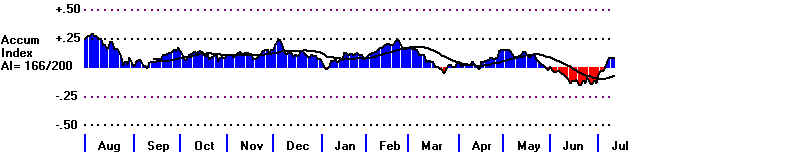

8/11/2011 DJI = 11143.31 la/ma= .928 21-dmaROC= -1.329 P = -605 (-49 ) IP21= -.187 V= - 420 OP= -.271

BREADTH STATISTICS:

58 (+15) MAXCP

stocks - Bullish MAXCP Stocks

129 (-311) MINCP stocks

- Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

3 new

highs on NASDAQ. 26 new

lows on NASDAQ

2 new

highs NYSE

11 new lows on NYSE

8/11/2011 ===> See Key Peerless

TigerSoft Index Charts: Industry Groups and ETFs

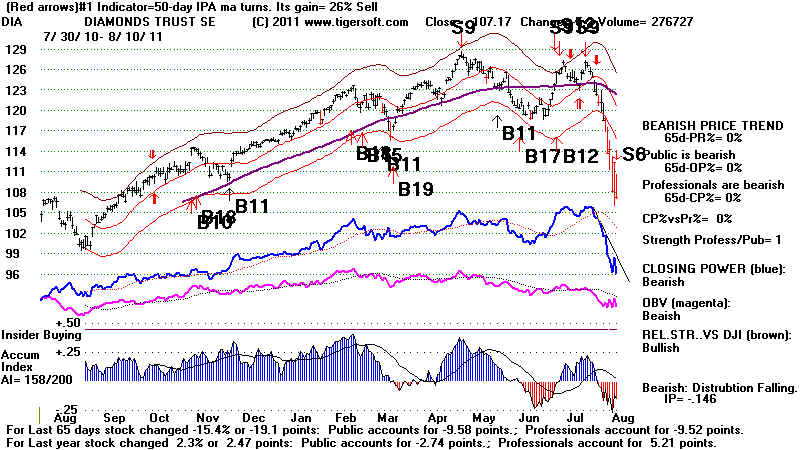

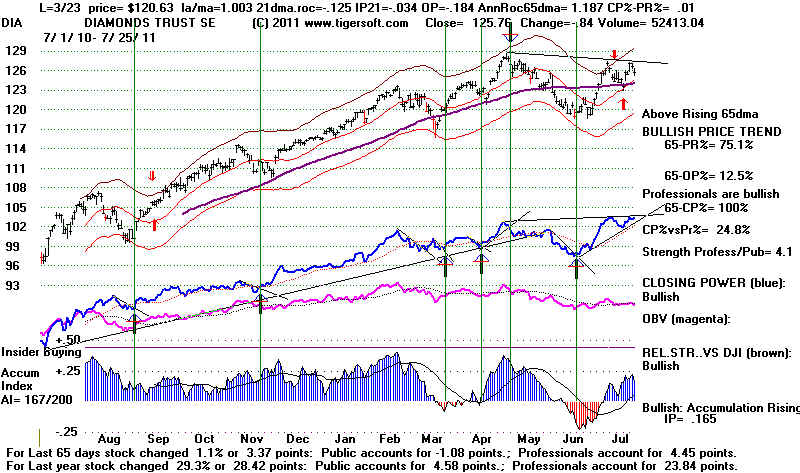

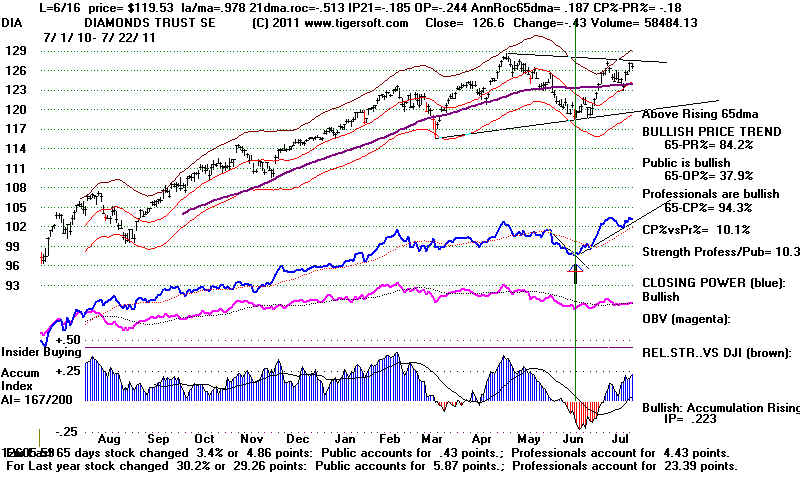

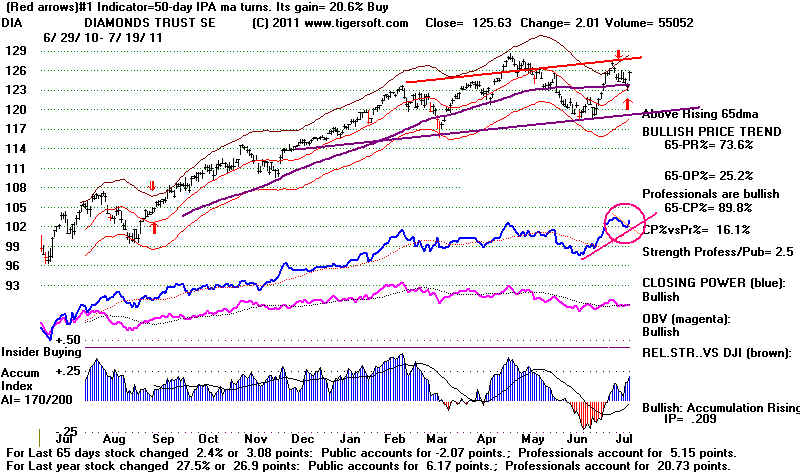

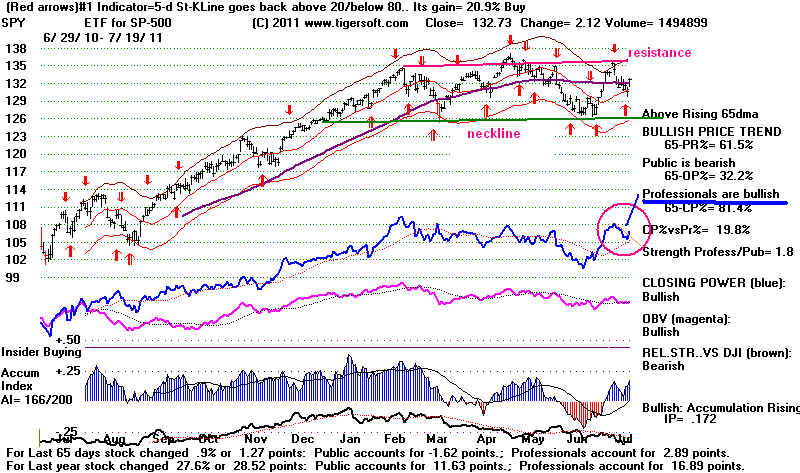

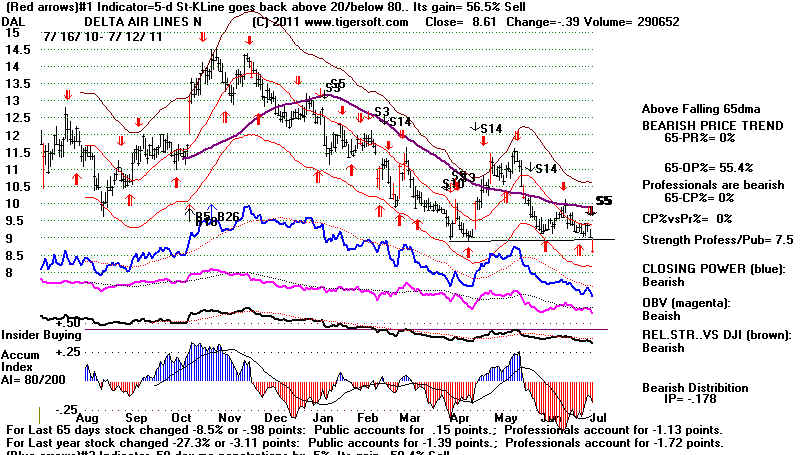

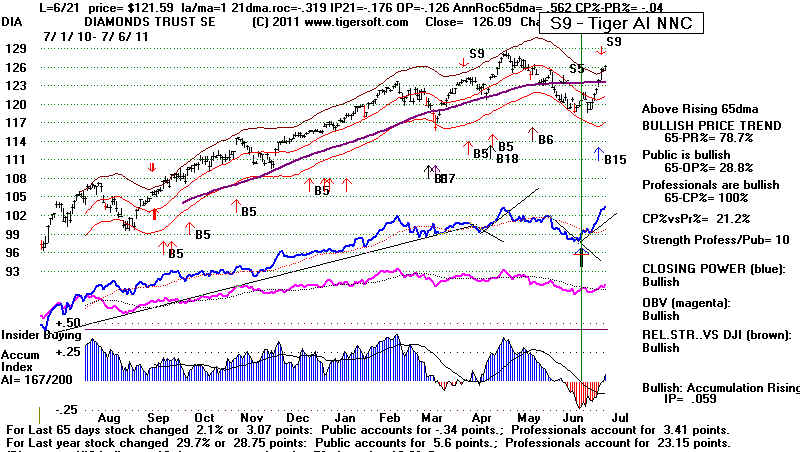

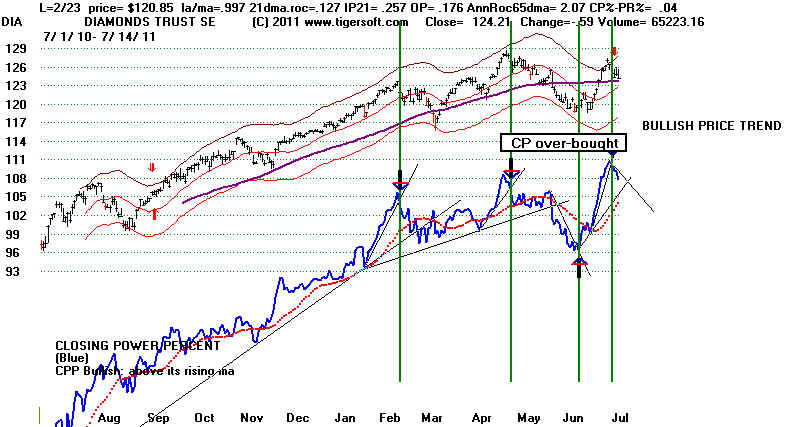

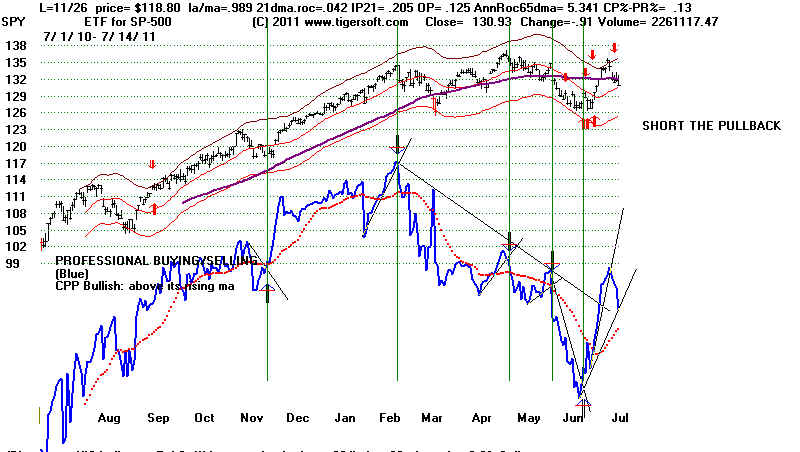

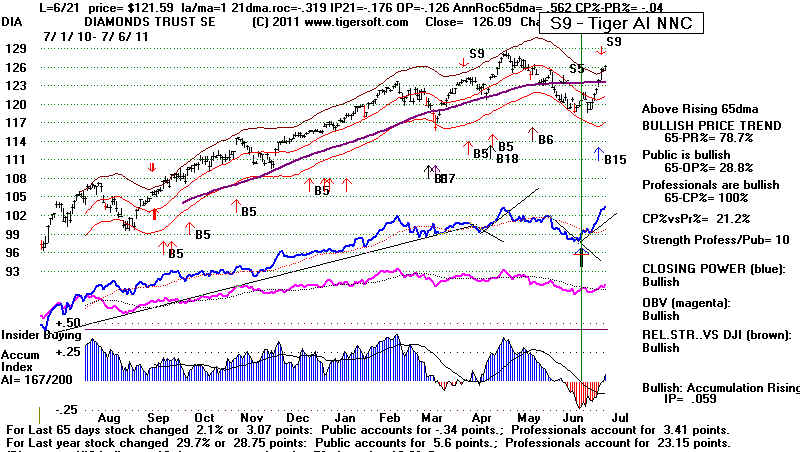

DIA SPY

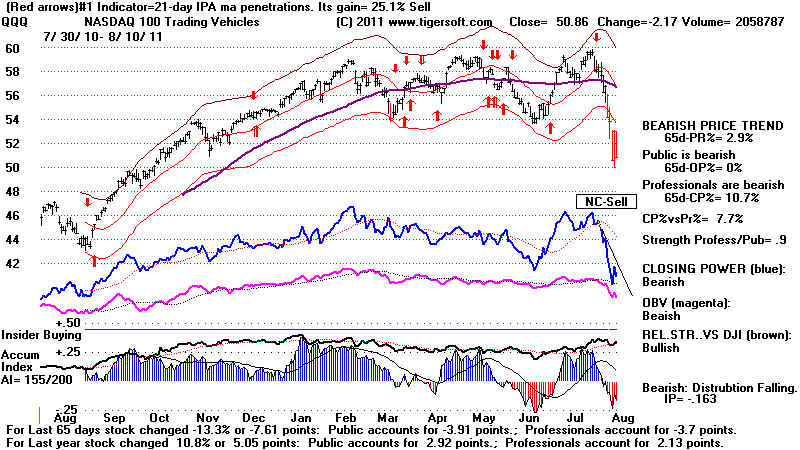

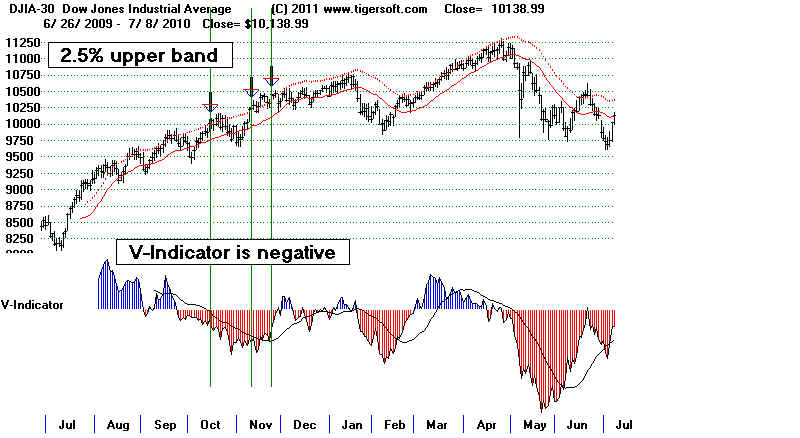

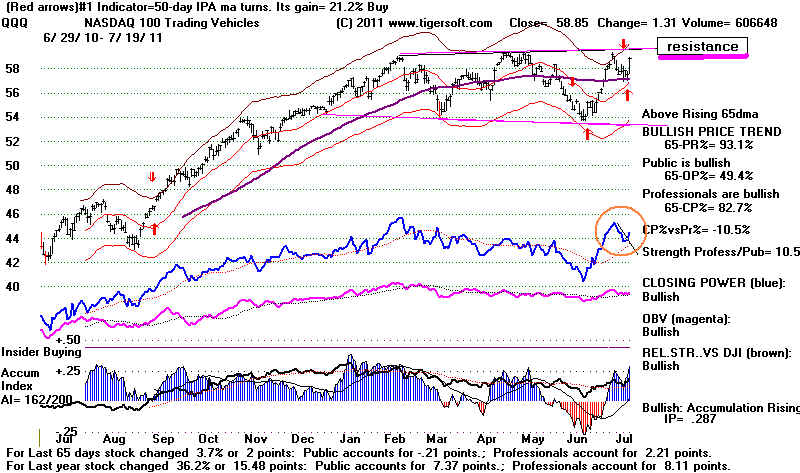

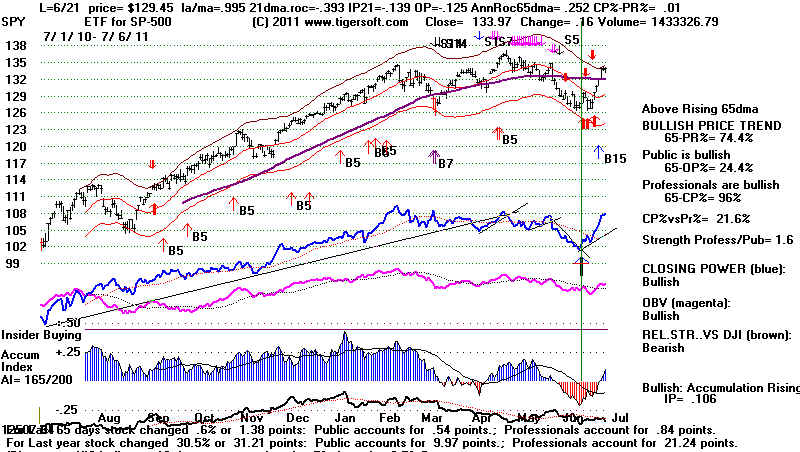

QQQ DJIA-Peerless

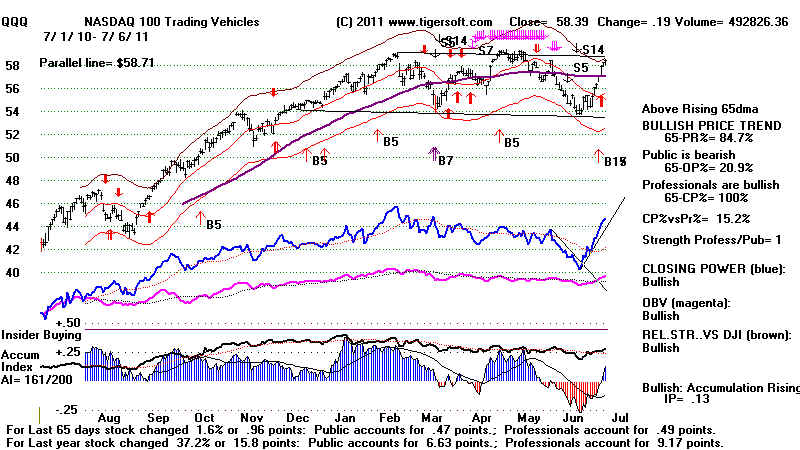

TigerDJI TigerSPY TigerQQQ

GLD SLV

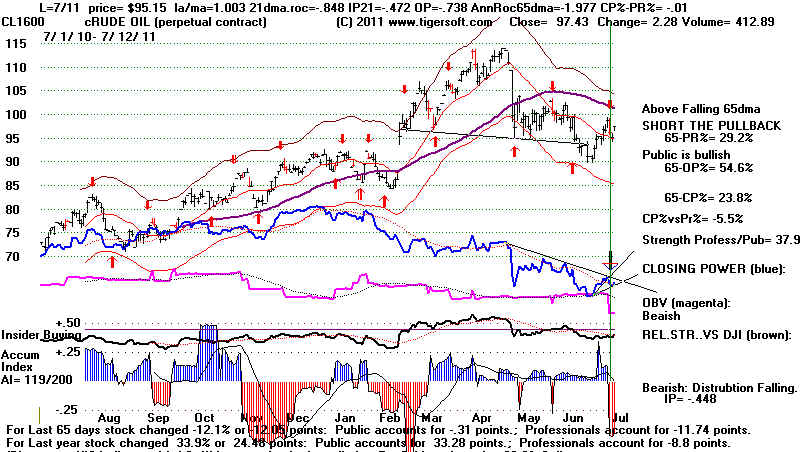

Crude

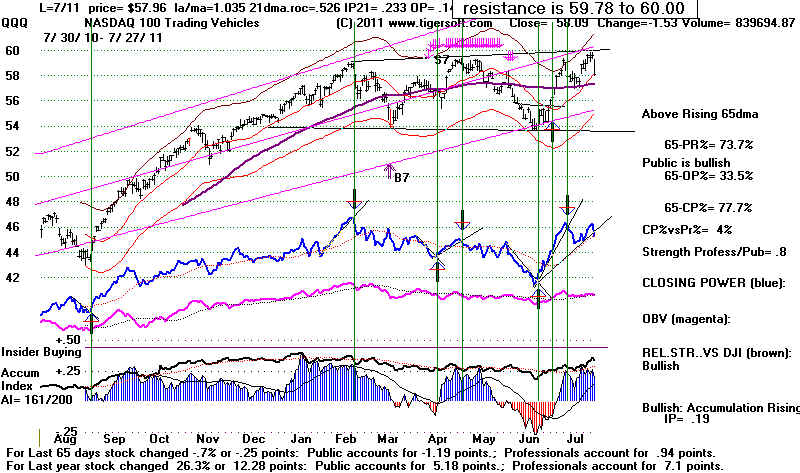

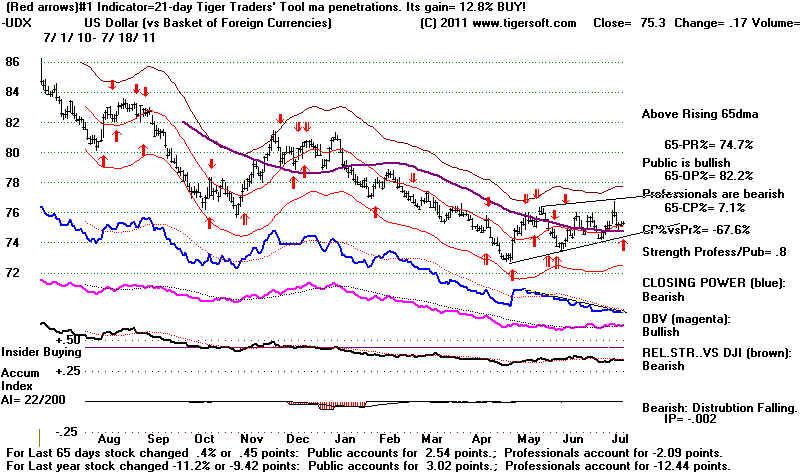

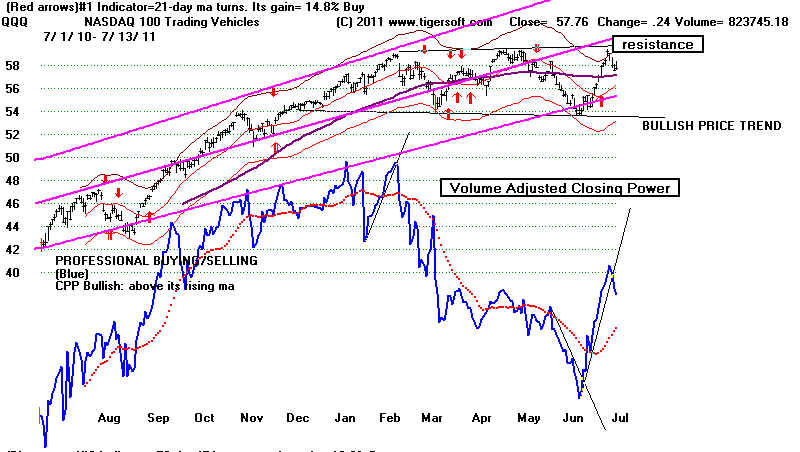

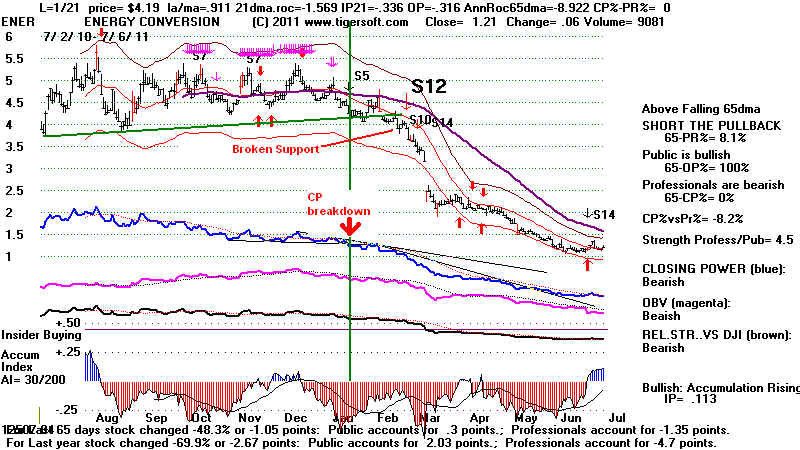

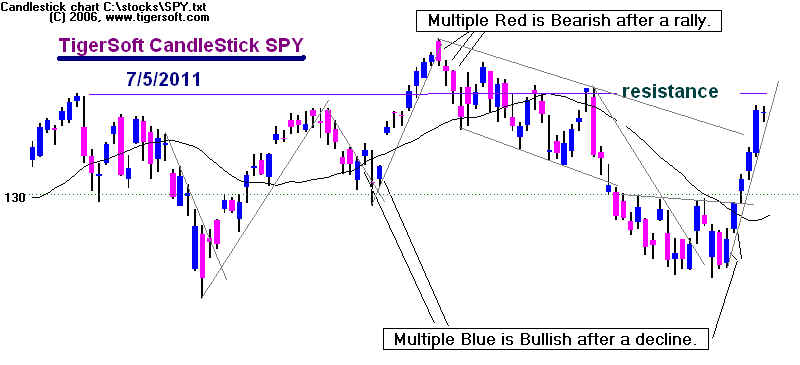

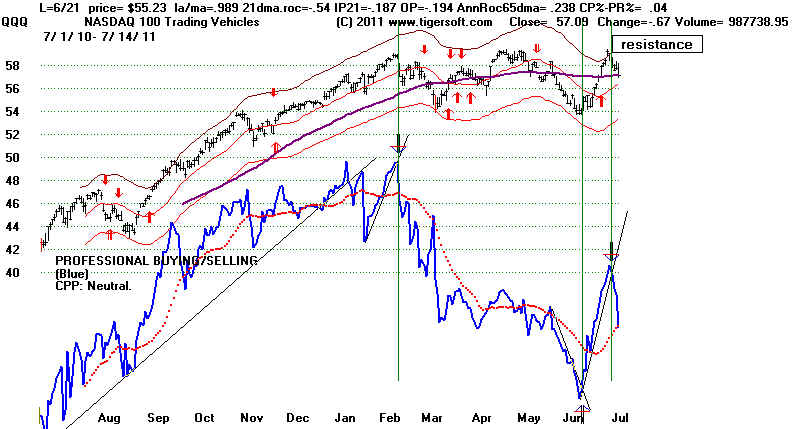

