|

Gold and Gold Stocks' Breakouts

Are Powered

by FED Cut in Interest Rates by 1/2%

Gold's rate

of ascent is rising faster and faster. Look at the chart of GLD, the bullion ETF.

Two weeks ago it moved past $68, as

Gold went over $680/ ounce. Back in 1980, it peaked

near $725. We are on the

verge of an all-time high. Our Tiger chart shows very bullish (blue)

levels of Accumulation. GLD's

Least Squares Regression Line shows a rate of ascent that

is now 14% per year. An

all-time high will surely cause a buying stampede. (Note- 9/20/2007:

Gold made an all-time high today.)

As long as the Fed is willing to add liquidity (a euphemism for printing

greenbacks), like

it has for the last 6 weeks, gold

will be very strong. I have talked about the decline in the

dollar elsewhere. The

continued reckless wastage of US tax dollars in Bush's insane war on

and occupation of Iraq virtually

guarantees a dollar collapse! What

this will do to retired

people living on a fixed income is

CRUEL!

See http://www.tigersoft.com/Tiger-Blogs/9-13-2007/index.htm

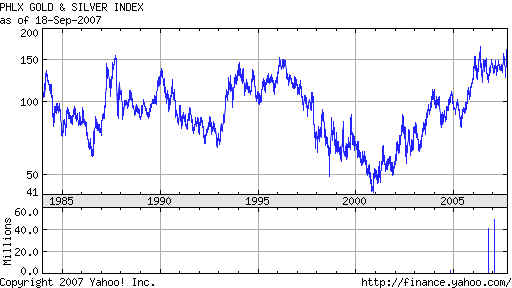

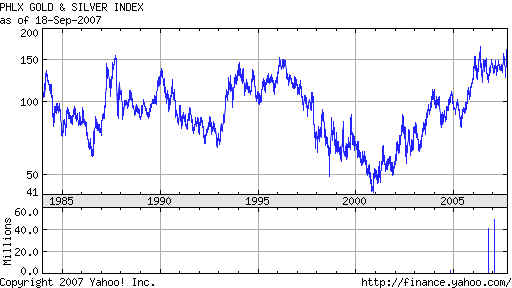

Gold stocks, as measured by the Philadelphia Stock Exchange's XAU

Index, have today made

a 20 year new high

past flat resistance formed by more than a ten earlier peaks between 150

and 160. Here is

the Yahoo long-term chart of the XAU. Its close of 164.78 is not shown

yet in the Yahoo longer-term

chart. This is a reliably very bullish development for Gold.

It is a baleful sign for the

Dollar.

