Tiger Software - Bill's Blog

11/2/2007 -- SILVER

STOCKS' TAKEOFF --

Tiger Software - Bill's Blog

11/2/2007 -- SILVER

STOCKS' TAKEOFF -- |

Daily

Blog - Tiger Software SILVER STOCKS: A NEW RUN IS STARTING Anyone Remember 1980 when Silver hit $50/ounce. SSRI IS OUR #1 BUY IN GROUP. Updated 11/6/2007 ======================================= |

This is not the first recommendation made

here of Silver and SSRI. Here are the earlier mentions of SSRI.

October 28, 2007 Evaluating Breakouts:

Case Study: The Silver Stock SSRI SSRI

was $39.

September 19, 2007 Gold Breaks out with Power as Fed Cuts Interest Rates by

1/2%

June 26, 2007

Silver Is Starting To

Tarnish. SSRI slipped to $26 a month later.

May 18, 2006 Calling A Bottom Using The Diagonal Lines Command

with SSRI. SSRI was $19.

February 2, 2006 -

"Hi-Ho,

Silver"...>$10/ounce SIL SSRI was $20.

November 29, 2005 - Silver Stocks Are Shining

SSRI was $17.

---------------------------------------------------------------------------------------------------------------------------------------------------

Friday AM - SPOT

SILVER IS NOW OVER $14.50

---------------------------- http://www.kitco.com/charts/livesilver.html

--------------------------------------------

---------------------------------------------------------------------------------------------------------------------------------------------------

11/2/2007

SILVER STOCKS - A NEW RUN IS STARTING

Anyone Remember 1980 when Silver hit $40/ounce.

BUY MORE SSRI

Silver is approaching a price breakout from a bullish flat topped, ascending triangle pattern.

Surpassing 15 will likely start another vertical ascent. See the chart just below.

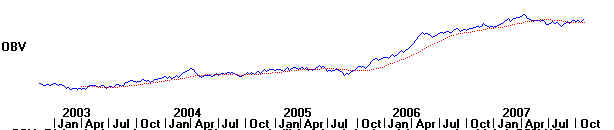

You can see how it quickly advanced when it broke out over $8.00 two years ago. The OBV

Line is rising, which shows ample aggressive buying. Our Tiger Accumulation Index shows

lots of blue "big money" buying on weakness. This means Silver is reasonably tightly held.

A breakout should yield much higher prices. Back in 1979, a similar breakout led to an

explosion of prices and $40/ounce silver for a few days.

100% of the rise in Silver since 2003 has come in the 4 months following a price breakout.

The rest of the time Silver is biding its time, backing and filling.

Gold has been capturing the headlines. But Silver often plays catch up when Gold has been

booming. At TigerSoft we watch a relative strength line which compares Silver to Gold bullion.

That ratio has been downtrending, but a burst of Silver would bullishly break the downtrend

line. Our TigerSoft red Buys and Sells have garnered a gain of more than 85% in this trading

range for Silver. But just as the XAU (Gold Stocks) broke above a year-long trading range

a month ago and then took off, I think Silver will soon breakout and advance very quickly. The signals

that worked for a trading range will cease to be effective. A Buy and Hold approach will then work well.

Seasonal studies show that Silver should be able to rally for at least two more months.

SSRI IS MY FAVORITE SILVER STOCK

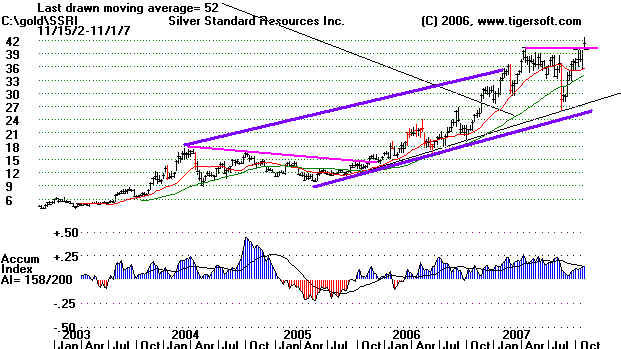

Silver Standards Resources, SSRI, has already broken out above a 6 month long resistance

at $40. It had a steep advance up from $20 to $40 before entering this trading range. I would think

another $20 point rally is quite possible. That would mean a move to $60. Of course, if there is

a rush into silver, SSRI will become a "glamour stock" and will move much higher. I have also

recommended GLD (Gold Bullion), ABX, GOLD, the Canadian gold stock RIC, at 2.94

and the Canadian Dollar.

