TigerSoft Serving All Investors since 1981. www.tigersoft.com

Peerless Stock Market Timing: 1915-2014: Software & Hotline

and TigerSoft Insider Trading, Charting Software

> Peerless Stock

Market Timing: 1915-2014

> Buying and

Hold? - Very Risky and So Unnecessary.

Bear Markets and Mini-Bears

from 1901-2014

Peerless is

PROOF that the

stock market can be profitably timed.

The short-seller will

make most of his money in bear markets. Peerless can help

you see the tops as

they are being made. Below are 35 bear markets and mini-bears

that Peerless timed

extremely well. There are many other smaller decline which

Peerless also would

have helped the short seller. All the Peerless charts since

1915 will be available

in a new book, Peerless Stock Market Timing: 1915-2014,

which will be available

soon.

6/17/1901 - 7/01/2008

----

Beginning ---- ------ Ending ------

Date

DJIA

Date

Dow % Loss

Days

06/17/1901 57.33 11/09/1903

30.88 -46.1 875

01/19/1906 75.45 11/15/1907

38.83 -48.5 665

11/19/1909 73.64 09/25/1911

53.43

-27.4

675

09/30/1912 68.97 07/30/1914

52.32

-24.1

668

11/21/1916 110.15 12/19/1917

65.95

-40.1

393

11/03/1919 119.62 08/24/1921

63.90

-46.6

660

03/20/1923 105.38 10/27/1923

85.76

-18.6 221

-------------------------------------------------------------------------------------------

PEERLESS HAS SUFFICIENT DATA TO GIVE SIGNALS

TIMELY PEERLESS SELL SIGNALS

--------------------------------------------------------------------------------------------

