(C) 2009 www.tigersoft.com

Call 858-273-5900. Email us: william_schmidt@hotmail.com

(C) 2009 www.tigersoft.com

Call 858-273-5900. Email us: william_schmidt@hotmail.com

Tiger Software

Since 1981, our TigerSoft and Peerless Stock

Market Charts, Automatic Buys and Sells and Nightly Analysis

have been Helping Professionals and the Public around the World To Maximize Stock Profits

and

Avoid Devastating Far-Reaching Market Declines.

28 Years of Studying Stock

Market History -- William Schmidt, Ph.D. (Columbia University)

Tiger Software Charts Make

Analysis of Stocks Simple, Easy and Profitable!

Welcome

Open Public Letter

from TigerSoft's Author

Welcome

Open Public Letter

from TigerSoft's Author

Last

Updated 11/4/2009

------------------------------------------------------------------------------------------------------------------------------------------------------------

Sample Charts

with The Automatic Buys/Sells Testimonials

Blog Insider Trading

Predictions

Nightly Hotline

Data TigerSoft Peerless Stock Market Timing Super Stocks' Power-Ranker

Full TIgerSoft Special

2009 Explosive

Super Stocks

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Other

Links Humor Baseball Football Music Psychology Turquoise Opals Roses Dahlias Hubble Space

------------------------------------------------------------------------------------------------------------------------------------------------------------

Coming Soon:

Book - Peerless Stock Market Timing And Trends

of NYSE A/D Line: 1928-2009

How Reliablly Bullish Now Is The End-of-Year Seasonality Factor in a

rising market?

