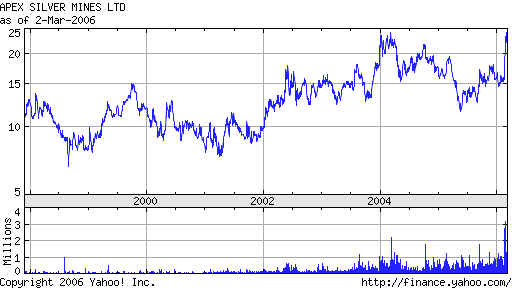

Apex Silver Mines Limited (AMEX: SIL)

Apex Silver Mines's San Cristobal mine in southern Bolivia is a 470,000-acre concession that holds an estimated

450 million ounces of silver, as well as tons of zinc and lead, making it one of the largest open pit deposits of its

kind in the world. While site development continues, construction of the project is expected to be finished by late

2006 and production will begin in 2007. Apex Silver owns several other properties in Bolivia, Mexico, and Peru,

where it continues to explore for other resources.

Here's why silver is going up:

By Myra P. Saefong, MarketWatch

Last Update: 4:34 PM ET Mar 2, 2006

SAN FRANCISCO (MarketWatch) -- Silver futures closed above $10 an ounce Thursday, at the highest level

in more than two decades, with traders upbeat about the prospects for a silver exchange-traded fund.

At the same time, gold futures touched a one-month high above $570 an ounce to mark a third-straight

session of gains, as concerns about global unrest lifted oil to a high above $63 a barrel -- supporting investment

in gold as a safe-haven asset.

May silver climbed as high as $10.235 an ounce on the New York Mercantile Exchange. Futures prices haven't

traded at levels this high since at least 1984. The contract closed up 41.8 cents, or 4.3%, at $10.208.

"I believe the proposed silver ETF can be the biggest thing for silver since the Hunt brothers," said

Peter Grandich, editor of the Grandich Letter, referring to the duo that tried to corner the silver market,

and pushed silver to $50 an ounce around 1980. The Securities and Exchange Commission recently closed

its 21-day public-comment period on the iShares Silver Trust, a silver-backed security from Barclays

Global Investors. The iShares are expected to be traded under the symbol "SLV" on the American Stock Exchange.

"Unless there's a sticking point, it could be approved in the next few weeks," said Grandich.

But Reuters reported Tuesday, citing sources close to the matter, that no immediate decision was expected

from the SEC as the review process continues. Still, "the 130 million ounces of silver needed for the launch

of securitized silver are not going to be easy to come by, nor will they leave much available for investors who

have been just starting to chase after the white metal as soon as gold reached new highs," said Jon Nadler,

an investment products analyst at bullion dealers Kitco.com.