TIGER

HOTLINE

TIGER

HOTLINE

william_schmidt@hotmail.com

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE TIGER

HOTLINE

TIGER

HOTLINE

william_schmidt@hotmail.com

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

TigerSoft and

Peerless Daily Hotline

(C)

1985-2012 William Schmidt, Ph.D. www.tigersoft.com

All rights

strictly reserved.

| Earlier Hotlines - See MASTER-LINK which was sent to subscribers. |

|

To Renew the Hotline, order here 350 (check) - 360(Visa/MC) |

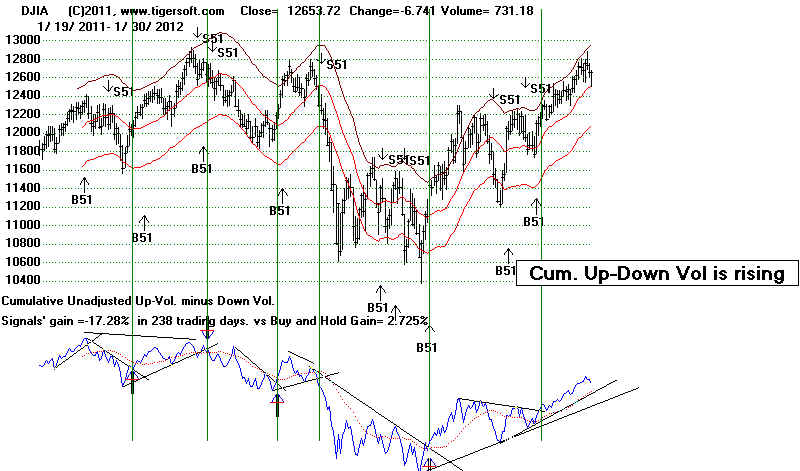

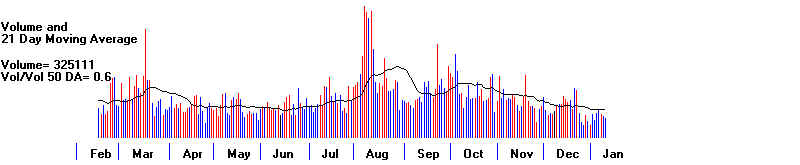

Hotline 1/30/2012

12661 -74

Advance= 1112 Declines= 1904

BUY B10 and

Rising A/D Line Predict Higher Prices. 12900 Remains Our Target.

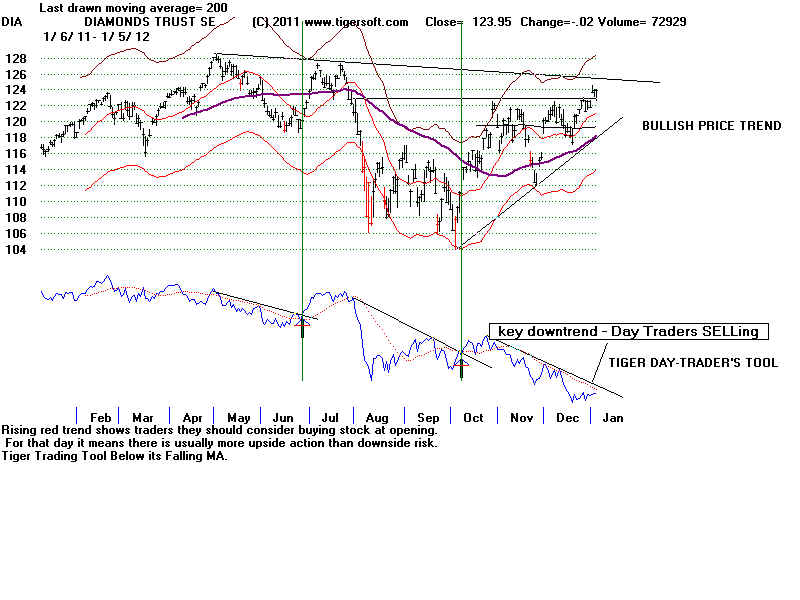

The DJI found

support at its rising 21-day ma and turned up at the close so that the DJI's loss

was very minor.

I noticed that NYSE new highs rose for the day. Dividend stocks and

speculative high

performance stocks are in favor. The breaking by the Opening Power

of its rising

21-day ma is a warning that more weakness at the openings could be ahead.

But, as long, as

the Closing Power uptrend in intact, we should expect 12900 or more.

And as long as

the NYSE A/D Line is rising, the intermediate-term trend is clearly up.

The proportion of

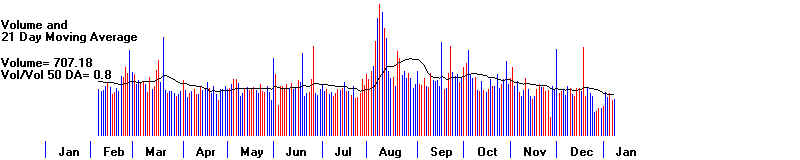

NYSE Up Volume to Down Volume is falling behind the ratio of NYSE

advances to

declines. See the last chart for today below. This has to be of concern, but

as long

as such a NC

(non-confirmation) does not occuur on a tagging of the upper 3.5% band and

the NYSE A/D Line

is uptrending, I think we have to trust the Peerless Buy signal. A break

in the

uptrend of what has been a very strong period of Daily and Weekly Advances-Declines

would likely stop

the advances as it did early 1977, 2001 and 2002. For now, let's see if the

DJI can reach the

expected keenest resistance at 12900

DJI remains on a Buy B10

NYSE A/D Line is

uptrending.

1/30/2011 BREADTH STATISTICS:

175 (+32) MAXCP stocks Bullish MAXCP Stocks Bullish.

3 (-1)

SUPER2011 Stocks making New Highs: Incl REGN 88.88 +3.34

29 (-5) MINCP stocks

Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

31 (-17) new highs on NASDAQ. 10 (+4) new lows on NASDAQ Bullish.

102 (+1) new

highs NYSE 6 (0) new lows on NYSE Bullish.

1/29/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

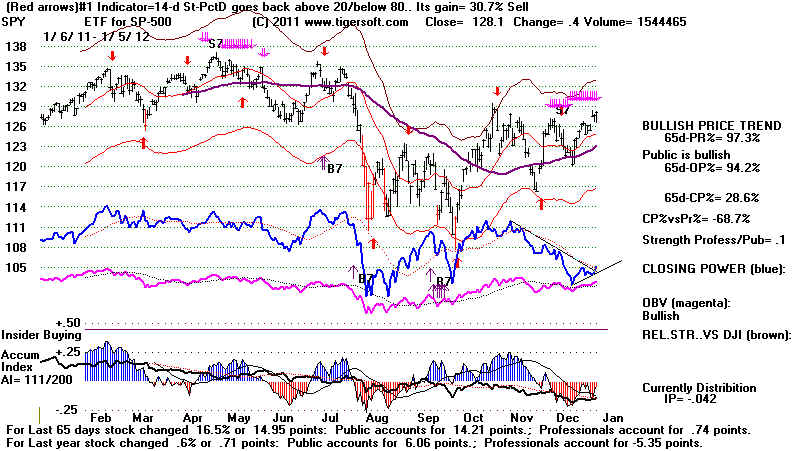

DIA SPY

QQQ DJIA-Peerless TigerDJI TigerSPY

TigerQQQ

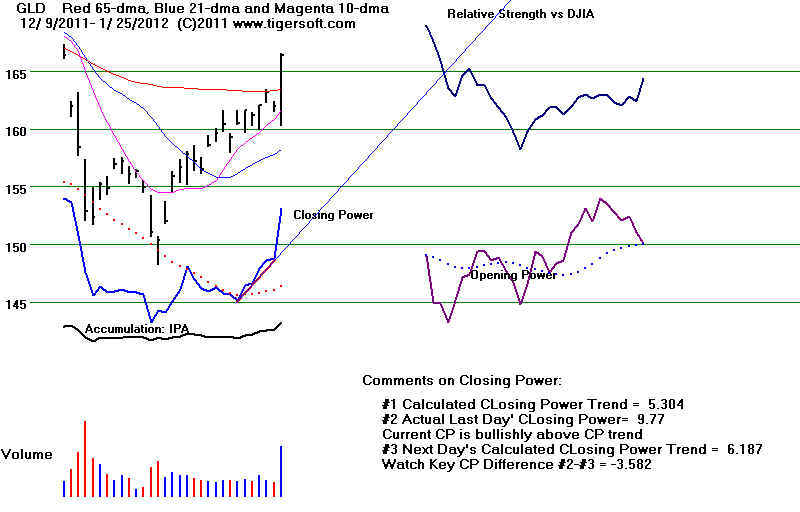

GLD

SLV

Crude Oil

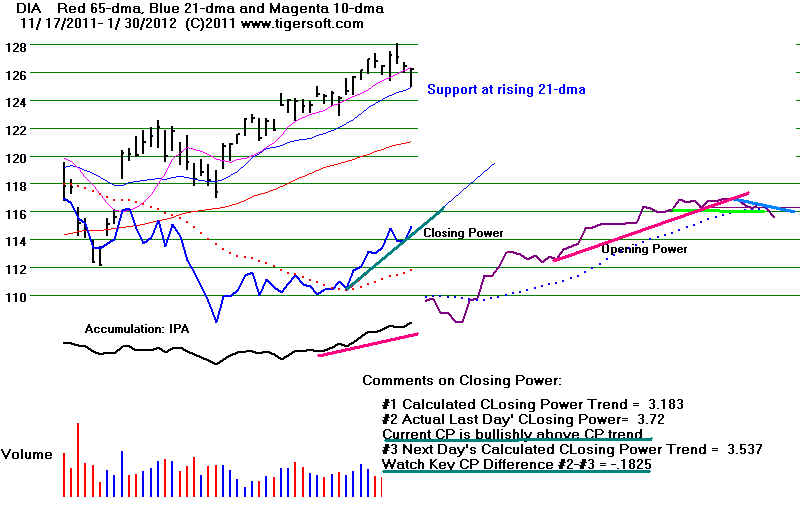

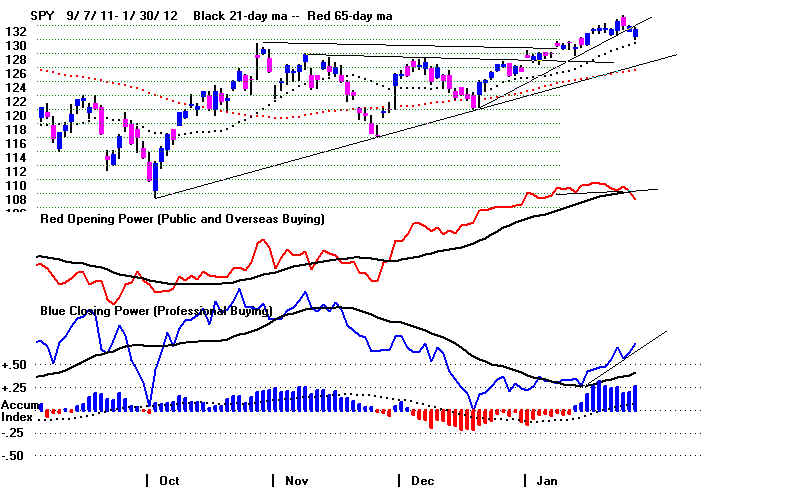

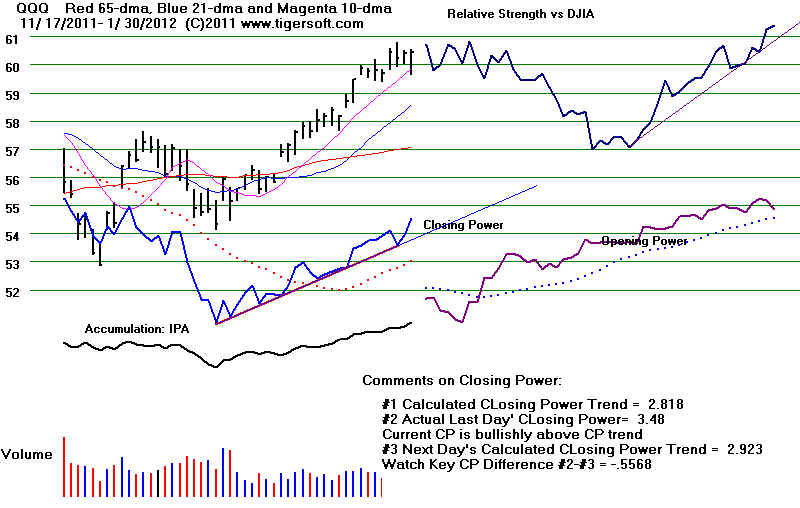

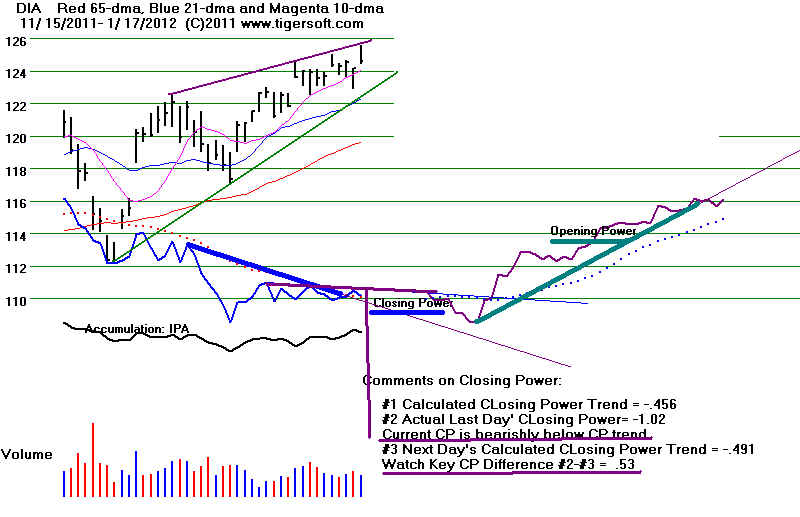

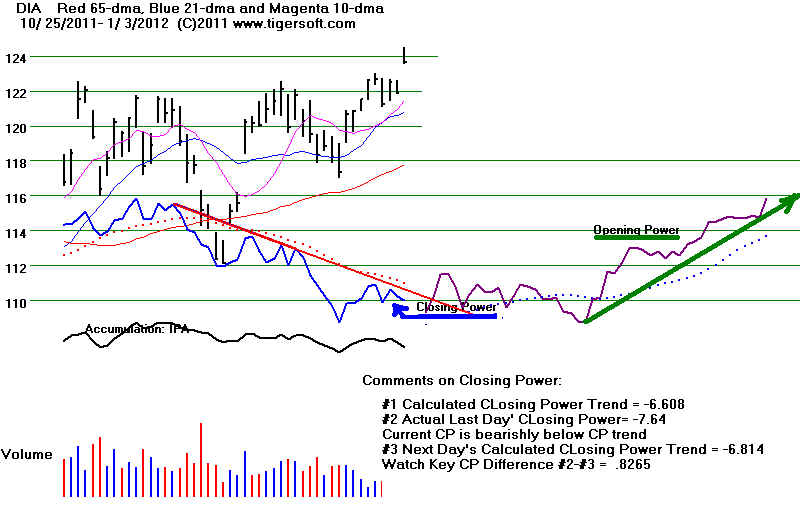

1/29/2012 ===> Closing

Power (CP) Status Report: KEY ETF CHARTS:

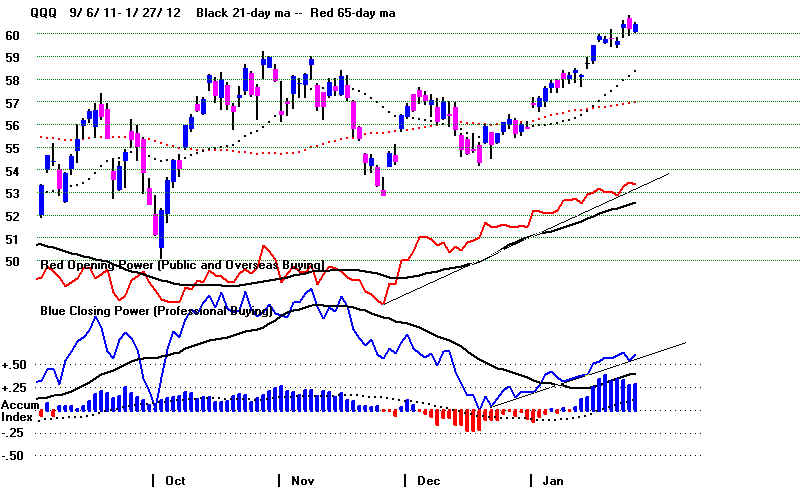

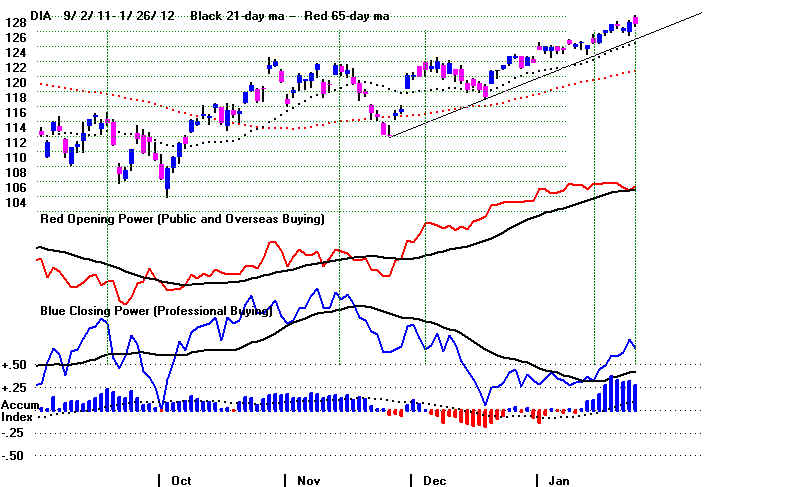

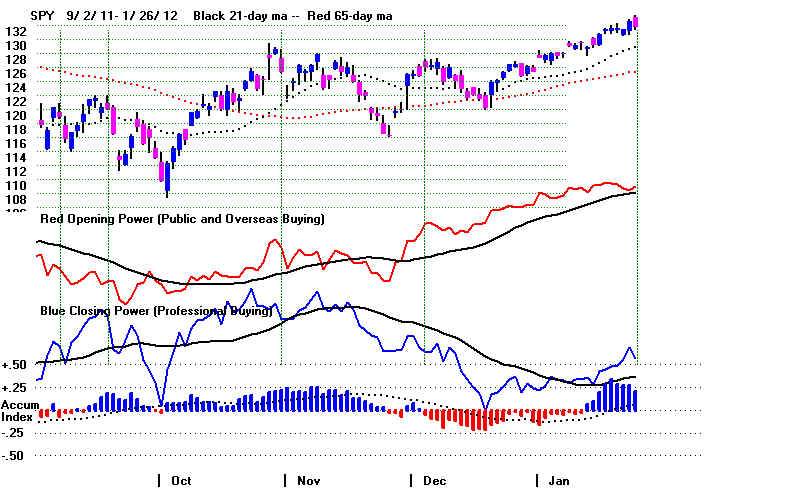

Opening Power are rising, as are CLosing Powers. This is

bullish

until one of them violates its 21-day ma.

