SPY: 1993-2013

You can see that the Stochastic-5-day K Line was only the basis of the best

or second best trading system in 6 of the 20 years studied:

1993, 1997, 1999, 2009, 2012 amd 2013.

Each was a rising market.

The Stochastic-14-day K Line was the basis of the best

or second best trading system in 1996, 2000 and 2011.

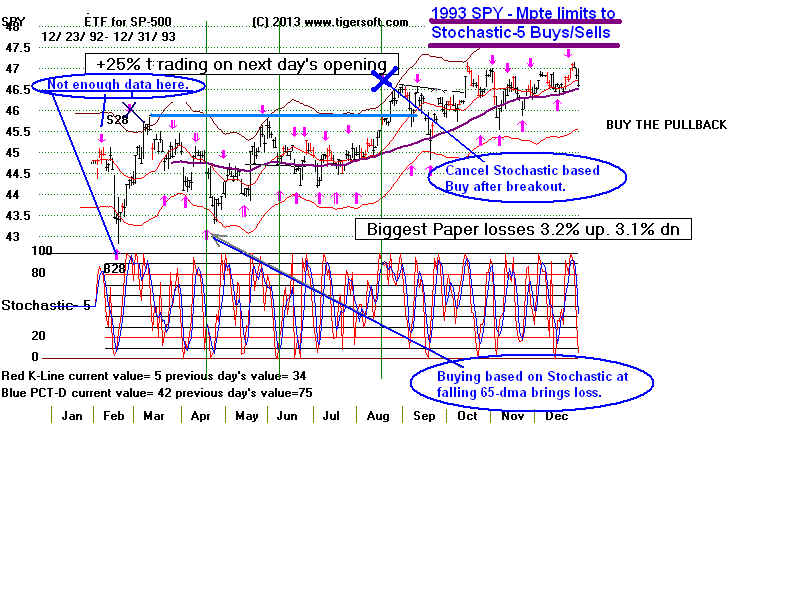

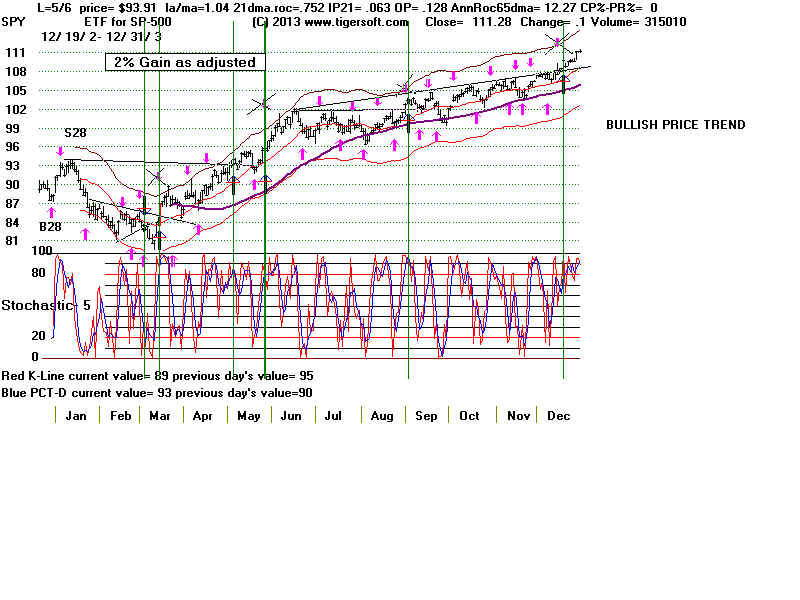

1993 #1 Stoch-5day KLine turns up/down

$2 Stoch-5day KLine crosses Pct-D

65-day IPA turns - Up whole year. Very good.

