TigerSoft's Recent

Predictions

TigerSoft's Recent

Predictions

On Nightly On-Line HOTLINE

(C) 2014 www.tigersoft.com See also Recent TigerSoft Headlines and Signals, June 29, 2010

-------------------------------------------------------------------------------------------------------------

$350-$370/Yr Order Here.

Notice:

We offer research based on valuable intellectual property. It is

copyrighted. It is not to be re-distributed. That is a violation of

our contract with you when you purchase the Tiger/Peerless Hotline.

As we explain to all new customers, we offer no trials. You

cannot return intellectual property. So study our charts on

our www.tigersoft.com These are what we provide nightly on the

Hotline. We will be glad to explain them. Focus first on the

current Peerless signal. Then see what we recommend to trade

it. This includes the nightly most Bullish MAXCP and most Bearish

MINCP stocks. You can make money hedging, too, being long

the most bullish and being short the most bearish stocks. Buy

what Insiders and Professionals are buying. Sell short what Insiders

and Professionals are selling. Our Tiger Accumulation Index

and Closing Power show what they are doing.

Tiger's NIGHTLY HOTLINE Predictions have Helped Investors for since 1985

by William Schmidt, Ph.D. Founder of TigerSoft www.tigersoft.com

----------------------------------------------------------------------------------------------------------------------

Peerless Auotmatic Buy and Sell Signals allow you to predict a wide range

of markets, all around the world.

TigerSoft Closing Power and Accumulation Charts to show you what Insiders

and Professionals are doing.

Automatic Optimized Signals showing you what system has worked best for

the last year. Fixed rule technical Buys and Sells signals.

Plus each night

> Most Bullish and Most Bearish Stocks

> Key ETF, stock and Industry Charts

> The News behind the Scenes: Political Economy.

and much more...

-----------------------------------------------------------------------------------------------------------------------------

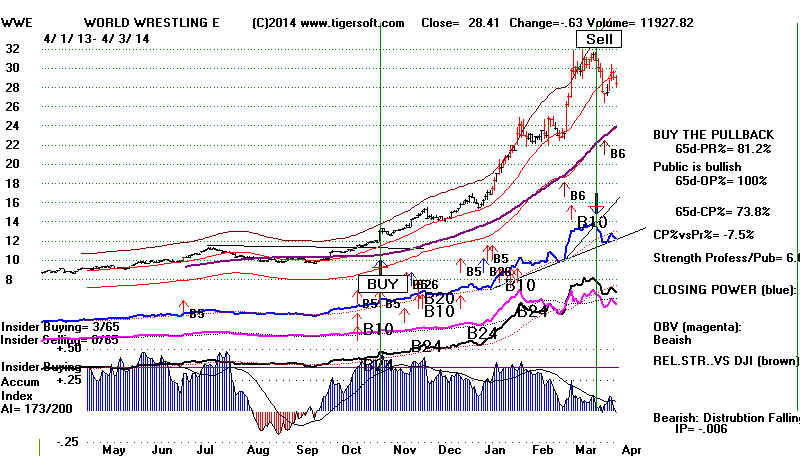

Buy Recommendations that recently made Subscribers money.

------------------------------------------------------------------------------------------------------------------------------

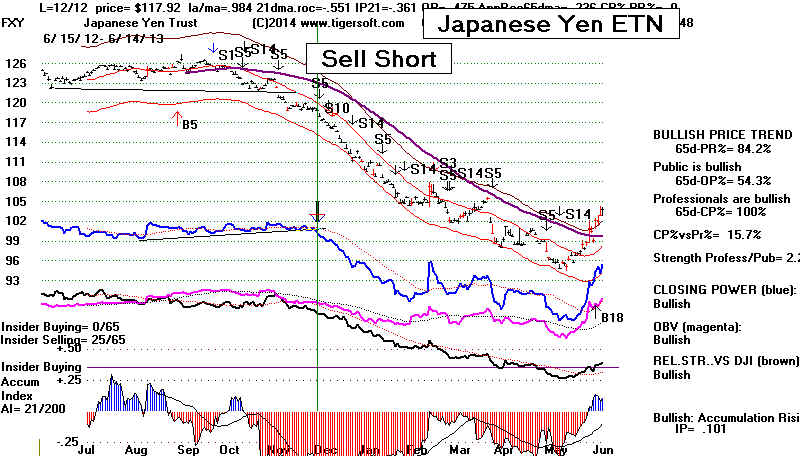

Short Sale Recommendations that made Subscribers money.

