What We Want To Avoid!

Shanghai Composite Is Very

Over-Extended.

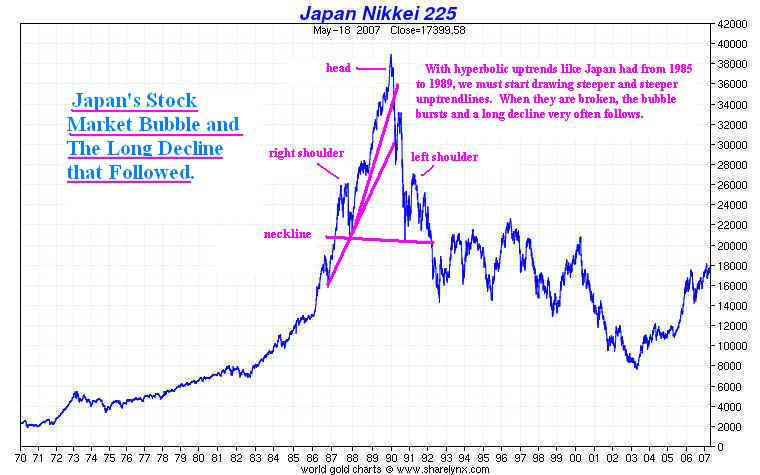

China's stock index has risen more than 400%

since mid 2005. On the long term

chart below we see that it is on the verge of breaking its uptrendline. Our Hotline

has taken profits in all foreign ETFs when they simply violated a much faster

ascent line based on their breaking of a ten-day moving average.

China and foreign markets have been the

locomotives for the long bull market

that began in early 2003. If that were to change, the last pillar holding up the

market

would be taken away. There are few support levels close by if the necklines in the

bearish head and shoulders patterns are broken. What's worse, the DJI has gone a

record 56 months with closing down 10% from its highs. Any way we look at it, stocks

appear vulnerable. The best thing we can say now is that bearishness of the

financial

world has been in the press for many days, though they ignore the root causes or the

seriousness of the longer term situation for the US, thinking the Fed can simply make

the problems go away by lowering interest rates. That simple-mindedness is a core

feature of the problem. As long as the US government squanders tens of

billions on

Bush's stupid and insane war of occupation in Iraq, the US Debt will seem hopelessly

large and foreigners will dislike the Dollar and distrust America.

The next chart is Tiger's Index of

Chinese stocks and ETFs. See the head

developing head and shoulders

pattern in it. The 20% decline since the peak a month

ago exactly matched the depth

of the July-August peak and puts this index at the key

neckline in the pattern.

A breaking of the neckline would be very bearish, especially

since Chinese stocks are so

over-extended, and at the very least, in need of a "correction"

or "shake out" to

clear out the weakest holders.

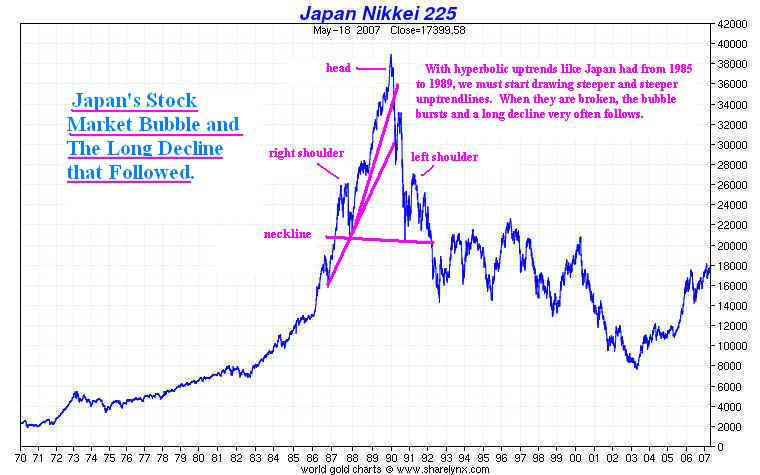

Do not underestimate how many people watch these popular patterns They

are self-fulfilling to

some extent. But they are also reliable in this context. Bad

things happen to stocks

when necklines like this are broken. Beware!

