAQ

5 new

highs NYSE 2

new lows on NYSE

10/13/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

Near Term: updated last: 10/13/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

All 3 general market ETFs' Closing

Powers are rising but below the rising CP. So are the Opening Powers.

This is the bullish "BOTHUP" condition. With prices at the 65-day

ma, a reversal is possible,

but the momentum now is clearly upwards.

DIA is

below steep CP UPtrendline -

It would take a close of more than 3.96 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

also fall to

become short-term bearish.

SPY on

steep Uprendline - It would take a close of more than 4.70 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

also fall to

become short-term bearish.

QQQ below steep CP Uptrendline - - It would

take a close of more than2.77 ABOVE the Opening

to restore the CP uptrend. In cases like this, we should probably wait for the CP to

also fall to

become short-term bearish.

GLD ABOVE CP

DOWNtrendline - A close of 5.14 BELOW the Opening is needed tomorrow to restore

the CP DOWNtrend. GLD CP is still

below its CP 21-dma but Openings are

above its 21-dma.

New TigerSoft Exploded Charts shows

exactly how much of a move from the Opening

to the Close is needed to break the Closing Power trendline. Note that a visual break will require,

at least .25 more of a penetration of the calculated uptrend. We have been using

visual

CP trend-breaks. http://tigersoft.com/CP-Trendbreaks/index.html

-----------------------------------------------------------------------------------------------------------------

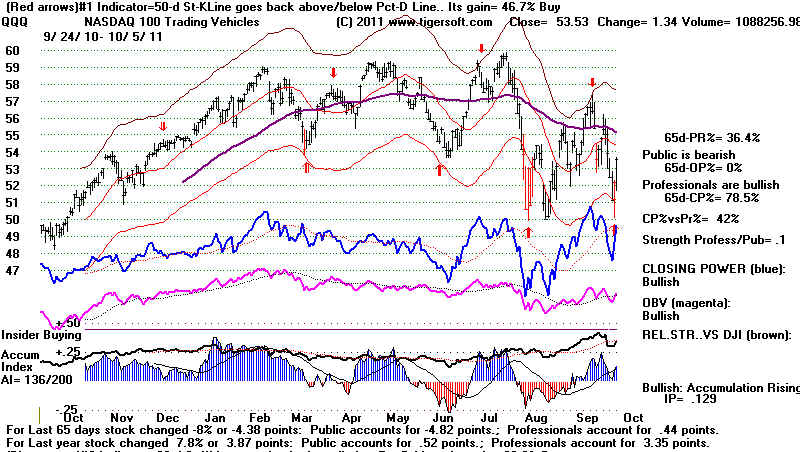

10/13/2011

Multiple Peerless Buys Versus 65-Day MA

Stick with Peerless. We Have The Bears on The Run...

The DJI impressively recovered from a 120 point loss, closing down only 41 while the

NASDAQ

actually rose 16 on rising volume. Without a Peerless sell signal, I think we have

to give the

markets a chance to move higher. Closings are still bullishly above their openings.

MAXCP stocks

outnumber MINCP stocks 5:1, also showing Professionals are much more bullish than bearish.