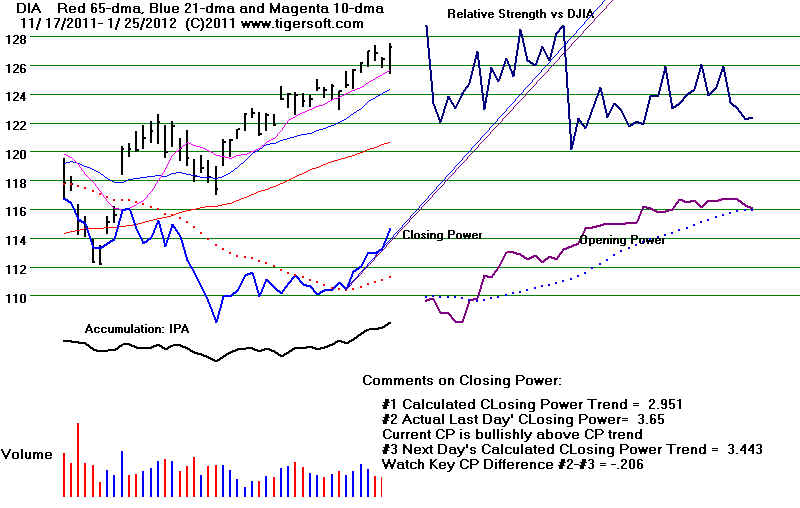

DIA' s

Slower CP is uptrending But steeper CP uptrend was violated.

A close 0.19 BELOW its opening would break the shallow CP uptrend.

Opening Power broke its 21-day ma.

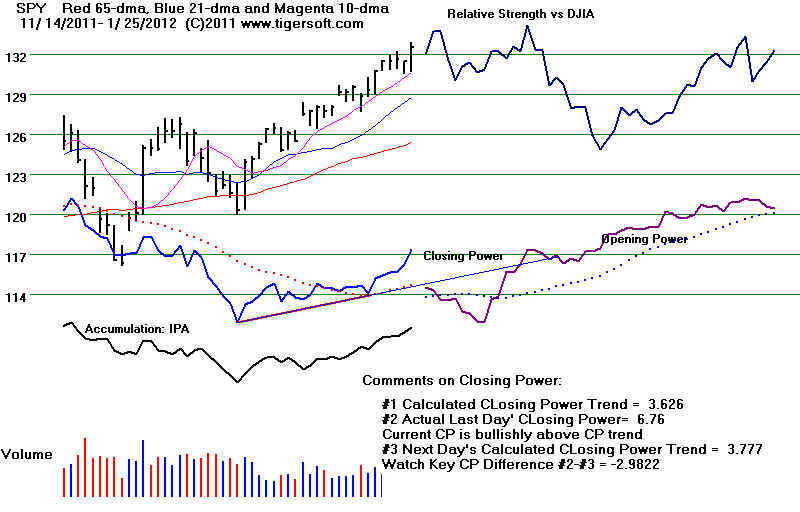

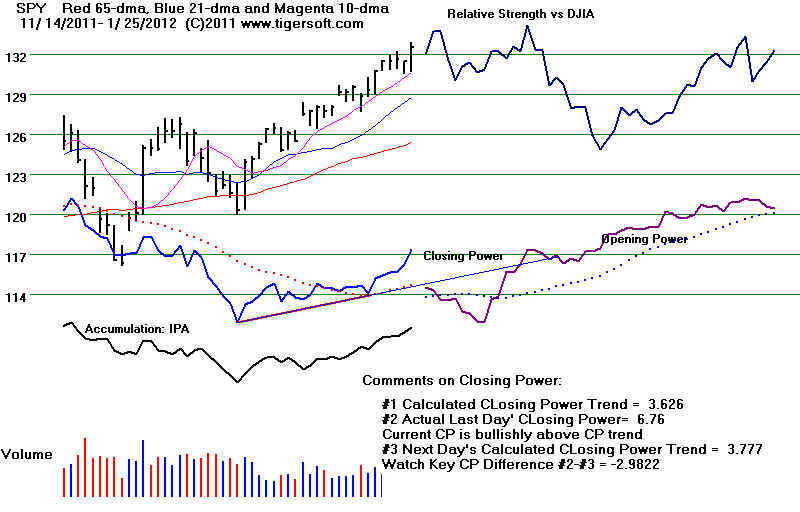

SPY's Shallow CP's

is uptrending.

A close 0.31 BELOW

its opening would break the steep CP uptrend.

Opening Power broke its 21-day ma.

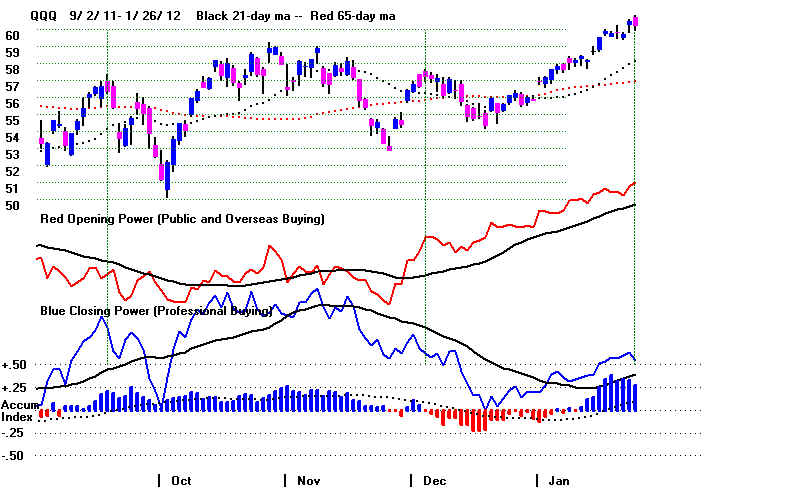

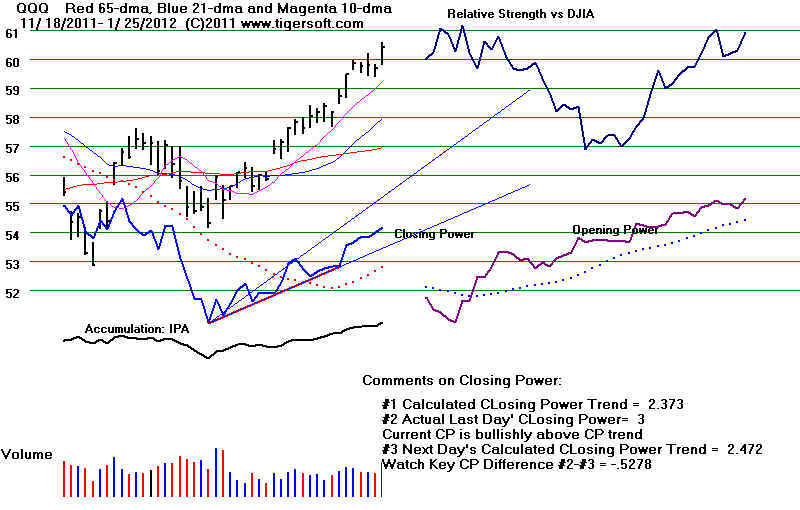

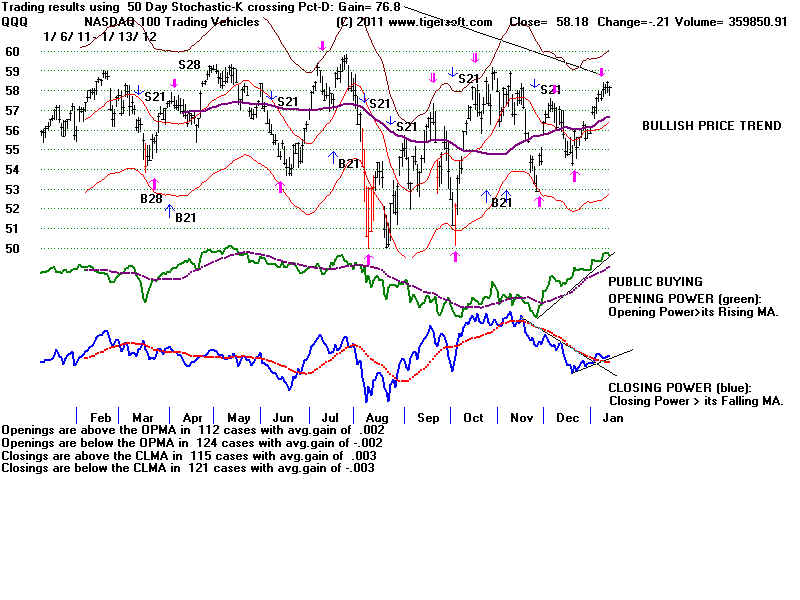

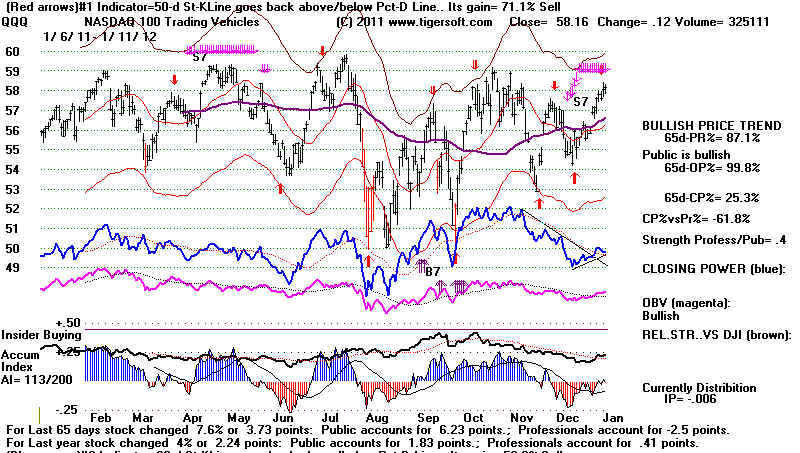

QQQ's Steeper CP is uptrending.

It will take a close of more than 0.56

BELOW the Opening to break the steeper

short-term CP UP-trendline.

Opening Power broke its 21-dma

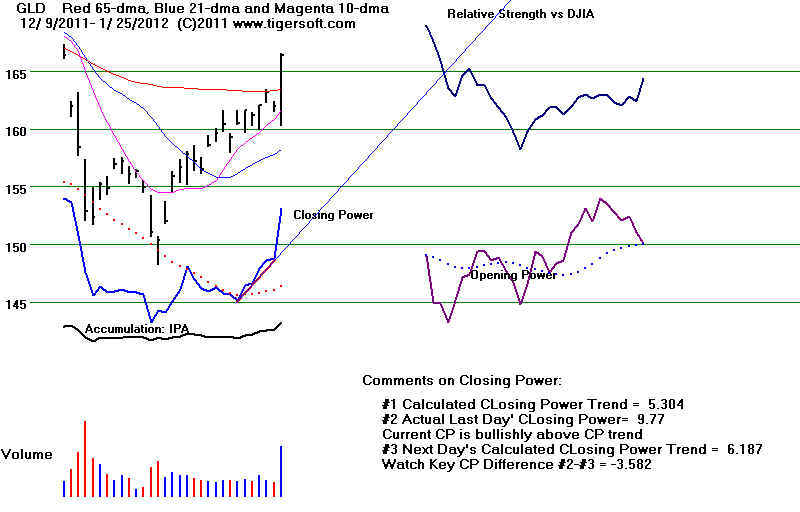

GLD's CP is

uptrending.

It would take a close of .56 BELOW the Opening

to break this CP-UP-trendline.

Its Opening Power is still rising.

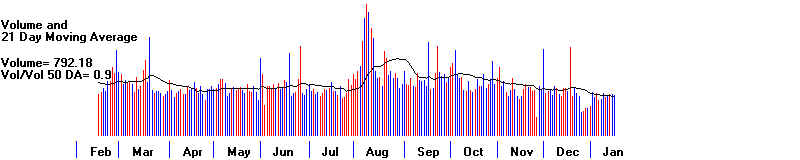

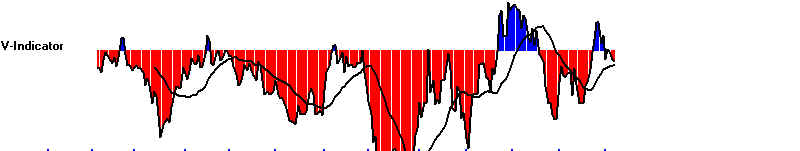

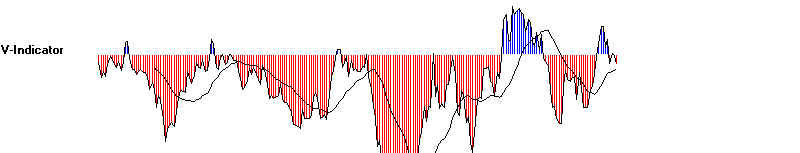

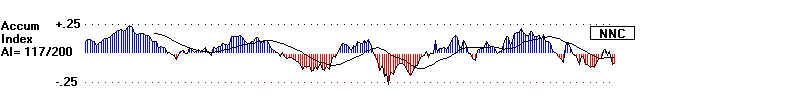

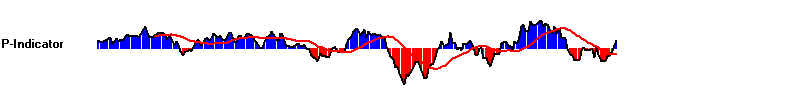

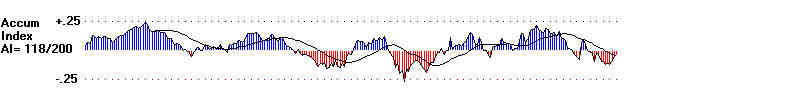

WARNING: Up Volume is

Rising but No Longer in Proportion to the Ratio of NYSE Advances to Declines.

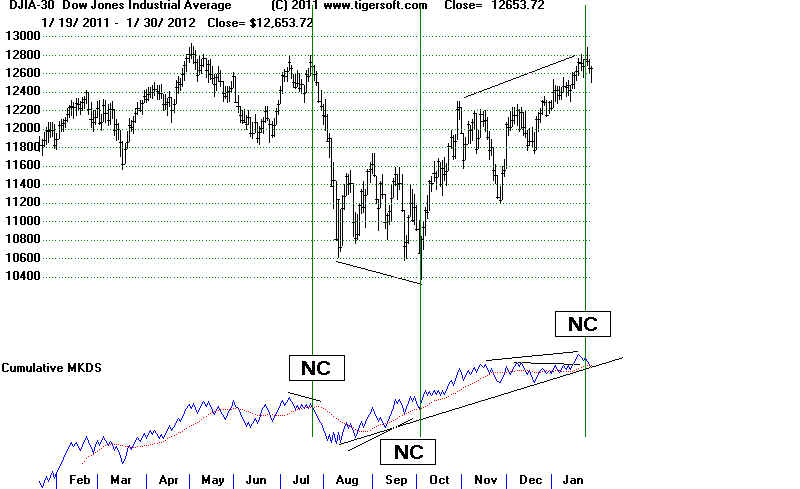

In the second chart below, see how the last DJI new high was not confirmed by the Tiger

Inverted Cumulative

(MKDS) making a new high of its own. "NC" means non-confirmation of a

price new high or low. I will post 1/30/2012 Inverted Traders' Index

NCs at upper and lower bands have good predictive value: 1990-2012

=================================================================

OLDER HOTLINES

===============================================

Hotline 1/27/2012

12661 -74

Advance= 1947 Declines= 1061

HOTLINE ADDRESS WILL BE CHANGED TUESDAY NIGHT

LOOK FOR EMAIL MONDAY.

