(C) June 15, 2013 William Schmidt, Ph.D.

If one knew of DUST's extstence, it was actually quite easy to make a lot of money

recently in DUST, the 3x leveraged short on gold mining stocks. There were several

key technical signs that gold stocks were in bad trouble, even apart from their being

overly recommended to the Public by shils (like Glen Beck) for the precious metals and

gold coin sellers.

First Bearish Sign for Gold Stocks as A Group.

Early this year, a TigerSoft user should have notice that gold mining leaders,

ABX and NEM, the world's biggest and second biggest gold mining stocks

were breaking down badly in January 2013. Their Closing Powers made new lows

ahead of price. Their 65-day ma turned down. And their Accumulation Index became

very read and negative. Our Hotline mentioned this as an indication that the January

turn upwards in the general market would continue. (Usually, the DJI does not turn

down in a strong advance until gold stocks turn upwards.)

ABX - World's Biggest Gold Stock

NEM - World's Second Biggest Gold Stock

Second Bearish Sign for Gold Stocks as A Group.

By the end of February 2013, gold and silver mining stocks began to frequent in

significant numbers our Tiger/Peerless Hotline's Bearish MINCP stocks each night.

We know from past experience that when a group of stocks from the same industry

start appearing in numbers as a group in the Bearish MINCP stocks, the whole

group is very bearish and they are apt to go much lower.

Typically there are only 8 or 12 bearish MINCP stocks on any given night. They

are selected very mechanically out of 5,000-6000 stocks. All the MINCP stocks

have Closing Powers making new lows ahead of price. The most "Breaish" of these

are found automatically by the Tiger PowerStock Ranker because they show

exceptionally heavy red Distribution and a lagging Relative Strength Lines. In other

words, they are being sold very aggressively by Professionals, Insiders and Institutions.

The Bearish MINCP stocks very often decline even in a rising general market. And

as our TigerSOft Hotline pointed out many times, gold stocks do tend to fall when the

overall equities' market is quite strong.

It was very bearish for the industry as a whole that so many gold and silver mining

companies starting popping up as Bearish MINCP stocks.

On 2/22/2013 there were 2 mining stocks in our Bearish MINCP posts: ANV and NEM.

www.tigersoft.com/-2GBL13HL/special/2-22-down/index.html

On 2/28/2013, there were 6: IAG, EGO, SSRI, BVN, NEM, ANV.

www.tigersoft.com/-2GBL13HL/special/2-28-down/index.html

On 3/4/2013, there were 3: EXK, ABX, GOLD.

www.tigersoft.com/-2GBL13HL/special/3-4-down/index.htm

On 3/5/2013, there were 8: EXK, ANV, NEM, GG, ABX, BVN, GOLD, SSRI.

www.tigersoftsoft.com/-2GBL13HL/special/3-5-down/index.htm

On 3/6/2013 there were 7: EXK, ANV, GG, NEM, GOLD, SSRI. BVN.

www.tigersoftsoft.com/-2GBL13HL/special/3-6-down/index.htm

Third Bearish Sign for Gold Stocks as A Group.

TigerSoft gives you the ability to chart an Index for any group of stocks you

wish and too look at their internal strength indicators including:

Relative Strength

Accumulation Index

Advance-Decline for the Group

Pct of Stocks above their 65-dma

It also lets you see the best trading system for this index.