That's

an example of what our Nightly On-Line Hotline

answers. Subscribe today, after you

see how effective our real-time Peerless Buys and

Sells have been. Peerless Market Timing

tells you when the market is dangerous

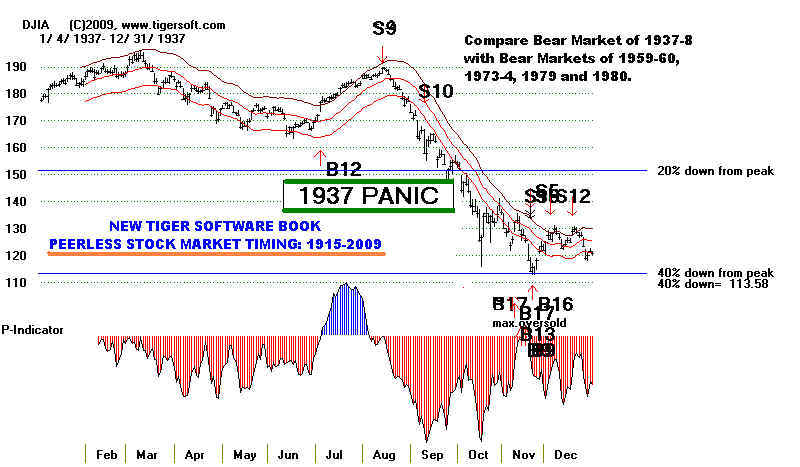

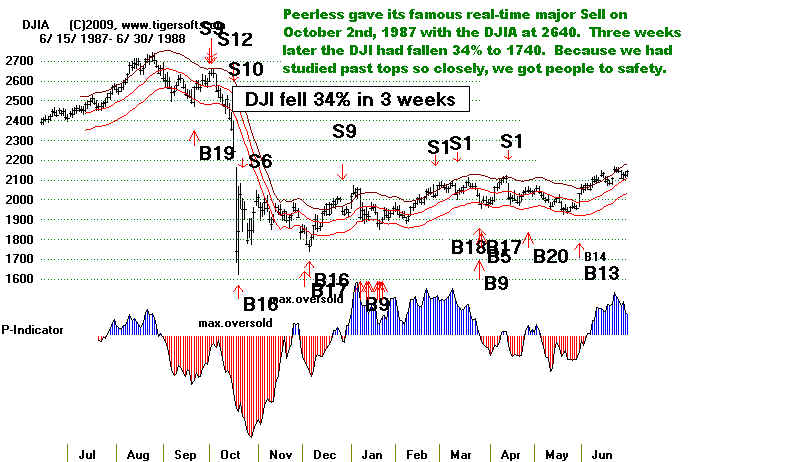

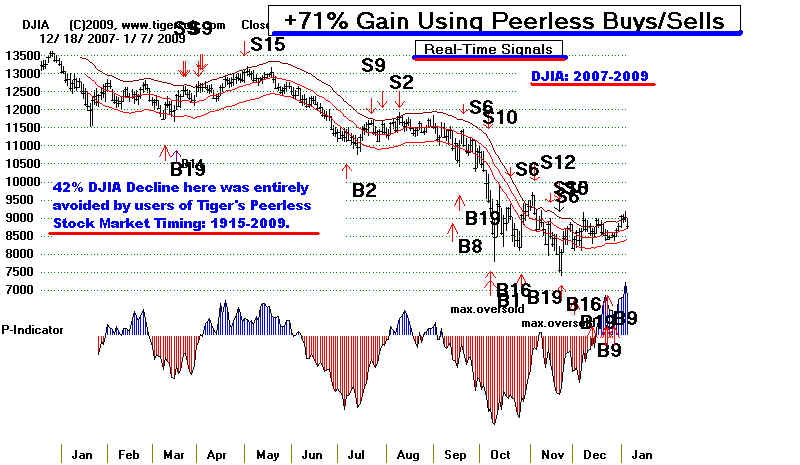

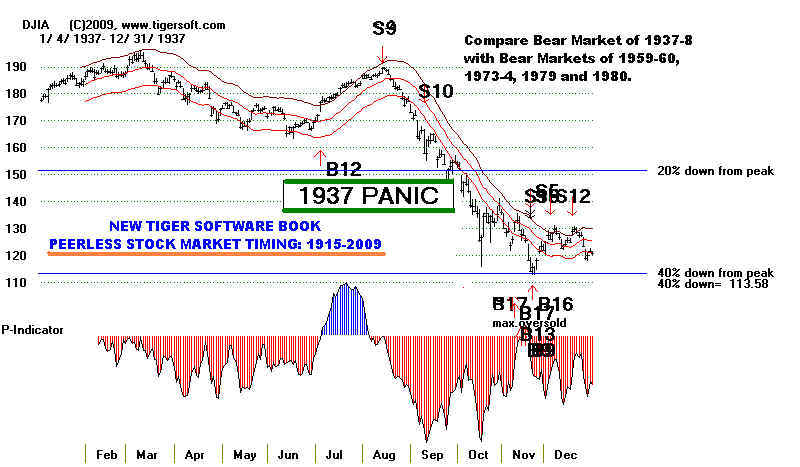

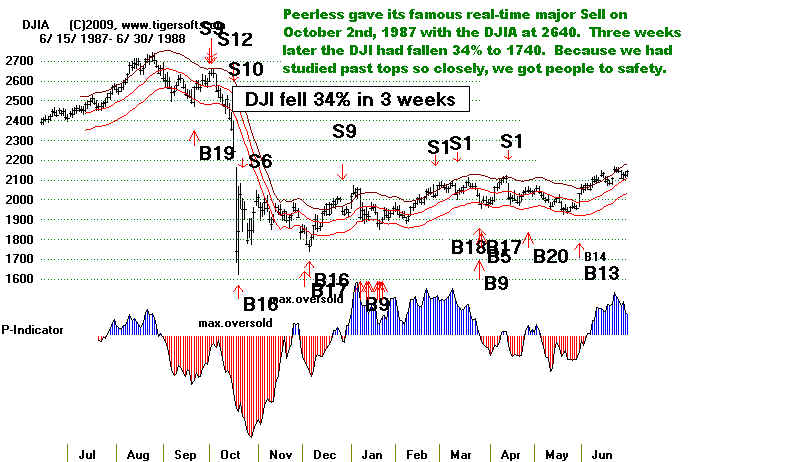

(Compare the 1929, 1987 and 2007 charts

shown below). Peerless also

shows when aggressive speculation pays as in March 2009.