DJI Weakness vs NASDAQ Strength.

Buy B10 and Seasonality are bullish. Breadth was excellent despite

DJI decline. Resistance up to 12900 has not yet been overcome in DJI.

NASDAQ-100 is stronger and has made a new yearly high and shows

both Opening and Closing Power to be rising. This is bullish. The

"red popcicle" Tiger Candlestick charts do suggest a DJI and SPY

retreat. Odds

are that it will be minor. The rising 65-dma ma now at 12100 should be

very good support because there is no Peerless Sell.

All 4 of the earlier B10s in January were profitable.

Current 1/18/2012

DJI = 12579

la/ma

21-dmaROC P-I Change

IP21

V-I Opct.

1.023

.69

P= 553 (+46) .125

+95 .107 (low)

1 1/13/1967 835.13 Gain= +4.0%

la/ma 21-dmaROC

P-I Change IP21

V-I Opct.

1.039 .273

135 21

.07

5 .221

Bottom formation B10 after a Bear Market. DJI rose

immediately. No paper loss.

... Reversed at 968.49 on 3/16/67 by S12

2

1/7/1976 898.69 Gain = +12.3%

la/ma 21-dmaROC

P-I Change IP21 V-I

Opct.

1.054 1.124

286 35 .20

2 .536

DJI rose immediately .. Reversed at 1009.21 on 3/24/76 by S9 No

paper loss.

3

1/12/1989

2222.32 Gain = +24.7%

la/ma

21-dmaROC P-I Change IP21 V-I Opct.

1.023 .454

118 21 .078

11 .185

DJI rose immediately ... No paper loss...Reversed at

2771.09 on 10/4/89 by S9

4 1/31/1991 2736.39 +22.6%

la/ma

21-dmaROC P-I Change IP21 V-I Opct.

1.058 .58

143 33 .116 12 .218

DJI rose immediately ... Reversed at 3353.76 on 4/15/92 by S9

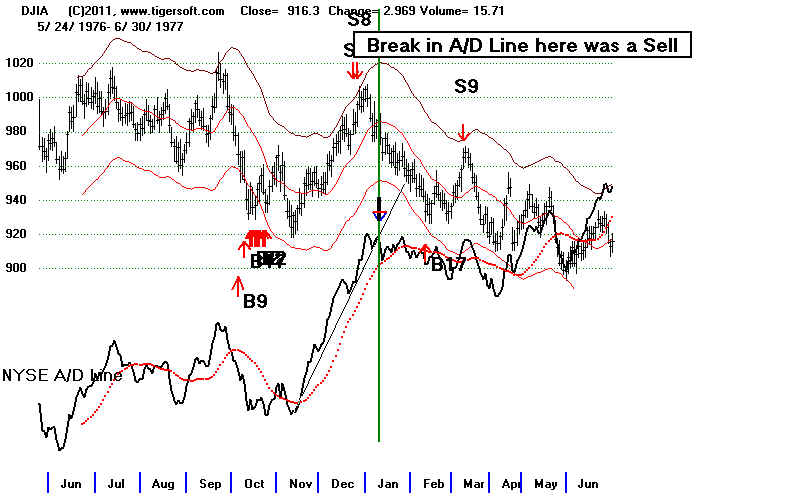

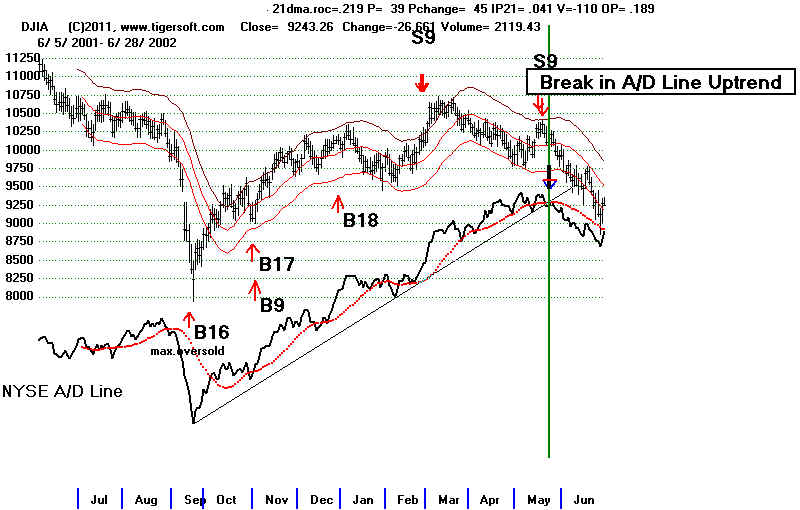

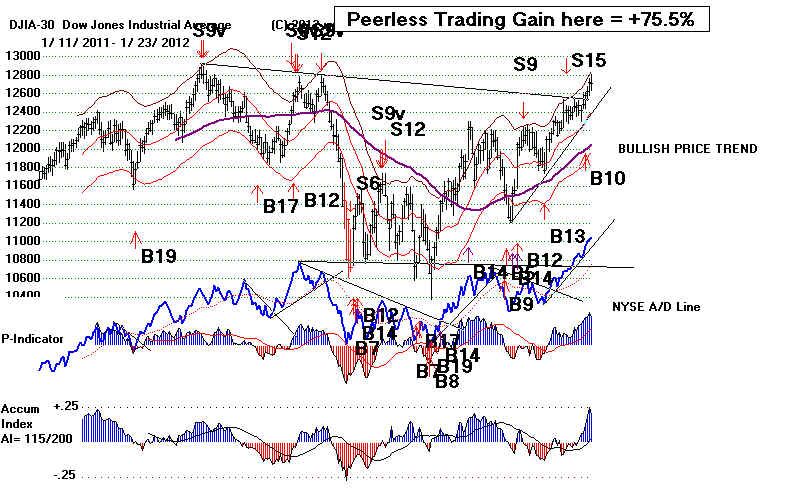

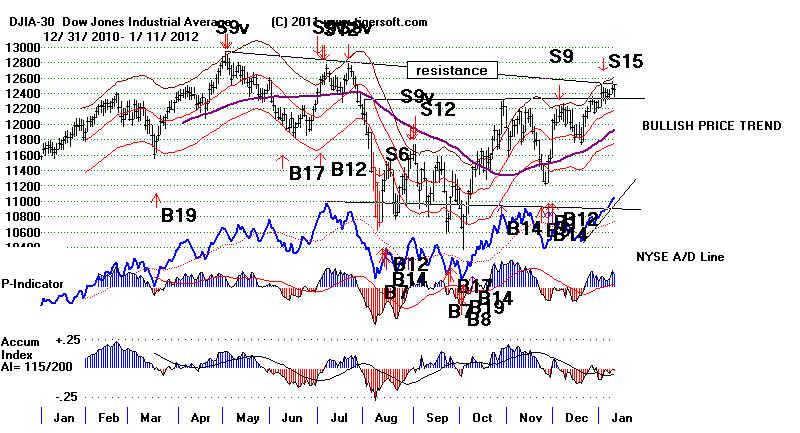

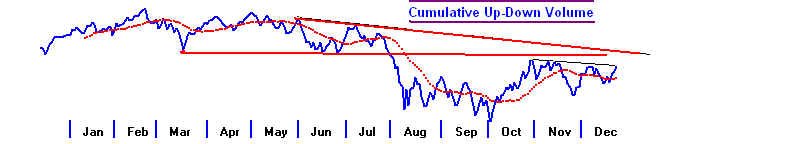

The Weekly DJI and NYSE A/D Line

chart shows how much stronger the A/D Line is

than the DJI. This is usually bullish. The

exceptions are 1977, 2001 and 2001. Breaks in

the NYSE A/D Line uptrend would be the best warning other

than a new Peerless Sell

that a big decline is developing.

Looking

at the 5-year weekly charts of the DIA, QQQ and SPY show

what I take to be

the most important resistance lines:

Weekly

DIA - Resistance from apex of right shoulder - 127.15

Weekly QQQ - Resistance from rising resistance

line - 60.71

Weekly SPY - Falling resistance line - 131.82

The review of 650

weekly charts for the biggest stocks shows none with

bearish head and shoulders patterns that I can identify. A number of these

stocks

could make significant upside breakouts. This will show the general market's

rally has

started again in earnest.

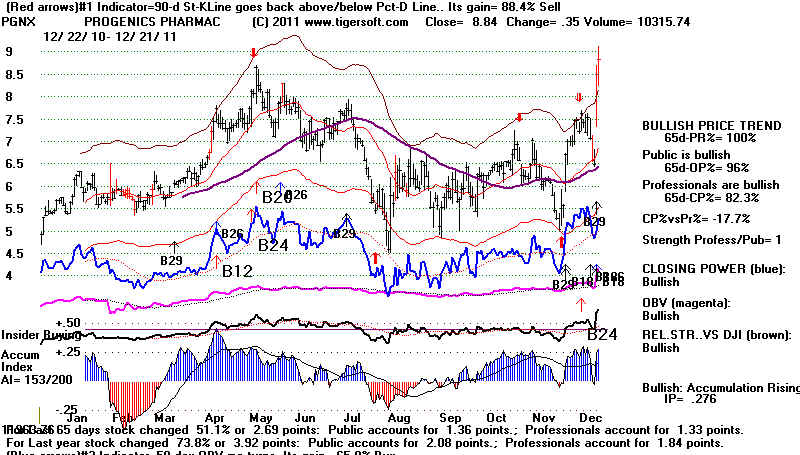

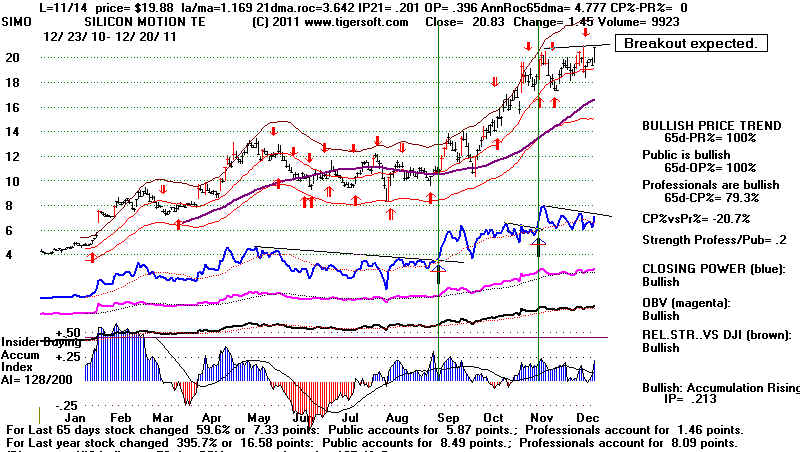

IMPENDING

BREAKOUTS

CELG - 76 and 78 are resistance

CLB - 110 resistance

CVX - 111 resistance

EBAY - 34.2 resistance

HRL - 30.57 resistance

IBM - 193 ressitance

QCOM - 60 resistance

SNPS - 29.5 resistance

ULTA - 80 resistance

VAR - 71 resistance

XOM - 88.5 resistance

1/27/2012 DJI = 12661 -74 la/ma=1.013 21-dma ROC=.352

P= 544 (-39) IP21= .158 V= +48 OP= .071

1/27/2011

BREADTH STATISTICS:

142 (-37) MAXCP stocks Bullish MAXCP Stocks Bullish.

4 (-2) SUPER2011

Stocks making New Highs

34 (+19)

MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

48 (+8) new highs on NASDAQ. 6 (+2) new lows on NASDAQ Bullish.

101 (-28) new

highs NYSE 6 (+2) new lows on NYSE Bullish.

1/27/2012

GRAPHS ===>

See Key Peerless TigerSoft Index Charts: Industry Groups and ETFs

DIA SPY

QQQ DJIA-Peerless TigerDJI TigerSPY

TigerQQQ

GLD

SLV Crude

Oil

1/27/2012 ===> Closing

Power (CP) Status Report: KEY ETF CHARTS:

Opening Power are rising, as are CLosing Powers. This is

bullish

until one of them violates its 21-day ma.

DIA' s

Slower CP is uptrending But steeper CP uptrend was violated.

A close 1.80 BELOW its opening would break the shallow CP uptrend.

Opening Power is at its 21-day ma.

SPY's Shallow CP's

is uptrending.

A close 2.09 BELOW its opening would break the shallow CP uptrend.

Opening Power is at its 21-day ma.

QQQ's Steeper CP is uptrending.

It will take a close of more than 0.20

BELOW the Opening to break the

steeper short-term CP UP-trendline.

Its Opening Power is rising.

GLD's CP is

uptrending.

It would take a close of 2.56 BELOW the Opening to break this CP-UP-trendline.

Its Opening Power is rising.

QQQ's Opening and CLosing Power are Both Rising.

====================================================================================

OLDER HOTLINES

====================================================================================

1/26/2012 DJI = 12735 -22

Important: CHANGE

Our hotline's location will change this Tuesday.

Look for an email from us Monday giving the new location.

I will also send you links to the Peerless historical research

and past Hotlines. This is needed to protect our research.

------------------------------------------------------------------------------------------------------------------------------------------------------

Buy B10, Rising Opening and Closing Powers

plus Low Interest Rates

Rising A/D Line Are Bringing DJI CLoser to 12900

Yearly Intra-Day

High Resistance. But now Tiger "Red

Popcicle" Candlesticks Patterns

Suggest A Shallow Retreat Soon. Just Hold Long

Posiitons for now.

"Both-Up" Tiger Condition favors higher

prices: both Opening

and Closing Power are above

their rising 21-day ma.

As long as the NYSE A/D Line

is rising, stick with your long positions.

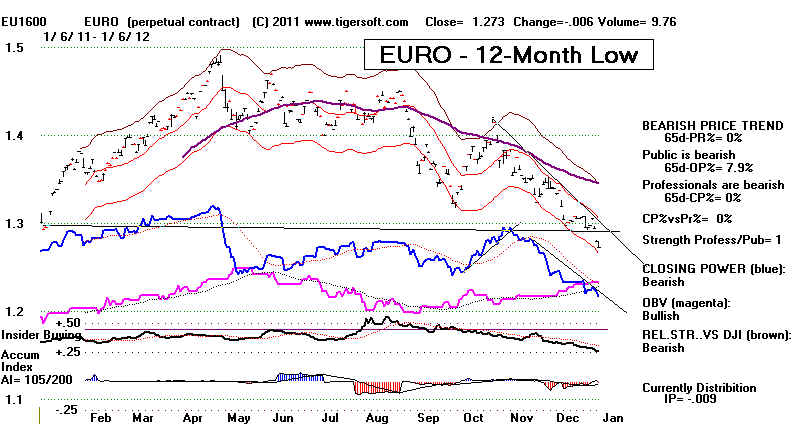

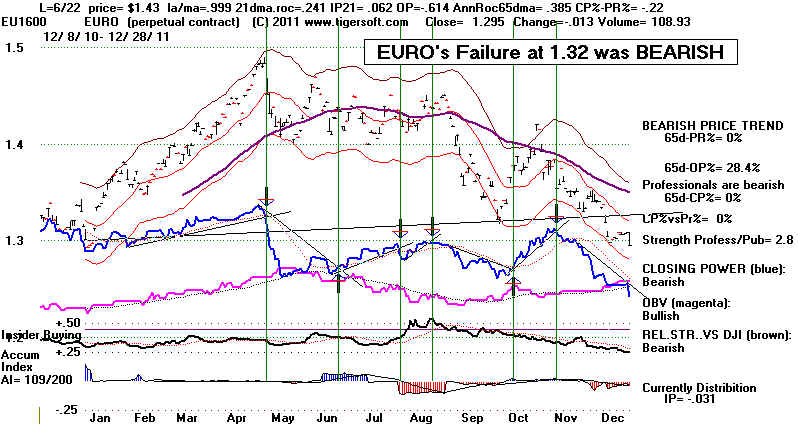

Interest

rates are falling again short-term. The Dollar's

weakness the last few days

seems controlled, and as such

invites hedging with stocks. (It should

be clear from last August's

sell-off that a collapsing Euro is not in the

interest of US investors or

US banks.)

January B10s have

averaged gains of 15% since 1928.

