Tiger's

Peerless Stock Market Timing: 1915-2013

Full List of Peerless Signals on DJIA 1/1/2014

Example: Peerless

Automatic Buys/Sells Chart, for 12 months ending May 25, 2012

William Schmidt, Ph.D. (Columbia Unversity) Tiger Software

858-273-5900 william_schmidt@hotmail.com

--------- CALLING ALL TOPS --------

You,

too, Can Call The Tops with Peerless

TIP: When you know how to call tops, you also

can tell when the market is safe.

This lets you buy aggressively early in a bull market

and not sell out prematurely.

TIMING IS EVERYTHING IN THE STOCK MARKET.

> Trade with new confidence. Peerless has called

every major top real-time since 1981.

> It calls bottoms, too. Amazingly,

Peerless has averaged more than 20%/ year

using the blue chip Dow Jones

industrial Average.

>

Its automatic Buys and Sells have been

painstakingly back-tested to 1929.

>

Profitably super-impose the Peerless

signals on DIA, SPY, QQQ, IWM, FAS, TNA.

>

When Peerless gives a Buy, go long the

strongest stocks and ETFs with new confidence.

> When

Peerless gives a Sell, sell short the weakest stocks and ETFs.

>

You can run the software yourself or

get a discussion of the signals and the

market each night from our on-line

Hotline.

You

are invited to:

> Discover the technical rules behind the Peerless Automatic Buys and Sell

Signals.

> Study

their individual track record since 1928 and trade them confidently.

> Use our Buy B1....Buy B19 and Sell

S1...S19 signals.

The numbers allow us to distinguish them and study their individual

potency and reliability since 1928.

====================================================================================

Introduction

Many casual writers glibly say market timing cannot be done.

They call it a waste of time and "a fool's

errand". If you're "lucky" to get

out before a big decline, they warn, "you'll surely miss the next bull market."

But just because these nay-sayers cannot do it, does not mean it can't be done.

Our real-time track record is proof of the power of Peerless. I've spent 30

years back-testing, verifying and predicting the stock market. At least,

consider all that my Peerless can teach you. Over and over, the same

type of tops occur. Over and over, the same type of bottoms occur.

Next time you run into one of these nay-dayers, asking them some questions?

1) "How do you prove a negative?"

2) "Are you really familiar with technical analysis?"

3) "How much original historical research have you done?

4) "Have you ever used Peerless Stock Market Timing?"

5) If they're still

snippy, ask them why they persist in helping Wall Street insiders

keep their biggest trading secrets and advantage all to themselves?

Stock market history and our automatic Buys and Sell offer overwhelming evidence

showing how wrong they are. The very Wealth and Power of Wall Street

is contrary proof. Insiders time and manipulate the market all the

time.

There's so much at stake here, keep an open mind and please read on.

Discover that you do not have to suffer through long bear marets.

Instead make money from them and still buy at the bottom!

Too often buying and holding is very costly. You can easily lose 50% or more

in a market "correction". Anyone who went through a market Crash like 1987

or 1998

or a long bear market like 2000-2003 or 2007-2009 will tell you how much they now wish

they had not listened to a "buy and hold" stock broker.

How Many Times Must

We Prove Peerless Works?

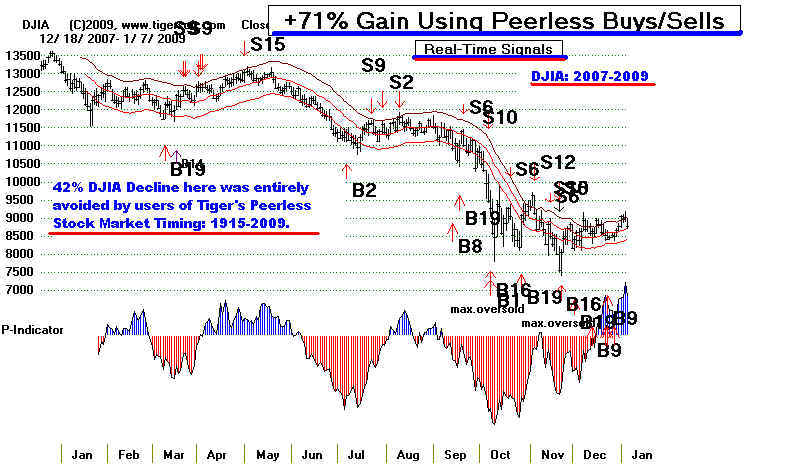

Peerless is proof that the stock market can be timed. In fact, we have been

successfully

timing the market real-time since 1981. We have had subscribers for 30 years.