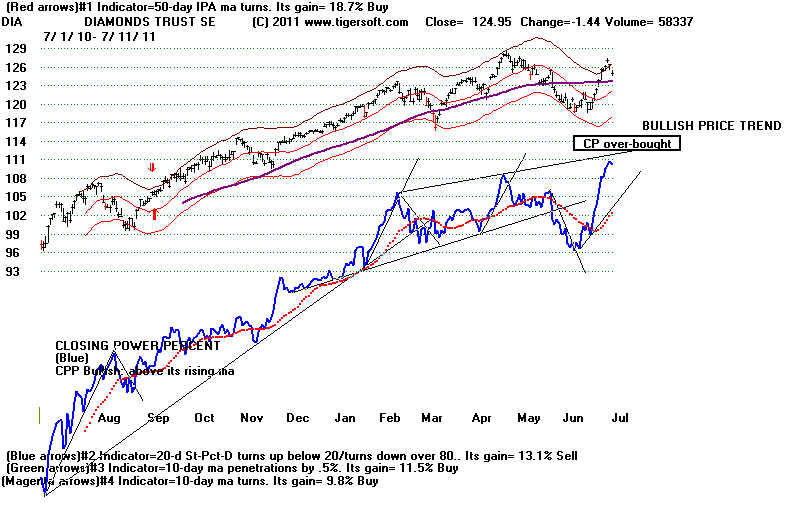

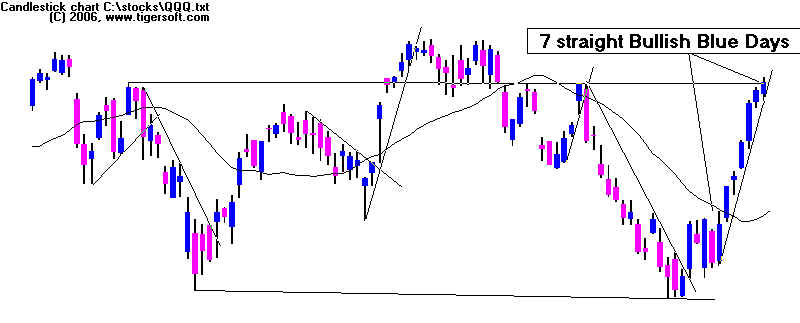

8/11/2011 The Dramamine Market. We have greatly reduced the number of

our short sales as each broke its

downtrendline. Now there is a rising

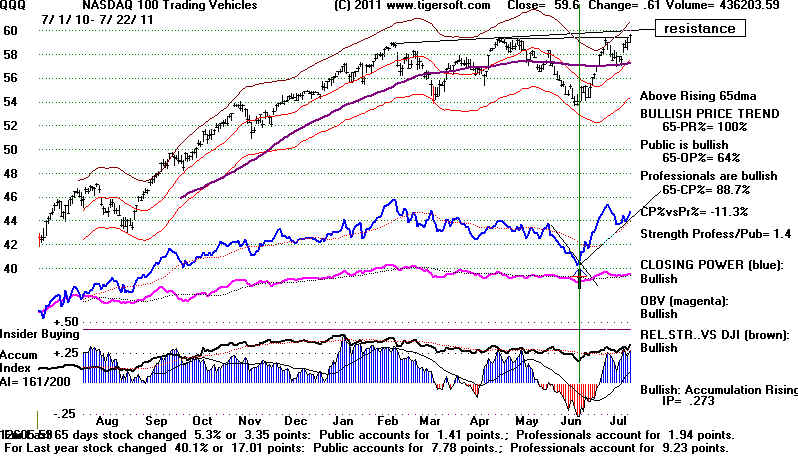

Closing Power uptrend for the QQQ. Very

nimble traders may wish to

trade it LONG, but the extreme volatility

is too much for me. Also, the

pattern after comparable past steep sell-offs

is for the peaks of the first tight

pattern on the decline to be resistance.

A close above DIA 112.95, the top of

its tight pattern, would be bullish. But

even then, there will be resistance at the

falling 21-day ma and at the broken lows.

There are still many more MINCP

stocks than MAXCP stocks. This is a good

time to let the computers trade with each other.

The danger is our little boats will be capsized

by traders rushing from one

side of the boat to the other. Let's go

ashore for a while.

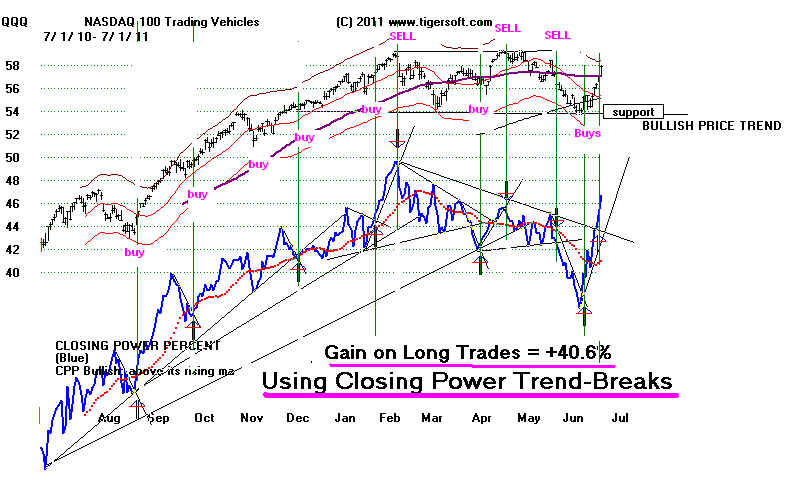

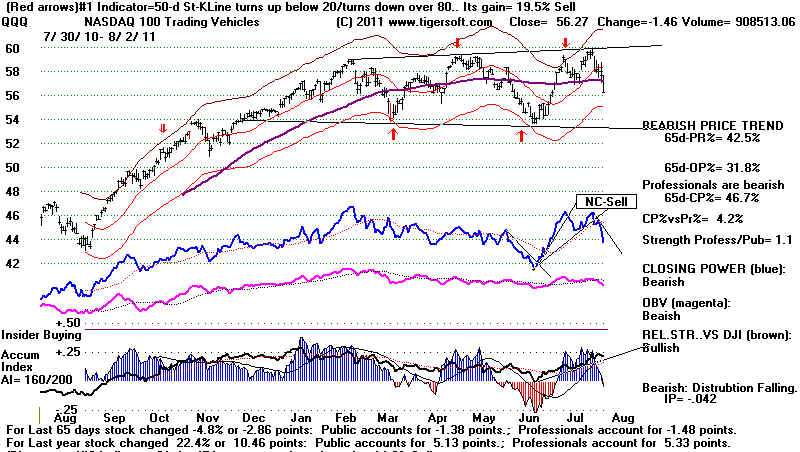

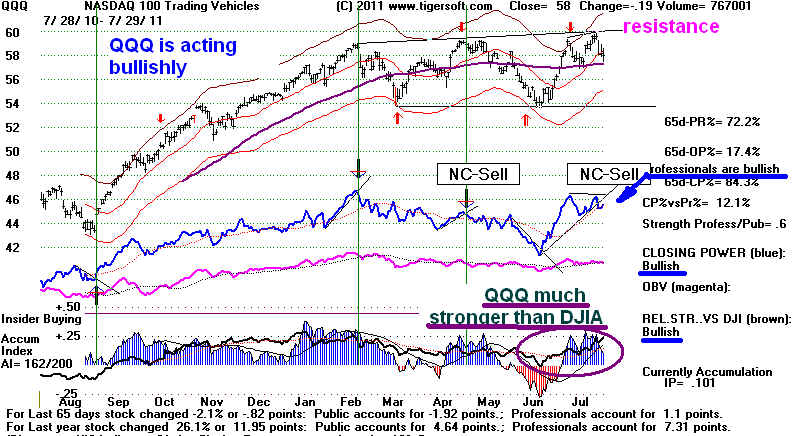

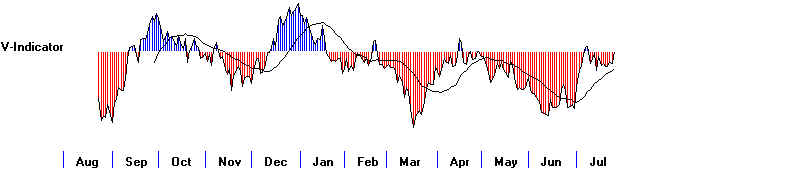

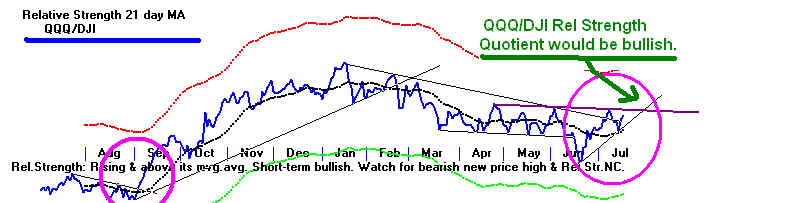

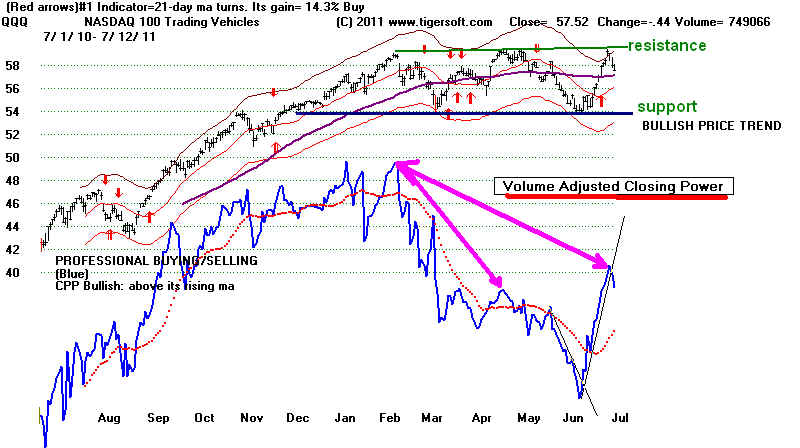

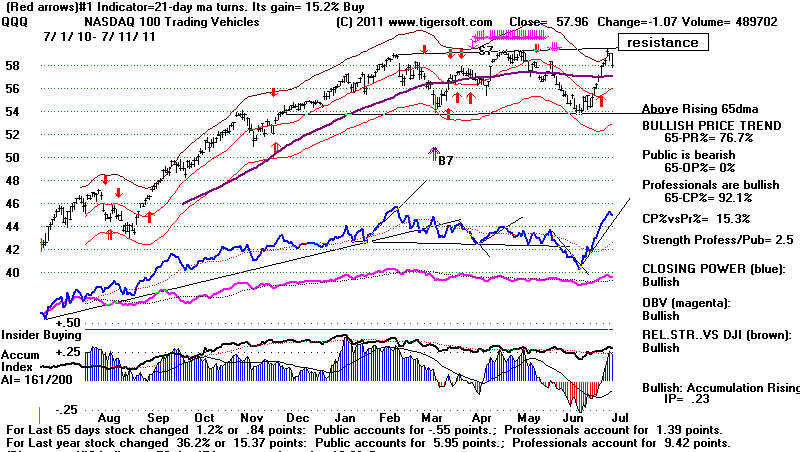

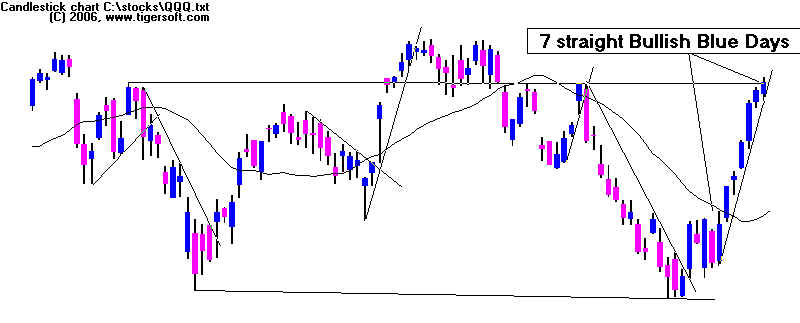

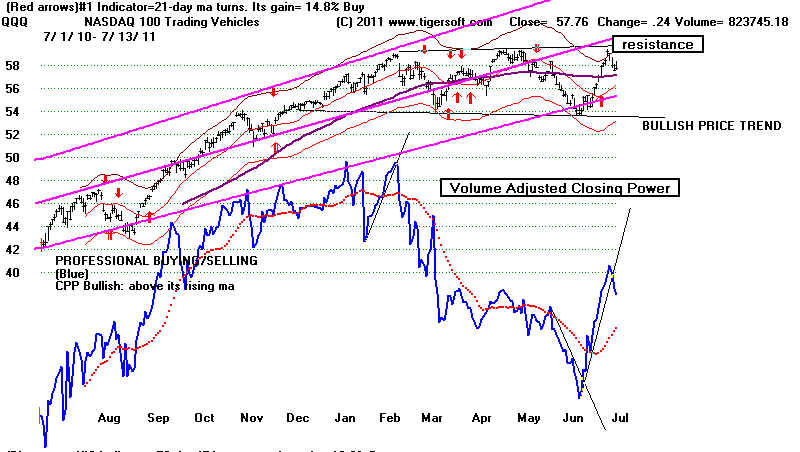

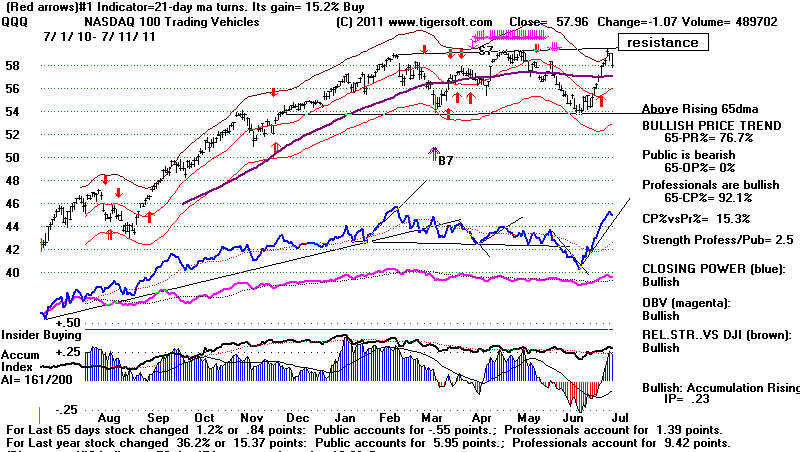

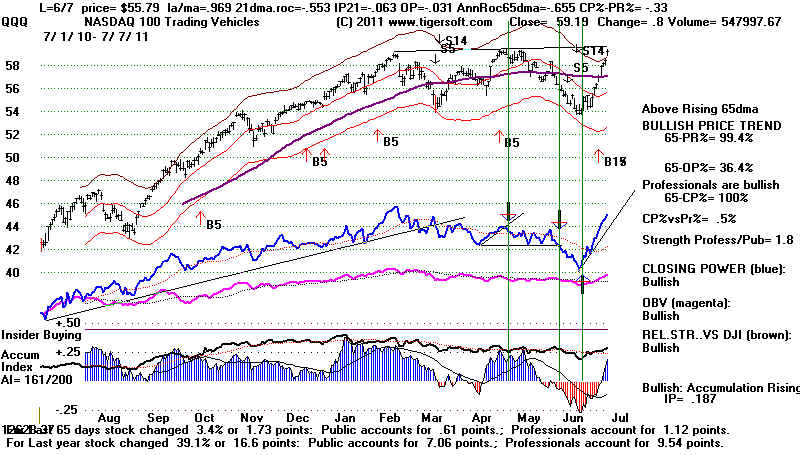

QQQ Closing Power has zig-zagged

upward.