The DJI is nearing

resistance. Profit-taking is natural. The

steep Closing Power uptrends

of the SPY and QQQ were broken

today. I expect a DJI

close near 12900 before much of a decline

occurs. End of the

month buying will help the DJI reach 12900.

Since 1965, the DJI has risen

69% of the time over the next 3 trading

days and 60% over the next

two weeks. Seasonal weakness does

set in for two weeks around

the middle of February.

The DJI often makes a nominal

12-month closing high or low at important reversal points.

Look back at some of the

older DJI charts to see this.

On April 29th, 2011 the DJI

closed at 12810.54. A close above that would

seem likely at a minimum if

that pattern continues. After that, if the rally

continues, resistance will be

keenest at the peak of May 2, 2009 at 13058.

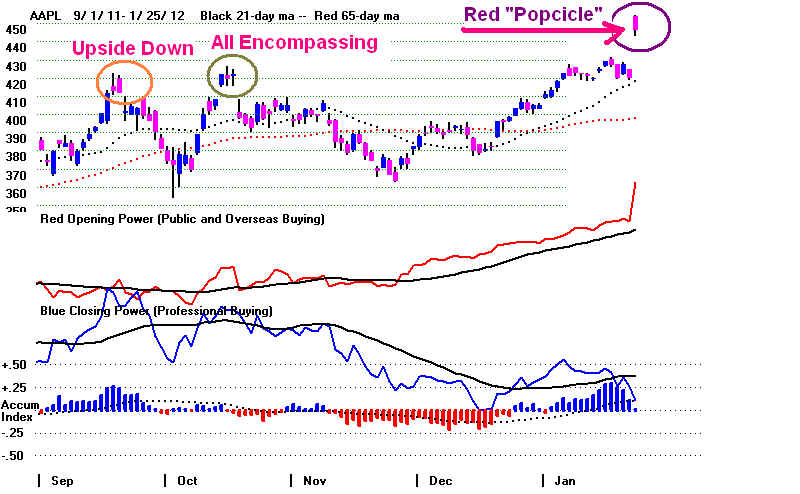

Our Tiger candlestick charts

do show "red popcicles" for the QQQ and SPY.

This is a warning, despite

the Peerless Buy signal. See last night's hotline.

With seasonality and breadth

strong, this may only mean a shallow decline to

the rising 21-day ma.

DJA |

SPY |

QQQ  |

ETF Notes - 1/26/2012

Looking regularly through the ETFS in Tiger's SECTOR data base is a

good exercise.

Some of the data needs

correcting this weekend, for one thing. I also see biotechs

and pharmaceuticals are due

for a retreat and some profit-taking while oil and gas

could get slip. That

would be in keeping with some hesitation in prices here, perhaps

as more speculative stocks

get new attention. Low priced atocks are also at

resistance.

So, the speculation will

probably be in the super-2011 (strongest performing) stocks.

>BBH (Biotechs) and IBB (Nasdaq Biotech) Bearish reversal day

after a 6 week move from 103 to 128

>BGU (3x large caps) have

rallied up to point of breakdown (resistance) from late July 2011.

>DUG (Ultra Oil Short) has

just given a red Buy. 5-day Stochastic.

This trading signal

has gained 199% for the last

year. Its CP has just broken its downtrend-line.

>GAZ (Natural Gas) failed to rally past its falling 21-day ma again. The warm winter

has created a surplus of

natural gas.

>GLD is back above its 65-dma, after turning up from its rising 52-week ma.

>PPH (Pharmaceuticals) are

showing steady Red distribution for the last two months and

weakening Relative Strength.

PEERLESS and DJIA

1/26/2012 DJI = 12735 -22

la/ma=1.021 21-dma ROC=.421 P= 503 (-59) IP21= .164

V= +45 OP= .101

1/25/2011 BREADTH STATISTICS:

179 (+54) MAXCP stocks Bullish MAXCP Stocks Bullish.

6 (+6) SUPER2011 Stocks making New

Highs

15 (-14)

MINCP stocks Bearish

MINCP Stocks - none listed tonight.

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

40 (-27) new highs on NASDAQ. 4 (-3) new lows on NASDAQ Bullish.

129 (+38) new

highs NYSE 4 (+2) new lows on NYSE Bullish.

1/26/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY

TigerQQQ

GLD SLV

Crude Oil

1/26/2012 ===> Closing

Power (CP) Status Report: KEY ETF CHARTS:

Opening Power are rising, as are CLosing Powers. This is

bullish

until one of them violates its 21-day ma.

DIA' s

Slower CP is uptrending But

steeper CP uptrend was violated.

A close 1.11 ABOVE its opening would restore the CP uptrend.

SPY's Steeper CP's is

uptrending. But steeper CP uptrend was violated.

A close 1.29 ABOVE its opening would restore the CP uptrend.

QQQ's CP is uptrending.

It will take a close of more than 0.3 BELOW the Opening to break the steeper short-term CP UP-trendline.

GLD's CP broke its

down-trendline and is considered uptrending.

It would take a close of 1.93 BELOW the Opening

to break this CP-UP-trendline.

=====================================================================================

OLDER HOTLINES

=====================================================================================

1/25/2012

Buy B10, ETF's Rising CLosing

Powers and Low Interest Rates

Bring DJI CLoser to 12900 Yearly Intra-Day High Resistance.

"Both-Up" Tiger Condition

favors higher prices: both Opening

and Closing Power are above their rising 21-day ma.

Also:

AAPL's Huge Profitability invites

competition and questions

about use of Chinese "slave labor" instead of American workers.

Bearish TigerSoft Candle Sticks

and AAPL: 1990-2012

"Red Popcicle"

"Upside-down Red Popcicle"

PEERLESS and DJIA

1/25/2012 DJI = 12757

+81 la/ma=1.024 21-dma ROC=.563 P= 561 (+1) IP21= .219

V= +70 OP= .191

1/25/2011 BREADTH STATISTICS:

179 (+54) MAXCP stocks Bullish MAXCP Stocks Bullish.

6 (+6) SUPER2011 Stocks making New

Highs

15 (-14)

MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

67 (+34) new highs on NASDAQ. 7 (+1) new lows on NASDAQ Bullish.

91 (+2) new

highs NYSE 2 (-2) new lows on NYSE Bullish.

1/25/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV Crude Oil

DIA' s CP is

uptrending

A close 0.21 BELOW its opening would bearishly break the steeper CP uptrend

Opening Power is rising.

SPY's CP's is uptrending.

It would take a Close 2.99 BELOW the Opening to break the uptrend

Opening Power is rising.

QQQ's CP is uptrending.

It will take a close of more than 0.53 BELOW the Opening to break the short-term CP UP-trendline.

Opening Power is rising.

GLD's CP broke its down-trendline

and is considered uptrending.

It would take a close of 3.59

BELOW the Opening to break this

CP-UP-trendline.

Opening Power is rising.

APPLE's Stunning Profits Send It and NASDAQ Up Sharply

Todays AAPL rally could be construed to be as a

classic "buying climax"

which

could potentially end a long and steep

uptrend. TigerSoft candle stick charts show this.

The rightside-up "red popsicle" it formed today with a monster gap certainly

represents a lot short covering and public

buying. Red popcicles have been reliably

bearish in the past with AAPL. See the

sampling I did quickly tonight. Admittedly,

the sample is biased, in that it took only the

last 100 trading days of each year

since 1990. Look at these charts and draw your

own conclusions. Mine - and I

have not studied Japanese candle sticks' theory

very much - is that "red popcicles

are reliably

bearish, as are "upside

down red popcicles" and "encompassing red" candle-sticks, too.

See http://tigersoft.com/1211-HH/AAPL-CAN/index.htm

I did a similar sampling of SPY a while back

and reached similar conclusions about

red popcicles, upside-down and right-side up.

2/23/2011 SPY Candle Stock

Charts: 1993-2011

WIll this be an exception. Could all this

public buying be correctly bullish now?

The world-wide market for these AAPL smart

phones is astronomical, in theory.

Since 2009, APPL has been rising more at the

openings than at the closes.

As long as APPL's OPENING POWER trends this

steeply up, calling a top in APPL

seems crazy. And seeing a stock like this

creates speculative confidence and

draws in the long absent public to the broader

market. It would seem a bear market

is unlikely with AAPL running like this, unless

it sucks out too much speculative capital

from stocks elsewhere.

Too Much Success?

There is a Hegelian dialectic

here. Success like AAPL has always breeds carping from the

envious. But also some real future

problems and a bearish potential. Such

problems may be over-looked by the buying crowd

in all the excitement. APPL's

profitability was huge, something like 28.1% of

revenues. A breakthrough technology

with such profitability will surely attract

compeitors. How can AAPL protect itself

from copying by pirates around the world?

And critics will assail APPL, or try to

it, for hiring so many "slave

workers" in China instead of paying decent wages

in the US. Go to Yahoo's message board and read the

comments there.

http://www.bloomberg.com/news/2012-01-24/apple-posts-record-quarterly-profit-sales.html

http://www.nytimes.com/2012/01/26/business/ieconomy-apples-ipad-and-the-human-costs-for-workers-in-china.html?_r=2&pagewanted=2&hp

Apple

Passes Exxon As Most Valuable U.S. Company

| Quotes from

AAPL's Message Board on Yahoo "Slave Labor Conditions... http://market-ticker.org/akcs-www?post=2..." "

|

=====================================================================================

OLDER HOTLINES

=====================================================================================

1/24/2012 DJI = 12676 -33 la/ma=1.02 21-dma ROC=.545 P= 559 (-22) IP21= .196 V= +69 OP= .176

1/24/2011 BREADTH STATISTICS:

124 (+35) MAXCP stocks Bullish MAXCP Stocks Bullish.

0 SUPER2011 Stocks making New

Highs

29 (-9)

MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

33 (+3) new highs on NASDAQ. 6 (-1) new lows on NASDAQ Bullish.

39 (-17) new

highs NYSE 4 (-2) new lows on NYSE Bullish.

1/24/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV Crude Oil

Reversing Buy B10 and The FED

Should Send

DJI up closer to 12900.

The Closing Powers Are Stil Rising

But Opening

Powers are breaking their uptrends.

Trading the Opening

trend-breaks is profitable. But I reckon it is

more than twice as profitable to trade with the Peerless signals.

I would be concerned, however, if the NYSE A/D Line broke the

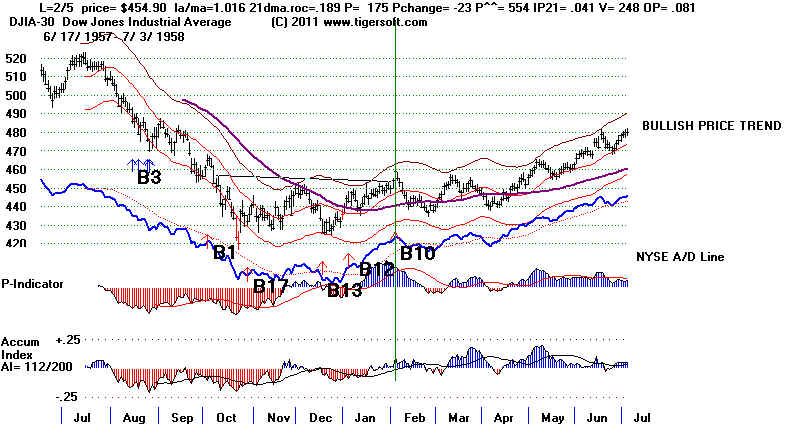

uptrendline shown below. That would remind us of early 1977

and mid 2001 where unusally powerful A/D Line uptrends

were broken after moves which took it up much faster than the

DJI.

See below how the 1976-1977 and 2000-2001 A/D Line uptrend

breaks did bring serious declines. In both these cases,

it should be noted, Peerless gave timely automatic Sells.

Unless one dismisses the Buy B10, Peerless has given no Sell

here.

January B10s are very reliable.

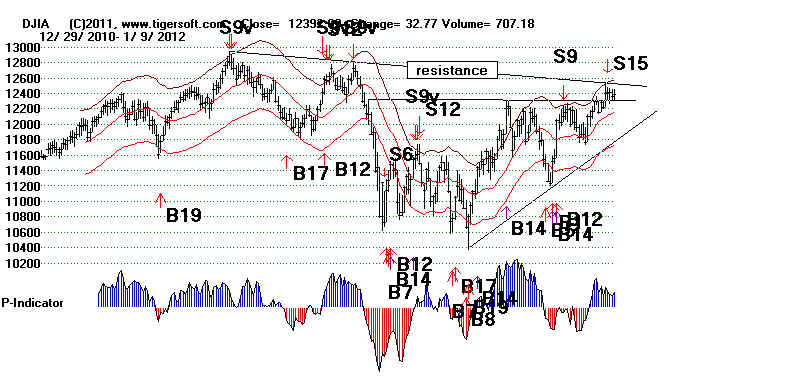

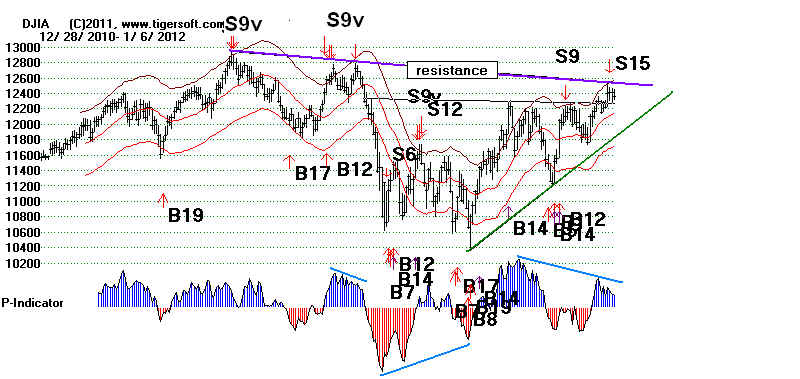

DJIA 2011-2012 - 12900 Being Challenged.

DJIA 1977-1978 Steep A/D Line Uptrend

Break was Bearish.

DJIA 2001-2002 Steep

A/D Line Uptrend Break was Bearish.

Watch QQQ

The QQQ has now reached its July peak. Watch to see if it

can breakout. Even if not

the NYSE A/D Line's strength should bolster the market.

LOW PRICED SPECULATION: US BASED GOLD STOCK

SFEG - Santa Fe Gold

http://www.santafegoldcorp.com

53 employees

http://finance.yahoo.com/q/pr?s=SFEG.OB+Profile

300,000 shares

purchase din last 6 months. None sold.

Insiders own 40%.

Institutional holders own 1%

SFEG is a very highly accumulated low priced stock which

shows lots of Professional

buying. It is thin. So buy it carefully.

Its story is that it now has significant amounts

of gold going to a refinery and has ample financing, along

with steady insider buying.

Not many stocks show such high levels of Accumulation.

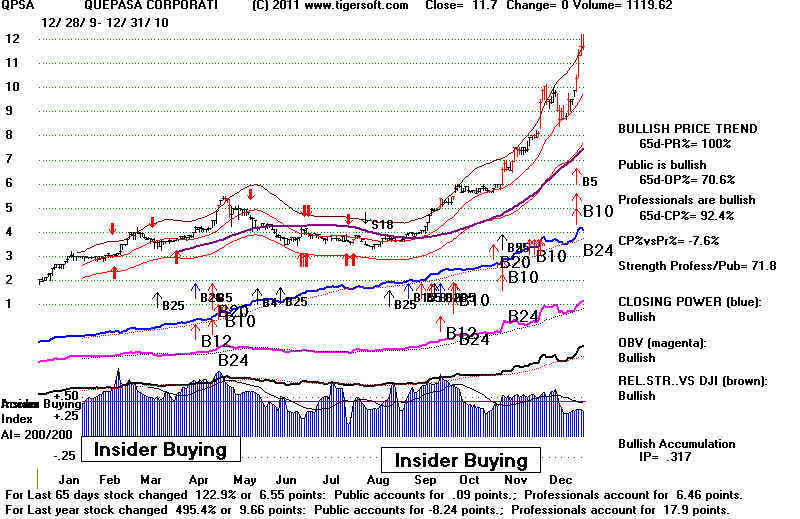

The last one that looked like

this was QPSA. It went from $2 to $15. Compare

the chart of SFEG now with QPSA

back in 2010. TigerSoft's Blog SFEG Charts:

2001 to 1-15-2012

That SFEG is way below the radar screen of the big boys is

very good. And as

a gold stock based entirely in the US, it should be a lot

safer than companies that must

deal with populist discontent, threats of nationalization

and the necessity of bribing

politicians. Its production costs are half what NEM's

are per ounce of gold. So, it may

be attractive as a take-over bid after a suitable rally,

say, to $5 or $10.

SFEG is the best looking low priced stock since QPSA at

$2.00 on its way to $15.

Compare it with ANV below, too. ANV shows how fast

and far a US gold stock

can rise.

| 2011-2012 SFEG multiplied

by 100 for better scaling. The next edition of TigerSoft will multiply low priced stocks by 100.  |

2010 QPSA on its

way to $15. |

2019 ANV on its way

to $46 in 2011. |

=====================================================================================

OLDER HOTLINES

=====================================================================================

1/23/2012 DJI = 12709 -12 la/ma=1.025 21-dma

ROC=.582 P= 580 (-89) IP21= .202 V= +82 OP= .288

1/23/2011 BREADTH STATISTICS:

89 (-5) MAXCP stocks Bullish MAXCP Stocks Bullish.