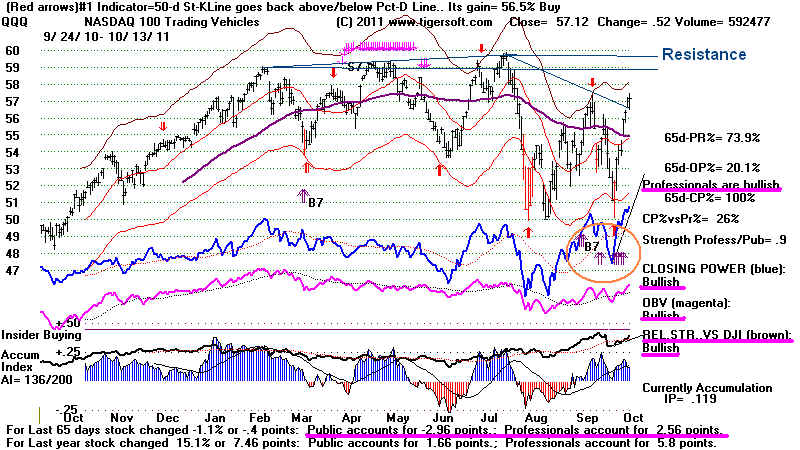

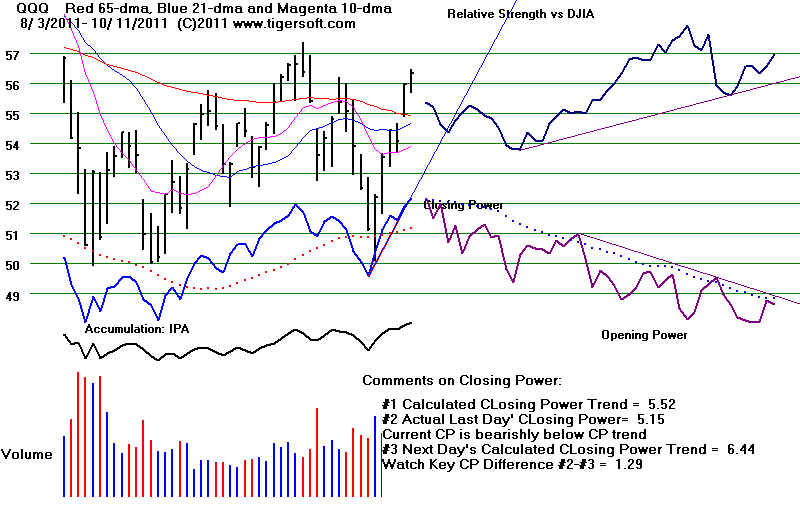

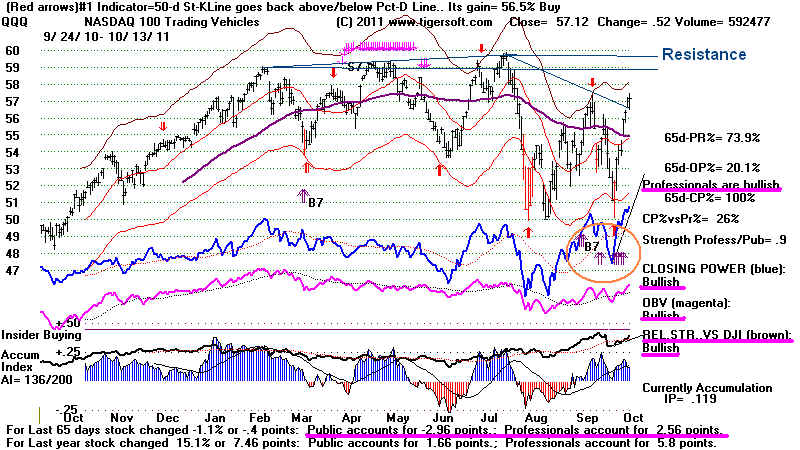

The QQQ is much stronger than the DIA. See below how the CLosing Power has made 12

month highs

ahead of price. This is reliably bullish. The QQQ is above its 65-day ma.

The brown Relative Strength Line

(QQQ/DJI) is rising. See also the Bullih (CP versus OP) Buy B7s recently in the QQQ

chart. Given the

public bearishiness, I take this as quite bullish. IBM,

the most weighty stock in the DJI, and a tech stock

of course, is challenging its all-time highs. This is not what we would expect in a

developing bear market.

The odds of the 65-day ma holding back the DJI clearly are reduced

as we get into late October, November

and December. Since 1972, I count 20 cases of DJI rallies in the Oct-Dec period to a

falling 65-dma,

in 13 cases (65%) the DJI rises more than 4% in the next 2 months.

Our Stocks' Hotline remains 100% bullish (no short sales.)