Professionals

are covering their shorts.

The Whipsaw

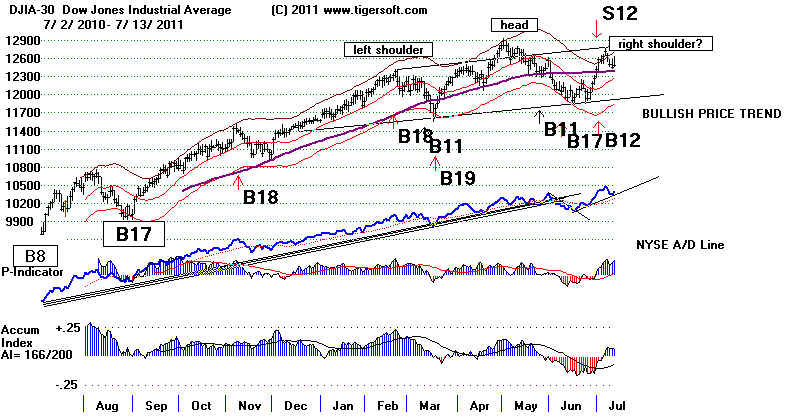

Computerized Trading Market Brought a New Buy B12.

I would only trust it as long as

the short-term QQQ's Closing Power and NYSE

uptrendlines are not violated.

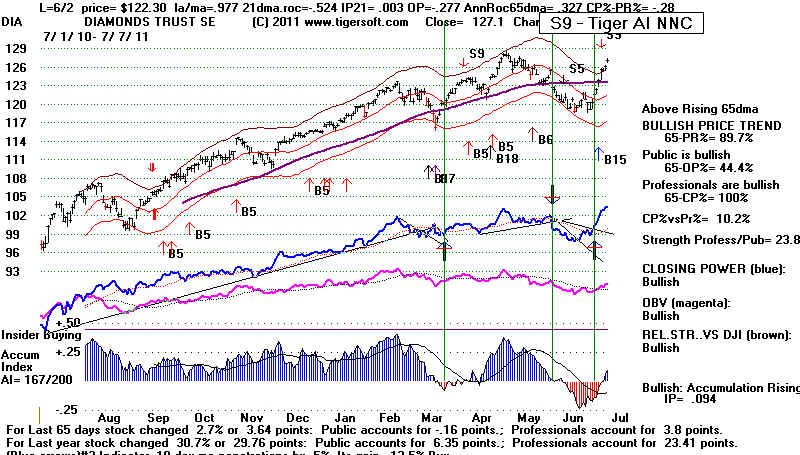

Historically, the earlier four price patterns like the

present after a sharp

market-selloff each broke down after being unable to get

past their short-term highs.

Just as the Buy B14 had to

mistrusted two days ago and discarded yesterday

because it occurred with its

downside momentum too powerful and far below

previous cases of the same signal

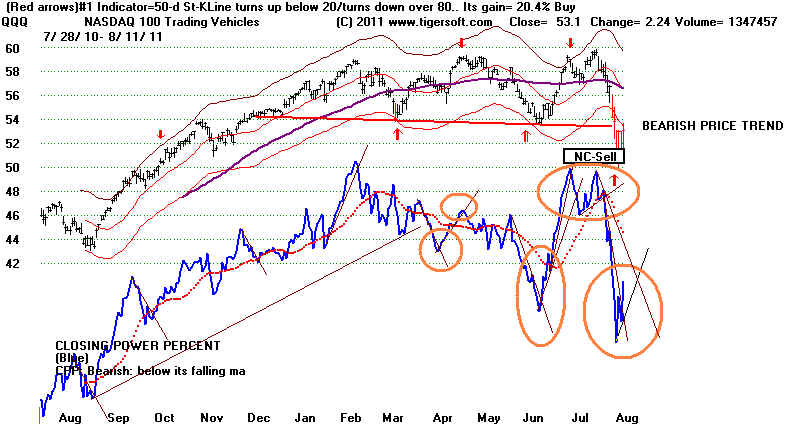

going back to 1928, so too, today's Buy B12

also takes place farther below the

21-day ma and with greater downside momentum

of the annualized 21-day ma than

any earlier case of the Buy B12. When I wrote

the Peerless software I did not

even consider that a Buy B14 or a Buy B12 could

take place immediately after such

market weakness. This consideration should,

I think, make us doubt the new Buy

B12. I would prefer to trust the QQQ's rising

Closing Power.

This particular Buy B12 signal

occurs when two of the last three days show

exceptionally high ratio of NYSE

advances to declines, more than 10:1. There

are only five previous cases since

1928, but they were each very profitable.

However, as you can see below the

lowest key values for all five B12s were higher

than the all our current key

values, except IP21. Accordingly, the current Buy B12

has to considered highly suspect.

CL/MA ROC

PI AI (IP21)

V OP21

Current

.928 -1.329 -532

-.131 -361 -.224

Lowest for all

.988

-1.186 -496 -.179 -317 -214

previous 5

4/10/1933 62.10 Gain= +66.5% No Paper Loss

CL/MA ROC PI AI (IP21) V OP21

1.074 1.992 15(13) -.03 90 .367

Volume was 30% above its 21-dma

|

6/22/1938

129.90

Gain=

+ 13.4% No Paper Loss

(Also 6/23/1938 127.40 and

6/24/1938 129.1 )

CL/MA ROC PI AI (IP21) V OP21

+0.7% if exetreme bearish mode used.

1.095 1.056 43((34) .08 61 .216

B12s also on the next two days.

Volume was 100% above its

21-dma. |

9/30/1938

141.50

Gain= +

11.3% No Paper Loss

B12s also on the next two days.

CL/MA ROC PI AI (IP21) V OP21

+0.7% if exetreme bearish mode used.

1.032 .191 0((34) .077 -50 .048

Volume was 20% above its

21-dma. |

11/4/1943

136.3 Gain= + 9.0%

1/14/44 S1 5% Paper Loss

also 11/5/1943 - 135.3

CL/MA ROC

PI

AI (IP21) V OP21

.988 (lowest)

-.285 121 (54) -.179

62 -.135

DJI fell to 129.60 on 11/30 and then recovered to up per band, declined

again and took off. Very low IP21 here.

Volume was 60% above its

ma. |

3/12/2009 7170.06 Gain = 9.3% No Paper

Loss.

CL/MA ROC PI

AI (IP21) V OP21

.998

-1.186 -496 (+227) -.113 -317 -.214 |

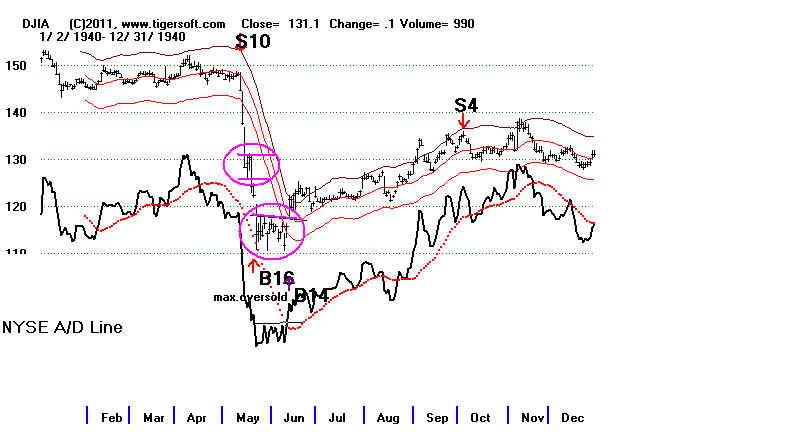

The up-down-up trading here has precedent after a steep decline. The pattern here

is a tight trading range bound by the

short-term highs and lows. I found four cases.

In each case the first tight pattern was

a continuation pattern. There was then another

decline. The second tight

consolidation proved to be a pivot point and the DJI moved higher.

1940 German attack on

Western Europe sends the DJI lower.

|

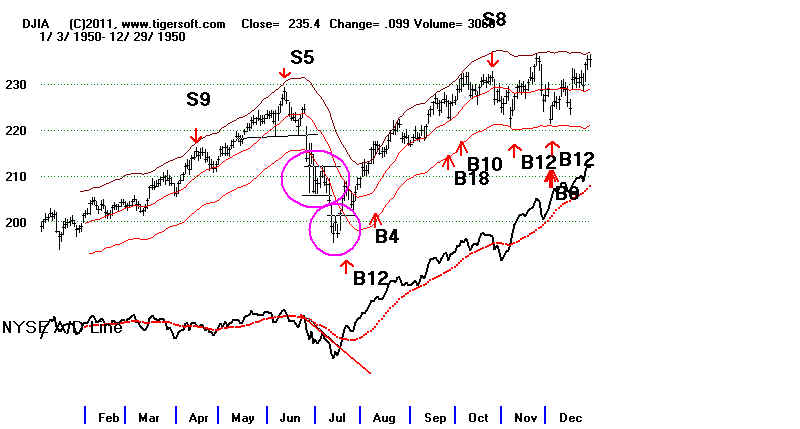

1950 - North

Korea attacked South Korea to drop the DJI in June..

|

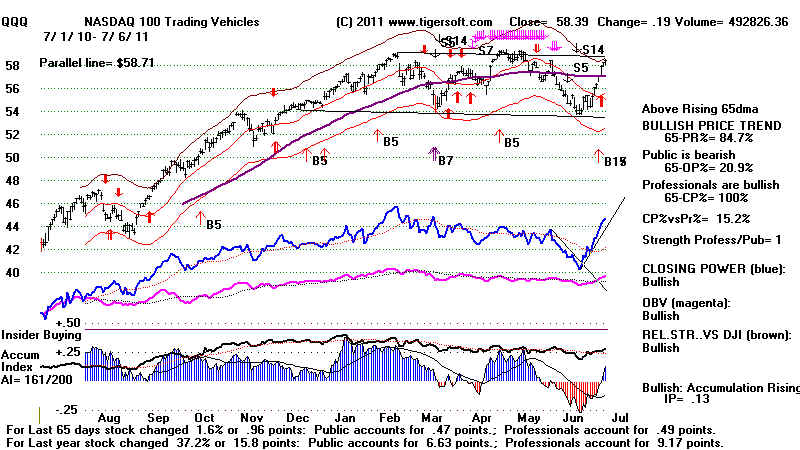

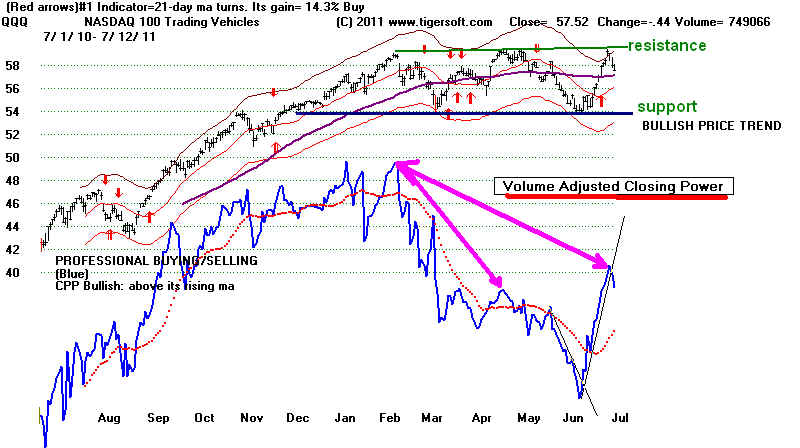

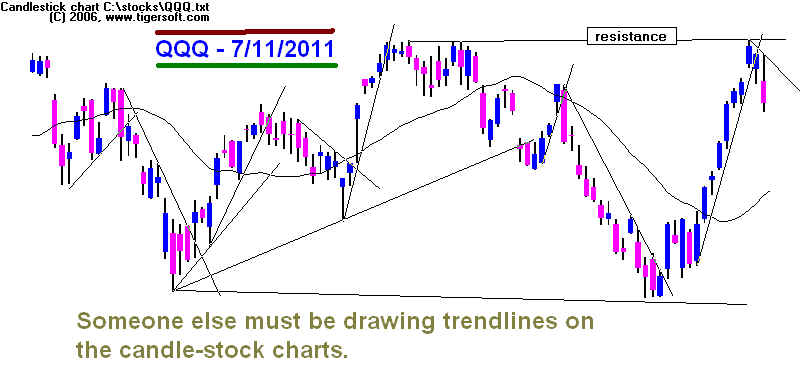

QQQ Zig-Zagging higher.

This gives traders a way to watch and reverse trading potations.

Note that the red Buy and Sell signals are optimized for the data on

the chart.

Yesterday, with different data, there was a different optimum trading

system and

it was on a Sell.

|

====================================================================================

Older Hotlines

====================================================================================

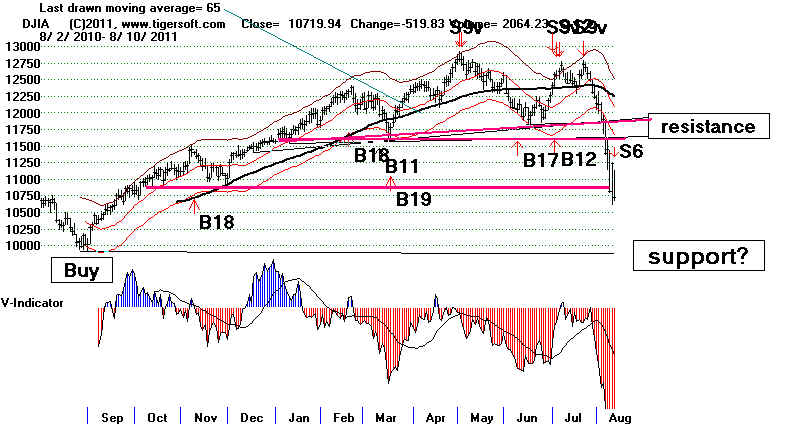

8/10/2011 DJI = 10719.94 la/ma= .888 21-dmaROC= -1.691 P = -605 (-49 ) IP21= -.187 V= - 420 OP= -.271

BREADTH STATISTICS:

43 (-4) MAXCP

stocks - Bullish MAXCP Stocks

440 MINCP stocks

- Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

3 new

highs on NASDAQ. 155

new lows on NASDAQ

2

new

highs NYSE

153 new lows on NYSE

8/10/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY

QQQ DJIA-Peerless

TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

8/10/2011 ONE DAY UP BIG and the NEXT DAY DOWN BIG = SELL S6

.

This signal only has occurred in Extreme Bear Markets and 1987.

Hold Tightly Half Your Shorts and the Long Gold Position.

As I write this the Futures

are up +188 for the DJI and 22.5 for the SP-500.

Keep in mind that a higher

NYSE Opening will only make it harder for a still higher

NYSE close and that is what

is needed to break the Closing Power downtrend.

Without a new Peerless Buy

signal, only nimble traders should try to play the rally

that a break in the Closing

Power downtrends usually predicts.

Blue Closing Power Downtrend is still operative.

So

much for the yesterday's Buy B14 and boost of low interest rates for

two more years. At

least the B14 was never clinched by the Closing Powers and it

came with ample warning here.

This is a dangerous market.

The inability to mount more than a one day rally is

is the trademark of such

extreme sell-offs as October 1987 and August 1937. Traders

and institutions want out

before there can even be a second day of rally. And everyone

remembers 2008-2009.

This time they want to sell first and ask questions later. Add to

this the short selling in 3x

leveraged short ETFs that can be margined and you can see

how quickly the herd of

trend-following big hedge fund players can trample on

everyone else. And, of

course, courtesy of the SEC, they can also readily sell short

on down-ticks. The SEC

at the behest of Wall Street has engineered the perfect

mechanism for creating a

Crash. So, the rate of decline is very high now, and matched

only by 1987's 3 week 35% DJI

free-fall.

The market is afraid of everything

now. Of events in London, France and elsewhere.

Of the potential for the gathering

recession world-wide. Of another US depression,

because we now have what the

economist Keynes called a "liquidity trap".

"The liquidity trap, in Keynesian

economics, is a situation where monetary policy

is unable to stimulate an economy, either through

lowering interest rates or

increasing the money

supply. Liquidity traps typically occur when expectations

of adverse events (e.g., deflation, insufficient aggregate

demand, or civil

or

international war) make persons

with liquid assets unwilling to invest."

It may be interesting for you to read the entire article at http://en.wikipedia.org/wiki/Liquidity_trap

Even the national mainstream media

is asking where the national leadership is?

Obama's

ignorance of economics shows clearly. He has allowed the Presidency

to be straitjacketed when it comes

to fiscal macroeconomic initiatives. Sadly,

contemporary Republican leaders

seem not even believe in the need for much

government, except to make wars.

How is this different than when the Hoover's

Treasury Secretary,

proclaimed “Liquidate labor, liquidate stocks, liquidate the farmers,

liquidate real estate.”

When prices were low enough, strong-willed entrepreneurs

would pick up the pieces and

restore the economy. Hoover described Mellon's

views on the economic collapse like

this:

"It will purge the rottenness out of the system. High

costs of living and high living

will come down. People will work harder, live a more moral life. Values will be

adjusted, and enterprising people will pick up the wrecks from less competent people”.

http://delong.typepad.com/delong_economics_only/2007/02/why_oh_why_cant.html

The DJI's Annualized Rate of

Decline Is -169%

As I feared last night might

happen, the downward momentum was too great and

yesterday's 1-day rally was

completely snuffed out with an even bigger decline today.

This produced the Sell S6 in the

Peerless DJI chart you see below. The Closing Powers

never clinched the Buy B14.

And today I added to our software the requirement that

the DJI's close in the case

if Buy B14s be above 95% of the DJI's 21-dma Elite

Subscribers and those who got

the Sell S9v update will be emailed the address

for this update tonight.

