|

Daily Blog - Tiger Software

September 5, 2007

How To Find A BioTech Boomer Early On

Part 1 of a 10 part series.

Back to

Home Page

__________________________________________________________________

Index of All Tiger Blog Topics

If you like our stock market insights, think how

much you will like our Software and Hotline.

www.tigersoft.com

People

have asked me to write a Daily Blog.

They seem to want me to give them a thought

or two each day. About what? Well,

we'll just

have to wait and see. As, I see it, a blog is a

personal statement. I will try to make it enter-

taining and relate it mostly to the stock market.

I do promise not to belabor the

obvious. So,

I hope these thoughts, reflections and finds are

worth your time. I will give you my best.

Send any comments or questions

to william_schmidt@hotmail.com

|

|

|

9/5/2007 How To Find A BioTech Boomer Early On

The Beginning of A

Multi-Part Series on Biotech Investing.

As "baby boomers" age and

retire, some biotechs will surely boom, too. In the US there are more

than 75

million baby boomers.

Biotechs are manic. They seem to fluctuate widely. There are long periods

during which few

of

them advance and most drift lower. And there are exciting periods, often spurred on

by a well

publicized breakthrough and a block-buster drug. After AMGEN discovered and got FDA

approval for

two

blockbuster drugs, Neopogen and Epogen, in early 1991, other biotech stocks went wild.

The 20-year chart of Fidelity's Biotech (FBIOX) fund is shown below. In it you can

see all of the

advance in prices came in 2 important surges: 1989-1992 and 1998-2000. Technically

speaking,

a

chartist would have bought early in 1990, never mind that there were two steep general

market

declines that year, and sold when Amgen shareholders met in 1991 to celebrate their good

fortune.

His

profits would have been 300% in a year and a half. The breakout by FBIOX in

December 1998

was the

second point of important entry. Early in 2000, just as Greenspan was reappointed by

Clinton,

FBIOX had

achieved a triple again. Except for those two episodes that took up less than

3 years

in the 20

year period, FBIOX was either going sidewise or down. The FBIOX seems to go

into

dormant

periods lasting 7 or 8 year. So a new move up is due. One more thing, you can

bet on:

the

Democrats, if they take the White House in 2009, are going to increase public funding of

stem

cell

research. This will bring publicity to these companies' prospects and overseas'

biotech

companies'

successes. I would not wait until November 2009 to buy a biotech. I would

anticipate

this

development.

Now as we look at the Tiger chart of FBIOX below we see it is approaching a series

past peaks at 69. A

breakout above that level would be bullish. Not as bullish as a

breakout into all-time high

territory, but still very bullish. The Tiger chart of FBIOX

(Fidelity Biotech) shows that a

breakout has already taken place when FBIOX is

compared with the DJI.

I have observed that Biotechs are often a place where hot money goes when it

is starting to get nervous about

the market. The collapse of many housing and mortgage

stocks has cast a pall on may

sectors of the stock market. But tech stocks, and biotechs

are starting to get a play.

How do we decide which stocks to buy? That is the subject of

the next few blogs.

One of the easiest approaches is to simply see what stocks Fidelity has invested

in. Yahoo reports their 10

biggest holdings, as last reported. Right now these are their

holdings.

