KILLER SHORT SALES

KILLER SHORT SALES

KILLER SHORT SALES

KILLER SHORT SALES

|

|

|

|

CP CP |

|

|

|

It is DANGEROUS for you to try to ride out long

bear markets. It is unnecessary.

And you can make much more money if you go short when a big general market

decline starts. Our Peerless Stock Market

Timing's track record at calling

stock market tops is unequalled.

Nor do you have to wait for a bear market to profitably sell short. We only avoid

short sales when a new bull market is starting just after a reversing Peerless Buy

signal and often at the end of the year and the beginning of the new year when

tax considerations often bring brief advances in the weakest stocks. Otherwise

there are almost always a good number of stocks that are in their own bear markets.

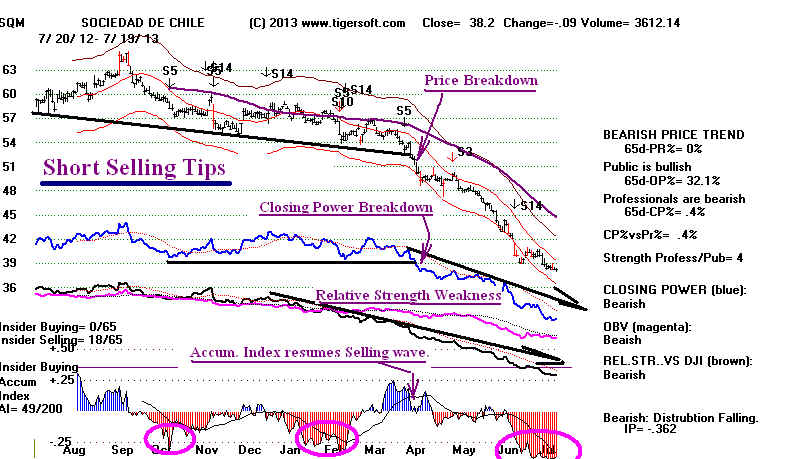

This is a book about our best strategies to find them. For example. we use

TigerSoft "bearish MINCP"stocks to hedge and sell short. These are the

stocks we identify as havining the heaviest insider AND professional selling.

Example:Week after week, FSLR was our number #1 short selling candidate. It was

the #1 most bearish MINCP stock on our Hotline using our software and data. See

below how it fell 75% in the last 8 months, ending April 2012, while the DJI rose 25%.

Then see all the red Distribution by insiders and the heavy Net

Selling by

Wall Street Professionals in the stock. This combination is very bearish.

Our Tiger Power Ranker easily finds you the most vulnerable stocks, the ones

that BOTH professionals and insiders are heavy sellers of. It also finds for you

with

one command the stocks that

decline the most when Peerless switches to a Sell.

Protect yourself from long

bear markets and severe intermediate-term corrections.

You

do not have to endure them. Make money from them and be ready to buy

and

go long when they are over. Peerless Stock Market Timing makes that

possible.

Big Bear Markets Are More Certain than Ever

The

stock market goes down faster than it rises. Governments no longer use

Keynesian

macro-economics to smoothe the business cycle. Instead the rich

favor

de-regulation of banks that are "too big to fail". They oppose government

intervention except in military spending and big oil subsidies. They oppose

taxation of the rich at the same level that working people are taxed. The result

is an

impoverished average American. "Austerity" has become the cruel

watch-word

among

Conservatives.

Nor

do most Democrats argue the point, ignoring the

role

of AUSTERITY and the 1937 FDR Crash and

the 1930-1932 HOOVER

CRASH.

They

ignore that income and wealth are now even more unevenly distributed than

right

before the 1929 CRASH.