These two-day dramatic

reversal Sell Signals are associated with and have only

occurred in the much

bigger declines in the extreme bear markets of 1929-1932 and

1937-1938, as well as

once in 1987. See

these charts here with the past Extreme

Bear Market Sell S6s.

|

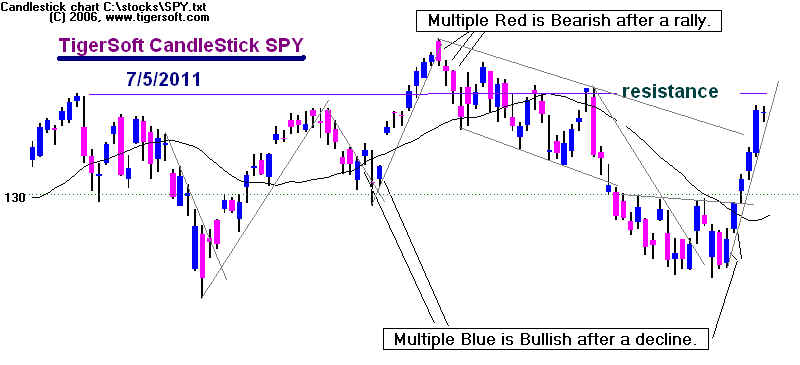

|

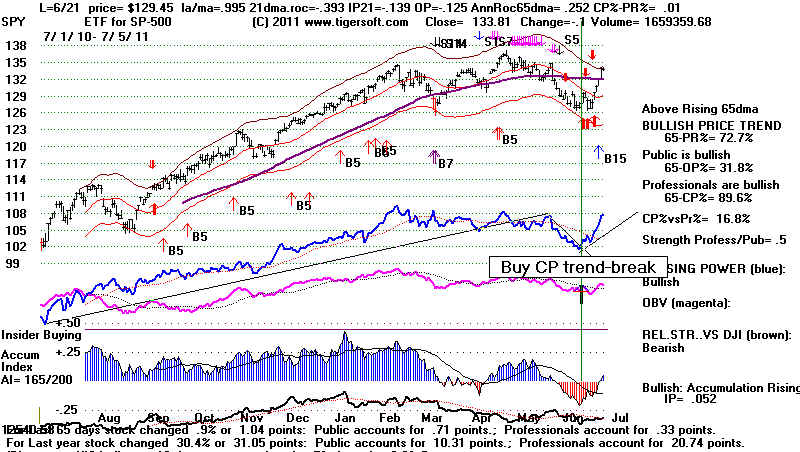

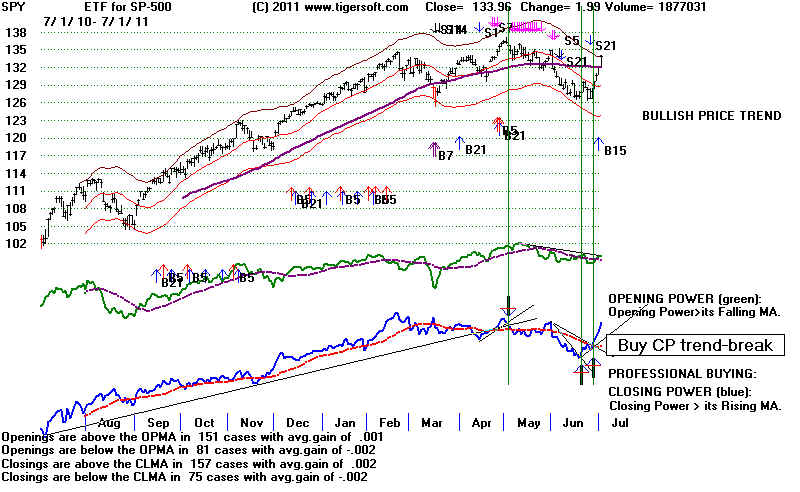

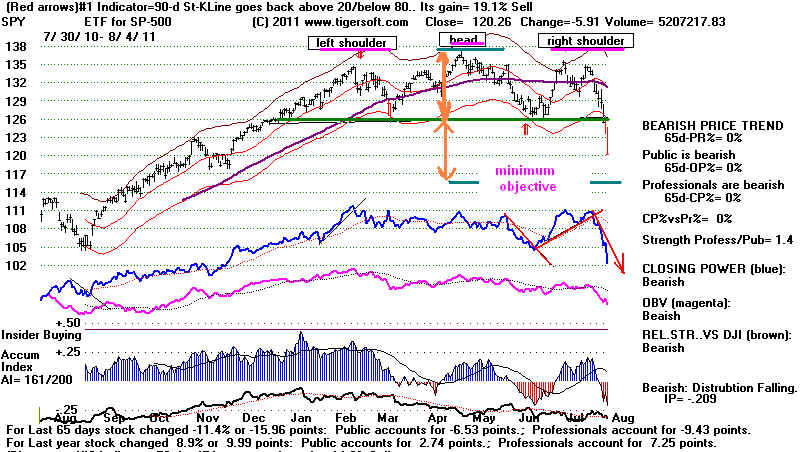

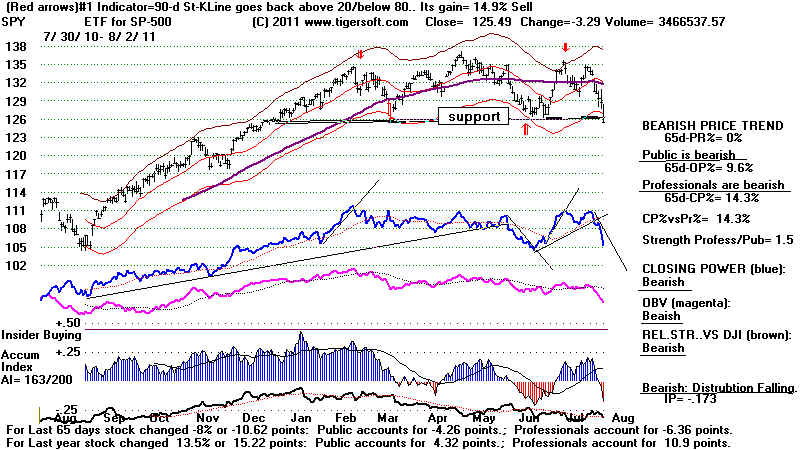

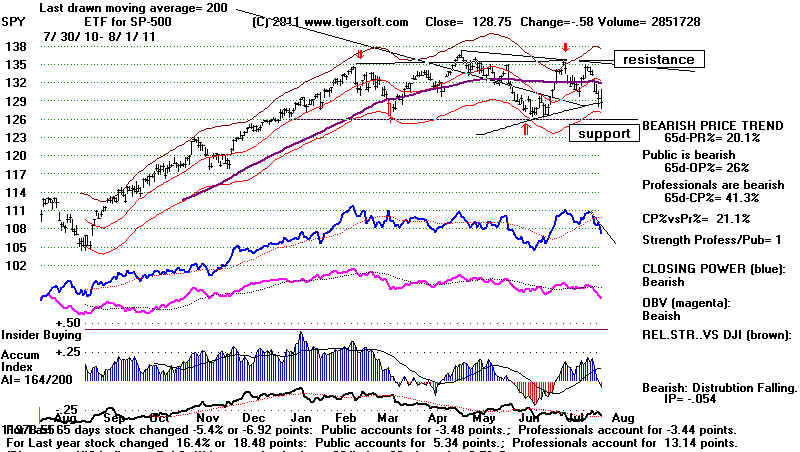

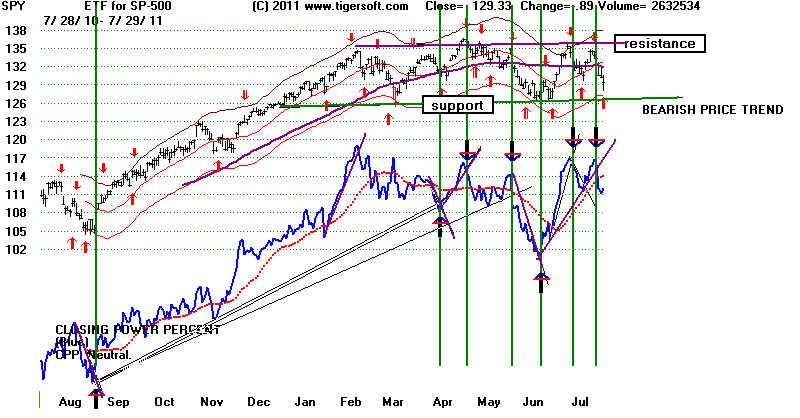

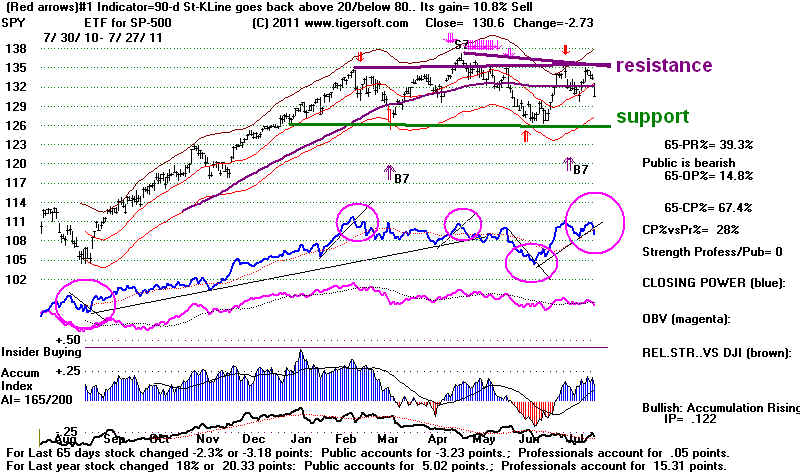

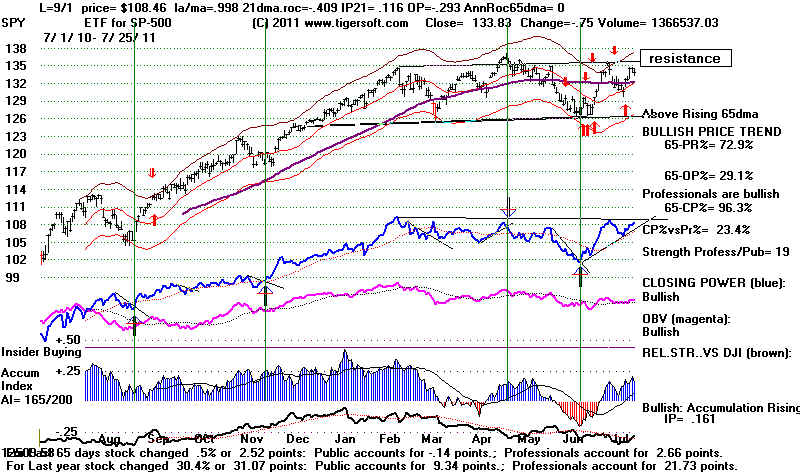

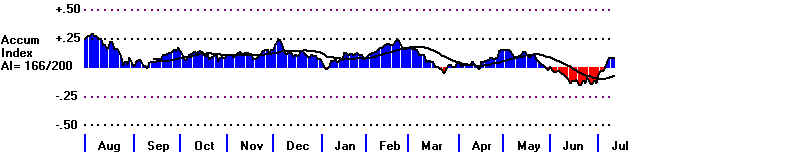

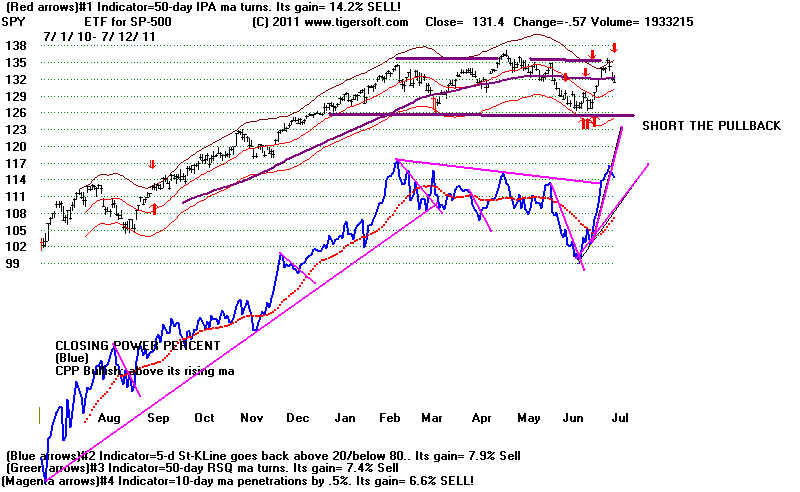

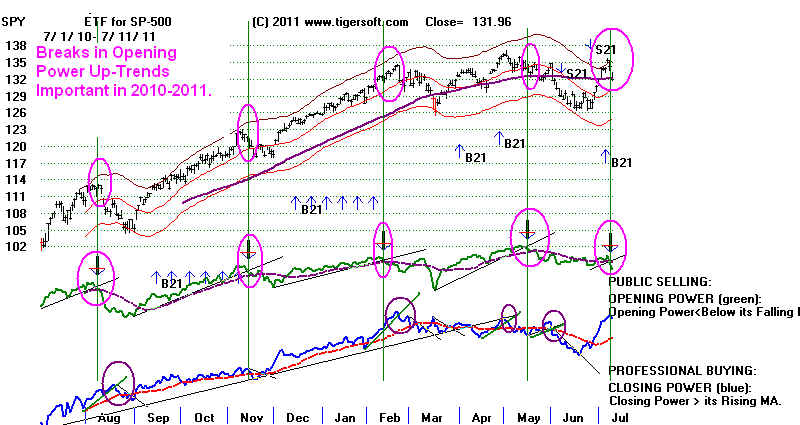

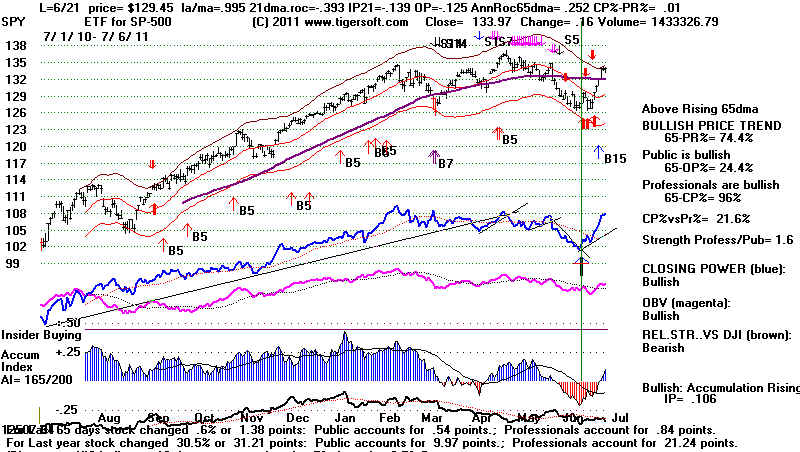

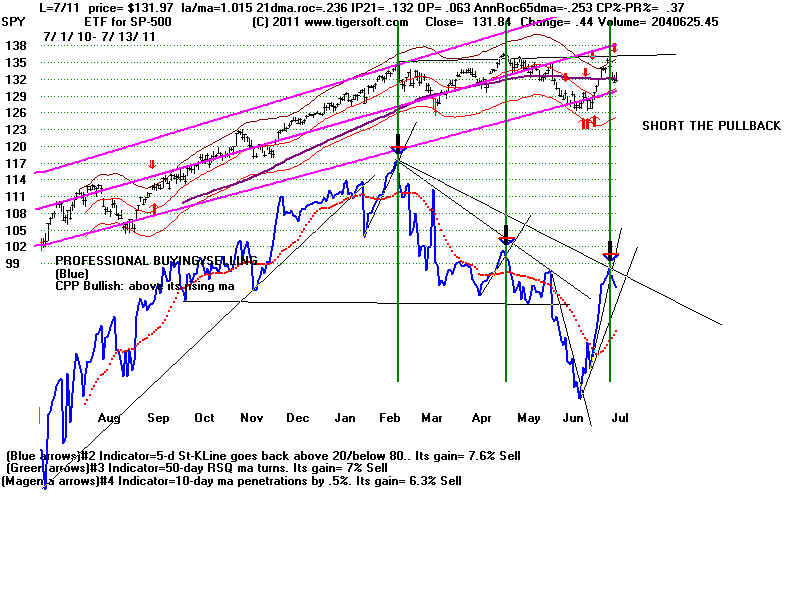

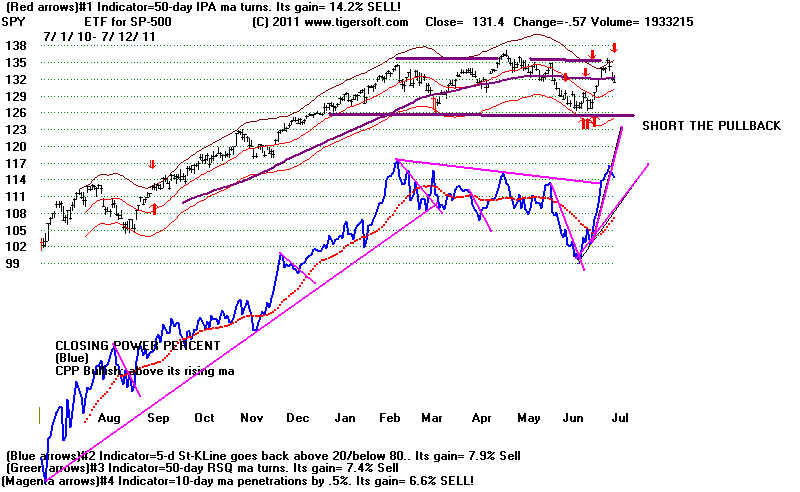

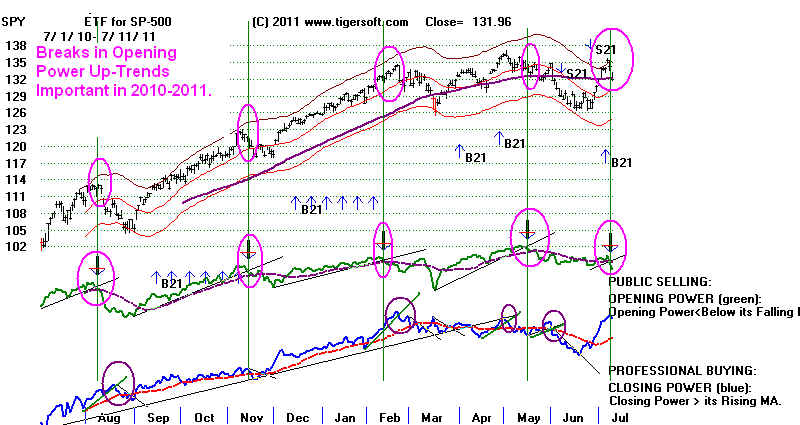

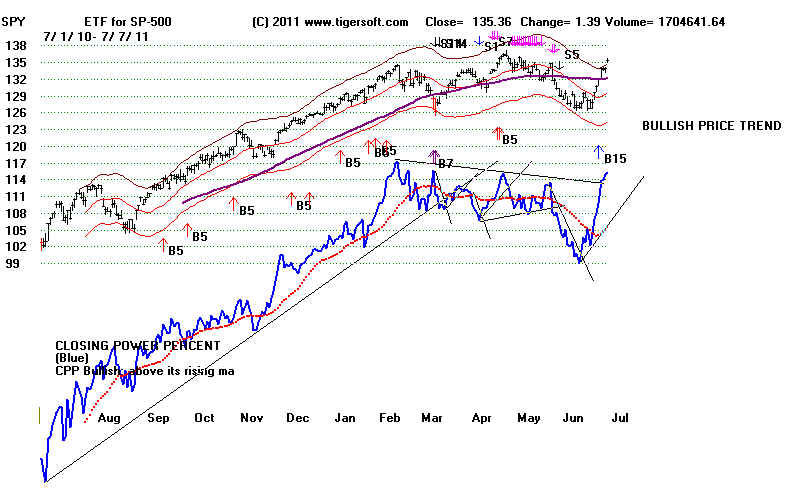

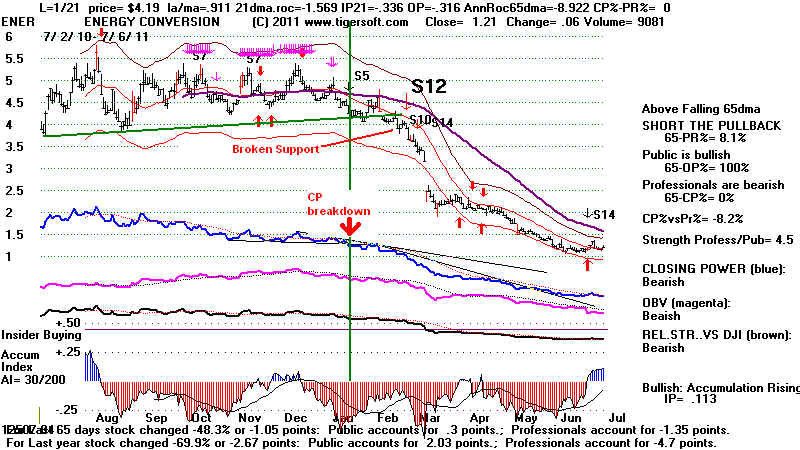

SPY with green Opening Power and Blue Closing Power.

B21s and S21s show when both indicators are trending up or down.

|

|

|

o

====================================================================================

OLDER HOTLINES

====================================================================================

8/9/2011 DJI =

11239.77 la/ma= .924 21-dmaROC= -1.233 P = - 557 (+228) IP21= -.161 V= - 350 OP= -.237

BREADTH STATISTICS:

47 (+12) MAXCP

stocks - Bullish MAXCP Stocks

782 MINCP stocks

- Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

12

new

highs on NASDAQ.

69 new lows on NASDAQ

0

new

highs NYSE

664 new lows on NYSE

8/9/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY

QQQ DJIA-Peerless

TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

A ONE DAY BUY B14 RALLY IS PROBABLY NOT ENOUGH.

The

New Buy B14 Needs To Be Clinched by A Closing Power Break of Its

Downtrend. A Strong Closing above the NYSE

Opening Will Do

That.

8/9/2011

New Buy B14 The DJI

has dropped 11.7% since the Sell S9V on July 21st

with the DJI at 12724.41. Support

is now at 10900 and resistance starts at 11600 and

will be greatest at 11800. A rapid, high

volume move up stands the best chance of

overcoming the resistance. If there is a

Buy B14 rally, we will be watching the Tiger Closing

Power uptrend to get a sense of when the next

decline and test of support at 10900 will

probably start. While the Buy B14 works

out profitably more than 85% of the time, the

DJI is now further below the 21-dma than in any

earlier case. Time will tell if the type of

Sell S9V we saw on July 21st should prevent the

appearance of a Buy B4 buy, as other S9s

and S12s do. The back-testing did not

insert this condition. So, I am not so worried

about the Sell S9V, as simply the downward

momentum in so many stocks. The number

of MINCP stocks is huge. Professionals

are still selling and heavily short 15 times more stocks

than they are bullish .