Protect yourself with TigerSoft's

Peerless Stock Market Timing Software

and Nightly on-Line Hotline.

New Peerless Stock Market

Timing: 1915-2009

On-Line

Book

Important

breaks in A/D Line trends is only one of many keys themes in the new Peerless book

that will be available in early December. It

will be offered on-line first for $95 and show and discuss

each of the Peerless signals, the A/D Line and

the use of the key TIGER internal strength indicators.

If

you wish to save $45, order it now here before November 27th and pay for it by check or

card by clicking hte link above.

==> Order Web-Book Here: Only $50 until 11/27 and $95 afterwards.

The

book will be uniquely helpful. It will show all the DJIA charts since 1916, the full

year and

the two-half year charts. You will learn how to

spot important tops and bottoms using our P-Indicator,

the NYSE A/ D Line, the TigerSoft Accumulation Index,

OBV-PCT and Daily Volume.

It will be an inavaluable reference book. The track

record of each Peerless signal will be given

along with an emphasis on the importance of the

4-year Presidential cycle, the role of politics and

the FED. This will give many more details about

the exact basis of each signal. You will also get

all the unmarked charts since 1915 with the key

indicators. This you will want to print out and

mark up and write your own notes on. Elsewhere,

I have placed key notations on each chart.

====================================================================

- Our Famous Warning of June 24, 2007 -

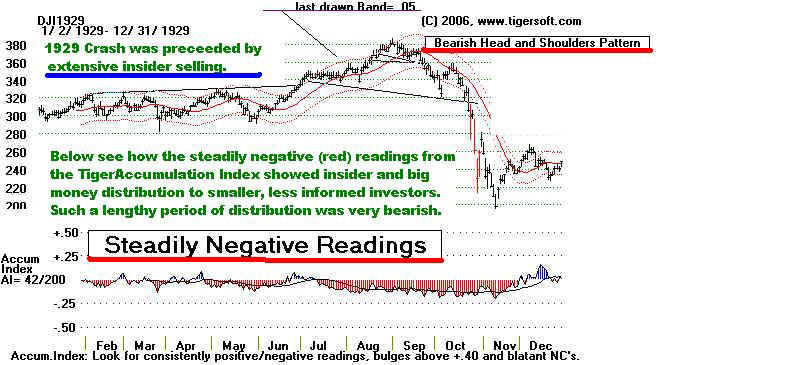

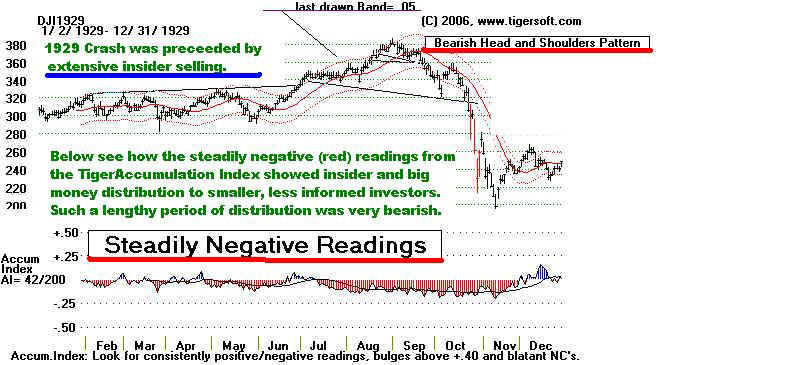

The 1929 Crash: Could It Happen Again? Yes - Absolutely.