------------------------------------------------------------------------------------------------------------------------------

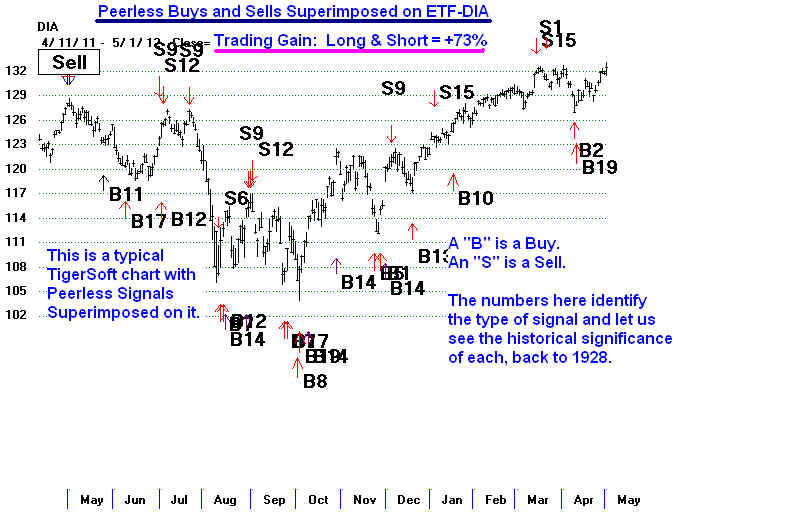

5/11/2012 DJI = 12821 +77% Trading Gain

B=Buy S=Sell Any Buy reverses any Sell and vice verse.

> We keep proving that the Stock Market is clearly much more predictable

than most "experts" say: Our Peerless has gained +77% trading the swings

of the DJIA this past year, using the time-tested Peerless rules that have been

researched back to 1915.

> The Buys and Sells in the chart below are real-time. Someone trading the DJI

or its many close equivalents would have made a lot of money this past

year. So, consider this as your invitation to call us. 858-273-5900 or

Order Peerlss and TigerSoft. If history shows anything, it is that we can set

you on a path to much greater financial security.

Peerless Automatic Buys and Sells' Trading Gain = 77%.

Buy on a reversing Buy and Cover Short Positions.

Sell on a reversing Sell and Initiate Short Positions.

> Whatever you trade, by successfully Calling the major Tops and Bottoms

in the DJI, Tiger's Peerless Stock Market Timing Software or Hotline

will make your trading and investing safer and much more profitable.

> See What To Trade When Peerless Gives a Reversing Buy or Sell

DIA - ETF for DJIA

----------------------------------------------------------------------------------------------------------------------

OLDER HOTLINE COMMENTS, Real-Time....

9/1/2011 DJI = 11484 NASDAQ S4 and DJI S9V. "We have sold and now would go

short bearish MINCP stocks."

8/25/2011 DJI = 11150 "Peerless Buys signals"

"Our Stocks' Hotline has today closed out our short sales and went long...

recent "Tahiti" stocks, CVX, CAT and IBM."

8/25 now 8/31's opening (when this is being written)

CVX 95.96 99.12

CAT 83.25 92.00

IBM 165.58 172.51

8/24/2011 "Buy DIA" (111.26)

----------------------------------------------------------------------------------------------------------------------

