TigerSoft and Peerless Daily

Hotline

http://www.tigersoft.com/-SBL13HL

New HOTLINE

location

(C) 1985-2013 William Schmidt, Ph.D. www.tigersoft.com All rights strictly reserved.

---> To renew this Hotline, order here $350 (check) - $360(Visa/MC)

=====================================================================================

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

TigerSoft and Peerless Links, Older

Hotlines...

Please report broken links to william_schmidt@hotmail.com

=====================================================================================

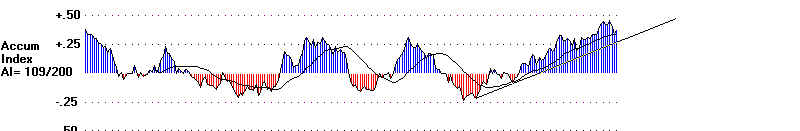

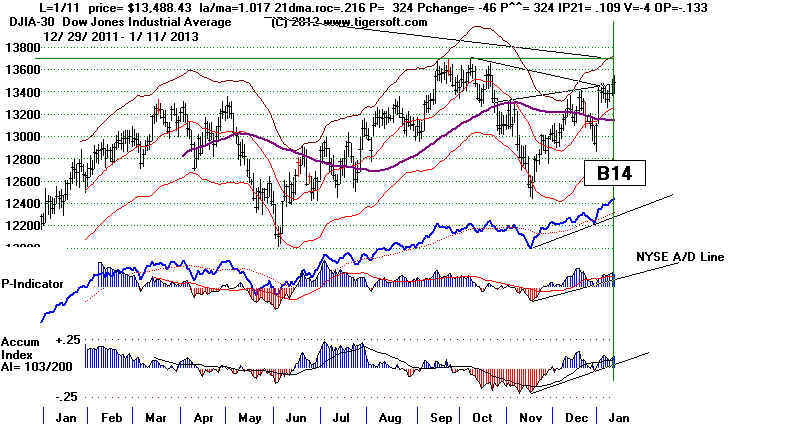

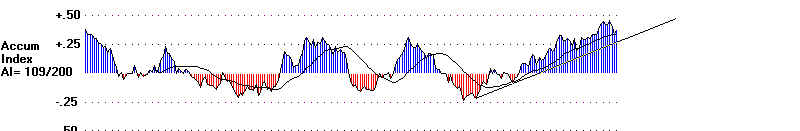

1/28/2013 Buy B10

How much higher can we go? Until there

is a Peerless Sell signal, the NYSE A/D Line breaks its uptrend or

the key ETFs' Closing Powers break their uptrends, I think we must

simply stay heavily long the highest Accumulation stocks and the

strongest big ETFs.

1/28/2013

Key Values: DJI

13882 -14 la/ma=1.029 21droc = .679

P= +553 Pch= +21

IP21 = +.284 V = +59

Opct = +.39

Value Line Is Already Making 12-Mo Highs.

Are we in a new "secular bull market"? Ones

that last only 4-5 years

are often said to be "cyclical bull markets"?

There are many ways

one could try to answer this important question.

My first reaction to this question, as a technician, is to look at the charts.

It suggests more caution now. But not immediately.

The longest DJI advances, those of the 1920s, the 1950s and the 1980s

and 1990s occurred after breakouts from long bases. Breakouts from such

bases are more bullish than simply a recovery back to an old high. Presumably,

there is a lot of pent-up energy that a breakout releases. By contrast, now,

we really do not have a long, multii-year base now that we can be said to be

breaking out of. Rather, the advance above 12000 seems more like a

short-covering advance that begun in earnest once the right shoulder apex was

surpassed. See the long-term chart below.

Technically, one would expect that the 2007 closing high at 14165 will pose

a lot of resistance because of how deep and scary the intervening decline

was down to 6500. This is a long-standing principle of technical analysis.

In fact, it is the failed rallies back up to the previous high that is what helps

set up a base which when broken brings about secular bull markets.

In fact, there were 3 failed rallies up to 110-120 between 1916 and 1924.

I count 5 failled rallies up to 980-1050 between 1966 and 1982. And there

were no less than 8 failed rallies between 150-210 in the period 1937-1948.

It was only when the DJI broke out above these bases that the DJI

made its longest advances, as shown below.

Aug 1921 - Aug 1929 (8 years)

Feb 1934 - Aug 1937 (3 years, 6 months

April 1942- May 1946 (4 years, 1 month)

Sept 1953 - November 1961 (8 years, 2 months

Aug 1982- Aug 1987 (5 years)

Oct 1990 - July 1997 (6 years, 9 months) - continuation of

1982-1987 advance

Oct 2002 - Oct 2007 (5 years) - recovery based on very easy credit for homowners.

March 2009 - ? - recovery based on very easy credit for big banks.

This is not to say that Federal Reserve policies cannot have a huge impact on

the length of a bull market. The long 5-year bull market from October 2002

to

October 2007 can be explained in part by how low the Federal Reserve

set

the Discount rates in 2001 and 2002, between 1% and 2%.

This

helped set the stage for the housing boom that followed.

The FED's lax regulation of the housing bubble and bank stocks' leverage

go

a long way in explaining the unusual length of the 2002-2007 bull market.

The present bull market, which started in March 2009 is now almost 4 years

old. But, if anything, the Fed is even more accomodating. And rhetoric aside,

the

Obama Administration and Congress seem just as accomodating to Wall Street

and big banks. So, I would think, the bull market will continue. But it will

take

a different shape. As was true from 1967-1969, I think the biggest gains

will be made in smaller stocks; the DJI, itself, will have a harder time, I suspect,

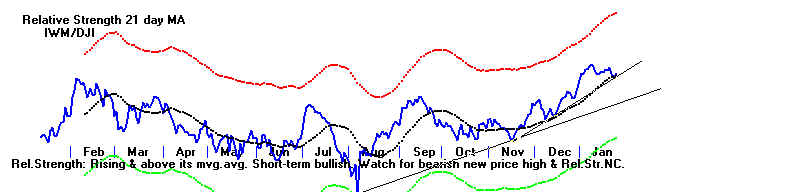

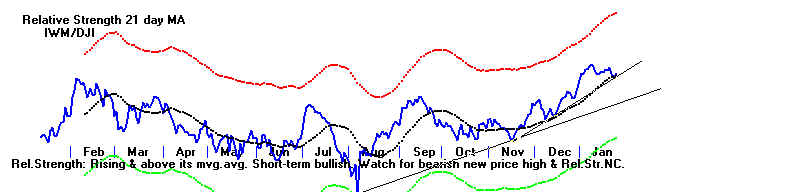

getting past 14200. The greater relative strength now seen in the Value Line

and

Russell-2000 is probably a sign of things to come.

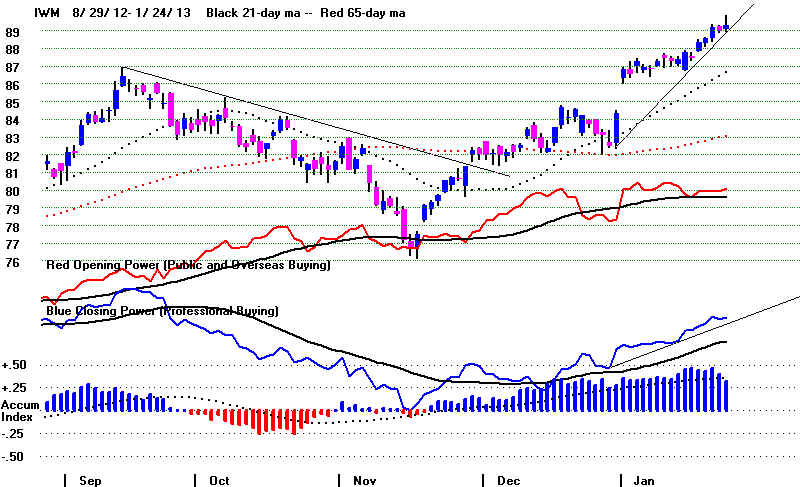

IWM (Russell 2000) and Peerless Automatic Signals

====================================================================================

OLDER HOTLINES

====================================================================================

1/25/2013 Buy B10

Buying Stampede? Don't Get Tranpled.

The DJI has now risen 11 of the last 12 days and is less than 200 points from

its all-time high closing of 14164.93 on 10/9/2007. DIA's Closing Power has

now risen

12 straight days. More on these streaks historically Monday night. .

1927 Cowboys, Horses, Bulls Stampede - W.R. Leigh

Yippie - Yi - Yo!

The

rush into stocks this January has ample precedent, as I showed a week ago.

Tops

are seldom made in the last two weeks of January. But usually January breakouts

that are going to advance past February also produce B12s and/or Buy

B4s. This

requires a strng of closes above the 3.0% upper band and very good breadth. All 8 of

January take-offs with a Buy B4 or B12 advanced into March before peaking and then

falling back to their 2.5% lower band. Such enhancing Buy signals have not yet

occurred.

