|

Navajo Silver Jewelry on Ebay

========================================================

Previous

TigerSoft Blogs on Silver:

This is not the first recommendation made here of Silver and SSRI.

Here are the earlier mentions of SSRI.

November

2, 2007 Silver

Stocks: A New Run Is Starting

October 28, 2007 Evaluating Breakouts:

Case Study: The Silver Stock SSRI SSRI was $39.

September 19, 2007 Gold Breaks out with

Power as Fed Cuts Interest Rates by 1/2%

June 26, 2007 Silver Is Starting To

Tarnish. SSRI slipped to $26 a month later.

May 18, 2006 Calling A Bottom Using The

Diagonal Lines Command with SSRI. SSRI was $19.

February 2, 2006 "Hi-Ho,

Silver"...>$10/ounce SIL SSRI was $20.

November 29, 2005 Silver Stocks Are Shining

SSRI was $17.

=======================================================

Silver Breaches $17. "All Aboard. Next Stop

$20."

Will It Again Surge 600%, As In 1979-1980

Silver Is Starting to Outperform

Gold....Silver Stocks To Trade.

In the period September 1978-1980 when Silver made its record advance from $5/ounce to a

high

of $48/ounce there were three violent

declines in the stock market. In the Fall

of 1978, the DJI swooned

14% in less than three weeks. In the Fall of 1979, the DJI fell 12% in two weeks.

And in early 1980

the DJI sank 18% in 3 weeks. The steep

rise of silver should make us very nervous about the market.

It shows that it is a very good time to

use the lessons on Peerless Stock market Timing.

But also view it

as a great trading opportunity when we

understand the forces at work that are making Silver rise now.

Will Silver Now Rocket Upwards as It Did 1979-1980? The boom in 1979 and

January 1980

saw silver rise from $6 to $48. Wouldn't

that be nice to see again? In truth, I think it's more likely we are

years away from such an extreme advance.

But it's coming. Silver started going up in 1967 when the US

stopped making 90% silver coins. In 1968

they made 50% silver dimes, quarters and half-dollars.

After that, silver was no longer used. It

took 13 years of a long advance before silver's final climax upwards

from $6 to $48, between November 1979 and

January 1980. The Hunt brothers tried to corner the

silver market in 1980, but created so much

hardship for professional shorts that the commodities'

exchanges limited how many contracts

individuals could buy. Record silver prices brought in a

large supply of silver coins and jewelry for

melting. It also encouraged industry to look for

substitutes. When digital photography

took over, silver was dealt a heavy blow. Eastman Kodak had for

years been the biggest purchaser of silver.

Interestingly, mine production changed very little

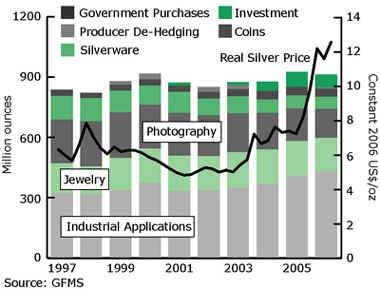

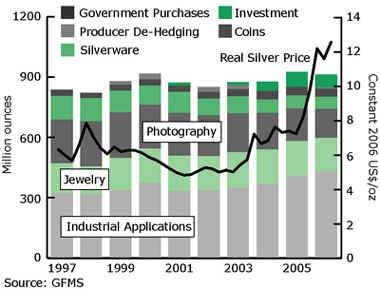

because of the higher prices. Once again, we see surging demand for Silver from industrial sources

and little increase in the supply from new

mines.

The yearly new supply of silver from

mines has not increased much more than 5% since 2000.