And

we share the secrets of what we have learned, so that you can back-test the signals

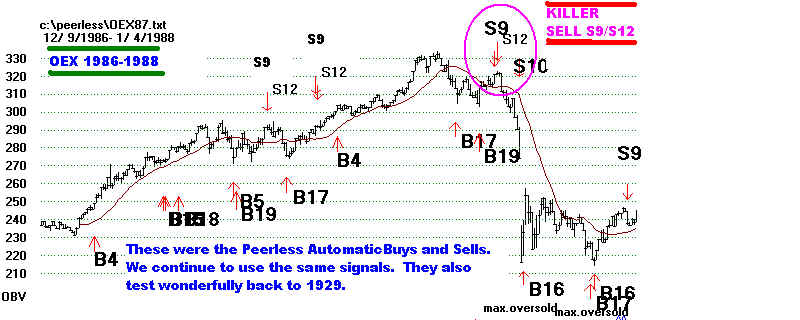

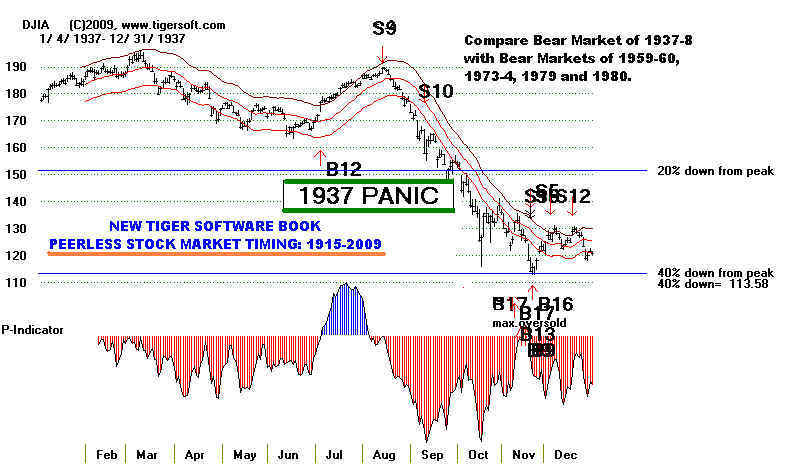

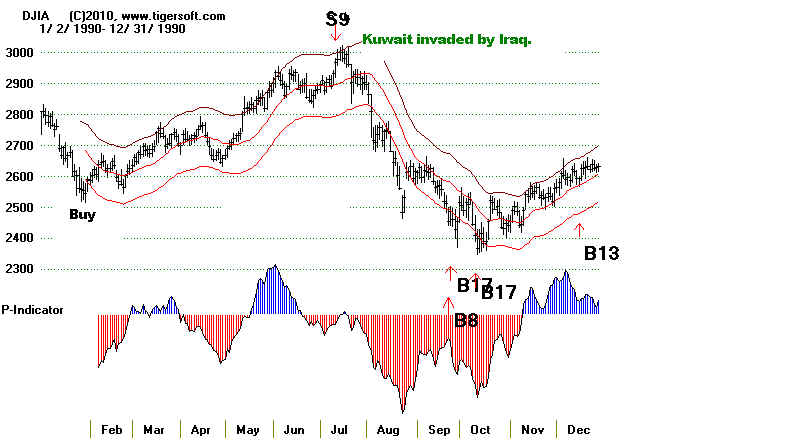

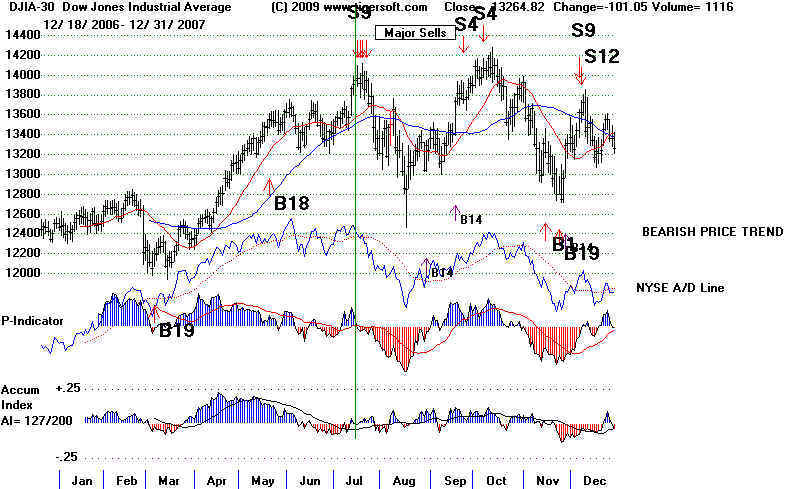

themselves. Take for example our famous Sell S9. Look at what has happened

real-time when a Peerless Sell S9 has occurred. How many subsequent big

declines in the market will it take to convince the doubters?