My recommendations:

A retreat to test 11000 is quite possible. Close out half the shorts

on this weakness and the rest when their

Closing Powers break their downtrend.

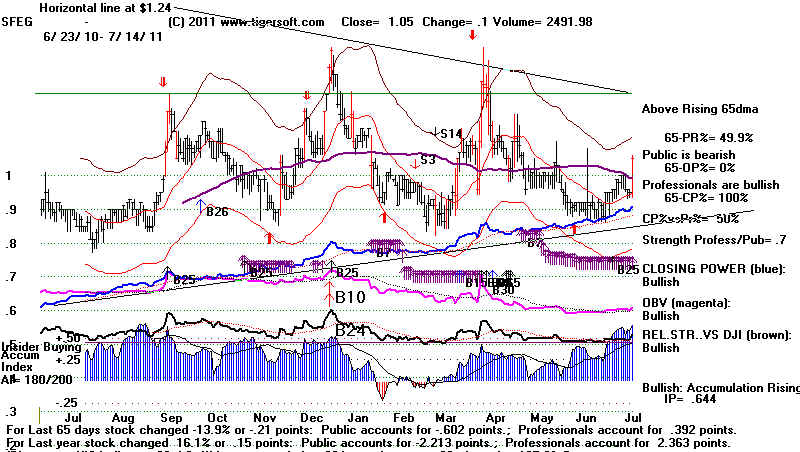

Hold Gold and do some buying in recently

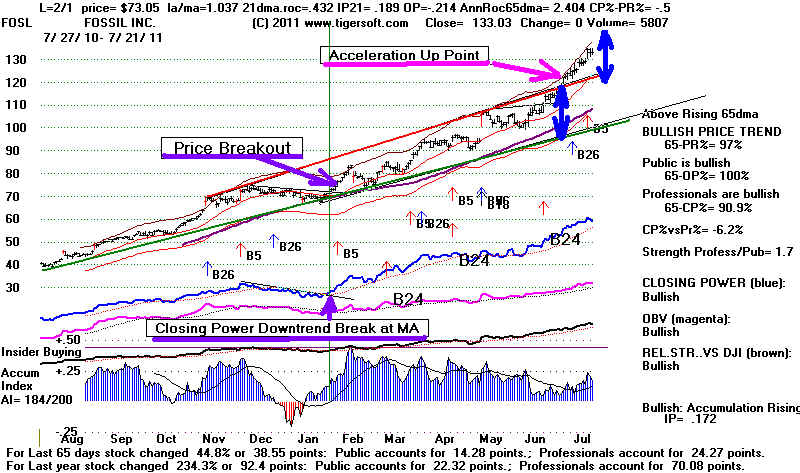

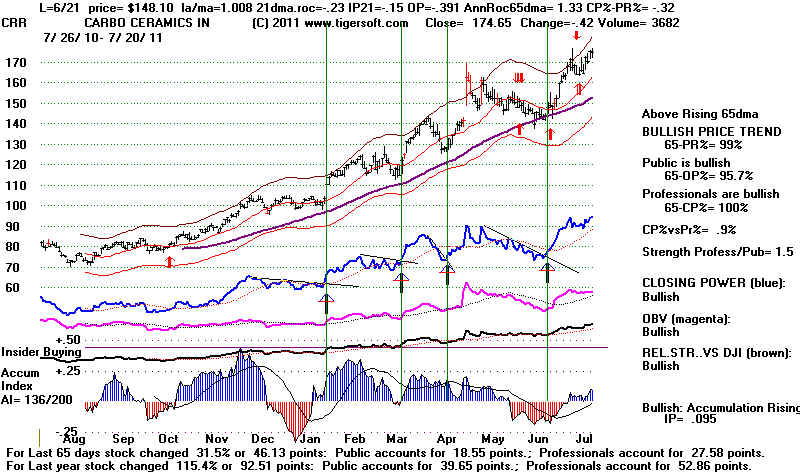

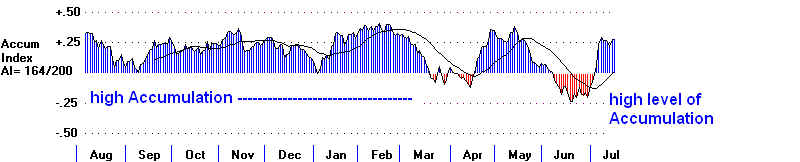

bulging Accum. Index stocks whose

Closing Power downtrend has been broken.

See the AI Bulge and Bullish MAXCP Stocks.

MY CONCERN

A one day DJI relief rally is probably

not enough to reverse the many badly faltering stocks.

The fiscal strait jacket I have talked

about so much also has not changed. The market may

still heed the Sell S9v with this signal

over-riding the the Buy B14. With regular S9s, the B14

would be suppressed for 20 days.

A sharply down day tomorrow would mean

the market is spurning Bernanke's

low interest rates and expects a much

deeper Recession. This is a distinct possibility.

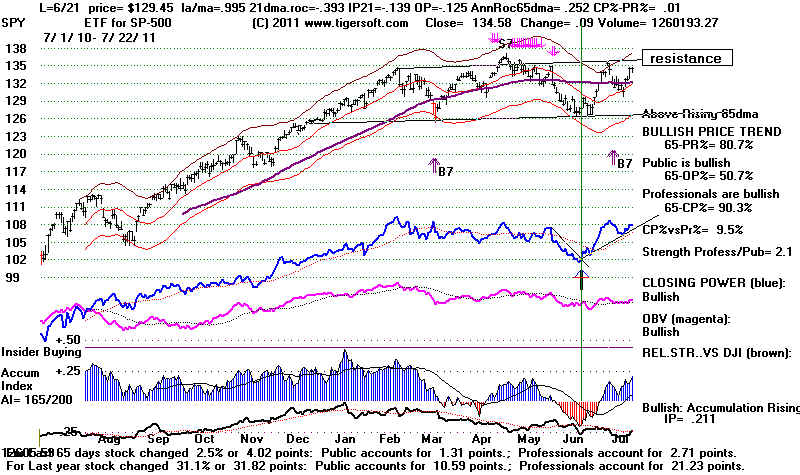

So use the Closing Power of the SPY to

clinch the Buy B14.

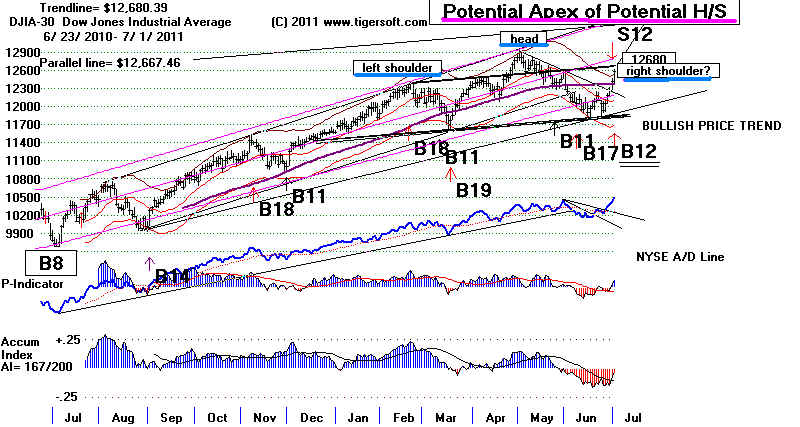

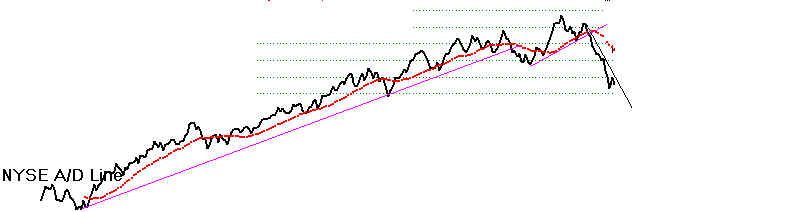

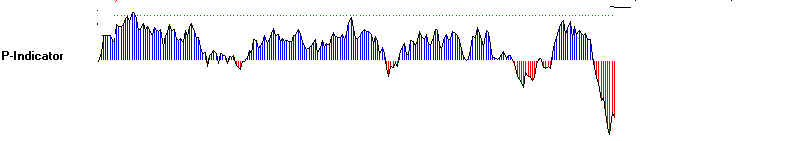

Current DJI with Peerless Signals, A/D Line, P-Indicator and Accum.

Index.

Today, Bernanke said interest rates would

not be raised by the Fed until 2013. If we

really can believe he can really make

such a guarantee (which had 3 Fed dissenters

and might have to be reversed if there is

a big Dollar slide when other nations

raise their interest rates) then this

removes one of the biggest fears the market has,

namely that higher interest rates will

woo investors away from equities. It may also spur

some investment and jobs, though now

there is no hurry to borrow to begin a development

before rates go up. The big

question is will this help a faltering economy. Can a

stimulate monetary policy override a

deflationary fiscal policy? Will it prevent

the economy from stalling out, as

occurred in 1930 and 1937, because of budget

balancing in a growing Depression?

My belief is that it will prop up the stock market,

and that is one of the responsibilities

of the Fed,as it was originally set up. It will probably

not help Main Street much.

Tiger Blog - February 5, 2008

The Limits of Monetary Policy: Will The

"Stagflation" of The 1970s Reappear?

Richard Fisher - 1/12/2011

The Limits of Monetary

Policy: ‘Monetary Policy Responsibility Cannot Substitute for Government

Irresponsibility’

The Buy B14 signal historically

produces a profit more than 80% of the time. There

are some paper losses, but these

tend to occur when the Buy B14 tries to turn up an

long, on-going bear market.

It occurs when daily NYSE Up volume is more than 18x

NYSE Down Volume. Today we

saw a ratio of more than 30 to 1, a complete reversal

from Monday's emotional sell-off.

Summer B14s are the most reliable. However, there

are no cases of a Buy B14 taking

place after such a swift sell-off and with the DJI

so much (7.6% here) below the

21-day ma. After other Sell S9s and Sell S12s based

on A/D Line, P-Indicator and

Accumulation Index divergences and negative non-confirmations

at the upper band, the Peerless

software requires a 20 trading day wait before there

can be a Buy B14. So, the

question here is should the S9V which is based on the

V-Indicator's negative

non-confirmation also have prevented a Buy B14. My feeling

is we should take the Buy B14 if

the Closing Power clinches it.

Back in 2007, Buy B14s successfully

turned up the DJI after the July and October Sells

and their steep 10% sell-offs.

Waiting for the Closing Power to break its downtrend

made the B14 safer Of course,

the DJI here has fallen 15% from its high and

the broken support levels are not

very far overhead. They are apt to act resistance if a

recovery does not quickly take the

DJI above them.

The biggest problem now from our

point of view is that the Tiger Closing Power

downtrend has not clearly been

violated and it has a lot of downward momentum.

A new CP uptrend, with a rising zig and

zag would be very constructive. See how the

Closing Powers turned up in 2007 on

the SPY. This shows us what we want to see here.

SPY - 2007 with Peerless Signals and Closing Power Trends.

We've made a lot of money in

the short sales these past two weeks. Lock the profits

in on at least half and cover

them tomorrow. The other half should be covered fully when

their Closing Power

downtrends are broken. Gold has been a stellar performer. It is

above the top of its price

channel and running in all-time high territory. Low interest

rates and a potentially weak

Dollar lie behind its rise. Let it run. And buy some

of the high Accumulation,

bulging Accumulation stocks when their Closing Power

downtrend is broken.

===================================================================================

OLDER HOTLINES

===================================================================================

8/8/2011 DJI = 10809.85 la/ma= .885 21-dmaROC= -1.787 P = - 786 (-85) IP21= -.275 V=

- 477 OP=

-.386

BREADTH STATISTICS:

25 (-1) MAXCP

stocks - Bullish MAXCP Stocks

1000 reached MINCP stocks

- Bearish MINCP Stocks These are really falling!

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

0 new

highs on NASDAQ.

616 new lows on NASDAQ

0

new

highs NYSE

1202 new lows on NYSE

8/8/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY

QQQ DJIA-Peerless

TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

8/8/2011

Sell S9v No

Peerless Buy Yet. Closing Powers are declining. Hold the

shorts. Gold is our only long.

Respect the Peerless Sell signals and what Professionals

are shown to be doing using Closing

Power. The way the market knifed easily through

support levels today should make us

extremely reluctant to try to pick a bottom until, perhaps,

we reach the 2010's mid-year correction

low around 9700. Note that this would represent

a 50% correction of the entire gain from

March 2009 to July 2012, but it would all be telescoped

into perhaps 3 weeks. The DJI's

rate of decline is particularly steep compared to the declines

from other tops. I take that to be

very bearish.

Going back to 1929, we only find one more

rapid decline when the DJI fell more than 10%

from a peak near the bull market high.

That was in 1987 when a 35% decline from the

top occurred. The DJI is now

falling at a rate of 7.5%/wk. We might also compare the

speed of the decline now with 1929

(4.5%/wk for 10 weeks) and 1940 (4.1% in 6 weeks.)

Declines from Near Bull Market Tops

DJI TOPs

DJI BOTTOMs

Pct Drop

Rate of Decline

--------------

----------------------

-------------

----------------[------

>> 7/21/2011

12724.41 - 8/8/2011 10809.85 15% in 2 weeks. 7.5%/wk

<<

9/3/1929 381.20 -

11/13/1929 -198.70 45% in 10 weeks.

4.5%/wk

4/15/1930 293.30 - 6/23/1930 -

219.50 28% in 9 weeks

3.1%/wk

8/16/1937 189.30 - 11/23/1937 - 115.98

40% in 13 weeks 3.1%/wk

4/8/1940 151.30 -

5/21/1940 - 114.10 25% in 6 weeks

4.1%/wk

9/18/1941 128.80 - 12/23/1941 - 106.30

18% in 13 weeks 1.4%/wk

8/13/1946 204.50 - 10/9/1946 - 163.10

20% in 7 weeks

2.8%/wk

6/12/1950 228.40 - 7/17/1950 - 197.68

13.5% in 5 weeks 2.7%/wk

7/12/1957 520.80 - 10/21/1957 - 423.10

19% in 13 weeks 1.5%/wk

1/15/1960 685.50 - 3/8/1960 - 599.70

12% in 7 weeks

1.7%/wk

3/15/1962 723.50 - 8/26/1962 535.70

26% in 22 weeks 1.3%/wk

2/9/1966 995.15 - 3/15/1966 -

911.08 8.5% in 5 weeks

1.7%/wk

5/14/1969 968.95 - 7/29/1969 -

801.96 17% in 10 weeks 1.7%/wk

4/28/1971 950.82 - 6/23/1971 -

879.95 8% in 7 weeks

1.1%/wk

1/11/1973 1051.70 - 3/22/1973 -

925.70 13% in 10 weeks 1.3%/wk

12/31/1977 1004.65 - 2/11/1977 -

931.52 7% in 6 weeks 1.2%/wk

10/12/1978 896.74 - 11/15/1978 -

785.50 12% in 4 weeks 3.0%/wk

10/5/1979 897.61 - 11/17/1979 -

796.67 12% in 6 weeks 2.0%/wk

2/13/1980 903.84 - 3/27/1980

- 759.98 16% in 6 weeks

2.7%/wk

6/15/1981 1911.99 - 9/25/1981

- 824.01 19% in 14 weeks 1.4%/wk

1/9/1984 1286.22 - 2/23/1984

- 1134.63 11.5% in 6 weeks 1.9%/wk

10/2/1987

2640.99 - 10/19/1987 - 1738.74 34.5% in 3 weeks. 11.5%/wk

10/9/1989 2791.41 -

10/13/1989 - 2569.26 8.5% in 1 week

8.5%/wk

1/2/1990 2810.15 - 1/30/1990

- 2543.24 10% in 4 weeks

2.5%/wk

10/7/1997

8178.31 - 10/27/1997 - 7161.15 13% in 3 weeks 4.3%/wk

7/17/1998 9337.97 - 8/31/1998

- 7539.07 19% in 6 weeks 3.2%/wk

8/24/1999 11283.30

-10/15/1999 - 10019.71 11% in 6 weeks 1.8%/wk

1/13/2000 11582.43 - 3/7/2000 -

9796.03 16% in 7 weeks 2.2%/wk

5/21/2001 11337.92 - 9/21/2001 -

8235.81 28% in 17 weeks 1.7%/wk

12/10/2008 13727.03 - 1/22/2008 -

11971.19 15% in 6 weeks 2.5%/wk

Of course, the market is quite oversold

on a short-term basis. Just a rally to

get shorts to take some quick profits

could bring a rally back up to 11000 on the DJI.

A higher opening is not to be trusted.

We need to see a big improvement

at the NYSE Close up from the NYSE

Opening to cause our Tiger Closing Power

to break its downtrend.

Without that and a new Peerless Buy, I

would use a rally to perhaps 10000 to go

short more of the Bearish MINCP

Stocks. I cannot recommend shorting the

ETFs until we see a rally and another

Closing Power uptrend-break.

"Don't Blame the S&P People", Mr.

President. They are only the messengers.

Obama looked listless and exhausted.

He did not seem to have any idea what to

say about today's 6% one day.

Mainly, he blamed the S&P downgrade

for the current decline. He would

not admit that his compromise with the

Tea Party has left him in a spending

straight jacket and without any new

revenue sources. As a result, he

cannot use fiscal policy to provide jobs. Wall

Street understands this all to well and

how vulnerable the weakening US economy is now.

Just what is there now to prevent a

"Double Dip" and a market crash like 1937-1938?

The unpleasant truth is that government

austerity programs like those of Cameron in the UK

and now Obama in the US are much more

suited to bringing another Depression and

an extreme bear market decline

(1930-1933), not to mention urban riots, widespread

social unrest and more dangerous

political demagoguery. (See the Blog I have

written about this: http://tigersoftware.com/TigerBlogs/83---2011/index.html

)

There is so much more to the severity of

this decline than Washington wants to

admit. Democrats and Republicans

there, it is now widely perceived, are not facing the

real issues. Neither party is

considering ending the costly wars, imposing

protective tariffs or even Buy American

in the government's own buying. Taxation of

the very wealthy is popular 3:1, but the

leaders of both parties want all the big campaign

contributions and so do nothing.

Worse still for us, Obama is clearly unfamiliar with the

history of the 1930s. He is

unwilling to use the Presidential bully pulpit to shape the political

agenda.

As much as Hoover, he does not seem to be

able to conceive how much good could

come from a massive public works program

like FDR employed. As a follower of the

Chicago free market school, he appears

unable to conceive of, or seriously consider,

any specific direct government jobs'

plan. What he did in 2009 in the name of public

works turned out to be a very token

gesture, after a lot of rhetoric and exaggerated

advance billing. Like Hoover, he

is almost exclusively relying on growth to

come in the private sector. Many

economists warned him it was not enough. Quite

possibly, it was actually designed by his

Wall Street advisers to fail, to give a bad name

to such programs in the future. See

http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=439x1672584

In any case, he can talk all he wants

about Public Works now, but he knows he does

not have the votes or the federal

revenues And Unfortunately, the last two week's market

decline has just made adequate private

investment in jobs much more unlikely. Expect the

Wall Street decline to reduce consumption

and investment dramatically in the coming months. .

=====================================================================================

OLDER HOTLINES

=====================================================================================

8/5/2011 DJI = 11444.61 la/ma= .930 21-dmaROC= -1.227 P = - 701 (-152) IP21= -.173 V=

- 383 OP=

-.322

BREADTH STATISTICS:

26 (-6) MAXCP

stocks - Bullish MAXCP Stocks

969 MINCP

stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

2 new

highs on NASDAQ. 260 new lows

on NASDAQ

1

new

highs NYSE

395 new lows on NYSE

8/5/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY

QQQ DJIA-Peerless

TigerDJI TigerSPY

TigerQQQ GLD SLV

Crude

8/5/2011

Sell S9v No

Peerless Buy Yet. Closing Powers are declining. Hold the

shorts. Gold is our only long.

Respect the Peerless Sell signals and what Professionals

are shown to be doing using Closing

Power. To buy we need a Peerless Buy and a Closing

Power downtrend-break. I have

previously painted a picture of a perfect financial storm.

Read below the charts what some of the

positives are. Perhaps, a crash or a bear

market will be avoided. Let's hope.

Our Closing Power gives you an edge. You

can with reasonable safety go short

the Bearish MINCP stocks if

you are willing to cover when the Closing Powers

break their downtrend. This is your way

to stay in agreement with the perceptions

of the professionals and market makers.

If a rally were to occur, something which I do

not expect, I would buy only the highest

AI/200 stocks with recent bulges of Accumulation

soon after their CP downtrends are broken.

(The Elite Subscribers' Page will make some

suggestions here.)

Stick with what Peerless and the Closing Power Tells Us.

The financial news is very unnerving, to

put it mildly. But before repeating my

concerns that we are starting a new bear

market, let me show some positives.

I do this both to be balanced and because

another crash or a Depression would

be a horrible tragedy. I do not

want to propel the ball downhill, even by a nudge

with what I write. A buy signal and

a Closing Power downtrend-break would

be bullish and get us to do some buying.