There just in not

enough silver. Industrial demand has risen steadily: The trade organization

for Silver

at www.silverinstitute.com is most interesting.

| Demand

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

| Industrial Applications |

319.5 |

313.2 |

336.1 |

371.3 |

332.4 |

336.5 |

346.8 |

364.2 |

405.8 |

430.0 |

| Photography |

217.4 |

225.4 |

227.9 |

218.3 |

213.1 |

204.3 |

192.9 |

181.0 |

162.1 |

145.8 |

| Jewelry |

150.6 |

140.6 |

159.8 |

170.6 |

174.3 |

168.9 |

179.2 |

174.8 |

173.8 |

165.8 |

| Silverware |

117.7 |

114.2 |

108.6 |

95.6 |

105.2 |

82.6 |

83.0 |

66.2 |

66.6 |

59.1 |

| Coins & Medals |

30.4 |

27.8 |

29.1 |

32.1 |

30.5 |

31.6 |

35.6 |

42.4 |

40.0 |

39.8 |

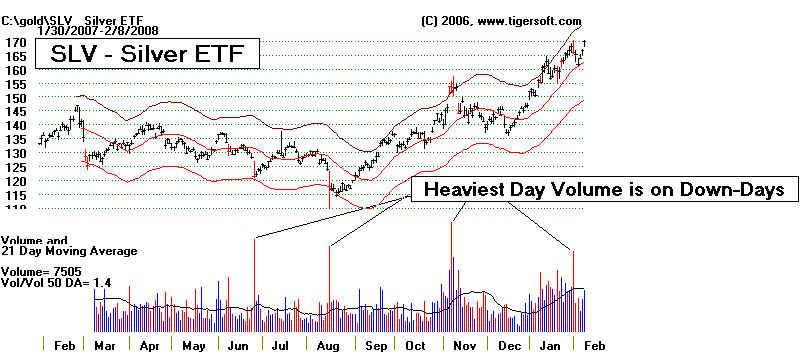

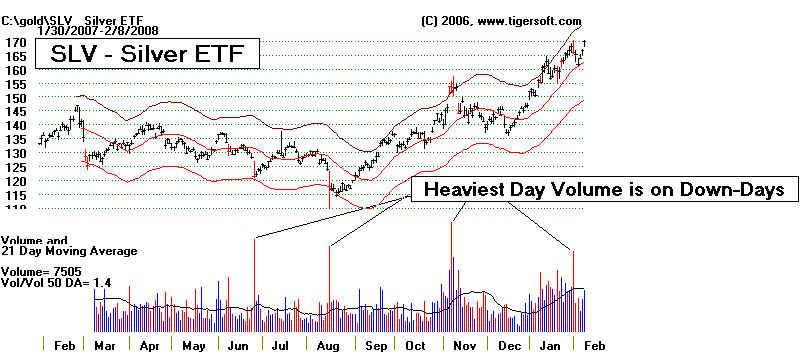

The four highest trading volume days for the last year have

been Down-Days. I take

this as a sign that there may be a very big seller. It could be a government.

We don't

have statistics on government sales of Silver. Last year Spain was the biggest

government

seller of Gold.

World Silver

Supply

(in millions of ounces) |

|

|

|

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

| Supply |

|

|

|

|

|

|

|

|

|

|

| Mine Production |

520.0 |

542.1 |

556.8 |

590.9 |

606.2 |

593.8 |

600.7 |

622.2 |

645.7 |

646.1 |

| Net Government Sales |

-- |

33.5 |

97.2 |

60.3 |

63.0 |

59.2 |

88.7 |

61.9 |

65.9 |

77.7 |

| Old Silver Scrap |

169.3 |

193.9 |

181.6 |

180.7 |

182.7 |

187.5 |

184.0 |

181.5 |

186.4 |

188.0 |

| Producer Hedging |

68.1 |

6.5 |

-- |

-- |

18.9 |

-- |

-- |

9.6 |

27.6 |

-- |

| Implied Net Disinvestment |

78.9 |

45.2 |

42.0 |

83.5 |

-- |

8.3 |

-- |

-- |

-- |

-- |

| Total Supply |

836.3 |

821.2 |

877.5 |

915.4 |

870.8 |

848.7 |

873.4 |

875.2 |

925.6 |

911.8 |

|

World Silver Demand

http://www.silverinstitute.org/supply/index.php |

World Silver Supply Sources:

| Supply from Above-Ground

Stocks |

| (Million ounces) |

2005 |

2006 |

| Bullion |

|

|

| Implied Net Disinvestment |

-77.2 |

-64.5 |

| Producer Hedging |

27.6 |

-6.8 |

| Net

Government Sales |

65.9 |

77.7 |

| Sub-total Bullion |

16.3 |

6.4 |

| Old Silver Scrap |

186.4 |

188.0 |

| Total |

202.7 |

194.4 |

|

In the chart below, you can see the three waves upward after 1967 until 1980.