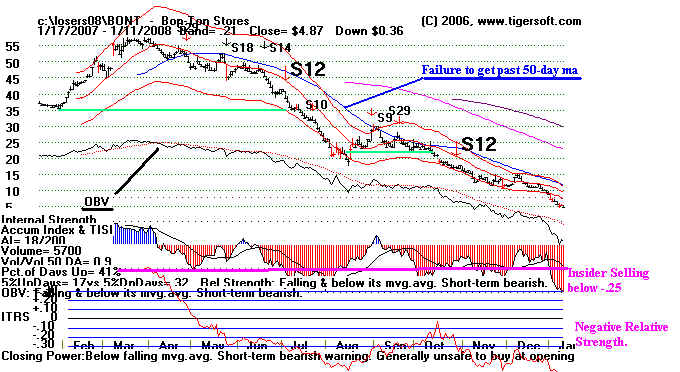

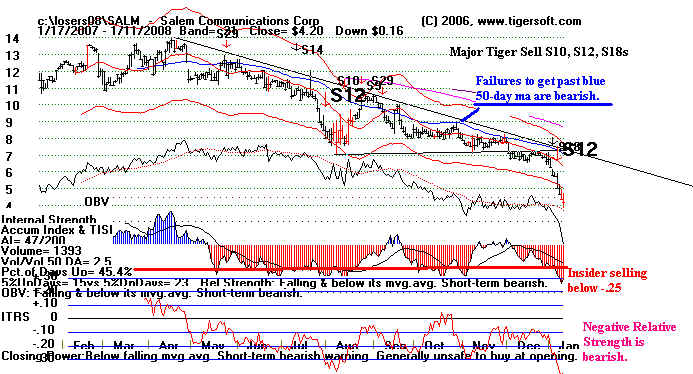

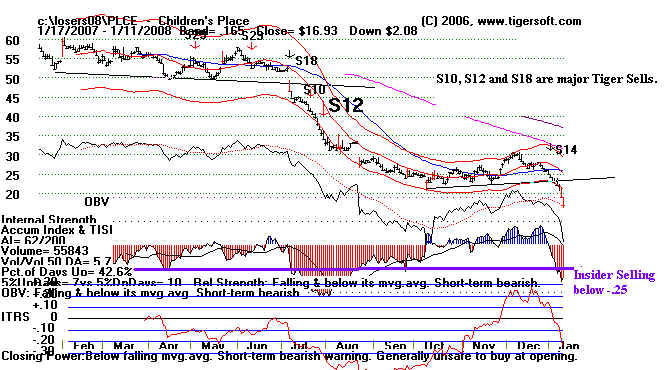

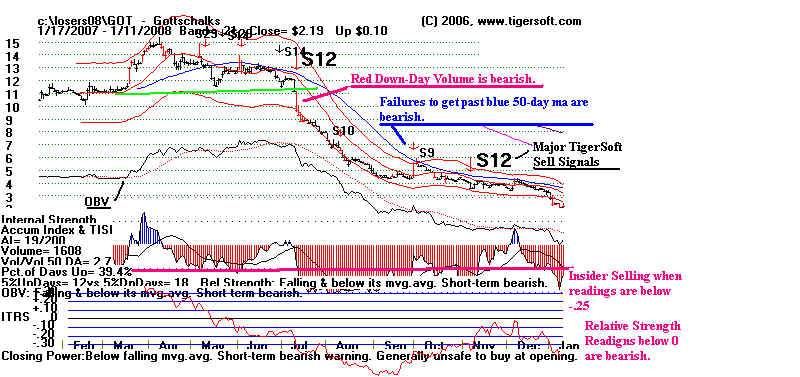

The Key To Killer Short Selling Profits in The Stock Market:

Best and Worst Performing Stocks for 2007.

