POWER-STOCK-RANKER SOFTWARE

Call or write us today.

(C) 2011 www.tigersoft.com 858-273-5900 william_schmidt@hotmail.com

The Tiger Power Ranker is included in the Full TigerSoft Package for $995.

It requires purchase of the TigerSoft and Peerless Stock Market Timing.

The Power Ranker can be added for $395 later, if you have the first two programs. ($495).

Find The Most Bullish and Bearish Stocks and ETFs in Seconds.

Ranks and Flag 6000 stocks on your PC with one command.

Quickly be alerted to:

Closing Power new highs showing maximum Accumulation.

Closing Power new lows showing maximum Distribution.

Major new Tiger Buy Signals and new Trading Buys

Major new Tiger Buy Signals and new Trading Sells,

The 15 most bullish Stocks in any Group you specify (Oil, biotechs, computers...),

The 15 most bearish Stocks in any Group you specify (Bank, ETFs, pipelines...),

Confirmed new highs

Confirmed new lows,

Hundreds of other technical conditions: Breakouts, Gaps, High Volume

The most effective and profitable Stochastic trading Buys and Sells.

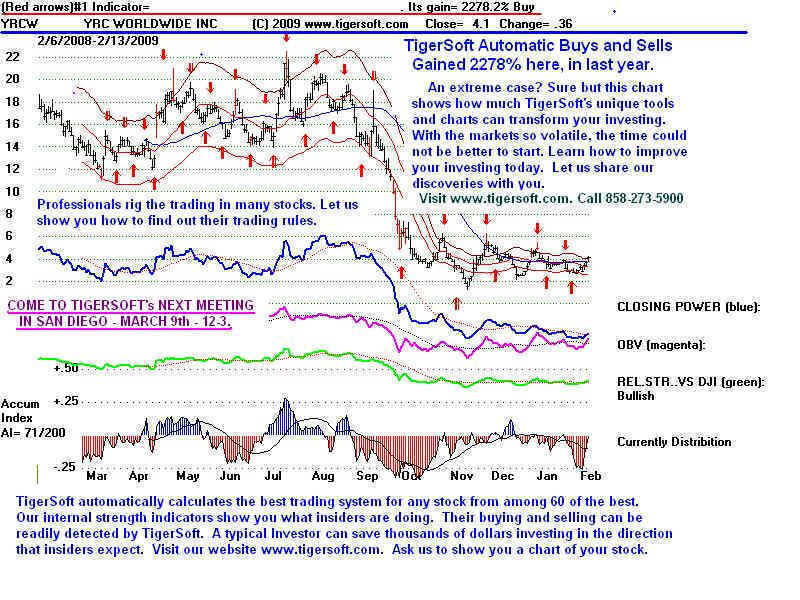

Imagine a 2278% trading gain in one year. Here's an example.

Then display resulting spreadsheet of these stocks with their key values

and click on stock's row and see TigerSoft graph.

This is a huge time-saver. In seconds, you can see a ranking of stocks for

long-term Accumulation and Insider Buying. Tiger Accumulation Index

is the most powerful predictive indicator out there, bar none! Used with

Tiger's Professionals' Closing Power (CP), the combination is UNBEATABLE!!

Buy these CP qualified High Accumulation Stocks. Sell Short the Most Distributed

showing CP Selling and you will find the biggest gainers and lowers.

Then use their automatic Buys and Sells and short-term CP trend-changes

to take and exit positions..

Call or write us today.

(C) 2009 www.tigersoft.com 858-273-5900 william_schmidt@hotmail.com

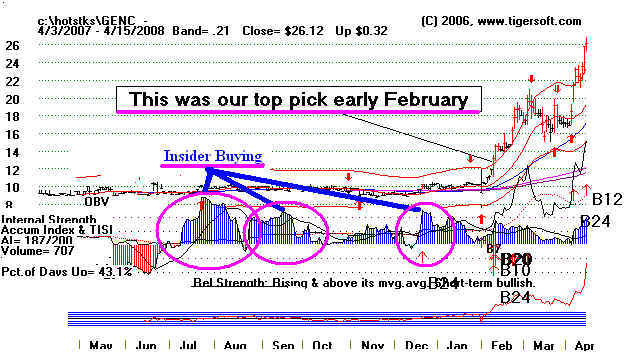

TIGERSOFT'S POWER RANKER FINDS SUPER STOCKS

AT THE START OF THEIR BIG ADVANCES.

