KILLER SHORT SALES

KILLER SHORT SALES

IN ANY MARKET

By William Schmidt, Ph.D. (Columbia University)

===> Order Book

It is DANGEROUS for you to try to ride out long bear markets. It is unnecessary.

And you can make much more money if you go short when a big general market

decline starts. Our Peerless Stock Market Timing's track record at calling

stock market tops is unequalled.

Nor do you have to wait for a bear market to profitably sell short. We only avoid

short sales when a new bull market is starting just after a reversing Peerless Buy

signal and often at the end of the year and the beginning of the new year when

tax considerations often bring brief advances in the weakest stocks. Otherwise

there are almost always a good number of stocks that are in their own bear markets.

This is a book about our best strategies to find them. For example. we use

TigerSoft "bearish MINCP"stocks to hedge and sell short. These are the

stocks we identify as havining the heaviest insider AND professional selling.

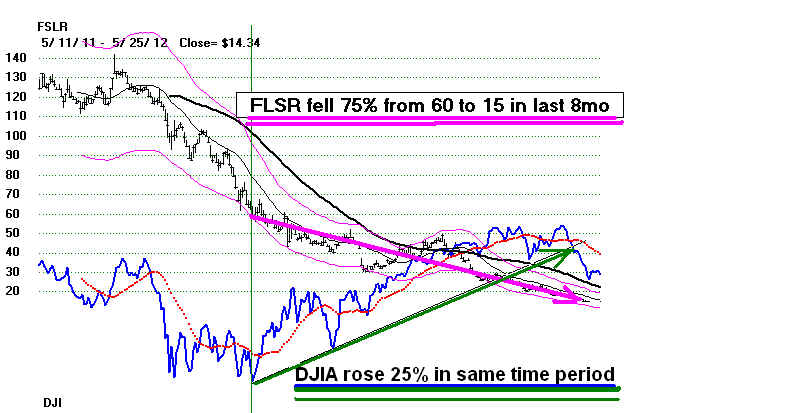

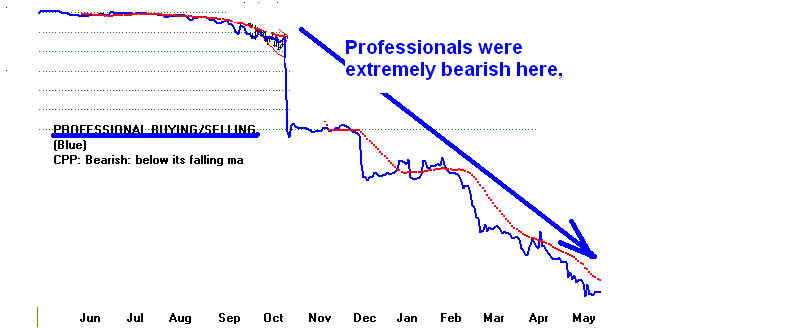

Example:Week after week, FSLR was our number #1 short selling candidate. It was

the #1 most bearish MINCP stock on our Hotline using our software and data. See

below how it fell 75% in the last 8 months, ending April 2012, while the DJI rose 25%.

Then see all the red Distribution by insiders and the heavy Net Selling by

Wall Street Professionals in the stock. This combination is very bearish.

Our Tiger Power Ranker easily finds you the most vulnerable stocks, the ones

that BOTH professionals and insiders are heavy sellers of. It also finds for you with

one command the stocks that decline the most when Peerless switches to a Sell.

Protect yourself from long bear markets and severe intermediate-term corrections.

You do not have to endure them. Make money from them and be ready to buy

and go long when they are over. Peerless Stock Market Timing makes that

possible.

Big Bear Markets Are More Certain than Ever

The stock market goes down faster than it rises. Governments no longer use

Keynesian macro-economics to smoothe the business cycle. Instead the rich

favor de-regulation of banks that are "too big to fail". They oppose government

intervention except in military spending and big oil subsidies. They oppose

taxation of the rich at the same level that working people are taxed. The result

is an impoverished average American. "Austerity" has become the cruel watch-word

among Conservatives. Nor do most Democrats argue the point, ignoring the

role of AUSTERITY and the 1937 FDR Crash and the 1930-1932 HOOVER CRASH.

