TigerSoft and Peerless Daily

Hotline

-----------------------------------------------------------------------------------------------------------------------

(C) 1985-2014 William Schmidt, Ph.D. www.tigersoft.com

All

rights strictly reserved.

Tiger Software 858-273-5900

PO Box 22784 San Diego,

CA 92192

Email william_schmidt@hotmail.com

Previous Hotline - http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

----------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

Shhh.

Sharing this hotline address with non-subscribers is a violation of our contract

with you and a violation of copyright laws. I work hard for you. Respect that

effort!

---> To

renew this Hotline,

order here $350 (check) - $360(Visa/MC)

www.tigersoft.com/-2GBL13HL/index.htm

-----------------------------------------------------------------------------------------------------

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

Peerless Signals: 1915-2013

Peerless Signals: 1915-2013

New Peerless

Signals and DJI Charts - version 7/4/2013

1965 1965-6

1966

1966-7

1967

1967-8

1968

1968-9

1969 1969-70

1970

1970-1 1971

1971-2

1972

1972-3

1973

1973-4

1974

1974-5

1975

1975-6

1976

1976-7

1977 1977-1978

1978 1978-79

1979

1979-80

1980

1980-1

1981

1981-2

1982

1982-1983

1983

1983-1984

1984 1984-1985

1985 1985-1986

1986

1986-1987

1987

1987-8

1988 1988-9

1989

1989-90

1990 1990-1

1991

1991-2

1992

1992-3

1993

1993-4

1994

1994-5

1995

1995-1996

1996

1996-7 1997 1997-8

1998

1998-1999

1999

1999-2000

2000

2000-1

2001

2001-2

2002

2002-3

2003

2003-4

2004

2004-5

2005

2005-6

2006

2006-7

2007

2007-8

2008

2008-9

2009 2009-10

2010

2010-11

2011

2011-12

2012

2012-2013

Background and New Studies

Introduction to

Tiger/Peerless Buys and Sells.

Peerless Charts and Signals

Documentation for TigerSoft

Automatic and Optimized Signals.

How reliable is a rising

200-day ma? 2/9/2014

The New 2014 Peerless.exe Software has now been posted on the Elite Stock Professional

Page.

==================================================================================

2/28/2013 IMPORTANT:

This

server has become very slow. The Hotlines will be posted

starting

tonight at www.tigersoftware.com/112211-H/index.htm

a little later

than

usual. Note the "ware" in the address. We will use this new address

until

further notice.

==================================================================================

2/27/2014

It seems that the "Expanded Buy B9" needs a new Sell signal to be

reversed. At the very least, it needs a trend-change in our measures of

Professional (CP)

and Day-Trading buying, if we are to expect even a short-term pullback. Today

SPY's Closing Power broke out above a series of flat tops. That's usually bullish.

So is the powerful surge in the A/D Line since Yellen became Fed Chairwoman.

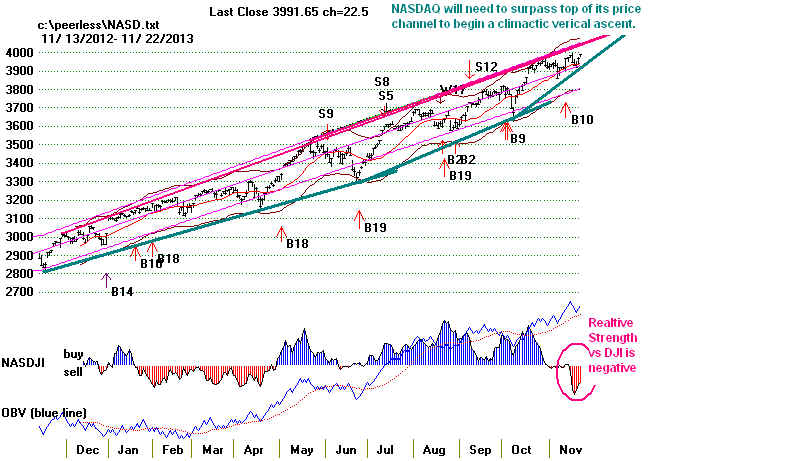

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

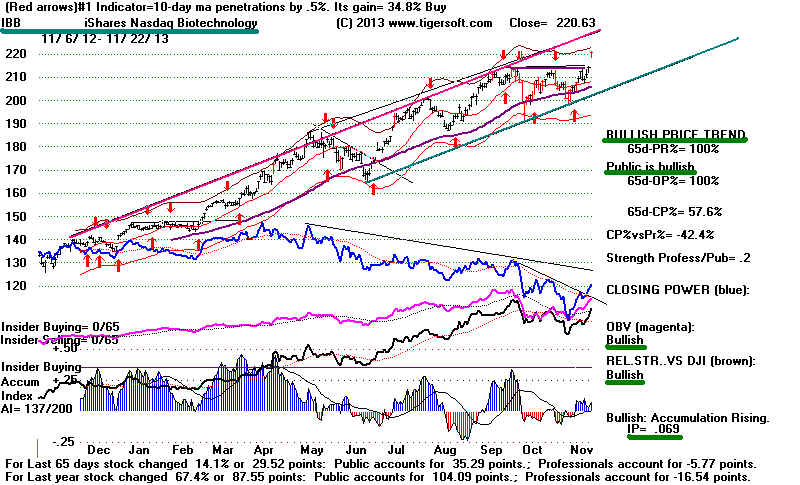

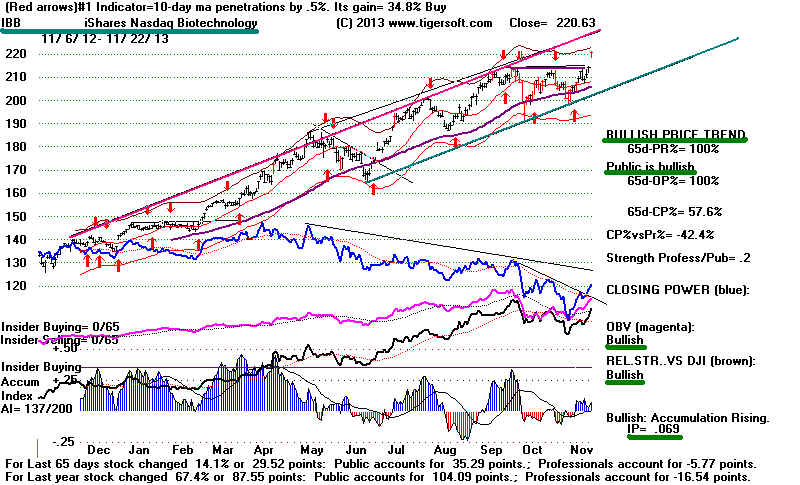

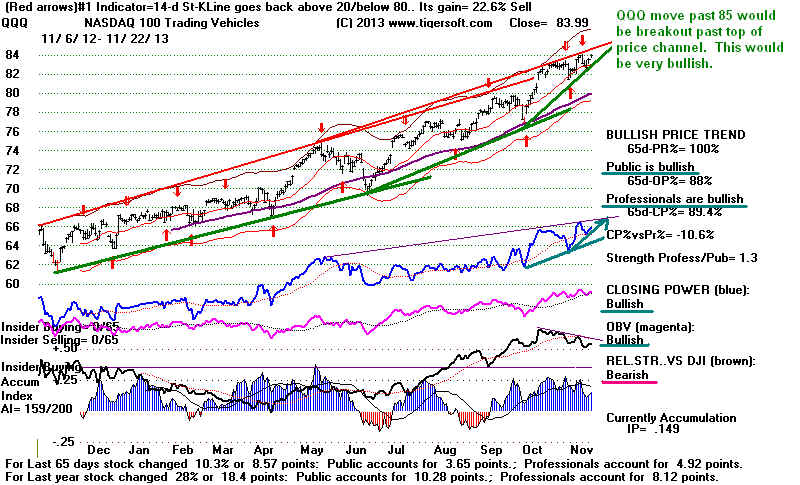

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 237 +52 MAXCP stocks Bullish MAXCP Stocks (2/27/2014)

Bullish plurality

--> 46 -15 MINCP stocks Bearish MINCP Stocks (2/27/2014)

--> 91

+18 New Highs on NASDAQ ? new lows. Bullish plurality

--> 79 +5 New Highs on NYSE 9 -6 new

lows. Bullish

plurality

Have you noticed that the most bearish MINCP charts now are those of the short ETFs?

See the charts of SDS, RWM and TZA below. This has to be bullish.

It is true that many low-priced stocks have enjoyed unsustainable, wild run-ups since

last Summer. But more keep coming on line. Individually, as long as their

Closing Powers

stay above their rising 21-day ma or their steep CP uptrends if they run up too far,

they can be played safely, I think, by users of TigerSoft.

Yes, The Market Appears Over-Bought, but...

Each time I think a convenient pull-back is at hand because of the over-bought

condition of the DJI relative to its 21-day ma, or the lagging Hourly OBV (DISI)

Line or SPY's inability to make a decisively breakout, stocks move higher on economic

news or comments by Yellen, the Fed Chairwoman. Let's just wait for a new

Peerless Sell or, at least, some change in the upper direction of the Closing Power

or the Tiger Day Traders' Tool on SPY (see last chart tonight). Obama's meeting

privately with Boehner may yet yield something constructive. I'm

betting the

Republicans will get aboard a big new (and patriotic) infrastructure rebuilding

program, just as they did under Coolidge and Eisenhower. That would be very

bullish.

Why fight the Fed?

Janet

Yellen says we don't have a stock bubble. Maybe, we should appreciate

not

whether she is right or wrong, but the effects that her statements have on stock prices.