----------------------- Tiger Index

of 42 Chinese Stocks and Closed End Funds --------------------------

A breaking

of the neckline would be quite bearish, given its long advance.

Head and Shoulders Tops Warn Us That

The Current Long World Bull Market May Be Ending

The chart below shows the Tiger Index

of 55 foreign ETFs. This is a good measure

of the world bull market for the last

year. The gains in foreign markets have been huge.

See what I wrote this summer about what

many consider a "bubble" waiting to be burst.

On June

17, 2007 I noted another bullish breakout in a long series of excellent trading

opportunities. But the next day, I warned that the foreign markets bullish runs

were

becoming more and more over-extended.

---------------------------------------

Tiger Index if 55 Foreign ETFs ----------------------------------------------

Sometimes, these patterns don't get completed.

But they are distinctly bearish. Watch to see if it is.

That would be most bearish.

ETFS' Head and Shoulders Patterns Are

All Too

Common Now. This IS

Bearish!

We analyze

foreign ETFs individually. An alarming number of individual

ETFs display current head and shoulders patterns. There are 55 foreign ETFs

that we currently

follow. 31 of them have bearish head and shoulders patterns.

This is a very

high percentage.

18 of the price patterns have already been completed. The worst is the EQU UK.

Chinese ETFs have not yet broken below their neckline, but are very close to it.

Completed downsloping neckline (9)

EWU - United Kingdom - Accum Index = +.25

GRR - Asia Tiger - Accum .Index = +.07 26.88

200-day ma -24.15

IEV - Europe 350 - Accum .Index = +.05 115.72

200-day ma= 114.

SGF - Singapore - Accum Index = -.15 below

all mvg.avgs. VERY BEARISH

TWN - Taiwan - Accum Index = -.05 below all key

mvg.avgs.

EPP - Pacific except Japan - Accum. Index =+ .12 above 200-day ma

JFC - China Region - Accum Index <0 weak OBV Very Bearish

KF - Korea Fund - Accum Index =. +.10

.82 above 200-day ma.

TFC - Taiwan Greater China Fund below all

mvg,,avgs. Accum Index = =.22

Completed flat or rising neckline (9)

EKH - Europe - Accum.Index = + ..04

Closed at 200 day ma.

EWC- Canada - Accum. Index = <0. 200-day ma= 29.5

EWD - Sweden - Accum. Index= +.20

below all key mvg.avgs.

EWH - Hong Kong - Accum Index= -.02 Very weak OBV.

200-day ma=18.75 VERY BEARISH

EWN - Netherlands - Accum .Index =

0 Weak below all key mvg.avgs..

EWY - South Korea - Acc. Index = +.15 Just above 200-day ma

EZA - South Africa - Accum Index = +.05 above 200-day ma

EZU - EMU Index - Accum .Index = +.15 above

200 day ma

VGK - Europe - Accum Index = +.25 Just above

200-day ma

Incomplete downsloping neckline (11)

CHN - China Fund -

Acc.Index <0 ... red distribution on right shoulder.

EEB - Foreign ADRs - Accum. Index<0

EEM - Emerging markets - Accum. Index = +.10 above 200-day ma OBV is

strong.

EWA - Australia - Accum Index <0 Classic pattern. Very Bearsh At neckline

EWI - Italy - Accum Index= +.15

EWQ - France - Accum. Index = .05

EWT - Taiwan - Accum. Index = -.05

FXI - Xinhua China 25 - Accum .Index = +.04 Closed at neckline.

IXP - Global Telecomm - Accum Index = +.25

VPL - Vanguard Pacific

Accum index = +.18

VWO - Emerging - Accum Index Accum index = .10

Incomplete flat or rising neckline (2)

ILF - Latin America - Accum Index - -.02 Watch

FEZ - Euro - Accum Index <0 OBV is very weak..75 above neckline

===================================================================================

Review:

CLASSICAL

TECHNICAL ANALYSIS:

HEAD AND SHOULDERS PATTERNS

Bearish Head And Shoulders Patterns Show Increasing Red

Distribution

From Tiger's Original and Proprietary Accumulation Index. on Their

Right Shoulder.