8%, 7-day rally has now taken prices slightly above the potential resistance of

the falling 65-

====================================================================================

OLDER HOTLINES

====================================================================================

10/12/2011

DJI = 11519 +103 la/ma=1.034 21-dma ROC= .442 P =

+133 (+10) IP21= .054 V= -35 OP= +.23

BREADTH

STATISTICS:

127 +10

MAXCP stocks Bullish MAXCP Stocks 10/11/2011

22

-7 MINCP stocks Bearish

MINCP Stocks

10/11/2011

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

14 new highs on NASDAQ. 8 new lows on NASDAQ

7 new

highs NYSE 4

new lows on NYSE 1

10/11/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

Near Term: updated last: 10/12/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

All 3 general market ETFs' Closing

Powers are uptrending again. So are the Opening Powers.

This is the bullish "BOTHUP" condition. With prices at the 65-day

ma, a reversal is possible,

but the momentum now is clearly upwards.

DIA on

steep CP UPtrendline - A close

of less than 1.03 ABOVE the Opening would violate CP uptrend.

In cases like this, we should probably wait for the CP to also fall to become short-term

bearish.

SPY on

steep Uprendline - A close of less than 3.57 ABOVE the Opening would

violate CP uptrend.

In cases like this, we should wait for the CP to also fall to become short-term bearish.

QQQ below steep CP Uptrendline - - A close of

less than 2.47 ABOVE the Opening would mean

a second-day violate of steep CP uptrend. In cases like this, we should probably

wait for the CP

to also fall another day to become short-term bearish.

GLD ABOVE CP

DOWNtrendline - A close of 4.06 BELOW the Opening is needed tomorrow to restore

the CP DOWNtrend. GLD CP is still

below its CP 21-dma but Openings are

above its 21-dma.

New TigerSoft Exploded Charts shows

exactly how much of a move from the Opening

to the Close is needed to break the Closing Power trendline. Note that a visual break will require,

at least .25 more of a penetration of the calculated uptrend. We have been using

visual

CP trend-breaks. http://tigersoft.com/CP-Trendbreaks/index.html

-----------------------------------------------------------------------------------------------------------------

10/12/2011

Multiple Peerless Buys Versus 65-Day MA

Stick with Peerless. We Have The Bears on The Run...

The DJI's 8%, 7-day rally has now taken prices slightly above the potential resistance of

the falling 65-day ma.

This is un-nerving to the bears, but they are still counting on the the resistance

created by the July

penetration of the June lows (DJI - 11600 and NASDAQ - 2600) to halt

the recovery. A

close above these resistance levels will bring, I predict, much more short-covering.

Seasonality favors a

further rally. The DJI is up 57.8% of the time in the week following

October 12th.

Of course, the rally past the resistance still has not yet happened and volume has been

low

on the rally. But

I think we can confidently believe that Professionals and market makers

are still trying to run

up prices. I say this because the number of stocks making Closing Power

new highs (MAXCP) is 5x

the number of stocks making Closing Power new lows (MINCPs) and

because the Closing

Powers are much stronger than the Opening Power on this rally

for the DIA, SPY or QQQ.

It's true that some traders (and hedge funds) took profits today in leading biotechs

and bonds. But I am impressed that other sectors among those we

follow are now showing

a plurality of their

stocks to be above the 65-dma. The recovery is significantly broadening.

Military stocks (67%),

QQQ stocks (66%),

Utility stocks (63%),

Auto stocks (63%),

Retail Stocks (57%)

DJI-30 (57%)