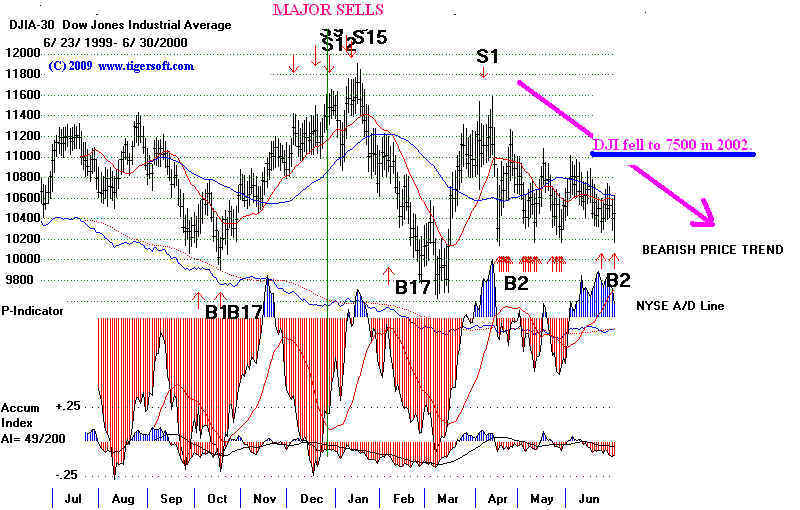

Recent Famous Sell S9s Subsequent

DJI Decline

----------------------------------------------------------------------------

October 1987 Sell S9 brings 34.1% gain on short sale.

July 1990

Sell S9 brings 16.8% gain on short sale.

July 1998

Sell S9 brings 16.8% gain on short sale.

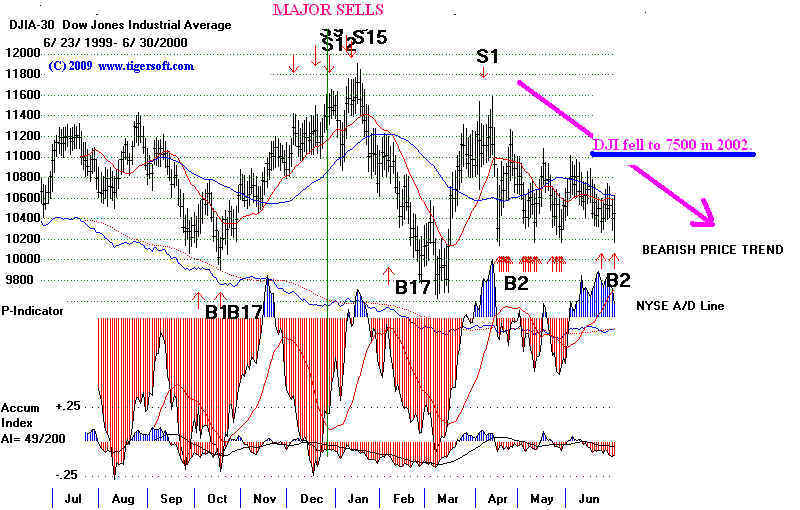

January 2000 Sell S9

brings 12.8% gain on short sale.

February 2001 Sell S9 brings 12.8% gain on short sale.

May 2002

Sell S9 brings 12.8% gain on short sale.

July 2007

Sell S9 brings 4.7% gain on short sale.

December 2007 Sell S9 brings 9.9% gain on short sale.

March 2008

Sell S9 brings 9.3% gain on short sale.

May 2008

Sell S9 brings 9.3% gain on short

sale.

Peerless works because history repeats. Tops are made in a limited number of

of well-defined ways. They show insider Distrbution. They show measurably

foolish over-enthusiasm. And they show too much money is going into too few

stocks at the final top. We mumber the ways the market tops out. Some of

our Sell signals are extraordinarily deadly. Others only call for 5%-8%

intermediate-term

declines. Similarly, market bottoms are also made in a limied number of very

definable ways.

The Sells and Buys are numbered so that we can distinguish them, one from another,

and so that we can study their track record going back to 1928. You will want

to

readily study these signals so that you validate them and see their likely

significance when they occur real-time. Peerless will elevate you to a completely

new level of understanding about the stock market. And it will be much better than

most market Pros have.

====================================================================================

Peerless Shows History Does Repeat.