Buying and Blindly Holding Is Dangerous.

So is,

trusting Wall Street and CEOs To Tell You The Truth.

Peerless Stock Market Timing:

1915-2009

The

1987 Crash:

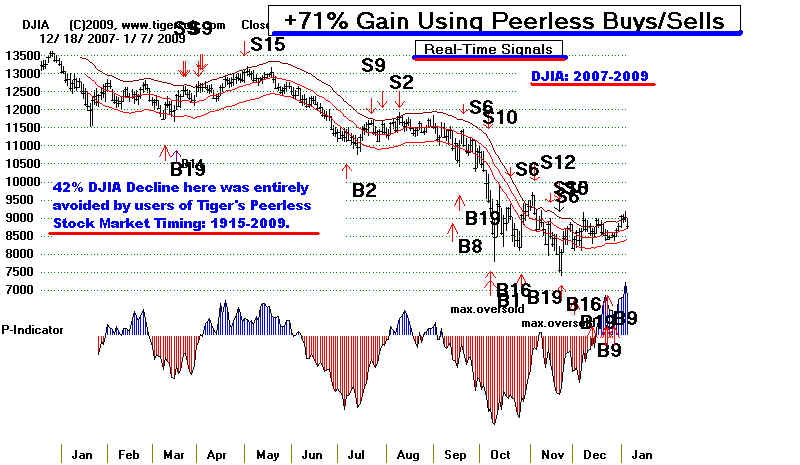

The 2007-2009 Crash:

===================================================================

World Wide, Insider Trading Is Rampant.

But using TigerSoft, you can easily spot it and profit from it.

SEC Now Admits Insider Trading Is

Rampant.

The First

Task for A Successful Trader:

Determine How Safe The Market Is.

Our Peerless Stock Market

Timing: 1915-2009 Will Tell You When The Market Is Safe

and When It Is Dangerous. Look at Its real-time

track record. As the world markets

become more and more integrated, the Peerless

automatic Buys and Sells have proven

themselves universally. Peerless averages 3

reversals per year. The average gain on

the DJI from Buy to Sell produces an average gain of

17%/year. 91% of Peerless signals

have been profitable. We provide all the data

needed. And if you prefer to simply get the

Buys and Sells with explanations and historical

justification, subscribe to our popular

on-Line Nightly Hotline.

Buys and Sells You Can Count On and Understand.

Peerless Stock Market Timing:

1915-2009: Automatic Buys and Sells:

6/18/2009 Bigger Profits and More Safety

Peerless Gain = +96% April

2008-March 2009

Calling All Tops: 1929, 1937, 1957 1959, 1962, 1966,

1973, 1978, 1979, 1980, 1987, 1990, 1998, 2000 and 2007

Calling All Bottoms: 1933, 1938, 1942, 1949, 1953, 1958, 1961, 1962, 1967, 1970, 1975,

1978,

1980, 1982, 1984, 1988, 1991, 1995, 1998, 2003... (Peerless Book coming soon.)

LOOK AT THE SUPERB PEERLESS TRADING GAINS from 7/30/2008 to 6/25/2009:

SPY

+132% QQQQ +129% IWM +230.8%

EWU (UK) +158% EWW (Mexico) +288% FXI (China) +221%

EWZ (Brazil) +452% EWO (Emerging Markets) +277%

IBM +114% AAPL +206% NEM +296%

SSRI +5005%!!! (Longs and Shorts)

2006 - Real-Time Peerless Signals

2007 - Real-Time Peerless Signals

2008 - Real-Time Peerless Signals

------------------------------------------ 2009 - Real-Time Peerless Signals

---------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------------------------------------------

Peerless Stock Market Timing:

1915-2009 Tells You When The Market Is Safe

and When It Is Dangerous,

Peerless Signals Applied To ETFs.