Positives:

1) The S&P downgrade has probably

been already priced into the decline. Many

expected it, after the long delay by

Washington to do the routine raising of the

debt limit.

2) August is typically an up month.

In years before the Presidential Election it has

fallen in just 7 of the last 24 cases

since 1915.

3) The DJI is still above the 13.5%-down

level which reliably warns of a bear market.

AA+ is not so bad.

4) Moody's and Fitch have not downgraded

US credit yet.

5) Canada survived a similar downgrade in

the 1990s.

6) AA+ is still a long ways above junk

bond status.

7) Corporations are sitting on a hoard of

$2.5 Trillion Dollars.Even, if they are slow to

deploy it to hire people, they will, at

least, use if to buy bonds, buy their stock back and

for R&D. And even if they spent

it all on PR and lobbying, it would mean money circulating

and jobs for someone.

8) the FED may do more to prevent the

collapse of big bankers. It may accept more

"toxic mortgages" as

collateral for cheap 0% loans. (This seems unlikely, however,

given how much red ink is already on

their hidden balance sheets.)

9) QEIII? The Fed will probably

have to continue printing money by buying Treasury bills.

This will prop up the bond market.

The bond market is much bigger than the equities'

market.

Positive Possibilities for Employment in

US

Between now and the Election, the

Administration must be expected to do all

it can to reduce joblessness in the US

and boost the economy. Do not underestimate

Obama's desire to get re-elected.

1) The Admijistration can speed up the spending of appropriated money.

2) They could go around the country and

campaign for a US JOBS bill. (Conceivably, some

Republcans will go along with it and it

could pass.)

3) They could popularly campaign to buy

American. (This runs against the Democrat's

Free Trade bent, however and what Wall

Street wants them to do.)

4) They could legally award contracts

much more to those companies who make in the US

what the government buys.

And the very costly wars half way around

the world could be stopped earlier than expected.

They are unpopular and Obama wants to get

re-elected.

---------------------------------------------------------------------------------------------------------------------------------------------

Comparisons with 1930 and 1937 Are Certainly Bearish

.

In both years, Presidents Hoover

and Roosevelt moved to balance their federal

budgets in the miidle of worsening

economies in recessions. Depressions followed>

The DJI has recovered more than 2/3

of what it lost in the 51% decline in 2007-2009

from 11460 to 6560. In 1930,

the DJI recovered a little more than 50%. In 1937, the DJI

had recovered not quite 50% of what

was lost between 1929 and 1932. I am no

Elliot Wave expert, but I believe

it is bullish when more than 2/2 is recovered.

====================================================================================

OLDER HOTLINES

====================================================================================

8/4/2011 DJI = 11383.68 la/ma= .920 21-dmaROC= -1.19 P = - 549 (-154) IP21= -.204 V=

- 331 OP=

-.429

BREADTH STATISTICS:

32 (-15) MAXCP stocks - Bullish

MAXCP Stocks

831) MINCP

stocks - Bearish MINCP Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

4 new

highs on NASDAQ. 260 new lows

on NASDAQ

3

new

highs NYSE

404 new lows on NYSE

8/4/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY

QQQ DJIA-Peerless

TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude

8/4/2011

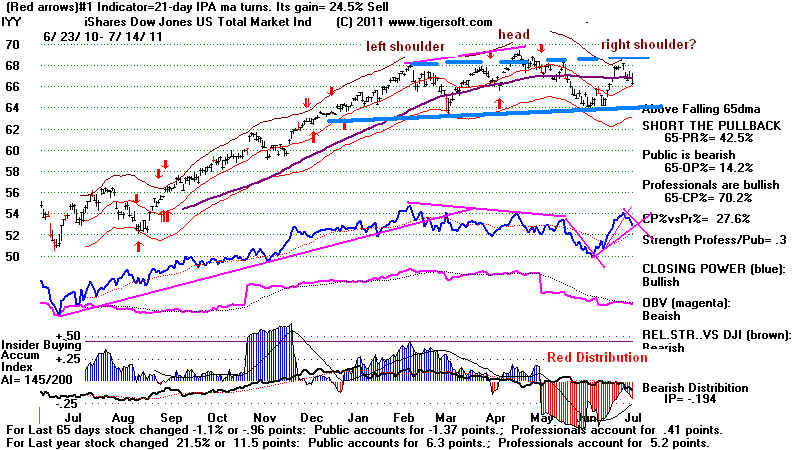

Sell S9v No

Peerless Buy Yet. Closing Powers are declining. The

plunge below the 200-day ma has brought

about a lot of profit-taking after a 26

month long bull market.

Unfortunately, as I have written, this free-fall appears to be much

more than a technically based sell-off.

The head/shoulders pattern plunge stems

from gaping doubts about the economic

intelligence of our leaders and a realization

that our political system is locked in

grid-lock and the US government appears now

powerless and unwilling to prevent a

double-dip. This could be a "Hoover moment."

We will be very lucky to only see a

decline back to 10000.

Our Tahiti rule is that multiple Peerless

Sells and a key support failure should cause

us to prepare for a bear market. We

should sell all our Tahiti DJIA-30 stocks.

The parallel with 1937 is still close.

I was surprised that so many talking heads on

television have reached Keynesian-based

bearish conclusions about what Obama

has agreed to. CNBC, of

course, blamed European difficulties. The continued sell-off

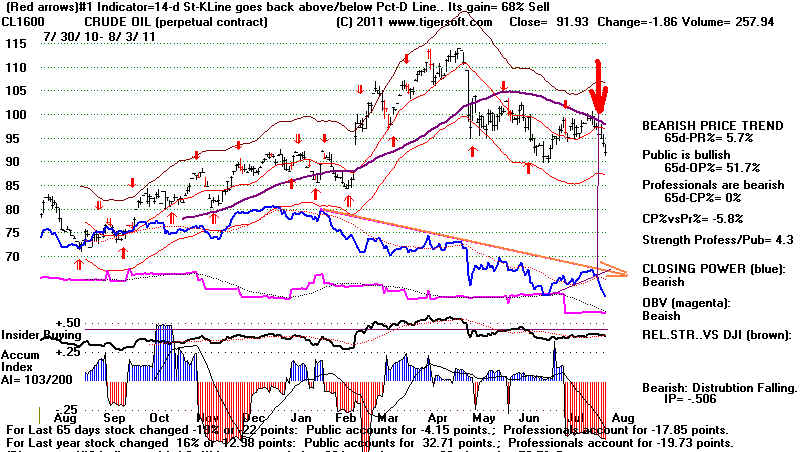

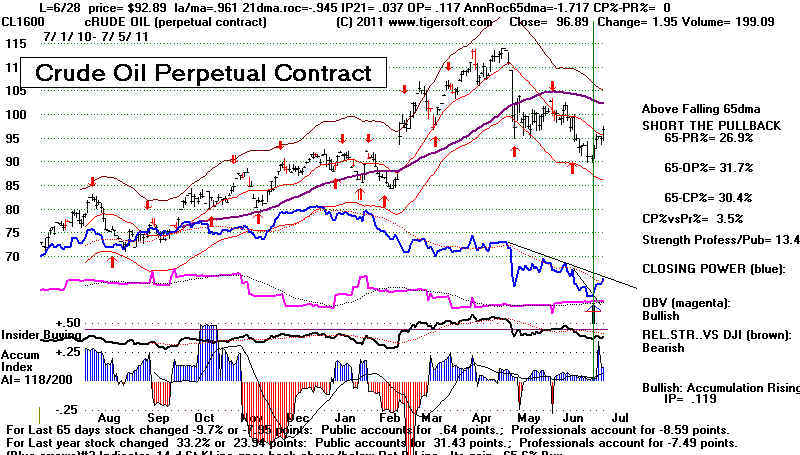

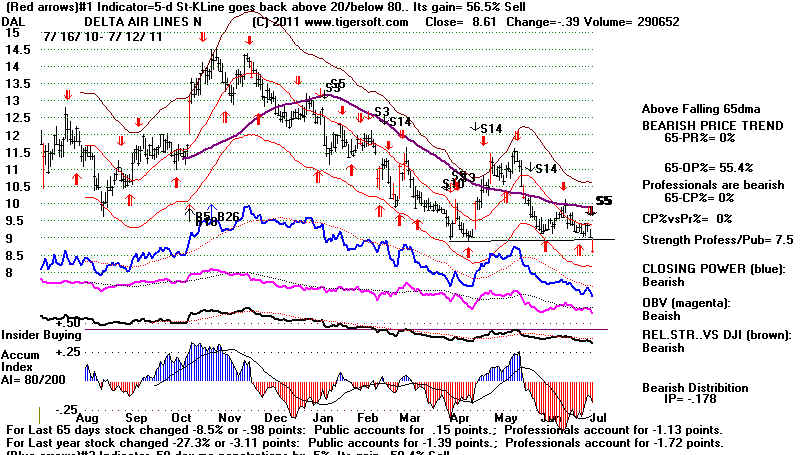

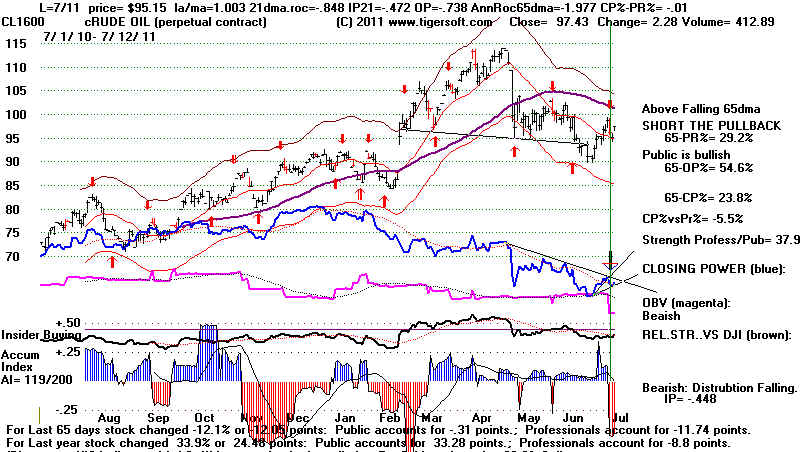

in Crude Oil is mostly a reflection of US

deflation fears. The Jobs Report tomorrow is

expected to show a worsening employment

picture in the US. In many ways this

is a "perfect financial storm".

We have no good reason to buy yet.

The downside volatility reflects

institutions rushing to the exits. It is not just

momentum players who are selling.

Gold's reversal today tells me that leveraged hedge

funds are worried and have decided to

raise money to protect against margin calls.

The lesson of 2008 is fresh in their

minds.

An emotional sell-off on Monday morning

has been set up. The failure to rally has

caught a lot of investors in various

unproductive states of mind, ranging from

DENIAL, DEER-in HEADLIGHTS to SHEER

PANIC. We are better served by waiting

for a Peerless Buy and a break in the

Closing Power Lines' downtrends.

Could Monday bring a selling

climax? Perhaps. The DJI is already down 11% from the peak.

Corporations, Maria B. says, are

sitting on a hoard of $2.5 trillion. And the 13.5% down-

from-the peak line has not been

penetrated. This line very often is the boundary between a

correction and a bear market. See

such lines on the bear markets since 1981.

HEDGE LESS and SELL MORE

We have taken a lot of short sales

among the Bearish MINCP stocks. At some point we

may want to cover them as a public

service. But do not do any buying yet. Gold is

the only long position I would hold

now, unless a position's CLosing Power is

still rising. The REITs we

turned to as a defensive play early in the week have dropped

like everything else, perhaps even

more, as funds have sold alomost everything they

still had a profit in. This

is not a good sign. Unless the Jobs Report figures are distorted

for political purposes, they should

not offer much comfort. The best hope the market

has is that the Fed will try to

stem the tide. But its balance sheet must look very red.

I'm not so sure it will have any

more courage than Obama did until the DJI is down

much more.

=====================================================================================

OLDER HOTLINES

=====================================================================================

8/3/2011 DJI = 11896.44 la/ma=

.957 21-dmaROC= -.643 P = - 396 (+26) IP21= -.109

V= - 248 OP= -.318

BREADTH STATISTICS:

47 (+6) MAXCP stocks - Bullish

MAXCP Stocks

447 (-26) MINCP stocks - Bearish MINCP

Stocks

(MAXCP stocks are those showing Tiger Closing Power

making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

15 new

highs on NASDAQ. 78 new

lows on NASDAQ

7

new

highs NYSE

86 new lows on NYSE

8/3/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless

TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude

8/3/2011

Sell S9v No

Peerless Buy Yet.

The Market Should Try To Extend The

Bounce. But Stay Hedged.

There is zone of support still underneath

the market. We cannot assume a new

bear market until the DJI drops 13.5%

below the peak. On the other hand, we cannot really

trust that the search for, and test of

support, is over until the Closing Power downtrends

are broken.

Respect the Speed of the Decline.

Appreciate that Head and Shoulders are the

way the market adjusts to unexpected

news. That news I take to be the perception now

of how vulnerable the US government is to

minority Tea-Party threats to bring It down,

causing massive harm to all Americans,

while it is at war and at a time when the economy

is slowing appreciably.

Yahoo

Economic news sours investors

Services

firms expand at slowest pace in 17 months

Unemployment

rose in nearly all US cities

Foreign investors must surely be

re-thinking their investments in the US and

buying Gold. Gold is about to get past the top of its year-long price

channel.

I still recommend buying it. It

could go "vertical" soon. The Dollar today was turned

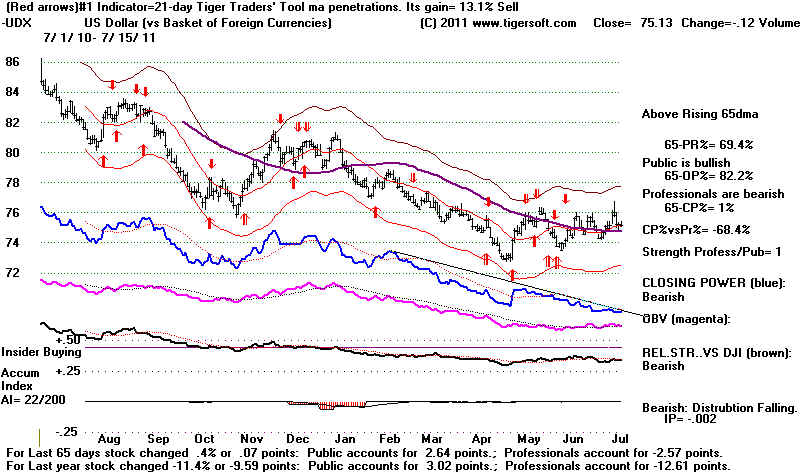

back down from its 65-dma, even though

Crude fell 1.86 today. A falling Dollar

and a weakening economy comes too close

to being the worst of all economic worlds.

Let us hope the Federal Reserve is not so

easily bullied and intimidated, as Obama was.

Bernanke needs to speek out soon.

After eight straight days, a recovery

attempt was to be expected. The Closing Powers

are still falling. The 8% decline we have

seen in the DJI would look like a typical

intermediate-term correction were it not for

the speed of the decline. In this, as I showed

yesterday, the current decline is a lot like

the dangerous top in 1937.

Today's rally, however, was on increased

volume. In 1937, the first day's rally to

occur with higher volume than the down-day

before was not until the DJI was 10.4%

below the lower band. Maybe, the Fed will come up with something from their toolbox.

There is another reason for not despairing.

Really significant tops usually show a much

wider breadth divergence (A/D Line divergences

and P-I NNCs), one or more regular S9s

and often have S12s and other Sells. All

we had at the July twin peaks were a set of

Sell S9vs. Another point, independent

Sell S9vs are rare and there are no cases of

the subsequent declines going more than 8% down

from the top. Below are the

independent Sell S9vs.

INDEPENDENT Sell S9Vs (no accompanying Peerless Sell S9)

Deepest Intra-Day Decline

8/23/1996 2.9% intra day decline at low on 8/30/1996 and a close 1.3% below the

21dma.

8/4/2010 7% intra day decline at low on 8/26/2011 and a close 4% below the

21dma..

5/2/2011 7.5% intra day decline at low on 6/16/2011 and a close 2.3% below 21dma.

This independent Sell S9v's decline is the

deepest to date. That should be a caution, in itself.

Historically, Sell S9vs are more likely to

bring declines that last at least 4-5 weeks. That

should be a caution, too, and suggest there

could easily be more of a decline or bottoming

here. Of course, the DJI could

choose to ignore all the worsening economic reports and

it could reverse here quickly without a major

Peerless Buy. That would be unusual. But it

could happen. Short-term traders, as

opposed to those who want to hold for longer than

two weeks, should just watch the Tiger CLosing

Power on the DIA, SPY and QQQ and

buy the one that first that breaks its CP

downtrend.

=====================================================================================

OLDER HOTLINES

=====================================================================================

8/2/2011 DJI = 11866.62 la/ma=

.952 21-dmaROC= -.682 P = - 422 (-177) IP21= -.193 V=

- 153 OP=

-.442

BREADTH STATISTICS:

41 (-6) MAXCP stocks - Bullish

MAXCP Stocks

473 (+18-0 MINCP stocks - Bearish MINCP

Stocks

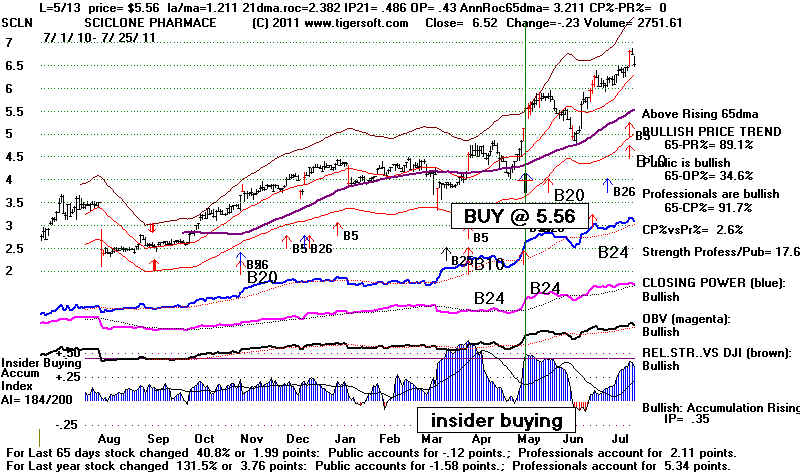

5/13/2011 Hedging Examples -

SCLN @ 5.56 and RDN, @5.18 now 6.27 and 3.55, respectively

(MAXCP stocks are those

showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

6 new

highs on NASDAQ. 121

new lows on NASDAQ

4

new

highs NYSE

151 new lows on NYSE

8/2/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless

TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude

8/2/2011 The

Markets Are at Key Support. Stay Hedged. Things Could

Easily Go from Bad to Worse. Wall Street Seems To Be

Losing Control

just when It Seems They Have Been Victorious.

Sell S9v No Peerless Buy Yet. The DJIA seems to have violated its

rising

200-day ma and the neckline support in its

head/shoulders pattern. With the

Closing Powers falling, I see no reason to buy

or close out short positions.

Professionals are selling heavily and staking

out short positions. We have already

done this. Now a

one or two day bounce would seem likely. Even the steepest sell-offs

do not go down 9 or 10 straight days.

The dramatic fall in interest rates I mentioned

last night can be interpreted as a

flight by investors to safety, because they

sense a serious economic slump

lies ahead. Investors have been bidding

up the stock market rather than starting

new businesses in the US. So too, I

suspect, have corporations and banks. With the

trend breaking down, they will sell and sell

some more. To prevent this, the market

and the Fed must make a stand here.

I would look for Bernanke to do something

soon to try to prop up the market and turn it

back up. The Fed cannot let shorts

get comfortably in control.

I have warned that S9Vs historically are more

likely to drop the DJI below the

lower band than have it stop there. In

addition, with an Sell S9V operative,

it normally takes 5 weeks for the DJI the DJI

to fall below the lower band.

In the present case, it only took two.

I hate to scare readers, but the severity,

speed and steadiness of the decline (8 straight

days down) invite comparions

with the the start of the worst bear markets

from their tops. In our case, the DJI is

down 6.7% in 8 days. Only the 1937 and

1987 tops saw 8 days slides that

were down more. Like after the August

1937 top, in 8 days the DJI fell about 7%

and was about 5% below the 21-day ma. In

all the other cases, the decline started

more gradually.

To me this suggests, we study the 1937 chart

closely. In the 1937 case, the DJI

only managed 1 day rallies until it had fallen

more than 16%. The exceptional

downward velocity here soon afterward generated

a Peerless Sell S13

automatically. This tells Peerless users

to switch to the Extreme Bearish mode.

Of course, we may not see such a big sell-off.

Steep intermediate-term corrections

usually stop about 10% to 13.5% down from the

peak. That would mean we have

perhaps 3.3% to 6.8% more to endure. A

DJI decline of more than 13.5% tilts

the scales to being in a bear market of 20% or

more.