Very Profitable Applications

Superimposing Peerless Reversing Signals on Various Investments:

30% Annualized

Rate of Return since 1993 Trading SPY (Long and Short)

Long Trades Only, 2%

Slippage/Commissions allowed for each round-trip trade.

SAFER, HIGH Peerless

Investing Returns on SPY, DIA, QQQ and EWC (Canada).

Which Country ETFs

Have Worked Best with Peerless Automatic Buys and Sells since 1996?

$1,000 would have

become $100,000 in 15 years.

Which Sectors Work Best

Trading with Peerless Automatic Buys and Sells?

Peerless Fidelity

Sector Funds' Performance: 1986-2011

FSLBX Gained 26% per

year. $1,000 Becomes $340,000.

Trading Individual SP-500 Stocks

Using Peerless: 1980-2011

One Year of Peerless/Tiger HOTLINE $350

Peerless Stock

Market Timing: 1929-2011 $395.

TigerSoft &

Peerless Stock Market Timing: 1929-2011 $495.

Introduction to Peerless Stock

Market Timing Older Real-Time Track Record:

1981-2009

New Peerless with On-Line Book - Peerless

Stock Market Timing: 1915-2011

---------

CALLING ALL TOPS --------

You,

too, Can Call The Tops with Peerless

The First Task for A Successful Trader:

Determine How Safe The Market Is.

Most

of your profits will normally be made in rising markets. A reversing Peerless

Buy signal should be your starting

point to buy aggressively. The lastest Peerless

Buy in late June 2010 has now seen

the DJIA rally 25%. Our stocks have done

much better. We bought

aggressively, because we know how reliable Peerless is

at getting out as the market peaks.

Peerless Buys/Sells on DJIA

You do not have to suffer through declines in the

stock market. And you do

not

need to wonder if it's safe buy.

Peerless can show you exactly when to get out

of the market. It has done

that, REAL-TIME, in early 1981, January 1984, October 1987,

July 1990 and at the tops in 1997, 1998,

2000, 2001, 2007, 2008 and 2009.

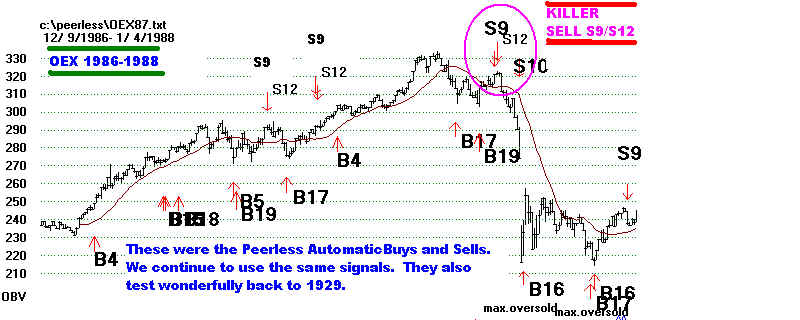

You can actually make a fortune from declining markets.

Our Peerless users made millions in the

1987 Crash. Many bought OEX puts

because of the fourth Sell S9 in early

October 1987. Three weeks later the

options had risen 50-fold. The OEX

fell from 321 on 10/1/87 to 233 on 10/20/87.

The Peerless Sell S9 was classic.

It was unmistakeable. And it was made

more bearish by the fact that there had

been earlier Sells without a market break.

Instead of buying puts, one can now buy

leveraged short sale ETFs on various

indexes.

PEERLESS DJIA CHART - OCTOBER 1987 CRASH

PEERLESS SIGNALS ON OEX - OCTOBER 1987 CRASH

Peerless can also show you when it's safe to buy, just as it did real-time August 1982,

July 1984, December 1987, October 1990,

January 1995, October 1997, October 1998

and March 2003 when major Buys occur.

Trade anything with Peerless.

The world markets have never been

so closely

linked as now. That has made our

Peerless Stock Market Timing even more valuable

and necessary for trading and

investing success. The result is that Peerless can be

used not just by traders of general

market ETFs (DIA, SPY and QQQQ and their more

leveraged equivalents), Options'

and S&P Futures' traders, but also investors

in foreign ETFS and certainly most

stocks, too.