Compared to

the 13 years rise between 1967 and 1980, we are

only in the forth year, if we take the beginning of

the current rally to be the beginning of 2003

when prices broke above their long base between $3 and $5.

I would say we are

on the third wave of a recovery now. That means

exciting gains lie just ahead.

Look at the chart below and see if you agree.

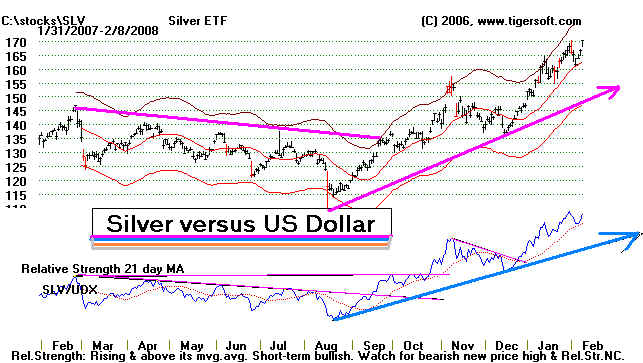

Silver is

used primarily as an industrial metal. But it also has found many buyers who

consider it,

like gold and platinum, a very good hedge against the declining dollar,

which has fallen 24% since early 2003.

Someone buying silver in 2003 would have almost

tripled their money, easily beating the rate of

inflation. In 2003-dollars a $1000

invested in silver would now be worth $2194.

The Dollar's weakness has been accelerated by the recent dramatic cuts in the

Discount rate.

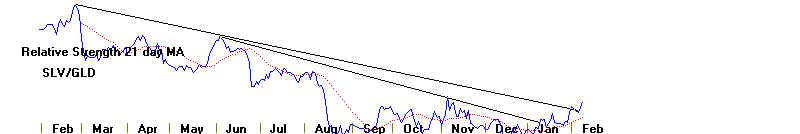

I think it is a sign of how strong Silver is

now that it has just made a new high above $17.00,

despite the gathering weakness of the world's

economies. And as you can see below, the

Silver/Gold Relative

Strength Line has just broken above its year-long downtrend.

"According to The

Silver Institute, total industrial demand exceeded 50% of total global fabrication

demand for the first time in 2006. Supply

from the top silver mining countries like Peru, Mexico, China,

Australia, and Chile dropped 10% at

primary mines. Silver prices have risen almost 70% over the past

two years and could rise even

higher."

( http://www.fool.com/investing/general/2008/01/29/top-rated-stocks-leaders-loathe.aspx

)

-----------------------------------------------------------------------------------------------------------------------------------------

SILVER and GOLD as Inflation Hedges.

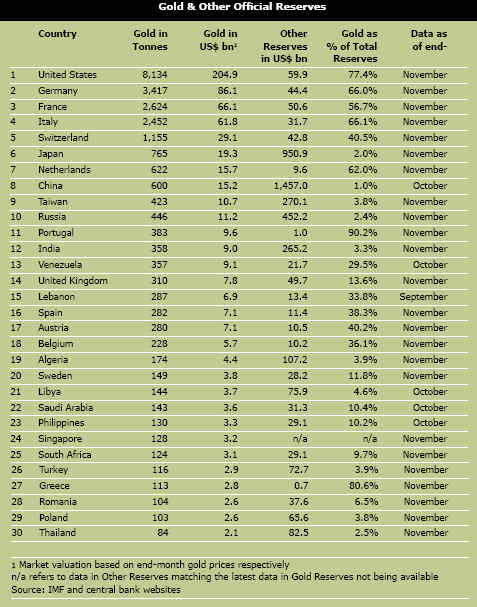

Gold historically trades 15 to 20 times the price of silver. So as Gold goes up, so

will silver.