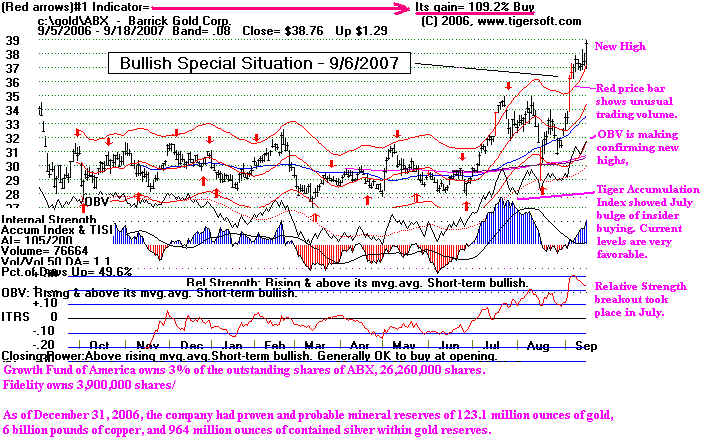

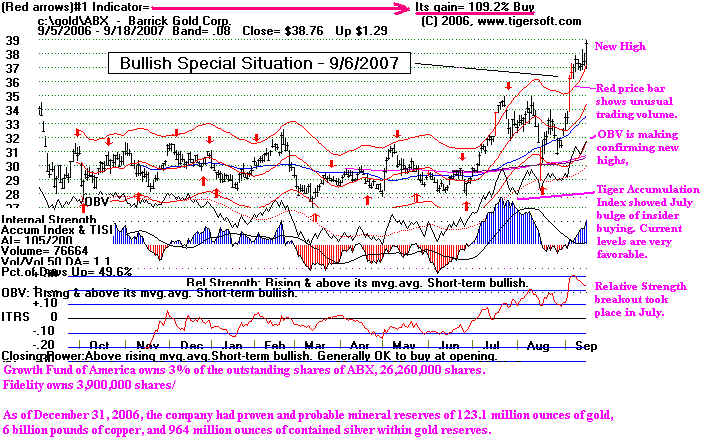

More than a week ago, Tiger Software recommended traders buy Gold bullion and

the gold stocks, ABX (Barrick

Gold of Toronto - http://www.barrick.com ) and

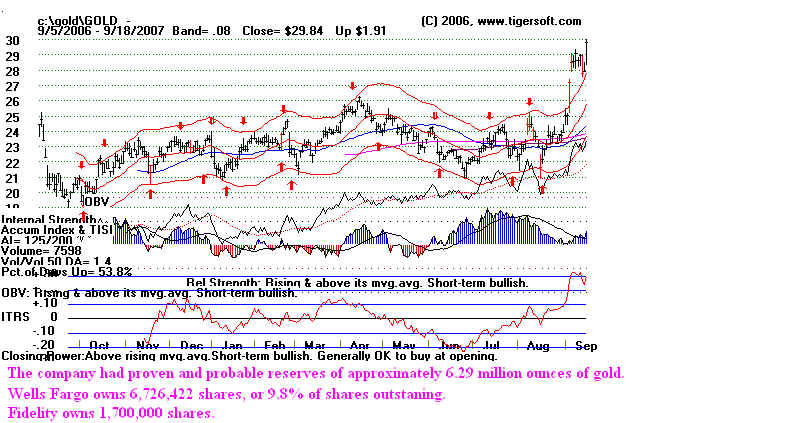

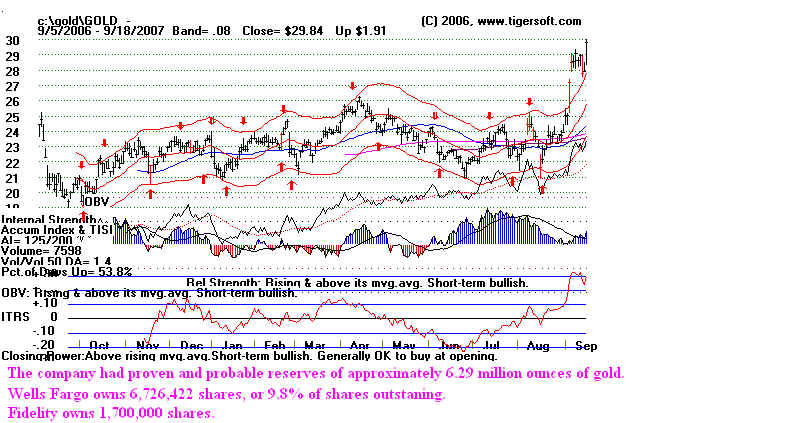

GOLD (Randgold Resources

Ltd - http://www.randgoldresources.com )

Both are

now running in all-time high

territory, where technical resistance is light, because

traders cannot bunch their orders

at an obvious earlier level.

ABX - American Barrick Gold

GOLD - Randgold Resources Ltd

Why

did we choose these stocks to recommend? Tiger Software's Power Ranker gave

them the highest marks for accumulation and insider buying

and they were "the first-out-of-the-gate",

that is, they made new 12-month highs before the others

this past month.

A good way to go now,

is to buy the highest gold stock with very high current reading from

the Tiger Accumulation Index, provided there is

not technical resistance just overhead. Using this

approach, one should look at AZS (11.42, but at

resistance), FCX (103.3, which looks like a Buy. ),

ABX (38.86) and EZA (131.59 - South Africa ETF).