They ignore that income and wealth are now even more unevenly distributed than

right before the 1929 CRASH.

This author wrote his dissertation at Columbia University on the Disastrous

Consequencs of Austerity in the 1920s and 1930s in the UK. Churchill wrote later

on that austerity and going back on the Gold Standard were the single biggest mistakes

of his long political career, even exceeding his tragic landing of marines at Gallipoli

in World War I.) So AUSERITY when UNEMPLOYMENT IS HIGH is a prescription

for economic and financial disaster. Learning about short selling with TigerSoft

is a must for the intelligent investor.

Question: Why should only insiders sell and professionals sell short when the

stock market is about to collapse? Making money in a down market will give you

much more buying power when declines comes to an end. Watching the

Insiders and Professionals' net selling switch to net buying is easy with

TigerSoft. And it will, in our view, make all the difference to your portfolio's value

and to your successful attainment of your goal of financial independence.

The Key To Killer Short Selling Profits in The Stock Market:

Learn To Spot Insider Selling with Tiger's Accumulation Index.

What gives us the edge and makes our short selling so profitable is how

extensive, endemic and systemic INSIDER SELLING before bad news is

released to the general public. TigerSoft spots the selling of their shares by

CEOs and other insiders weeks and months before the sharply lower earnings,

consumer lawsuits, governmental challenges and bankrutcies are announced.

Explore the Dark Side of Wall Street:

This is a world of insider selling, cooked books, earnings disappointments,

recalls, contaminated products, over-hyped "cats and dogs"... Use TigerSoft's

Accumulation Index and Closing Power to spot "Insider-informed Big-Money selling",

"distribution" and "dumping". See Insider Selling's HALL of SHAME

There is no just low to which greedy insiders will go to sell ahead of their shareholders

if they think their stock will collapse. They know the SEC is largely a toothless

facade trying to fool small investors into thinking Wall Street is a level-playing

fielfd!

90% of all big decliners all have one thing in common: Insider Selling!

Links to more short selling examples and opportunities:

Rampant Insider Selling: More Examples: 1990-2007

Picking Short Sale Candidates with TigerSoft's Power-Ranker.

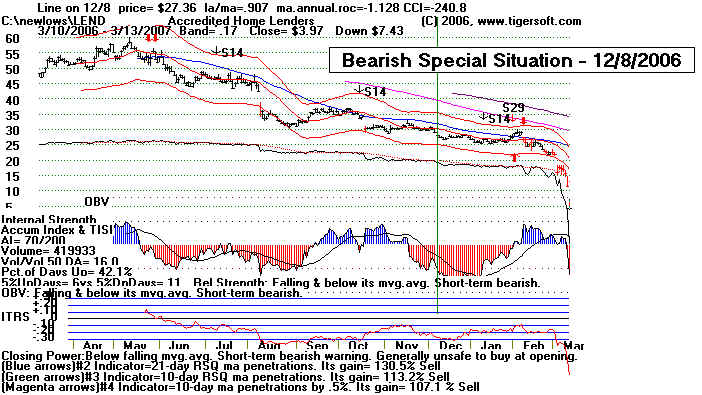

Sub-Prime Mortgage Lenders: Report on 3/10/07

Examples: 2007 Biggest Decliners

Imclone - Insider Selling and Data Falsification

What To When Peerless Gives A Major Sell.

Concealing Bad News from shareholders: Newmont Mining 2006

In our book, "How To Spot Insider Selling and Make Killer Short Sales in Any Market."

===> Order Book

We show how to :

1) Spot the tops just before the start of a bear market. We discuss the

basics behind employing the key formulae in our Peerless Stock Market

Timing. We reveal the exact formulae for the key indicators.

2) We show you how to pick the most vulnerable, most distributed stocks

in a bear market and how to short them when the upside risk is lowest.

3) We show you when statistical testing suggests it is best to cover your

short sale at a profit but also when to limit losses to very modest amounts.

4) We show you how to spot the weakest industry groups for shorting

and leave the strongest for later consideration.

5) Most importantly, we show you when Insiders are getting out in a way

that suggests real vulnerability.

When you start using TigerSoft you will be amazed

at how easy it is to find good short sales.