With one click, your computer will screen 6000 stocks for

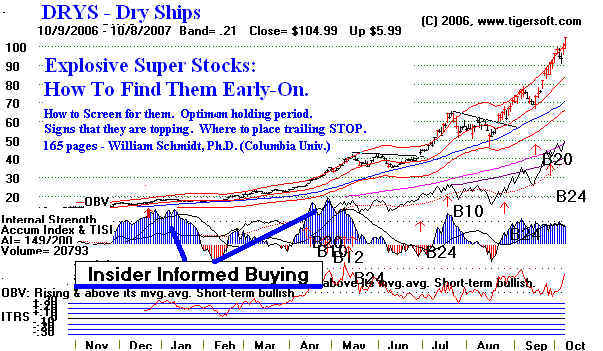

1) the most bullish stocks, showing new Buy B10s, B12s, B20s

" and B24s and having SPIKES of INSIDER BUYING with

NEW HIGHS being made by TigerSoft's Professionals' CLOSING POWER.

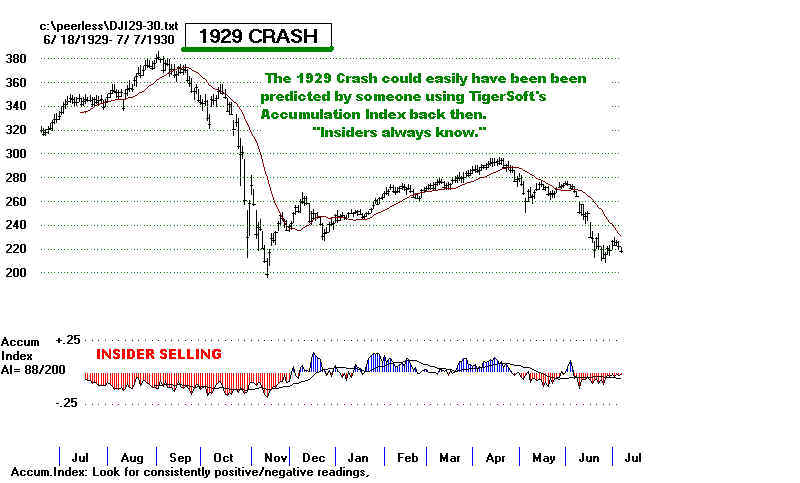

2) the most bearish stocks, showing new Sell S7s, Sell S10s,

Sell S12s, etc and showing MASSIVE INSIDER SELLING with

NEW LOWS being made ahead of price by TigerSoft's Professionals'

CLOSING POWER.

3) the trading range-bound stocks showing the

biggest percent gains for the best optimized TigerSoft trading system.

4) the Top Tiger Power Ranked/Accumulated Stock in the DJIA-30

or any other group. For DJIA stocks, the top Accumulated DJIA-30

stock held 21- months has gained nearly 24%/year.

When the Power Ranker is done, look at the Tiger Insider Trading

Graphs of these and other categories' stocks OR inspect the

TigerSoft spreadsheet of these stocks' key values.

____________________________________________________________________________________

TIGER USERS SEEKING NEWLY EMERGING EXPLOSIVE SUPER STOCKS

WILL WANT TO USE THE TIGER POWER RANKER AND SCREEN FOR

1) BULGING ACCUMULATION and INSIDER BUYING,

2) PROFESSIONAL CLOSING POWER NEW HIGHS

3) RELATIVE STRENGTH NEW HIGHS.

WE EVEN POST THESE "BULLISH MAXCP STOCKS" and their opposites,

the "BEARISH MINCP STOCKS" on our Hotline each night, if you would

prefer not to do the screening yourself.