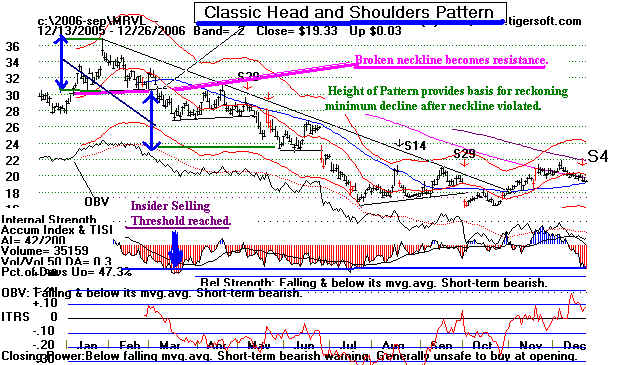

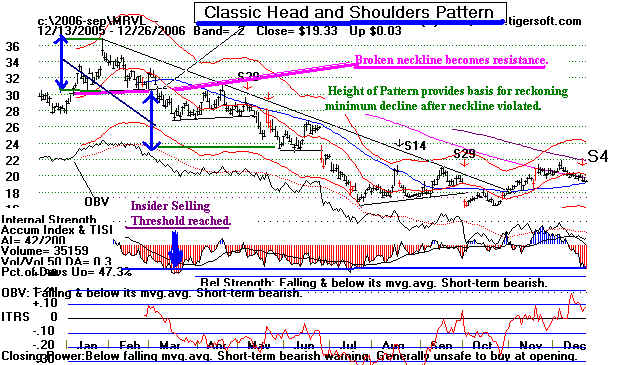

-------------------------------- MRVL Head and Shoulders

------------------------------------------

Would you have bought MRV at 28

above in March 2006? The general market was

still rising. We

had no Major Sell until May 5th, 2006. Simply avoiding it until it came back

above a rising blue

50-day mvg.avg. was a much better choice. the negative readings from the

the Tiger Accumulation

index typical make rallies to a declining 50-day ma a good point to

sell short. There

was never any reason technically to buy the stock.

------------------------------------------------------------------------------------------------------------------------