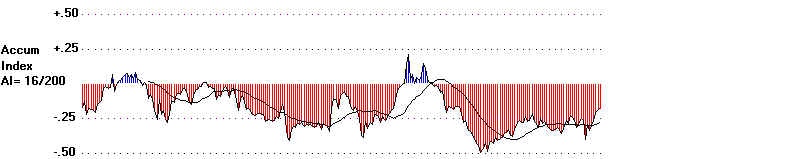

Compare the patterns of red (heavy insider selling) distribution.

6) Use TigerSoft Closing Power to close out profitable short sales. Watch

the Closing Power at all times. Often its next trend-break down gives a

second excellent shorting opportunity.

Best and Worst Performing Stocks for 2007.

Our book does a lot

more than show how to make money shorting stocks

in a bear market. Most of the time,

markets are rising, not falling. So for the

short seller, the trick is to spot pervasive and

intense Big Money

Distribution. It is seldom wrong! Trade

with what the Insiders are doing

with their money, not with what they are saying.

And forget about the

"upgrades" and "downgrades" of

brokerages. They are too unreliable.

And sometimes, forget even about the general

market. Many a stock has

collapsed in a bull maket.

How can an average investor,

an outsider, spot INSIDER SELLING?

That is the function of

Tiger's own Accumulation Index. When such selling

persists, and the indicator shown below turns RED,

for month after month,

it is highly likely that the Big Money Selling is the

result directly of insider information

which is negative about the company.

Is this too rash a

statement? Read more.

Is this type of

"insider-informed", "big money" selling illegal? Yes.

Absolutely,

Is it policed and

prevented? Hardly. It is rampant. The SEC is not staffed to

pursue more than a few show cases each year. Class

Action law suits and

TigerSoft's Accumulation Index are really the only

protection the typical investor has.

The chart in DSCO below

shows a recent example of alleged "insider trading".

Our software spotted what we take to be the tell-tale

signs of insider-tipped

Big Money selling easily. The pattern of Red

Distribution was there along

with the other key characteristics our book tells you

about.

The stock (DSCO - Discovery

Labs) fell by 35% in a month! And it has

been sued for Insider Trading! Our book shows

you how to spot these

just before they CRASH!

Spotting Insider buying /selling

with Tiger's

Accumulation Index

Insider Buying HALL of

FAME: Insider Selling HALL of SHAME

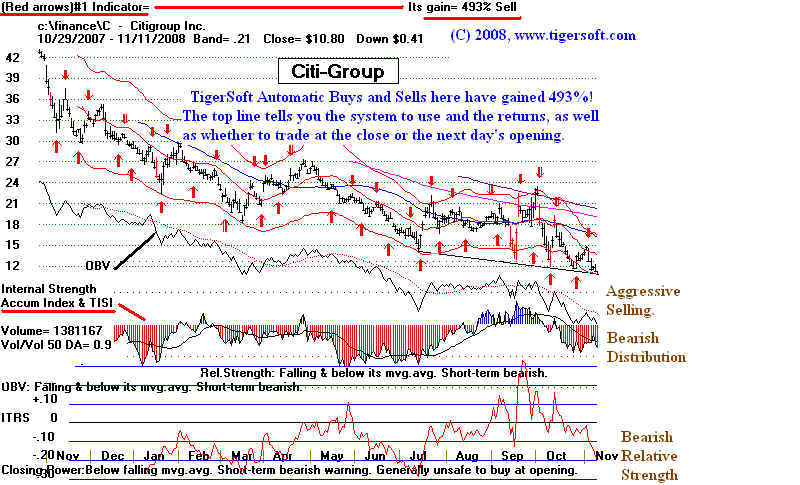

Heavy Distribution Stocks, like CitiGroup

Should Be Shorted on New Red Sells.