January Take-Offs since 1966:

First Decline

First Decline

to 2% lower band

to 3.5% lower band.

1967 Buy B6, B10 ...

2/8/1967

5/8/67

1975

Buy B6, B4, B12 ...

3/18/1975

3/18/1975

1976

Buy B9, B10, B12,B4

3/24/1976

3/24/1976

1985

Buy B4

3/1/1985

none in 1985

1986

Buy B4

3/27/1986

5/29/1986

1987

Buy B6, B14, B4

4/6/1987

4/6/1987

1989 Buy B10, B4

2/7/1989

10/9/1989

1992

Buy B17, B10, B4

3/4/1992

6/1/1992

1993

Buy B18

2/5/1993

none in 1993

1995

Buy B6, B18

7/12/1995

none in 1995

1996

Buy B4

3/6/1996

3/19/1996

1997

Buy B17, B4

3/10/1997

3/10/1997

2011 Buy B18

2/10/2011

2/10/2011

2012

B6, B12, B10

3/16/2012

5/1/2012

2013

B14, B10

-------------

---------------

More cases and

their charts

The

Closing Powers are all rising, though they are over-extended short-term.

It is not often that we get 12 straight days where the close is above the opening.

One

warning sign of a top that is definitely NOT present is a

rising XAU, the

Philadelphia Stock Exchange of 15 Precious Metals' Mining Stocks. In fact,

gold

stocks now make a disproportionate share of the Bearish MINCP stocks:

EXK, ANV, ABX and NEM. I did a study of the XAU and

its ITRS (50-day

pct

change of XAU minus 50-day pct change of DJI) as a predictor of the DJI.

The

2012 year-end and January 2013 weekness of XAU's ITRS also occurred

in

1995 and 2003, when new bull markets were being sprung.

See new Blog ---> XAU

As Predictor of DJI: 1984-2013

A Perfect Confluence of Bullish

Factors

Much

of the rally stems from the end of tax-loss selling owing to the desire of

many

to capture gains in 2012 while taxes are lower and some of it in beaten-down

stocks is the result of the end of tax-loss selling for 2012. But without question,

there

is more retail customer optimism. Gold stocks are weak. There is more

confidence. Interest rates will not go up until the official unemployment level

drops

to 6.5%. And Republican threats to bring another debt-crisis as in 2011

have

dried up. All of which has produced a lot of hasty short-covering. We

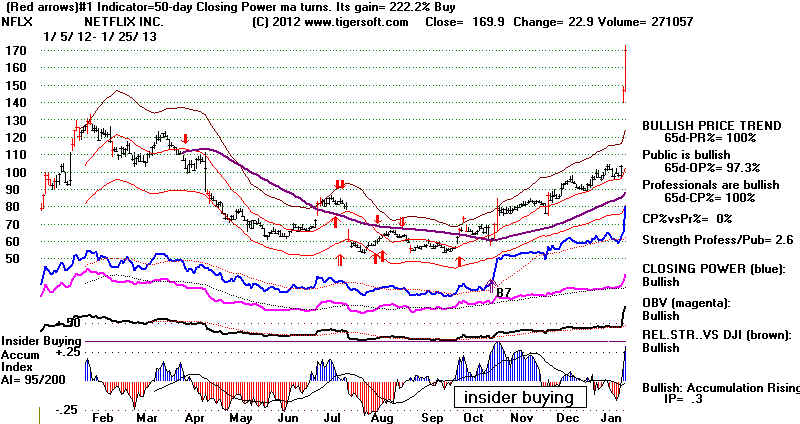

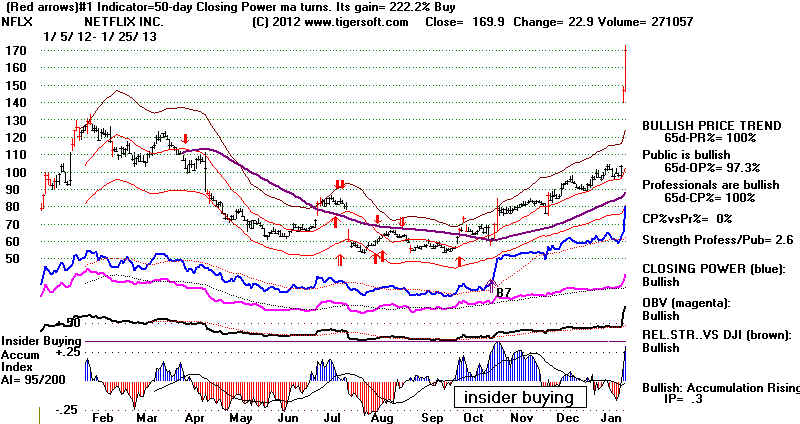

can

actually see the effects of this is stocks like NFLX, which has rallied 60% in

the

last two days.

Its short interest fell from 13.2 million shares to 10.1 million

on 1/15. So, we

can imagine how stressed these short sellers have been. And this

could

easily become a pattern, as one group of professionals target the shares

of

other stocks with big short interest levels when earnings hold up, as was the

case

for Netflix.

SHORT-COVERING RALLIES:

How Can We Find Them Early-On?

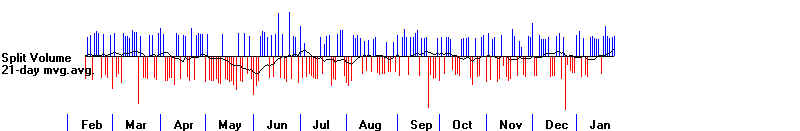

If you look closely at the chart above you will see that the day before it starting

rising so rapidly, its Closing Power rose back above its rising 21-dma. My friend

Fran in San Diego has suggested that this would be worth screening for. Accordingly,

I will be posting on the Tiger Data page each night all the stocks whose CP moves

back above its 21-dma and all those that fall back below its declining 21-dma.

These will be called CPCROSSA and CPCROSSD. I will start recording the

count of each every night here, because I believe that this should help us catch sight of

the

short-term swings of the market. You can easily see the biggest short positions

on th\e NASDAQ here.

I think it will be productive to start following these stocks

with the biggest, say, 50 short positions. I understand that some may prefer to

work with the stocks with the biggest short interest. That should also be possible.

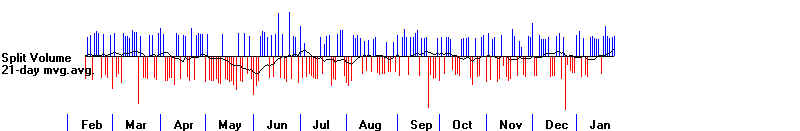

Below is our Tiger Index of the 42 most shorted stocks.

1/25/2013 Key

Values: DJI 13896 +71 la/ma=1.033

21droc = .671 P= +532

Pch= +61

IP21 = +.286 V = +63

Opct = +.384

1/25/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 455 MAXCP stocks Bullish MAXCP Stocks (1/25/2013) BULLish plurality

---> 49 +14

MINCP stocks Bearish

MINCP Stocks (1/25/2013)

--->

124 New Highs on NASDAQ

7 new lows. BULLish plurality

--->

219 New Highs on NYSE

8new lows. BULLish plurality

=====================================================================================

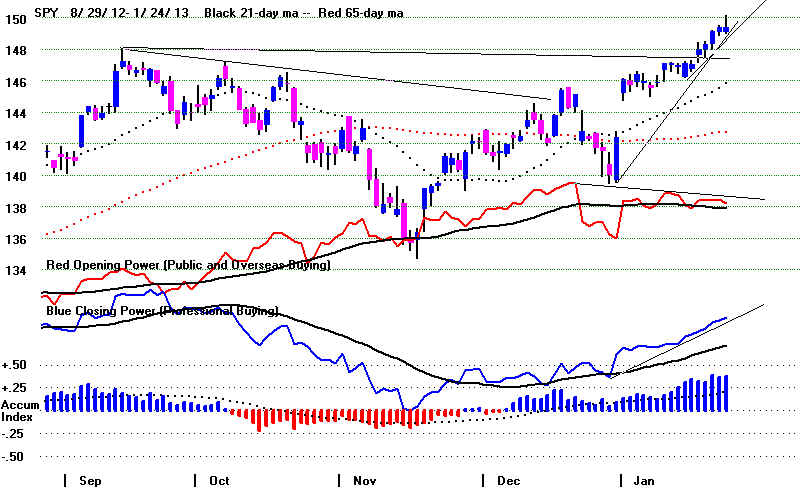

1/24/2014 Buy B10

AAPL's 12% plunge today might

easily have unsettled

a

lesser market. But we are still seeing heavy Professional buying and what

looks

like might be a gathering speculative binge. See below how steady is the

rise

of the blue Closing Powers.

Last

night, I showed how reliably bullish are January Automatic Buy B10s

and

breakout surges. The DJI round number 14000 is expected to be both

a

magnet and a barrier, too.