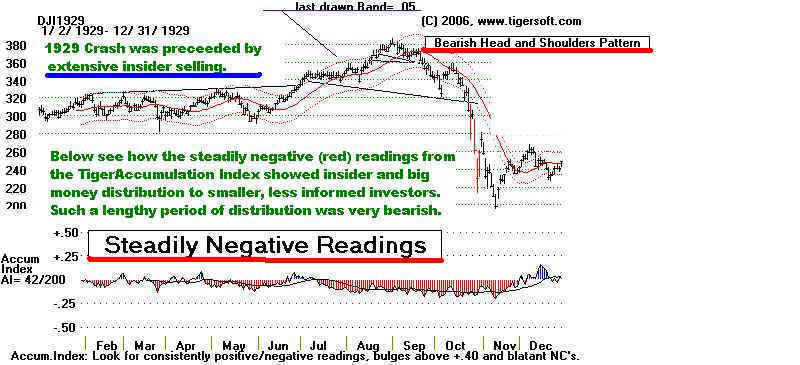

09/03/1929 381.17 11/13/1929

198.69 -47.9 71

8/1/1929 S7, 8/8/28 S12, 9/3/1929 S9

04/17/1930 294.07 07/08/1932

41.22

-86.0 813 4/2/1930, 4/17/1930 S9

09/07/1932 79.93 02/27/1933

50.16

-37.2

173 9/9/1932 S12

02/05/1934 110.74 07/26/1934

85.51

-22.8 171

2/5/1934

S12

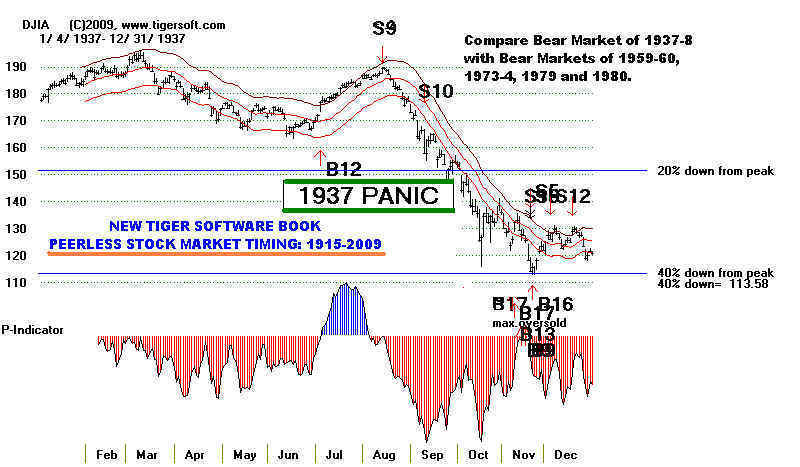

03/10/1937 194.4

06/14/1937 165.50

-14.5

94 2/10/1937 S15, 2/11/1937 S9

08/13/1937 189.30 03/31/1938

98.95

-47.1

166 8/3/1937 Sell S4, 8/10/1937 S7, 8/13/1937 S9

11/12/1938 158.41 04/08/1939

121.44

-23.3 14

11/10/1938 Sell S12

09/12/1939 155.92 04/28/1942

92.92 -40.4 959 9/13/1939 S9

05/29/1946 212.50 05/17/1947

163.21 -23.2

353 5/29/1946 S5, 7/11/1946 S4

06/15/1948 193.16 06/13/1949

161.60 -16.3

363 6/15/1948 S2

01/05/1953 293.79 09/14/1953

255.49

-13.0 252 12/30/1952 S16

04/06/1956 521.05 5/28/1956

468.8

-10/0 52

4/6/1956 S5, 4/9/1956 S2

(08/2/1956 521.00

10/1/1956

468.7

-10.0

60 8/2/1956 S2

7/12/1957 520.8

10/22/1957

419.79 -.19.5

102 6/12/1957 S4, 7/5/1957 S7,

7/12/1956 S9

01/05/1960 685.47 10/25/1960

566.05

-17.4 294

12/31/1959 S16, 1/5/1960 S15

12/13/1961 734.91 06/26/1962

535.76

-27.1 195 12/28/1961 S16,

1/5/1962 S10

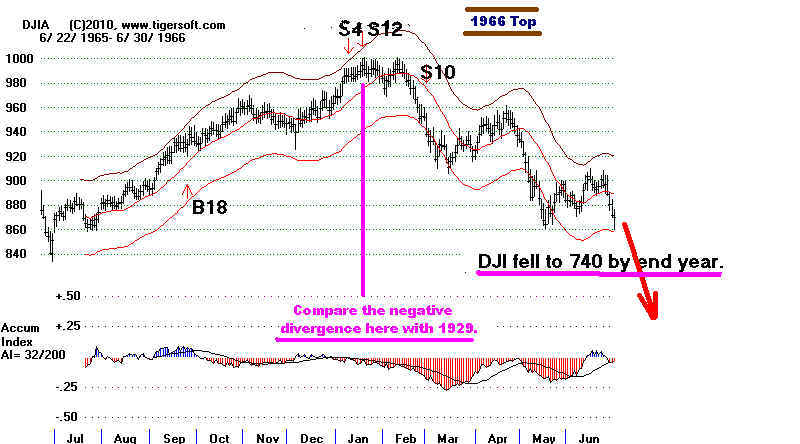

02/09/1966 995.15 10/07/1966

744.32

-25.2 240 1/6/1966 S12, 1/10/1966 S4

12/03/1968 985.21 05/26/1970

631.16

-35.9 539

12/5/1968 S1, 4/30/1969 S9, 5/6/1969 S3

04/28/1971 950.82 11/23/1971

797.97

-16.1 209 5/6/1971 S19

01/11/1973 1051.70 12/06/1974

577.60 -45.1 694 1/5/1973 S15, 1/8.1973 S9, 19/1973 S4,

1/11/1973 S10

09/21/1976 1014.79 02/28/1978

742.12 -26.9

525

9/24/1976 S1

09/08/1978 907.74 12/18/1978

787.51

-13.5

107 9/8/1978 S12, 9/13/1978 S1,