Silver has outstripped Gold since

2003, but gold stocks have recently risen more than silver stocks.

I think this is because investors

historically have rushed to buy Gold stocks when they feared inflation and

a weak Dollar. Silver stocks

seem relative under-priced. If silver keeps rising as fast as I

expect, silver stocks will

certainly play catch-up.

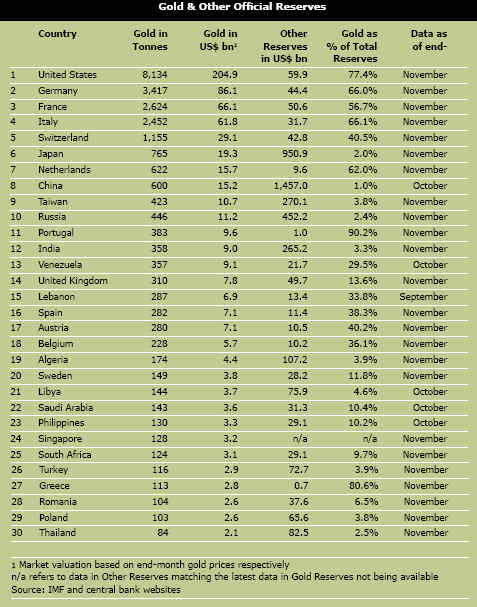

Gold bugs have long urged investors to see the hand-writing on the wall, as it were. Here is

a sample I read this week-end:

"The well-documented financial issues in the U.S., keeper of the

world’s reserve currency ...

almost guarantee an ever-more rapid

debasement of that currency. The combination of a

sinking economy and crippling

levels of debt ensure that the injection of truly excess liquidity

lies ahead. For those who doubt me,

contemplate the existence of $43 trillion in notional value

of credit default swaps

(CDS’s)... This alone should be enough to put the fear of God in any

thoughtful person. Moreover, there

is little doubt in my mind that the dollar’s demise will drag

every other fiat currency in the

world down with it. We see evidence every day that the other

countries can’t tolerate their

currencies rising sharply against the U.S. dollar due to competitive

pressures, and thus they are forced

to devalue their currencies to cushion the U.S. dollar’s

inevitable fall.... (Y)ou ain’t seen nothing yet."

He goes on to argue that Gold and Silver ETFs are the means by which central banks

hold back the rise of these metals,

claiming that "Western central banks are rapidly

running out of gold to fill the

widening gap between burgeoning demand and falling

mine supply...There are numerous central banks in the Far East and Middle East as

well as the Russian central bank

that are awash in U.S. dollars. To date they have been

content to maintain the status quo

by holding onto these dollars. However, the unending

flow of U.S. dollars as the result

of the U.S.’s continuing massive current account deficit

is leading to unrest. It is

becoming apparent that a number of these countries have reached a

saturation point on the greenback.

As a result, some of the central banks are already

clandestinely buying gold," (John Embry Speech to Cambridge

House Conference January 2008 Vancouver, B.C.)

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

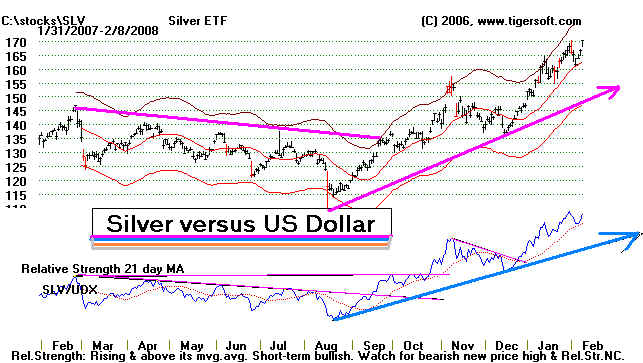

Silver's chart is shown below. A TigerSoft chart

(not below) shows that Silver

started out-performing

the DJI in early August when it moved above its 50-day ma with a strong,

positive confirmation by the Tiger Accumulation

Index. This system is the one we recommend

generally for commodities. See the

discussion of using TigerSoft

charts with food commodities.