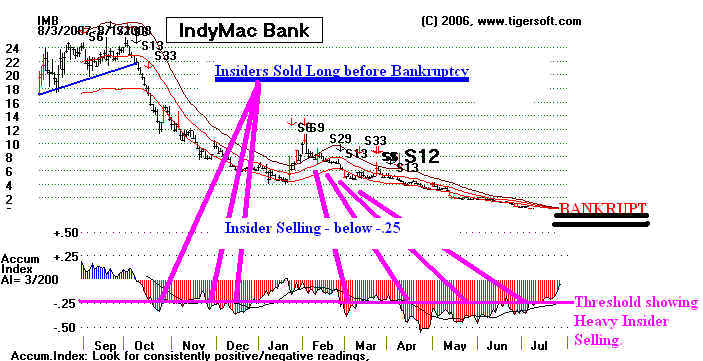

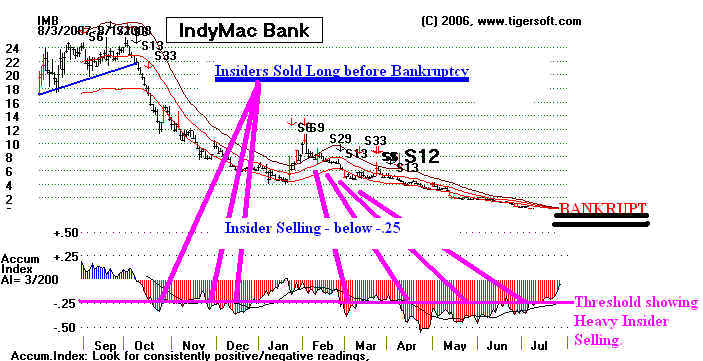

| How can an

average investor, an outsider, spot INSIDER SELLING? That is the function of Tiger's own Accumulation Index. When such selling persists, and the indicator shown below turns RED, for month after month, it is highly likely that the Big Money Selling is the result directly of insider information which is negative about the company. Is this too rash a statement? Read more. Is this type of "insider-informed", "big money" selling illegal? Yes. Absolutely, Is it policed and prevented? Hardly. It is rampant. The SEC is not staffed to pursue more than a few show cases each year. Class Action law suits and TigerSoft's Accumulation Index are really the only protection the typical investor has. The chart in DSCO below shows a recent example of alleged "insider trading". Our software spotted what we take to be the tell-tale signs of insider-tipped Big Money selling easily. The pattern of Red Distribution was there along with the other key characteristics our book tells you about. The stock (DSCO - Discovery Labs) fell by 35% in a month! And it has been sued for Insider Trading! Our book shows you how to spot these just before they CRASH!