http://www.tigersoftware.com/TigerBlogs/June-5-2009/index.html

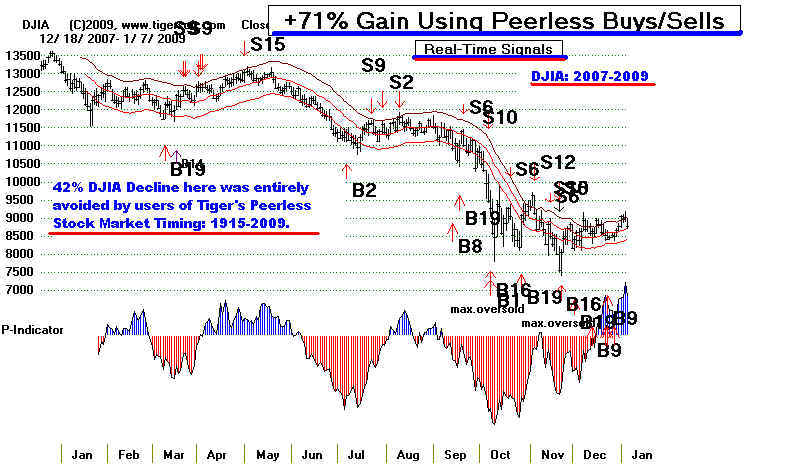

At least, hedge with Peerless. Instead of losing money, in the 2008-2009 market crash,

a Peerless user who traded DIA (the

equivalent of the DJIA) long and short from

April 2008 to March 2009 would have

gained more than +96%, most conservative

calculated. Please note: these were

real-time signals, documented on our Hotline,

so that you get these signals, even if

you did not have Peerless.

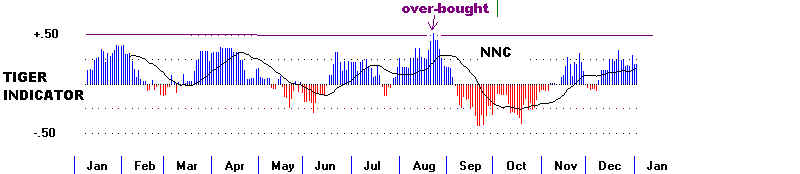

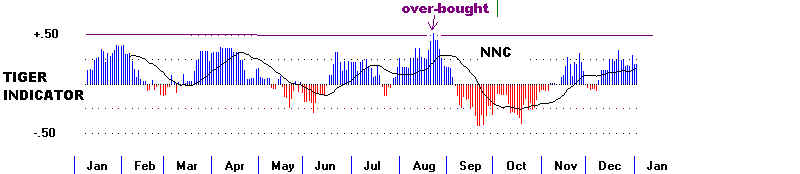

Short-term traders should trade the trend of TigerSoft Professional Buying

Power for the DIA, SPY, QQQQ etc.

primarily in the direction of the operative

Peerless Signal.

http://www.tigersoftware.com/TigerBlogs/August162008/index.html

http://www.tigersoftware.com/TigerBlogs/August162008/qqqq.html

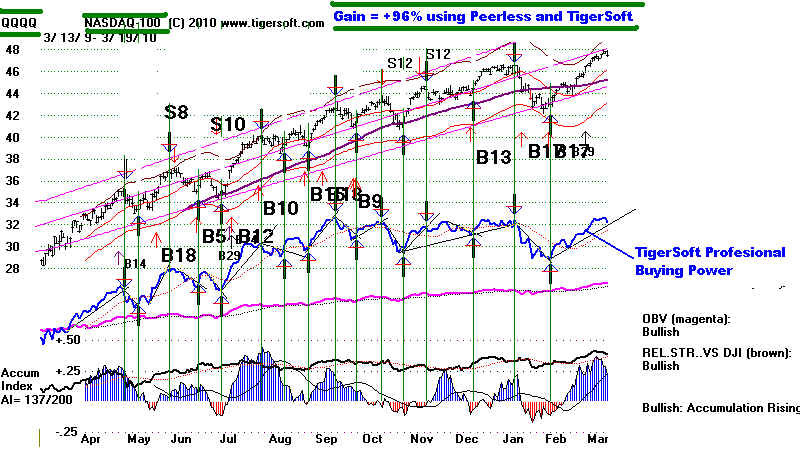

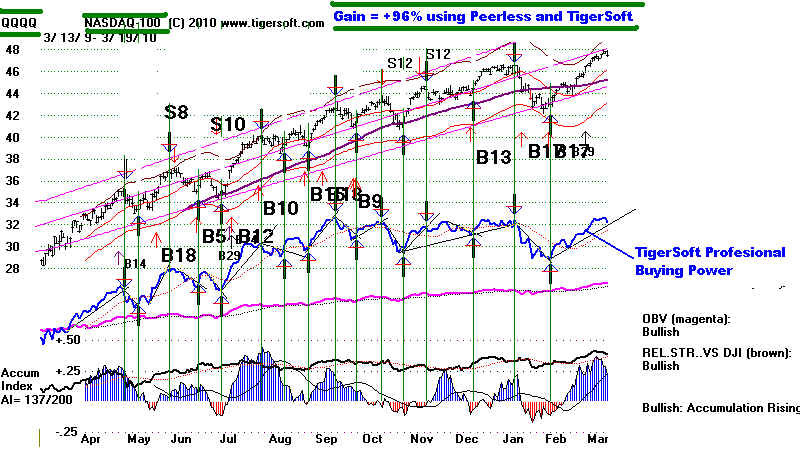

The QQQQ chart below shows both the Peerless

signals and the Professional Buying Power

signals.