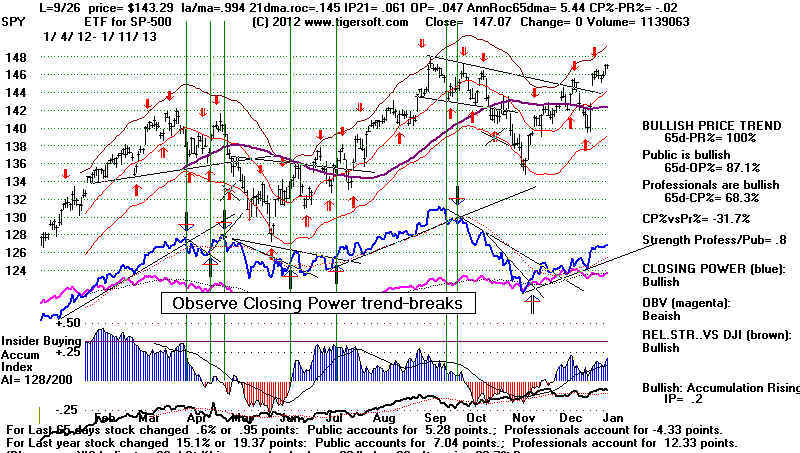

The Closing Powers for DIA, SPY and QQQ are much stronger than their

Opening

Powers. The pattern is now well established: dull openings followed

by

impressive closes. I suspect we will see the Opening Powers turning up

before too

long. Then if Closings remain strong, we will see even more impressive

gains.

Needless to say, AAPL's weakness is spoiling the QQQ for the bulls.

1/24/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 448 MAXCP stocks Bullish MAXCP Stocks (1/24/2013) BULLish plurality

---> 35

MINCP stocks Bearish

MINCP Stocks (1/24/2013)

--->

111 New Highs on NASDAQ

5 new lows. BULLish plurality

--->

218 New Highs on NYSE

9 new lows. BULLish plurality

==================================================================================

1/23/2014

Buy

B10 January Automatic Buy B10s Are Reliably Quite Bullish.

The round number

14000 will likely act as a magnet and a barrier, too. For now,

institutions are

still taking positions aggressively for more of a rally that could

easily last until

March or April for the DJI and much longer for the high Accumulation/

high Closing

Power "Bullish MAXCP Stocks".

1/23/2013 Key

Values: DJI 13779 +67 la/ma=1.029 21droc = .416 P= +402 Pch= -58

IP21 = +.238 V = -7

Opct = +.144

Today's DJI

jump owed entirely to IBM's 8.64 gain. There were slightly more decliners

than

advancers on the NYSE. Some of the big biotechs, AMGN, ALXN,

BIIB, ILMN

and TEVA

have broken down below falling 65-day ma. And AAPL's

earnings out after

the close

are said to be disappointing.

But the SPY, DIA and IWM Closing Powers are still rising and, above all,

the history

of Peerless

automatic Buy B10s suggests prices will most likely continue to rise without

much of a

pullback for another 6 weeks, at least. Of the 10 January automatic Buy B10s

since 1928,

only one was followed by a decline to the lower band. That was in 1979.

The 1983

case might also be considered a case, too. But in these cases the declines

were

temporary and relatively shallow. Holding the best performing stocks worked out

very well

in those years, too. As you can see in the table below, January DJI-breakouts

which were

only judged Buy B10 breakouts (No B10 appears in their cases) mostly

(60%) also

were followed by rallies that lasted, as least, until March.

Our present

2013 B10 case shows the highest IP21 value (current level of the Tiger Accum. Index)

of any of

the January automatic B10s. No doubt, there is an institutional rush into the

market.

I would

think the DJI itself will face very heavy overhead resistance at the round number 14000.

But, rather

than try to be too clever, I think we should just let the market run until there

is a new

automatic Peerless Sell or the Closing Powers reverse course.

------ January Buy B10s since 1928

------------------------------------------------

Gain la/ma

ann-roc

P-I ch

AdjP-I IP21 V-I Opct

Current Case

1/22/2013

1.026 .411 460 +57 +460 .263

12 .146

1. Auto 1/25/1943 +14.6% 1.028 .516 108 +19

+549 .113 +57 .121

No pullback... Up steadily until May.

Judged 1/15/1954 big gain

1.017 .313 82 _37 +275 .094 +13

.046

No pullback...Up steadily until August

2. Auto 1/5/1961

big gain 1.016 .569 120 +28 +351

.085 +129 .18

No pullback...Up steadily until May.

Judged 1/8/1964 big gain

1.015 .222 33 +13 +93

-.004 -171 .37

No pullback...Up steadily until May.

3. Auto 1/12/1967 +6.9% 1.033 .14 144 +3

+286 .011 +3 .109

No pullback...Up steadily until May.

4. Auto 1/22/1971 +8.8%

1.024 .547 322 +11 +705

.114 +2 .545

No pullback...Up steadily until May.

5. Auto 1/6/1972 +5.6%

1.033 .694 246 +13 +528

.066 +2 .391

No pullback...Up steadily until April.

Judged 1/27/1975 big gain

1.076 1.636 422 +44 +802 +.134 +3 .492

No pullback...Up steadily until July.

6. Auto 1/7/1976 +12.3% 1.057 1.124 286

+35 +539 .200 +2 .534

No pullback...Up steadily until March,

7. Auto 1/15/1979 +6.9% 1.042 .568 133

+42 +252 .108 +2 .321

Pullback to lower band...Then up until

April.

( 1/7/1983 Sell S12

1.04

.334 48 +12 +95 -.062 +1

.002 )

Pullback to lower band... Then up until

October.

Judged 1/21/1985 Big gain 1.041

.525 237 +38 +469 +.097 +8 -.113

Pullback to point of breakout in March and then up strongly.

Judged 1/7/1987 20.6%

1.033 .426 -11

+57 -22 +.149 -3 .096

No pullback...Up steadily until July.

8. Auto 1/12/1989 big

gain 1.023 .454 118 +21

+204 .078 +11 .185

First peak was 2/8/1989 with decliune to lower band.

9. Auto 1/31/1990 big

gain 1.051 .367 109

+18 +201 .062 +7 .133

No pullback until March.

(Auto 12/27/92 +6.6% no

pullback until April).

Judged 1/29/1996 4.6%

1.029 .484 88 +9

+113 +.198 -7 .183

No pullback...Up steadily until March

Judged 1/10/1997 3.8%

1.035 .424 102 -11 +.125 +.055 -5

.304

Pullback below lower band started with S9 on 2/12/1997.

Judged 1/7/1999

1.05 .614 23 -58 +22 +.075 +2 .13

DJI immediately pulled back to the lower band.

Judged 1/11/2006

1.016

.291 358 -14 +330 +.034

+57 .116

DJI immediately pulled back half way to the lower band.

Judged 1/11/2010

1.016

.371 533 +10 +518

+.017 +65

.40

DJI immediately pulled back to the lower band.

Judged 1/3/2011 +9.7%

1.016 .320 277 +11 +277 +.001

+117 .135

No pullback...Up steadily until May

10. Auto 1/18/2012

+4.9% 1.023 .690

553 +46 +553 .125 +95 .108

No pullback until March.

1/23/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 469 MAXCP stocks Bullish MAXCP Stocks (1/23/2013) BULLish plurality

---> 30

MINCP stocks Bearish

MINCP Stocks (1/23/2013)

--->

75(-21) New Highs on NASDAQ

4 new lows. BULLish plurality

--->

180 (-72) New Highs on NYSE

1 new lows. BULLish plurality

=====================================================================================

Mid-Morning 1/23/2014 Comment

I left out the

red words in the key first sentence in last night's Hotline.

Peerless remains on a Buy B14. The new Buy B10 signal today

registers the new closing high for the DJI more than it shows how

much higher the DJI can go. Volume did not rise on the DJI's new

high necause the SP-500, Value Line and NYSE had already made

made new highs.

Mid-Morning additional commentary:

The type of "V" bottom we are seeing does sometimes being a pullback

after another 1% to 2% more DJI gain, but, on the other

hand, if you look at all the cases where the Peerless "V-I" was lagging

and negative, as was true on Friday's close, you can see that there

are many more historical cases of a continued move up than a retreat of 3% or 4%.

How much higher? I would say, as long as the Closes are strong, the

market is going to keep rising. But a very strong opening (75 points up

or more) and then a weak close would be a reversal sign. The DJI 14000

round number is the next most likely level of high resistance.

1/22/2013

Peerless remains on a Buy B14.

The Buy registers the new closing high

for the DJI more than

it sshows how much higher the DJI can go. Volume did not rise

on the DJI's new high

necause the SP-500, Value Line and NYSE had already made

made new highs.

Consolidation just beneath the old highs would have been more bullish.

But as you can see from

the Bullish MAXCP stocks there are a great many stocks

show ing very high

levels of Accuulation as they break out to new 12-mon highs. Normally

these bulges occur 6

months to a year, or a more, before the final new highs.

