THAT MIGHT COLLAPSE NQ DID.

10/27/2013

OUR MODEL FOR A DECLINE:......

Just because a stock is up a lot does not mean it will

decline. We want to see distribution and a weaking closing power.

We want to see red popsicles on the Tiger candle stock chart.

And even then, we must work with buy (to cover) stops both at a new high

and when the Closing Power turns up after a test of the 65-dma.

See how PRTA turned up just above its 65-dma despite having

lots of red popsicles and being over-extrended. See how its

Closing Power turned up when it was readt to rally up from 20.

Below are the recent big gainers among the stocks up more than 150%

in the last 100 days that look the most vulnerable, showing negative

Accumulation, red popsicles and a bearish Closing Power divergence.

Even these have very evident support levels that may well hold up.

So we must watch the Closing Power for hooks back up..

BEAT has key support at 9. A break below that would also

break its rising 65-dma.

BioTelemetry, Inc. (BEAT) 728 employees

Conshohocken, PA 19428

Website: http://www.cardionet.com

Cardiac monitoring, cardiac monitoring device

manufacturing, and cardiac core laboratory services.

Initiated The Benchmark Company Buy $15 Oct 24

- 5

Stocks Under $10 Set to Soarat TheStreet (Thu, Oct 3)

dqdqq- BioTelemetry Is A Rock Solid Investmentat Seeking Alpha (Wed, Sep 25)

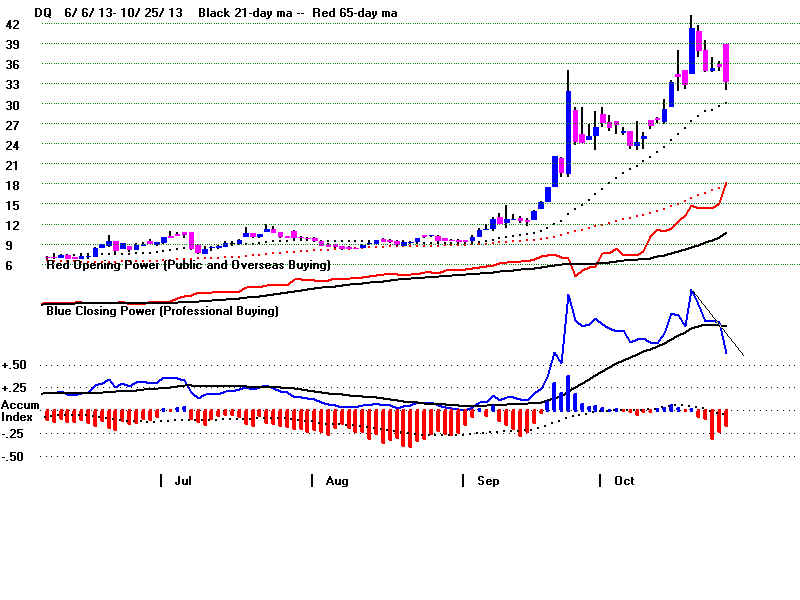

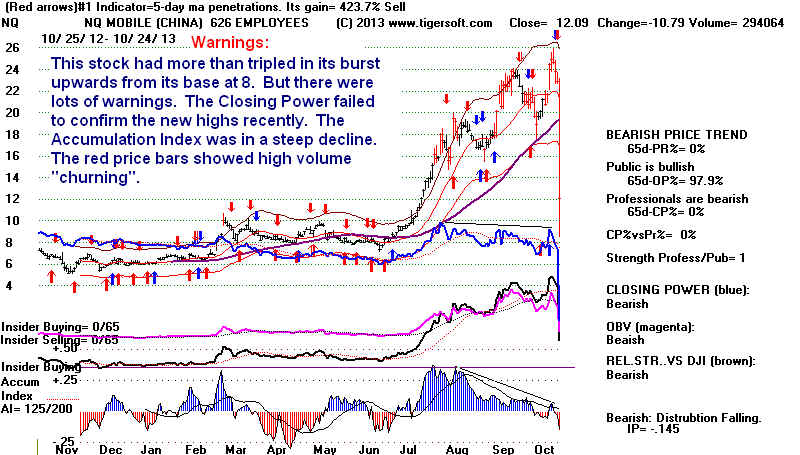

DQ - 2 red popsicles and a regular red popsicle. This has

quadrupled in 2 months.

Daqo New Energy (China)

Manufacture and sale of polysilicon and wafers in China. The company sells its

polysilicon to photovoltaic product manufacturers, who further process it into ingots,

wafers, cells, and modules for solar power solutions. It also manufactures and sells

crystalline-silicon based photovoltaic products.