The weekly chart of SSRI goes back 5 years. It proves the stock makes reliable breakouts. And

it shows the rise is accelerating.

================== SILVER FUNDAMENTALS ================================

Silver is a consumable industrial commodity.

It's used in computers, cells phones, and electrical relays. This means that as

countries like China, India, and Vietnam, and regions like Eastern Europe, become more

modernized, the demand for silver will increase.

Silver is also applied in medicine. One little-known use is as a bactericide, a role silver has filled throughout history. Today, medical devices such as catheters and stethoscopes use silver, and every hospital in the western world uses silver sulfadiazine to prevent infections.

• Silver is scarcer than gold.

Gold is hoarded. It's estimated that 95 percent of all gold ever mined is still around.

The exact opposite is true of silver: An estimated 95 percent of all silver ever mined has

been consumed.

Forty-five percent of all silver mined is burned up in industrial uses. Jewelry

accounts for 28 percent, and 20 percent has been consumed in photography. Only 5 percent

is in coins.

• Silver supplies are down.

In 1900, it was estimated that the world had 12 billion ounces of silver. By 1990 it

had dropped to 2.2 billion ounces. By 2007, the supply was down to 300 million ounces.

Some of the more pessimistic forecasts estimate that the world will be out of silver in about 10 years. This could be catastrophic to the world economy. In 10 years, silver might have as much of an impact on the world economy as $200-a-barrel oil.

(Source: http://finance.yahoo.com/expert/article/richricher/42433

)

============================== FUNDAMENTALS OF SSRI

--------------------------------------------

You will want to find more out about the stock's

fundamentals. Here is a little of what Yahoo

reports. Google's Financial section should also be

used.

Silver Standard Resources Inc.

999 West Hastings Street

Suite 1180

Vancouver, BC V6C 2W2

Canada - Map

Phone: 604-689-3846

Fax: 604-689-3847

Web Site: http://www.silver-standard.com

Silver Standard Resources, Inc. engages in the acquisition, exploration, and development

of silver mineral properties in Argentina, Australia, Canada, Chile, Mexico, Peru, and the

United States. It owns a 100% interest in the Diablillos silver-gold project located in

the province of Salta in north-western Argentina; the Pirquitas silver property located in

the province of Jujuy in northern Argentina; the Bowdens project located in New South

Wales, Australia; the Silvertip, Snowfield, and Sulphurets projects located in British

Columbia, Canada; the Sunrise Lake deposit located in Northwest Territories, Canada; and

the Challacollo silver project located in northern Chile. The company also holds a 100%

interest in the Pitarrilla property located in the Durango and the San Marcial silver

property located in Sinola in Canada; the Berenguela property located in the province of

Lampa in southern Peru; the Candelaria silver mine in Nevada; and the Shafter silver mine

located in Presidio County, Texas. It has an option to acquire a 100% interest in the Veta

Colorada silver property located in the state of Chihuahua, Mexico. In addition, Silver

Standard Resources holds a 55% joint venture interest for the exploration of the San Luis

property located in the Ancash Department, Peru. Further, the company has an exploration

and development agreement with Vista Gold Corp. to explore silver resources hosted in the

Maverick Springs gold-silver property in northern Nevada. It has a strategic alliance with

Minco Silver Corporation to pursue silver opportunities in the People's Republic of China;

and an agreement with Esperanza Silver Corporation for the exploration of silver projects

in Peru. The company was incorporated in 1946 and is headquartered in Vancouver, Canada.

================================= SSRI CEO OUTLOOK =======================================

Outlook on Silver and Silver Stocks with Robert A. Quartermain of Silver

Standard Resources

http://www.miningsectorstocks.com/Articles/092107a.asp

What is your outlook on silver?