Market Behavior 8 Trading Days after The Worst Market Tops

DJI top 8 days later of 8 days

internals 8 days later

la/ma P IP21 V-I

9/3/1929

381.20

366.90 -3.8% 4 were down

.989 -26 -.11 -478

8/16/1937

189.30

175.90 -7.1%

7 were down .95

-124 -.131 -177

3/16/1962

722.30

711.30 -1.5% 6 were down

.996 -20 -.033 -256

5/14/1969

968.75

946,94 -2.3% 4 were

down .992 22 .067

0

1/11/1973

1051.70

1004.39 -4.5% 6 were down .976 .051

-.021 -3

10/5/1987

2640.18 2355.09

-10.8% 6 were down .926 -237 -.108

-27

7/17/1990

2999.75 2917.33

-2.8% 5 were down .995 -71

.144 -16

7/17/1998

9337.97

8914.96 -4.5% 4 were down ,979 -250

-.006 -79

1/14/2000

11722.98 10738.87 -4.0%

5 were down .949 -137 -.155 -.055

10/9/2007 14164.53.

13566.97 4.2% 7 were down

.974 -18 -.007 -133

7/21/2011 12724.41

11866.62 -6.7% 8 were down

.952 -422 -.153

-266

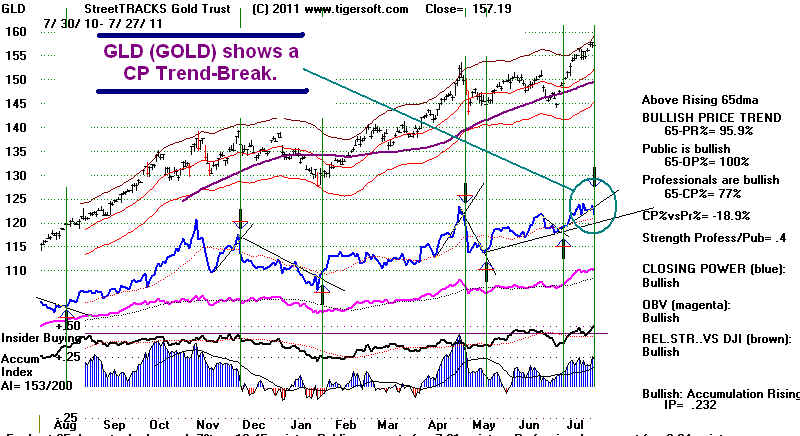

Why Is Gold So Strong?

GLD gave a CLosing Power Buy today by breaking

its short-term CP downtrend.

If it continues to rally, it will get past the

top of its price channel and go into blow-off

mode. We should be buyers. I think

that is what will happen.

The Italian and Spanish markets are very weak.

These economies are too big to be

bailed out as Greece was, if these countryies

go into fiscal crisis mode. As a

consequence, Gold and the Swiss Franc are being

used by Europeans as havens,

just as bonds are here.

Budget Balancing Now Is Dangerous

The Conservative government is the UK under

Cameron is curring back on

government spending. As an avowed

Keynesian, I think this will only make

the budget much harder to eventually balance.

It vitrually guarantees higher

unemployment, especially when wealthy

individuals, corporations and banks

are in hoarding mode.

George Santayanna warned that "Those who

do not learn from history are

doomed to repeat it. I fear Obama and the

Tea Party folks are about to get

a lesson the hard way. Tragically, tens

of millions of Americans will suffer for

their so-called leaders' ignorance of

economic history. Of course, this is my

opinion, but it was the subject of my

dissertation. Here is some of the forgotten

evidence:

1) FDR's budget balancing and cutting

government spending in the middle of

the deep recession in 1937 was, I think,

the primary cause for the 1937 47%

stock market crash.

2) Later in life, President Hoover rued

the laisseez-faire advise of Andrew Mellon,

his Treasury Secretary. Tragically,

he ran a Federal Budget surplus in 1930 and

engaged only in paltry increases (under

$257 million / year) in federal government

spending in 1930 and 1931, just when

private investment and government revenue

were collapsing. 1932 saw an increase of

$1 billion, but in 1933 he reduced

government spending, despite unemployment

levels of 25%..

, 3) Winston Churchill, who was British Chancellor of

the Exchequer from 1924-1926,

at the end of his life accepted the harsh

Keynes judgement at the time (1926) and said

the worst mistake of his long career was taking

Britain back on the Gold Standard

as London's bankers had insisted was necessary

to defend the Pound while unemployment

was very high.

DJIA

|

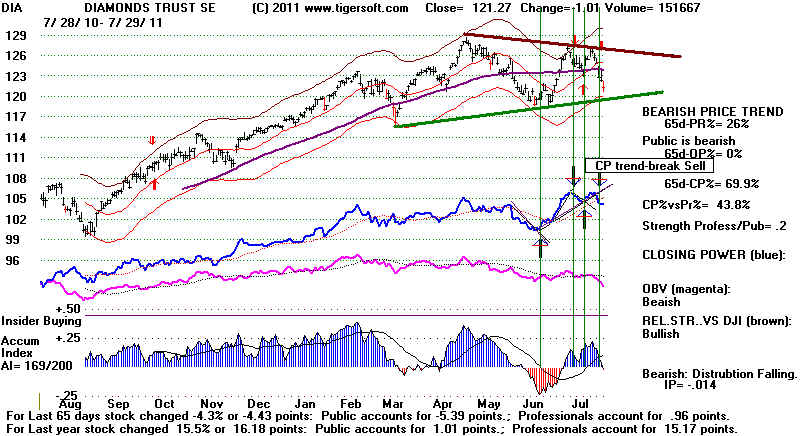

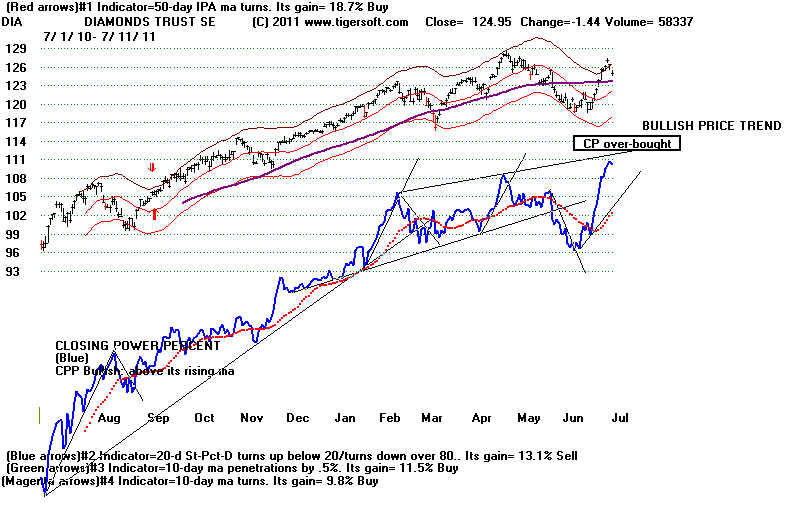

DIA

|

TIGER INDEX

OF DJI-30

|

SPY

|

QQQ

|

====================================================================================

OLDER HOTLINES

====================================================================================

8/1/2011 DJI = 12132.49 la/ma= .971 21-dmaROC= -.268 P = - 246 (-60) IP21= -.061 V=

- 164 OP=

-.339

BREADTH STATISTICS:

47 (+13) MAXCP stocks - Bullish

MAXCP Stocks

293 (+59) MINCP

stocks - Bearish MINCP Stocks

5/13/2011 Hedging Examples -

SCLN @ 5.56 and RDN, @5.18 now 6.23 and 3.36, respectively

(MAXCP stocks are those

showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

13 new

highs on NASDAQ. 48 new

lows on NASDAQ

10 new

highs NYSE

46 new lows on NYSE

8/1/2011 ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless

TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude

8/1/2011 The

Markets Are at Key Support. Stay Hedged. Things Could

Easily Go from Bad to Worse. Wall Street Could Be

Losing Control

just when It Seems They Have Been Victorious.

Sell S9v No Peerless Buy Yet. The DJIA is in the process of testing

its rising

200-day ma and the neckline support in its

head/shoulders pattern. There were

more up than down today, but NYSE Down Volume

was 75% more than NYSE Up Volume.

The selling pressure has not come off, as

Professionals are still selling. The

Closing Powers for the key general market ETFs

are still falling. The DJI lost

all of a 170 point opening and 130 points

more, only to close flat. Don't

discount the DJI's head and shoulders pattern

because its neckline is rising. After a two

year rally, there is a lot that could be

reversed by a decline. And if we weight the

DJI not just by price (which over-weights high

priced IBM, XOM and CVX) the

dangers of a breakdown are clearer, because the

neckline is flat. See the chart below.

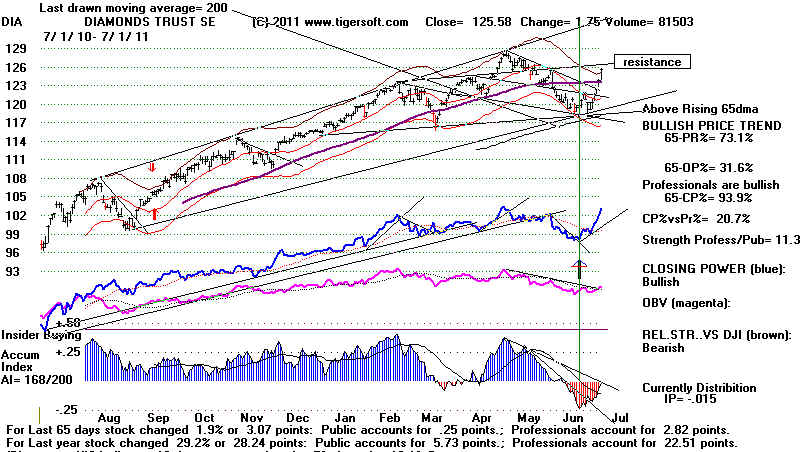

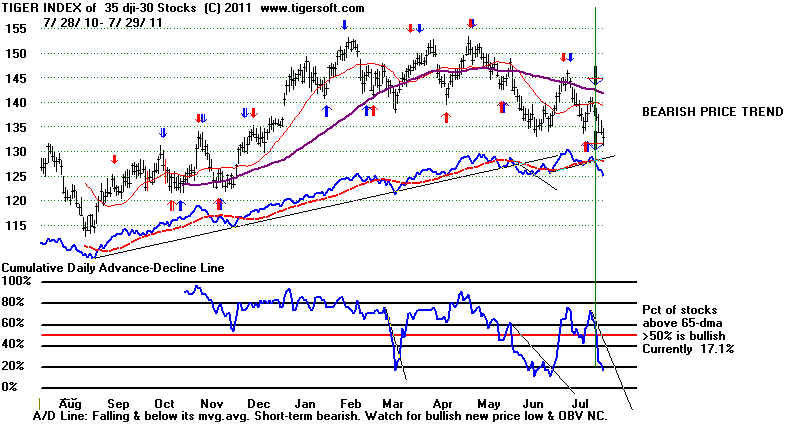

Tiger Index of DJI-30 Stocks

The Tiger Index charts weight each stock is

weighted by volume as well as by price.

This respects capitalization and investor

interest better, I think. Significantly, it

shows the DJI is below its 200-day ma.

The falling 65-day ma is also more

apparent, in that its rate of decline is

accelerating. And since only 17% of the

DJI stocks are above their 65-day ma, any rally

will face resistance as these

stocks approach their 65-day ma

What To Do?

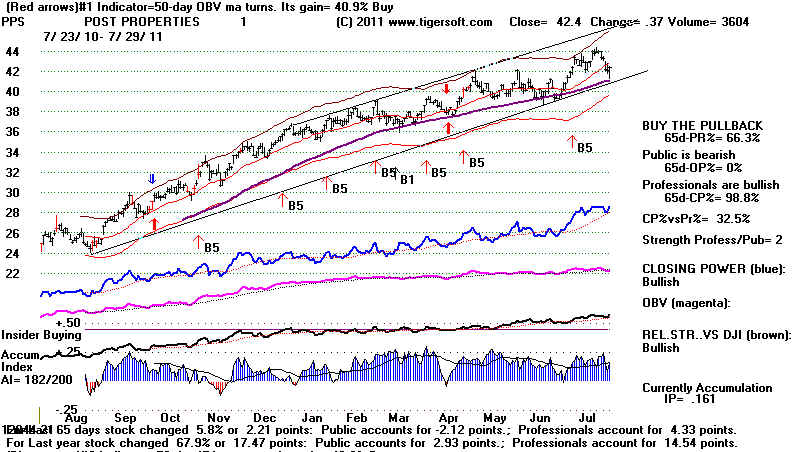

I suggested

staying hedged and buying the highest ranked REITS yesterday.

I forgot to

say "Do Not Buy at the Opening" if it is inordinately higher. Obama

gave Wall

Street what they wanted, no new taxes, reduced spending and no

immediate

default. One might expect Wall Street to, at least, say "Thank you".

And, in

fact, interest rates did fall today as the Dollar held steady. Reits are

usually among the

last stocks to seriously decline when a bull market is ending.

Obama Seems Much More Vulnerable.

As a quiet friend of Wall Street, this is bearish.

The problem now, as I see it, is that Obama has again totally "caved in"

to the T-Party people, who really do not believe in the US government

anyway. Like Neville Chamberlain, Obama has engaged in appeasement

with people who are destructive terrorists,

.

They correctly see that he is a political invertebrate. They will keep testing him

at every turn in the months to come. The resulting spending cuts will grow

deeper just as the economy slides downhill. Layoffs will grow and

consumer demand will drop. Businesses will hoard or invest overseas.

Banks will tighten, not loosen, their loans even to very good customers.

Home prices will sink further.

And government revenues will shrink further, too. Whether intended or not

by the T-Party, and they certainly do not read Keynes, they are doing just the

right thing to weaken the US economy just when it is most vulnerable, and

thereby make Obama susceptible to a political upset in 2012. The public has

largely been led by the mainstream media into thinking that the credit-rating

of the US easily trumps the issue of 16% long-term unemployment. But much

higher employment would solve a lot of fiscal and revenue problems.

Obama avoids the bully pulpit on the issues of taxing the very rich, ending

foreign wars, closing unneeded overseas military bases, infrastructure

spending and new trade policies which protect American jobs and require

investment in the US, rather than expatriation of hundreds of billions each

year.

These are supported 2:1. But he does not raise these issues frontally. He

appears to be betting his political future on Wall Street and so does not want to do

anything which could rock that boat of campaign contributors.

But if economic conditions worsen, as seems likely, it will be Obama who will be most

blamed in 2012. I have argued here that Obama's protection and support of

Wall Street lie behind much of the DJI rally from 6500 to 12800 over the last

18 months. Now it looks like he will lose his bet, A weaker economy will

make

him much more politically vulnerable. This will add a lot more financial

uncertainty.

Whereas Wall Street has long ignored Main Street. It cannot ignore Washington.

So, It behooves the moguls of Wall Street now to get the Senate to swiftly

sign onto the Debt legislation that has just passed the House and then to

prop up now and boost the stock market. I just can't see how a market collapse

is in their interest. A collapse would only generate a much fiercer, possibly

more dangerous, round of public contempt for Wall Street. A new TARP would not

be possible.

Accordingly, If the market does break support, it probably means the economy is

much worse than has been admitted and there is nothing the Fed can do

any longer to prop it up. In that case, look out below! We will be closing out

long positions and even more aggressively shorting.

For the sake of the economy, let us hope a risky breakdown below

the price neckline of the DJI-30 is averted.

We appear to be at a cross-roads, a high inflection point. It is best to stay

hedged with some of the many bearish MINCP stocks. In that connection,

the meaning of there being so many more MINCP stocks (293) than MAXCP

stocks (47) is clear. Professionals are still betting that there will be a

breakdown.

They are usually right.

DJIA

|

DIA

approaching neckline support and 200-dma.

TIGER INDEX OF DJI-30

|

SPY

at rising 200-day ma

|

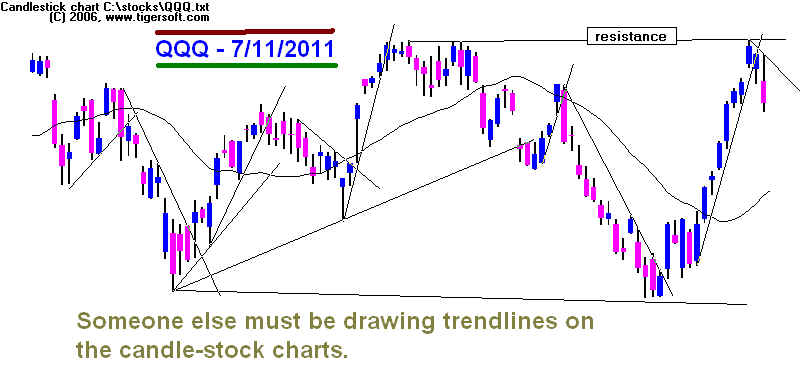

QQQ

seems to be holding up at 65-dma but Closing Power

is declining.

|

===================================================================================

Older Hotlines

===================================================================================

7/29/11 DJI = 12143.24

la/ma= .971 21-dmaROC= -.112 P = -186 (-106) IP21= -.029 V= - 148 OP= -.218

BREADTH STATISTICS:

34 (-6) MAXCP stocks - Bullish

MAXCP Stocks

234 (+4) MINCP stocks - Bearish MINCP

Stocks

5/13/2011 Hedging Examples -

SCLN @ 5.56 and RDN, @5.18 now 6.23 and 3.36, respectively

(MAXCP stocks are those

showing Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power

Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

20 new

highs on NASDAQ. 48 new

lows on NASDAQ

9 new

highs NYSE

76 new lows on NYSE

Apparently An Agreement to Cut Back Domestic Spending back

to 1950s levels and Raise Debt Limit. But Progressive Dems may bolt

and Tea Party Repubs may vote "No" and even Fillibuster in the

Senate to require a 60% Approval. The DJIA futures are up +181 as

this is written. REITs should resume

their place as the strongest

industry group. Buy the Highest Power Ranked but stay hedged.

Sell S9v No Peerless Buy Yet.... Will the agreement hold?

Will the market rally now?

The DJI has tagged the lower band.

But S9vs are just as likely to produce

declines below the lower band as stop

there. The speed with which the DJI has

fallen to the lower band from the last

Sell S9v is historically additionally bearish.

Sell S9 signals suppress most Peerless

buys for 15 trading days, so that

the bearishness of the signal has had a

reasonable chance to play out.

Since 1965, there have been 20 similarly

rapid declines from the upper band to the lower

band. In 11 cases, 55% of the time,

the DJI fell below the lower band. In 9 cases (45%)

of the the time, the DJI rallied back to

the upper band. There were 3 earlier July cases.

Each saw the DJI continue to fall and

break below th elower band.

10/29/73 below lower band.

4/24/74 reversed up

8/1/74 reversed up

8/14/74 below lower

band.

7/23/75 below lower band

10/19/78 below lower band

12/15/82 reversed up

9/11/86 below lower band.

4/14/87 reversed up

10/12/87 below lower band

10/13/89 reversed up

8/15/97 reversed up

7/27/98 below lower band

4/13/00 reversed up

5/24/00 reversed up

5/19/06 below lower band S9V

7/27/07 below lower band

3/10/08 revered up

11/17/08 below lower band

6/23/10 below lower band

=================================

11 below lower band

9 revered up to upper band

The uptrending support line through the

March and June bottoms crosses at about 11950.

The rising 200 day ma crosses at

this level. This "should" be support. But it has not

yet even been tested. The

general sense is that if there is a budget comprimise, the market

will rally again. The pundits could

be wrong that there will, in fact, be a compromise.

And they could be wrong that raising the

Budget Deficit limits will bring more than a short-term

bounce in the market.

The stock market is pretty smart.

It knows that cutting a trillion Dollars out of the US

Budget is hugely deflationary in the US.

But I don't think it cares. The US stock market

is, I would argue, less closely connected

to Main Street in America than the perceptions

of the very weathy who own most stocks.

As they have not had their taxes raised, they

should be very pleased and the market

should be happy with that.

. True, we still have a huge federal deficit.

Also true, cutting a trillion Dollars from the Federal

Budget guarantees thousands of lay-offs

and much less spending by the elderly and the

unemployed. And they will be angry.

Expect much more political polarization in 2012.

But all this is not what the stock market

cares about until the political status quo is

seriously threatened. It is

not. Obama dies not even have a challenger in sight.

So, I would think that a short-term rally

back to the upper band will occur if there is

an agreement. I suspect there will

be an Agreement. (Wall Street demands it of its puppets

and they will listen.) As long as

the US credit rating of "AAA" is retained, look for a nice

rally by bonds, utilites and REITs. Those

have been the leaders. They should turn up

quite powerfully this week.