The gain for these signals was 92.2%, conservatively calculated, using the next

day's

openings to make the trades and allowing $40 commission for each trade with

the

proceeds from $10,000 fully re-invested. There were 14 winning trades. 3

losing trades.

The biggest

intra-day loss was 5.2%. Trading beat buying and holding by 35.7%.

See also

Trading DIA, SPY and QQQQ

with Peerless Signals

and TigerSoft's Professional

Buying Power Index

See also:

http://www.tigersoft.com/--1--/index.html

http://www.tigersoft.com/majorpeerless.htm

http://www.tigersoft.com/products/peerless.htm

Look at

the real-time track record of Peerless major "Sell S9s" and "Sell S12s" since

1928 in the charts below. When they appear, the

market becomes dangerous.

The more such signals appear, the more dangerous the

market becomes. The

failure of key support following Peerless major Sells

always has brought a bear

market.

Our Peerless Stock Market

Timing: 1915-2011 Will Tell You When The Market Is Safe

and When It Is Dangerous. Look at Its real-time

track record. As the world markets

become more and more integrated, the Peerless

automatic Buys and Sells have proven

themselves universally. Peerless averages 3

reversals per year. The average gain on

the DJI from Buy to Sell produces an average gain of

17%/year. 91% of Peerless signals

have been profitable. We provide all the data

needed. And if you prefer to simply get the

Buys and Sells with explanations and historical

justification, subscribe to our popular

on-Line Nightly Hotline.

Buys and Sells You Can Count On and Understand.

Calling All Tops: 1929, 1937, 1957 1959, 1962, 1966,

1973, 1978, 1979, 1980, 1987, 1990, 1998, 2000 and 2007

Peerless Gain = +96% April

2008-March 2009

Calling All Bottoms: 1933, 1938, 1942, 1949, 1953, 1958, 1961, 1962, 1967, 1970, 1975,

1978,

1980, 1982, 1984, 1988, 1991, 1995, 1998, 2003...

Calling All Tops:

1929, 1937, 1957, 1966, 1973, 1978,

1987, 1990, 2000, 2007, 2008

and others, too.

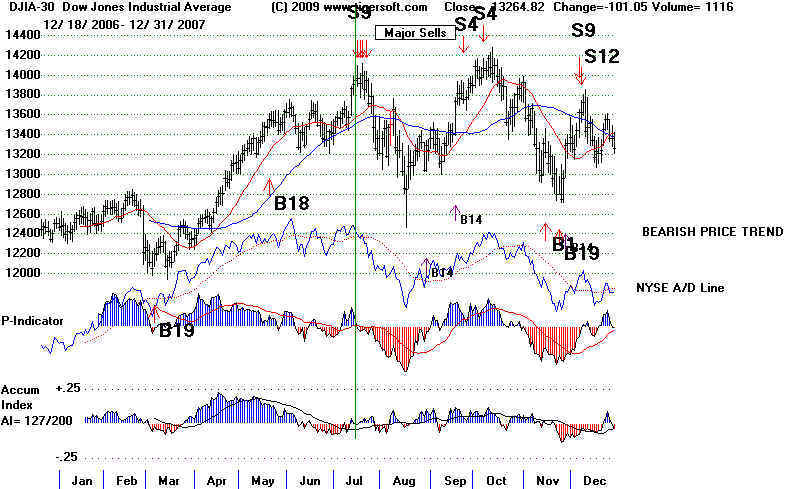

- Our Famous Warning of June 24, 2007 -

"SELL S9, SELL S12"

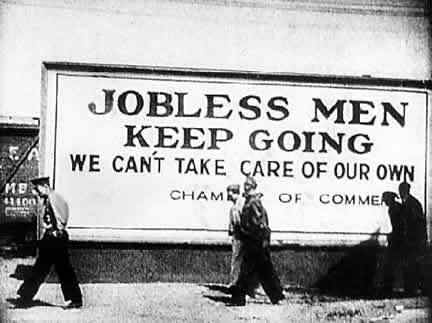

The 1929 Crash: Could It Happen Again? Yes - Absolutely.