________________________________________________________________________________

EXAMPLES:

_______________________________________________________________________________

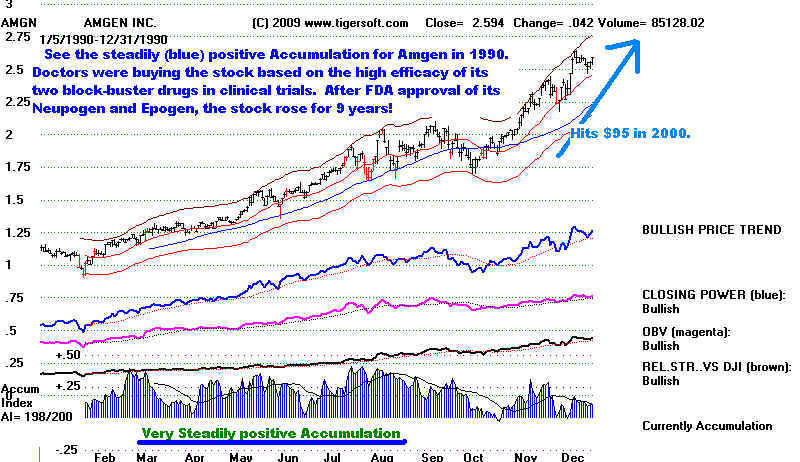

Below is a stock that rose from 2.75 to 95 nine years later. What was unusual

about its TigerSoft chart was how consistently positive was the TigerSoft

Accumulation Index. Our customers were in on the ground gloor with this one.

AMGEN 1990

1990 was a year when the DJI fell 20% from July to October. AMGN barely

fell. Instead, it showed very high (blue) accummulation. That was the "tell"

that made us buy it and buy it.

Save Time FLAG and RANK for High Accumulation.

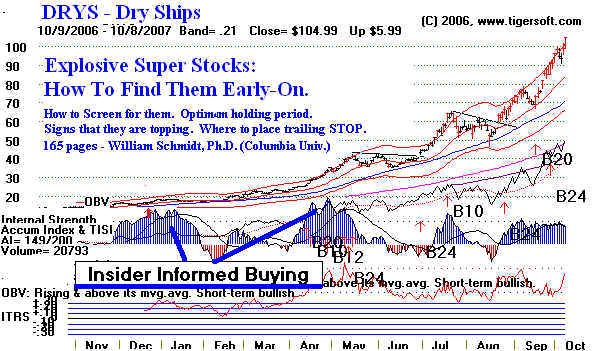

Over and over the best performing stocks show the same

internal strength characteristics at the start of their big moves. Mainly

they show intense insider buying. The TigerSoft Accumulation Index bulges

past the level (+.50). This is a key screen used by the Tiger Power Ranker.

It is a vital part of the major Buys our graphs post and the Power Ranker

screens for. Each year shows many, many examples of this phenomenon

of insider buying.

Purchasers of the Tiger Power Ranker after getting Peerless or

TigerSoft have access to our own picks as Bullish Special Situations for

three months. Purchasers of the Full set of programs we offer, get access

to this service for a year. Here are examples of some EXPLOSIVE SUPER

STOCKS that the TIGER Power Ranker let us identify early on. at the start

of their big moves. Most of these are stocks of companies you never hear of.

That's part of the story. Our software can find stocks that you can also start

to investigate fundamentally on the internet. You'll be fascinated by how the

story behind the stock gradually emerges publicly as the stock goes up and up..

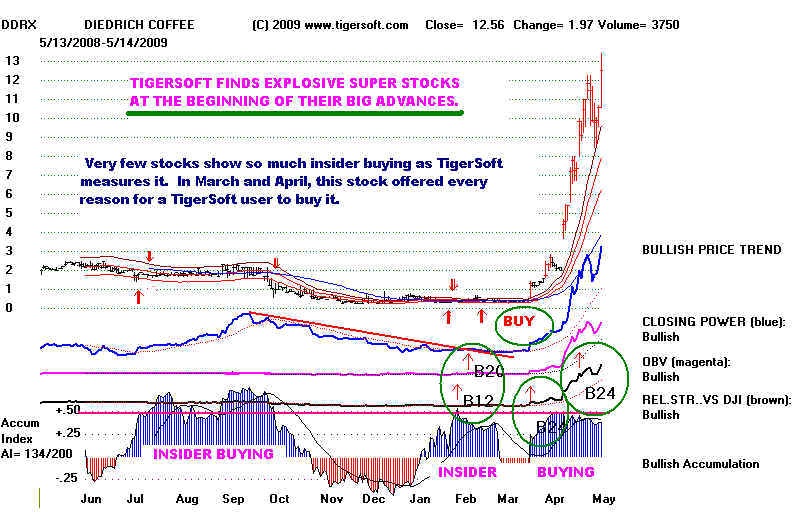

DDRX 2008-2009

It is rare to see a B10,B12,B20, B24 all occurring at once.

