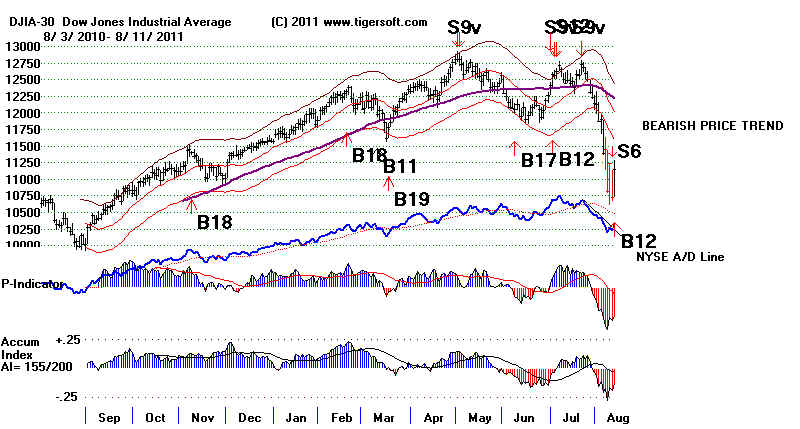

| CORRECTIONS IN A BULL MARKET

Since

1929, there have been 11 bull markets lasting more than 24 months without a

DJI decline of more than 13.5%. In that time,

there were 27 cases of 8%-13.5% declines

that puncutated these long advances, like we are now

in. A decline of more than

13.5% was always bearish, in that it always led to a

much deeper bear market.s. It

seems reasonable to use a CLOSING SELL STOP 13.6%

below the highest DJI close.

Here that would be at 11050.

Corrections in the 11 Longest DJI Advances

since 1928

1. 7/26/34 -

3/10/1937 30 months

Feb-March

1935 10% decline

(There was a Sell S12 in January 1935 and Buy B5 at bottom).

March-April

1936 12% decline

(There was a Sell S12 in March 1936 at top and B2 at bottom.)

March-June

1937 15% decline (Sell S9 at top and B8 at bottom.)

2. 4/28/42 -

5/29/46 49 months

July

1943-November 1943 11% decline(June

1943 Sell S9. November 194 Buy B9

3.

9/14/53 - 7/12/57 46

months

Sept

1955-October1955 10% decline

(Sell S4 at top. Buy B17 at bottom.)

April

1956-May 1956 10% decline

(Sell S2 at top. Buy B19 at bottom.)

August

1956-Nov 1956 11% decline

(Sell S2 at top. Buy B2 in October.)

4. 10/21/57 -

1/5/60 26 months

August

1959-Sept 1969 9% decline

(Sell S4 at top. Buy B17 at the bottom.)

5. 10/23/62 - 1/5/66 38 months

May

1965-June 1965 11% decline

(Sell S8 at top. Buy B10 in August after the bottom.)

6. 7/24/84 - 8/25/87 37 months

July

1986-Aug 1984 9% decline

(Sell S9 before top. Buy B17 in July before the bottom.)

Sept

1986-Sept 1984 9% decline

(Sell S9 before top. Buy B17 just before the bottom.)

April

1987-May 1987 9% decline

(Sell S9 at top. Buy B17 at the bottom.)

7.

12/4/87 - 7/17/90

32 months

Oct

1989-Oct 1989 9% decline

(Sell S9 at top. Buy B17 at the bottom.)

Jan

1990-Jan 1990 9% decline

(Sell S4/S15 at top. Buy B17 at the bottom.)

Aug 1987 - November 1987 35% decline (Sell S9/S12 at top. Buy B9 at

the bottom.)

8.

12/4/87 - 7/17/90

32 months

Oct

1989-Oct 1989 9% decline

(Sell S9 at top. Buy B17 at the bottom.)

Jan

1990-Jan 1990 9% decline

(Sell S4/S15 at top. Buy B17 at the bottom.)

2.2%

declines: 1991 1 ok 3 bad, 1992 2 bad

9. 10/11/90 - 7/15/98 93 months

Jun

1992-Oct 1992 8% decline

(Sell S9 at top. Buy B17 at the bottom.)

Jan

1994-April 1994 11% decline

(Sell S4 at top. Buy B19 at the bottom.)

May

1996-July 1996 8% decline

(Sell S1 at top. Buy B17 at the bottom.)

March

1997-April 1997 10% decline

(no sell signal at top.

Buy B17 at the bottom.)

July

1997 - October 1997 13.5% decline (Sell

S12 in September after top. Buy B1/B17 at the bottom.)

END July 1998 - October 1998 20% decline (Sell S9/S12 at top. Buy B9 at

the bottom.)

2.2%

declines: 1991 1 ok 1 bad, 1993: 1 bad, 1994: 1 OK, 1 bad, 1996 2 bad, 1997 2 ok 4

bad.1998

10. 3/12/2003 - 10/9/07 51 months

Feb

2004-Oct 1994 9% decline

(Sell S9 at top. Buy B2/B9 at the bottom.)

May

2007-July 2007 8% decline

(Sell S9 at top. Buy B9 at the bottom.)

July

2007-Aug 2007 9% decline

(Sell S9 at top. Buy B14 two weeks after the bottom.)

October

2007-November 2007 10% decline

(Sell S4 at top. Buy B1 a week before the bottom.)

END December

2007-February 2009 Bear Market 51% Decline. Sell S9/S12 at top

2.2%

declines: 2003 1 ok, 2007 5 ok.

11. 3/9/2009 - 4/29/2011 25.5 months

Jan

2010-Feb 2010 8% decline

(Sell S9 2 months before top. Buy B17 at the bottom.)

END April 2010 - June 2010 13.5% decline (no sell signal at top Buy B8

at the bottom.)

2.2%

declines These failed to predict a decline in 13 cases. They accurately predicted a

decline only 2x.. |