---------------------------------------------------------------------------

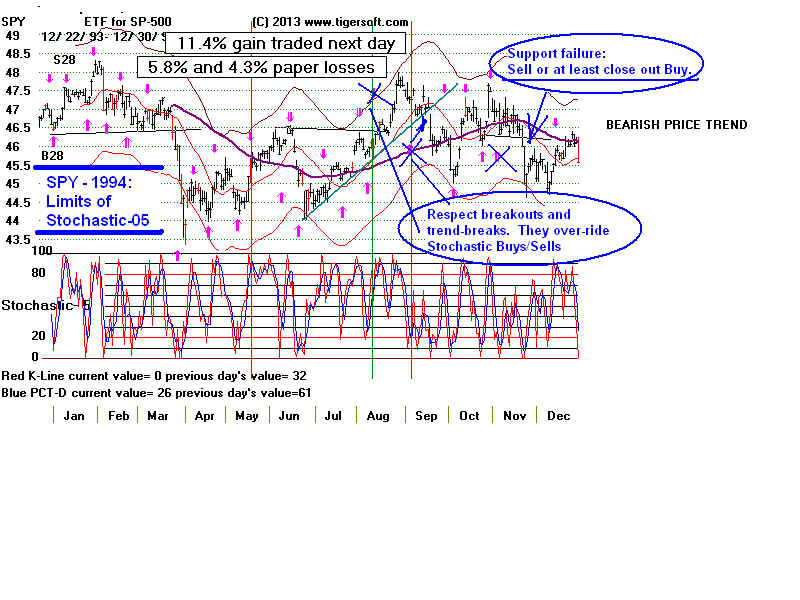

1994 #1 Stoch-5day Kline turns up/down

#2 Stoch-50day-Kline crosses up past 20/down below 80

----------------------------------------------------------------------------

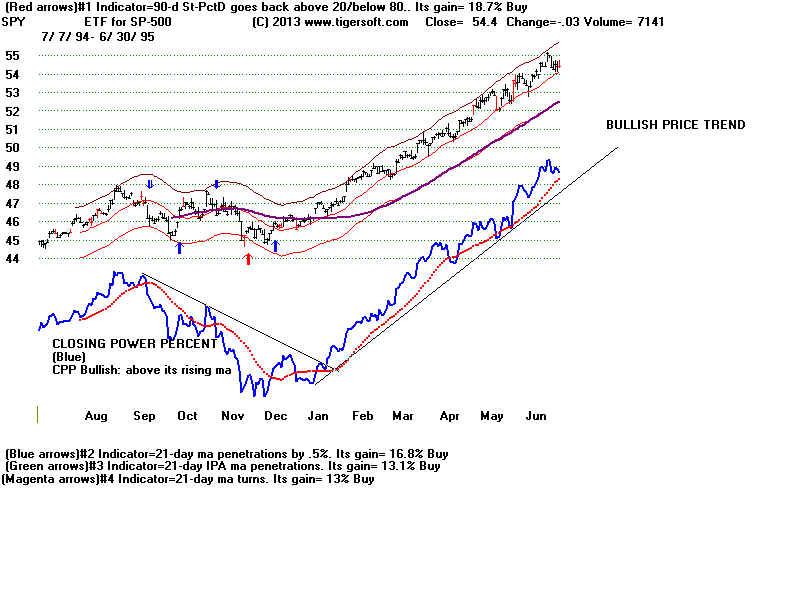

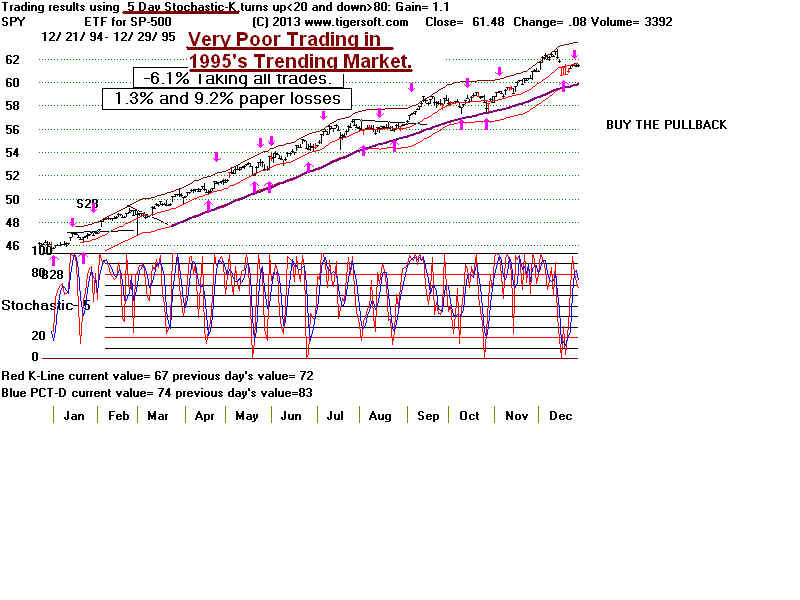

1995 #1 IPA -50-day ma turns 23.5%

#2 IPA 21-day ma penetrations 12.4%

----------------------------------------------------------------------------

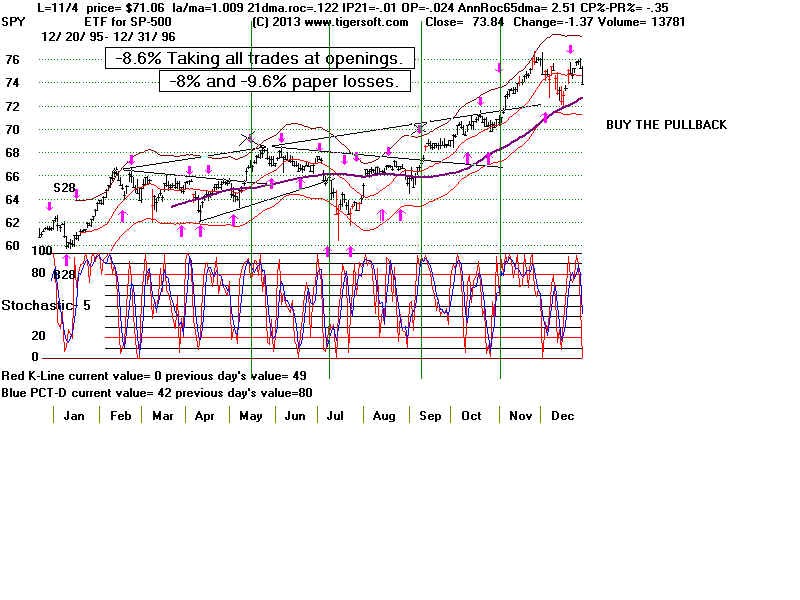

