Investment Software

PO Box 9491

San Diego, CA 92169

(858)-273-5900

The

Tahiti System

Using Tiger's

Power-Stock-Ranker Software

List of All Trades 1970--2007

TIGER’s

“BLUE-CHIP” Strategy of Individual Stock Selection:

A Safe & Easy +24.4% per Year from 1970-2007!

The gains are consistently more than +20%/year

even since 2003.

20% per Year Will

Turn $10,000 into $950,400 in 25 Years

20% Annualized Rate of Return

5 years $10,000 becomes $24,900

10 year $10,000 becomes $62,000

16 years $10,000 becomes $185,000

20 years $10,000 becomes $383,300

25 years $10,000 becomes $950,400

30 years $10,000 becomes $2,370,000

Computers are supposed to make our lives

easier and more productive.

Computers are supposed to make our lives

easier and more productive.

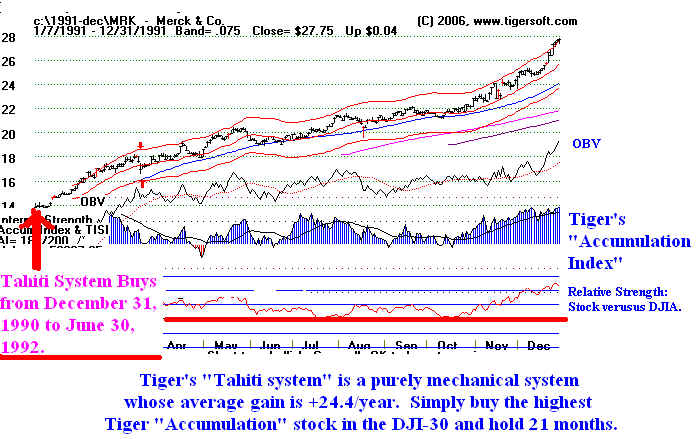

To that end, my discovery in 1994 that since 1970 we could simply have bought the TOP TIGER (Accumulation Index) Ranked DJI stock and held it automatically for 21 months and made 26 % on average per year, not counting dividends, is as important as my discovery of the “killer” PEERLESS “S9” in 1981 that regularly calls market tops. Let me explain.

In the Spring of 1994, I undertook a study of how well TIGER’s stock ranking system would have performed historically when applied to the current stocks that make up the Dow Jones Industrial Average. Historical data back to 1970 was obtained from Dial Data. (This was as far back as we could get data.) Our Power-Stock-Ranker Software program was then run against a year’s worth of data for all these stocks at the end of each quarter, starting with December 31, 1970.

Tiger's Power-Stock-Ranker software readily let us pick at the end of each quarter the top-ranked stock in the DJI using TIGER’s proprietary measure of long-term accumulation. Data on subsequent performance of these top-ranked blue chip stocks was then computed given a holding period of one, two, three...and up to 12 quarters. The average performance rose with each additional quarter’s holding time, starting with an average gain of 7.2% if the holding period was just one quarter.

The optimal holding period was 21 months,

or seven quarters. The average gain after 21 months for these top-accumulated blue chip

stocks was a startling 50% in 1996, and 46.4% in 2007. This is better than 24.4% per year.

If you start with an investment of just $10,000 and let the magic of just 20% compounding

make your money grow, you will have $954,000 in 25 years with no additional investment.

The optimal holding period was 21 months,

or seven quarters. The average gain after 21 months for these top-accumulated blue chip

stocks was a startling 50% in 1996, and 46.4% in 2007. This is better than 24.4% per year.

If you start with an investment of just $10,000 and let the magic of just 20% compounding

make your money grow, you will have $954,000 in 25 years with no additional investment.

My book shows that if one had invested $70,000 into this TIGER system starting in 1970, one would have accumulated more than $11,166,464 as of June 30, 1994 - without the introduction of any additional funds. The gains since mid-1994 are also shown in the table below

Use Tiger's Power-Stock-Ranker Software to buy the top accumulated stocks with maximum confidence.

Even in a bear market, you should be a buyer of these top accumulated DJI stocks. Boeing, for example, was picked by Tiger's Power-Stock-Ranker Software every quarter from 12/31/73 to 12/31/74, a wretched time for most stocks; yet, its subsequent 21-month gains here were 50% to 191%. Amazingly, the average yearly gain for our top POWER-RANKED stocks from 1970-1982 while the DJI bounced up and down between 580 to 1050 was just as high as it has been from 1983 to 1996 while the DJI as a whole has risen from 1050 to 5700.

Longer-term investors will want to put

Tiger's Power-Stock-Ranker's DJI selection into their tax-deferred retirement accounts.

Traders may want to buy on margin these stocks and hold them only so long as they are #1.

These safer DJI stocks rose more than 7% from the end of the one quarter when they were #1

to the end of just the next quarter.

Longer-term investors will want to put

Tiger's Power-Stock-Ranker's DJI selection into their tax-deferred retirement accounts.

Traders may want to buy on margin these stocks and hold them only so long as they are #1.

These safer DJI stocks rose more than 7% from the end of the one quarter when they were #1

to the end of just the next quarter.

We have run our tests on the 30 DJI stocks partly because of their added safety. Investors should not underestimate the importance of safety in a market that has risen so far since 1982. We also chose the DJI stocks for our study’s sample because we wanted no one to believe we had chosen our sample simply to prove our theory.