I

think that each time we learn she is going to give a speech, we should buy before it.

“Stock prices have risen pretty robustly,” she told

Congress in November

But looking at several valuation measures -- she specifically cited equity-risk premiums

--

I do "not see stock prices in territory that suggest…bubble-like

conditions.” Source

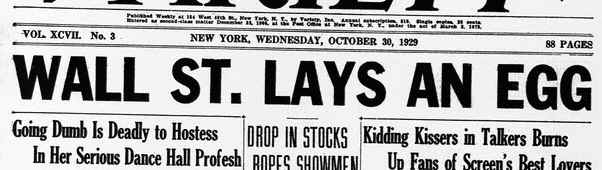

Bubbles Can and Do Last A Long

Time

It is in their nature. It is the way Wall Street and human nature work.

Low interest rate bubbles have many critics. Examples:

This

is no recovery, this is a bubble – and it will burst

Fed

Has Become 'Facilitator and Financier' of Government Debt

But it has always seened to me that most of the time these critics of a loose

Fed monetary policy are simply re-fighting the battle against a super-inflated

Weimar Deutch Mark of the 1922-1923. When they point out that that

the

Real Economy in the US is lagging, they are right, of course. But that was true

in the 1920s from October 1927 to October 1929, during which time the DJI doubled.

In England, it was true throughout the 1920s when official unemployment never

fell below 7.5%.

What the critics of cheaper credit are missing is that in many ways, the stock market

is rising now precisely because the "Real Economy"

is lagging.

1) It is the weak economy which gives the FED reason to keep rates low.

2) The stock market is rising in large part because it is still the best game

in town for investors, In a weak economy, other forms of investment generally

show much lower rates of return.

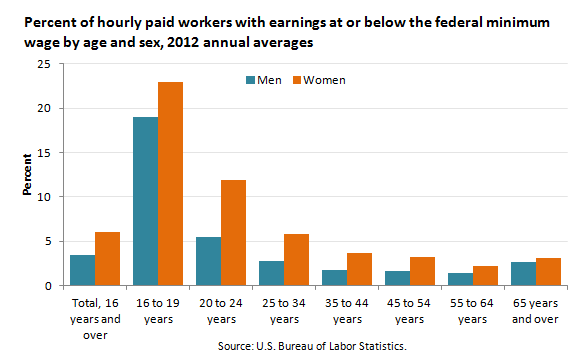

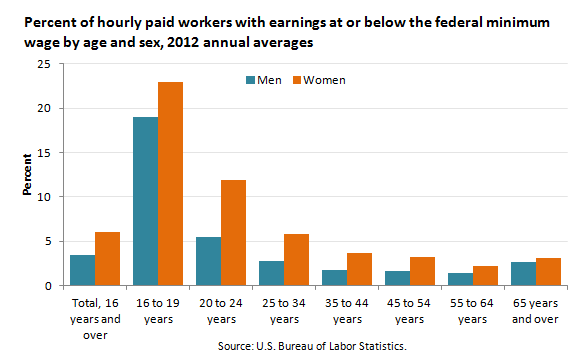

3) Why do the critics not understand that high unemployment means low wages

and this contributes mightly to higher profits?

4) A weak US economy means corporation will search for markets overseas

to make and sell things. In a low tariff environment, this is very profitable.

5) A weak US economy also means corporate cash reserves are built up.

These can be used to buy back stock. Or even better, to buy out competitors

when US anti-trust laws are ignored.

6) Finally, critics forget that the Fed is charged specifically under law

with shoring up a weak Economy with low interest rates, even though its

monetary policy is now a very poor alternative to a real Jobs Bill or a

massive investment in public infrastructure, such as highways were in 1920s

and 1950s. |

So, bubbles last much longer than most shorts can tolerate. That was

true in

1967-1968, 1999-2000 and even in 2008 when penny oil stocks went crazy. Proof

of this

today were the rallies in some of the most (red) distributed (and shorted) stocks,

like JCP below. This means that even when hedging, if you go short, it works

out best

overall to cover when the steep Closing Power downtrend is violated. Lots of

back-testing

validates this principle even in bear markets. There are always more Bearish MINCP

stocks to go short.

==================================================================================

OLDER HOTLINES

==================================================================================

2/26/2014

The SPY Needs to Plumb

for Support

The very good breadth and expanded Buy B9 should limit the decline.

Use the Bearish MINCPs to be equally hedged with long

positions.

With the Stochastic-20 over the 80-level and the DJI 1.9% over the 21-dma

the market is in overbought territory. The SP-500 still has not broken out over its

key 1850 resistance. Having found ressitance, the markets must search for support.

Fortunately, the internal strength indicators have turned positive. This should

help limit the decline. Futures are down today. A DJI decline back to test its

rising

21-dma at 16000 is needed. So stay fully hedged. If the

DJI breaks below its 21-day

ma, about 100 poin ts below today's close, we will probably see it fall to 15500.

But because the DJI is up a little more than 5% on this recovery, it is now more likely to

advance to new highs than retreat significantly. I say this looking at the S16 cases

that did not bring sell-offs in March or April when they recovered more than 5%.

Notably 1934 and 1990. If the DJI produces a new high, that would almost

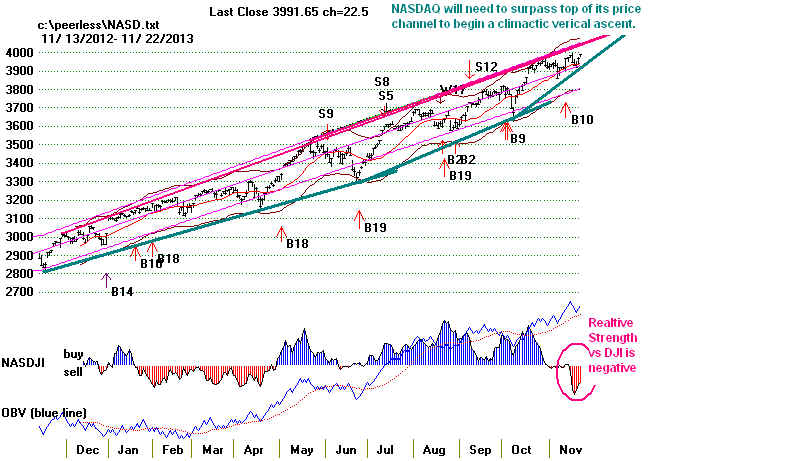

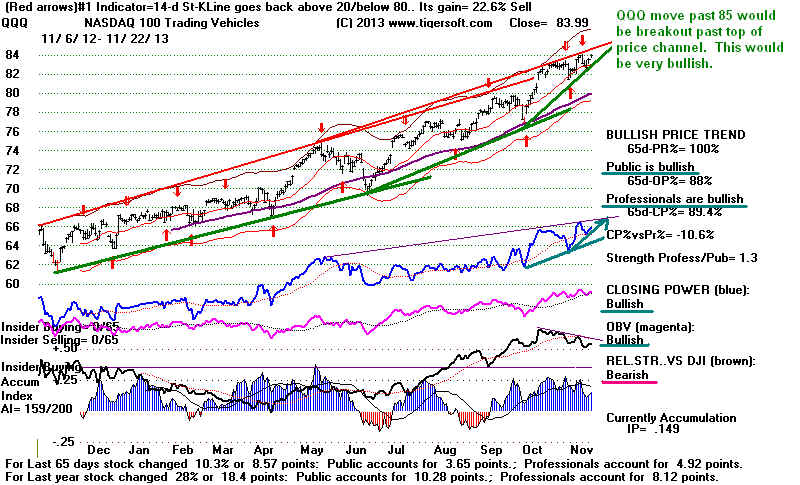

certainly mean an SP-500 breakout run and the possibility of a NASDAQ/QQQ

vertical ascent above their uptrend resistance lines. Peerless Sells

occur only in 1/4 of the cases when the DJI makes a new high in March.

So the bullish Spring seasonality may surprise traders if the DJI can make

another run to new highs.

When I consider the past results of the new "expanded Buy B9", I note that

it's average gain is 13.3%. Breadth (A/D Line) is particularly strong now,

reflecting the low interest rates and Yellen's reputation as a "dove" (i.e.,

a Fed member who places concerns about a weak economic revival above

worries about signs of inflation.)

We see megaphone or diamond

formations in development in the case of

DIA, SPY, QQQ... Usually, they do not reverse until a new high is made.

More often than not they are bullish.

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 185-10 MAXCP stocks Bullish MAXCP Stocks (2/26/2014)

Bullish plurality

--> 61 -4 MINCP stocks Bearish MINCP Stocks (2/26/2014)

--> 73

+8 New Highs on NASDAQ 8 new lows. Bullish plurality

--> 74 +11 New Highs on NYSE 15 new

lows. Bullish

plurality

Positive Internal Strength Indicators

DJI change

la/ma

annroc P-I

IP21 V-I Opct

65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

2/26/14 16198 +19

1.019 .270

+493 +103

+.057 +20 .091 .018

All are positive.

The V-Indicator has turned positive. But 10-day Down Volume is

rising and

10-day Up-volume is falling. That was not bearish enough last year in March

to drop the DJI below its 21-day ma. In the research I did a few years ago on S9vs,

I found that 1st quarter bullish seasonality over-rode a negative V-Indicator

reading at the upper band. There needs to be a bearish breadth divergence, too,

at this time of year.

http://www.tigersoft.com/PeerInst-2012-2013/refinedS9v.htm

It may be that the Hourly OBV Line's declining slope may

also be overridden

right now as long as breadth remains very good. But

clearly, there is some

heavy insitutional selling.

Bank Stock Weakness

I do think it's a good idea to watch the bank stocks.