However, It is very bullish. And when such an event occurs,

TigerSoft's POWER-RANKER and Tiger's Elite Stock Professional Service

flags and highlights such stocks for you! One command from

the TigerSoft Power-Ranker will scan 6000 stocks.

AXYS

2008-2009 ... Hit

79 in August 2008

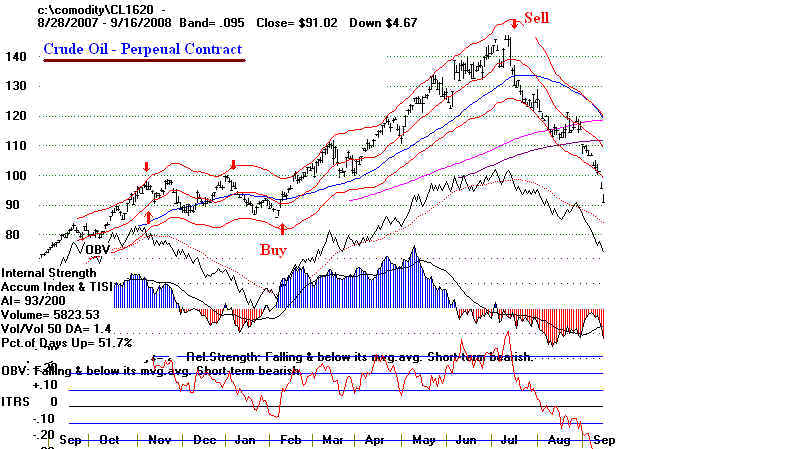

CRUDE OIL 2007-2008

CWEI 2007-2008

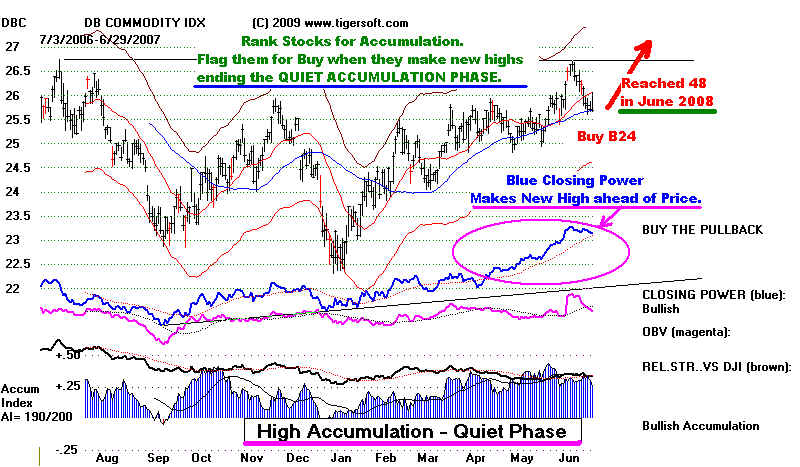

DBC 2007-2008 - JUST BEFORE THE COMMODITY BOOM

DBC is an ETF for such commodities as metals, oil. corn and

wheat..

See how massive Insider

buying and accumulation preceded Commodity Boom.

SID 2007-2008

Tiger's Power

Ranker lets you screen and validate breakouts to new highs.

DRYS 2006-2007

WHEN TO SELL

We recommend you mostly trade with the general market's expected

trend as by predicted by Peerless

and then look for the computer's

pick of "bullish" or "bearish" stocks. These categories are

quickly

rendered by the Tiger Power-Stock Ranker. Each stock gives its

own automatic sell signals. TigerSoft's Power Ranker scans all stocks

for such automatic Sells.