10/11/1978 S9

10/5/1978 897.61

11/7/1979

796.67

-11.0

33

9/20/1979 S7, 9/21/1979 S8

2/13/1980 903.84

04/21/1980

759.13 -16.0

76 1/16/1980 S4, 2/13/1980 S9 and S15

04/27/1981 1024.05 08/12/1982

776.92

-24.1 472 3/26/1981 S4, 4/24/1981 S15,

4/27/1981 S7

11/29/1983 1287.20 07/24/1984

1086.57 -15.6

238 11/22/1983 S4, 1/5/1984 S12

08/25/1987 2722.42 10/19/1987

1738.74 -36.1

55 8/26/1987 S4, 10/1/1987 S9, 10/2/11987

S12, 10/5/1987 S8

07/16/1990 2999.75 10/11/1990

2365.10 -21.2

87 7/121990 S9, 7/17/1990 S9

08/06/1997 8259.31

10/27/1997 7161.15

-13.5

77 9/18/1997

07/17/1998 9337.97 08/31/1998

7539.07 -19.3

45 9/23/1998 S9

01/14/2000 11722.98 09/21/2001

8235.81 -29.7

616

12/31/1999 S9, 1/7/2000 S15, 1/11/2000 S4

03/19/2002 10635.25 10/09/2002

7286.27 -31.5

204 2/26/2002 S15, 2/27/2002 S9, 5/17/2002 S120910-0

10/09/2007 14164.53 3/9/2009

6547.05

-53.5 500 9/19/2007 S2, 1-/5/2007 S4, 12/6/2007 S12, 12/7/2007 S9

04/23/2010 11204.28 7/2/2010

9686.48

-13.5

70

3/23/2010 S3, 4/16/2010 S11, Tiger

Sell S5.

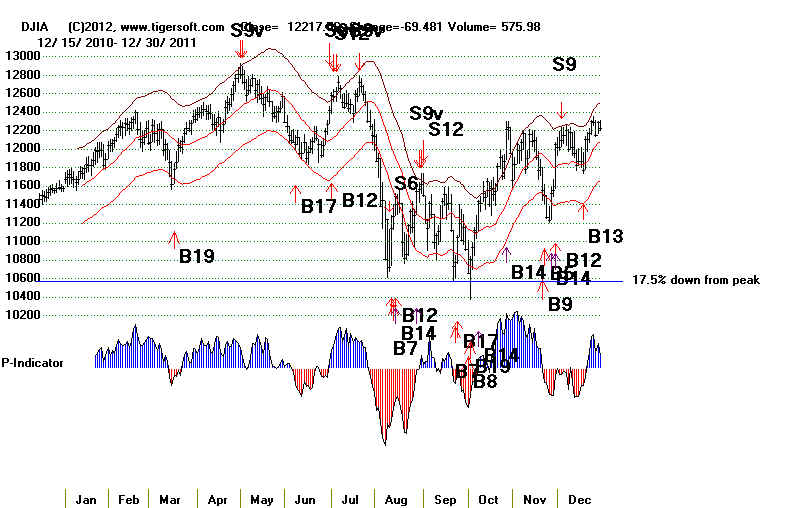

05/02/2011 12807.36 10/3/2011

10655.30 -16.9

154 5/2/2011 S8 and S9V

8%-17%

Since 1929, there have been 11 bull

markets lasting more than 24 months without a

DJI decline of more than 13.5%. In that time,

there were 28 cases of 8%-17% declines

that puncutated these long advances, like we are now

in.

Corrections in the 11 Longest DJI Advances

since 1928

1. 7/26/34 -

3/10/1937 30 months

Feb-March 1935 10% decline

(There was a Sell S12 in January 1935 and Buy B5 at bottom).

March-April 1936 12% decline

(There was a Sell S12 in March 1936 at top and B2 at bottom.)

March-June 1937 15% decline (Sell S9 at top

and B8 at bottom.)

