(C) 2012 www.tigersoft.com All rights reserved.

(C) 2012 www.tigersoft.com All rights reserved.Author; William Schmidt, Ph.D, (Columbia Univ) TigerSoft PO Box 9491 San Diego, CA 92169 858-273-5900

EMAIL william_schmidt@hotmail.com About Us Unsolicited Testimonials

|

History Does Repeat. Track Record of Peerless Buys/Sells: 1928-1948 1948-2012

|

|

| DJI-30

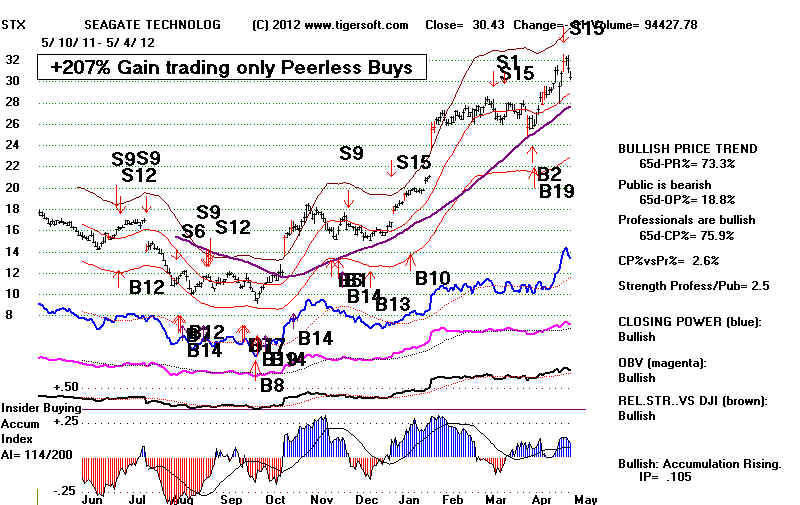

5/10/11- 5/4/12 35 Stocks and ETFs Stocks vary their performances when trading with Peerless Buys and Sells on the long side and the short side. The tables below show the results using the closings the day of the signals and assuming it costs $40 commissions and slippage to take and close out each position, starting with $10,000. Below in red are the best stocks to trade on the long side and also on the short side among highly liquid DJI-30 and NASDAQ-100 stocks and non-US ETFs. Of course, the past will not be the future, but this gives you an idea of the power of the automatic Peerless Buys and Sells. >> Send us your stocks' symbol and we'll tell you how well Peerless would have traded it. << Imagine making +50% trading just a stock on the short side when Peerless gives a reversing Sell Signal, i.e. shifts from a Buy signal to a Sell signal. That would have happened with AA for the last 12 months. Its weak internals, using Tiger's Power ranker, would have made it a prime candidate for shorting.  Past Success is more apt to repeat than not On a Peerless BUY, go long BA, CAT, DIS, HD On a Peerless SELL, go short AA, BAC, CAT WHAT HAPPENS TO $10,000 TRADING PEERLESS SIGNALS Symbol LONG SHORT -------------------------------------------------------------------------- AA 11991 17694 AXP 14023 11691 BA 15257 13992 BAC 14739 16609 CAT 15741 15307 CSCO 12966 10430 CVX 14453 13867 DD 14537 13972 DIA 13217 12279 DIS 17025 14537 GE 12965 12106 HD 16189 10824 HPQ 10482 14869 IBM 13536 11199 INTC 13299 10262 IWM 13672 13583 JNJ 10935 11106 JPM 15311 14042 KFT 11828 10511 KO 11637 10080 MCD 10943 9533 MDY 13662 13199 MMM 12882 13235 MRK 12292 10908 MSFT 13689 11314 PFE 12600 11192 PG 11013 10783 QQQ 12799 11082 SPY 13261 12427 T 12830 12033 TRV 12528 11063 UTX 13895 14405 VZ 12331 11210 WMT 12358 11054 XOM 13315 12487 |