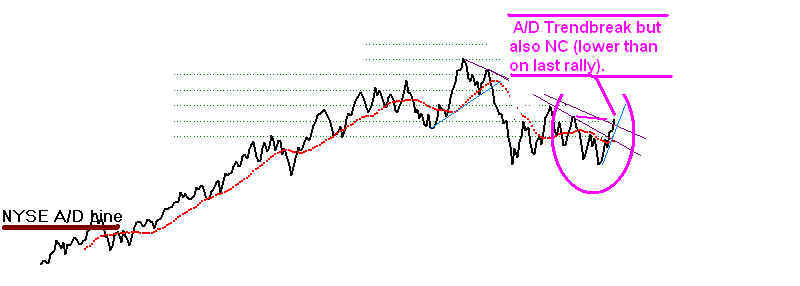

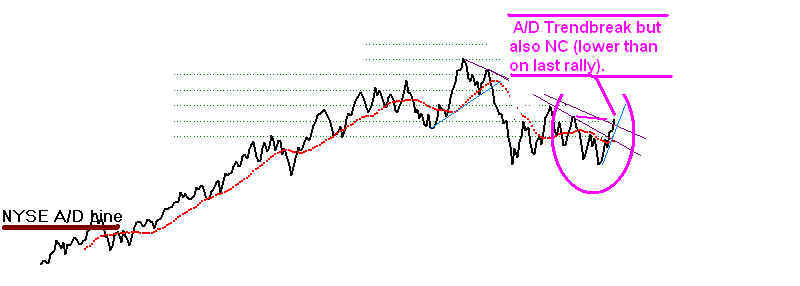

Though Peerless remains on Buys, we should note the rally still needs to strengthen

more. To be

confirmed, the NYSE A/D Line needs to improve and for the current run to make new

recovery highs.

The older 2006 Peerless would have considered these A/D NC's to be Sell S13s.

The new Peerless has

dropped this signal because it gives too many false or unproductive

Sells. The new

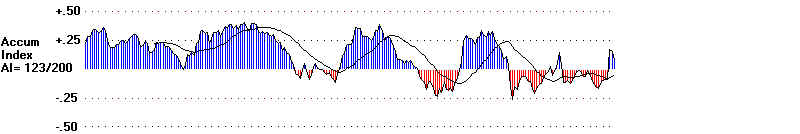

Peerless has new ways to call tops on runs like this. One way would be

for the current

Accumulation Index to drop below its 21-day ma. We came close to this

today. In fact,

if you do not use the hypothetical DJI lows as we require with Peerless, but

use the trading

lows, you will get this new signal, a Sell

S4. It could occur this week or

next if the Accum.

