TigerSoft Freedom News Service --

last updated `10/4/2010

TigerSoft Freedom News Service --

last updated `10/4/2010 WHAT A BUY OUT LOOKS LIKE BEFORE

THE TAKEOVER IS ANNOUNCED

1) Insider Buying 2) Professional Buying 3) Public Selling

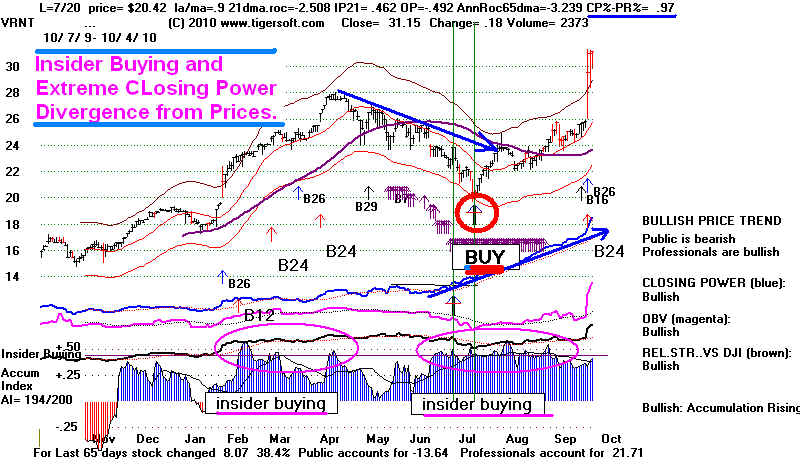

VRNT - on 7/20/2010 @20.42

HOW TO SPOT A COMING TAKE-OVER BID

BEFORE IT IS ANNOUNCED.

(C) 2010 William Schmidt, Ph.D. www.tigersoft.com 9/14/2010

When one company buys out another it first discusses the possibilities with its

Wall Street bankers, its lawyers and accountants and often the Board of DIrectors

of the company being bid for, at least to feel them out. These are the insiders

whose "insider buying" we detect. They are seldom required to post their purchases

with the SEC in other companies unless their buying is massive..

Rarely does the SEC police the "insider buying" that a takeover bid usually engenders,

except perhaps to look at the option trading before the accouncement. Usually, the SEC

only takes up a case where the insider buying of options is obvious and egregious.

Most of the time, the SEC does not want to challenge the big players on Wall Street.

It is far more likely to accomodate Wall Street professionals, for example, as it did when it

changed the short-selling rules in June 2007 to make aggresive professional short selling

much easier, conveniently for Wall Street right before the 2007-2009 bear market.

I have wrtten a number of essays on complicity of the SEC with Wall Street criminals.

and the Crash of 2008=2009. They will show, I think, that investors should not rely

upon the SEC to level the playing field for the public investor.

June 28, 2007 Who's Guarding The Investors' Hen House?. SEC Chairman Cox?

August 15, 2007 The SEC Role in The 2007 Market Crash

11/19/2008 The Role of ULTRA ProShares EYFs in the Bubble and the Crash..."The current

SEC is clearly in cahoots with criminal bear raiders."

More and more, the SEC seems to only pick a case of insider trading that is easy to prove

where the insider trading profits are very big. Insiders realize this and they buy and

sell with little fear that the SEC will penalize them unless they are particularly careless.

Lawyers do bring class action suits against some CEOs that Sell based on unreleased

and material insider knowledge, But I have not heard of class ation law suits against insiders

who bought heavily before a stock rose.

It may be human nature to show off their insider status or it may be simple greed,

but you can usually count on some of the insiders to quietly tell their friends and trading

associates about the stock that is going to be bid for. Wall Street is filled with analysts

and stock brokers who trade inside information with each other for a living. Secrets like

a takeover-bid are next to impossible to keep silent about.