Now you can readily reap the benefits of this new discovery. Simply subscribe to my Nightly E-Mail Service ($80/month) or subscribe to my nightly Peerless Hotline or run our Power-Stock-Ranker Software on a regular basis. Then buy the highest ranked stock and sell it, say, 21 months later. The Tiger Power-Stock-Ranker package includes a 6 months’ subscription to the bi-weekly newsletter, a Nightly Hotline and a Weekly Screening of 11,000+ stocks for those with the highest “Accumulation Index” score as ranked by the TIGER system.

The performance of our top TIGER Accumulation Index picks is now proven. My new 225 page book, Twenty Six Percent a Year Can Make You Rich documents and discusses each trade from 1970 to 1994.

Bear market ahead? My strategy lets you

completely ignore the general market if you wish.

Bear market ahead? My strategy lets you

completely ignore the general market if you wish.

Our average gains were just as high in the rocky period from 1970-1982 as for the bull market 1982-1996. However, because bear markets can take their toll on our peace of mind, my study shows you how you can achieve an average gain of 46% over 21 months for each stock by using Tiger's Peerless Stock Market Timing Software’s killer “SELL S9” rules.

Keeping it Really Simple! Use Tiger's Power-Stock-Ranker Software and you will need to make only one decision every 90 days - if you follow our plan for investing 1/7 of your long-term investment capital in only the top Accumulation Index ranked quarter by quarter for 7 quarters.

Should you watch our system for a while - to see if it really works? I don’t see why. It has worked well for 37 years on more than 100 selections. It has done just what it was supposed to since my book was first published in 1994. The study, itself, is completely objective. Anyone can replicate its results with a historical data. Even more important, these #1-TIGER-Ranked stocks rise on average more than 2% per month and they tend to rise in all but the very worst markets.

Should I Buy Your Latest Pick? Certainly history teaches it will probably advance a 46% over the following 7 quarters. So, if it is a recent recommendation, it will probably prove to be a good idea. However, we can do even better. Buy the next new stock that becomes #1. Our studies show a stock that becomes #1 at the end of the most recent quarter typically moves up the fastest. Their average gain was 7.32% over just 90 days. Even more important, is to buy the new #1 stock just as it becomes #1. As more and more savvy investors and traders use our system, we see our #1 stocks advance very quickly. (For example, in early January 1996 Sears became the #1 DJI stock, taking that position away from Exxon. This was at 40. By the the end of the first quarter of 1996 - ten weeks later - when it became the official recommendation - it was 48.)

Do I Need The Software? Or Should I Just Subscribe To The Newsletter? The answer depends on whether you have the time to watch the top stocks day to day.

(1) It is very advantageous to buy them as they become #1 and not just automatically at the end of the quarter or when you get the bi-weekly newsletter.

(2) It is also advantageous to add to these positions in the #1 stock on dips when TIGER automatic BUY signals appear.

(3) It is also very advantageous to actually see and study how widely varying the Accumulation Index is from one stock to another. Thus, when you do buy the #1 ranked stock in the DJI or the SP-500, you will better appreciate how special its action really is. This will give you the confidence to buy it or hold it on what seems like a menacing decline that quickly ends and is replaced by a new sudden surge.

(4) You will, undoubtedly, want to decide what to do about other stocks that you already own.

Does The TIGER RANKER Help with Other

Stocks?

Does The TIGER RANKER Help with Other

Stocks?

Tiger's Power-Stock-Ranker Software works excellently with any group of stocks or commodities, provided the data includes a high, low, close and volume. We have lots of professionals who use it with stocks of every type and price. TIGER’s ranking of your stocks will give you strategic guidance. TIGER’s automatic BUY and SELL signals typically provide excellent tactical entrance and exit points.

Tiger's Power-Stock-Ranker Software will let you evaluate any stocks you already own by means of its ability to show relative POWER Rankings, current levels of "Big-Money" accumulation or distribution as well as automatic major buy and sell signals.

How Many Stocks Can I Screen & Rank? You may rank up to 519 stocks per directory, with an unlimited number of directories. It is very easy to update, rank and graph multiple directories.

In addition, we offer an in-house screening of all stocks for high accumulation. The Elite Stock Professional Report is posted weekly on our Tiger BBS and on this web site.

Purchasers of Tiger's Power-Stock-Ranker Software get FREE access for six months to this weekly Elite screening of all 11,000+ stocks for high and intense accumulation. Using this and our software you will discover the best and most “accumulated” smaller company stocks.

Will the TIGER System Find Stocks To Sell Short in A Bear Market? You bet. The single most common characteristic among stocks about to decline sharply is the presence of steady or intense “distribution”. This works particularly well with smaller companies where insiders and their friends are bailing out before the bad news hits publicly.

How Easy Is It To Run TIGER? We

hear every day that folks find our software very easy and very quick. Moreover, you can

use several different data vendors: Dial Data, TC-2000 and Stock Data.

How Easy Is It To Run TIGER? We

hear every day that folks find our software very easy and very quick. Moreover, you can

use several different data vendors: Dial Data, TC-2000 and Stock Data.

Data may be converted to TIGER from Metastock or TC-2000 formats. The TC-2000 CD is a great way to look at historical charts back to 1985.

Tiger's Power-Stock-Ranker Software is $995. Besides the easy-to-use software, the Power-Stock-Ranker package also includes a year's back data on the current stocks that make up the SP-500, a year's back data on the 100 most heavily "accumulated" stocks of all stocks. For support you also get a six months' subscription to our bi-weekly PEERLESS FORECASTS, our Nightly HOTLINE and our weekly Elite Stock Professional Report showing the most accumulated and distributed stocks from a universe of 11,000+.

More information about Tiger's Power-Stock-Ranker Software as applied to High Tech Stocks