Yellen's "dovishness"

comes with a desire to see banks have higher reserve requirements. I learned

in ECON-101 that tinkering with this potentially can have a big impact on

the economy. Since the big banks are now as much inclined to use their extra

reserves

to trade the equity, bond and currency markets as make loans, I would view any

news on this front - reserve requirement changes for the big banks -

as bearish for the markets. This may explain the weakness now in Goldman Sachs

(GS), why JPM has also slipped below its 65-dma and why BAC could bearishly

break a lengthy uptrend. She also may be more inclined to enforce the Dodd-Frank

limits on speculative trading, especially in commodities, as opposed to hedged

trading by big banks. The new limits on Commodity trading has sparked a good

rally there.

http://www.bloomberg.com/news/2013-11-05/traders-face-curbs-on-speculation-with-cftc-vote-on-new-limits.html

March Peerless Sells in Rising Markets Are Infrequent

What can bring about a significant top in March in a rising market? Here

are the cases of March tops since 1928 when the 65-day rate of change was

above -4. March Sells are in rising markets did not occur in 1942,

1943, 1944,

1945, 1950, 1954, 1955, 1956, 1957, 1959, 1963, 1964, 1965, 1967, 1969, 1971,

1972, 1975, 1985, 1986, 1987, 1989, 1990, 1991, 1992, 1993, 1995, 1996, 1997,

1998, 1999, 2000, 2003, 2004, 2006, 2010, 2011 (37 instances). This suggests

that the odds are 37:13 against a March top if a new high is made next month.

March Peerless Sells in Rising

Markets: 1928-2014

1 19290301 S9 321.2 .056 19290314 S9 316.3 .041

2 19360303 S15 156.2 .042 19360304 S12 156.7 .045

3 19370303 S9 192.9 .142 19370305 S15 194.1 .147

19370310 S9 194.4 .149 19370311 S4 192.2 .139

4 19390309 S3 151.3 .18

5 19660301 S10 938.19 .173

6 19760324 S15 1009.21 .048 Following a top

7 19770315 S9 965.01 .164

8 19800307 S10 820.56 .052 Following a top

9 19810326 S4 1005.76 .032

10 19840316 S9 1184.36 .083

11 20050308 S4 10912.47 .076

12 20090302 S13 6763.29 .025

13 20120321 S1 13124.62 .024 |

---------------------------------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

---------------------------------------------------------------------------------------------------------------------------------------------------

2/25/2014 The

market refuses to sell-off. The DJI is still above its 65-dma.

Consider the past results of the new "expanded Buy B9. Paper losses are

inconsequential

and the average gain is 13.3% with these signals. This make them one of the better

Peerless Buys. We should definitely use it the future. As for now, my

judgement is

that we can employ the Buy B9 and go long SPY (or DJI if you prefer) on a close

by SPY above its resistance, 186. If there is no breakout, we will go long on a DJI

of SPY decline back to their 21-day ma. That should act as support so long

as breadth remains so positive. The S16s's warning of a bigger next decline

may still come true. That would be a natural development in the broadening

top pattern we see in the DJI and SP-500.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 195-47 MAXCP stocks Bullish MAXCP Stocks (2/25/2014)

Bullish plurality

--> 65 +15

MINCP stocks Bearish MINCP

Stocks (2/25/2014)

--> 65

-45 New Highs on NASDAQ 10 new lows. Bullish plurality

--> 63 -44 New Highs on NYSE 12 new

lows. Bullish

plurality

The bearish devergence between the Hourly DJI and OBV (DISI) is increasing.

The Stochast-Pct-D-20 has reached the 80-level. This means it is over-bought.

A decline from here would be signalled by a short-term Stochastic-20 sell. I doubt

if the

markets will runaway to the upside if there is a breakout. With the IP21 still

negative, we could even get a new Peerless Sell at the 3% upper band (la/ma = 1.03).

What to do now in this environment?

Sell short bearish MINCP stocks/ETFs like MXF when they

breakdown below

well-tested support. Each short like this can be used to hedge a bullish MAXCP

stock. The result is usually quite favorable to the hedger.

Revised Buy B9.

2/24/2014; "Expanded Buy B9"

Previously if the DJI reached the lower 3% band and the

P-Indicator

was positive, a Buy B9 results. The new B9 expands these parameters,

by giving a Buy B9 if the P-Indicator is above -34 and the DJI

is more than 4% below the 21-day ma provided it is not January

or the the DJI is not more than 4% down from 65 days ago.

Earlier Expanded

Buy B9s

#1 12/11/1928 very good. Gain = +.161 65-day up-pct = .126

la/ma ann-roc PI PI-ch IP21 V

Opct 65-dayup-pct

.958 .263 -24 +18 .028 -511 .13

.126

Also already a Buy B2.

------------------------------------------------------------------------------

#2 7/24/1933 94.3 Gain = +.054 65-day up-pct = .304

la/ma ann-roc PI PI-ch IP21 V Opct 65-dayup-pct

.932 .165 12 49 -.145 -528 .082 .304

Also A Buy b6

----------------------------------------------------------------------------[--

#3 8/1/1933 92.7 Gain = +.072 65-day up-pct = .268

la/ma ann-roc PI PI-ch IP21 V Opct 65-dayup-pct

.927 -.641 -19 9 -.171 -630 .012

.268

Also a buy B16

-------------------------------------------------------------------------------

#4 11/8/1943 131.7 164 Gain = +.254 65-day up-pct = -.038

la/ma ann-roc PI PI-ch IP21 V Opct

65-dayup-pct

.958 -.527 158 32 -.261 126

-.225 -.038

Already a Buy B9 under previous rules

-------------------------------------------------------------------------------

Avg.Gain = +.133

#5 2/4/2014 15445.24 up so far. 65-day Up-Pct was -.012

la/ma ann-roc PI PI-ch IP21 V Opct 65-dayup-pct

.957 -.753 -30 10 -.149 -133 -.358 -.012

-------------------------------------------------------------------------------

In these expanded Buy B9s, the January cases must be eliminated.

These failures all had an Up-Pct below -.125, so it's hard to know

which of these two factors over-rides the bullishness of the expanded

B9.

1) 1/29/2003 8110.71 TO 7524.03 3/11/04 and then 65day-Up-pct was -.139

2) 1/15/2009 8212.49 fell to 6547.05 ON 3/9/09 65day -UP PCT was -.126

3) 1/23/2009 8077.57 fell to 6547.05 ON 3/9/09 65DAY -Up pct

was =.129 |

==================================================================================

OLD HOTLINES

==================================================================================

2/24/2014 With the

DJI up more than 5% from its low, it seems clear it would

be best to incorporate a new expanded Buy B9 for those cases where the DJI is

4%-5% below the 21-day ma and breadth is improving and the P-Indicator

is above -34. This always worked out well in the past from February to December

as long as the 65-day pct change was not below -.04. A new

Peerless with this

change and the ability to see longer 200-day and 149-da mvg avgs. will be

posted tomorrow on the Tiger ESP page.

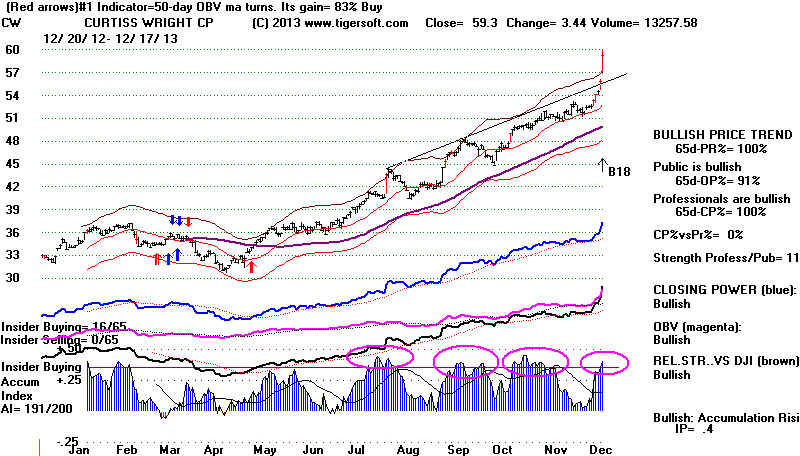

Secondary stocks, biotechs, gold and silver stocks, military stocks and

food commodities are the favored groups now. Note, that in the past a rise in

gold and silver stocks is actually a warnng for the market. That was true

for example in August of 1987. When inflationary forces build up, the Dollar gets

weak and the Fed usually decides to raise interest rates. Janet Yellen may not

be able to keep the more conservative Fed Governors from taking actions to

defend the Dollar. Still, considering how far the Fed was behind the curve in 2008,

my guess is that they will be much more concerned about triggering another recession

than inflation.

I do think we still have to be on guard that there will be another, bigger leg down

from a top in March. It is worrisome that the SP-500 could not breakout decisively

above 1850 today. The last hour's sell-off was on heavy volume. See this

in the

Hourly DJI chart below. Bearishly, the DJI is now 2.2% over the 21-day ma

but the IP21 is negative, -.006. This is not enough to bring a sell signal

when

the P-Indicator is as positive as it is now. But it does show lots of institutional

selling

into the strength we are seeing. Look at the 10-day day ma of NYSE Up and Down

Volume below. They appear to be starting to bearishly converge. In additon,

the Stochastic-20 for DIA and SPY have now reached the 80-over-bought levels.

The Tiger Day Traders' Tool is still rising for DIA and SPY.

The volume warnings suggest a pull-back seems likely.

This will probably have only

a small effect on the NASDAQ and QQQ. Out TigerSoft Stocks' Hotline

remains about equally hedged long and short using the MAXCP and MINCP

stocks..