TigerSoft also gives you some helpful

statistics on the typical behavior of SLV for the different

trading days of the week:

Days of the Week and Silver Price Behavior

Probability of Probability of

Probability of

an Rise. A Higher

Opening A Higher Opening

than Previous Close

----------------- --------------------------

---------------------------

Monday 53.0%

57.1%

51.0%

Tuesday 47.0%

51.9%

43.1%

Wednesday 56.6%

60.3%

45.2%

Thursday 60.3%

56.6%

52.8%

Friday 66.0%

73.5%

48.4%

Tuesday is

the only day of the week that Silver shows a tendency to retreat. In general,

buying

on weakness on Tuesday's

opening or at Wednesday's close is recommended.

Don't be afraid to buy Silver on weakness. After 3 straight down days, the chance

of it falling

a fourth day is very limited

if the last year is taken as a basis for estimating "streaking probabilities",

another unique TigerSoft

concept. Regularly higher openings (overseas' demand) for Silver

since August has been a major

factor in the rise. As said earlier, I take its relative strength breakout

when compared to Gold to be

very significant.

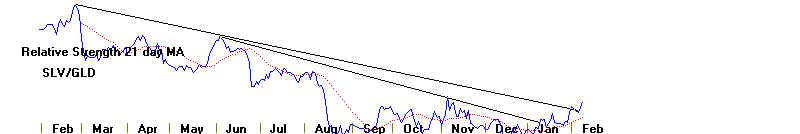

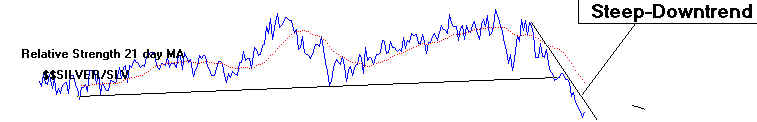

SLV/GLD (Silver versus Gold) RELATIVE STRENGTH

Silver

is now outperforming Gold. That is the messge in the trend-break below.

This

may partly be a result of an announcement this past week that the International

Monetary

Fund and the Group of Seven rish nations plan to sell Gold. The Fund holds

103.4

million ounces of gold worth some $92 billion at current market prices. That is up

from

$23 billion just five years ago. Before the US can sell, Congressional approval

will

be required. ( http://in.reuters.com/article/businessNews/idINIndia-31847320080209?sp=t...

)

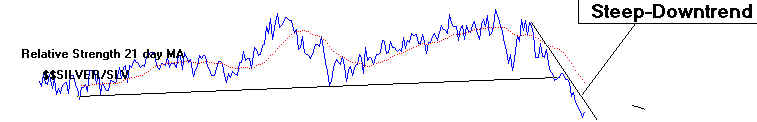

Silver Stocks see to be stuck in trading ranges. It seems as long as silver keeps

rising the stocks will have nice trading bounces. But taken as a group, Silver Stocks

are seriously under-performing Silver. We can build a

TigerSoft index chart for the

leading Silver producers: PAAS, SSRI, HL, CDE, SIL and SLW.

------------------------------------ Tiger Index of

Chart of Silver Stocks

--------------------------------

Silver Stocks - Relative Strength versus Silver

Silver

Stocks: Weekly Charts

The number of silver stocks we can buy in the US is quite limited. Rising mining

costs

are taking a bite out of profits.

The stocks have been weaker the SLV, the ETF for silver. This is

also explained by investor fears

that there will be another leg down for the overall market.

The top two, PAAS and SSRI, are

discussed below. Weekly charts of the others are shown, too.

.