Index drops further. In addition, if the Accum. Index drops more and

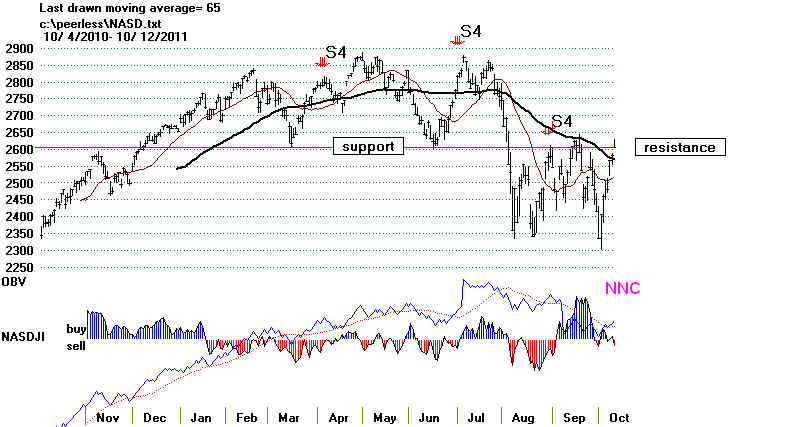

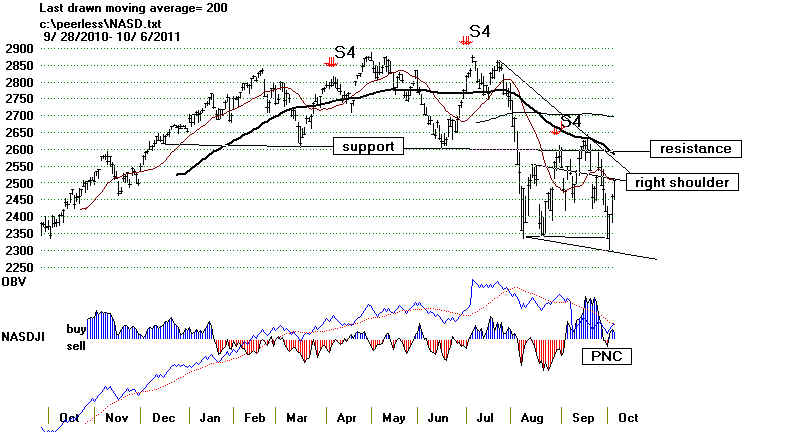

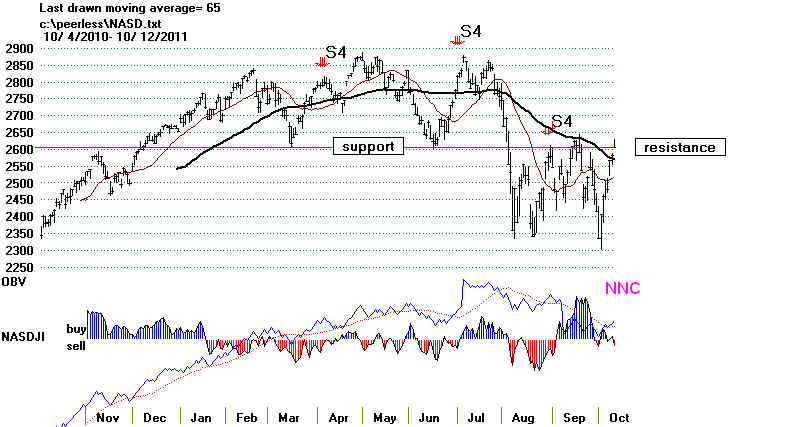

the NASDAQ

rallies, we could get a NASDAQ Sell S4. As you can see in the NASDAQ

chart below, these

have been quite reliable Sells.