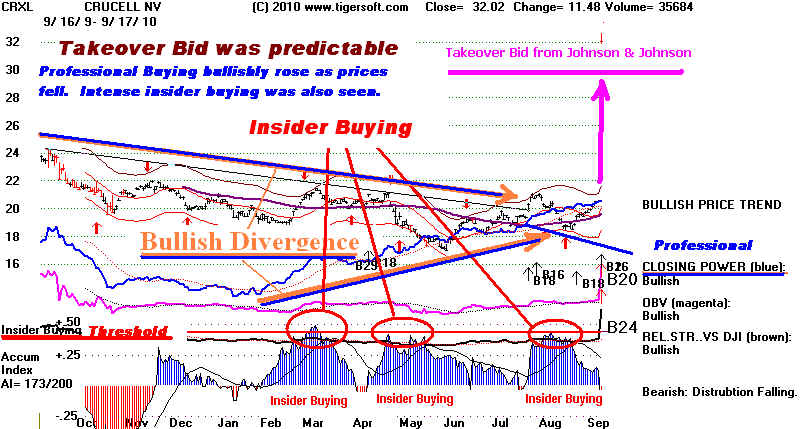

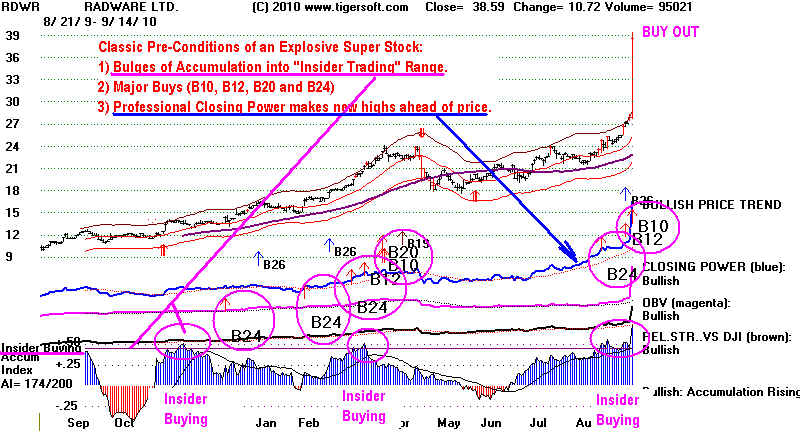

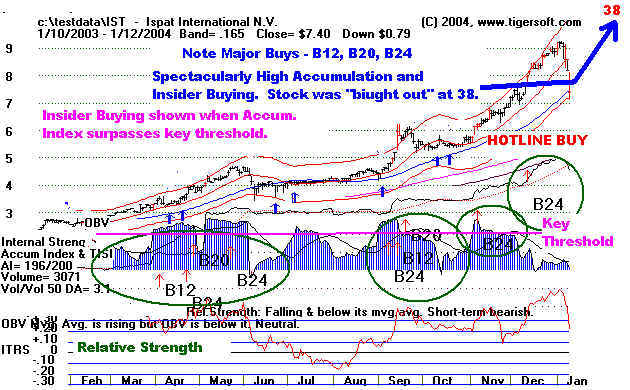

It is all this insider buying that TigerSoft picks up on. We nearly always spot tell-tale bulges

of insider buying in the stock's TigerSoft Insider Charts, first from our invention, the Tiger

Accumulation Index and second from the stock's rising Professional Closing Power that leads

such stocks to new highs.

I emphasize we are outsiders. We do not know who the buyers are. We do not know how

much they will offer to buy a compnay out. And we do not know if the bid will be

accepted. Even so, we still can make big money regularly using Tiger's Insider Trading charts.

Here's how.

TIGERSOFT INSIDER TRADING CHARTS MAKE IT EASY.

> See which rumors should NOT be trusted

> "Someone always knows"

How To Spot Explosive Super Stocks Early in Their Move

Killer Short Sales in Any Market

> Because Professionals Run and Rig Stocks and the Market more than ever,

TigerSoft also shows Public versus Professional Buying and Selling

> Note the industry areas being focused on for buy-outs.

UNCA - Unica - biopharmaceutical company

Unica Corporation provides enterprise marketing management and on-demand marketing solutions to financial services, insurance, retail, telecommunications, and travel and hospitality industries worldwide.

CRXL - CRUCELL - biopharmaceutical company

RDWR - RADWARE

Radware Ltd. provides application delivery and network security solutions to banks, insurance companies, manufacturing and retail, government agencies, media companies, and service providers worldwide.

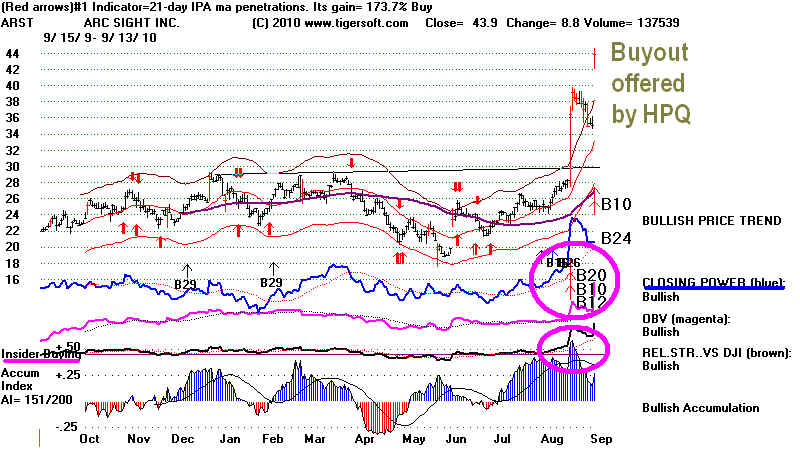

ARST - ARC SIGHT

ArcSight, Inc. provides compliance and security management solutions that protect enterprises and government agencies.

NZ - NETEZZA

Netezza Corporation provides data warehouse, analytic, and monitoring appliances to enterprises, mid-market companies, and government agencies

AKAM - AKAMAI Technoiogies

Akamai Technologies, Inc. provides services for accelerating and improving the delivery of content and applications over the Internet in the United States and internationally.

MFE - MCAFEE

McAfee, Inc. operates as a security technology company that secures systems and networks worldwide.