Silver

stocks should enjoy this run, too. But sliver prices are often more dependent on the

level

of economic strength, though. They will top out

sooner than gold if a recession is looming. Here is the

current "perpetual futures contract" chart of

silver. It shows red distribution and is just below

the expected resistance posed by declining 30-week and

200-day moving averages. Perhaps, it

will breakout and catch up with Gold. But the charts

say otherwise. Almost three months ago,

I pointed out that "silver stocks were starting to tarnish".

Two very fine silver stocks, PAAS and SSRI are only doing as well as

silver.

I hope they play catch-up. That

will mean that a recession is farther away than some

of the pessimists think. Red sell

signals have appeared on this rally. But I think they will

keep rising if the XAU stays as strong as

I expect and Gold can get past $725 an ounce

and keep going.

The ending of the XAU trading range, will mean a lot of

short covering.

Jim Sinclair says

that "there is a huge illegal short in each and

every one of the

(gold stock) juniors.

Those shorts are going to run for cover." And he points out that many

companies have limited

how much they can make if there is a steep rise in gold, because

of the extent to which

they themselves hedge with derivatives.

Watch the top 10 holding of Fidelity Gold on FSAGX

on Yahoo. They have a new fund manager there.

The one before

could not beat the performance of just owning GLD (Gold bullion). Here are their

reported holdings

now.

Top 10 holding of Fidelity

Gold, FSAGX

| TOP 10 HOLDINGS ( 67.00% OF TOTAL ASSETS) |

|

| Company |

Symbol |

% Assets |

YTD Return % |

| MERIDIAN GOLD INC. |

MDG |

9.63 |

-0.07 |

| Newcrest Mining Ltd |

N/A |

9.17 |

N/A |

| BARRICK GOLD CP |

ABX |

8.51 |

6.48 |

| IAMGOLD CORPORATION |

IAG |

8.21 |

-24.97 |

| NEWMONT MIN CP (HLDG |

NEM |

7.94 |

-5.95 |

| Lihir Gold Ltd |

N/A |

6.75 |

N/A |

| KINROSS GOLD CP |

KGC |

4.91 |

2.86 |

| GOLD FIELDS LTD ADS |

GFI |

4.42 |

-18.40 |

| GOLDCORP INC |

GG |

4.00 |

-16.73 |

| ARIZONA STAR RESOURC |

AZS |

3.46 |

-16.67 |

|

Here is the chart showing Fidelity's FSAGX and a relative

strength comparison with GLD (gold bullion)

In fairness to FSAGX, most gold stocks have not done

as well as GLD. And it ranks higher for the

last month than 38 of 47 gld and sillver stocks.

Note that if Gold continues to run, the automatic red Sell

signal will finally be bested. But they served

us very well for nearly two years.

Fidelity

Gold Fund's Breakout and Under-Performance Relative to Gold Bullion

Best Performing Gold and Silver Stock for

Last 3 Months (65 trading days.)