Peerless Is A Great

Way To Trade DIA, QQQQ, SPY or IWM,

Peerless Made

More than 200% in 2008-2009 Trading ETFs for Russia, Brazil and Mexico.

Peerless and Major

ETFs: 1996-2009

Peerless Buys and Sells Brought Whopping Gains in

Brokerage Stocks,

Gold Stocks and Volatile Tech Stocks.

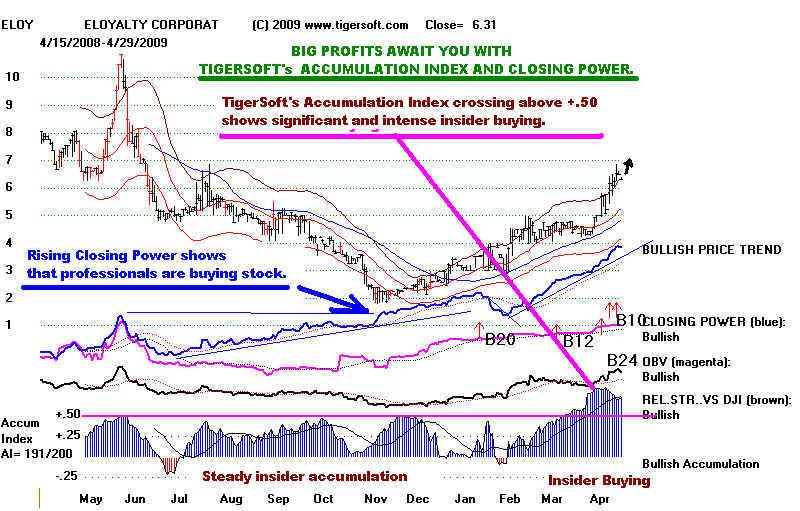

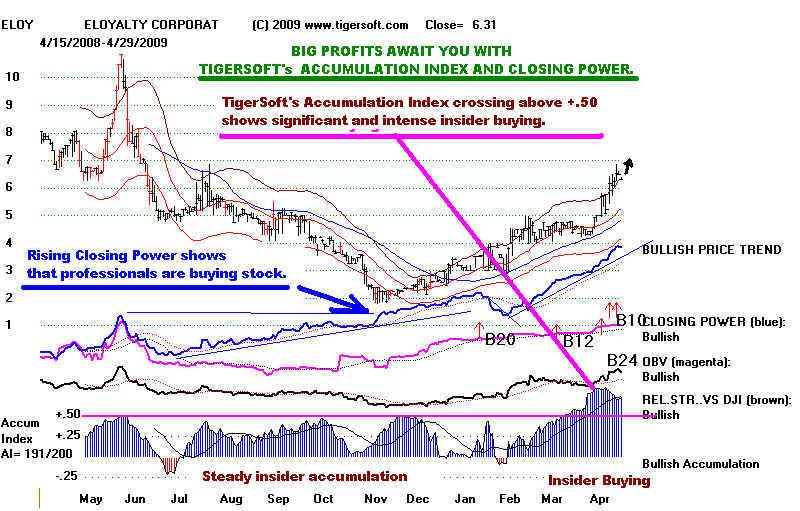

TigerSoft's

Unique Inventions - TigerSoft's "Accumulation Index"

and

"Closing Power"

To Spot Insider Buying and Selling.

Don't trade without these tools.

Insider Buying

Insider Selling.

Professional Money Manager: "TigerSoft's

Closing Power is a game-changer"

Can You Spot The Difference?

Insider Selling in 1929 versus Bunker Hunt's Buying Silver in 1979.

=============================================================

The KEY to Profitable Trading

Spot When Professional Buying Turns To Selling.