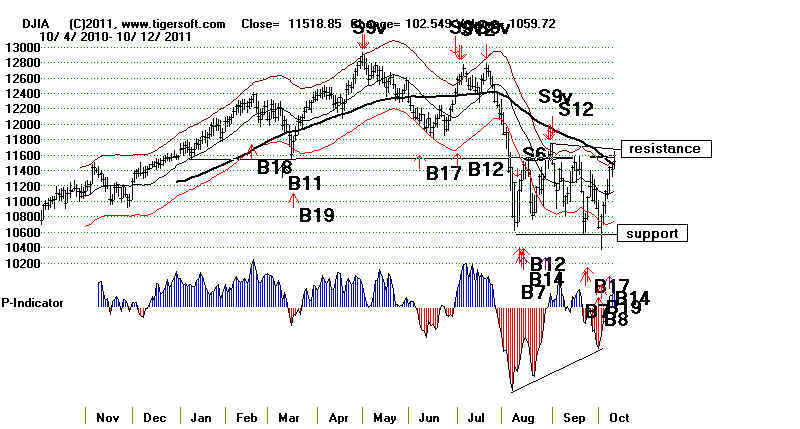

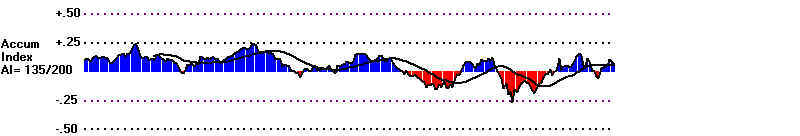

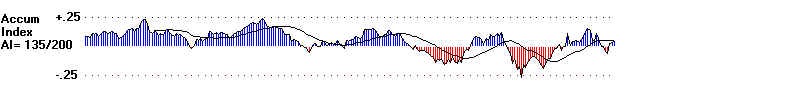

DJIA - Peerless Signals

P-Indicator: non-confirmation of today's high

A/D Line non-confirmation of today's high

Accumulation non-confirmation of today's high

IP21 just above its 21-day ma

I

|

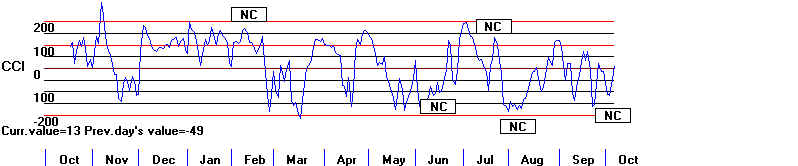

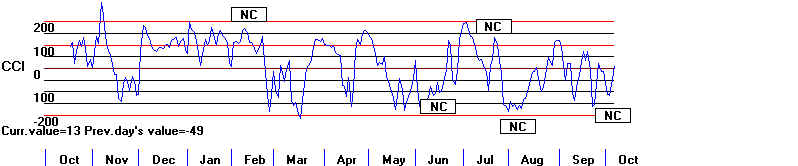

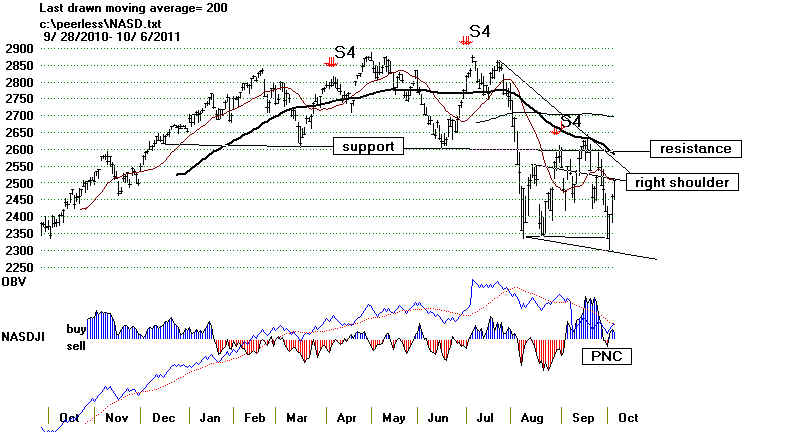

NASDAQ

--- At resistance from broken earlier support

--- RELDJI shows negative non-confirmation.

--- Accumulation non-confirmation of today's high

--- IP21 still above its 21-day ma

AI Still above AI MA

|

====================================================================================

Older

Hotlines

====================================================================================

10/11/2011

DJI = 11416 la/ma=1.027 21-dma

ROC= .381 P = +122 (+21) IP21= .073

V= -40 OP= +.23

BREADTH

STATISTICS:

117 +38

MAXCP stocks Bullish MAXCP Stocks 10/11/2011

29

+5 MINCP stocks Bearish

MINCP Stocks

10/11/2011

MAXCP stocks are those showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

Also use the BOTHUPs condition with MAXCPs and BOTHDOWNS MINCPS.

12 new highs on NASDAQ. 18 new lows on NASDAQ 10/10/2011

5 new

highs NYSE 8

new lows on NYSE 10/10/2011

10/11/2011 ===> See Key Peerless TigerSoft Index Charts: Industry Groups and

ETFs

DIA

SPY QQQ

DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

Near Term: updated last: 10/11/2011

------------------- Closing

Power (CP) Status Report: CHARTS:---------------------

All 3 general market ETFs' Closing

Powers are uptrending again but the they are very close to

their rising trendlines and so any weakness would break the CP uptrend.

DIA on

steep CP UPtrendline - A close

of less than 1.81 ABOVE the Opening would violate CP uptrend.

In cases like this, we should probably wait for the CP to also fall to become short-term

bearish.

SPY on

steep Uprendline - A close of less than 2.11 ABOVE the Opening would

violate CP uptrend.

In cases like this, we should wait for the CP to also fall to become short-term bearish.

QQQ on steep CP Uptrendline - - A close of less

than 1.29 ABOVE the Opening would violate CP uptrend.

In cases like this, we should wait for the CP to also fall to become short-term bearish.

GLD ABOVE

CP DOWNtrendline - A close of 7.4 BELOW the Opening is needed tomorrow to restore

the CP DOWNtrend. GLD CP is still

below its CP 21-dma but Openings are

above its 21-dma.