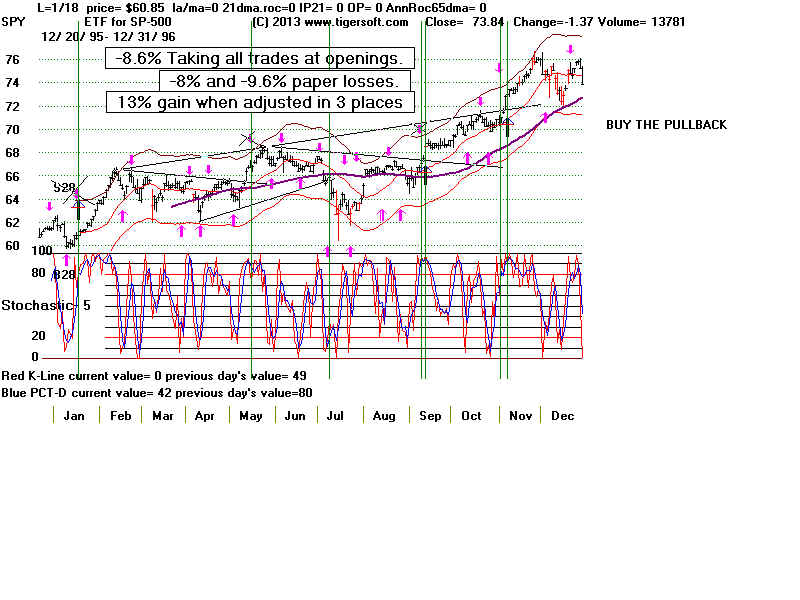

1996 #1 50-day OBV ma turns 26.7%

#2 Stoch-14-KLine crosses Pct-D 21.1%

----------------------------------------------------------------------------

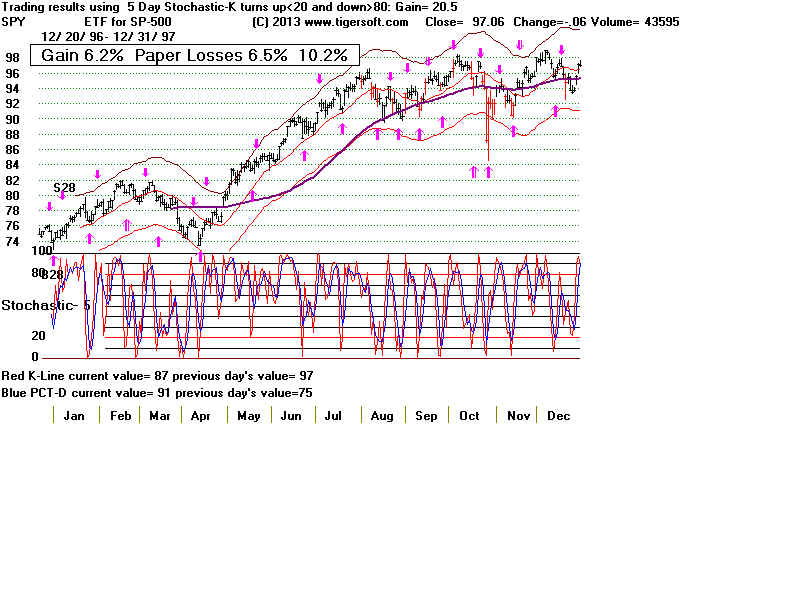

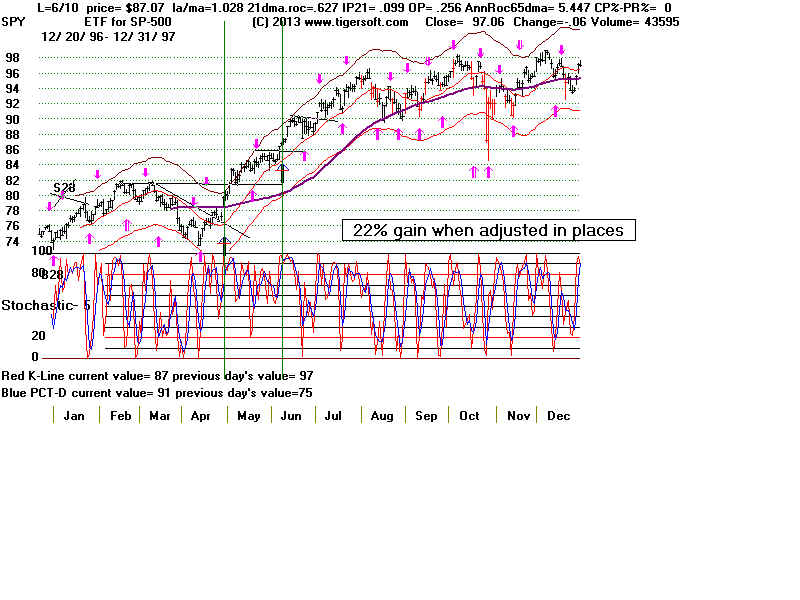

1997 #1 Stoch-50day-KLine up past 20/down below 80 19.7%

#2 Stoch-5day-Kline up past 20/down below 80 19.7%

----------------------------------------------------------------------------

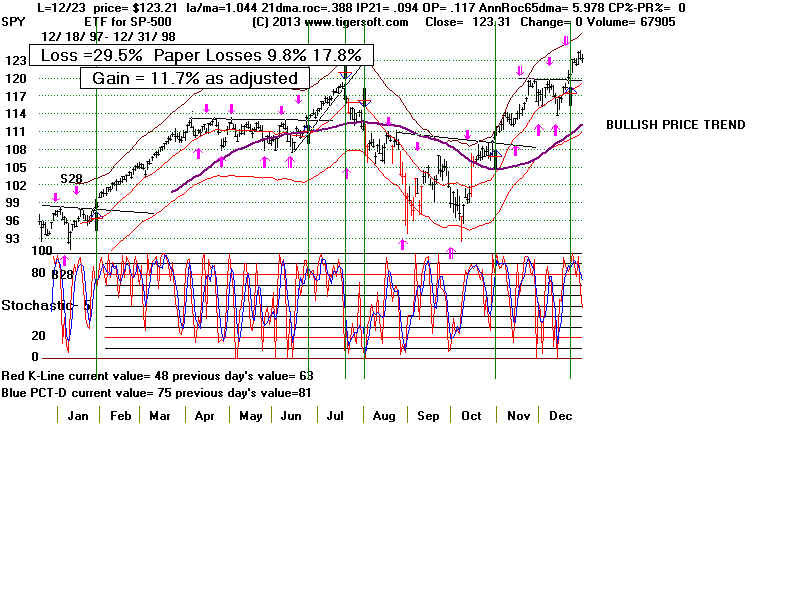

1998 #1 Stoch-20-day-KLine up past 20/ down below 80 23.5%