JPMorgan

Twenties

party, as depicted in the 1929 film Gold Diggers Of Broadway

1929 Car

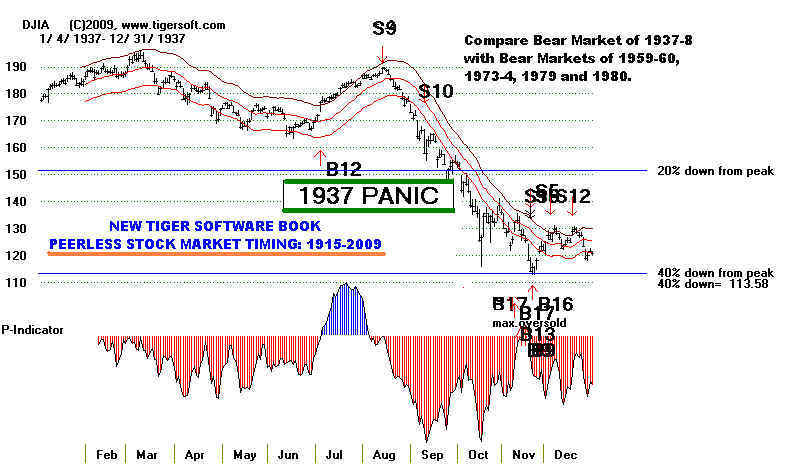

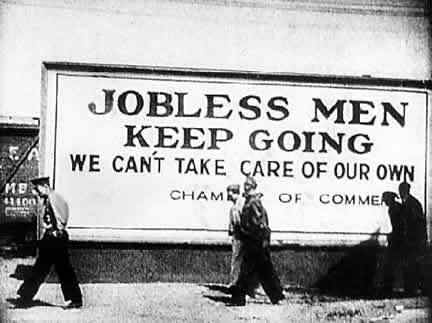

The 1937 Panic:

"SELL S9"

http://www.dailykos.com/story/2009/5/24/727557/-STFU

1957 Bear Market:

"SELL S9"

World

Wide Influenza Pandemic of 1957

Sputnik

1966 Bear Market:

"SELL S12"

1973 Top to 1973-1974 Bear Market:

"SELL S9 SELL S12"

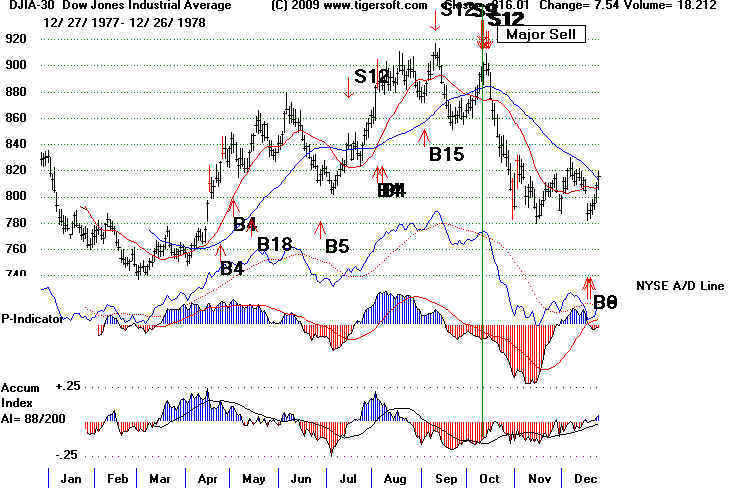

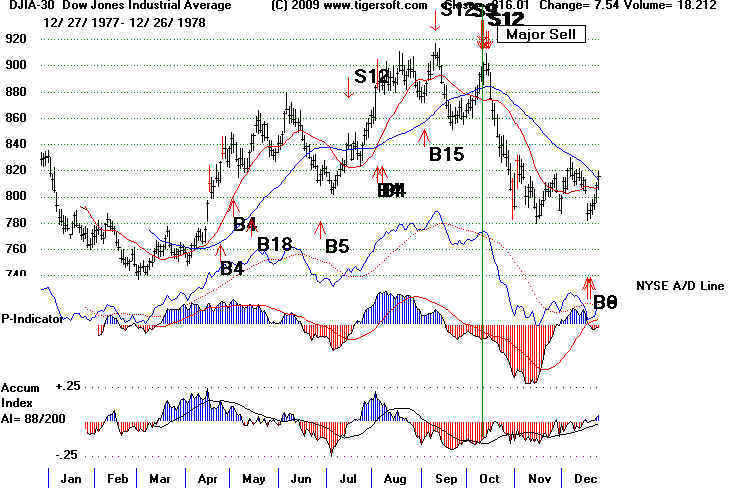

1978 Mini Crash:

"SELL S9 SELL S12"