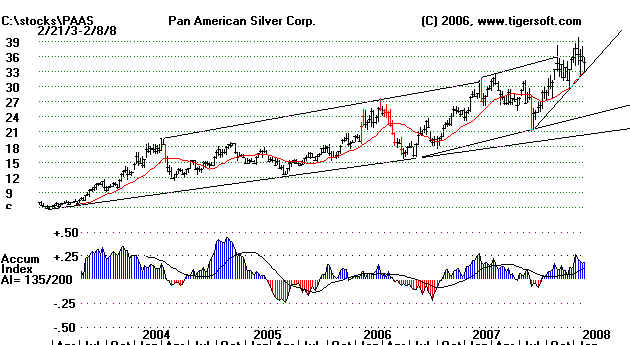

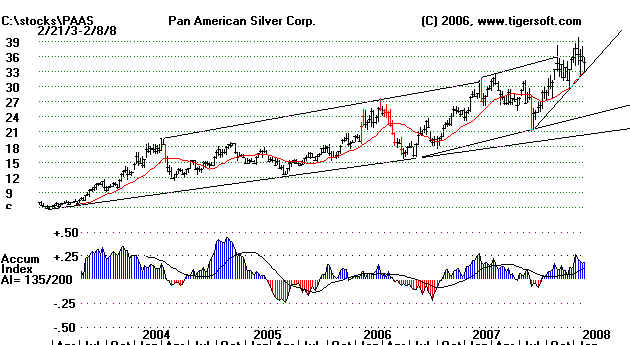

---------------------------------- PAAS --------------------------------------------------------------------------------------------

Pan American Silver Corp. 625 Howe Street Suite 1500 Vancouver,

BC V6C 2T6 Canada

Phone: 604-684-1175

Web Site: http://www.panamericansilver.com

Pan American Silver Corp.

engages in the exploration,

acquisition, development, and operation of silver properties. It also focuses

on copper, zinc, lead, and

gold minerals. The company has mining operations in Mexico, Peru, Argentina,

and Bolivia; and has

non-producing silver resources in the United States and Argentina. It owns and operates

the Quiruvilca silver mine,

the Huaron silver mine, and the Morococha silver mine in Peru; La Colorada Mine,

Mexico; and San Vicente,

Bolivia. Pan American's development projects include the Alamo Dorado silver project

in Mexico and Manantial

Espejo in Argentina. The company was founded in 1979 and is headquartered in

Vancouver, Canada. ( http://finance.yahoo.com/q/pr?s=PAAS )

The TigerSoft chart of PAAS shows it is

still on a Red Sell. That optimum system for the last year has

gained +137% long and

short, according to the Red arrows. Not shown, it is on a short-term buy from

a trading system that

has gained 46% for the last year using only the long-side and the openings the day

after the signal to

trade the stock. Aggressive buying is weakening noticeably. But the stock

found support

at its rising

uptrendline. The "strong" buyers in the stock are patient and trade the

pull-backs to the rising

uptrtendline.

Until that is violated, this stock in definitely favored.

1/25/2008 - "Pan

American Silver Corp. (PAAS) announced much higher costs than

anticipated when it

reported fourth quarter

results Wednesday, prompting Blackmont analyst Richard Gray to reduce his price

target on the stock. Mr. Gray called Pan American's average cash costs of C$4.54 per

ounce for the

quarter

"disappointing" when compared with his estimate of C$2.37 per ounce."

( http://seekingalpha.com/article/61601-pan-american-posts-disappointing-q4-results?source=yahoo

)

The following quote comes

from the "Motley Fools":

http://www.fool.com/investing/general/2008/01/28/hi-ho-silver.aspx

"While I'm not sure I find much value in being the biggest primary silver miner,

that's the goal

of Pan

American Silver (Nasdaq: PAAS). The company started out much

like Silver Standard Resources

(Nasdaq: SSRI), buying up uneconomic silver

deposits in the '90s. The key difference is that Pan American

chose to move

much more rapidly into production. Silver Standard, which I've written about previously,

is still

largely a call

option on the price of its ounces in the ground. Pan American is instead playing the

production growth

game. We

got an operational update last week, when the company reported its fourth-quarter results.