#2 Closing Power - 50-day A turns 13.2%

---------------------------------------------------------------------------

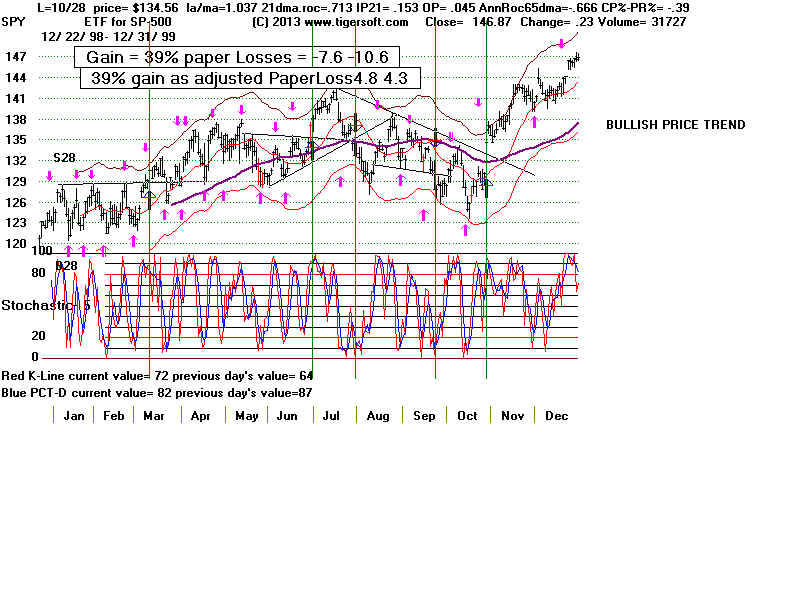

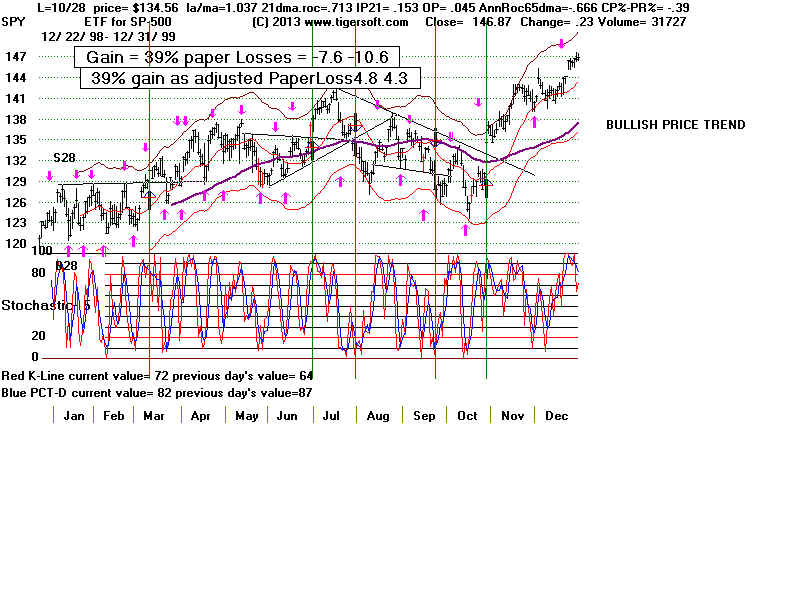

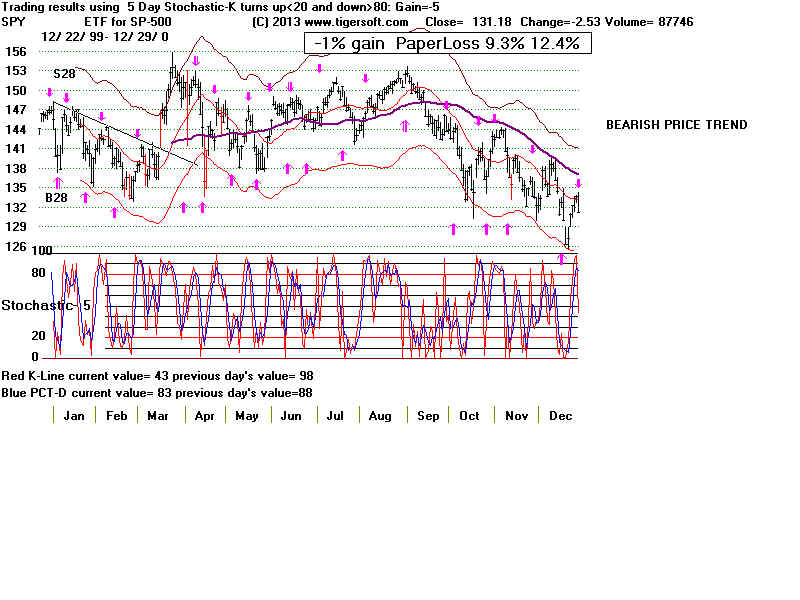

1999 #1 Stoch-5-day-KLine -turns up/down 35.1%

#2 Stoch--20-day-KLine -turns up/down 28.6%

---------------------------------------------------------------------------

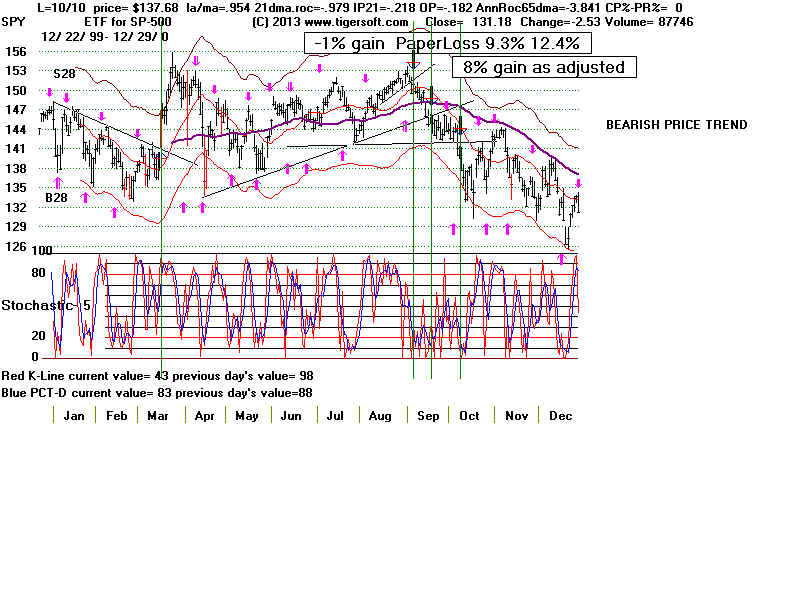

2000 #1 Stoch-20-day-KLine-turns up/down 32.6%

#2 Stoch-14ay-Pct-D -up past 20/falls below 80 26.4%