2. 4/28/42 -

5/29/46 49 months

July 1943-November 1943 11%

decline(June 1943 Sell S9. November 194 Buy B9

3.

9/14/53 - 7/12/57

46 months

Sept 1955-October1955 10% decline

(Sell S4 at top. Buy B17 at bottom.)

April 1956-May 1956 10% decline

(Sell S2 at top. Buy B19 at bottom.)

August 1956-Nov 1956 11%

decline (Sell S2 at top. Buy B2 in October.)

4. 10/21/57 -

1/5/60 26 months

August 1959-Sept 1969 9% decline

(Sell S4 at top. Buy B17 at the bottom.)

5. 10/23/62 - 1/5/66 38 months

May 1965-June 1965 11% decline

(Sell S8 at top. Buy B10 in August after the bottom.)

6. 7/24/84 - 8/25/87 37 months

July 1986-Aug 1984 9% decline

(Sell S9 before top. Buy B17 in July before the bottom.)

Sept 1986-Sept 1984 9%

decline (Sell S9 before top. Buy B17 just before the bottom.)

April 1987-May 1987 9%

decline (Sell S9 at top. Buy B17 at the bottom.)

7.

12/4/87 - 7/17/90

32 months

Oct 1989-Oct 1989 9% decline

(Sell S9 at top. Buy B17 at the bottom.)

Jan 1990-Jan 1990 9%

decline (Sell S4/S15 at top. Buy B17 at the bottom.)

Aug 1987 - November 1987 35% decline (Sell S9/S12 at

top. Buy B9 at the bottom.)

8.

12/4/87 - 7/17/90 32 months

Oct 1989-Oct 1989 9% decline

(Sell S9 at top. Buy B17 at the bottom.)

Jan 1990-Jan 1990 9%

decline (Sell S4/S15 at top. Buy B17 at the bottom.)

2.2% declines: 1991 1 ok 3 bad, 1992 2 bad

9. 10/11/90 - 7/15/98 93 months

Jun 1992-Oct 1992 8%

decline (Sell S9 at top. Buy B17 at the bottom.)

Jan 1994-April 1994 11%

decline (Sell S4 at top. Buy B19 at the bottom.)

May 1996-July 1996 8% decline

(Sell S1 at top. Buy B17 at the bottom.)

March 1997-April 1997 10% decline

(no sell signal at top.

Buy B17 at the bottom.)

July 1997 - October 1997 13.5% decline

(Sell S12 in September after top. Buy B1/B17 at the bottom.)

END July 1998 - October 1998 20% decline (Sell S9/S12 at

top. Buy B9 at the bottom.)

2.2% declines: 1991 1 ok 1 bad, 1993: 1 bad, 1994: 1 OK, 1 bad, 1996

2 bad, 1997 2 ok 4 bad.1998

10. 3/12/2003 - 10/9/07 51 months

Feb 2004-Oct 1994 9%

decline (Sell S9 at top. Buy B2/B9 at the bottom.)

May 2007-July 2007 8% decline

(Sell S9 at top. Buy B9 at the bottom.)

July 2007-Aug 2007 9% decline

(Sell S9 at top. Buy B14 two weeks after the bottom.)

October 2007-November 2007 10%

decline (Sell S4 at top. Buy B1 a week before the bottom.)

END

December 2007-February 2009 Bear Market 51% Decline. Sell S9/S12 at top

2.2% declines: 2003 1 ok, 2007 5 ok.

11. 3/9/2009 - 4/29/2011 25.5 months

Jan 2010-Feb 2010 8%

decline (Sell S9 2 months before top. Buy B17 at the bottom.)

END April 2010 - June

2010 13.5% decline

(no sell signal at top

Buy B8 at the bottom.)

2.2% declines These failed to predict a decline in 13 cases. They accurately

predicted a decline only

April 29. 2011-October 3, 2011. 17%

decline. Perfect Peerless Sell and Buy signals.