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 242 +8 MAXCP stocks Bullish MAXCP Stocks (2/24/2014)

Bullish plurality

--> 50 +4

MINCP stocks Bearish

MINCP Stocks (2/24/2014)

--> 110

+3 New Highs on NASDAQ 9 new lows. Bullish plurality

--> 107 +34 New Highs on NYSE 9 new

lows. Bullish

plurality

|

|

|

|

ARWR was driven up by underwriters to a big new issue of

the stock.

I think I would take profits in it.

|

==================================================================================

OLDER HOTLINES

==================================================================================

2/21/2014

Sell S16 - Watchful Waiting. The DJI has not risen more than 5%

from its lows, but speculative "animal spirits" have taken over a number of

high performance funds. None more than FBIOX

(Fidelity biotech).

An SP-500 breakout over 1850 should bring another 5% advance.

Another 1.5% Rally in DJI may bring a Peerless Sell S12

The DJI is now 1.5% over the 21-day ma. The IP21 is -.011.

A lot of distribution

is taking place on this rally. In addition, the Hourly

DJI's chart shows a bearish

OBV (DISI) divergence now. Somewhat higher DJI price will cause the 20-day

Stochastic-Pct

to rise above 90, a level it has reached on every rally in the past year. The Tiger

Traders' Tool has not yet turned down.

The most bullish

factor now is still the Fed and the up-trend.

.

This

weekend a lot of people are reading about Janet Yellen dovishness in 2008

ahead of all the other Fed Governors in 2008. 2000 pages of FOMC and FED

minutes from 2008 were released on Friday.

This is important because many speculators believe the Fed will once again

be behind the curve just as they were in 2008. Partly because of this but mostly

because of human nature, it's a good bet that stock traders (large and small)

will be the victim of their own Animal Spirits

(Keynes' term for what

swerves investors back and forth between excessive fear and excessive confidence.)

And to quote him again: "Markets

can remain irrational longer than you can

remain solvent".

The Fed's Biggest Fear Now:

Letting The Economy Slip into Another Deep Recession.

The minutes shed new light on the Fed in the Dark or off skiiing in Idaho (Mishkin)

while the bank stocks and then the economy plummeted down in 2008.

The FED is clearly very wary of making the same mistake they made throughout

2008 when they badly underestimated the severity of the coming financial collapse.

Geithner's remarks at this time seem particularly uninformed and way off-base.

He was, after all, the head of the NY Fed. His primary concern on March 18th, 2008

was that any pre-emptive actions by the FED would scare confidence away from the

markets. Big US banks were not "as

a whole under-capitalized". This was a few days

after Bear Stearns had collapsed and its assets sold to JP Morgan. (Source.)

.

Bernanke, at least, had the good sense to call emergency FED meetings

starting in January

2008. But he also badly underestimated how much the

mortgages' collapse and derivatives would affect the market. On Sept. 16,

the day after Lehman Brothers filed for bankruptcy, Bernanke declared,

“I think that our policy is looking actually

pretty good.” The Fed declined

at that meeting to cut short-term rates. But three weeks later they were

forced to rescue AIG with a twenty billion bailout.

In October, 2008, with the DJI below 900, Yellen was the most forceful Fed

member calling for action. "Frankly, it is time for

all hands on deck when

it comes to our policy tools...We need to do much more and the sooner the

better...I don’t believe in gradualism in circumstances like these.”

Source.

Fisher in Dallas who had nearly always opposed rate cuts in October 2008

relented: “I will conclude with actually once again agreeing with President Yellen,

as I think I have done twice in history."

---> Hedging by being long the most Accumulated Bullish MAXCPs

and

short the most Distributed Bearish MINCPs keeps working out well.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 234 -27 MAXCP stocks Bullish MAXCP Stocks (2/21/2014)

Bullish plurality

--> 46 -9

MINCP stocks Bearish MINCP Stocks (2/21/2014)

--> 107

+8 New Highs on NASDAQ 9 new lows. Bullish plurality

--> 73 -18 New Highs on NYSE 7 new

lows. Bullish

plurality

As long as the DJI is unable to move up more than 5% from its

recent botton, the bearish scenario remains alive for the DJI, wherein it falls back

in a second decline to lows. The best way to know that the market is too

strong

for this possibility anytime soon will be a powerful breakout by the SP-500.

Actually, there are three markets now. First, there are the bullish MAXCP stocks

that keep surging to new highs after shallow retreats. Srcond, there are the majority

of

stocks that are going sidewise, like the DJI-30, and are not close to making

breakouts or beakdowns. Third are the more and more bearish MINCP stocks.

These have broken their 65-dma, show Closing Powers at or near their year's lows

and show an AI/200 score below 75. These show no ability sustain much of a rally.

Instead some of these steadily decline week to week and some drop precipitously

at unexpected times, ofen when the market is up.

In this environment, I think we should just wait to see whether the DJI will fall

back or

the SPY-500, OEX and IWM will follow the lead of the QQQ and make new

highs. Speculative markets like 1967-1968 and 1999-2000 teach us not to

underestimate

the bullish stampede bt investors into the leaders of the time.

On the other hand, the lessons of early 1977, mid-1986, early 2000 and 2001 and 2002

show that the DJI-30 lead the rest of the market downward and that these these other

indexes

could top out 1-2 months after the DJI does. In this bearish scario, a 10% decline

is

the least depth that occurred. Always Peerless was on a sell. So, waiting now

for a clear A/D Line trendbreak and a Closing Power uptrend break should serve us

well now. That would show the Sell S16 will producing its second leg down.

Such breaks could signal a significant sell-off by the whole market. But,

fortunately

for the bulls, such a top historically is not made until March at the earliest,

when there has been a 5% rally, like now.

DJI

change la/ma

annroc P-I

IP21

V-I Opct

65-day Pct Change S20-Pct-D

----------------------------------------------------------------------------------------------------------------------------------------

2/6/2014 15628 +188 0.973 -.667 -16

-..095 -121

-.357

000 Back above 200-dma

2/7/2014

15794 -5 0.986

-.496 +83 -.058 -98 -.261

+.009

2/10/2014 15802 +8

0.988 -.478 +100 -.044 -99 -.176

+.011

2/11/2014 15995 +103 1.002 -.329 +119

-.014 -88

-.088 +.015 At 65-dma

2/12/2014

15995 -29 1.001 -.218 +205 .010 -66 -.083

+.023

2/13/2014

16028 +33 1.005 -.258 +216 .015 -69 -.086

+.016

2/14/2014

16154 +126 1.014 -.245

+221 .029 -71

-.02 +.023

2/18/2014

16130 -24 1.014 -.214 +246 .025 -66 -.095

+.024

2/19/2014 16041 -89

1.009

-.313 +227 -.009 -64 -.199

+.013

2/20/2014 16133 +92

1.016

-.211 +228 .015 -53

-.110 +.016

2/21/2014

16103 -30 1.015 -.202 +206 -.011 -59 -.120

+.008 +75

==================================================================================

OLDER HOTLINES

==================================================================================

2/20/2014

Perhaps, the Sell S16 probably should have

been reversed by a B9.

B9s typically occur near the 3.5% band with the P-Indicator positive. The revised

B9 would occur 4.5% below the 21-day ma with P-Indicator no lower than -35

and rising.

Bearish Scenarios. The DJI is

still not up more than 5% from the recent bottom. That

means a significant second, delayed S16 decline could start in March. In addition,

a rally 1.5% higher by the DJI would probably bring a new Peerless Sell.

Bullish Scenario. Traders, watch now for a bullish SP-500 breakout above its flat top

at 1850. This should set off a buying surge. Even a shallow pull-back here.

could set up a bullish continuation head and shoulders. Either eventuality

would be quite bullish. Traders should buy SPY on

such a breakout at the

close. It may signal a wild, vertical ascent and we would want to play that

possibility.

5% Up Rule for DJI, Sell S16:

Towards A Revised Buy B9

The 5% DJI

rally up from the recent bottom may appear stronger than the

unreversed

Sell S16 should allow. I would agree. Accordingly, I must look

for new

ways that might spot such reversals in the future. The mere crossing back

above the

rising 200-day ma, however, does not test well enough by itself, or

even when

good breadth is factored in. Early 1977's Peerless chart

shows this.

What about

a 3-day reversal pattern recognition, Michael in Germany has suggested?

I think

that is an excellent idea. It needs to be tested. What about a revised B9 that

looks for

the DJI with these parameter?

la/ma < .959, P> -32. P-change>0 and 65-day up pct > -.015?

This is

more easily back-tested. See below how well it works in most cases. 3 of the

5 failures

came in January. These would be eliminated in the revised Buy B9.

We can also

eliminate the bear market cases by simply requiring the 65-day Up-Pct

to be above

-.05. Let me do a little more study. But I think with these modifications

to a Buy

B9, the program will be improved. There were only 4 earlier cases where

these

parameters

allapplied. But some of the bear market occurrences would have produced

outstanding

gains. Applying these parameters would expand the current B9 in a safe and

reliable

way, I think you will agree.

Revised Buy B9 with parameters shown above

#1 12/11/1928 very good. Gain = +.161

65-day up-pct = .126 Also already a Buy B2

now,

8/11/1930 OK 5.1% 65DAY PCT was -.151

6/29/1932 Perfect 42.8 ---> 76.2 on 9/9/1932

65DAY PCT was -.422

#2 7/24/1933 94.3 --> 99.4 on 8/17 -

65-day up-pct = .304 Also another Buy

#3 8/1/1933 92.7 --->99.4 on 8/17 - 65-day up-pct = .268

Also another Buy

11/18/1937 125.5 FELL TO 11 3.6 ON 11/24

65DAY PCT WAS -.387

1/31/1938 121.9 --- 6.2% -->129.5 65DAY PCT WAS -.092

3/23/1939 140.3 FELL TO 123.8 ON 4/11 65DAY PCT was -.071

#4 11/8/1943 131.7 TO 129.6 ON 11/30 and THEN

ROSE A LOT Buy 65-day up-pct = -.038 Already a Buy B9

10/9/1946 163.1 THIS WAS BOTTOM of BEAR MKT 65DAY PCT was -.214

11/9/1948 CLOSE TO BOTTOM 173.9 ---> 171.2 and then up to upper band.