---------------------------------------------------------------------------

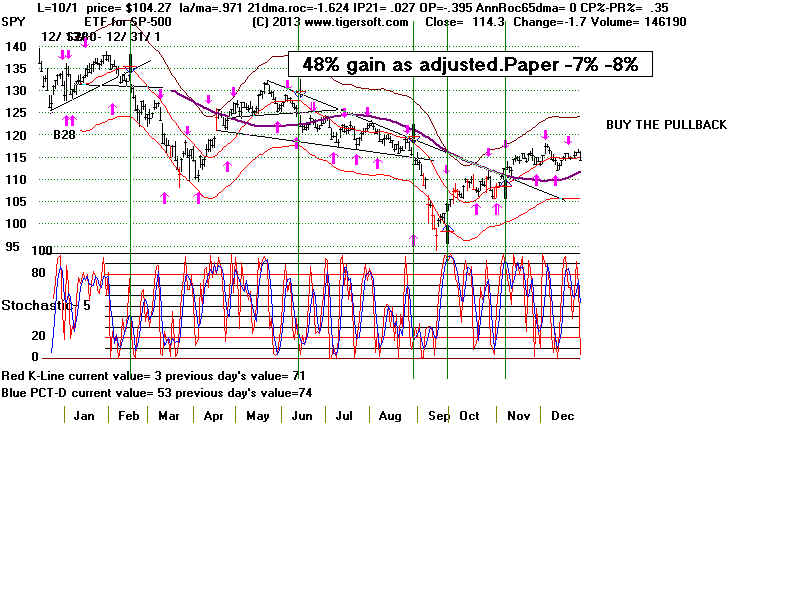

2001 #1 Closing Power 21-day MA pentr. 27.2%

#2 Price 21-dma penetr 20.9%

---------------------------------------------------------------------------

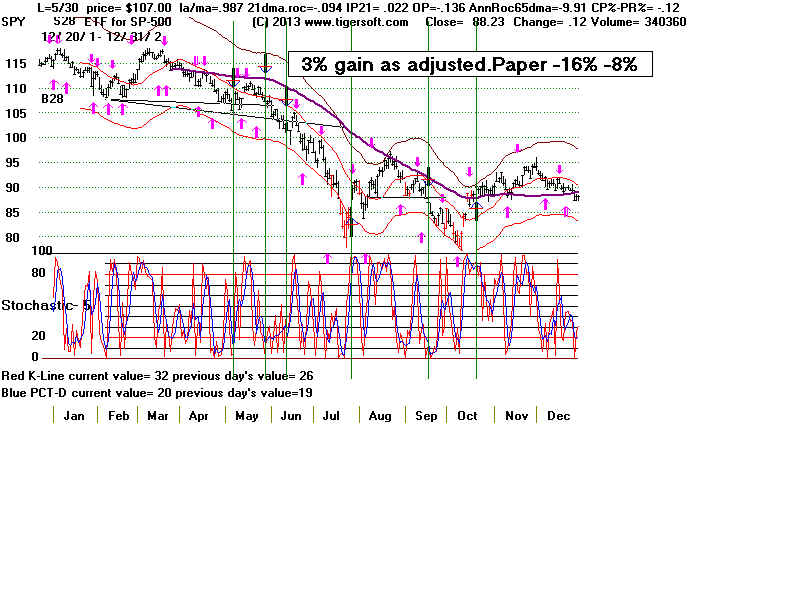

2002 #1 RSQ 50-day ma turns 29%

#2 Price-21-day ma turns 11.6%

---------------------------------------------------------------------------

2003 #1 Price-50-day ma turns 22.5%

#2 IPA 50-day ma turns 16.5%