In regards to my outlook on silver I think it continues to remain good. Key drivers in the silver market are its uses in electrical and industrial applications. For the first time ever last year, more than 50% of silver consumption on a global basis was in electronics and industrial applications which meant that there was less consumption in its more conventional uses such as silverware, jewellery and photography. One of the driving forces of that is the use of silver as a catalyst and as a result of having this quality, it is used in the oil & gas industry, it is used to produce plastics and also in many high temperature applications. As well, if you apply a current to silver it doesn't spar k and as a result of this it is used in a lot of small electrical connections such as those used in palm pilots and things of that nature where the solder incorporates silver. As a matter of fact in July of 2007, the European Union banned the use of lead in solders and some of the potential replacement that's being used (that we are seeing from anecdotal information) would be silver in solders. Solders of course are used in light switches that you use in homes and so we are starting to see a bit of an uptake in silver demand in those applications. Silver is also used in photovoltaic cells, in solar panels and a wide variety of everyday uses such as cell phones and computers. So I think that as we see the growing economies in both China and India and the movement there towards consumer goods, particularly cell phones and other communication devices then we should continue to see consumption growth in electrical and consumer applications of silver so the outlook for the commodity remains bullish.

What is you outlook for silver stocks?

Regarding silver stocks, they are somewhat dependant on the market. Till date the price of silver has gone from $5/oz level 3 to 4 years ago to its current $13/oz level.

Stocks which are focused on silver such as ours and our peer group have enjoyed an increasing share price because of the leverage we have to the commodity from our project base. Investors should also keep in mind that market fluctuations may sometimes override movements in the stock relative to silver price. We are currently coming into the season where physical demand picks up particularly in India due to their wedding as well as religious festival that occur in the fall and this often results in increased seasonal consumption of silver. India in the past has been a fairly large consumer of silver both from a jewellery point of view as well as an in investment.

Later in October there is a conference organized by the silver institute in China which I'll be attending and one thing t hat the conference focuses on is Chinese consumption of silver. Over the last few years the amount of consumption of silver jewellery in China hasn't been comparable to that of India, so if we start to see that kind of consumption pick up in China, it will result in an incremental increase in demand and that will certainly be reflected in price of the commodity and then onto silver share prices.

| Press Releases |

Source: Silver Standard Resources Inc. |

Nov 01, 2007

TORONTO, ONTARIO--(Marketwire - Nov. 1, 2007) - Valencia Ventures Inc.

("Valencia")(TSX VENTURE:VVI) is pleased to announce that it has entered into an

agreement with Silver Standard Resources Inc ("Silver

Standard")(TSX:SSO)(NASDAQ:SSRI) to acquire an 80% interest in the Nuevo Juncal

Silver property. The Nuevo Juncal property is located approximately 125 km southeast of

Valencia's Cachinal Silver Project in northern Chile. Valencia has focused its corporate

development effort in the region surrounding the Cachinal project to utilize its local

expertise and knowledge to build on the resource the Company is establishing at Cachinal.

http://www.marketwire.com/mw/release.do?id=787561

Silver Standard and Esperanza Announce Further High-Grade Results at San Luis

Tuesday September 18, 5:00 am ET

VANCOUVER, BRITISH COLUMBIA--(MARKET WIRE)--Sep 18, 2007 -- Silver Standard Resources Inc. (Toronto:SSO.TO - News)(NasdaqGM:SSRI - News) and Esperanza Silver Corporation (CDNX:EPZ.V - News) are pleased to announce more results of ongoing diamond drilling at the San Luis high-grade gold and silver joint venture property in central Peru.

Infill drilling on the Ayelen Vein continues to confirm high-grade gold and silver mineralization and to define the mineralization before the commencement of an underground exploration program, which is planned to begin later this year, subject to receipt of permits. Significant drill results from the current program include:

- in drill hole A-SL-098, an angled hole drilled close to drill holes A-SL-016 and A-SL-018 (both of which intersected very high-grade values), a 26.2-foot interval averaging 2.05 ounces per ton gold and 27.2 ounces per ton silver (8.0 meters averaging 70.3 grams per tonne gold and 932.0 grams per tonne silver).

- in drill hole A-SL-087, an angled hole drilled beneath hole SL-06-085 toward the north end of the vein system, a 67.6-foot interval averaging 0.21 ounces per ton gold and 9.0 ounces per ton silver (20.6 meters averaging 7.2 grams per tonne gold and 309.1 grams per tonne silver).

High-grade mineralization within the Ayelen vein has been identified over 650 meters of strike length and exploration is continuing to define the structure to the south. The high-grade mineralization has been found for a depth of up to 225 meters, from below the top of the ridge down to the 4,350 meter level. Recent infill drill results for the Ayelen Vein are summarized below:

Top Holders:

| TOP INSTITUTIONAL HOLDERS |

|