=============================================================

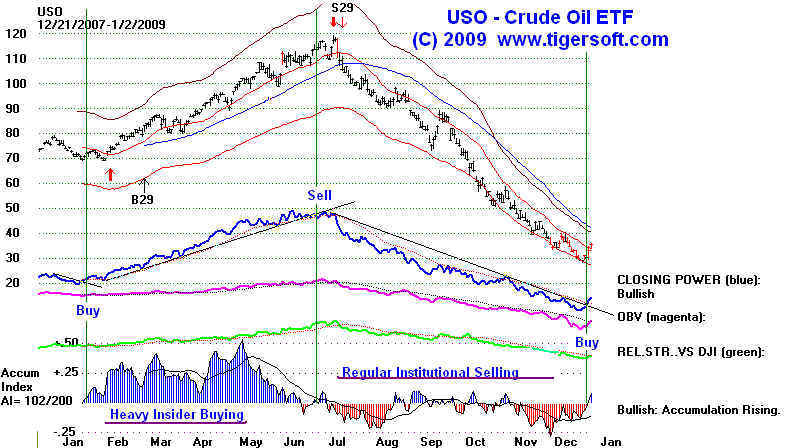

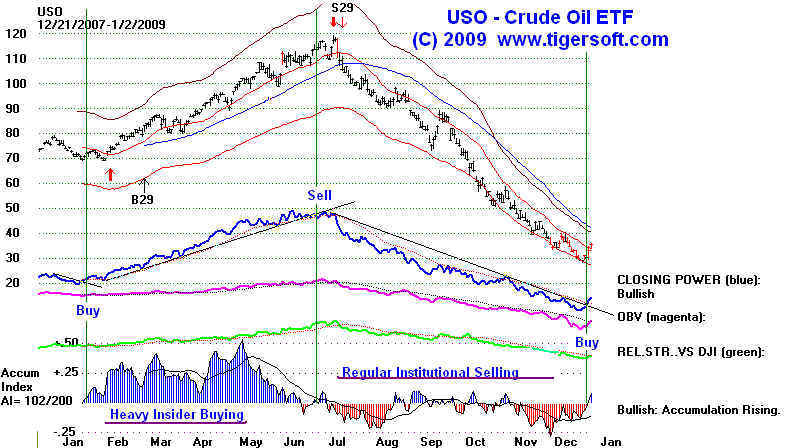

See how Accumulation turns into Distribution in the case of Crude Oil.

Buying and Holding is extremely dangerous. Use TigerSoft.