NOVL - Novell

AIPC - AMERICAN ITALIAN PASTA

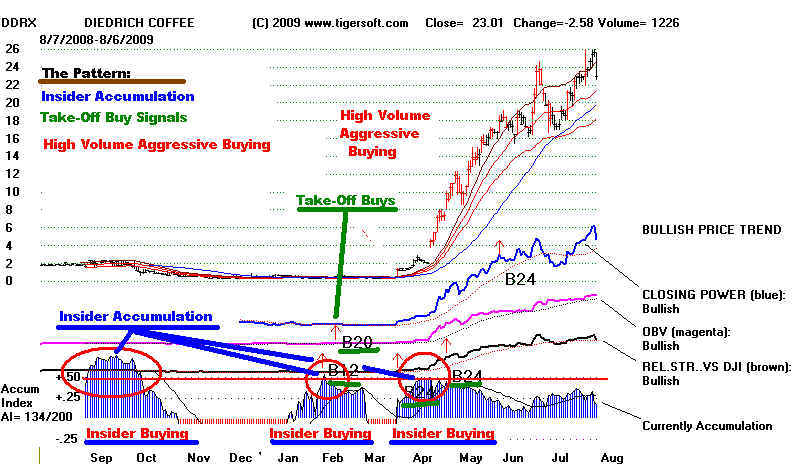

DDRX - DIEFRICH COFFEE

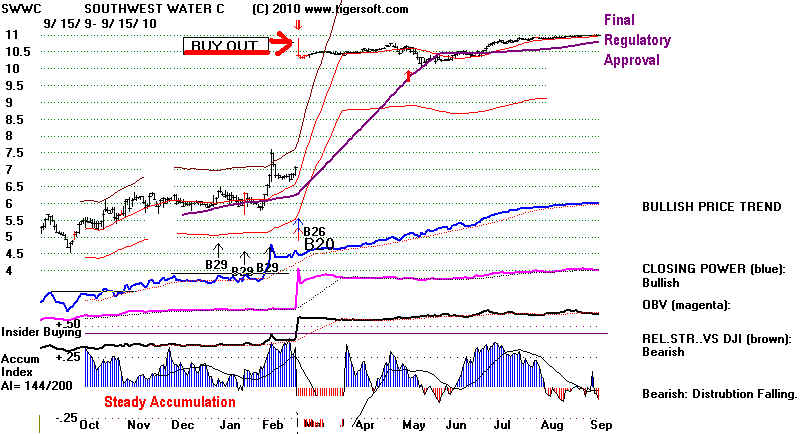

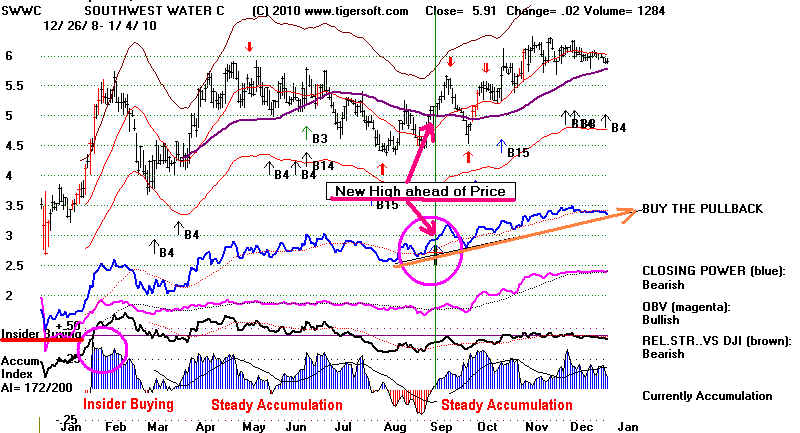

SWWC - SOUTHWESTERN WATER,

More will be posted here. Check back often

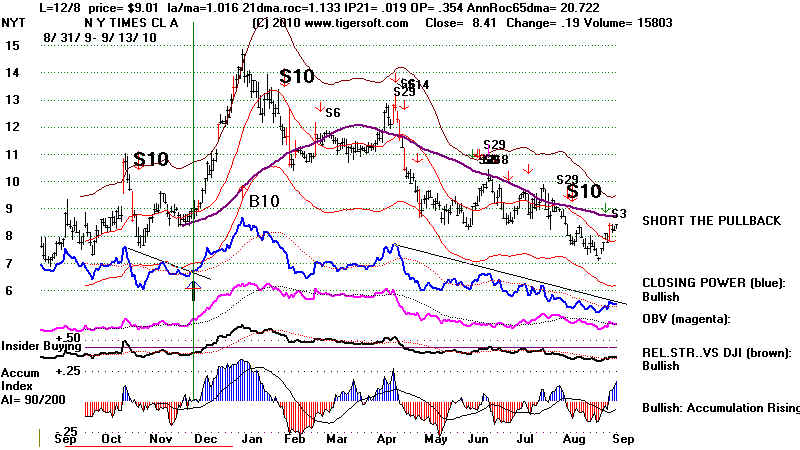

BUYOUT AT $11.

BUYOUT AT $11.