New TigerSoft Exploded Charts shows

exactly how much of a move from the Opening

to the Close is needed to break the Closing Power trendline. Note that a visual break will require,

at least .25 more of a penetration of the calculated uptrend. We have been using

visual

CP trend-breaks. http://tigersoft.com/CP-Trendbreaks/index.html

-----------------------------------------------------------------------------------------------------------------

10/11/2011

Multiple Peerless Buys Versus 65-Day MA

Stick with Peerless. We Have The Bears on The Run...

I showed last night that 2/3 of the

time when there are multiple Buys in a two to three

week period, the DJI falls back to at least the lower band, but more often below it, once

the

resistance of the upper band has been reached. The DJI has now almost tagged the

upper

band. So, there is a better than even chance that the market will have to retest its

lows. That might ordinarily get us to take profits in some of the stocks that have

lagged the

last week's rally.

But there is so much public disbelief in this rally and Peerless is still on Buys.

So,

I would prefer just to hold the strongest stocks, including IBM and the biotechs

recommended

here. You might short or two from tonight's bearish MINCP stocks as a hedge.

They keep

falling even in this rising market. However, that runs against the Peerless

strategy. So,

I would rather not do this until we get a Peerless Sell or the Closing Power starts

downtrending, not just breaking its steep uptrend.

Tagging The Falling 65-dma

I do want to study the DJI's behavior when it rallies to a falling 65-day ma, as it has

now. (This will take a few hours. So look for this report later than usual

tonight.)

Early returns show great variability. Simply reaching the falling upper band does

tend to bring a decline, but not by nearly as wide a margin as to permit us to make this

into a Peerless signal. Looking at all these charts does show that a clear upside

penetration

of the 30-week ma reliably bring an additonal rally for at least two weeks, but after that

a re-testing of the 30-week ma is quite common.

A Small Study

I will look at only the bearish periods: 1930-1942, 1960, 1966-1970 to err on the

side of caution.

This is only a sample. But it may offer clues about how what might happen next in

our market

if we look for past cases where the key Peerless parameters were similar to what they are

now.

Now having done the the study, I can say again, the 65-day ma has power to turn back but

also to boost DJI prices if penetrated. Predicting which way it will go is very

difficult based

on only one key indicator, in that some key parameters would seem to be bullish and other

parameters are associated with bearish outcomes.

What does work are the Peerless Buy and Sell signals. Look at how well Peerless

predicts the tests of the 65-day ma with the DJI at the upper band. This is shown in

the list

just below. (There was not time to do the same for the other matching

parameter cases.)

Most important, consider all the cases with the DJI 2.5% to 3.5% over 21-dma

Outcome:

4/6/1933

explosive rally

Buy B12 sets it off

5/27/1936 rally and

bull mkt in two weeks. Buy B2s at bottom

5/24/1939 decline back below lower band.

Earlier Buy B17

7/30/1940 rally after

re-testing two weeks later. Buy B16, Buy B14

6/9/1941 3 month rally Buy B12 sets it off

5/21/1942 major bull mkt starts Buy B4 sets it off

11/9/1960 hesitation and then bull market. Buy B2 and B17 sets it off

10/25/1966 hesitation and then bull market. Buy B6

12/6/1967 2 week rally.

then decline below lower

band. B17

4/1/1968 bull market. Buy

B14 set off rally.

1/5/1970 Decline below lower band Sell S9, S15 are oerfect warnings.

2/27/1970 Hesitation and then decline

below lower band. Sell S9

6/22/1970 Decline to lower band. Sell S9

======================================

9 bullish for 2 weeks at least

3 bearish

======================

Next consider first all the October cases in this period.

Outcome:

10/14/1929

steep decline

10/25/1966 hesitation and then bull market.

10/14/1969

2 week rally. then decline

below lower band.

===========================================

2 bullish for 2 weeks at least

1 bearish

Third, here are all the cases with the

IP21 above .053 and below .103

Clearly an average IP21 as shown now is probably bearish.