On the

upside, Pan

American slightly exceeded its annual production target of 17 million ounces. Any

celebration

on that front has

to be tempered by the fact that in its 2003 Annual Report, the company was projecting 20

million ounces of

production by 2006. Production guidance is as much art as science, particularly when

operating

outside of North

America. Permitting delays are par for the course, and it's the rare mining company that

fails to

overpromise on

production at some point. Pan American has and will continue to ramp up silver

output at an

impressive rate. The

more acute issue is -- you guessed it -- cost inflation. In the previous quarter, the

firm's cash

costs came in above

expectations because of equipment failure. There were maintenance issues this time around,

as well. Issues like

currency appreciation, tight labor markets, and falling by-product prices don't leave a

whole

lot of room for

production gaffes. That's not to say the company is careless with its cash,

however. While chairman

Ross Beaty has had a

remarkable string of successes with smaller Canadian-listed companies, Pan American is his

baby. Beaty retains a

significant stake -- only the investment funds of Royce & Associates and Bill Gates

hold

larger positions. I've

read interviews with Beaty, and he strikes me as extremely entrepreneurial, ethical, and

shareholder-friendly.

To cherry-pick but one Buffett-esque quote: "I just love creating wealth for

shareholders

through building

resource companies from the ground up. It's what gets me out of bed in the morning.

If I ever cast

my lot with a silver

producer, Pan American would most likely be the one."

-------------------- Weekly

PAAS Chart -------------------------------------------------------------------

--------------------------- SSRI ------------------------------------------------------------------------------------------

Silver

Standard Resources Inc. 999 West Hastings Street Suite 1180 Vancouver, BC V6C 2W2

Canada

Phone: 604-689-3846

Web Site: http://www.silver-standard.com

Silver Standard Resources, Inc. engages in the

acquisition, exploration, and

development of silver mineral properties in Argentina, Australia, Canada, Chile, Mexico,

Peru, and the United States.

It owns a 100% interest in the Diablillos silver-gold project located in the province of

Salta in north-western Argentina;

the Pirquitas silver property located in the province of Jujuy in northern Argentina;

the Bowdens project located in New

South Wales, Australia; the Silvertip, Snowfield, and Sulphurets projects located

in British Columbia, Canada; the

Sunrise Lake deposit located in Northwest Territories, Canada; and the Challacollo

silver project located in northern

Chile. The company also holds a 100% interest in the Pitarrilla property located in the

Durango and the San Marcial silver

property located in Sinola in Canada; the Berenguela property located in the province

of Lampa in southern Peru; the

Candelaria silver mine in Nevada; and the Shafter silver mine located in Presidio County,

Texas. It has an option to acquire

a 100% interest in the Veta Colorada silver property located in the state of Chihuahua,

Mexico. In addition, Silver

Standard Resources holds a 55% joint venture interest for the exploration of the San Luis

property located in the Ancash

Department, Peru. Further, the company has an exploration and development agreement

with Vista Gold Corp. to explore

silver resources hosted in the Maverick Springs gold-silver property in northern Nevada.

It has a strategic alliance with

Minco Silver Corporation to pursue silver opportunities in the People's Republic of China;

and an agreement with Esperanza Silver

Corporation for the exploration of silver projects in Peru. The company was

incorporated in 1946 and is headquartered

in Vancouver, Canada.

SSRI's chart shows a "false breakout" over 40. That poses considerable

resistance. It is in the bottom

of its trading range. It is on a

Red Buy fromt he top TigerSoft system, which has gained 116.4% for the past year.

buying on the red up arrows and selling

short on the red down-arrows. Aggressive buying has been weaking.

But the red distribution indicator did

not confirm the recent decline. That is a bullish sign, as is the upside breakout

in SSRI's relative strength

down-trendline.

Rising costs of production reduce SSRI's mine's profits. 2007 start up costs at

their new Argentine mine

rose 50% over what they estimated a year

ago. Other mining companies are facing similar cost increases.