65-day up-pct = -.05

1/29/2003 8110.71 TO 7524.03

3/11/ AND THEN UP. 65DAY PCT was -.139

1/15/2009 8212.49 FELL TO 6547.05 ON

3/9 65DAY PCT was -.126

1/23/2009 8077.57 FELL TO 6547.05

ON 3/9 65DAY PCT was

=.129

#5 2/4/2014 15445.24

up so far. 65-day Up-Pct was -.012

--> To

Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 261 +70 MAXCP stocks Bullish MAXCP Stocks

(2/20/2014) Bullish

plurality

--> 55 +11

MINCP stocks Bearish MINCP Stocks (2/20/2014)

--> 99

New Highs on NASDAQ 10 new lows. Bullish plurality

--> 91 New Highs on NYSE 12 new

lows. Bullish

plurality

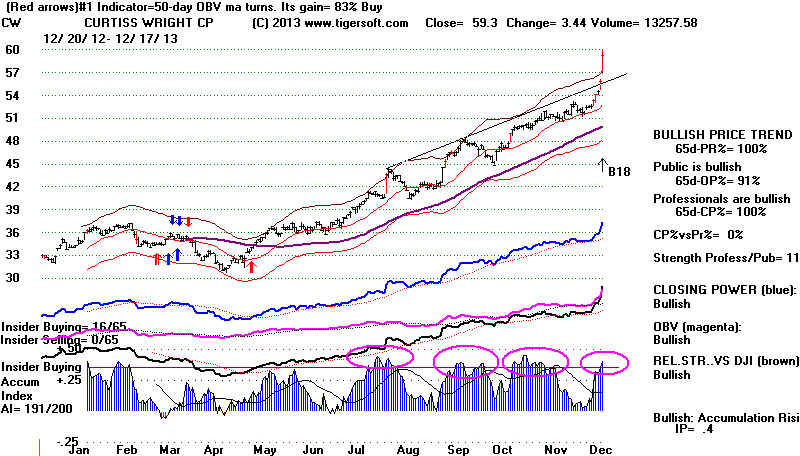

Consider the Broader

Market, not just the DIA or SPY.

Try to look beyond the DJI when the NASDAQ and QQQ outperform the

DJI

by a wide margin. This has happened before. I have mentioned 1967-1968

and 1999-2000. History teaches us that secondary growth stocks should be played

long at this time, even despite the Sell S16 that Peerless gave at the end of last year.

Look at the Bullish MAXCPs for ideas. Many of these

stocks have been

appearing on our lists nightly since the rally began. As should be expected,

the best

performers are those showing great bulges of Accumulation, Closing Power new highs

and a quickly rising Relative Strength versus the DJI. (The latter is shown by the

brown RSQ

line just above the Accumulation Index on our daily TigerSoft charts.

This is too strong a market to short any but the Bearish

MINCP stocks, which

surprisingly enough to outsiders, keep declining. JCP

and WLT are just the

most obvious examples of that.

.

The DJI is the weakest of the major market ETFs. In the past, a lagging DJI has

shown

that the market has entered a very speculative phase where secondary stocks get

their chance to dance in the sun. But right mow, the DJI is probably too strong

to short. Its coming back above the 65-dma was a warning to cover. So was

the excellent breadth again today. We know from classic chart theory (Edwards

and Magee) that megaphone patterns warn that prices can move unusually

swiftly up from support back to new highs. That is what the NASDAQ, IWM,

QQQ and the SP-500 show.

Last night's recommendation for traders to short DIA on mid-day strength today

was probably premature. But a significant top may still be made for the DJI in March.

While news of a sharp rise in January manufacturing got the DJI to jump up 100 points

between 10:00 AM and 11:00 AM, its close was less than 100 points up for the

day. See the Hourly DJI chart. Note that

the OBV line failed to move higher today.

This is a bearish divergence we should be kept in mind. DIA will probably be a good

short sale again, when the current move's upward momentum and uptrend are reversed.

If we only consider the DJI a little more, it would seem we may see a run to 16300-16400

where its upper band is. Breadth has been good, so other stocks will probably rise

faster and further than the "old-fashioned", "dinosaur" DJI-30.

See below that the

DJI could easily stall out at its 3%-3.5% upper band. Right now, it is may rise

further.

but there still appears to be too much distribution (shown by weak IP21), inadequate

up-volume (shown by negative V-I) and poor intermediate-term momentum (MA-ROC is

negative).

The Sell S16's second decline (wave down) is being delayed. If the DJI rallies up

more

than 5% from its recent lows, say another 200 points more, it would mean that

the S16 no longer looks like those past cases where the next top after the 5%

advance brought a very significant decline. Such an additional advance would suggest

that SPY will achieve a bullish flat-top breakout and we may be starting the long-awaited

NASDAQ's climactic vertical ascent.

Watch Tiger's Day Traders' Tool for DIA. When its current spike upwards ends,

we should see either a reversal or a period of consolidation. Which will occur will

depends on whether secondary stocks take off into a vertical ascent mode.

Secondary growth stocks in the Bullish MAXCPs should be

played aggressively long

now. Watch to see if the IWP can get past the top of its price channel.

==================================================================================

OLDER HOTLINES

==================================================================================

2/19/2014

Sell S16 Deferred. The DJI has reversed downward after

a typical 5% rebound late in a bull market without a Peerless Buy. I suspect

that the NASDAQ and QQQ will not retreat much. They made new

highs and their uptrends seem intact.

Bearishly, the SPY (SP-500) and IWM (Russell-2000) ETFs failed to get

past their January highs' resistance. The DJI and DIA did not even come close

on their 5% recoveries to making it back to the resistance from the

January highs. Today's declines establish price downtrends which will look more and

more formidable if there is a further decline.

I suggest going short DIA again but hold long most of any Bullish MAXCP stocks

you have. Given the recent strength in the major markets' Closing Powers,

traders

should not sell short at the openings. I would sell short DIA if it again opens

higher

but closes below the opening. This will produce a bearish "red

Popsicle" on our

candle-stick charts. We might also wait for the Tiger Day Traders' Tool to turn

down on DIA.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 191 MAXCP stocks Bullish MAXCP Stocks (2/19/2014)

Bullish plurality

--> 36

MINCP stocks Bearish MINCP Stocks (2/19/2014)

--> 48

New Highs on NASDAQ 7 new lows. Bullish plurality

--> 43 New Highs on NYSE 10 new

lows. Bullish

plurality

Deferred Sells and Delayed Sell-Offs Late in A Bull Market

Below I again show that there are a number of cases of "delayed second

declines"

where the DJI rallied only 5% late in a bull market against a successful

Peerless Sell and then fell sharply. In none of these cases, however, did the

decline come as early as February. Usually the peak of the counter-Peerless rally

was March or later.

Resistance commonly occurs when the DJI has advanced 5% against a successful

Peerless Sell signal late in a bull market. I have pointed to a number

of cases and suggested heeding a break in the NYSE to cover short sales

and then to resume the short sale in them. Another case supporting this

approach that I did not mention a few nights ago was in 1940. In all these

cases, abiding by an A/D Line uptrend-break would have worked well.

But the real lesson here is that we need protection against the next big move

in this context which is usually sharply down: viz. 1940, 1946, 1962, 1966 and 1978.

We can take into account other factors, too, which make the current situation

look more bullish, but except for the case of June 2012, the outcome was always

bearish. Such other factors are:

1) a head/shoulders pattern ... Bullishly not present now

2) the A/D Line's strength ... Bullish here.,

3) the tendency of the rebound to last at least until March... Bullsh

Here.

5% Rebounds without A Peerless Buy Late in Bull Market

Sell

Rallies without A Peerless Buy

Second Decline

----------------------------------------------------------------------------------------------------------------

January 1940 (S16)

5% up into April.

26% Sell-off.

May 1946 (S5,S4)

5% up to 65-dma and then

Bear market until October

Head/Shoulders

A/D Line worked well here.

January 1962 (S16)

5% up from 1/29 to 722.3 (3/16/1962)

Bear market

follows.

Head/Shoulders

A/D Line worked well here.

January 1966 (S12)

5% up from 3/15 to 949.83 (4/22/1962)

Bear market follows.

1) War escalating

A/D Line worked well here.

2) Fed also then accused of not

raising rates to fight inflation.

April 1976 (S15)

5% up from 958.09 6/7 to 1007.45

on 6/21 5% decline to 960.44 on 8/26

A/D Line worked well here.

Sept

11, 1978 (S9,S12) 5% up from 861.14 9/21 to 896.74 on

10/12 13% decline

New

S9/S12. A/D Line worked OK.