0 SUPER2011 Stocks making New

Highs

38 (-23)

MINCP stocks Bearish MINCP Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

30 (-11) new highs on NASDAQ. 7 (+5) new lows on NASDAQ Bullish.

56 (-36) new

highs NYSE 6 (-7) new lows on NYSE Bullish.

1/20/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY

TigerQQQ GLD SLV Crude Oil

Reversing Buy B10 and The FED

Should Send DJI up closer to

12900.

The Closing Powers Are Stil Rising

So are the ETFs' Opening Power. This is the most bullish of

configurations.

Until the Closing Power breaks its uptrend, there can be no real short-term decline.

And until it violates its 21-day ma, there can be no intermediate-term decline. I

would

let the Buy B10 have every chance to get the DJI past 12900. At the round number

13000, we may have problems. But seasonality is 60% bullish for next two weeks

and 64% for the next week.

Bullishly there are 89 stocks whose Closing Powers are making new highs.

Only

38 show Closing Power new lows. Professionals are sticking with the rally.

The Rising Market Tide Is Lifting Nearly All Industries.

21 one of the 24 Stock Groups and Industries we track have more

than 50%

of

their components above their 65-dma. It is not clear where new downside

"leadershp"

would

come from. Probably energy stocks. Lower energy costs would help the economic

recovery, as long as they do not signify world-wide Deflation.

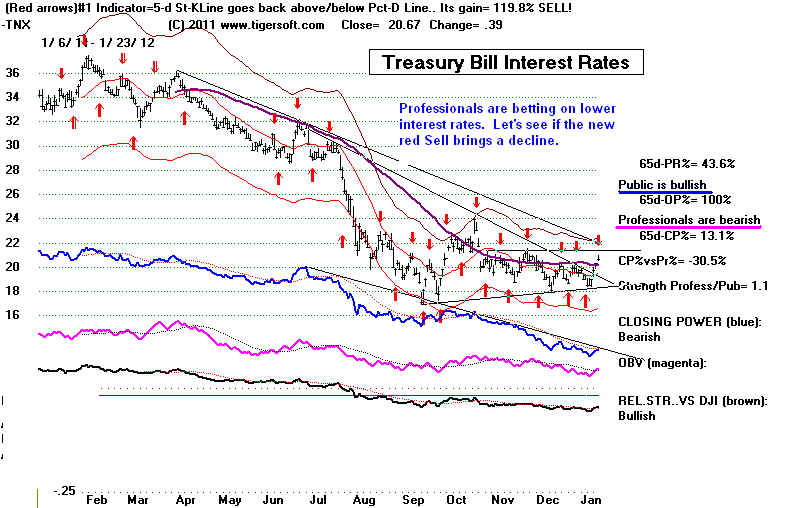

Low Interest Rates Are Bullish

But 10-Year Rates

Did Rise Today above Their 65-Day MA

I doubt if interest rates are about to rise up much. But

watch them...

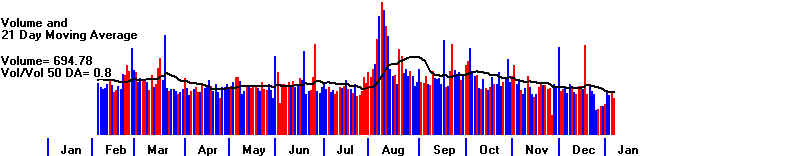

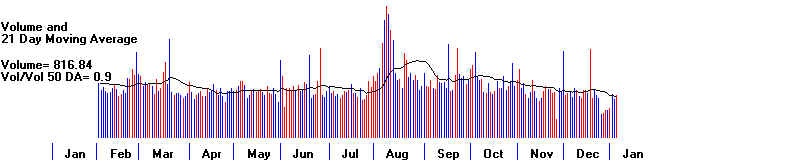

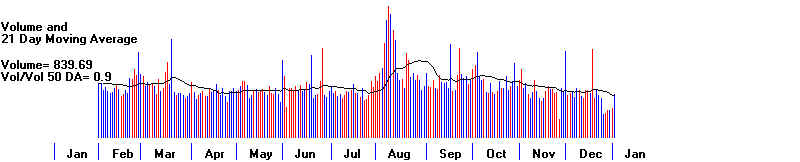

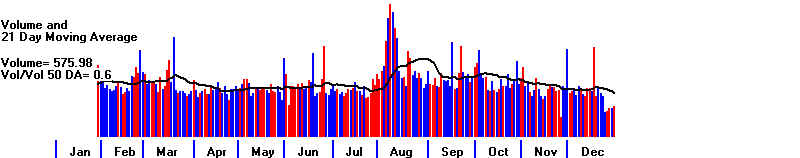

Volume remains very low. Joe

Granville has issued a major sell today because it. Two years

ago, Robert Prechter of Elliot

Wave fame did the same and has been wrong since. I think

that

Granville is making a similar mistake, though he is correct that nominal new closing highs

often

bring

reversals and that 20 of the 30 individual DJI stocks now show recent new highs that have

not

been

confirmed by OBV making a corresponding new high. He thinks the DJI will fall by

4,000

points in

2012. If there is a decline, the rising 65-day ma near 12000 should act as support.

I think the

market's gradual rise means a more sustainablble advance.

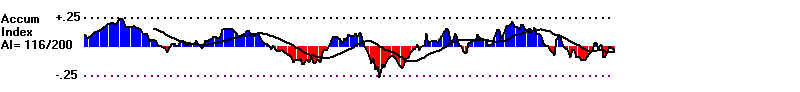

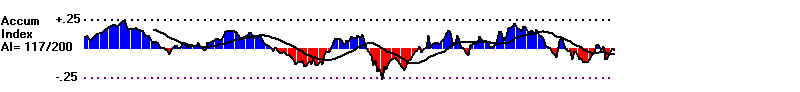

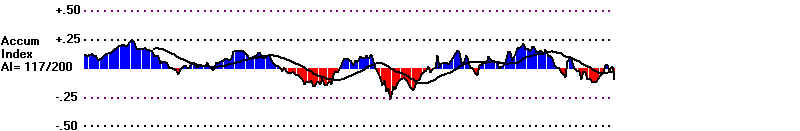

The very

high Accumulation readings on the DJI now (>.25) are two times more associated with a

continuing

rally of more than 3% or a new bull market than a decliue to the lower band and

a 3% paper

loss or less.

| High Accumulation (>.25) is Bullish 1 7/24/2009 . DJI moved much higher Big Loss 2 4/2/2003 . DJI moved much higher Big Loss 3 2/6/1996 DJI moved much higher. Big Loss 4 2/6/1991 DJI moved much higher. Big Loss 5 12/2/1987 DJI fell only to MA and then moved much higher. Big Loss 6 2/21/1986 DJI kept rallying Big Paper Loss 7 8/13/1979 DJI rallied for a month, rallying 4%. It then fell below lower band on Sell S9.. 8 9/21/1973 DJI rallied for a month, rallying 74%. It then fell below lower band on Sell S9.. 9 11/23/1963 DJI kept rallying Big Paper Loss 10 11/23/1963 DJI kept rallying Big Paper Loss 11 7/30/1958 DJI kept rallying Big Paper Loss 12 7/8/1954 DJI kept rallying Big Paper Loss 13 8/10/1951 DJI kept rallying Big Paper Loss 14 12/27/1949 DJI kept rallying Big Paper Loss 15 12/14/1949 DJI kept rallying Big Paper Loss 16 10/26/1949 DJI kept rallying Big Paper Loss 17 10/11/1949 DJI kept rallying Big Paper Loss 16 7/29/1949 DJI kept rallying Big Paper Loss |

High Accumulation (>.25) is

Bearish 1 8/2/2010 .DJI declined to lower band in next month. No paper loss if DJI shorted. 2 12/1/2010 .DJI advanced 3% and then fell to lower band in 2 months. 3 11/22/2002 .DJI advanced 3% and then fell to lower band. 4 8/20/2001 .DJI advanced 3% and then fell below the lower band. 5 10/21/1988 DJI fell to the lower band. No paper loss. 6 8/30/1987 .DJI advanced 2% and then fell below the lower band. 7 9/4/1986 .DJI fell 10%. No Paper Loss. 8 9/21/1973 .DJI fell below the lower band in 6 weeks.

|

Granville's Record

Granville's

creation, OBV, is a cumulative Volume line that goes up or down depending

on whether

prices rise or fall from the previous day. The weakness here is that OBV is

crude,

because it

adds or subtracts 100% of the volume no matter how small or large the daily change is

or whether

prices opened high or low... Granville can be very good and also very bad in his

predictions.

http://www.amazon.com/Granvilles-New-Stock-Market-Profits/dp/0133634086

http://www.amazon.com/Granvilles-Strategy-Market-Timing-Maximum/dp/0133634329/ref=pd_vtp_b_1

He was

completely wrong at the start of the 1982 bull market. He did not factor in the

"artificial" but

steep Fed

drop in interest rates. He remained bearish for years. Despite this, respect

him and

his ability

to move prices for a few days, as on Janaury 7, 1981. Granville taught people like

me that

stock

market tops could be correctly called. In this he and Larry Williams were mentors

and

inspirations. But Old Joe forgets that his famous book. Keys to Stock Market

Profits, actually

said that

the NYSE A/D Line was more important than his own On-Balance-Volume.

It is the

NYSE A/D Line strength born of very low interest rates that has boosted the

stock

market while Main Street Unemployment remains so high and Hourly Wages so low.

See how important

the Daily A/D Line was in the 2009-2012 advance. Look at the Daily A/D

line in the DJI

chart just below. It is making new highs far ahead of price. It shows

a bullish

divergence. This is even clearer when we view the weekly chart of the DJI

(second chart

below). The Weekly A/D Line has bolstered the bull market, despite the

many frustrated

critics, who cry out that the stock market's rally is "manipulated" and

made

"artificial" by low interest rates and deficit spending. Of course, the

stock market

is manipulated.

This is nothing new. Bull markets are launched by the Fed as much as

by inventions

like cars and the internet. See my discussion of the role of the Fed in 1970

and 1982. http://www.tigersoft.com/tiger-blogs/8-18-2003/index.htm

Bernanke and the

FED are supposed to, by their 1913

charter, bolster the banks in

hard times and

reduce business cycles with monetary policy. (My complaint is that they

do this secretly,

play favorites and impose NO lending conditions on the big banks.)

Tea-Party people,

I think, are the tools of those who want who own polluting industries, like

the Koch Brothers

do, who do not want to spend money on air scrubbers or abide by laws

to protect

waterways from their paper mill spills. The Kochs are eager to buy Wisconsin

publicly owned

utilities as cheaply as possible.

The larger fact

is that the Government is 1/3 of the entire US economy. The Bush years show

reducing

regulations and putting more money into the Swiss bank accounts of the top 0.2%

creates very few

more decent jobs in the US. Quite the contrary. Worse, it produced a

Bubble of

over-speculation in in mortgage debt, housing, energy and many stocks.

The 30,000

lobbyists in Washington DC prove that corporations need and want government

help. They

want cushy government contracts.

NOTE: The B13 has been added because of the

Santa Claus rally Buy we discussed ont he Hotline. This B13

will be part of the next release. If breadth is improving, the B13 can reverse

a Sell S9. If it is not improving,

as in December 2007, the Buy B13 is suppressed.

WEEKLY DJIA

=====================================================================================

OLDER HOTLINES

=====================================================================================

1/20/2012

DJI = 12720 +97 la/ma=1.028 21-dma ROC=.922 P= 669 (+105) IP21= .253 V= +116 OP= .392

DIA' s CP is uptrending A close

1.78 BELOW its opening would bearishly break the CP uptrend QQQ's CP is uptrending.

It will take a close of more than

I am impressed with how the DJI keeps rising despite the bearish seasonality for the last

week. Now the historical seasonality turns bullish. Since 1965, the DJI has

risen 64.4%

of the time in the week following January 22nd. Over the next ten days, it has risen

1% on average per year.

Chasing is difficult. I realize. But it is necessary, especially in January, to

stick with the

trend. The four earlier January B10s average gains of 15%. The Closing Powers

are

rising. A move to a new recovery high at 12900 seems highly likely. Fighting

the Feds-

Obama-Big Bank Financial Junta at this time is risky. Interest rates are low because

these people want a continued economic recovery to stay in power. Even Day Traders

are buying at the opening. There is more upside potential after the opening than

risk.

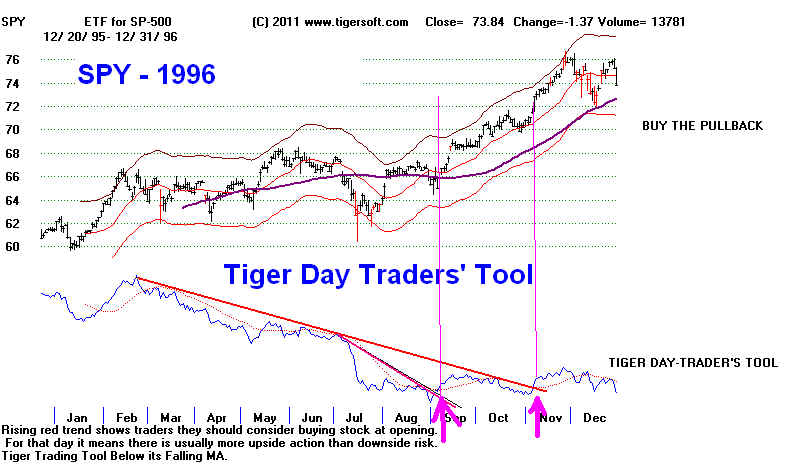

Their shift is shown in the breakout by the Tiger Day Traders' Tool.

This is reliably

bullish.

Only 3 of

the industry groups we follw still shows a plurality of stocks below their 65-day ma.

One is Food Commodities, which means inflation is not a threat to

the Fed' low interest rates'

policy.

Another are Gold Stocks. As these rise with

financial uncertainty and gathering inflation,

this is a

bullish sign. We should keep an eye on interest rates,

however. A rise in them would

drop the

many stocks and bonds on the NYSE that are rising because the Fed has promised

very low

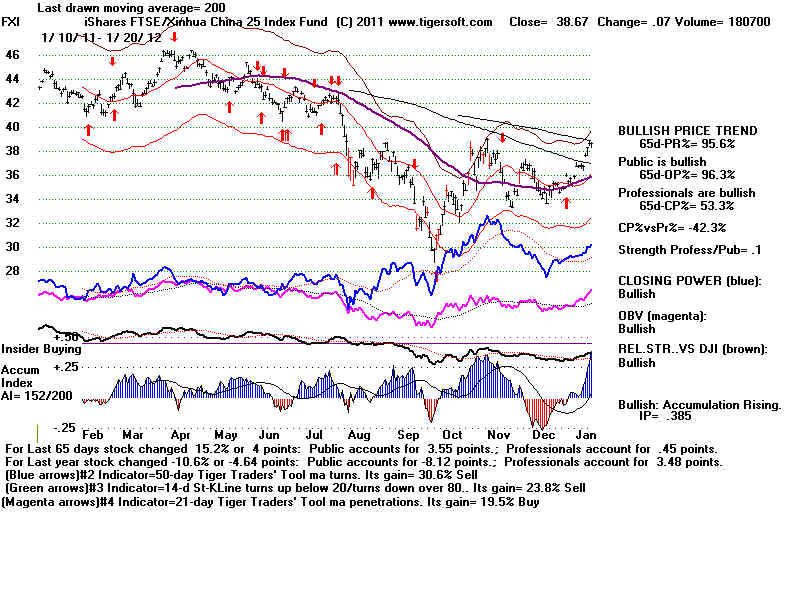

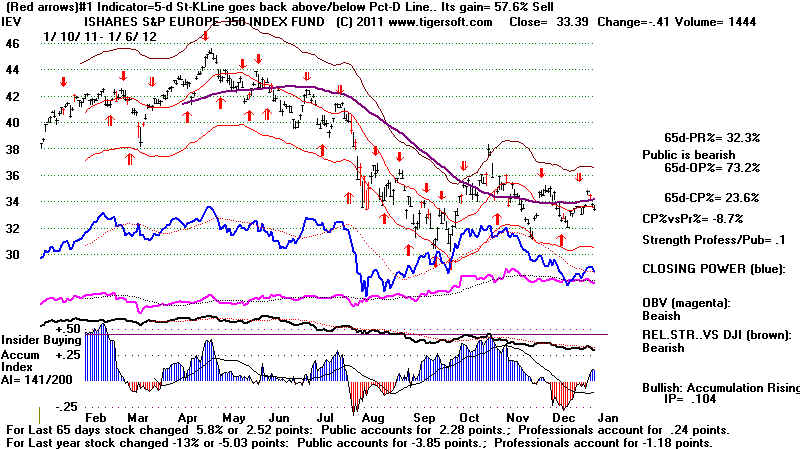

rates until 2013. Overseas markets have turned up, too. 82% of the 60 foreign ETFs

that we use

to build the Tiger ETFs' chart below are above their 65-day ma. FXI - the Xinhua

China

25 is the

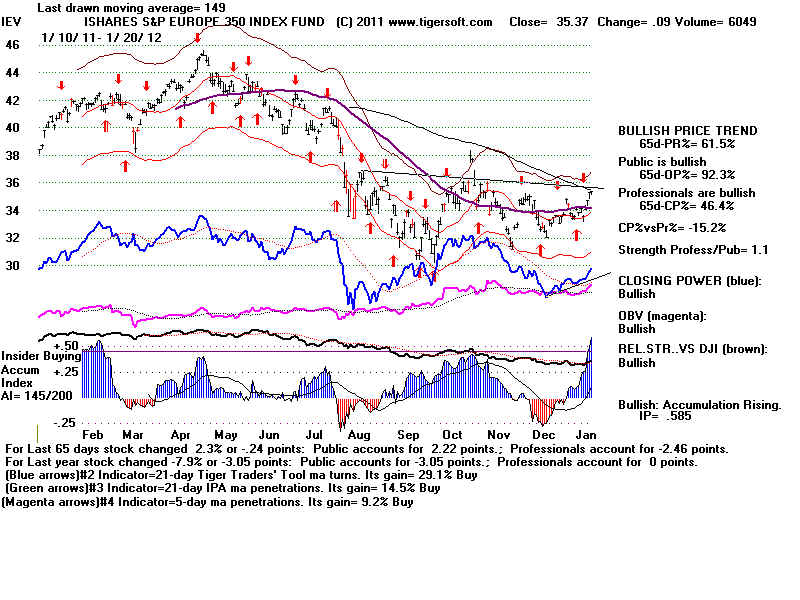

most bullish, as ranked by Tiger. Even Europe's IEV has risen back to its 149-day

ma.