1987 Crash

"SELL S9"

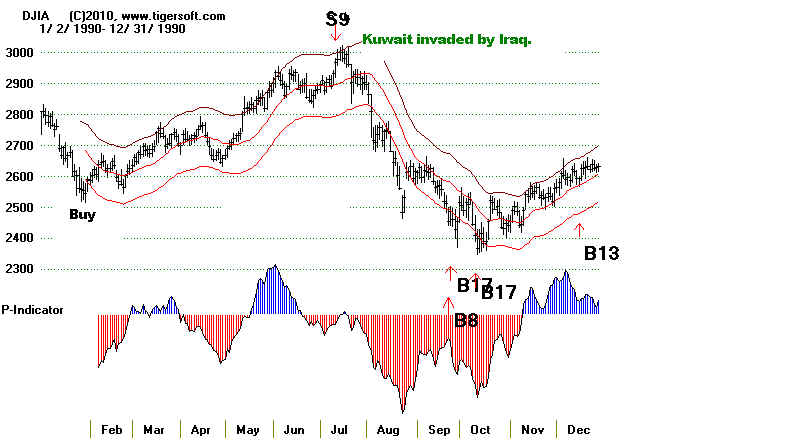

1990 Bear Market

"SELL S9"

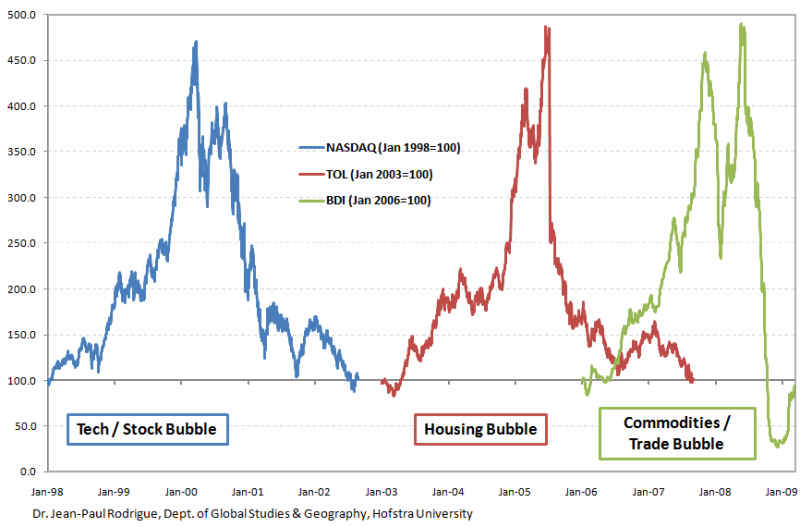

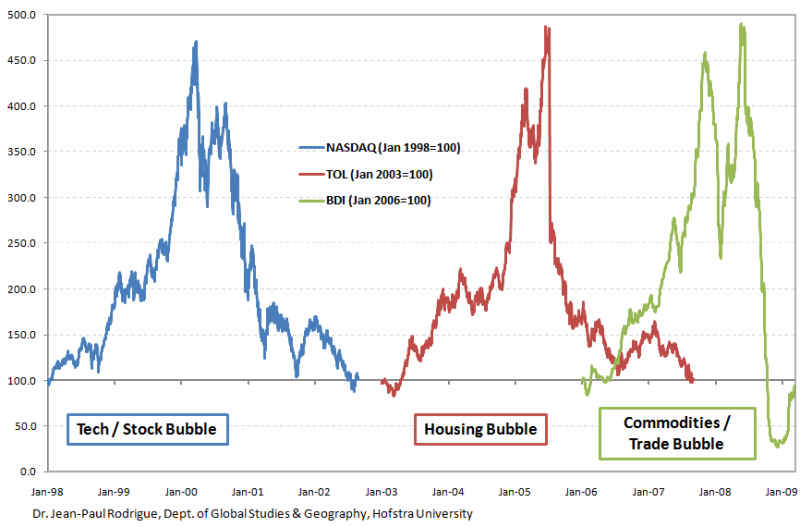

2000-2003 Bear Market

"SELL S9 SELL S12"

http://people.hofstra.edu/jean-paul_rodrigue/images/blowingbubbles.gif

2007 Top to Bear Market of 2007-2009

"SELL S9"

2008 Continuation Top

"SELL S9"

===============================================================================

ORDER One Year of Peerless/Tiger HOTLINE

$298

--

ORDER

TigerSoft & Peerless Stock Market Timing: 1929-2010 $395.

--

ORDER TigerSoft &

Peerless Stock Market Timing: 1929-2010 $495.