The Exception

The experience of June 2012 shows that is possible for the DJI to

regain its footing

after a brief dip below the rising 200-day ma late in a bull market and then after some

consolidation at the rising 65-dma, move significantly higher. At the time,

we also had no Buy signal at the time. The Hotline did note that, like now, the NYSE

A/D Line

had failed to confirm the decline to the 200-day ma. There WAs also a mis-shapen

head/shoulders. A Buy B3 was added later because further research discovered

that the Stochastic-20 Pct-D had failed to confirm the low (unlike now). In

addition,

Arthur Merrill showed years ago that June is frequently a bottom in the second

year after a Presidential Election. There are other big differences between then

and now. Our bull market now is two months' older and more vulnerable. Unlike

then,

the Fed now is threatening to retreat from its low interest rate policies. This is

the gist

of the Minutes

of its last FOMC

meeting. Rumor has it that Yellen is also considering

requiring banks to keep a high amount of cash reserves on hand. Big bank stocks

were weak today. And also bearish, arbitrage and take-over bulls surely did not

like the big declines today in both Comcast and Time Warner. Perhaps, Obama's Justice

Department will actually do something to fight the anti-consumer trend towards

monopolization which took off in the 1980s and 1990s. One last point, food commodity

prices are soaring. Inflation is likely to become a much bigger factor in their

thinking

if drought conditions grow worse.

2012 DJI - Note June bottom.

At the time, there was no Buy B3

On balance, I think we have to go short DIA again, but not if the market opens

sharply lower. In that case, I would wait for a rally or another day. Two

stocks

to consider shorting because of their bearish-looking head/shoulders patterns

are AMZN and MMM. Foreign

ETFs look like they are bearishly falling away

from their falling 65-dma.

==================================================================================

OLDER HOTLINES

==================================================================================

2/18/2014 Sell S16

Deferred... First a Rally To New Highs. The NASDAQ,

QQQ (Nasdaq-100), BBH (Biotech ETF),

Military Stocks like GD are already there

and running strongly upwards. Note the megaphone patterns in SPY, QQQ, IWM,

OEX, NYSE. These usually signify that the markets are running wildly and are

temporarily out of control of the market makers and professionals. But Opening

Powers are weaker than Closing Powers. Professionals are buying from the Public

and from investors overseas. This should be bullish. It may even mean

the top of

the megaphone patterns will be broken above.

That is asking a lot, however. Peerless is not on a Buy and there is growing

weakness

in the Dollar which could bring a new rise on interest rates if precious metals, energy

prices and foods keep rising in price for another few weeks. The DJI has achieved

the 5% advance it sometimes gets late in a bull market without the benefit

of a Peerless Buy signal. In addition, the SPY has reached ressitance. Let's

see if a lower opening is reversed again to the upside or this is the end of the

DJI's recovery.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 301 MAXCP stocks Bullish MAXCP Stocks (2/18/2014)

Bullish plurality

--> 36

MINCP stocks Bearish MINCP Stocks (2/18/2014)

--> 124 New Highs on NASDAQ 8 new lows.

Bullish plurality

--> 147 New Highs on NYSE 11 new

lows. Bullish

plurality

Our Stocks' Hotline is long 2x more Bullish MAXCPs than the Bearish MINCPs

we are short. If there is

now a break in the NYSE A/D Line uptrend, the DJI will

fall back, but at this point, it is not clear that its retreat would be able to have

much effect on the favored groups. At 36, the number of MINCP

stocks now

is quite small compared to the 301 MAXCP stocks.

One element that could change that would be signs of inflation, the bugaboo of low

interest rates. Food commodities, oil, natural gas, gold and silver have recently moved

up above long-term downtrends. A weakening Dollar will

put a lot of pressure on

the Feds to raise rates. Watch these early warnings signs of higher interest rates.

A second force in the markets could be the Chinese stock market. Many low

priced Chinse stocks there have had speculative binges in the last six months. Now

the Tiger Index of Chinese stocks shows a head/shoulders pattern with heavy

red distribution. In November 2007, the Tiger Index of Chinese stocks also

showed a similar pattern. That led to a Crash. If China's economy were to

stumble

badly, many bad things might follow, not the least of which would be that they might

have to sell a lot of their US Treasuries. So, let's watch this Index in the coming

days.

SPY Has Reached Resistance

SPY (below) is challenging its January highs. The Mid-cap

stocks and Russell-1000

are lagging a little more. We will be watching to see if these broader indexes can

also make new highs.

The DJI is now up 5% from its recent lows. Ordinarily this is about as much of a

rally

as we are likely to see when there has been no Buy signal late in a bull market.

We could reverse here. Breaks in the A/D Line and Closing Power will tell us

if this 5% limit is to repeat here. As the NASDAQ is much stronger now, it seems

likely we are in a very speculative phase like 1967-1968 and 1999-2000. At

these times the DJI lags the rest of the market. As long as the NYSE A/D Line

is rising, prices for the favored groups will probably keep rising.

============================================================================================

OLDER HOTLINES

============================================================================================

2/14/2014 Sell S16 Deferred... First a Rally To New Highs.

The DJI is now up 5% from its recent lows. Ordinarily this is about as much of a

rally

as we are likely to see when there has been no Buy signal late in a bull market.

We could reverse here. Breaks in the A/D Line and Closing Power will tell us

if this 5% limit is to repeat here. But given the NASDAQ's strength, Yellen's

reitteration of historically low interest rates and the new mergers' environment,

I suspect the DJI will reach its January highs while the other indexes make

their own new highs. It does seem like the NASDAQ is being drawn back to 5000.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

No Peerless Buy. What should we do?

We do know we do not want to let a short sale

gain turn into a loss.

In a rising market, Peerless sometimes gives a good Sell but does not give a Buy

signal even though the DJI rallies. No Buy is produced because the circumstances

of the reversal are not reliably bullish. (Here, for example, the DJI's rally above

the rising 200-day ma is bullish, but not reliably so. There are too many cases

where it fails. I spent two days testing it back to 1928.) Even so, we

can predict

a rally. These tend to occur after Sell S16s if there is a January reversal.

We do not get a Peerless intermediate and automatic Buy because at the time of the

reversal, it cannot be predicted that the rally will reliably present a big

enough

advance, because the resulting rally may be too limited to give a good Peerless sell

and because we will want to be short if there is a sudden reversal down.

Traders can guard against a 5% rally by

using other tools.

Traders in this situation should watch:

1) the Closing Power trend on DIA,

2) the A/D Line trend on the NYSE and

3) use a closing above the 65-dma to close out short positions if they are

still open..

Rallies against A Peerless Sell Late in A Bull Market

and Then A Bigger Second Decline

Sell

Rallies without A Peerless Buy

Second Decline

----------------------------------------------------------------------------------------------------------------

May 1946 (S5,S4)

5% up to 65-dma and then

Bear market until October

A/D Line worked well here.

January 1953 (S16),

1 month 3.2% up to 290.6 (3/17/1953) Fell to

263.4 on 6/10/1953.

A/D Line worked well here.

January 1962 (S16)

5% up from 1/29 to 722.3 (3/16/1962)

Bear market follows.

A/D Line worked well here.

January 1966 (S12)

5% up from 3/15 to 949.83 (4/22/1962)

Bear market follows.

A/D Line worked well here.

April 1971 (S16)

3.5% rally for two weeks to 903.4 7/12/71 7% decline to 839.59

8/10/71.

A/D Line worked well here.

April 1976 (S15)

5% up from 958.09 6/7 to 1007.45

on 6/21 5% decline to 960.44 on 8/26

A/D Line worked well here.

Sept 11, 1978

(S9,S12) 5% up from 861.14 9/21 to 896.74 on 10/12

13% decline

New S9/S12. A/D Line

worked OK.

The

market's swift rise back towards its January highs owes to unusually steady Professional

buying

and

the speculative dynamics of broadening megaphone patterns. While I can't

accord Peerless Buy

status to the DJI's cross-over above a rising 200-day ma

because there are too many failures, I can

certainly advise watching the rising trends of the NYSE A/D

Line and the Closing Powers of

DIA, QQQ and SPY.

Why The Rally?

It's

not clear why Professionals are so intent upon buying other than Janet Yellen

is

believed to be even more of a dove than Bernanke was in the matter of keeping interest

rates

low. Their buying is also sharply increased by Comcast's buying

control of Time Warner.

They

reason there could be a lot more buy-outs, given the massive

amount of idle corporate

cash,

low rates and a seemingly corporate-compliant and deferential Justice Department.

> Justice

Department Weak on Charging Individuals for White Collar ... Jan 20, 2014

> A

Washington activist group has sued to derail the Justice Department's record-setting

$13

billion settlement with JPMorgan,

> What

Goldman Sachs Did and the Justice Department Didn't

Also

Erik

Holder's past corruptability.

200-day ma cross-overs

The BUY B20 is not a new signal. I only put it here in the chart below

to show the DJI's cross-over of the 200-dma. I also used it to do the

back-testing.

It is NOT part of a new Peerless. But there are some changes and discoveries.

New will be the longer-term 30-wk and 200-dma. They will go back to 150 days

from the last day of the graph. I also want the green 200-day ma to change to red

when it turns down. I tried this with the 65-dma, but it makes the Peerless chart to

complicated and hard to read. Very often the zone between the 149-day ma

and the 200-day ma is the "sweet spot". Declines to a rising sweet spot

are bullish.

Rallies to a falling sweet spot are bearish. Declines only to the rising 149-day ma

may actually be more bullish than declines to the 200-day ma. It shows more

strength. The same is true in reverse. Rallies only to the 149-day ma are

more bearish. They show more weakness. The new book will show this and

many things more.

--> 140 -1 MAXCP stocks Bullish

MAXCP Stocks (2/14/2014) Bullish

plurality

--> 51 +2 MINCP stocks Bearish MINCP Stocks (2/14/2014)

--> 65 -34 New Highs on NASDAQ 5 -4 new lows.

Bullish plurality

--> 94 -8 New Highs on NYSE 6 new

lows. Bullish

plurality

DJI change

la/ma

annroc P-I

IP21 V-I

Opct

65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

2/3/2014 15373 -326

0.949 -.783 -41

-.167

-148

-.382 -.02 65-dma turned down.