| TOP 10 HOLDINGS ( 67.38% OF TOTAL ASSETS) |

|

| Company |

Symbol |

% Assets |

YTD Return % |

| AMGEN |

AMGN |

20.68 |

-21.33 |

| GENENTECH INC |

DNA |

8.34 |

-8.32 |

| BIOGEN IDEC INC |

BIIB |

8.13 |

14.94 |

| GILEAD SCIENCES |

GILD |

7.42 |

14.68 |

| CELGENE CP |

CELG |

5.80 |

5.27 |

| CEPHALON INC |

CEPH |

4.95 |

6.72 |

| ALEXION PHARM INC |

ALXN |

3.77 |

44.00 |

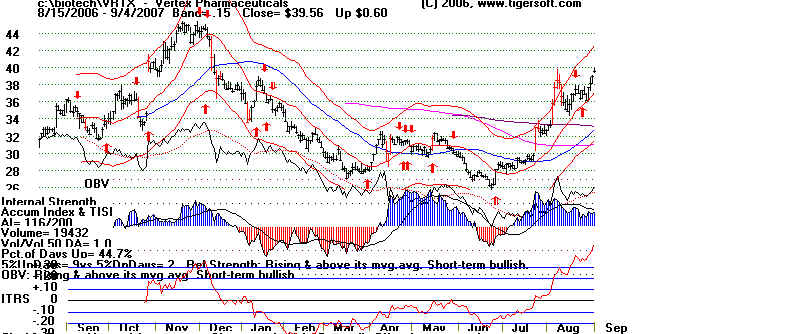

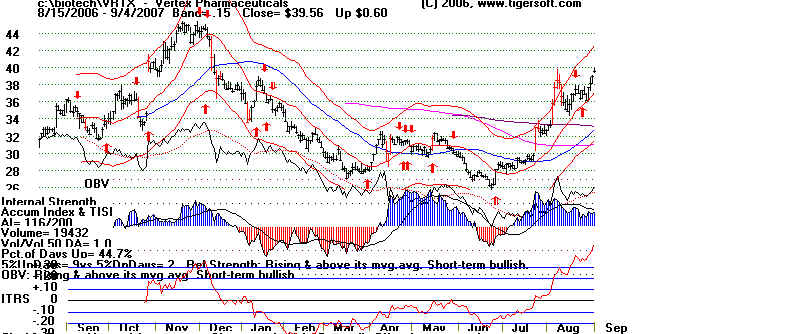

| VERTEX PHARMACEUT |

VRTX |

3.04 |

-13.68 |

| PDL BIOPHARMA INC |

PDLI |

2.68 |

16.63 |

| OSI PHARMACEUTIC |

OSIP |

2.57 |

-7.8 |

|

Tiger lets us easily graph these stocks.

AMGN - Amgen ... On Buy... Top System's Gain = 58.3%

DNA - Genentech

... On Buy... Top System's Gain = 56.2%

Decisive breakout past blue 50-day ma.

BIIB - ... On Buy... Top System's Gain = 50.1%

Strongest

of these. Shows most blue from Tiger's Accumulation Index.

GILD - Gilead Sciences ... On Buy... Top

System's Gain = 50.1%

CELG - Celgene ... On Buy... Top

System's Gain = 58.1%

CEPH - Cephalon ... On Buy... Top

System's Gain = 82.6%

Watch

- back to the resistance of its nest key mvg. avgs. other than 50-day ma

ALXN - Alexion ... On Buy... Top System's

Gain = 106.2%

Powerful up move today!

VRTX - Vertex Pharm ... On Buy... Top

System's Gain = 104.6%

PDLI - Protein Design Labs ... On

Buy... Top System's Gain = 149.5%

To Be continued.. This is the first of a long series

on Biotech Investments

|

|

Biotech Jokes, Cartoons and Tidbits To Talk about.

Genetics Savings and Clone, charges $1000 to collect and

cryogenically store cells from a family cat or

dog, and $250,000 to clone it.

Gene Patents Prevent Research

"A few years ago, UCLA geneticist Wayne Grody was working

hard to help deaf children. Grody

was conducting clinical tests on Connexin 26, a human gene linked to deafness, hoping it

would lead to

more effective treatment for kids. Then one day he received a letter from Athena

Diagnostics, a

Massachusetts-based biotechnology company. Grody says the letter informed him that Athena

owned

a patent for the Connexin 26 gene -- and he could no longer perform tests on it himself.

Instead, he would

have to pay thousands of dollars up-front and send future gene samples to Athena for

testing. He had no

choice. "I had to stop," Grody says. "The cost was out of sight." The

clinical tests ground to a halt."

-- Source: Michael Crowley, "They Own Your Body" Readers' Digest, August

2006 --

http://72.14.253.104/search?q=cache:bndLkT3qcsUJ:www.rd.com/content/thats-outrageous----patenting-human-genes/+biotech+joke&hl=en&ct=clnk&cd=6&gl=us&client=firefox-a

)

Biotech Personals

I've been single-stranded too long! Lonely ATGCATG would like to pair up

with congenial TACGTAC.

Menage a trois! Ligand seeks two receptors into binding and mutual

phosphorylation. Let's get together and transduce some signals.

Some dates have called me a promotor. Others have referred to me as a real

operator. Personally, I think I'm just a cute piece of DNA who is still

looking for that special transcription factor to help me unwind.

Highly sensitive, orally active small molecule seeks stable well-structured

receptor who knows size isn't everything.

There must be a rational way to meet a date! I'm tired of hanging out in

those molecular diversity bars, hoping to randomly bump into the right

peptide. I want a molecule that will fit right into my active site and

really turn me on. I'll send you my crystal structure if you send me

yours!

Gene therapy graduate. After years of producing nothing but gibberish, I've

shed my exons and am ready to express my introns. All I need is a cute

vector to introduce me to the right host.

My RNA, I'm sorry I misread your UAAUAAUAA and inserted three tyrosines

when you repeatedly asked me to stop. Something got lost in the

translation. Please forgive me.

Naked DNA with sticky ends seeks kanamycin-resistant plasmid. EcoR1 sites

preferred.

Uninhibited virus seeks reason to make me shed my coat protein.

This very selective oliogonucleotide has been probing for just the right

target for long term hybridization.

Mature cell seeks same who still enjoys cycling and won't go apoptotic on

me. Let's fight senescence together!

I'm a prolific progenitor with great potential for growth and self-renewal.

Call me if you're a potent hematopoietic factor who still believes in

endless nights of colony stimulation.

I don't always express myself on the surface, but I'm looking for a signal

that you appreciate my complexity. Send me the right message that will

penetrate my membranes, turn on my protein expression and release my

potential energy.

|

|