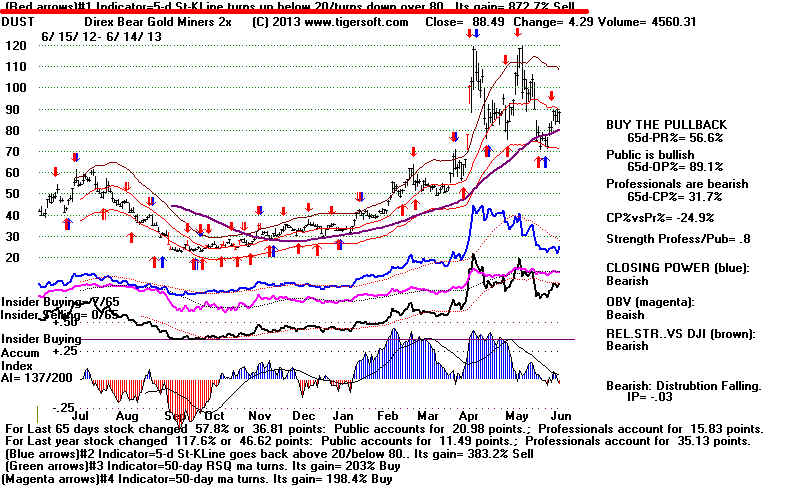

All signs were very bearish for Gold stocks as a group. The best trading system

for the group currently is the 5-day Stochastic K-Line turning up from below 20

and down from above 80.

What To Do?

After studying these charts, there could be no doubt that this whole gold stocks'

group would probably keep going down.

: .

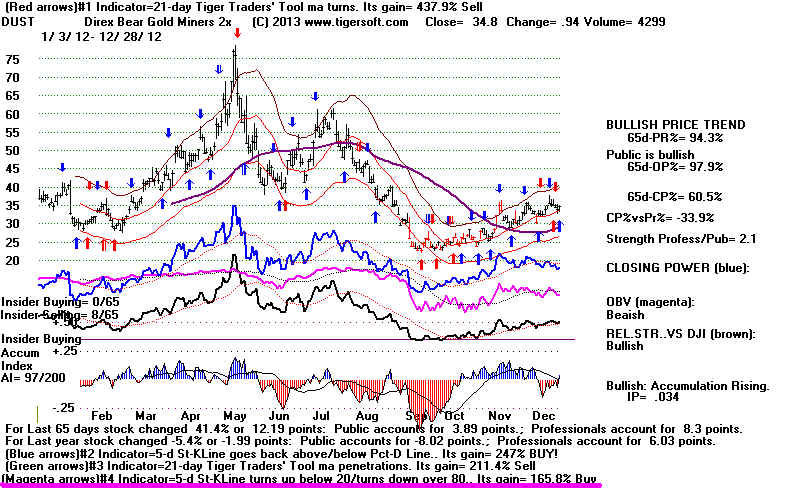

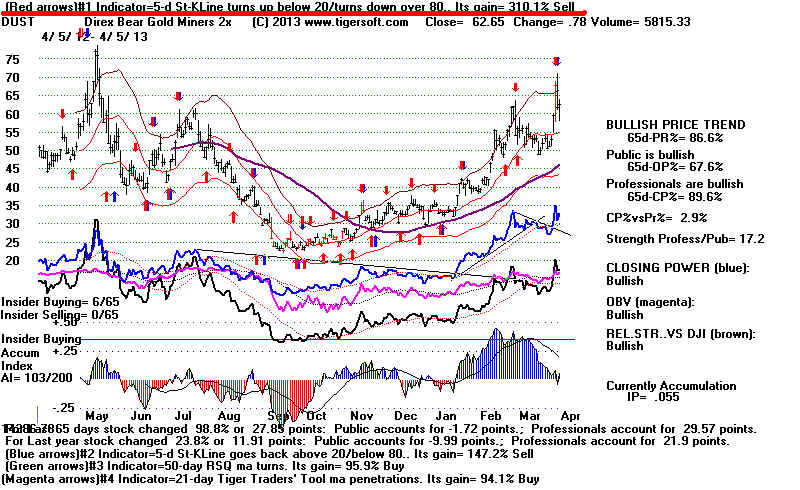

With this persepctive, DUST (the 3x leveraged short on gold mining stocks)

was a natural long. Usually in a very bullish situation, it work out well to

buy on short-term automatic Stochastic buys and sell when the Closing Power uptrends

were broken. In fact, the 5-day Stochastic-K-Line turning up below 20 as a buy

and turning down below 80 as a Sell was consistently profitable, as you can see

below. So, this approach had to be favored.

DUST chart ending 9/21/2012

5-day Stochastic K-Line turning up below 20 is a buy and down from above 80 is sell gained 80.5%

But best system was 21-day Tiger Day Traders' Tool MA turns +206.3%.