2/4/2014

15445 +72 0.957 -.753 -31

-.149 -133

-.358

-.012

2/5/2014

15440 -5 0.959 -.726 -44

-.120

-135

-.361

-.007

2/6/2014

15628 +188 0.973 -.667 -16

-..095 -121

-.357

000 Back above 200-dma

2/7/2014

15794 -5 0.986

-.496 +83 -.058 -98 -.261

+.009 65-dma

starts rising

2/10/2014 15802 +8

0.988 -.478 +100 -.044 -99 -.176

+.011

2/11/2014 15995 +103 1.002 -.329 +119 -.014 -88 -.088

+.015 At 65-dma

2/12/2014

15965 -29 1.001 -.218

+205 .010 -66

-.083 +.023

2/13/2014

16028 +66 1.005 -.258 +216 .015 -69 -.086

+.016

2/14/2014 16154 +127 1.014 -.245 +221 .029 -71 -.092

+.023

==================================================================================

OLDER HOTLINES

==================================================================================

2/13/2014 The Sell

S16 remains the operative Peerless signal. But the DJI has

reached its

now rising

65-dma. Rising 65-dma are much less likely to act as resistance.

If DIA and

DJIA move decisively above the 65-dma, they will then bullishly join all the other

and key

indexes and ETFs that have already done this. See NASD, QQQ, SP-500, OEX, SPY,

IWM, FAS, IBB.

Biotechs remain the leaders. A number of the most

Bullish MAXCP

stocks have

reached resistance lines I have drawn. Breakouts by them are apt

to start an

even steeper new leg up. Its already hard to imagine much steepter

rises than

in ARWR and ALXN.

Their rockets' glare ignites a lot of greed,

as do the many line-formation breakout/followed by

long runs that I showed last night.

These

spectacular advances create and reflect a bullishness which will not easily

be stopped.

Even with some profit-taking yesterday, our Stocks' Hotline is long

about twice

as many stocks it has short. In part, this is because there are so

many more Bullish MAXCP stocks than Bearish

MINCP stocks.

In this environment, we must limit losses on short sales. "Don't fight the Fed".

Never has

the Federal Reserve played such a powerful role as now in keeping a

bull market

alive, while running the risk of a speculative bubble. If you have not already

closed your

short on DIA, I would then cover it if the DJI gets hourly above 16052.

Today's

Professional Buying surge after a very weak opening was very impressive.

The DJI's

next resistance is at its recent highs, around 16600.

The Hourly DJI

shows an inverted head/shoulders with a neckline that crosses at 16051.

A move

above that would also decisively put the DJI above its rising. 65-dma. In addition,

seasonality, apart from S16s is bullish. Since 1965, the DJI has risen 70.2% of the

time

in the

month after February 13th with an average gain of 1.6%.

Peerless

normally works well, in part, because markets are mostly moving in close allignment

and because

there have been quite a few cases where the DJI has led down the NASDAQ, the

rest of the

market and the NYSE A/D Line even when they had been acting much stronger.

See the

Peerless charts of 1977, 1986, 2000 and 2001.

What Type of Sell Signal Might We Get if The DJI Makes A New

High?

Sells S16s, except for the one in early 1990, carry with them the

added warning that if

the

initial decline is shallow, the next decline after the next Sell may be much worse.

Right

now, the A/D Line is clearly confirming the DJI's advance. But that will

not

prevent us getting a Sell signal after an advance back to 16600.

This is because a confirming A/D Line has not prevented important Sells at a

number of

past major tops. The A/D Line was also making new highs at the market tops

just below.

By sheer count, the most common Peerless Sells in this environment

are: S16(4),

S4(4), S11(2), S5 (1), S15 (1) I will discuss these more this weekend if

the advance

continues.

May 1946 (S5,S4),

January 1953 (S16),

January 1962 (S16),

January 1966 (S12),

December 1968 (S1)

April 1971 (S16),

September 1976(S1, later S4, S16),

January 1993 (S4), April 2010 (S11)

May 2001 (S4, S11)

March 2002 (S9, S15)

May 2011 (S8, S5).

Sell S16s Often Bring Two Declines

The first decline may end in January but the next leg-down

is apt to be deeper and last until May, October or later. This was true in

1938, 1940, 1960, 1962, 1970, 1977, 1981, 1990 and 2000.

This means the next top may be important. The only real exception

is 1934.

--> 140 -1 MAXCP stocks Bullish MAXCP Stocks (2/13/2014)

Bullish plurality

--> 51 +2

MINCP stocks Bearish

MINCP Stocks (2/13/2014)

--> 99 +33 New Highs on NASDAQ 9 -1 new lows.

Bullish plurality

--> 104 +55 New Highs on NYSE 6 new

lows. Bullish

plurality

DJI change

la/ma

annroc P-I

IP21 V-I

Opct

65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

2/3/2014 15373 -326

0.949 -.783 -41

-.167

-148

-.382 -.02 65-dma turned down.

2/4/2014

15445 +72 0.957 -.753 -31

-.149 -133

-.358

-.012

2/5/2014

15440 -5 0.959 -.726 -44

-.120

-135

-.361

-.007

2/6/2014

15628 +188 0.973 -.667 -16

-..095 -121

-.357

000 Back above 200-dma

2/7/2014

15794 -5 0.986

-.496 +83 -.058 -98 -.261

+.009 65-dma

starts rising

2/10/2014 15802 +8

0.988 -.478 +100 -.044 -99 -.176

+.011

2/11/2014 15995 +103 1.002 -.329 +119 -.014 -88 -.088

+.015 At 65-dma

2/12/2014

15965 -29 1.001 -.218

+205 .010 -66

-.083 +.023

2/13/2014

16028 +66 1.005 -.258 +216 .015 -69 -.086

+.016

#1 19341231

S16 104.00 Gain = +.104

Paper loss = 3.1% Next market bottom 3/18/1935

-------------------------------------------------------------------------

#2 19381230 S16 154.4 +.100 3 straight up days

Paper Loss = none Next market bottoms 1/26/1939 and 4/11/1939.

-------------------------------------------------------------------------

#3 19400103 S16 152.8 +.045 4 straight up days

Paper Loss = none Next market bottoms 1/15/1940 and 6/10/1940.

-------------------------------------------------------------------------

#4 19420102 S16 112.8 +.132 4 straight up days

Paper loss = 0.6% Next market bottoms 4/28/1942

-------------------------------------------------------------------------

#5 19521230 S16 292 +.098 4 straight up days

Paper loss = 0.6% Next market bottoms 6/16/1953

-------------------------------------------------------------------------

#6 19591231 S16 679.3 +.099 3 straight up days

Paper loss = 0.9% Next market bottoms 3/8/1960 and then lower

-------------------------------------------------------------------------

#7 19611228 S16 731.5 +.263 4 straight up days

Paper Loss = none Next market bottoms 1/29/1962 and 6/26/1962.

-------------------------------------------------------------------------

#8 19700102 S16 809.7 +.056 4 straight up days

Paper Loss = none Next market bottoms 2/2/1970 and 5/26/1970

-------------------------------------------------------------------------

#9 19761229 S16 994.93 +.061 5 straight up days

Paper loss = 0.977% Next market bottoms 4/4/1977 and 11/3/1977

-------------------------------------------------------------------------

#10 19810102 S16 972.78 +.042 5 straight up days

Paper loss = 3.3% Peak was on a Friday 1/6/1981 and much lower after

next rally.

-------------------------------------------------------------------------

#11 19900102 S16 2810.15 +.075 4 straight up days

Paper Loss = none Next market bottoms 1/30/1990

-------------------------------------------------------------------------

#12 19991229 S16 11484.66 +.128 2

straight up days

Paper loss = 2.1% Peak was 1/14/2000 Next market bottoms 3/7/2000 and 2001! |

==================================================================================

OLDER HOTLINES

==================================================================================

2/12/2014 Peerless

remains operating under the Sell S16. The DJI failed to get

past its

flat 65-dma. This is bearish. Most likely there will be a DJI retest of its

recent lows

or the DJI

200-day ma. Traders should go short DIA and take

some profits in the

biotechs.

The biotech ETF, IBB, produced a red popsicle on the

Tiger candle-stick charts.

I do not

expect this decline to drop the DJI below the 15000 support. DJI declines

of more

than 9%-13.5% are rare unless there has been a bearish breadth divergence,

multiple

Peerless sell signals and/or a DJI head/shoulders pattern.

Speculative

fevers, like what we are seeing in low-priced

stock line-formation breakouts

some along

only infrequently. They are not easily snuffed out. In 1968, margin

requirements

and

curtailment of trading hours had to be used. The Fed now is still guided by a

de-regulatory

set of

view. So, things are apt to become even wilder on the speculative front, I think.

Wall

Street will be busy today. New mergers' and acquisitions' stories will be

flying about. This will drive up a whole new group of stocks. The reason:

today,

Comcast (#1

cable company) is expected to announce its terms for buying out Time Warner

(#2 cable

company). Last year, Comcast took control of NBC. Comcast has been criticized

on the left

for pushing its more conservative

right-wing programs onto subscribers.

So, it's

possible the Justice Department and the FCC may issue some mild verbal

concerns.

However, there has been very little Government protection of the Consumer

in the last

20 year', as empire-building and monopolization in the Communications industry

increased

rapidly. Consumers are not protected and the Government no longer

cares.

Our Time Warner Cable bill here is up 75% in last five years. Meanwhile,

the

connection to the internet gets slower and slower.