. The biggest gainers

among ETFs for the last 65 trading days have reached resistance levels.

The DJI-30 and the QQQ will probably

have to lead the advance now, if it is to continue. I would

expect the

DJI to reach a nominal new high near 12900. If it moves up in relative isolation,

there

will

probably be a Peerless Sell signal there.

EWZ - Brazil +15% at falling 200-day ma

Peerless and

Brazilian Stocks

FXI - Xinhua +15% (China) at falling 200-day ma

ILF - Latin America +11% at falling 200-day ma

Peerless and

Latin American Stocks

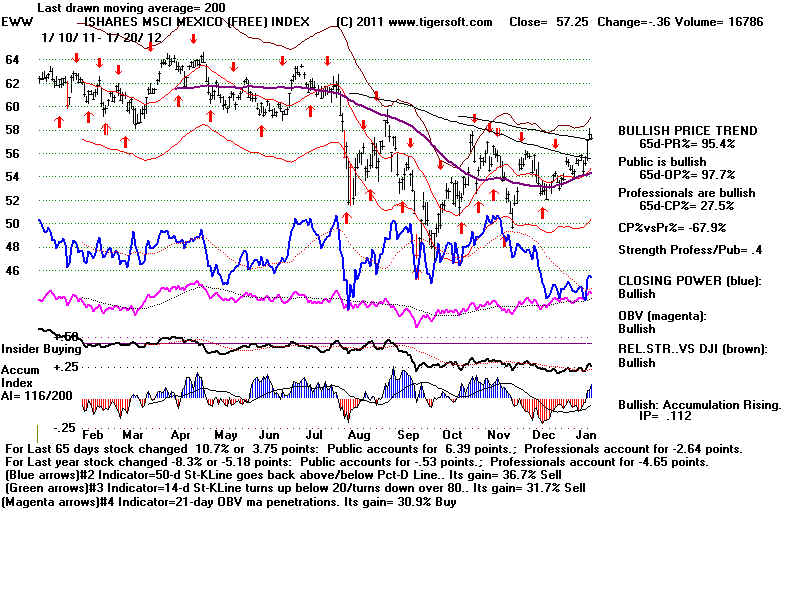

EWW - Mexico 10% at falling 200-day ma

Profitably

Trading Mexican Stocks

See Which Country ETFs

Have Worked Best with Peerless Automatic Buys and Sells since 1996?

$1,000 would have

become $100,000 in 15 years.

FXI - Xinhua

+15% (China) at falling 200-day ma  |

Europe's IEV |

EWZ - Brazil

+15% at falling 200-day ma  |

ILF -

Latin America +11% at falling 200-day ma |

EWW - Mexico

10% at falling 200-day ma |

=====================================================================================

OLDER HOTLINES

=====================================================================================

1/19/2012 DJI = 12624

+45 la/ma=1.024 21-dma ROC=.734 P= 564 (+10) IP21= .188

V= +84 OP= .286

Reversing Buy B10 Reigns Now.

Volume could certainly

be higher, but breadth is good

and the Closing Power

trends are now rising. The DJI

does face generally

bearish seasonality for the next week.

Since 1965, the DJI has

risen only 40% of the time in the

week after January

19th. Our Stocks' Hotline is more than 2:1

bullishly hedged.

DIA' s

CP is uptrending

A close 1.02 BELOW its opening would bearishly break the CP uptrend

Opening Power is rising.

SPY's C's is uptrending.

It would take a Close 1.19 BELOW the Opening to break the uptrend

Opening Power is rising.

QQQ's CP is uptrending.

It will take a close of more than 0.46 BELOW the

Opening to break the short-term CP UP-trendline.

Opening Power is

rising.

GLD's CP broke its down-trendline

and is considered uptrending.

it would take a close of

1/19/2012 BUY B10s Do Successfully Reverse Earlier Sells Narrative of Hotline

DIA's late 1999 CP recovery and breakout

|

DIA's late 2005 and early 2006 CP recovery and breakout |

Tiger Index of Foreign ETFs |

Tiger Index of Big Banks |

Tiger Index of Home Building |

==============================================================

1/18/2012 DJI = 12579 +97 la/ma=1.023 21-dma

ROC=.69 P= 553 (+46) IP21= .125 V= +95 OP= .107

Reversing Buy B10

Today. Excellent A/D Line but volume was low.

12800-12900 is the next target.

1/18/2011

BREADTH

STATISTICS:

110 (+42) MAXCP stocks Bullish MAXCP Stocks Bullish.

2

(-1) Super-2011 Stocks making New Highs

65 (-57) MINCP stocks Bearish MINCP

Stocks

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

57 (+21) new highs on NASDAQ. 7 (-12) new lows on NASDAQ Bullish.

86 (+27) new

highs NYSE 9 new lows on NYSE Bullish.

1/18/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ GLD SLV Crude

1/18/2012 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

DIA' s

CP is uptrending

A close 0.87 BELOW

its opening would bearishly break the CP uptrend

Opening Power is rising.

SPY's C's is uptrending.

It would take a Close 1.12 BELOW the Opening to break the uptrend

Opening Power is

rising.

QQQ's CP is uptrending.

It will take a close of more than 0.46 BELOW the

Opening to break the short-term CP UP-trendline.

Opening Power is

rising.

GLD's CP broke its down-trendline

and is considered uptrending.

it would take a close of 1.22 ABOVE the Opening to

break this CP-UP-trendline.

Opening Power is rising.

1/18/2012

Narrative of Hotline

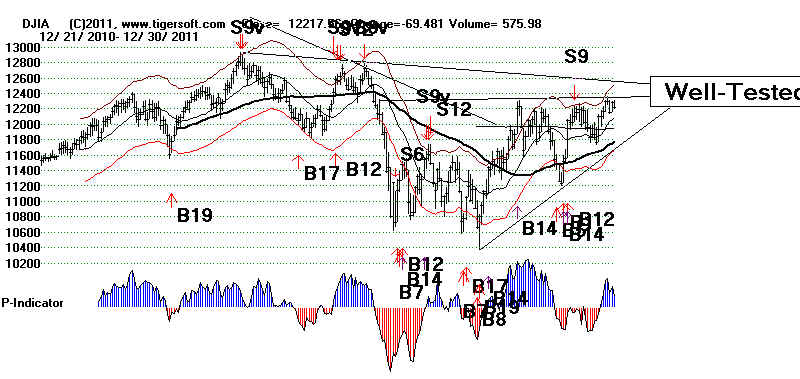

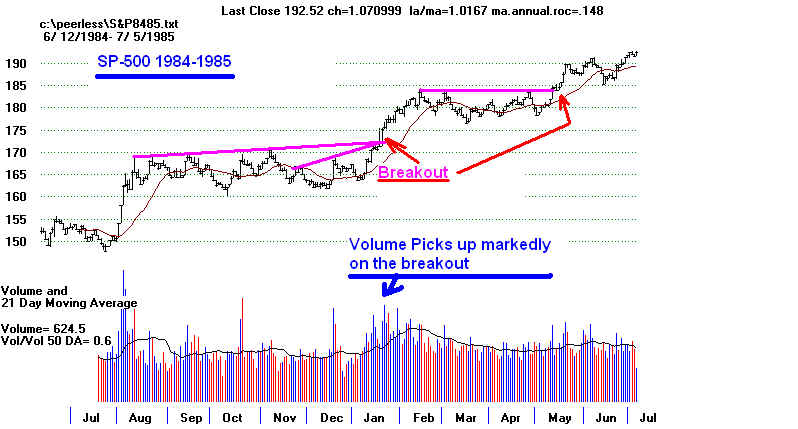

Today brought a Buy B10 from Peerless. This

repepresents a breakout and close above well-tested,

flat resistance that goes back at least 40 trading days.

The P-Indicator and current Accumulation

Index must be quite positive. See http://tigersoft.com/PeerInst/-Buy-B10.htm

Automatic B10s average gains

in the DJI of about 10% when next reversed by an automatic

Sell There have been 4 January Buy B10s.

These averaged a DJI gain of +15.9%

at the time of the next Peerless Sell. See the FIRST TABLE below.

It is best to accept the small loss

now in the short of DIA and any short sales whose Closing Power has

broken out above its downtrendline or above the 65-dma.

Following our suggestion, one would have

shorted on Monday's opening at 125.04 and closed at today's

close at 125.62. Consider buying the most

bullish (as ranked by the Power Ranker) of the Home-Building, Biotechs, Pipe-Line and Super-2011

Stocks.

HOME BUILDING: HD

44.88 NVR 752.7

BIOTECHS:

PCYC 16.39 BMRN 36.03 ELGX 12.48

PIPELINES: MWE 56.39,

WES 39.28

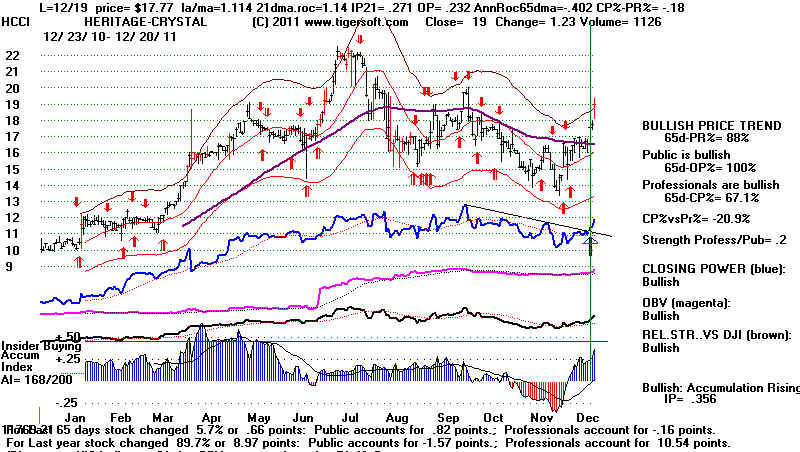

SUPER 2011: PCYC

16.39, AKRX 11.56, HCCI 20.86

With the Buy B10, we must expect the general market to rise

further. Buy B10s have 4 times reversed a

Peerless Sell Signal, like now. Only one brought a paper

loss. All of these brought significant gains.

Three of the four brought gains of more than +17%.

See the SECOND TABLE below and the charts of

these four cases.

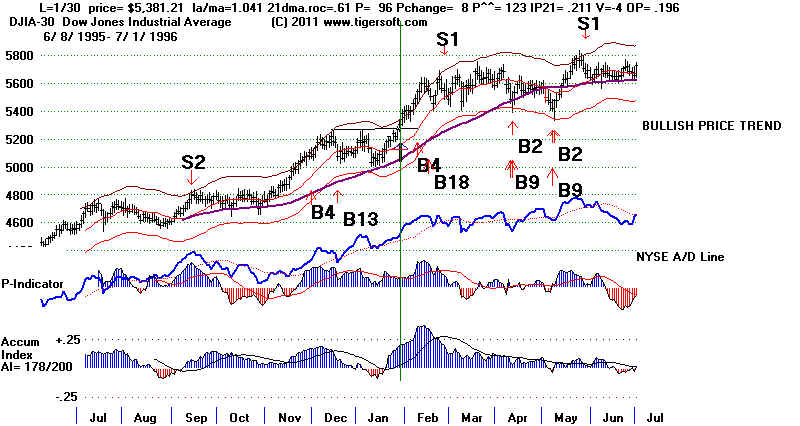

FIRST TABLE

JANUARY B10s were all profitable.

1/18/2012 DJI = 12579

la/ma

21-dmaROC P-I Change

IP21

V-I Opct.

1.023

.69

P= 553 (+46) .125 +95 .107 (low)

1/13/1967 835.13 +4.0%

la/ma 21-dmaROC P-I Change IP21 V-I Opct.

1.039 .273 135 21 .07 5 .221

Bottom formation B10 after a Bear Market. DJI rose immediately. No paper loss.

... Reversed at 968.49 on 3/16/67 by S12

|

1/7/1976 898.69 +12.3%

la/ma 21-dmaROC P-I Change IP21 V-I Opct.

1.054 1.124 286 35 .20 2 .536

DJI rose immediately .. Reversed at 1009.21 on 3/24/76 by S9 No paper loss.

|

1/12/1989 2222.32 +24.7%

la/ma 21-dmaROC P-I Change IP21 V-I Opct.

1.023 .454 118 21 .078 11 .185

DJI rose immediately ... No paper loss...Reversed at 2771.09 on 10/4/89 by S9

|

1/31/1991 2736.39 +22.6% la/ma 21-dmaROC P-I Change IP21 V-I Opct. 1.058 .58 143 33 .116 12 .218 DJI rose immediately ... Reversed at 3353.76 on 4/15/92 by S9 |

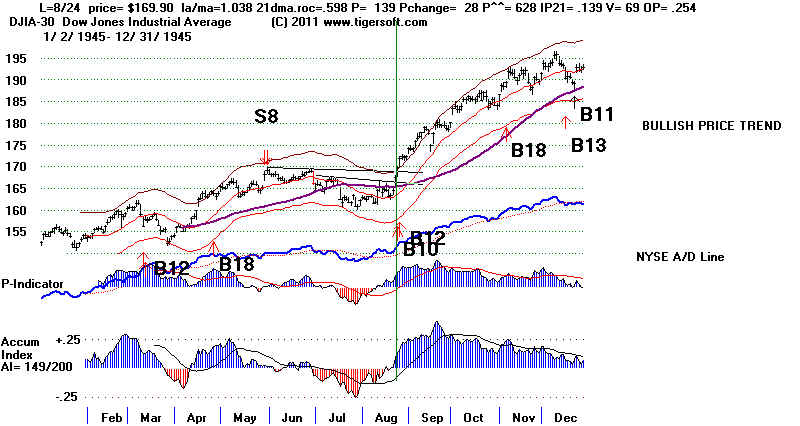

SECOND TABLE

Buy B10s have profitably reversed 4 Peerless

Sells.

Sell S8 5/28/1945 164 -1.0% On-Going Bull Market

BUY B10 8/24/1945 169.9 +17.2%

SELL S9 1/7/58 447.8 -2.4% Bear Market Bottom

BUY B10 2/4/58 458.7 +41.7%

SELL S2 9/3/68 900.36 -3.9% On-Going Bull Market

BUY B10 9/30/68 935.79 +4.5%

Sell S9V 8/12/96 5794.98 -2.3% On-Going Bull Market

Buy B10 9/13/96 5838.52 +17.0%

Buy B10 8/24/1945 169.9 +17.2%  |

Buy B10 2/4/58 458.7 +41.7% |

Buy B10 9/30/68 935.79 +4.5% |

Buy B10 9/13/96 5838.52 +17.0%  |

==============================================================

OLDER HOTLINES

==============================================================

1/17/2012 DJI = 12482 +60 la/ma=1.018 21-dma

ROC=.641 P= 507 (+96) IP21= .068 V= +80 OP= .118

1/17/2011

BREADTH

STATISTICS:

68 (-10) MAXCP stocks Bullish MAXCP Stocks

NEW 3 Super-2011

Stocks making New Highs

112 (+35) MINCP stocks Bearish MINCP

Stocks

Bearish.

MAXCP stocks are those showing

Tiger Closing Power making new highs.