2009 Bull Market in Low Priced Stocks

A new year in a bull market often brings in new buying for the coming

year's best performers. Tiger's Power Ranker finds these in many ways:

"Best Performing" among "Bullish" Stocks

"Intense Accumulation",

Major Buys: B10, B12, B20, B24,

Closing Power Confirmed Price New Highs,

OBV at New Highs ahead of Price

Unusual Volume

and eventually - New Sells: especialy "confirmed Sell S29".

Here are Blogs showing more about the qualities

we look for and scan for.

December 31, 2007

What Distinguished

Early-on The Stocks about To Rise The Most in 2007

See also:

June 18, 2008 What Bear Market? Picking the Best Performing Stocks

of 2008

Is Easy with

TigerSoft's Power Ranker and our Accumulation Index.

When to sell a stock that you have made

good gains in is taken up in

all our books. The decline in ALL equities and industries since July

2007 shows the importance of doing this reading. Mostly, you will have

to get our books and software to see what we look for to sell. But using

Peerless is very important. Look at this Blog I did on precious metals'

stocks to get some ideas.

September 4, 2008 How To Trade Silver

(SLV) and Silver Stocks More Profitably

After the July 17-20, 2007 major Sells, I wrote Blogs to show how to pick stocks

using the Power-Stock Ranker. Here are the links:

July 29, 2007 Using Peerless Major Sell

Signals

One quick way to find good short sale candidates is to look for the weakest stocks

whose price weakness is confirmed by low rankings in internal strength.

August 7, 2007

How To Pick The Best Short

Sales?

August 13, 2007

Killer Short Sale

Techniques

November 6, 2007

Lots of Stocks

Look Like Good Short Sales

January 13, 2008

Insider Selling, as

TigerSoft Measures It,

Is A Common

Characteristic of Weakest Stocks of 2008.

March 3, 2008

Weak Stocks for Short

Selling as Found by TigerSoft's Power-Ranker

May 14, 2008

Spotting The Most

Vulnerable Stocks

Is Washington

Mutual the Next Bear Stearns or Northern Rock?

June 4, 2008

Far from Over, The

Credit Crunch Is Worsening:

October 30, 2008 Learning How To

Spot Tops in Stocks Using TigerSoft Is Easy

And Will

Save You Many Thousands in The Next Stock Market Crash.

Speculative bubbles can be extraordinarily

profitable if you know how to

trade them. There is a point at which stocks go up too far and too fast.

Having traded in and studied closely the 1999-2000 internet bubble,

the commodites' and oil bubble of 2008 was easy to spot. See how easily

we recognized what to buy at the end of 2007 and early in 2008. Note

the great bulges of accumulation and insider buying as these items

started very big and frothy moves to tops in mid-2008.

February 26, 2008

Food Commodities Streak

Upwards.

TigerSoft Easily

Spotted The Start of Their Moves..

May 20, 2008

Oil Stocks Are Going

Wild. How

TigerSoft Can

Find The Best Oil

Super Stocks for You To Trade.

June 3, 2008

King Coal's Super

Stocks.

TigerSoft's Charts

Spotted Them Early-On.

You do not have to trust our conclusions, withg the Tiger Power Ranker

you can easily examine charts and their indicator-readings for the best performing

stocks, early in their move. You could easily replicate the study I did on

February 16, 2008.

February 16, 2008 Today's

Biggest Gainers and Losers Can Tell Us Lots about Using TigerSoft Trading Tools.

At other times, you will want to use particular screens that suit your

trading purposes and test well. With one command, identify stocks:

(1) with new automatic Buys and Sells,

(2) showing bulges of significant Accumulation of Distribution,

(3) with OBV (aggressive buying or selling) leading prices to new highs,

strong or weak Closing Power, clustered major Buys or Sells and hundreds of

conditions.

This saves hours and hours looking through charts on any given day.

And you will find the best such situations. The Power-Stock-Ranker comes

with its own manual, but we recommend our 3 books.

Want to make some serious money?

Always look at the stocks flagged for Buy B10's, B12s and

B24.

TIGERSOFT'S

TIGERSOFT'S