This is

patently a monopoly situation. Cable could be a public utility. As it is, who

do you

complain to

or switch your business, too? They have a monopoly. And when you want

help, you

talk to someone in the Phillipines. So, consumer

groups and some other communications'

companies

are bound to complain. But "Fool me once, shame on you. Fool me

twice, shame

on

me". I fully expect the Obama Adminisitration to cave in here, just as they

have

before the

pressure of health insurance companies and big banks. Some consumer advocates

are aghast

at the implications here. For example, Peter

Weber:

"There's no way Comcast will buy Time Warner Cable: Regulators will look

closely

at giving one company such dominance ...They'll balk at giving Comcast the keys

to our internet."

The

consumer

comments on Yahoo that I've read are all negative towards the merger

and

fearful there will be no regulatory challenge.

Background:

http://en.wikipedia.org/wiki/Concentration_of_media_ownership

Overseas Selling

Greece

is back in the headlines. Official unemployment there is now 28.0%. Youth

unemployment is 61%. The Greek Government has been following the austerity

path

demanded by north Europeon bankers for several years now. Nothing good seems

to

have resulted from this. And again, the anti-Government/anti-Bank protests are

becoming very large and very intense. Terrorists are now making direct threats on

the

bankers pulling the strings. This will almost certainly cause selling in the

overseas

markets. It is not clear that Professionals in the US will do much to prop up the

market

against this selling, given the DJI's weak technical position, with it falling back from

its 65-dma.

http://www.reuters.com/article/2014/02/13/greece-unemployment-idUSL5N0LH1KU20140213

http://online.wsj.com/news/articles/SB10001424052702304603704579326373101984420

http://www.timesofmalta.com/articles/view/20140212/world/Greek-militants-attack-was-protest-at-austerity-policies.506458#.Uvy1JlNTZrM

Another Fed Surprise?

But,

it's always possible that the FED will surprise us as it did last June and suddenly

postpone any reduction in the QE-III buying of long-term mortgages from the Big

Banks.

So, I would close out the DIA short sale if it closes back

above its 65-dma. Instead,

I

think they may do this when the DJI is down 10% and threatening a more significant

support-break at 14700.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 140 -1 MAXCP stocks Bullish MAXCP Stocks (2/12/2014)

Bullish plurality

--> 51 +2

MINCP stocks Bearish

MINCP Stocks (2/12/2014)

--> 66 +11 New Highs on NASDAQ 10 +4 new lows.

Bullish plurality

--> 49 -17 New Highs on NYSE 8 new

lows. Bullish

plurality

DJI change

la/ma

annroc P-I

IP21 V-I

Opct

65-day Pct Change

----------------------------------------------------------------------------------------------------------------------------------------

2/3/2014 15373 -326

0.949 -.783 -41

-.167

-148

-.382 -.02 65-dma turned down.

2/4/2014

15445 +72 0.957 -.753 -31

-.149 -133

-.358

-.012

2/5/2014

15440 -5 0.959 -.726 -44

-.120

-135

-.361

-.007

2/6/2014

15628 +188 0.973 -.667 -16

-..095 -121

-.357

000 Back above 200-dma

2/7/2014

15794 -5 0.986

-.496 +83 -.058 -98 -.261

+.009

2/10/2014 15802 +8

0.988 -.478 +100 -.044 -99 -.176

+.011

2/11/2014 15995 +103 1.002 -.329 +119 -.014 -88 -.088

+.015 At 65-dma

2/12/2014

15995 -29 1.001 -.218

+205 .010 -66

-.083 +.023

==================================================================================

OLDER HOTLINES

==================================================================================

2/11/2014 The easy

part of the DJI's recovery has been completed. Yellen

pulled no

surprises, as was generally expected. Will the DJI now get

past the

resistance

of its now flat 65-dma? It is important for the bulls that it accomplishes

this.

If not, a re-test of the lows is the most likely

scenario. With the DIA's

blue

Closing Powers rising, we have to give it a chance to do this, even with the S16

signal

still active. The booming NASDAQ and BBH seem not much concerned with

what the

DJI does. This is typical of speculative markets like ours.

The Bounce Up off the 200-day ma Is Bullish

A Peerless

S16 signal still operates, but the DJI seems to have

bullishly

tested its rising

200-day ma in that breadth has been excellent and the super-charged

NASDAQ seems ready to explode to new highs. This weekend I examined the

weekly

DJI charts since 1928 and used

a 40-wk ma to approximate a 200-day ma. This study

suggests that the

DJI's coming back above this 200-day ma is a reliable Buy provided

that there has

not been a DJI head and shoulders and the A/D Line confirmed the last

DJI high.

Bullish now, we have no DJI head/shoulders and breadth is good. In

addition,

the DIA's Closing Power and the NYSE A/D Line downtrends were broken

on last

Thursday's close.

In addition, we have many more Bullish MAXCP stocks

than Bearish

MINCP stocks. With the Closing Powers rising and the NASDAQ

showing the

"animal spirits" are here in full force, let's see if the DJI can get past

the 65-dma as

easily as SP-500 did today.

As a result, I

have suggested short-term traders (under a month) cover their DIA short sales

and go long more

stocks than they are short using our Bullish MAXCP and BEARISH

MINCP lists. Last night I mentioned that there are a

number of high relative strength,

very high

Accumulation stocks (especially biotechs) that Professionals are buying

very

aggressively. These are the ones we should favor.

--> To Key Index and Leading Stock Charts: DJI, SP-500, etc.

DJI Chart

SPY Chart NASDAQ Chart IBB Chart

IWM Chart

--> 141 +32 MAXCP stocks Bullish MAXCP Stocks (2/11/2014)

Bullish plurality

--> 49 -26

MINCP stocks Bearish

MINCP Stocks (2/11/2014)

--> 55 +0 New Highs on NASDAQ 6 +3 new lows.

Bullish plurality

--> 66 +30 New Highs on NYSE 7 new

lows. Bullish

plurality

The Fed Has Given Another Green Light To Speculators.

In the past, I

have witnessed how the speculative periods of 1967-1968, 1977, 1999-2000

and 2008 offered

many, many profitable long trades despite a lagging DJI, even though

it turned our to

be the end of bull markets. This seems to describe our own market now.

. It's OK to be long, I thnk.

Our Tiger trading tools should tell us when to sell the

current explosive

super stocks. (See the list I gave last night. My new Explosive Super

Stocks talks at

length about this. A printed 2014 edition will be offered soon).

Hold More Long than Short for Now

Tomorrow we

will see if the DJI's flat 65-dma halts the recovery. In a non-speculative

market,

which this is not, one usually can count on a pullback from this resistance.

But in a

speculative market, we often see uncontrolled "zags" upward. The more of

these these

that occur, the more dangerous the market becomes.

Wilder

zigs(down) and then zags (up) very often set up a final top. These

speculative

bursts up

after 5%-11% DJI declines result in giving the Public a false sense of

confidence.

It makes them think that all declines are buying opportunities. It is when

the last

and final zig downwards is not followed by a zag upwards, that they end up losing

so much

money.

Below I

show tonight the type of price patterns that have occurred at important tops since

1929.

In 17 of the 21 cases there were NYSE A/D Line non-confirmations of the

last

new high.

In 4 instances this was not true. Since the A/D Line

has recently confirmed

the last

DJI, until prices form an obvious top, especially a head/shoulders, we

probably

should feel safe. But if the DJI were to turn sharply lower from here,

it would

make the present pattern of zigs and zags look like the basic one that

occurred in

1929, 1972-1973, 1980-1981, 1986-1987 and 1999-2000. The problem

with this

analogy is that breadth (A/D Line) is now much stronger. All these patterns

showed lots

of S9s. We have very positive breadth now. There have been no S9s.

Top Patterns in The Past Often Repeat

Wild "Zigs and Zags", Breadth NCs (non-confirmations of DJI new

highs)

and

Head/Shoulders pattern mark most major tops. We still need Peerless Sell

signals to

be sure and to time these tops.

|

ZIG and ZAGS AS A TOP IS MADE:

1928-2014

=============================1929 3 zigs (down), 3 zags (up), a 30% advance,a 48% plunge

(There also was a head/shoulders.)

A/D NC, Sell S9/Sell S12 at top, head/shoulders top.

---------------------------------------------------------------------------

1937 Double top (second below the first),a 40% plunge.

A/D NC, Sell S4, S8

---------------------------------------------------------------------------

1939-1940 8 mo-long "home plate" Pattern, a 26% plunge

A/D NC, Sell S16, Sell S1, S13

---------------------------------------------------------------------------

1946 10% decline/snap back to new highs, head/shoulders,24% plunge

NO A/D NC, Sell S5, S4, S13

---------------------------------------------------------------------------

1956-1957 3 10% zags down, 2 zigs up and a 19% plunge.

A/D NC, Sell S7, S4, S10

---------------------------------------------------------------------------

1959 1 9% zig and zag and 17% sell-off

A/D NC, S16, S15, S1, S10

---------------------------------------------------------------------------

1961-1962 9 month wide head/shoulders pattern and 27% plunge

A/D NC, S16, S10

---------------------------------------------------------------------------

1965-1966 10.5% zig and 18.5% zag and a 24% sell off

A/D NC, S4, S12, S10

---------------------------------------------------------------------------

1968-1969 8.7% zig and 8% zag and 331/962 bear market decline

A/D NC, S9, S3

---------------------------------------------------------------------------

1971 3 month head/shoulders and 17% decline.

NO A/D NC, S19 (formerly B9B)...Later S9s.

---------------------------------------------------------------------------

1972 3 5% zigs down, 2 5% zags down, a final 14% up and 45.2% bear mkt.

A/D NC, S4, S9, S12, S10

----------------------------------------------------------------------------