---------------------------------------------------------------------------

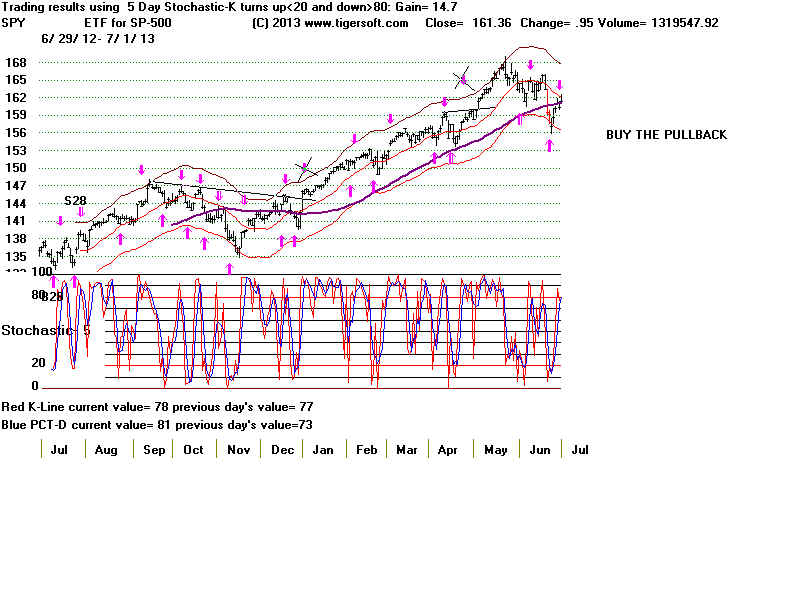

2009 #1 Stoch-5 day-Pct-D goes back 20/below 80 20.0%

#2 Tiger Trading Tool 21-day ma penetr 19.3%

---------------------------------------------------------------------------

2010 #1 Stoch-20-day-Pct-D turns up/down 23.3%

#2 Stoch-20-day-Pct-D crosses back avove 20/ falls below 80 20.8%

---------------------------------------------------------------------------

2011 #1 Stoch-14-day KLine crosses Pct-D Line 27.6%

#2 Stoch-90-day Pct-D-goes back above 20/falls below 80 26.1%

---------------------------------------------------------------------------

2012 #1 Stoch-90-day K-Line goes back above 20/falls below 80 26.1%

#2 Stoch-5-day K-Line goes back above Pct-D/falls below it 19.9%

------------------------------------------------------------------------------

2013 #1 IPA MA turns 18.6%

#2 Stoch-5-day K-Line goes back above Pct-D/falls below it 17.2%

------------------------------------------------------------------------------

---------------------------------------------------------------------------