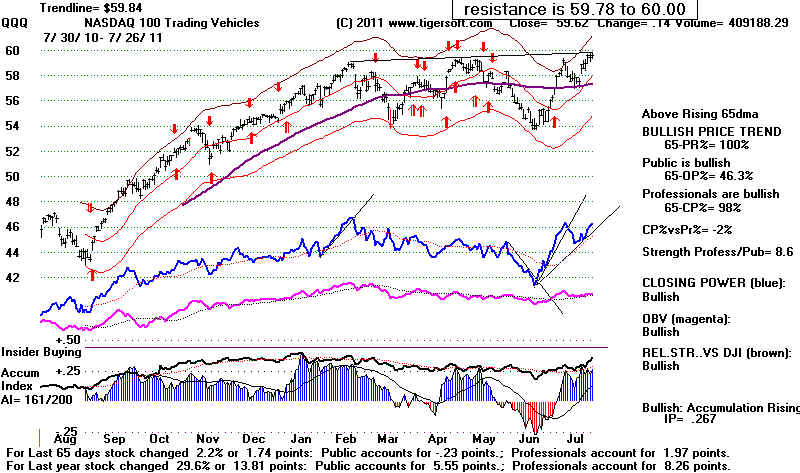

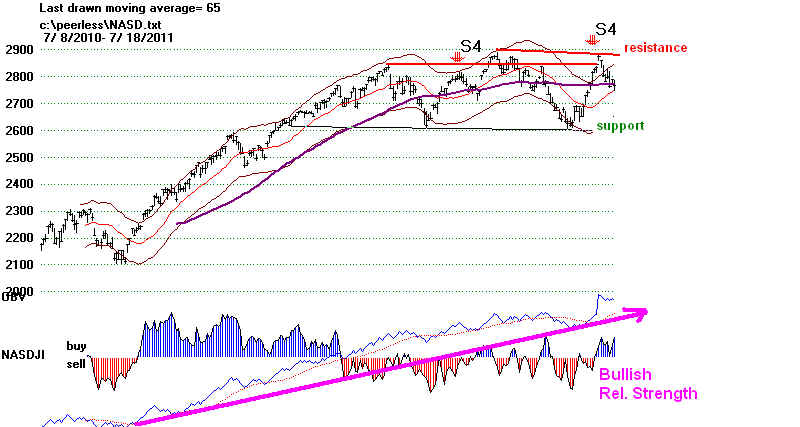

The QQQ has been much stronger than

the DIA or SPY. Its strength owed to the

success recently of AAPL, GOOG and MSFT.

They look over-extended. I would

rather buy the best of the REITS. Of

course, if QQQ should break above 60, I would

buy it, too. Continue the

hedging, too, but shift some money into the bullish MAXCPs.

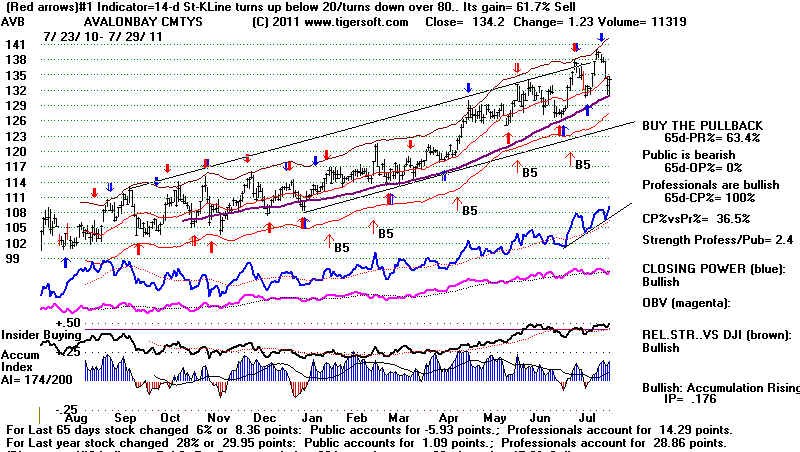

HWE, PPS and AVB are the three highest Power Ranked REIT. I would

buy them now.

|

|

|

DJIA

|

DIA

|

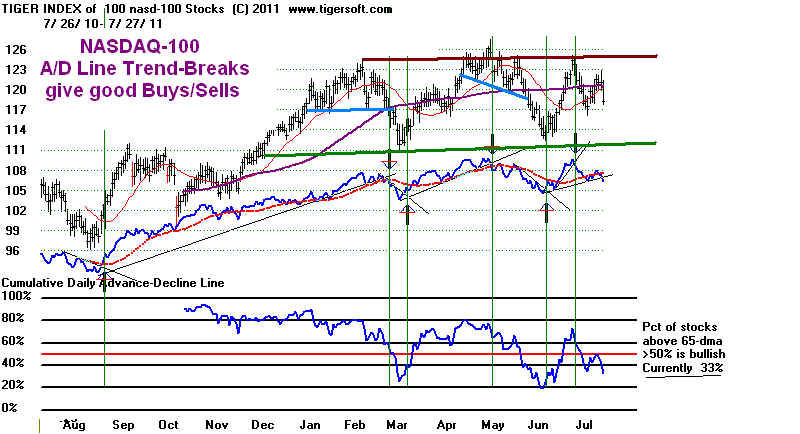

Tiger DJI

and A/D Line falliing. 17% above 65-dma

|

SPY

|

Tiger

SP-500 nnd A/D Line falliing. 29% above 65-dma

|

QQQ

|

Tiger QQQ

and A/D Line falliing. 31% above 65-dma

|

====================================================================================

OLDER HOTLINES

====================================================================================

7/28/11 DJI = 12240.11

la/ma= .978 21-dmaROC= .049 P = -81 (-123) IP21=.004 V= - 101 OP= -.114

BREADTH STATISTICS:

34 (-6) MAXCP stocks - Bullish

MAXCP Stocks

234 (+4) MINCP stocks - Bearish MINCP

Stocks

5/13/2011 Hedging Examples -

SCLN @ 5.56 and RDN, @5.18 now 6.23 and 3.36, respectively

(MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

12 new

highs on NASDAQ. 47 new

lows on NASDAQ

12 new

highs NYSE

67 new lows on NYSE

7/28/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless

TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude

Sell S9v The DJI has nearly reached the lower band. But S9vs

are just as likely

to produce declines below the lower band

as stop there. And as I mentioned last

night, the best support in a horizontal

trading range is not the lower band, but the

line going through the earlier DJI lows.

(See the charts of 1956 and 1986 as examples.)

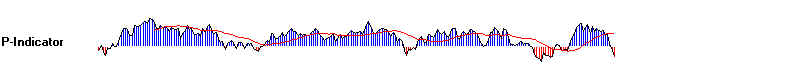

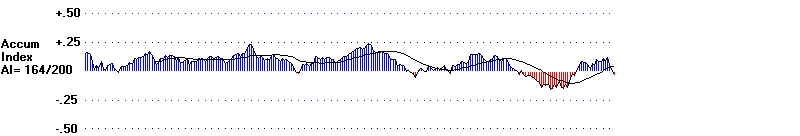

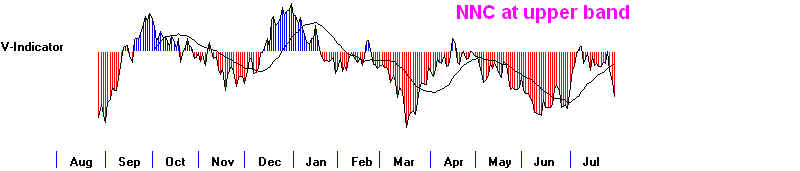

Each of the key Peerless Indicators

(P-Indicator, A/D Line, Accum. Index and V-Indicator

dropped below) their 21-day ma.

This is not a good sign. Nor is the abundance of

bearish MINCP stocks with a current

Accumulation Index below -.20.

===================================================================================

OLDER HOTLINES

===================================================================================

7/27/11 DJI = 12302.55 la/ma=

.983 21-dmaROC= .247 P = 42 (-176) IP21=.055 V= -

63 OP= .025

BREADTH STATISTICS:

40

(-94) MAXCP

stocks - Bullish MAXCP Stocks

Check out our CPHD

230 (+128) MINCP stocks - Bearish MINCP

Stocks

5/13/2011 Hedging Examples -

SCLN @ 5.56 and RDN, @5.18 now 6.23 and 3.36, respectively

(MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

5 new

highs on NASDAQ. 68 new

lows on NASDAQ

7 new

highs NYSE

79 new lows on NYSE

7/27/2011

===> See

Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless

TigerDJI TigerSPY TigerQQQ

GLD SLV

Crude

Sell S9v Today hurt the market a lot. Interest rate sensitive

stocks were hit with a

selling we have not seen for some time. Suddenly more

Bond Funds are below their

65-dma than above it. They have been the leaders.

Now the concern is that interest rates

will soon be rising. Only 32% of the SP-500 stocks

are above the 65-dma. They now

have that much more resistance overhead to stop the next

rally.

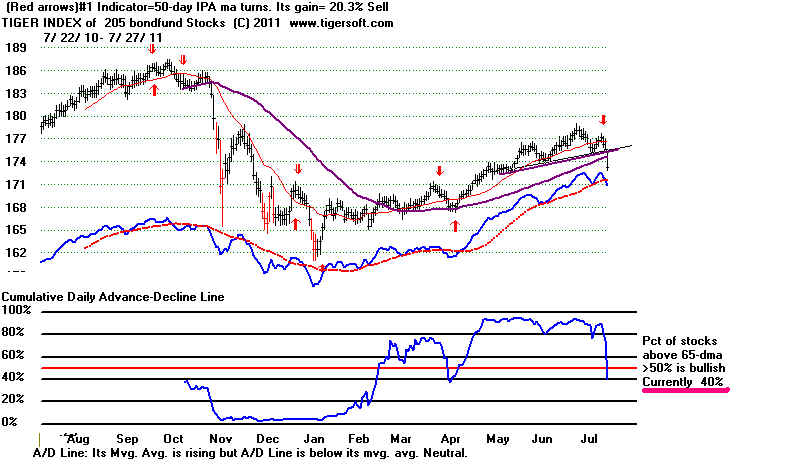

TIGER INDEX OF BOND FUNDS

The history of refined Sell S9vs suggests that there is a

47% (9/19) probability

of a DJI decline below the lower band within the next 5

weeks and a 94% chance that the

lower 3.5% band will be reached. The lower band is

now only 1.8% away. With the

P-Indicator and Accumulation Index still positive, we might

see bounce tomorrow

or even a Buy B9 if the DJI falls 200 points lower.

But a Buy signal tomorrow seems unlikely.

Without a buy signal, it's difficult to see much of a

recovery. And even if there was

a Buy signal, usually in trading ranges like the SP-500 now

shows, there are not sufficient

bids in the middle of the range to hold up prices once they

start to fall in earnest. The best

support is to be expected at the bottom of the trading

range. A surprise compromise

on the Debt ceiling would, however, cause a rush by shorts

to cover and bring the

QQQ back to the 59-60 level. I would buy the QQQ on a

close by the it above 60. The

reasoning was explained last night.

SPY

|

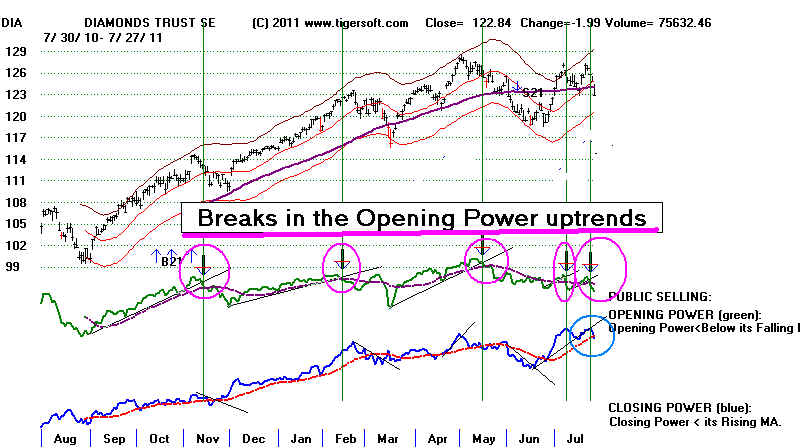

Note how today the ETFs' Closing Powers broke their uptrends.

What I was afraid would

happen has occurred: we have seen three days of very weak

openings this week that

have set the tone for the rest of the day. Waiting for the

Closing Power trend-break to

Sell would have given too much away, Breaks in the Opening

Power 21-day ma was

be watched. This past year they have been bearish.

The bearishness of the refined

S9v really helped here. It also made me accept the reality

of the extreme polarization

over the budget in Washington.

DIA CLOSING POWER TREND-BREAKS

The best thing now seems to remain short a decent

number of bearish MINCP

stocks.

Most of them keep falling.

DJIA

|

GLD

|

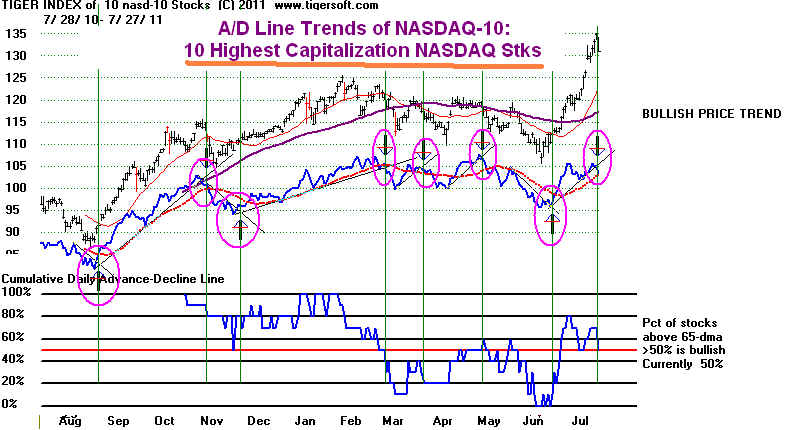

QQQ

NASDAQ-100

|

|

NASDAQ-10

|

------------------------------------------------------------------------------------------------------------------------

OLDER HOTLINES

-------------------------------------------------------------------------------------------------------------------------

7/26/11 DJI = 12501.30 la/ma= 1.00 21-dmaROC= .541 P = 217 (-4) IP21=.226 V= +1 OP= .081

BREADTH STATISTICS:

136

(-50) MAXCP

stocks - Bullish MAXCP Stocks

Check out our CPHD

102 (+27) MINCP stocks - Bearish MINCP Stocks

5/13/2011 Hedging Examples -

SCLN @ 5.56 and RDN, @5.18 now 6.62 and 3.52, respectively

(MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

At this point these are extended a long ways, so - use well-tested CP trendbreaks

to close out positions. Sell S7s occur when Professionals are much more bearish

than the Public is.

15 new

highs on NASDAQ. 20 new

lows on NASDAQ

20 new

highs NYSE

35 new lows on NYSE

Sell S9v The history of refined Sell S9vs suggests that there is a 47%

(9/19) probability

of a DJI decline below the lower band within the next

5 weeks. That does not preclude

the possibility of a QQQ flat-topped breakout over

60. (See the parallel with 1996, when

there would have been a 2.3% loss using the Sell S9v,

after the DJI formed a flat-topped

resistance and then broke out over it to the upside

with a reversing Buy B10 after only

a DJI retreat to the 21-day ma. <Added

Wednesday AM> )

The Closing Powers of the DIA, SPY and QQQ are still

rising and the three biggest NASDAQ

stocks are surging. See the charts of AAPL, GOOG and MSFT below.

The NASDAQ

and QQQ are capitalization weighted. These

three stocks explain much of why the

NASDAQ has held up this week while the DJI

declined. And don't forget, too, that IBM

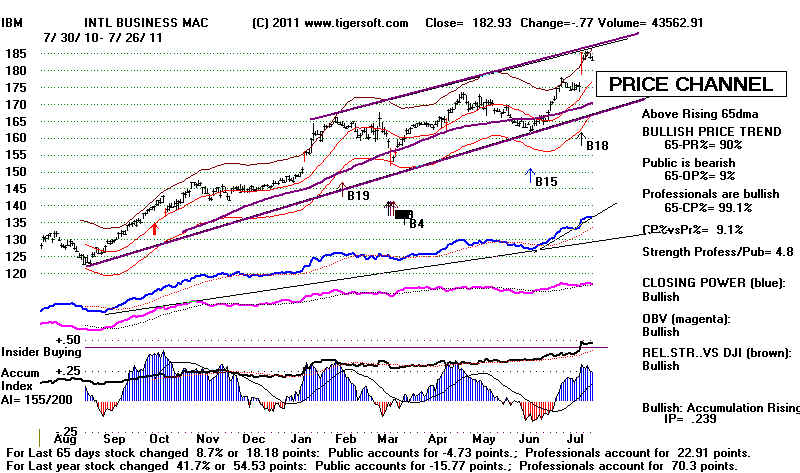

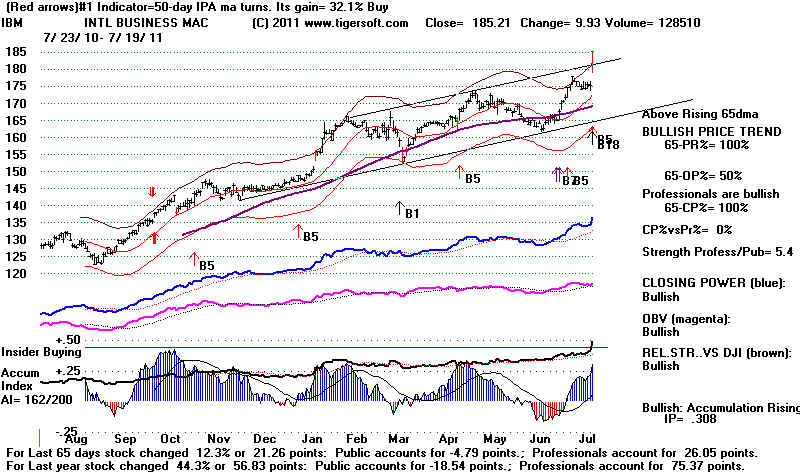

single-handedly has more say about where the DJI-30

goes than any other stock, simply

by virtue of its very high price. And IBM's

uptrend and high Accumulation right now are

most impressive. It is at the top of its price

channel. If it should break above the top of

its channel, look out shorts! See its chart

below.

So, it may be that we are the verge of a new narrow

"nifty rally" to new highs, led perhaps

by the biggest tech stocks. This would explain

the high level of Accumulation in our NASDAQ

chart. If there is a further narrow rally led

by these the biggest tech stocks and the DJI makes

a new high and reaches the upper band, we could see a

normal Sell S9 in August, as the A/D

Line and the P-Indicator badly lag the DJI. We

will; have to watch and see.... Traders should

buy the QQQ on a close above 60 to take advantage of

a flat-topped breakout situation

where shorts are forced to cover.

Until then, the Sell S9v signifies trouble ahead for

the market and I urge taking some short

positions in the Bearish MINCP Stocks . Long

positions among the Bullish MAXCP Stocks

should still be held if their Closing Powers are

rising. As proof that these bullish MAXCP

stocks still have the power to move higher, I mention

CPHD's nine point take-off Friday

and CLFD's jump higher

today. Both are stocks we have been long on the Tiger Hotline

and held in the belief that the reason for the

insider buying surge we detected using our

Accumulation Index had yet to come out, and when it

did the stocks would be significantly higher.

Software Update

The

refined Sell S9v will be added this week as a signal option on Peerless programs and

made available to all Elite Subscriber users.

Because the Sell S9v cannot be accurately

tested before 1966, I am reluctant to include it as a

full-fledged Peerless signal, but its 46-year

track-record is significantly bearish. So,

traders using it with our Closing Power should

expect good results. Updates to the Peerless

Software are available to others, but

it is necessary to charge $60 for the update, if you

are ready have Peerless.

|

QQQQ

|

NASDAQ-100 Stocks

with A/D Line

|

|

Watch for zig-zag clusters downwards, as MMM recently

displayed.

These we have frequently noted usually have a bearish

outcome.

|

====================================================================================

OLDER HOTLINES

====================================================================================

7/25/2011

MAXCP stocks - Bullish

MAXCP Stocks Check out our CPHD

MINCP stocks

- Bearish MINCP Stocks

14 new

highs on NASDAQ. 21 new

lows on NASDAQ

12 new

highs NYSE

29 new lows on NYSE

7/25/2011 The new warning Refined Sell S9v should keep us

very wary now...

While S9vs are

not fully satisfactory as independent, intermediate-term major

Peerless Sell signals, they have reliably brought retreats

to the 21-day ma since 1966

and 9 (47%) of the 19 S9vs produced DJI declines below the lower

band. That is what

worries me now. A decline below the lower band could start

to feed on itself if

interest rates belatedly rise.

Certainly, traders should employ S9vs when the key ETF's Closing

Power uptrends are

violated.

A big problem with S9vs is that they can only be accurately

tested back to 1966. When

the necessary Up and Down volume pre-1966 data are estimated

using total NYSE

volume and simply the ratio of advances and declines, we get too

many losing Sells in

the bull markets of 1935, 1936 and 1954. At first

blush, this casts some doubt on the S9v.