This suggests heavy Professional Buying. Applying the Tiger Power Ranker's

"bullish" to the MAXCP stocks find those with heavy insider buying and

institutional accumulation. Bearish MINCP stocks show the opposite.

36 new highs on NASDAQ. 19 new lows on NASDAQ Bullish.

59 new

highs NYSE 19 new lows on NYSE Bullish.

1/17/2012 GRAPHS ===> See Key Peerless TigerSoft

Index Charts: Industry Groups and ETFs

DIA SPY QQQ DJIA-Peerless TigerDJI TigerSPY TigerQQQ GLD SLV Crude

1/17/2012 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

DIA' s

CP's is flat A close 0.53 ABOVE its opening would be a CP breakout.

Opening Power is rising.

SPY's CP broke its uptrend.

It would take a Close 1.00 ABOVE the Opening to

restore the CP uptrend. Opening Power is rising.

QQQ's CP bullishly still above its UPTrendline.

It will take a close of more than 0.17 BELOW the

Opening to break the short-term CP UP-trendline.

Opening Power is

rising.

GLD's CP longer-term trading

DOWN-trendline is being challenged.

it would take a close of only 0.19 ABOVE the Opening to

break this CP-DOWN-trendline.

Opening Power is rising.

1/17/2012

Narrative of Hotline

Operative Peerless Signal is still a Sell S15.

S15s have always been profitable. The biggest Paper loss selling short the DJI with

one

was only 3%. See http://tigersoft.com/PeerInst/-SellS15.htm

A turning down now by prices would show that the Resistance

the DJI has neen reached and the Bearish Seasonality for the next two weeks

has won out. Unless the DJI can close clearly above the resistance line,

at 12550, the risks now are greater than the upside potentia. The number

of stocks making CLosing Power 52 week lows is almost twice the number

making new highs. This remains a defensive market. Utility stocks,

Pipeline stocks, Biotechs

and Bonds are the favored groups, along with

the exceptionally high performance stocks of 2011 (SUPER2011).

I thnk it is clearly bearish that IBM, the highest priced and most heavily weighted

DJI-30 stock shows a head/shoulders pattern with confirming red Distribution on

the right shoulder.

IBM Head/Shoulders, S9, S7s

Shorting the bearish MINCP stocks and buying some of

the Bullish MAXCP stocks

has been our strategy, rather than shorting DIA, until this Monday's opening, when

shorting was recommended of DIA. Hold the shorts

for now. The Openings have

been carrying the market higher, not the trading after the opening. This past year

has been unusual in that. Better gains this past year have generally been had

waiting

for the Opening Power to break its uptrend rather than CLosing Power uptrend-breaks.

The Opening Power uptrend is still rising, but its steep uptrend is becoming jagged and

was briefly

broken Friday.

DIA's Rising Wedge Pattern is Bearish.

Weak Closing Power and Rising Opening Power

A DIA close more than

0.53 above the Opening would be a CP upside breakout.

Selling when the Opening Power Broke its Trend-lines was profitable this past year.

Usually, weak closes and strong openings have meant Public Speculation or Overseas

Buying of US Stocks. Ordinarily this is bearish. But not always. I have

mentioned that

I believe that an Obama-Fed-Wall Street Financial Junta exists and may be buying Index

Futures

in overseas trading before the Opening to try to keep the rally alive. This

may be a new

version of "Don't Fight The Fed". Obama desperately needs a higher stock

market in 2012

to continue to get Wall Street backing in our Money-Is-Everything

Sytem now. And he

hopes that there will be enough trickle down jobs created thereby to get the millions who

are marginally employed to turn out and vote for him as they did in 2008.

Besides this, we do not want to be stubborn. .Professionals who do their buying

mostly

after the Opening in NY have been known to switch from bearish to bullish when

they see that the Openings are just too strong to fight. The CLosing Power now for

DIA and

SPY have broken their lengthy downtrends in this rally, but have not made upside

breakouts from their narrow trading range. If they do this, I would assume that the

Professionals have switched to buying and we should, too. For now, the odds are 2:1

that there will be a DJI decline, based on earlier cases when we saw such sizeable

divergence between a rising Opening Powe and falling Closing Power in the major market

ETFs. These divergences produce Tiger Stock Sell S7s. See the study a few

days ago.

I have emphasized the four year Presidential Cycle. I think we should again look

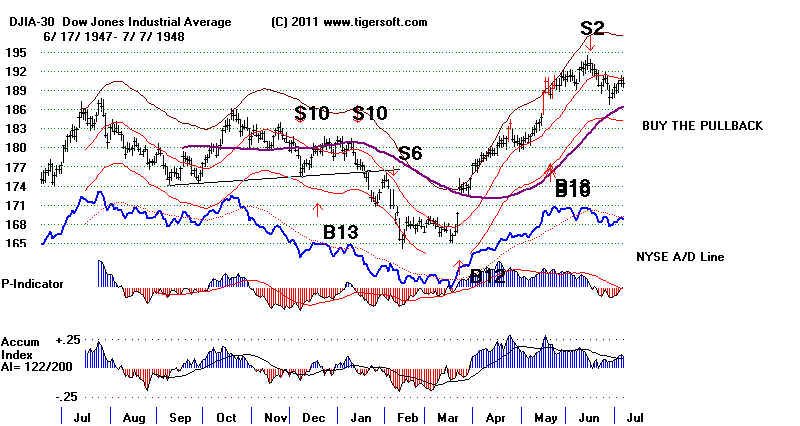

back at how the stock market has behaved with a Democrat in the White House

running for re-election. That means:

FDR in January 1936 --- Breakout without B10.

Truman in January 1948 --- Breakdown Sell S10s

LBJ in January 1964 --- Breakout without B10.

Carter in January 1980 - Multiple Sells and False Breakout

Clinton in January 1996. --- Breakout without B10.

Price breakouts in January and February of the Presidential

Election year

that did not bring Peerless Sell Signals went significantly higher. In early 1948 the

market broke down rather than up. In February 1980, it made a false breakout

comoplete with multiple Sells. To me this suggests that a

close above 12550 that

does not bring a new Peerless Sell should be taken as showing that the market

is too strong to stay short DIA.

FDR in January 1936  |

|

Truman in January 1948  |

|

LBJ in January 1964 (although one could also look at 1968)  |

|

Carter in February 1980  |

|

Clinton in January 1996.  |

=====================================================

OLDER HOTLINES

=====================================================

1/13/2012

DJI = 12422 -49 la/ma=1.016 21-dma ROC=.456 P= 411 (+18) IP21= .063 V= +52 OP= .012

1/13/2012 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

DIA' s CP's is flat A close 0.15 ABOVE its opening would be a CP breakout.

Opening Power is

rising.

SPY's CP is flat. It would take a Close 0.20 ABOVE the Opening to achive

an upside CP breakout.

Opening Power is rising.

QQQ's CP bullishly still above its UPTrendline.

It will take a close of more than 0.10 BELOW the

Opening to break the short-term CP UP-trendline.

Opening Power is rising.

GLD's CP longer-term trading

DOWN-trendline is being challenged.

it would take a close of only 0.15 ABOVE the Opening to

break this CP-DOWN-trendline.

The Opening Power is rising

again.

1/13/2012

Narrative of Hotline

| WHAT MARKET MAKERS KNOW A cutomer sent me a Zero-Hedge Link showing the "profitability of being long Gold in the overnight session and shorting it during the day". We have these statistics available using Peercomm + Charts 2011 + GO1600 (Gold Perpetual contract) + Ind.3 + Tiger Basis of Move. Whereas, they are taling about an annualized gain of 43% a year, in theory where commisssions and slippage are not factors, we can achieve a gain twice as large using the trend of the 21-day ma of Opening and Closing Power to decide whether to go long or short. See the Tiger chart below for just the last 12 months. The results here are typical. Bigger gains are made with individual Gold and Silver Stocks. See NEM, PAAS and ANV. Compare these results with DIA and QQQ, too. The problem of slippage and commissions would have to be factored in before using this approach. Market makers are in the best possible position to use this approach. Commissions are zero and the slippage they can strictly limit. Tiger Users have to find trading vehicles with bigger gains than the ones shown by Gold or DIA below. In the attached chart GO1620, we see a breakdown that improves the results. Openings above its 21-day ma 148 X .002 = .296 or 29.6% In this case we would go LONG at the "Close" in NY and Sell at OPening in NY for Gain of +29.6% Openings below its 21-day ma 88 X -.001 = - .088 or -8.1% In this case we would go SHORT at the "Close" in NY and Cover at OPening in NY for Gain of +8.1% Closings above its 21-day ma 139 X .003 = .417 = 41.7% In this case we would go LONG at the Opening in NY and Sell the position at the "Close" for Gain of +41.7% Closings below its 21-day ma 97 X -.003 = - .291 = -29.1% In this case we would go SHORT at the Opening in NY and Cover the position at the "Close" for Gain of 29.1% ------------------------------------------ Sum = over-night gains + NY session gains Sum = (29.6 + 8.1%) + (41.7% +29.1%) Sum = 37.7 + 70.8% Sum of Gains = +108.5% .GOLD PERPETUAL CONTRACT - B21 and S21s shown when both Openings and Closings are above their ma and vice verse. See the statistics at bottom of chart that TigerSoft generates. The Summation stats will have to be programmed.  |

NEM - Gold Stock |

PAAS - Silver Stock |

ANV - Gold Stock |

QQQ |

=====================================================================

OLDER HOTLINES

=====================================================================

1/12/2012

DJI = 12471 +22 la/ma=1.022 21-dma ROC=.439 P= 392 (116) IP21= -.007 V= +43 OP= .0041/12/2012 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

DIA' s CP's IS

now above its CO down-trend-line A close 0.10 BELOW its opening would restore the

CP DOWNtrend. Opening

Power is rising.

SPY's CP's minor

UPtrend-line is restored. It would take a Close 0.26 ABOVE the Opening to achive

an

upside CP breakout.

QQQ's CP bullishly still above its UPTrendline.

It will take a close of more than 0.08 BELOW the

Opening to break the short-term CP UP-trendline.

Opening Power is rising.

GLD's CP longer-term trading

DOWN-trendline is being challenged.

it would take a close of only 0.23 ABOVE the Opening to

break this CP-DOWN-trendline.

The Opening Power is rising

again.

1/12/2012

Narrative of Hotline

NYSE A/D Line is

streaking to new highs ahead of the DJI. This is bullish short-term.

But the DJI needs to penetrate the resistance

line it has reached. S15s are very reliable,

but can bring as much as a 3% paper

loss. A reversal down tomorrow would show the resistance

has overcome the low volume buyers. The

rising 65-dma as 12000 would be expected support.

Traders will be nervous about holding positions

over the weekend with US-Israeli tensions with Iran so high

HOW LONG CAN THE MARKET RALLY AGAINST AN S15

BASED ON RISING OPENINGS ALONE?

If the DJI can breakout

above the resistance it has now reached.

it can advance perhaps 2.5% more and for 6-7 weeks

more. Read the details below....

We remajn hedged, but we are not yet short the major

market ETFs despite the Peerless Sells.. A reversal

from resistance tomorrow would probably get me to

advise shorting DIA. But let's await market

action....

The biggest paper loss in the case of past

Sell S15s was 3%. In our case the Sell S15 occurred

with the DJI at 12418.42 on January 4th.

The DJI is now 53 points and only 1/2% higher than where

it was when the Sell S15 occurred. The

could move up another 250 points and tag the 12500 resistance

and still be within the range of past S15s.

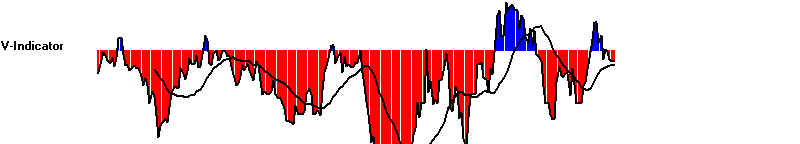

TIGER SELL S7s SHOW EXTREME DIVERGENCE BETWEEN

RISING OPENING POWER AND CLOSING POWER

The Opening Power for the DIA (and the other

major market ETFs) has been rising since November

30th even though the Closing Power has been

falling. For the last 30 trading days we have seen this

widening divergence. The divergence

causes Sell S7s to appear. A cluster of two weeks or more

Sell S7s is usually, but not always bearish.

The ratio of significant declines to significant rallies

after a cluster of consecutive Sell S7s is

10:3. See the tables below and the charts that are linked to.

You can see that there are in 4 cases the

cluster of S7s lasted between 7 and 13 weeks.

Sell S7s can be placed on the DIA chart

using the first choice under Ind-3 to show this divergence.

Our software measures the divergence in a way

that permits comparisons with the past. Tiger calculates

how far from its 65-day low to its 65-day high

are PRice, Opening Power and Closing Power are.

That is the meaning of the terms 65day-PR%,

65day-OP% and 65-dayCP%.

The values of each are shown on

all initial TigerSoft stock charts. For the DIA those numbers are:

65day-PR% = 100% (Price is at its 100-day high)

65day-OP% = 99% (Opening Power is 99% of the way up from its 100-day low to its

high)

65-dayCP% = 19.9% (Closing Power is 19.9% of the way up from its 100-day

low to its high)

We measure the divergence between the

CLosing Power Pct and the Opening Power Pct.

CP%-Pr% = -80.1% (19.9%-99%)

Tiger B7s show

when there is a bullish CP%-Pr% divergence greater than +.37 and

Tiger S7s show

when there is a bearish CP%-Pr% divergence with a value below -.37.

| STRINGS OF

CONSECUTIVE DAY SELL S7s ON DIA: 1998-2011 In 10 of 13 cases, the DJI fell at least 5% before it rallied more than 4%. In 4 of 13 cases, the cluster of consecutive Sell S7s lasted 7 to 13 weeks. #1 5/6/98-6/10/98 (5 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 5/14/98 1.009 -.026 .042 -.33 -.33 DIA fell 5%, from 91.81 to 86 (149-day ma) ---------------------------------------------------- #2 6/25/98-7/29/98 (5 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 7/15/98 1.029 .864 .153 .411 -.72 DIA fell 20% ---------------------------------------------------- #3 6/9/99-9/14/99 (13 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 8/24/99 1.037 .493 .161 .065 -.43 DIA fell 10% from peak on 8/25/99 ---------------------------------------------------- #4 11/2/99-1/27/00 (12 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 11/17/00 1.047 +1.294 .07 .615 -.71 small decl and rise 1/14/00 1.032 .549 .022 .47 -.56 top DIA rallied from 108 to 114 and then fell 17% ---------------------------------------------------- #5 5/8/02-5/23/02 (3 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 5/16/02 1.025 .091 -.031 -.037 -.41 BEAR MARKET FOLLOWS. ---------------------------------------------------- #6 7/31/03-9/2/03 (8 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 8/21/03 1.02 .306 .103 .284 -.56 8/22/03 1.006 .154 -.028 .136 -.73 After shallow decline to rising 65-dma, Bull market resumes. ---------------------------------------------------- #7 1/31/05-2/17/05 (3 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 2/15/05 1.024 .341 -.017 .099 -.45 3% DIA rally, then 7% decline ---------------------------------------------------- #8 12/9/05-3/2/06 (12 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 1/30/06 1.007 .251 .099 .288 -.35 65-DMA Acted as SUPPORT. Bull market resumes. Better to wait for new S9. ---------------------------------------------------- #9 8/14/06-9/5/06 (3 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 8/16/06 1.02 .546 .138 .066 -.73 9/5/06 1.017 .32 .145 .143 -.43 Bull market resumes. ---------------------------------------------------- #10 9/27/07-10/19/07 (4 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 10/9/07 1.028 .839 .188 .218 -.37 10% DECLINE by 11/26/07 ---------------------------------------------------- #11 6/9/08-6/18/08 (2 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 6/17/08 .981 -.61 -.192 -.068 -.48 SEVERE BEAR MARKET FOLLOWED ---------------------------------------------------- #12 12/22/09-1/6/10 (2 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 1/6/10 1.018 -.288 .058 .322 -.36 7% Decline ---------------------------------------------------- #13 4/20/11-5/24/11 (5 weeks) la/ma 21-dma-roc IP21 OPct CP%-PR% 5/2/11 1.022 .325 .142 .24 -.26 Top and 7% DIA DECLINE ---------------------------------------------------- #14 12/5/11-1/12/12 (6 weeks, so far.) la/ma 21-dma-roc IP21 OPct CP%-PR% 1/12/12 1.031 .503 -.026 .225 -.75 ========================================================== |

=====================================================================

OLDER HOTLINES

=====================================================================

1/11/2012

DJI = 12449 la/ma=1.022 21-dma ROC=.259 P= 275 P= -87 IP21= -.019 V= +8 OP= -.0881/11/2012 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

The Openings' CP uptrend is intact. The CLosing Powers have not established a

clear trend.

DIA' s CP's IS

now above its CO down-trend-line A close 0.10 BELOW its opening would restore the

CP DOWNtrend. Opening

Power is rising.

SPY's CP RESTORED its

UPtrend-line. It would take a Close 0.85 Below the Opening to

VIOLATE the

CP UPtrendline.