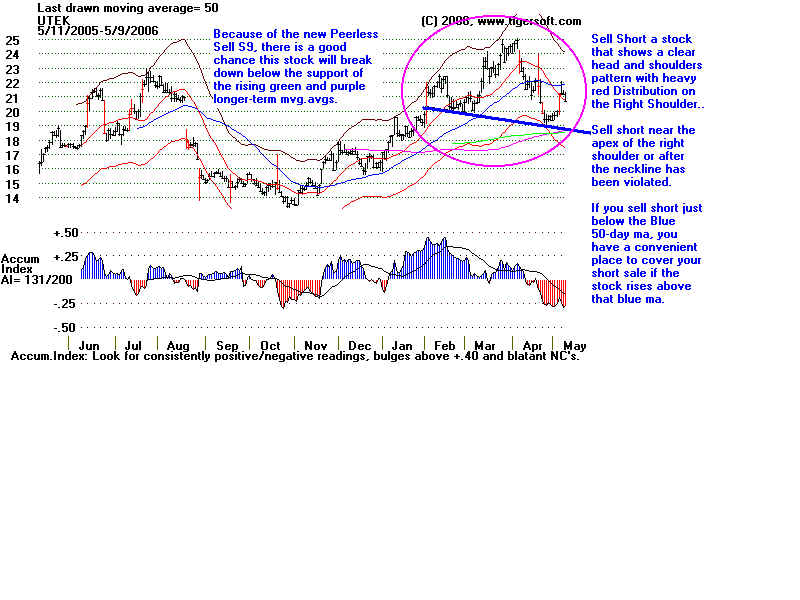

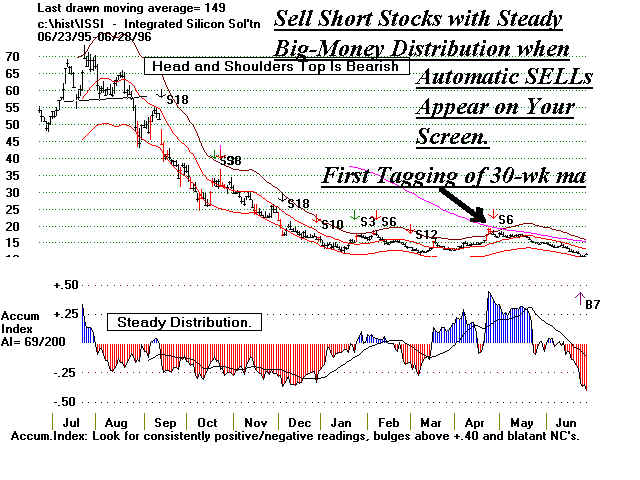

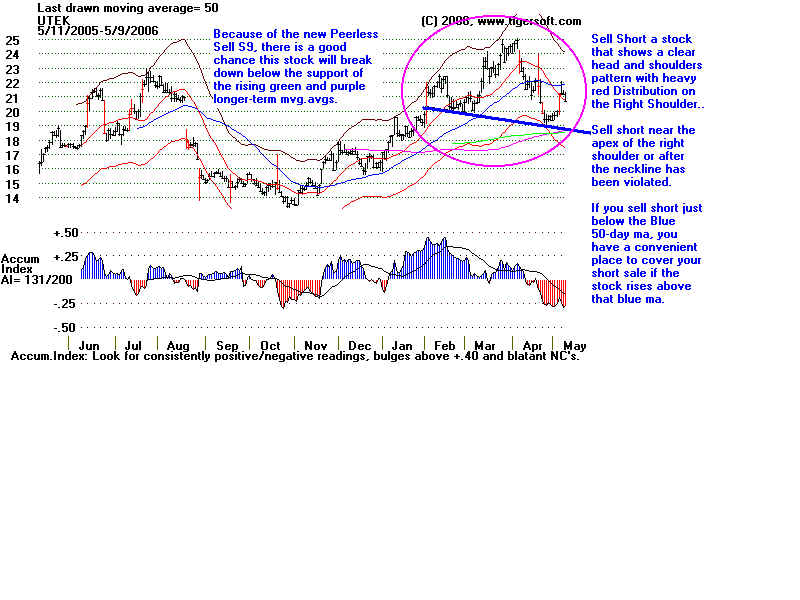

Study the classic head and shoulders in the stock below.

It made a lot of money for customers

who took our advice and

shorted it as shown.

The Bearish Outcome:

Bearish Head And Shoulders Patterns: Some

Pointers

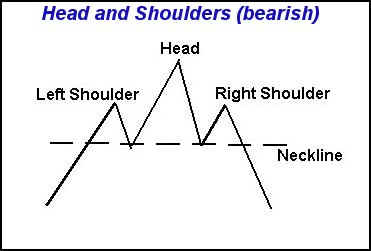

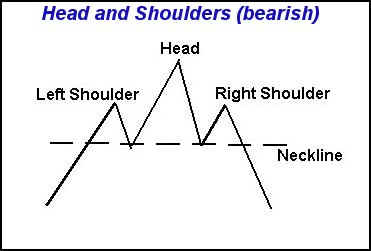

Things to notice:

Symmetry between right and left shoulder.

Apex of right shoulder is typical the same distance above the neckline as the right

shoulder's apex is.

Volume is light on right shoulder.

Volume usually picks up as the neckline is broken.

Head & Shoulders patterns show:

- Left Shoulder: Bulls push prices upwards making new highs; but these new highs

are short lived and prices retreat.

- Head: Prices don't retreat for long because bulls buy the dip. Prices surpass

the previous high; a bullish sign, often

on lower volume. Watch for a reversal day marking the head's peak. Prices

retreat again but find support.

- Right Shoulder: The bulls push prices higher again, but this time prices fail

to make a higher high. They make a

peak about the same distance away from the neckline as the first shoulder's apex is away

from the neckline. The time

it takes to form a right shoulder often matches the time it took to build a right

shoulder.

Neckline. Prices break below a line drawn through the recent intro-day or closing

lows. Volume picks up.

Pullback. If general market conditions are good there may be a quick rally back to

the neckline, where they

turn down again on rising volume.

Sell Signal:

If prices break the neckline- support line, it shows that the bears

are in charge. Sell and Sell short.

A downward sloping neckline is

sometimes seen as a more bearish than a pattern showing a flat line. This is

not necessarily true. It depends on

the stocks internal strength readings. See my Short Selling manual. pattern,

|