C:\gold Days back= 65

6 / 15 / 2007 - 9 / 18 / 2007

Rank Symbol Name Price Pct.Gain

--------- ----------------------------------- ---------- ------------

1 SA 29.61 65%

2 AEM Agnico-Eagle Mines Ltd. 49.98 35%

3 ABX Barrick Gold Corp. 38.76 33%

4 GOLD --- 29.84 30%

5 FCX Freeport-McMoRan C & G 103.3 22%

6 ANO --- 3 21%

7 MDG Meridian Gold Inc. 31.61 20%

8 XAU GOLD STOCK INDEX 164.78 17%

9 GG Goldcorp Inc. 28.9 16%

10 FSAGX FIDELITY GOLD 39.65 15%

11 SLW Silver Wheaton Corp. 12.99 14%

12 AU Anglogold Limited 46.5 13%

13 NEM Newmont Mining Corp. 45.99 13%

14 AGT Apollo Gold Corp. .45 12%

15 GLD StreetTRACKS Gold Trust 71.63 10%

16 IAU iShares COMEX Gold Trust 71.7 10%

17 KGC Kinross Gold Corporation 14.43 9%

18 IAG IAMGOLD Corp. 8.17 7%

19 GFI --- 17.24 5%

20 AZS --- 11.42 4%

21 CEF Central Fund of Canada 9.48 3%

22 EZA ISHARES MSCI SOUTH AFRICA 131.59 2%

23 HL Hecla Mining Company 8.33 1%

24 EGI Entree Gold Inc. 2.24 -1%

25 EGO Eldorado Gold Corp. 5.69 -1%

26 MGN --- 3.66 -2%

27 RBY Rubicon Minerals Corp. 1.58 -2%

28 ASGMF --- 1.65 -3%

29 SLV --- 128.68 -3%

30 PAAS Pan American Silver Corp. 26.71 -4%

31 MNEAF --- 1.92 -5%

32 GBN Great Basin Gold Ltd. 2.51 -6%

33 GSS Golden Star Resources Ltd. 3.48 -6%

34 CDE Coeur d'Alene Mines Corp. 3.49 -7%

35 NGD New Gold 6.38 -7%

36 SSRI Silver Standard Resources Inc. 34.6 -7%

37 TIE Titanium Metals Corp. 31.52 -8%

38 RDIAF --- .55 -9%

39 SIL Apex Silver Mines Limited 19.09 -9%

40 CALVF Caledonia Mining Corp. .136 -12%

41 HMY Heilig-Meyers Company 11.61 -17%

42 SWC Stillwater Mining Company 9.85 -19%

43 GRS Gammon Lake Resources Inc. 9.97 -24%

44 PAL --- 7.43 -29%

45 EXK --- 3.3 -30%

46 KRY Crystallex International 2.73 -39%

47 MGH --- .8 -44%

48 BMD --- 1.53 -51%

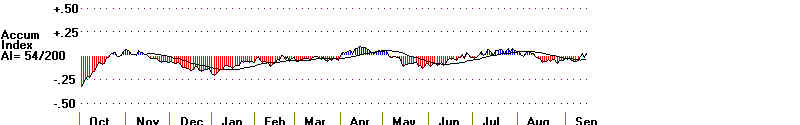

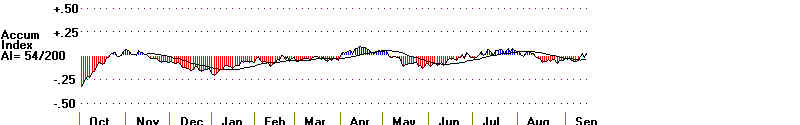

Another tool Tiger Software offers is the

ability to build your own index of any

group

of stocks. Here is the Tiger Index of 48 gold and silver stocks. It is a

composite

of all of them weighted by price times average volume. It lets us

see

Accumulation and an A/D Line. Right now the Tiger Gold Stock Index's

cumulative

A/D Line is not making a new high. So, most gold and silver stocks

have not yet made

new highs. There is

still red distribution. And aggressive

buying was

stronger in July. The

XAU breakout still needs to prove itself. I

think it will.

The Dollar is very weak now. And seasonality for gold stocks is

good until at

least January.

Tiger Index of 48 gold and silver stocks.

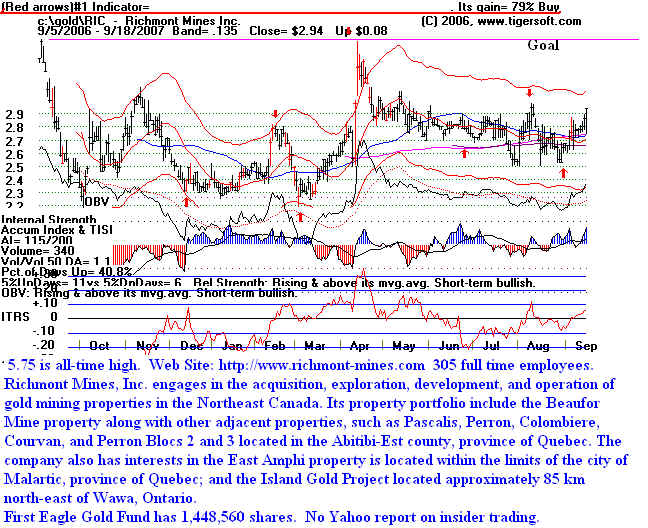

Want to speculate?