This is a broad

advance. 27 of the 30 groups of stocks we follow

show a majority of

their component stocks are above their 65-dma.

1/22/2013

To Key Index and Stock Charts

DJI with Peerless Signals

DJI-volume

DIA with CP SPy with CP QQQ with CP IWM with CP S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 524 MAXCP stocks Bullish MAXCP Stocks (1/22/2013) BULLish plurality

---> 28 +2

MINCP stocks Bearish

MINCP Stocks (1/22/2013)

--->

160 New Highs on

NASDAQ 2 new lows. BULLish plurality

--->

321 New Highs on NYSE

3 new lows. BULLish plurality

---> 1/22/2013 Stock Sector Ranking: 27 up and 3

down.

Strongest:

12/22/2013

12/24/2012 12/12/2012

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Homebldg

100.0% +29.2%

70.8% +4.1 66.7%

BigBanks

100.0% +14.3% 85.7% 28.6

57.1%

Pipeline 100.0% +83.3% 16.7%

16.7%

Reits

97.6% +14.0% 82.6% 61.2 21.4%

Transp

97.4% +19.0% 73.4% +8.8

64.6%

Military

96.3% +11.1%

85.2% +18.5

66.7%

Chem

94.6%

+26.7% 67,9% +3.6

64.3%

Insurance

93.6% +21.9%

61.7% -.4 68.1%

Gaming 93.3% 26.6% 66.7% +20 44.7%

Finance

92.7% +19.1%

73.6% 19.1 54,5%

For.ETFS

90.9% +8.5% 81.8% -8.9 90.9%

IndMaterials

90.6% +21.1% 69.5% +6.2

63.3%

Should We Worry about the Negative V (Volume) -Indicator Reading with the

DJI

with the DJI 2..3% over

the 21-dma in a rising market with DJI at or near 12-month high,

as was true Friday? The studies below show that without a Peerless Sell signal, there is a

much

greater probability of

a continued advance than a decline back as far as the lower band

or the rising 65-dma.

It should be added, though that a negative NNC by the V-I does

make more reliable a

Peerless Sell signal, should one occur.

First here are some

cases since 1945:

la/ma ann-roc

P-I ch

AdjP-I IP21

V-I Opct

3/21/1946

1.026 .037

51 57

202 .09

-93 -.071

DJI rallied from 196.7 to 212.50 (sell S5/S4) before starting a 4.5 mo 23% decline

7/23/1951

1.024 .253

6 22

21 .174 -122 .044

DJI rallied from 255.7 to 276.40 before retreating

to the lower band.

12/7/1952

1.025 .329

46 4

141 .029 -10 .066

DJI rallied from 267.00 to 275.40 before retreating to the lower band

11/4/1954

1.025 .12 -18 12

-59 -.055

-148 -.011

DJI surged into all-time high territory a month later and rallied

strongly until 1956. to 275.40

12/6/1956

1.029 -.067

-83 -20

-262 -.078 -316 -.143

DJI rallied from 492.70 to 499.50 (S9/S12) before retreating to 454.80.

11/6/1958

1.023 .341

37 6

117 .077 -132 .076

DJI rallied from 554.90 to 567.50 (S9/S12) before briefly dipping back to 540.50.

2/24/1959

1.023 .137

37 4

112 -.056 -110 .075

DJI rallied from 602.90 to 678.10 (S4) and then fell back to 616.50

5/17/1960

1.028

.259

64 19

187 .04 -57 -.063

DJI fell back to lower band, only 2% to

rising 65-dma buy.

11/9/1962

1.024 .265

54

1 157

.059 -39

.033

DJI rallied from 722.30 to 734.30 three days later and then collapsed 27% in 7 months.

4/7/1972

1.023 .215 -75 -5

-159

.064 -1

.018

DJI fell back to lower band. Also S9/S15.

8/4/1972

1.024 .265

54

1 157

.059 -39

.033

DJI rallied from 722.30 to 734.30 three days later and then fell to 2/5% lower band.

11/1/1972

1.026 .178

42 38

91 -.046 -1

-.007

DJI rallied from 958.54 to 1051.70 over next 10 weeks. Buy B10.

1/5/1973

1.023 .238

-77 -7

-149 .039 -2 .053

This was major top. Accompanying S9/S12/S15.

4/10/1975 1.024 .162

-84

25 -158 .042 -1

-.15

DJI rallied from 781.29 to 881.81 over next 3 months.

6/17/1976

1.027 .168

15 36 29 .082

0 .052

DJI fell back to lower band. Also

S2/S5.

10/11/1978 1.032 .068 -126 12 -261 -.124

-4 -.101

DJI fell back to lower band. Also S9/S12

8/7/1979 1.024

.097 +50

11 +95 .181 0 +/047

DJI rallied from 863.14 to 897.611 over next 3 months.

I will

check the rest. But the pattern is clear. Without a Peerless Sell,

the type of

negative non-confirmation we now see is not likely to prevent

higher

prices.

The difference in

outcome between the next two cases show that the

rate of change of the

21-dma and the level of IP21 are very important.

The 1986 and 1987 cases

show that January bullishness over-rides

the V-I NNC (negative

non-confirmation).

la/ma ann-roc P-I

ch AdjP-I

IP21 V-I Opct

10/18/1985

1.023 -.009 -1

47 -2

-.031 -2

.087

DJI fell back to lower band. There was no

Peerless Sell presently.

but

la/ma ann-roc

P-I ch

AdjP-I IP21

V-I Opct

10/14/1986

1.025 +.318 -34 66 -67 +.052

-1 .095

DJI began a huge advance,

1/31/1986

1.024 +.258 + 98

38 +187 +.088 -3 .058

DJI rose 15% in next 10 weeks.

1/5/1987

1.024 +.149 -88 73 -173 +.094 -13 -.121

DJI rose 15% in next 10 weeks.

12/23/1992 1.039 +.368 -32 44

-59 +.064 -8 .054

DJI rose 19o% in next 14 weeks.

11/6/1996 1.025 +.417 45

62 58

+.094 -3 .062

DJI rose 10% in next 4 months.

2/4/1998 1.037 +.229

55 3

85 +.122 -12 .062

DJI rose 10% in next 10 weeks.

and the big rally in 1999 despite multiple V-I NNCs.

10/15/2003 1.025 +.294

305 -102 295

+.016 -30 .026

DJI rose 10% in next 3 months.

and the big rally in 2009 despite multiple V-I NNCs.

Other cases of

interest..

la/ma ann-roc

P-I ch

AdjP-I IP21

V-I Opct

10/18/1991

1.023 .209 +73

-4 135

.027

-3 -.038

low

DJI fell back to lower band. There was no

Peerless Sell presently.

--------------------------------------------------------------------------------------------------------------------------------------------

Next here are the cases

where the DJI was testing it earlier high from a few months before

after a 7.5% to 13.5%

decline.

Date

Size of

Outcome

Intervening

Decline

Jan 1981

9.1%

Nominal new high and then decline to lower band. Sell S9

Peak 1/6/1981 la/ma

ann-roc

P-I ch

AdjP-I IP21

V-I Opct

Key Values: 1.059 .381

61 43

107 .031 -1 .11

V-Bottom: 11/20/1980 -> 12/11/1980 -> 1/6/1981

Length 1 months and 17 days.

------------------------------------------------------------------------------------------------------------------------------------------------

Feb 1980

11.0%

False breakout and 16% decline: S9/S12/S15

False breakout: 2/13/1980 la/ma

ann-roc P-I ch AdjP-I

IP21 V-I

Opct

Key Values:

1.028 .478 -26 1 -50

-.01 -1

.168

Semi-V-Bottom: 10/5 -> 11/7 ->2/13/1980

Length 3 months and 8 days.

-----------------------------------------------------------------------------------------------------------------------------------------------

Dec 1959

9.0%

"False breakout". Nominal new closing high

(breakout)

and 10 month decline. Sell

S12 and S15

la/ma

ann-roc P-I ch

AdjP-I IP21

V-I Opct

Peak's key values: 1/5/1960 1.018 .400

+4 +6 13

-.038 -170 .095

Semi-V-Bottom: 8/3/59 -> 9/22/59 ->1/5/1960

Length 5 months and 2 days.

=======================================================================================

1/18/2013

Peerless remains on a Buy B14.

The DJI has made a new 12-month closing high.

It still needs to close above 13700 to

achieve what will look like a price breakout, because the

close is above the previous 12 months'

highest intra-day levels. The S&P-500,

NYSE and

Value

Line have already done this. Apple

is still lagging. This helps account for why the

QQQ

and NASDAQ are lagging.

The history of the DJI forming V-Bottom

Price bottoms, like we see now, and other

bottom formations that last less than 5

months seems worth studying. Of the 17 cases,

only 6 produced a strong advance.

11 brought declines, 6 of which took the DJI far

below the lower band. Fortunately,

without a Peerless Sell signal, there were no

significant declines below the lower

band. I gleaned these from no less than 48

bottoms made with a low 7.5% to 13.5%

below the highest close.