QQQ's CP bullishly still above its UPTrendline.

It will take a close of more than 0.05 BELOW the

Opening to break the short-term CP UP-trendline.

Opening Power is rising.

GLD's CP steep DOWN-trendline

was broken.

it would take a close of more than 0.78 BELOW the Opening to

break the new CPUptrend-trendline.

The Opening Power is flat.

Narrative of Hotline

You can see below that the DJI has now rearched well-tested resistance. This invites

profit-taking. But so far, there are so signs of a reversal. Even though, the

DJI fell today,

there were 344 more up than down on the NYSE and the NASDAQ and SPY rose.

Look below at the Tiger of the chart of NASDAQ-100. It is on the verse of a flat

topped

breakout. It uses volume x price to weight stocks, rather than capitalization

as the QQQ does. By itself, a breakout here would be bullish, but we show a Peerless S15

and our

major market ETF charts show three factors which are usually bearish:

1) low volume recenlty on the rally.

2) red Distribution and

3) Falling Closing Powers.

See these in the Tiger chart of the QQQ below or DIA or SPY.

The stock market may continue to rally for the reasons mentioned here, but the potential

for a reversal now is also high. Accordingly, our Stocks's Hotline is about evenly

hedged,

long and short. Until we see a much clearer break-down by the CLosing Power, a break

in the Opening Power Uptrend and the NYSE A/D Line, I would respect the potential for the

DJI to breakout above the resistance line it has reached and thereafter run to 12800.

So,

I would not short DIA, SPY or QQQ.

The markets have shown great strength given the worsening Middle East situation. But

it will not be able to do this if fighting breaks out. Without the US President

acting as a

peace-maker, violence is likely to escalate into war there again. Remember that an

assassination started World War I.

"The

Strait of Hormuz is the greatest choke point in the world." NY Times.

In December, Iran warned the US and Europe that any embargo imposed on Iran's oil exports

as a way to rein in its nuclear program would get Iran to close the Sraits of Hormuz.

Today a

fourth Iranian nuclear scientist was assassinated. The US and Israel deny any hand

in the killing of the scientist. The US also denies that the sending of a second

aircraft carrier

group to the Arabian Sea is related to escalating tensions with Iran. If the CIA and

the Mossad

were involved, and they

are the logical suspects, the truth will come out and Iran will be

angrier, more vengence-minded and more determined than ever to be on an equal atomic

weapons' footing with Israel. Iran

will present its evidence against Israel in this to the United Nations.

The problem, as I see it, is that the US has put itself in the position of protecting the

Israeli right-wing Likud Party and its leader. These are the people who expand

|Jewish settlements

in formerly Arab lands and are trying to supress public protests about this. They

consider peace

with the Arabs unsafe and impossible. They are even being accuseed of turning Israel

into a dictatorship.

So much so, that the head of the Mossad resigned and called Netanyahu "reckless and irresponsible...

Netanyahu's decisions are driven by the same right-wing neocons that

drive the U.S."

Benjamin

Netanyahu 'turning Israel into a dictatorship' - Telegraph

Israel

government 'reckless and irresponsible' says ex-Mossad chief

Ex-Mossad

Chief: Radical-Right Jews More Dangerous than Iran

This situation seems likely to worsen and become still more dangerous. Whereas Pres

Carter

and Pres. Clinton could act as peace-makers and honest brokers, Obama is following Bush's

example of non-leadership in bringing about peace and choosing, as Bush did, to give

unconditional

backing to Israeli aggressions. The dynamics of this situation will probably,

therefore, spiral more and

more out of control. At some point, we will probably see a shutting off of the flow

of oil through the

Strait of Hormuz, which borders Iran. This would disrupt one third of the world's

oil tankers.

Dec/28. 2011 Iran

navy chief: Shutting off Gulf 'really easy' - At its narrowest, the strait is

34 miles wide. The oil traffic lane is 6 miles wide. 14 tankers carrying

15.5 million bar.

of crude oil pass through daily. It is the only sea passage for oil produced by Iraq

and

large parts of this region's oil. ( http://en.wikipedia.org/wiki/Strait_of_Hormuz

)

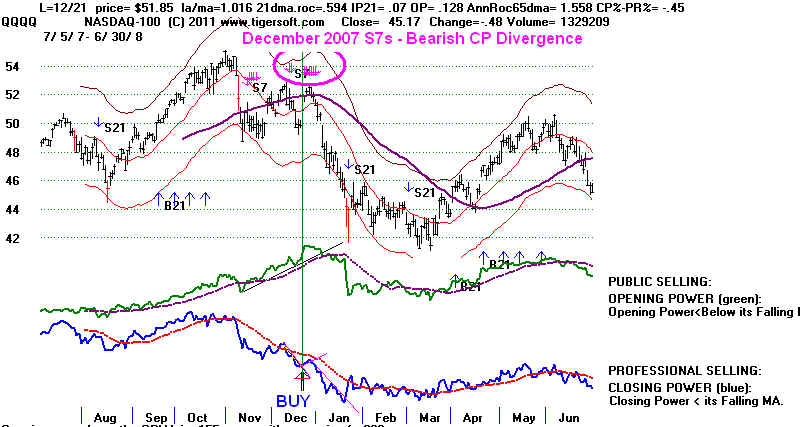

Tiger Index of NASDAQ-100

Note Flat top. We will watch this closely in the coming days. |

QQQ Tiger Chart with volume   |

=====================================================================

OLDER HOTLINES

=====================================================================

1/10/2012

DJI = 12462 la/ma=1.024 21-dma ROC=.455 P= +362 +183- IP21= -.004 V= +30 OP= .0061/10/2012 ===> Closing Power (CP) Status Report: KEY ETF CHARTS:

DIA' s CP's

bearishly broke its short-term uptrend-line

A close 0.39 ABOVE its opening would restore the

short-term CP Uptrend. Opening Power is rising.

SPY's CP broke its UPtrend-line. It would take a

Close 0.63 ABOVE the Opening to restore the

CP UPtrendline.

QQQ's CP bullishly still above its UPTrendline.

It will take a close of more than 0.08 BELOW the Opening to break the short-term CP UP-trendline.

Opening Power is rising.

GLD's CP steep DOWN-trendline

was broken.

it would take a close of more than 0.78 BELOW the Opening to

break the new CPUptrend-trendline.

The Opening Power is flat.

Narrative of Hotline

DJI Threatens A New Breakout despite Sell

S9 and Sell S15. I would remain hedged: long Bullish

MAXCP stocks and short BEARISH MINCP

stocks. I would not yet go short the major market ETFs.

The SUPER STOCKS of 2011

are doing very well. Those making new highs with high AI/200 (>145)

or with an IP21>.23 are moving up

nicely, as hot money is concentrated in a smaller number of

high performance stocks. These are shown here.

A subscriber asked late today whether I

have done a study to show the returns of waiting for an A/D Line

trend-break to clinch Sells and Buys.

I have not quantified it. But it's clear that in the vast majority of

cases, taking the automatic signals is

best. But, not always. And it is when the Sells do not work out

that I am concerned about, to reduce

risk. The clearest cases are June 1987 and January 1999 (using

the pre-2007 software that did not take

into account the four year Presidential cycle.)

So why have I thought it best to delay

shorting the major market ETFs here until there was more evidence

of a true top? It is a matter of

judgement, to be sure. But here are the main reasons:

1) Technically, flat tops beckon for

breakouts. Professionals understand that if a new high is made

above a flat top, it will cause a great

deal of short covering and breakout buying. The DJI chart

above shows we have seen the first flat

resistance breakout. Now the DJI is just below the resistance

line of the second That is

why I have said the DJI might be able to achieve a nominal new high

above 12800 on this run.

2) Interest rates as low as we see now

are unprecedented. They support the market and keep the

NYSE A/D Line uptrending. When the

A/D Line is stronger than the DJI, as it is now, Sell S9s and

Sell S12s do not appear. In 1977,

2001 and 2002 we also saw better breadth than the DJI. In these cases,

the general market did not turn

down until there was a break in the A/D Line uptrend. There was

plenty of profit still to be had in short

sales by waiting for this.

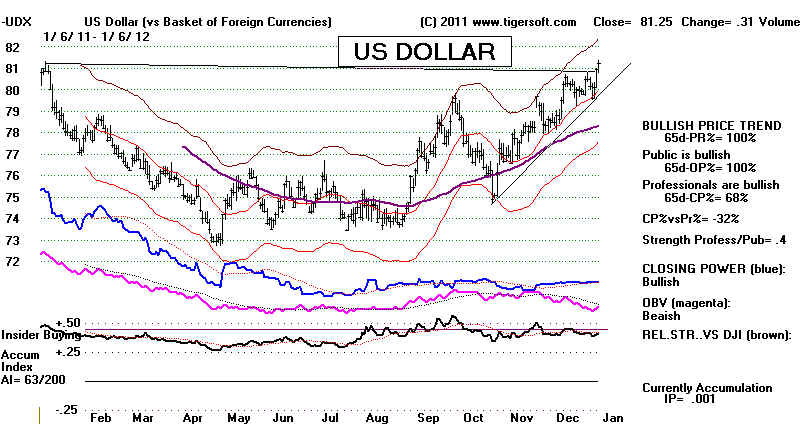

3) The strength in the Dollar and the US

Stock market for the last year is attracting foreign capital.

This boosts defensive stocks and the

DJI-30 for a while.

4) The most important element in all this

is my sense that the triumverate (Obama-Big Wall Street Banks- Federal

Reserve) have been ARTIFICIALLY

boosting the market since March 2009. Low volume has been no problem

for them in all this. Why woud they

stop artifically boosting the market now that we are in a Presidential

Election Year when supporting the market

is essential in their maintenance of political power?

The rally has been artifically lifted

partly by Big Wall Street Banks' buying index futures before the opening

in NY and partly by a steady stream of

computerized buy orders and very limited short selling. Realize that

75% of all NY trades now are computer

driven from the Big Banks, especially Goldman Sachs. The Fed, for its

part, has provided a trillion

dollars in liquidity to the big banks with no strings and interest rates approaching

zero. Obama has taken Wall

Street off the hook for the Crash of 2008 and has not prosecuted Wall Street fraud,

demanded lower CEO pay or more investment

in the US and has even prevented enforecment of Administrative

Law forbidding mis-use of customer funds.

Wall Street has bought Obama. His populist rhetoric is empty and

used very cynically. In

return, the computerized traders from the big banks have avoided the short side for

most of the advance from March 2009,

despite the weak economy. All this is part of an unwriten agreement,

I contend, that holds together this

Financial Junta that runs America now. I have been posting Blogs about this

since March 2008. Now many others,

including Conservatives agree with this popuist interpretation of the

huge rise in stock prices despite Main

Street's high unemployment and growing pauperization. I

urge you to read

what

these Conservatuves

say, Some are even joining

the Occupy Wall Street movement.

|

The Dirty Little Secrets of MF Global Bankruptcy. MF Global broke lots of regulations and rules on keeping customer money separate from its own trading accounts, and used some of its clients’ funds to invest in sovereign bonds issued by indebted European countries.When its leveraged bets lost, some customers like Koch Brothers and JP Morgan got advance word, before bankruptcy was declared. Ex-Goldman and Democrat Corzine lobbied the Democrat and ex Goldman Gary Gensler who ran the Commodities Regulation Board (CFTC) hard to weaken enforcement of rules protecting customers of MF Global customers. Source. Corzine-Gensler the Goldman Connection

|

I came across such a site today,

http://fellowshipofminds.wordpress.com/2011/11/23/why-the-collapse-of-mf-global-should-concern-you/

Now they know that they must keep lifting

the market if Obama is to be re-elected. They all have gambled

that a higher market will bring enough

extra spending by investors and boost business confidence enough to

increase the number of jobs in the

US. Only if millions of those who were unemployed in 2008-2009-2010

do get jobs or see better prospects will

Democratic voters actually turn out again and vote.

=====================================================================

OLDER HOTLINES

=====================================================================

1/9/2012

DJI = 12393 +33 la/ma=1.02 21-dma ROC=.193 P= +179 +30- IP21= -.036 V= -30 OP= -.0991/9/2012 ===>

Closing Power (CP) Status Report: KEY ETF CHARTS: SPY's CP broke its Downtrend-line. It would take a

Close 0.20 below the Opening to restore the

CP downtrendline.

QQQ's CP bullishly broke its DownTrending.yesterday.

It will take a close of more than 0.25 BELOW the Opening to break the short-term he CP UP-trendline.

Opening Power is rising.

GLD's CP steep DOWN-trendline

was broken.

it would take a close of more than 0.78 BELOW the Opening to

break the new CPUptrend-trendline.

The Opening Power is flat.

Narrative of Hotline

1/9/2012

Sell S15 and Sell S9 Versus Biotech

Breakouts.

We still have no clinching of the Sells using

the key general market CLosing Powers' Uptrend-Breaks

or a break in the rising NYSED A/D Line. But volume is

very low. A breaking of the A/D Line uptrend when

it is stronger than the DJI can bring a substantial decline:

1977, 2001 and 2002 are the best examples. So stay hedged,

but below are some biotech speculations to play on the

long side.

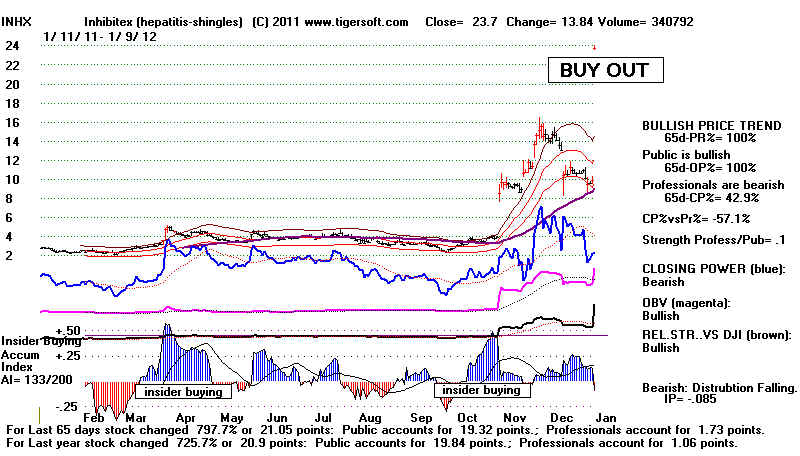

Today a biotech, INHX

(see chart below), that specializes in developing a drug to

fight hepatitis, jumped 140% on a buyout by BMY. In 2001, they paid top dollar

for Imclone just before the general market fell sharply Recall that VRUS, which

we recommended for long-term investors and a leader in developing new methods

to fight the world-wide scourge of hepatitis, was bought out two months ago at

a huge premium. Very often when one stock is bought out at a big premium,

others in the same industry become the objects of similar takeover bids. And

recall what I said about this being a narrow market, where hot-preformance money

is focused on a relatively small number of stocks and how, as a result, this environment

often brings stellar short-term gains to any stocks making new highs.

Today 18 biotechs rose more and 6% today. I consider only one of them, ACHN, to have

met our BUY standards for a current Accum. Index (IP21) value of greater

than .23.

BMRN is also consider a Buy because of

the flat topped breakout, AI/200>145 and

IP21>.22.

Growth Biotechs often top out last in a bull market and sometimes refuse even to decline.

Symbol

Name

Price Gain Today AI/200 IP21

Comments

--------------------------------------------------------------------------------------------------------------

INHX

Inhibitex

23.7 140%

133

-.08 Insiders knew of buyout.

IDIX

Idenix

9.66 37%

96

.06

ACHN

Achillon Pharm

9.72

22%

84

.23 High volume breakout BUY

HRT

Arryhythmia

3.84

14%

100

+ .27 very thin. Tax loss selling ended.

VVUS

Vivus

11.65 14%

58 -.10

TELK Telik

0.19 11%

17

-.11 Tax loss selling ended.

CBLI

Cleveland Bio 3.74

10%

70

.16 Tax loss selling ended.

ITMN

16.64 10%

100

-.20 Tax loss selling ended.

ZLCS

1.27 9%

72

-.05 Tax loss selling ended.

QCOR Questcor

42.14

8%

144 -.13 Rebound from 65dma

XOMA Xoma

1.39 8%

51

.02 Tax loss selling ended.

CGEN Compugen

5.49

7%

130

.13 5.75 is 12-mo high resistance.

DCTH Delcath

4.16 7%

52

.16 Tax loss selling ended.

MDVN

Medivation

52.8

7%

79

-.08 New High

DVAX Dynavax

3.52 6%

76

.25 New Closing High

ELN

Elan

13.88 6%

148

.17 Closing Power is lagging

JAZZ

Jazz Pharm

48.2 6%

129

.18

SPPI

Spectrum

15.5 6%

154

.18 Nice flat topped breakout BUY.

Also

ARIA

Ariad Pharm

13.79

1%

133

.05 New High

BMRN Biomarin

37.17 1%

172 .222

New High Breakout Buy

Highest IP21 (Current Accum) Biotechs

DJIA     |

INHX |

| Best Performing Stocks of