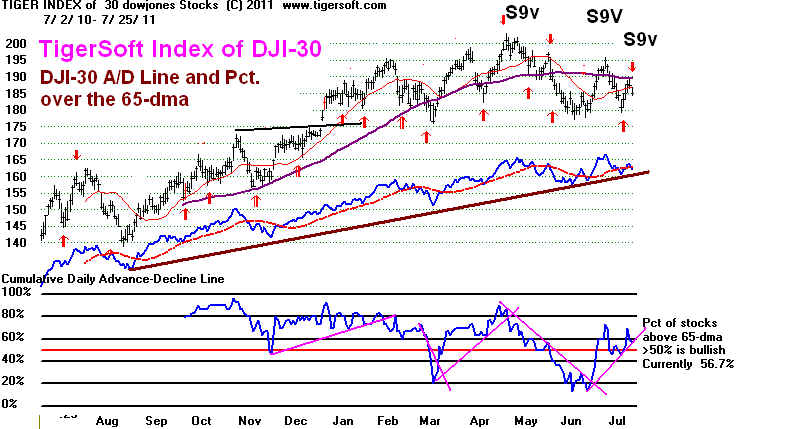

7/22/2011 "The Volume Fuel for An Extension of The Summer Rally is

Running Low... The research I have just done for the S9vs suggests

we are at or near a top, in which there is a 45% chance for a decline

below the lower band."

============================================  Tiger HOTLINE Subscribers do.

Tiger HOTLINE Subscribers do.

Sample HOTLINE Headlines

6/29/11 DJI

= 12261

BUY B17 Closing Powers are

rising, so I would just hold our long positions, including

SPY. Seasonality is bullish.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6/28/11 DJI

= 12189

BUY B17 Now The DJI Needs To

Get Past 12265. The bullish MAXCP stocks of the

last few days did well today... Our software

shows that the DJI has risen 58.7% of the

time over the ten trading days following 6/28 since

1965. And breadth was very good

today, as NYSE Advancers were 4x

Decliners.

----------------------------------------------------------------------------------------------------------------------------------------------------

6/27/11 DJI

= 12043

BUY B17 Today's

Rally Is Important, but The Rally Needs To Get Past 12265.

Short-term traders will want to use the weakness to buy or

play long the QQQ or SPY,

so long as the new Closing Power uptrends are left

generally in tact at the end of the day.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6/24/11 DJI

= 11934

BUY

B17 Next week will be important.

If the DJI can hold up without dropping much

below 10800, over the next week, the bullish seasonality of

early July will help the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6/23/11 DJI

= 12050

BUY

B17 but the test of support ...Is

Probably Not over.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6/22/11 DJI

= 12109.67

BUY

B17 still gives us hopes of the DJi

surpassing the resistance at 12300.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6/21/11 DJI

= 12190.01

BUY B17 The downtrends of the key ETFs' CLosing Power have been broken.

This and the Buy B17 should bring a recovery by the

DIA and SPY back to their (purple) 65-dma

and the resistance there, at a minimum.

------------------------------------------------------------------------------------------------------------------------------------------------------

6/20/11 DJI = 12080.38

BUY B17

The Closing Power downtrend for

the DIA has been penetrated.

The SPY's has slightly been violated,

too. With Peerless on a Buy and the DJI having

successfully tested the sweet spot

its rising 30-week (149-day) and 200-day ma, I think

it's time we buy DIA or SPY (see below) and

either some bullish

MAXCP stocks or biotechs

that have recently tested their 65-dma and had

their CLosing Power downtrends break.

-----------------------------------------------------------------------------------------------------------------------------------------------------

6/17/11 DJI

= 12004.36

BUY B17 Is Still Alive, but the SPY and QQQ continue to have trouble rallying.

We are not yet out of harm's way, as the

Closing Powers's downtrends are not yet broken.

-----------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINE

PREDICTIONS

Perhaps, our most famous predictions was the warning we

gave at the stock

market top just before the DJI fell 33% in 3 weeks.

That was on October 5th, 1987

when Our Peerless Stock Market

Timing Software issued the

famous

"Major Sell S9" that predicted the October 1987 Crash. That Top was

exactly pin-pointed. After a 33% decline, it was

followed by a record number

of consecutive Major Buy B9s in January 1988 with DJI just above

1900.

That soon proved to be an important long-term bottom.

That Have Been Very Profitably to Subscribers.