1/18/2013

Key Values: DJI 13650 +54 la/ma=1.023 21droc = .267 P= +403 Pch= -26

IP21 = +.202 V = -12

Opct = +.054

The still negative

-12 V-I readings now may be a problem but it is contradicted by high

IP21 readings of +.202. I think what is going on now is that we see selling in some

higher

priced, big growth stocks, AAPL MRK,

TEVA and AMGN, for example, and that some

money is being used to buy

smaller companies. But growth stocks are still favored,

Specualtion has not gone to an

extreme. While the sample 217 Low-Priced Stocks in

our Tiger download show 69.6% are

above their 65-dma, 79.4% of our Higher Priced

stocks above their 65-dma.

Re-investment is typical as a new year starts.

Conclusion:

as long as the Closing Powers for the key ETFs are rising and there is no

Peerless sell signal,

I would give the market more chance to advance. As I noted a

few days ago, very few tops

are made in the second half of January. At the same time,

we should watch to see if there is

an increase in stocks appearing in our MINCP

group.

.

----------------------------------------------------------------------------------------------------------------------------------------------------------

7.5%-13.5% Corrections

That Last Less Than 6 Months

and Their Outcome

Ranked from Shortest to Longest

Size of

Outcome

Intervening

Decline

-------------------------------------------------------------------------------------------------------------------------------------

Current Case 7.6%

Close above 13700 for clear breakout. Outcome?

No new Peerless Sell

V-Bottom: 9/14/2012 > 11/15/2012 bottom > new closing high 1/18/2013

Length 3 months and 4 days.

--------------------------------------------------------------------------------------------------------------------------------------

Previous Case ranked by length:

9.1% January 1981

Nominal new high and then decline to lower band. Sell S9

Peak 1/6/1981 la/ma

ann-roc P-I

ch AdjP-I

IP21 V-I

Opct

Key Values: 1.059 .381

61 43 107

.031 -1

.11

V-Bottom: 11/20/1980 -> 12/11/1980 -> 1/6/1981

Length 1 months and 17 days.

--------------------------------------------------------------------------------------------------------------------------------------

9.8%

April 1997 Breakout followed by 15% rise in 3 months. B4

Breakout 5/5/1997 la/ma

ann-roc P-I

ch AdjP-I

IP21 V-I

Opct

Key Values: 1.07

1.221 +249 +44

+304 .183 +37 .175

V-Bottom Dates: 3/11/97 -> 4/11/97 ->5/5/97

Length 1 months and 25 days.

-------------------------------------------------------------------------------------------------------------------------------------

10% April 1935 Bull market continues.

Breakout and pull-back only to point of breakout.

Breakout key values

la/ma

ann-roc P-I ch

AdjP-I IP21 V-I

Opct

4/22/1935 1.071 1.231

80 -6 449

.169 74 .394

V-Bottom: 2/18/35 -> 3/18/35 -> 4/18

Length 2 months

--------------------------------------------------------------------------------------------------------------------------------------

8.0% September 1986 Nominal new high and then 9% decline. Earlier S9

Peak 9/4/1986 la/ma

ann-roc P-I

ch AdjP-I

IP21 V-I

Opct

Key Values: 1.032 .916

214 29

410 .26 20

.384

V-Bottom: 7/2 -> 8/1 -> 9/4/1986

Length 2 months and 2 days.

--------------------------------------------------------------------------------------------------------------------------------------

8.1% October 2007 False breakout 9% decline. S4

False BO 10/1/2007 la/ma

ann-roc P-I

ch AdjP-I

IP21 V-I

Opct

Key Values:

1.038 .747 +313 +110

+282 +.089 +73 .346

V-Formation Dates: 7/19/2007 -> 8/16/2007 -> 10/1/2007

Length 2 months and 13 days.

--------------------------------------------------------------------------------------------------------------------------------------

8.0% August 1951. DJI pulled back 1%, rose 4% and then fell to the lower band.

Peak 8/6/1951 la/ma

ann-roc P-I

ch AdjP-I

IP21 V-I

Opct

Key Values 1.034

.707 142 8

433 .199 126

.262

Semi-V-Bottom: 5/3 -> 6/28 - 8/6/1951

Length 3 months and 1 days.

--------------------------------------------------------------------------------------------------------------------------------------

11.4% July 1936 Bull

market continues.

Breakout and pull-back only to breakout for one day.

Breakout key values

la/ma

ann-roc P-I ch

AdjP-I IP21 V-I

Opct

7/17/1936 1.029 .489

35 -12 155

-.004 11 .254

Semi-V formation: 4/6/1936 -> 4/29/1936 -> 7/15/1936

Length 3 months and 9 days.

--------------------------------------------------------------------------------------------------------------------------------------

11.0% February 1980 False

breakout and 16% decline: S9/S12/S15

False breakout: 2/13/1980 la/ma

ann-roc P-I ch AdjP-I

IP21 V-I

Opct

Key Values:

1.028 .478 -26 1 -50

-.01 -1

.168

Semi-V-Bottom: 10/5 -> 11/7 ->2/13/1980

Length 3 months and 8 days.

-----------------------------------------------------------------------------------------------------------------------------------------

13.5% October 1950. DJI

peaked on breakout and declined to lower band. Sell S8.

la/ma ann-roc

P-I ch AdjP-I

IP21 V-I Opct

Peak Key Values: 10/4/1950 1.03 .595

143 15 518 .133 169 .445

Semi-V-Bottom: 6/12 -> 7/14 ->10/3/50

Length 3 months and 21 days.

--------------------------------------------------------------------------------------------------------------------------------------

10% August

1956. DJI fell 10% after testing previous high. Sell S2.

Peak 8/1/1956 la/ma

ann-roc P-I ch AdjP-I

IP21 V-I

Opct

Key values: 1.015 .826

88 5

282 .108 33 .496

Semi-V-Formation: 9/23 -> 10/10 -> 11/5/55

Length 3 months and 25 days.

---------------------------------------------------------------------------------------------------------------------------------------

10% April 1946: Breakout but quick decline back 2.5% lower band.

Breakout point:

la/ma

ann-roc P-I ch

AdjP-I IP21 V-I

Opct

4/9/1946 1.048

.909 125

37 488 .237 109

.263

Semi-V Bottom: 2/4/46 -> 2/26 -> 4/9/46

Length 4 months and 5 days.

------------------------------------------------------------------------------------------------------------------------------------------

8.6% September

2012 False Breakout. 8% decline develops. Sell S4

False BO 9/13/2012 la/ma

ann-roc P-I

ch AdjP-I

IP21 V-I

Opct

Key Values:

1.026 .332 +403 +86 +403

+.06 +59 +.126

V-Bottom: 5/1/2012 > 6/4/2012 -> 9/13/2012

Length 4 months and 12 days.

------------------------------------------------------------------------------------------------------------------------------------------

9.5% May 1990

breakout followed by re-test of breakout point and 5% rally.

Breakout 5/21/1990

la/ma ann-roc

P-I ch

AdjP-I IP21 V-I

Opct

Key Values: 1.04 .649

101 54 198

.122 19 .455

Formation Bottom Dates: 1/3/90 ->1/30/90 ->5/21/1990

l Length 4 months and 18 days.

------------------------------------------------------------------------------------------------------------------------------------------

9.0% December 1959.

Nominal new closing high (breakout) and 10 month

decline.

Sell S12 and S15 called this "false

breakout".

la/ma

ann-roc P-I ch

AdjP-I IP21 V-I Opct

Peak's key values: 1/5/1960 1.018 .400

+4 +6 13

-.038 -170 .095

Semi-V-Bottom: 8/3/59 -> 9/22/59 ->1/5/1960

Length 5 months and 2 days.

--------------------------------------------------------------------------------------------------------------------------------------------

10.6% October 1965. 2% rise and 4% pullback and more new highs. B11 on oullback.

la/ma ann-roc P-I

ch AdjP-I IP21

V-I Opct

Breakout's key values 10/19/1965 1.013 .211 38

-7 106 -.073 8 -.024

Semi-V-Bottom: 5/14/65 -> 6/28/65 ->10/19/1965

Length 5 months and 5 days.

--------------------------------------------------------------------------------------------------------------------------------------------

10% November

1955. DJI stopped at previous peak exactly for 2 months

and then re-tested lower band before running to new highs.

la/ma ann-roc P-I

ch AdjP-I

IP21 V-I Opct

Peak's Key Values 11/16/1955 1.05 1.064 131

-10 + 376 .130 119 .439

Bottom Formation: 9/23/55 -> 10/11/55 -> 3/6/1956

Length 5 months 13 days

-------------------------------------------------------------------------------------------------------------------------------------------

13.4% March 1972

DJI

rallied 5% after testing point of breakout.

la/ma ann-roc

P-I ch AdjP-I IP21

V-I Opct

Breakout's Key Values: 3/1/1972 1.022 .433

58 8 125 .065

0 .189

V-Bottom: 9/6/1972 -> 11/23/72 ->3/1/1972

Length 5 months and 26 days.