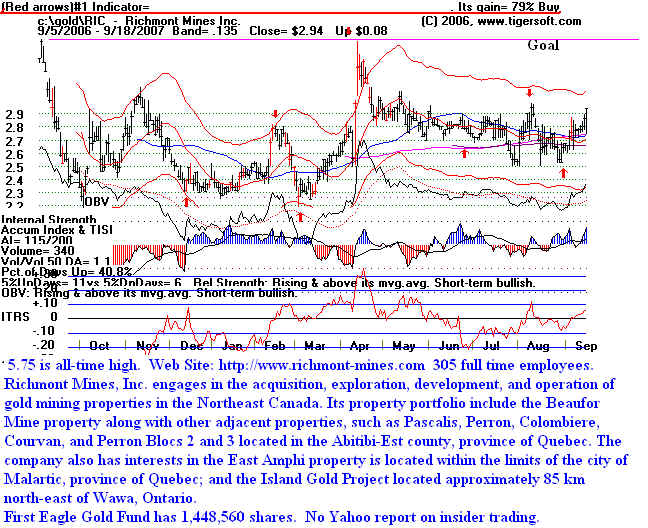

"Richmont (RIC) has a market cap of $50MM with $10MM in cash and a mill worth $30MM.

They are

buying back stock

and selling at 10 times 2007 earnings estimates. At today’s price, the market is

predicting

more

problems. They are un-hedged. They are leveraged to gold prices and the Canadian

Dollar."

(Source: http://seekingalpha.com/article/24948-gold-stock-earnings-to-shine-in-2007

)

News from

Yahoo - September 13, 2007 - http://biz.yahoo.com/iw/070913/0302074.html

Gold sales

increased by 28% in 2nd Qtr, while production costs declined $147 per Ounce.

http://biz.yahoo.com/iw/070802/0285606.html

From Yahoo message Board:

2.84 at the time of the Tiger Blog's posting of RIC..

POG (price of gold) @$720 will provide Additional

$50/oz profit to bottom line.

22,000 oz X Extra $50/oz = $1,100,000.00 Extra Profit

24 million shares = $0.0458/sh added profit

@ P/E of 8, added $0.36/share

$2.75 + $0.36= $3.11/share and adding.

So at POG $720, looks to me like you're losing $$$$ if you sell RIC below $3.11.

What happens if they hit on one or both mines this autumn?

BOOM! +100,000 ounces mined and a stock price +$5.25

Are you as intrigued as I am? "

Author: Goldisgoldisgoldisgolden

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks_R/threadview?m=tm&bn=15480&tid=5567&mid=5567&tof=3&frt=2

CANADIAN DOLLAR

Another way to play the prospects of a very weak dollar is to buy

the Canadian Dollar. Canada,

of course

is a major producer of natural resources. The trends we see will not change as long

as Bush's

trillion dollar blunder in Iraq continues to ooze blood, honor, prestige and dollars.

EZA

- SOUTH AFRICAN ETF

South Africa, long known as the world's biggest producer of gold is lagging. I would

look elsewhere for a good gold investment, though it will probably play catch-up. It

is underperforming

bullion (GLD)

===================================================================================

Let Tiger Boost Your Investments

These are some of the tools Tiger offers to analyze and pick from a group unoverse

of 48 gold and silver stocks, whose

data we provide each night. Seasonality studies and whether

to buy and the opening or at the

close and the projected next day;s highs and lows give you

still more reasons to use

TigerSoft. Give us a call - 858-273-5900.

|