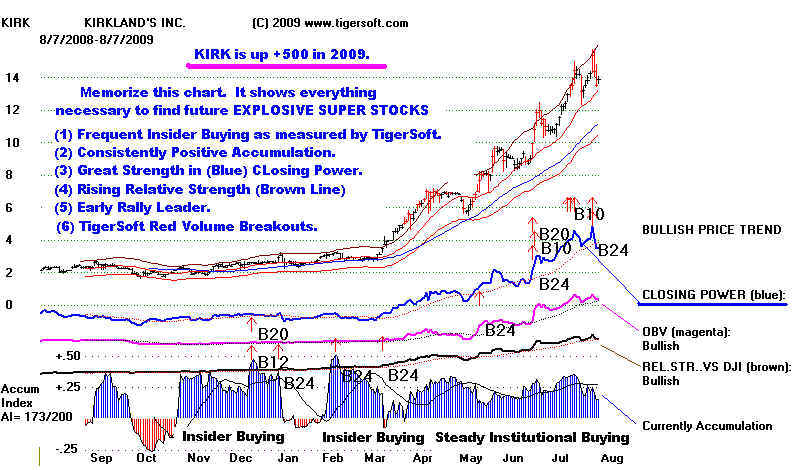

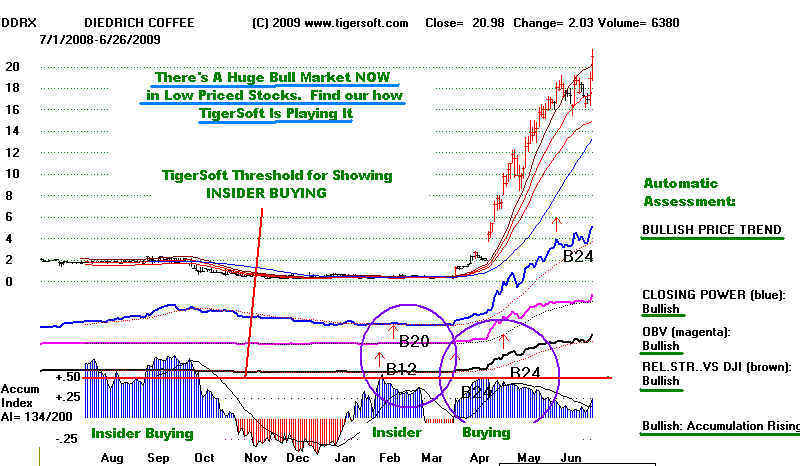

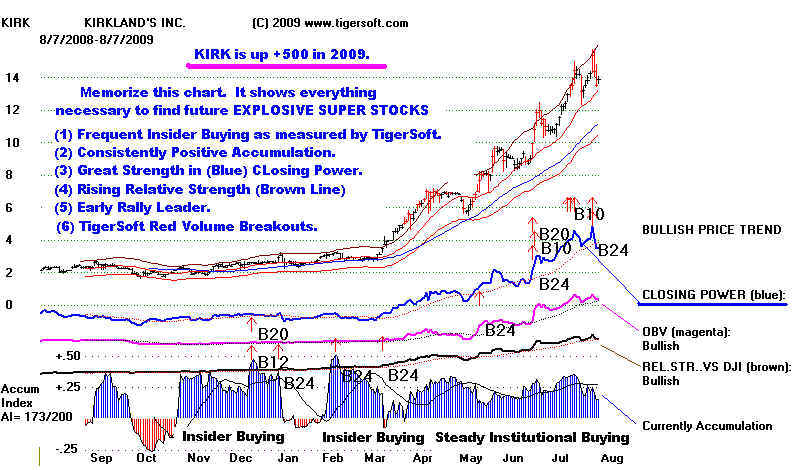

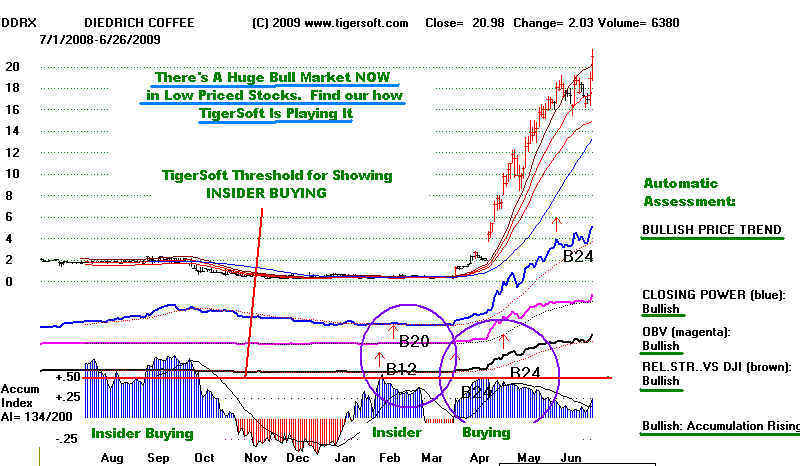

==================== EXPLOSIVE

SUPER STOCKS ========================

http://www.tigersoft.com/--6--/index.htm

8/7/2009

6/26/2009

4/20/2009

(C) 2009 www.tigersoft.com

Call 858-273-5900. Email us: william_schmidt@hotmail.com

(C) 2009 www.tigersoft.com

Call 858-273-5900. Email us: william_schmidt@hotmail.com

Welcome

Open Public Letter

from TigerSoft's Author

Welcome

Open Public Letter

from TigerSoft's Author