-------------------------------------------------------------------------------------------------------------------------------------------

The sense I get looking at all these cases is

that without a Peerless Sell signal, it is usually

best to assume that there will be still

higher prices. I reach the same conclusion seeing

how well all many our Bullish MAXCP

stocks are doing. Professionals remain bullish.

1/18/2013

Key Values: DJI 13650 +54 la/ma=1.023 21droc = .267 P= +403 Pch= -26

IP21 = +.202 V = -12 Opct = +.0542

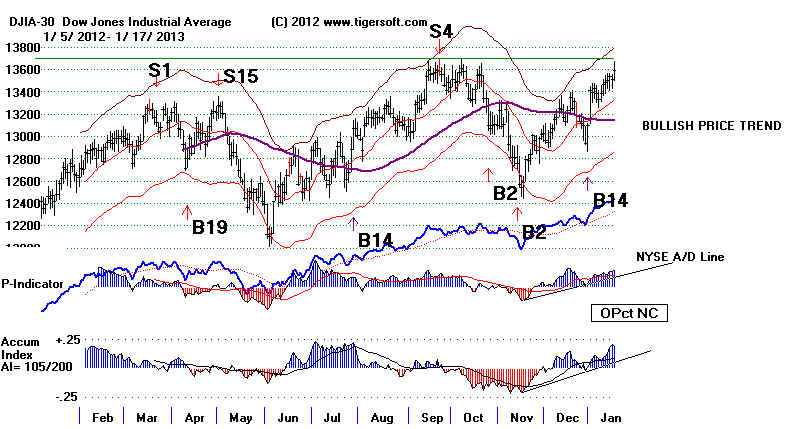

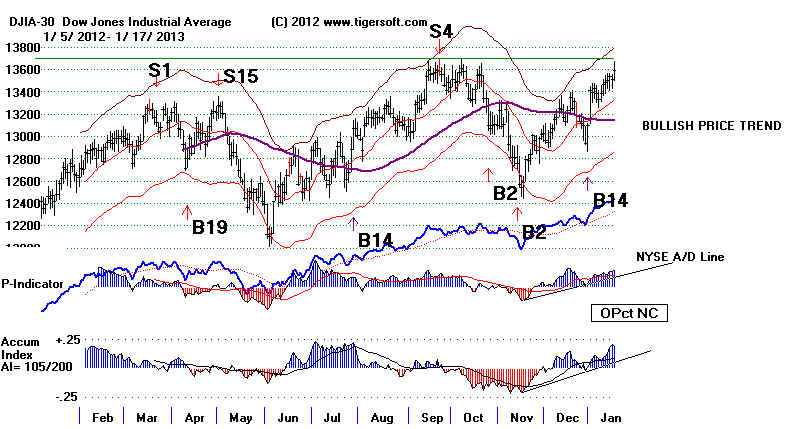

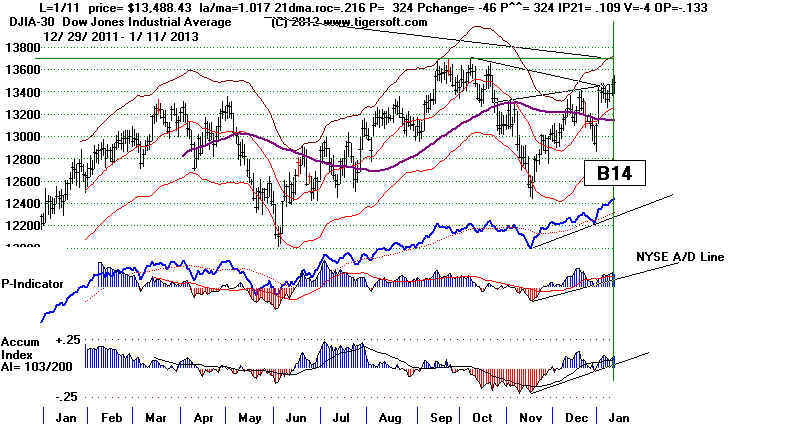

Peerless Automatic Buys and Sells on DJI

P-I, A/D Line and Tiger Accum. Index

Buy B14 is Operative Peerless Signal.

S= Sell B = Buy

Note the two V-Formations in the last year.

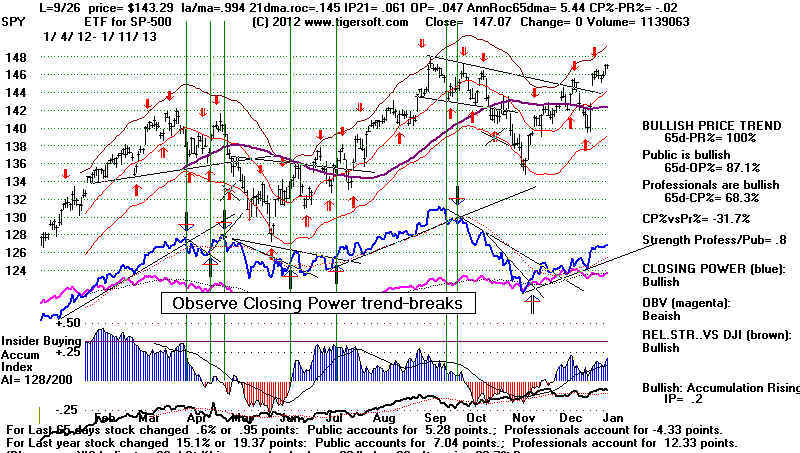

SPY's Closing Power Is Still Rising

1/18/2013

To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 443 +57 MAXCP stocks Bullish MAXCP Stocks (1/18/2013) BULLish plurality

---> 26

MINCP stocks Bearish

MINCP Stocks (1/182013)

--->

96(-8) New Highs on NASDAQ

1 new lows. BULLish plurality

--->

252 (+22) New Highs on NYSE

1 new lows. BULLish plurality

===================================================================================

OLDER HOTLINES

===================================================================================

1/17/2013

Peerless remains on a Buy B14. I would think the markets will rise more.

The number of MINCP stocks is very small (26) and the

number of MAXCP stocks (394)

is much, much higher. Clearly

Professionals are still pushing their (and our) favorites higher.

With Bernanke declaring that there will be no rise in

interest rates until the official Unemployment level

reaches 6.5%, traders feel the risks of bearish

surprises are limited and they are encouraged

to speculate in smaller stocks. This could

become the year of the "cats and dogs", where

low-priced stocks do very well. (Actually, most

of the biggest percentage gainers last year

were low-priced stocks, too.)

Powered by a NYSE A/D Line which has led the advance,

rising Closing Powers which

shows us that Professionals are bullish and mnay high

Accumulation breakouts and

tax-loss-ended turnarounds, the markets are back to their

recovery highs. In fact,

the SP-500 has

broken out above 1480 with a current Accumulation Index (IP21)

of better than +.25. This reading can be taken as a

confirmation of its new high. So

has the NYSE made

a new 12-month high with confirming Accumulation along with

the broad-based Value

Line. Smaller caps tend to do well at the beginning of the new

year.

The DJI is only now challenging its set of closing 12-month

highs at 1360013610. Typically it

makes a nominal closing high, at the very least, on a run

like this following a 7.5% to 13.5%

decline. The NASDAQ is still 50 points below its September

highs. The QQQ is 4.5%

below its highs. Should we worry? It is

probably rare for all markets to be rising perfectly

in synch. So, I'm not concerned so much about AAPL, should it fail to rally,

because there are many years

in the past when AAPL lagged in a bull market, as I feel

compelled now to study past situations early in the year

when the DJI closed 2% over

the 21-day ma and showed a V-I reading of only 1 and an

OPct of just +.042, as now.

Is Lagging Volume Much of A Problem?

Volume has been lower than bulls might wish for. And

weighted down by AAPL which has

been underperforming the DJI by 25% over the last 50 days, the

NASDAQ and QQQ

are now lagging. Because Barrons only started reporting

NYSE Up and Down volume

in mid 1965, I have to start with 1966. Below are the cases

where

la/ma > 1.096 and

VI < 2.0 and

OPct < .05 and

IP21> .15

Bull Mkt 6/4/1986 1.027

.457 4 -48 .152

1 .013 DJI advanced 2% over next

month and then fell 8%

low

Bear Mkt rally 10/16/02 1.051 .619 83 139 .169 -62

.004 DJI fell back to 2% lower band,

Bull Mkt 7/27/2013 1.023 .418

266 14 .266 -40 -.138 DJI rose 4% and

then fell 8%.

This is not enough cases to reach much of a conclusion from,

except that it would seem that a lack

of volume probably will act to limit the DJI advance in terms of

additional percentage gains

and how long we can go without a decline. So, we will have

to watch for new Peerless signals

and Closing Power trend-breaks.