Qwest

and Illegal Insider Selling: "To

Hell with the Widows and Orphans

( http://tigersoftware.com/Insider-Trading-News-Reviews/12-27-2007/index.html

)

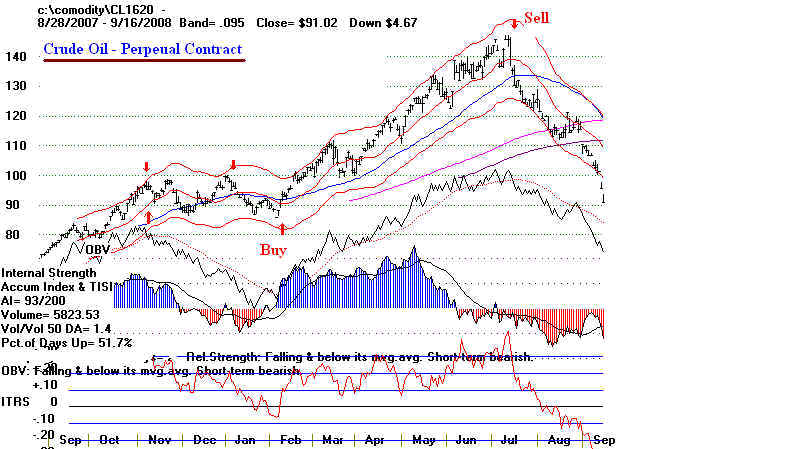

Crude Oil IS EASY TO TRADE

PROFITABLY USING TIGERSOFT.

Unregulated, World Wide, Insider

SELLING Is Rampant!

But using TigerSoft, you can easily

spot it and profit from it.

Special - SEC Now Admits Insider Trading Is

Rampant.

1/8/2008 Weakest

Stocks of 2008: Use TigerSoft's Accumulation Index To Find Them

The SEC Should Investigate The Fed for Insider Trading.

1/3/2008 - Insider

Selling by Dow Jones Insider Only

Brings

SEC Insider Trading Charges against The "Little Guys"

12/30/2007 Washington

Mutual's Shareholders Should Be

"Mad as Hell".

12/28/2007 Santa's

Toy Makers at Mattel May Go To Jail

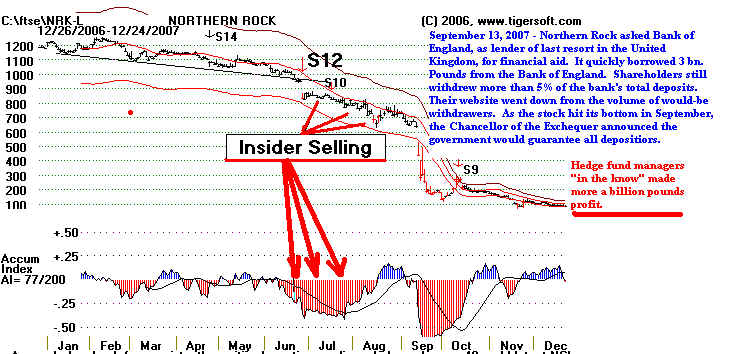

Is Northern Rock The Tip of The UK Iceberg? 12/26/2007

QWEST's Insider Trading

http://www.tigersoftware.com/Insider-Trading-News-Reviews/12-27-2007/index.html

12/28/2007 - Law Suit "MATTEL ( MAT ) HIDES TOY RECALLS UNTIL INSIDERS CAN SELL." ----

Trial and

error is way too expensive a way to learn what we can teach you in

a few hours. Adding this

knowledge and Tiger Software to your arsenal

of trading tools is a terrific way to tilt the odds

away from the Insider and make

yourself some serious money. often very quickly.!

INSIDER SELLING IN UK

British Northern Rock Debacle Made

Insiders A Billion Pounds

"Most investors only rosily look for stocks about to go up.

But there's a another world out there that they are missing.

It is is the world of "over-hyped", "over-recommended",

"bloated", "inefficient" companies run by the greediest of

white collar crooks that have sold their shares just before

the news gets out that their products or drugs don't work

or that their "books have been cooked" and just before

their company's earnings come crashing down.

This is the world where brokers with glaring conflicts of

interest, are over-paid to recommend shares in companies

they know nothing about, and could care less about.

This is the world of rampant insider buying and insider selling,

where the SEC serves mainly to give the appearance of

propriety and regulation of Wall Street.

This is the world where the Accountant gives the CEO

whatever bottom line fabrication he is told to come up

with because the Accounting firm does not want to lose

the client.

This is the world where trend-following lemmings bid

a stock up and up, always believing there is a bigger fool,

until, at least, the uptrend-line is broken and the stock

comes gapping down, supported only by the bids

of a few short-sellers who are taking mercy on the

those who are have just lost 50%, 75% or 90% of their

investment.