Spotting Insider buying /selling

with Tiger's

Accumulation Index

12/28/2007 - Law Suit "MATTEL ( MAT ) HIDES TOY RECALLS UNTIL INSIDERS CAN SELL." ----

British Northern Rock Debacle Made

Insiders A Billion Pounds |

| Here's

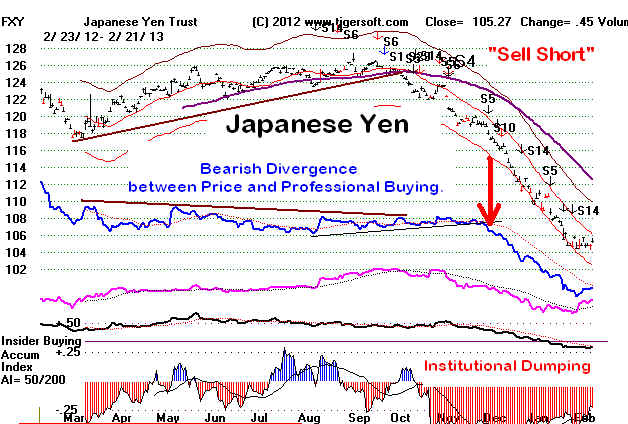

a passage from Explosive Super Stocks "Most investors only rosily look for stocks about to go up. But there's a another world out there that they are missing. It is is the world of "over-hyped", "over-recommended", "bloated", "inefficient" companies run by the greediest of white collar crooks that have sold their shares just before the news gets out that their products or drugs don't work or that their "books have been cooked" and just before their company's earnings come crashing down. This is the world where brokers with glaring conflicts of interest, are over-paid to recommend shares in companies they know nothing about, and could care less about. This is the world of rampant insider buying and insider selling, where the SEC serves mainly to give the appearance of propriety and regulation of Wall Street. This is the world where the Accountant gives the CEO whatever bottom line fabrication he is told to come up with because the Accounting firm does not want to lose the client. This is the world where trend-following lemmings bid a stock up and up, always believing there is a bigger fool, until, at least, the uptrend-line is broken and the stock comes gapping down, supported only by the bids of a few short-sellers who are taking mercy on the those who are have just lost 50%, 75% or 90% of their investment. This is the world of ENRON and IMCLONE and countless other companies who have been taken over by crooks, and whose shares are for a time little more than a criminals' tool for fleecing millions of dollars each day from innocent, unsuspecting, gullible investors who see the world of Wll Street through rose-tinted glasses right to the bitter end. We are here to tell you that you don't have to sit back and take it! You can fight back! You can now profiitably sell short in most any market, because with our TigerSoft technical analysis tools, you can see what corporate insiders and their well-heeled friends and cronies are actually doing with their own shares of a company's stock. "Watch their feet", my old basket ball coach used to say. "Forget about their eyes or their arms. They aren't going anywhere without their feet!!" Well, it's the same way in the stock market. +Use TigerSoft's "Accumulation/Distribution" Indicator to see what's really going on with your company's stock. The Stock Market is a JUNGLE! It is always survival of the fitest. You have to be prepared. That is why we named our company Tiger Software. Without TigerSoft you are at a distinct disadvantage. Let us show you how we can help you turn Wall Street's self-serving manipulation of news and stock prices to your lasting advantage." Learn from Tiger Software How To Profit from: (1) Bear Markets, which are predictable using our "Peerless" Automatic Sells. (2) Steep Market Corrections, which are predictable using our "Peerless" Automatic Sells. (3) and Those Stocks, which are Mortally Wounded by Heavy Insider-Selling and Massive Big-Money Selling even in Bull Markets. Such Bearish Special Situation Stocks can be spotted early-on in almost any market. Our Elite Report on the internet finds them for you. But our book will teach you how to find them yourself. All the necessary formulae are in the book. 1000's Have Learned from us How to Profit from Timely Short Sales. Let us show you, too. TigerSoft's 160 Page Book "SHORT SELLING: Killer Profts in Any Market Using Tiger's Accumulation Index." by William Schmidt, Ph.D. - only $55.... The book integrates our Peerless major Sell S9 signals on the DJI with TigerSoft's proprietary creation, the TIGER Accumulation Index, and classic technical analysis tools and concepts. The premise of the book is that someone always knows in advance when troubles are about to hit a company's stock or the market as a whole. Instead of being caught like a deer in the head-lights, we teach you how to spot the unmistakable, tell-tale signs of Insider Distribution that nearly always preceed significant declines. Exactly - what a Bearish Heavy Distribution Stock looks like. Chart of IMCLONE in 2002. IMCLONE's CEO was later convicted on insider trading. Without telling the public, he sold his shares in the stock when he learned the FDA was going to reject the company's anti-cancer drug Erbitux in late 2001. Shareholder lawsuits prolifferated. Other insiders like Martha Stuart were convicted of insider selling and have received jail sentences. A TigerSoft user looking at this chart would have readily spotted this Insider-Selling. Note the very negative RED distribution using TigerSoft's Accumulation Index and then the institutional dumping as the bad news spreads. A typical bearish-looking stock: CPQ - 1997 Sample charts and More Infomration: Link 1. >>> ORDER TIGER's "Short Selling: Killer Profits in Any Market" Book by Wm.Schmidt, Ph.D.

|

|

Insider Selling at Newmont Mining 2006 Look at how gold stock Newmont Looked Before Its Recent Decline from 50 to 40. Note the heavy Red Distribution (Insider and Big-Money Selling) while the stock was going sidewise between 48 and 58. Also see how the OBV Line - representing aggressive selling - was making new 12 month lows with the stock still over 48. What precipitated the decline was the accouncement made late in the decline by NEM that it's earnings' outlook would be much duller than expected for the next two years. Reuters: October 2, 2006 headline: Uzbek court declares Newmont gold venture bankrupt " Newmont, the world's second-largest gold miner, has run into difficulties in the former Soviet republic at a time of worsening diplomatic relations prompted by U.S. condemnation of a government crackdown on a rebellion in Andizhan a year ago....In July, Uzbek authorities seized gold and some of the assets belonging to Zarafshan-Newmont, the other 50 percent of which is owned by the government of Uzbekistan, and launched two tax claims for payments it said were due between 2002 and 2005....Denver-based Newmont has called the tax claims an attempt by the Uzbek government to expropriate its share of the company. The company has said the joint venture met its tax obligations...CEO Wayne Murdy said last week the company would write off its operations in Uzbekistan, where the joint venture ran for more than a decade. "We are finished there. When I left Uzbekistan in June, I took the last two expatriates with me," Murdy told Reuters in an interview last week.... Newmont's 50 percent share of gold sold by the Uzbek joint venture last year was 122,700 ounces. ($73 million) ...The company expects equity gold sales between 5.6 million and 5.8 million ounces worldwide in 2006, dropping to between 5.2 million and 5.6 million ounces next year before recovering in 2008 and 2009 when projects in the United States, Ghana and Australia reach full production." This bearish news was know to the company and insiders in June. It was not released until October.  |

|