1/17/2013 Key Values: DJI 13596 +85 la/ma=1.02 21droc = .322

P= +429 Pch= +24

IP21 = +.191 V = +1 Opct = +.042

Peerless Automatic Buys and Sells on DJI

P-I, A/D Line and Tiger Accum. Index

Buy B14 is Operative Peerless Signal.

S= Sell B = Buy

1/17/2013 To Key Index and

Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 394 +40 MAXCP stocks Bullish MAXCP Stocks (1/17/2013) BULLish plurality

---> 26 -6

MINCP stocks Bearish

MINCP Stocks (1/17/2013)

--->

104 (+48) New Highs on NASDAQ

2 new lows. BULLish plurality

--->

230 New Highs on NYSE

1 new lows. BULLish plurality

====================================================================================

OLDER HOTLINES

====================================================================================

1/16/2013

Peerless remains on a Buy.

Certainly,

volume could be higher. The OPct for te DJI stands only at .042 and

the

V-Indicator is only +9. But even negative numbers here would not themselves

bring a

Peerless sell until April. Such is the pattern of market advances if they can

get past

the reversal-prone first 14 days of January. Seasonally, the 5 trading days

following

January 16th are up bring a DJI advance only 39.1% of the time since

1965.

The DJI does average a 0.4% decline over the next week

and a day. But pullbacks

are

necessary to make breakouts more powerful. So, I'd stay optiministic. The

five

trading days after January 25th are up 69.6% of the time and average a

DJI gain of

0.8%.

The uptrends of

the major market ETFs are all still rising: DIA,

SPY, QQQ, IWM.

The key NYSE

ADLine is very strong. Professionals are buying many more stocks

aggressively than

they are shorting: MAXCP stocks outnumber MINCP stocks by

roughly

10:1. Bank stocks like BAC, JPM and GS

made new highs.

There are

numerous Bullish MAXCP stocks showing very high levels of Accumulation.

The SP-500 is

being drawn to its flat topped resistance to attempt a breakout. The

Closing Powers

for SPY and DIA are rising while their Opening Power is in a minor down-

trend. A

weak opening does not prevent an up-day. This is bullish. AAPL got back

above its one-day

broken easily spotted support-line at 500. And the DJI's IP21

stands at a

healthy +.209 Since 1950, there have been only three tops with higher IP21s

as they ran

upwards with the start of the new year. Each of the subsequent declines

only fell between

2.5% and 3.% below the lower band and then rebounded strongly.

If there is a

decline from here, it should be brief and not overly deep.

1/16/2013 Key

Values: DJI 13511 -24 la/ma=1.015 21droc = .337

P= +404 Pch= -4

IP21 = +.209 V = +9 Opct = +.035

Peerless Automatic Buys and Sells on DJI

P-I, A/D Line and Tiger Accum. Index

Buy B14 is Operative Peerless Signal.

S= Sell B = Buy

Technical

note:

There are

many DJI declines of 8% to 13.5% in a bull market. We would cover

short sales

on the general market in many of these cases when the downtrendlines

are broken

in the A/D line and CLosing Power even without a Peerless Buy. This

is

particularly true when there has been no new Sell other than a head/shoulders'

neckline

break, a judged Sell S10. See this below in June and November 2012.

1/16/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 354 MAXCP stocks Bullish MAXCP Stocks (1/16/2013) BULLish plurality

---> 32 +9

MINCP stocks Bearish MINCP Stocks (1/16/2013)

--->

54 (-15) New Highs on NASDAQ

3 new lows. BULLish plurality

--->

89 (-33) New Highs on NYSE

4 new lows. BULLish plurality

Revolutionary Biotech: SGMO: Turning Genes off and on to Stop

AIDs.

Sangamo Bioscience (SGMO) http://www.sangamo.com

64 employees

"Sangamo BioSciences, Inc., a clinical stage biopharmaceutical company, focuses on

the

research, development, and commercialization of zinc finger DNA-binding proteins (ZFPs)

for

gene regulation and gene modification in the United States. Its ZFPs could be

engineered to make ZFP transcription factors (ZFP TFs) proteins that could be used to turn

genes

on or off; and ZFP nucleases (ZFNs) proteins, which could be used to modify DNA

sequences in various ways." Can

genes be turned on and off in cells?

BBC

News - 'Brake gene' turned off in pancreatic cancer Apr 30, 2012

In

1950, SGMO was 50. Bullishly, it is getting some sponsorship now.

Fidelity Select Biotech fund already has 1.1 million shares. Watch Yahoo to see if it

is

increasing its position. There is no sign of insider buying on Yahoo, but

Tiger's

charts show

otherwise. We take insider-informed buying to be occurring in a rising

stock when

its Accumulation Index (IP21) rises above +.375. This buying is

circled in

the chart below.

--------------------------------------------------------------------------------------------------------------------------------------------------------

Older Hotlines

--------------------------------------------------------------------------------------------------------------------------------------------------------

1/15/2013

DJI Is Being Drawn to Test 13700 Resistance. Stay Mostly Long

until Peerless Gives A Sell, or at

least until Closing Power uptrends for DIA and SPY

are violated. AAPL's breakdown will worry tech stock holders and

may hold back QQQ.

For the DIA, SPY

and IWM, a pattern of weak openings with firmer

closes has set up.

Such Professional buying and Public

Selling is usually bullish.

1/15/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and

F

---> 347 +144 MAXCP stocks Bullish

MAXCP Stocks (1/15/2013) BULLish plurality

---> 23 -13

MINCP stocks Bearish MINCP Stocks (1/15/2013)

--->

69 (-8) New Highs on NASDAQ

8 new lows. BULLish plurality

--->

122 (-6) New Highs on NYSE

3 new lows. BULLish plurality

Peerless Automatic Buys

and Sells on DJI

P-I, A/D Line and Tiger Accum. Index

Buy B14 is Operative Peerless Signal.

S= Sell B = Buy

1/15/2013

Key Values: DJI 13535 +28 la/ma=1.018

21droc = .326 P= +407

Pch= +79

IP21 = +.181 V = +11 Opct = +.035

DIA, One-Year Optimized Red Signals (much less important),

Blue Closing Power and Accumulation Index.

Warning:

Red signals shown below are based on best trading system for last year only.

Stochastic Buys fail when key support fails. Stochastic Sells fail when

key resistance is overcome.

The Blue CLosing Power is still rising, showing Professionals are net buyers.

When that

uptrend is broken, look for a decline back to the support of the rising red

21-dma.

Peerless Remains on

A Buy B14

Without a new Peerless automatic

Sell signal or a head/shoulders top, the odds are

strongly against a decline to the lower

3.5% band. Tonight's new study shows that

DJI declines where there are first no

automatic Peerless Sell signals most often stop at the lower

2% band and

do not get to the lower 3.5% band. Since 1929, there

were 7 such DJI tops,

all in February and March, which dropped

the DJI only to the 2.5 lower band, In 3 cases,

the lower 3.5% band was reached. In

the two other cases where the DJI fell below the lower band

and there was no Peerless Sell, there was

first a head/shoulders pattern: 1931 and 1947. The

study tonight is of the first DJI peaks

of the new year, when they occurred, what the key values were,

what was the Peerless signal and what was

the outcome.

First DJI Peaks after Janaury 14th since 1929

Where There Was No Automatic

Peerless Sell

Date

la/ma annroc

P-I P-ch IP21 V-I Opct

Peerless Outcome

----------------------------------------------------------------------------------------------------------------------------------------------

2/24/1931 1.103 1.762

107 -6 .100

349 .466 No Sell.

Head/Shoulders and Extreme S7. Below LB.

2/10/1947 1.034 .416

84 11 .244

41 .257 No Sell.

Head/Shoulders DJI fell below LB.

2/5/1951 1.036

.693 82 -3 .198

47 258 No

Sell. DJI fell to lower band.

2/18/1963 1.012

.287 52 -3 .149

-61 .448 No Sell. Decline to lower 2% band.

2/8/1967 1.019

.661 219 16 .114 19 .377 No

Sell. Decline to lower 2% band.

3/17/1975 1.047 .948

149 8 .156

1 .364 No

Sell Decline to lower 2% band

2/13/1985 1.019

.629 317 18

.086 19 -.147 No Sell Decline to lower 2% band.

2/7/1989

1.031 .807 181 41

.156 30 .156 No

Sell. Decline to lower band.

3/6/1991

1.029 .831 263

-42 .102 31 .101 No Sell Decline to lower 2% band.

3/3/1992

1.009 .244 17

16 .408

-7 -.033 No Sell Decline

to lower 2% band.

2/5/1993

1.044 .627 233 15

.115 20 .425 No

Sell Decline to lower 2% band.

2/18/2011 1.023

.56 456

8 .238 36 .490 No Sell. Decline to lower band.