This is the world of ENRON and IMCLONE and countless

other companies who have been taken over by crooks,

and whose shares are for a time little more than a criminals'

tool for fleecing millions of dollars each day from innocent,

unsuspecting, gullible investors who see the world of

Wll Street through rose-tinted glasses right to the bitter end.

We are here to tell you that you don't have to sit back

and take it! You can fight back! You can now profiitably

sell short in most any market, because with our TigerSoft

technical analysis tools, you can see what corporate insiders

and their well-heeled friends and cronies are actually doing

with their own shares of a company's stock.

"Watch their feet", my old basket ball coach used to say.

"Forget about their eyes or their arms. They aren't going

anywhere without their feet!!" Well, it's the same way in

the stock market. +Use TigerSoft's "Accumulation/Distribution"

Indicator to see what's really going on with your company's

stock.

The Stock Market is a JUNGLE! It is always survival of the

fitest. You have to be prepared. That is why we named our company

Tiger Software. Without TigerSoft you are at a distinct disadvantage.

Let us show you how we can help you turn Wall Street's self-serving

manipulation of news and stock prices to your lasting advantage."

Learn from Tiger Software How To Profit from:

(1) Bear Markets, which are predictable using our "Peerless" Automatic Sells.

(2) Steep Market Corrections, which are predictable using our

"Peerless" Automatic Sells.

(3) and Those Stocks, which are Mortally Wounded

by Heavy Insider-Selling and Massive Big-Money Selling even in Bull Markets.

Such Bearish Special Situation Stocks can be spotted early-on in almost any market.

Our Elite Report on the internet finds them for you. But our book will teach you

how to find them yourself. All the necessary formulae are in the book.

1000's Have Learned from us How to Profit from Timely Short Sales.

Let us show you, too.

TigerSoft's 160 Page Book

"SHORT SELLING:

Killer Profts in Any Market

Using Tiger's Accumulation Index."

by William Schmidt, Ph.D. - only $55....

The book integrates our Peerless major Sell S9 signals on the DJI with

TigerSoft's proprietary creation, the TIGER Accumulation Index,

and classic technical analysis tools and concepts.

The premise of the book is that someone always knows in advance

when troubles are about to hit a company's stock or the market as a whole.

Instead of being caught like a deer in the head-lights, we teach you

how to spot the unmistakable, tell-tale signs of Insider Distribution that

nearly always preceed significant declines.

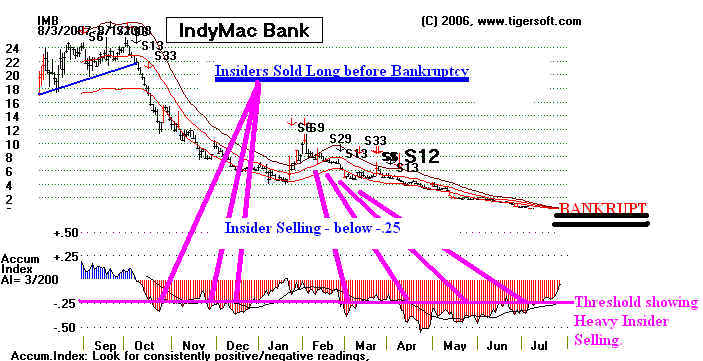

Exactly - what a Bearish Heavy Distribution

Stock looks like. Chart of IMCLONE in 2002.

IMCLONE's CEO was later convicted on insider trading.

Without telling the public, he sold his shares in the stock

when he learned the FDA was going to reject the company's

anti-cancer drug Erbitux in late 2001.

Shareholder lawsuits prolifferated. Other insiders like Martha Stuart

were convicted of insider selling and have received jail sentences.

A TigerSoft user looking at this chart would have readily spotted

this Insider-Selling. Note the very negative RED distribution using TigerSoft's

Accumulation Index and then the institutional dumping as the bad news

spreads.

A typical bearish-looking stock: CPQ - 1997

Sample charts and More Infomration: Link 1.

>>> ORDER TIGER's "Short Selling: Killer Profits in Any Market"

Book by Wm.Schmidt, Ph.D.