2005 From our Hotline:

August 1, 2005

"Housing Bubble Trouble" http://tigersoft.com/Housing%20Bubble/index.html

November 29, 2005

"Gold Is Gleaming. Silver is Shining!" http://tigersoft.com/silver_stocks/index.html

-----------------------------------------------------------------------------------------------------------------------------------------------------

2006 From our Hotline:

January 3, 2006

"Non-US Stock Markets Are Very Bullish" http://tigersoft.com/ETFs/index.html

February 2, 2006

"Hi-Ho, Away. Silver Just Broke $10/ounce" http://tigersoft.com/ETFs/index.html

February 6, 2006

"How To Make 40%/Yr. in Oil and Gas Stocks" http://tigersoft.com/7Paths/Oil_Gas%20Stks.htm

June 5, 2006

"Home Building Stocks Are Particularly Weak" http://www.tigersoft.com/What'sNew/index.html

---------------------------------------------------------------------------------------------------------------------------------------------------------

2007 From our Hotline:

March 10, 2007 "Insider Selling in Mortgage Lenders"

http://www.tigersoft.com/Housing%20Bubble/Second%20Leg%20Down.htm Extraordinarily right.

April 7, 2007

"Jobs Report Belied by Weakening Recruiting Firms' Stocks"

http://www.tigersoft.com/DL/recruiting.htm

June 19, 2007

"Years Ending in '7' Show Big Declines."

http://www.tigersoft.com/Tiger-Blogs/6-19-2007/index.htm

June 24, 2007

"Absolutely, The 1929 Crash Could Happen Again."

http://www.tigersoft.com/Tiger-Blogs/6-24-2007/index.html Sadly true.

June 28, 2007

"Housing Shows No Bottom in Sight." http://www.tigersoft.com/Tiger-Blogs/6-19-2007/index.htm

July 12, 2007 "US Dollar's Decline Is Getting Serious" http://www.tigersoft.com/Tiger-Blogs/6-19-2007/index.htm

The Dollar fell steeply to a bottom in March 2008.

August 3, 2007 "Widespread Insider Selling before The Bad News Comes Out." http://tigersoft.com/Tiger-Blogs/8-3-2007/index.htm

August 3, 2007 "Fed's Discount Rate Changes and Stock Prices: 1955-2007."

http://www.tigersoft.com/Tiger-Blogs/8-18-2003/index.htm

September 13, 2007 "The Coming Dollar Collapse, Gold and Interest Rates."

http://www.tigersoft.com/Tiger-Blogs/9-13-2007/index.htm

The Dollar fell steeply to a bottom in March 2008.

October 31, 2007 "The Untold Story behind The Run on The Dollar."

http://www.tigersoft.com/Tiger-Blogs/9-13-2007/index.htm

The Dollar fell 10% more, until March 2008.

November 6, 2007 "Lots of Stocks Look Like Good Short Sales." http://www.tigersoft.com/Tiger-Blogs/11-6-2007/index.htm

Certainly very true!

November 27, 2007 'The Chinese Bubble."

Tiger Index of 63 Chinese Stocks Show As Much Insider Selling as The DJI Did in 1929!

This was exactly right.

-------------------------------------------------------------------------------------------------------------------------------------------------------

2008 From our Hotline:

February 4, 2008 The Worst of All Worlds: Inflation and High Unemployment.

The Limits of Monetary Policy: Will The "Stagflation" of The 1970s Reappear?

Part III in Series on Monetarists versus The Keynesians

February 10, 2008 "As Silver Moves Past $17,

We Must Ask Is This The Start of An Exciting Third Wave Up"

All Aboard Silver. Next Stop $20.

February 22, 2008 "Food Commodities Are Going Hyperbolic"

Hyperbolic runs show excessive speculation.

March 1, 2008 The Biggest Theft in American History:

How The US Treasury Was Bankrupted by Bush's and Cheney' Buds at Halliburton.

Their Plan wa to leave no money left for needed social services or jobs' stimulation.

March 29, 2008 Bernanke Has Addicted Banks To Federal Reserve Hand-Outs.

Fed Policies Are Apt To Depress Housing Prices Much More.

Housing Prices and Hourly Wages have continued to decline as predicted here.

May 14, 2008 Spotting The Most Vulnerable Stocks

Is Washington Mutual the Next Bear Stearns or Northern Rock?

