| Daily Blog - Tiger Software |

Monday - June 18, 2007 Global Boom or Bubble?

I seriously doubt if more than 10% of Americans realize how rapidly many overseas

stock markets are rising. There is a lot of talk, though, about a Chinese "bubble".

But it is really a Brazilian, Chilean, Indonesian, Indian, Sri Lanan, Turkean...etc

and a Chinese "bubble". Admittedly, the Chinese Shanghai Composite is up particularly

steeply in the last 2 years, from 1000 in mid 2005 to 4000 now, or +300%... "The USA

is being left behind", some would say, "because the war in Iraq, which started in 2003, is

putting the USA further and further behind in the quest for international capital." Personally,

I am delighted that millions and millions of people worldwide are probably living much

better lives. As investors, we have to take advantage of these trends. We cannot control them.

. See the Multi-Year Charts. of these countries' stock markets,

Early 2003 Now Gain

Mexico IPC 6000 30000 + 400%

Indonesia Jakarta Composite 400 2000 +400%

Brazil Bovespa 10000 50000 ... +400%

Turkey ISE National 100 10000 47500 ... +375%

India BSE30 3000 14000 + 367%

Chile IPSA Index 800 3200 .. +300%

Sri Lanka All Share 700 2600 ... + 264%

Sweden Stockholm 30 450 1250 ... +175%

Chinese Shanghai Composite 1500 4000 +167%

DJI-30 7500 13500 +80%

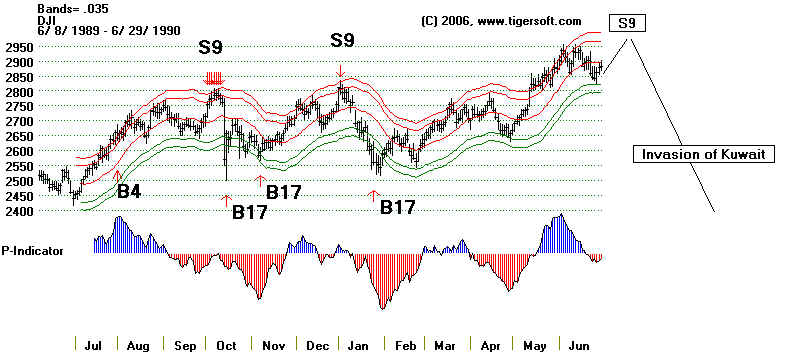

Of course, we will have to be watchful for a top. If the Japanese "bubble" of the

1980's that ended in early 1990 is a proper example, we will see major Peerless

Sell S9 signals, just as we did in 1989 and 1990 at the top. From October 1989

to July 1990, Peerless gave three separate sets of major Sell S9 signals.

Japanese Bubble peaked in early 1990 - Raised interest rates and corruption are given the blame.

But Peerless called it. Three major Sells in a 9 month period followed by a breaking of support is

bearish.