6/13/1934

decline

back below lower band.

8/22/1934 decline back below lower band.

4/3/1941 decline back below lower band.

6/22/1970 Decline to lower band.

======================================

4 bearish

=================================

Fourth, here all the cases with the OBVPct

above .18 and below ..28

11/11/1933

decline back

below lower band.

1/5/1933

one week advance... then below

lower band.

5/27/1936 rally and bull mkt

in two weeks.

4/7/1960 Decline back to lower band.

8/16/1960 Decline below lower band.

4/21/1966 Decline below lower band.

6/15/1966 Decline below lower band.

7/14/1970 hesitation and then bull market.

======================================

2 bullish

6 bearish

=================================

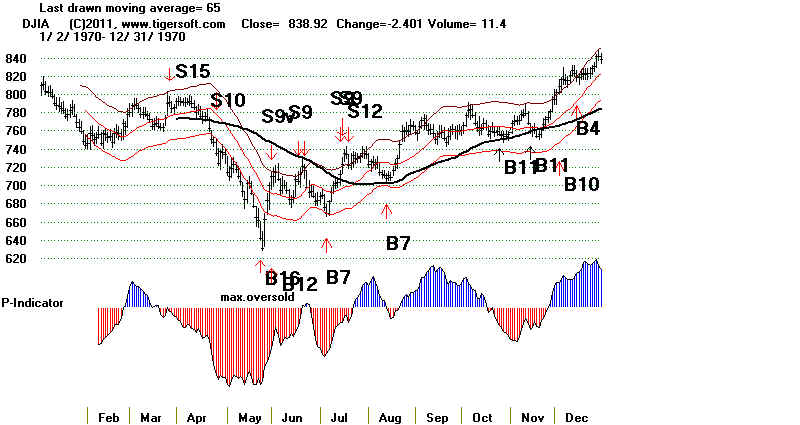

DJI Rally and Tag of flat

/ falling 65-dma

--------------------------------------------------------

Date

LA/MA AROC P

P-ch IP21 V-I

Obvpct

----------------------------------------------------------------------------------------------------------------------------------------

10/11/2011 1.027 .381

122 21

.073

-40 +.23 Only the

V-Indicator is negative.

Compare with:

1929-1942

-----------------------------------------------------------------------------------------------------------------------------------------

10/14/1929 .997 -.54

-99 4

-.113

-837 -.344 steep decline

----------------------------------------------------------------------------------------------------------------------------------------

8/26/1930 1.022 -.274

-55 6

.002

-344 .012 two week advance and then DROP

-----------------------------------------------------------------------------------------------------------------------------------------

6/23/1931 1.079 .986 -20

15

.018 -128 -.054 two week advance and then DROP

----------------------------------------------------------------------------------------------------------------------------------------

7/22/1932 1.081 .378

41 17

.025

37

.081 explosive rally

--------------------------------------------------------------------------------------------------------------------------------------

11/11/1933 1.091 1.209 17

8

.141

77

.20 decline back below lower band.

------------------------------------------------------------------------------------------------------------------------------------

1/5/1933 1.041 1.159

-7 6

.045

-59

.194 one week advance... then below lower band.

-----------------------------------------------------------------------------------------------------------------------------------------

4/6/1933 1.031 1.808

0 23

-.049

43

.386 explosive rally

----------------------------------------------------------------------------------------------------------------------------------------

6/13/1934 1.04 .881

72 8

.082

78

.13 decline back

below lower band.

----------------------------------------------------------------------------------------------------------------------------------------

8/22/1934 1.047 .437

72 41

.062

-8

.118 decline back

below lower band.

-----------------------------------------------------------------------------------------------------------------------------------------

9/26/1934 1.018 -.275 -60

16 -048

-101 -238 rally and

bull mkt in two weeks.

-----------------------------------------------------------------------------------------------------------------------------------------

5/27/1936 1.027 .466

42 6

.028

5