YES. It went bankrupt a few months later. The largest savings and loan in

US history to do so,

June 4, 2008 Far from Over, The Credit Crunch Is Worsening:

Use TigerSoft To Profitably Sell Short The Weakest Banks

July 13, 2008 Investing in A Perfect Financial Storm(1).

America Cannot Afford Its Empire or Its Military Industrial Complex

The History of US Bear Markets: 1915-2008: How To Trade Them.

Very useful, given how bear market did unfold.

July 15, 2008 Investing in A Perfect Financial Storm(2).

Socialism for The Friends of The Administration.

Certainly the $700 billion bailout proved socialism for Wall Street is alive and well in the US..

July 18, 2008 The SEC's Hand in The 2007-2008 Bear Market.

Why Do They Protect The Bear Raiders?

Unregulated Bear Raiders Have Made The Decline Much Worse.

September 8, 2008 Why Does Treasury Secretary Paulsen Look So Frightened?

The DJI subsequently fell from 11100 to 6500 in 4 months!

September 18, 2008 The CRASH and Greenspan's "De-Regulation" of Banking,

by Abolishing the Glass-Steagall Act of 1933, Has Led Directly to the 2007-2008 Bear Market.

Both Political Parties Are To Blame. Neither Admits This To Be The Central Malady.

At leastl, Greenspan now admits he was wrong.

--------------------------------------------------------------------------------------------------------------------------------------------------

2009 From our Hotline:

March 23, 2009 Obama's Biggest Wall Street Contributors Fleeced Shareholders

All The Way Down And Now Will Fleece Taxpayers All The Way Up.

March 25, 2009 Why Is The Stock

Market Rallying?

Obama Has

Signaled Wall Street That He Will Protect Them.

Right on the nose!..

April 19, 2009 Goldman's Huge Advantage:

Goldman Sachs Is

"The GREED CONNECTION" between Wall Street and Washington

Making US Financial Policies Pays Off Big for GS. Stock

rose from 140 to 195.

July 22, 2009 The 2009 Stealth Bull

Market

The Public Has Not Been Invited To The Party.

October 6, 2009 GOLD's

Breakout Past 1000/ounce into All-Time High Territory Invites Comparisons with 1970s.

--------------------------------------------------------------------------------------------------------------------------------

2010

From our Hotline:

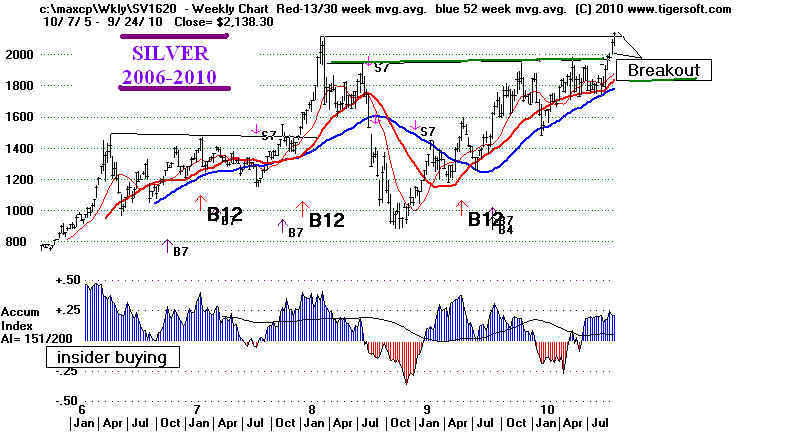

September 2010 - "Buy SILVER and SLV." ABOUT TO DOUBLE+!

September 2010 - "Bullish Technology Takeovers Abound...

Professionals are very bullish".

DJIA has rallied 20% since this.

November 2010 - "Very, very bullish seasonality for the Market Now."

December 2010 - Why The Market Keeps Rallying...

"Tax Cuts for Billionaires and Cuts in Social Security

Should Make Wall Street Even Happier in 2011."

"Shades of 1921-1929, 1983-2000"

"Learn how to think like a billionaire. Know what they are buying and selling

is the surest and safest way to make big money in stocks,

commodities and currencies." Use TigerSoft, Peerless and our Nightly Hotline.

Jan - April 2011 "Still on a Buy for Overall Market"

------------------------------------------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------------