|

|

On a Peerless BUY go long AKAM, CTXS, EXPE,FAST, FFIV, GRMN, ISRG, MAT, ORLY, ROST, STX, WCRX. On a Peerless SELL go short AKAM, CTXS, FLSR, FWLT, GMCR, PCAR, RIMM, SHLD WHAT HAPPENS TO $10,000 TRADING PEERLESS SIGNALS Symbol LONG SHORT -------------------------------------------------------------------------- AAPL 13924 8059 ADBE 13874 12505 ADP 12181 11656 ADSK 13484 12429 AKAM 17785 15533 ALTR 10395 13270 ALXN 13798 7046 AMAT 10790 11875 AMGN 12614 10167 AMZN 10858 9655 APOL 10309 12630 ATVI 12497 11578 BBBY 12039 10086 BIDU 11922 12000 BIIB 13803 10814 BMC 10678 13484 BRCM 10573 9885 CA 13692 11464 CELG 10593 8853 CERN 15509 11538 CHKP 10834 10973 CHRW 10853 13504 CMCSA 14821 12095 COST 12511 11845 CSCO 12952 10419 CTRP 7668 15582 CTSH 12093 12184 CTXS 17620 15273 DELL 11984 12111 DLTR 14988 9648 DTV 13671 13716 EA 11465 16498 EBAY 13799 11101 ESRX 14119 13197 EXPD 10426 12839 EXPE 16171 11166 FAST 15236 11942 FFIV 20613 14991 FISV 13771 12272 FLEX 12734 11634 FOSL 14410 11624 FSLR 3971 21162 FWLT 14967 17239 GILD 13654 10780 GMCR 6549 15621 GOLD 11363 10575 GOOG 11551 9642 GRMN 16439 11292 HSIC 12864 11916 IACI 13631 10374 INFY 10589 14400 INTC 13299 10262 INTU 14174 12207 ISRG 16964 10940 KLAC 13274 10427 LIFE 11551 12055 LINTA 13107 11536 LLTC 11843 11836 LRCX 11956 12167 MAT 15522 12511 MCHP 10596 11480 MNST 14343 8539 MRVL 10260 10071 MSFT 13689 11314 MU 10504 10938 MXIM 12402 11179 MYL 12703 13815 NFLX 5625 14841 NTAP 11023 14325 NUAN 13406 11451 NVDA 11425 14061 ORCL 10841 11915 ORLY 15531 9493 PAYX 11572 11534 PCAR 14125 15287 PRGO 11732 9928 QCOM 12878 11449 RIMM 9747 18325 ROST 15279 9488 SBUX 13944 9656 SHLD 15028 15089 SIAL 12108 12458 SIRI 10763 10252 SNDK 10089 10790 SPLS 13152 13220 SRCL 11760 11865 STX 29055 13378 SYMC 10414 12518 TEVA 11859 12109 URBN 13117 12653 VMED 10728 13067 VOD 11076 10549 VRSN 14092 11231 VRTX 6686 8433 WCRX 16581 16295 WFM 13336 9042 WYNN 11912 12888 XLNX 12907 12996 XRAY 13654 12752 PCLN 13435 8957

Imagine making +50% trading just a non-US ETF on the short side when Peerless

gives a reversing Sell Signal, i.e. shifts from an automatic Buy signal to a Sell signal.

There were a number of non-US ETFs that would have made you this much money,

As long as these countries' governments pursue AUSTERITY policies, expect

unemployment to rise and their stocks to fall. This is the clearest lesson a study of the

1930's will teach any economist who is not in the pay of rich right-wing moguls, like

the fascist Koch brothers, who now dominate many universities and "think"-tanks.

Please read what I have written on this.

May 24, 2010 Austerity is the new cool as Europe turns its back on Keynes

Aug 3, 2011 TigerSoft Blog - Keynes Revisited:

April 15, 2012 TigerSoft Blog - Ignoring Economic History and Keynesianism Put America in Great Peril.

TigerSoft News Service - 8/29/2011 and updated 4/15/2012

On a Peerless BUY go long TGA

On a Peerless SELL go short CEE, EWD, EWG, EWI, EWO, EWP, EWQ

FEZ, IEV, TRE

WHAT HAPPENS TO $10,000

TRADING PEERLESS SIGNALS

Symbol LONG SHORT

--------------------------------------------------------------------------

CAF 11160 13407

CEE 12568 15759

CH 10906 13046

CHN 9950 13200

ECH 12579 13317

EEM 13069 14178

EWA 13572 14455

EWC 12521 14061

EWD 14788 15859

EWG 14097 16081

EWH 12760 13014

EWI 13676 18947

EWJ 10741 11739

EWK 12596 14375

EWL 12242 13015

EWM 11790 12097

EWO 13049 17038

EWP 10634 16528

EWQ 13728 16941

EWS 11906 12284

EWT 11225 12718

EWU 13473 13578

EWW 13496 13197

EWY 14692 15196

EWZ 12922 14912

FEZ 13804 17336

FXI 12997 14010

GCH 12269 13074

GF 12892 14746

GMF 11998 13376

GRR 8992 12788

GXC 13006 13888

HAO 12886 15332

IDX 11551 11884

IEV 13601 15241

IF 11285 10929

IFN 9572 13496

IIF 10132 13756

ILF 13059 14219

INP 10204 13369

ITF 11238 12203

IXN 13052 11653

IXP 11952 12524

JEQ 10782 11926

JFC 12272 13763

JOF 11306 11733

KEF 10093 14519

MXF 11564 12913

PGJ 11949 13961

RSX 14812 18161

SGF 12364 13367

TF 13945 11039

TGA 18217 14021

TRF 13036 16512

TWN 11279 12914

VGK 12635 14718

VPL 11458 12535

VWO 12805 14116