-------------------- Weekly SSRI Chart

-------------------------------------------------------------------

----------------------- SLW Silver

Wheaton (Not Exploration) ) ----------------------------------

Silver Wheaton (SLW, Toronto) neither mines nor explores for silver

but acquires the silver revenue

stream from other

mining companies. It does this by making an up-front investment and a clearly defined cost

per

ounce. It

has modest risk, but positive upside should the silver price appreciate.

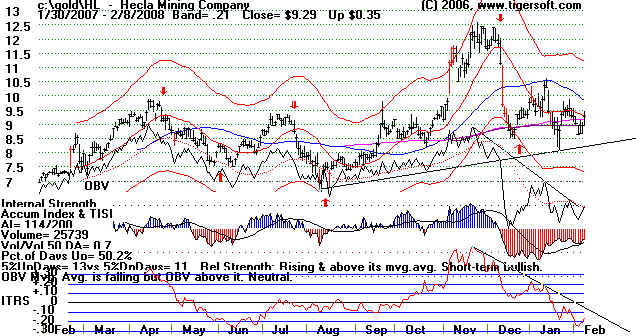

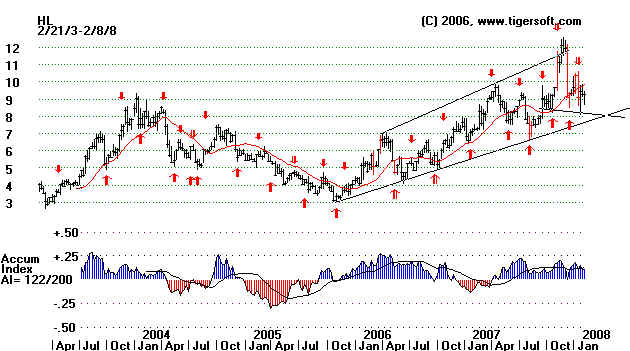

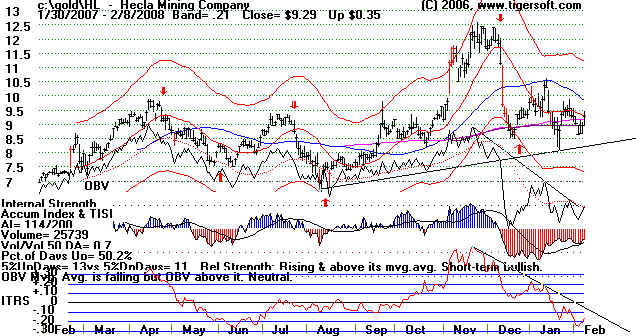

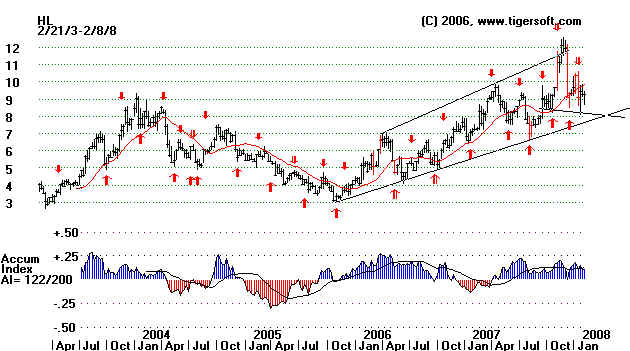

--------- ---------------- HL - Hecla Mines

-------------------------------------------------

Hecla - Daily

Hecla Weekly

----------------------- CDE

-----------------------------------------------------------------------------------------------

------------------------------- Weekly SIL Apex Silver Mines

---------------------------------------------------------------------

======================== CHARTS IN SUPPORT OF BLOG ===========================

====================== US

DOLLAR: 1999-2008. ============================

==--- US STOPPED USING SILVE RIN COINAGE IN 1968. =================

.

================= SILVER: 1964-2008 ====================================================

.

|