The study below shows many

interesting things. First, I wanted to see see how often

there were DJI tops that bring a

decline to the lower 3.5% band or lower from January 15th

to January 31st. In

all the past 65 years, there were only 7 cases of DJI tops over the

next two weeks: 1952, 1959, 1966, 1974, 1979, 1982, 1994 and 2010. Of interest,

none of these years were the year

after a Presidential Election. And by comparison, there

were 29 instances when such a top

occurred between Janaury 2nd and January 14th. A top

was 4x more likely to occur in the

first two weeks of the new year than the second two weeks.

This suggests

that the market may have more upside surprises for the Debt Ceiling bears

and those that consider Apple a

barometer for other stocks.

Significant trading declines

(because they brought a DJI decline to the lower 2% band) occurred as

follows:

Number of

Significant Tops

----------------------------------------------------------

First 2 weeks of January

29

Second 2 weeks of January

7

----

36

First 2 weeks of February

14

Second 2 weeks of Frbruary

5

----

19

First 2 weeks of March

8

Second 2 weeks of March

5

---

13

April

5

May

4

June or later

4

A

second question I wanted to answer was what how often did the DJI drop from

a second-half-January peak to

the lower 3.5% band without a warning. The answer is

only once, 1952, but in this

case a clear-cut head/shoulders pattern acted as warning.

1952 Head/Shoulders. DJI

fell to lower band.

1959 No Sell. Head/Shoulders.

Decline only to lower 2% band.

1966 S12.

DJI fell below lower band.

1974 Earlier S12. DJI fell below lower band.

1979 S12.

Decline to lower band.

1982 S12,

DJI fell below lower band.

1994 S4..

DJI

fell below lower band.

2010 Early S9. DJI fell below lower band

A third question for

the next two weeks that I can now answer is how bad will

a decline be if

we do get a Peerless Sell or a head/shoulder pattern. The data

show 5 instances

of a DJI drop below the lower 3.5% band. So, if a decline

does develop it

is more likely to bring a bigger decline than to just the 3.5% band.

A fourth notion

here is what is the highest level of each key indicator in a past peak.

We might infer

from this that the next peak cannot occur with higher readings.

At least. with

key value levels above these levels, would make a top seem unlikely.

I think we have

to leave out the pre-1945 cases.

There is a lot

more here to mine. "More later", as they say...

La/Ma (How far up from the 21-day ma, the close is, i.e. upper band)

1.059

Annroc (Annualized rate of change of21-dma) ...

1.466

PI (21-day ma of NYSE advances - declines)

456

PI change from previous day.

67

IP21 (Accumulation Index current value)

.408

VI (since 1966 when data first reported.)

53

January-February-March Tops: 1929-2012

Date

la/ma annroc P-I

P-ch IP21 V-I Opct Peerless Outcome

--------------------------------------------------------------------------------------------------------------------------------------------

2/1/1929

1.043 .545 -20

6 -.002 -408 .296 Sell S9/S12 DJI

fell to lower band

2/5/1930 1.065

1.198 90 12 .112

168 .462 Prematurer S9/S12. New S4. Decline to lower 2% band.

2/24/1931 1.103 1.762

107 -6 .100

349 .466 No Sell.

Head/Shoulders and Extreme S7. Below LB.

2/15/1932 1.046 -.484 -66

-18 -.096 -224 -.214 Sell S12. DJI

fell below lower band.

1/10/1933 1.068 .851

4 15

.016 -41 .117 Sell S12. DJI fell below lower band.

2/5/1934 1.059

1.547 233 32 -.01

680 .31 2 Sell S4. DJI fell below lower band.

1/7/1935 1.038

.292 10 -7

-.05 -49 .125 Sell S12 Decline to lower 2% band.

4/6/1936 1.034

.236 -37

-1 -.152 -249 .074 Premature S1/S8.

Concurrent S15. DJI fell below LB..

3/5/1937 1.028

.373 -15

5 .037 -231 .092 Premature

S15. Concurrent S15. DJI fell below LB.

1/11/1938 1.069 1.103

31 37 .038 -65 .181 Sell S9/S12. DJI

fell below lower band

1/4/1939

1.028 .578 29

37 .082 45 .359 No Sell. DJI fell below lower band

1/3/1940

1.026 .505 68

17 .072 54 .222 No Sell. DJI fell to lower band

1/10/1941 1.020

.20 45 11

-.068 7 .481 Sell S12. DJI

fell below lower band

1/5/1942

1.035 -.27

-48 6

.022 -236 -.153 Sell S9. DJI

fell below lower band

1943

No peaks and declines to Lower Band

during first 6 months of year.

1944

No peaks and declines to Lower Band

during first 6 months of year.

-----------------------------------------------------------------------------------------------------------------------------------------------------

3/6/1945 1.022

.581 144 2

.261 186 .525 No Sell/ H/S Top.

DJI fell to lower band

2/1/1946 1.028

.865 157 27 .260

235 . .382 Sell S4. Premature S9. Concurrent S8. Below LB.

Head/Shoulders

2/10/1947 1.034 .416

84 11 .244

41 .257 No Sell.

Head/Shoulders DJI fell below LB.

1/2/1948

1.01 .013 -33

12 .051 -101 .239 No Sell. Head/Shoulders DJI

fell below LB.

1/7/1949 1.024

.370 33 38 -.004 -51 .213 Sell S12. DJI fell below lower band

6/12/1950 1.027 .52

33 -3 .176

-50 .444 Premature S9, Concurrent S5.

DJI fell below lower band

2/5/1951 1.036

.693 82 -3 .198

47 258 No

Sell. DJI fell to lower band.

>1/22/1952

1.021 .349 74 10

.087 19 .371 S1.

Head/Shoulders. DJI fell to lower band.

1/5/1953 1.024 .453

67 21 .188 -9 .399 .Sell S8. Head/Shoulders. DJI fell below lower band

1954

No peaks and declines to Lower Band

during first 6 months of year.

3/3/1955 1.017

.249 105 3

0 74 .153 No Sell.

Quick 1-wk decline to lower band and recovery.

1/3/1956 1.002 .108 -7 -12 -.139 -165

.079 No Sell. Head/Shoulders.

DJI fell to lower band.

1/4/1957 1.014 .640

-38 0 .049

-62 .289 Earlier S12. Head/Shoulders.

DJI fell to lower band

1/7/1958 1.027 -.049 -3

15 -.051 -192 .054 Earlier S12. Decline to lower 2% band.

>1/21/1959

1.019 .515 112

9 .133 122 .442 No

Sell. Head/Shoulders. Decline to

lower 2% band.

1/5/1960 1.018 -.049

-3 15 -.051 -192 .054 S12/S15. Head/Shoulders DJI fell below LB.

5/19/1961 1.026

.376 66

9 .033 -43 .027 No Sell/ H/S Top. Decline to lower 2% band.

3/15/1962 1.014

.154 -6 -3 .033

227 -.029 S10 H/S Top. DJI fell below lower band

2/18/1963 1.012

.287 52 -3 .149

-61 .448 No Sell. Decline to lower 2% band.

5/6/1964 1.008

.078 -47 12 -.055 -582

.116 No Sell/ H/S Top. Decline to lower 2% band.

5/13/1965 1.018

.399 24

3 .110 -262 -254 S8. DJI fell below lower band.

>1/18/1966

1.020 .445 49 -2 -.028 5 .479 S12. DJI fell below lower band.

--------------------------------------------------------------------------------------------------------------------------------------------------

2/8/1967 1.019

.661 219 16 .114 19 .377 No

Sell. Decline to lower 2% band.

1/8/1968 1.020

.222 68 21

-.019 6

.163 S12. DJI fell below lower band.

2/13/1969 1.012

.309 60 -22 .141 0

.27 On earler S1. Decline to lower

band.

1/5/1970 1.027

.241 72

-31 -.034 -1 .058

S12. DJI fell below lower band.

4/28/1971 1.024

.608 82 2

.095 1 .412 S9 a week later. Head/Shoulders. DJI fell below

lower band.

4/18/1972 1.019

.327 -20

4 .054 -1

.151 S15. Decline to lower 2% band.

1/11/1973 1.024

.215 -96

9 .002

-2 .057 S15/S12 . DJI fell below lower band.

>1/17/1974

1.033 .799 182 18 .043

0 -.01

Earlier S12. DJI fell below lower band.

3/17/1975 1.047 .948

149 8 .156

1 .364 No

Sell Decline to lower 2% band.

3/24/1976 1/024 .192

-64

10 -.033 -1

.251 S15. Decline to lower 2% band.

12/31/1976 1.027 .674

289 17 .11

3 .462 S4/S8.

DJI fell below lower band.

12/30/1978 1.015 .021

-18

4 -.015

-1 -.029 No Sell Head/Shoulders DJI fell below lower band.

>1/26/1979

1.033 .734 234 50

.087 4 .268 S12.

Decline to lower band.

2/13/1980 1.028

.478 -26

1 -.01 -1

.205 S15. Head/Shoulders DJI fell below lower band.

1/6/1981

1.059 .381 61

43 .031 -1 .113

S12 Head/Shoulders. Decline to lower band.

>1/29/1982

1.02 -.028 -87

26 .005 -5

.048 S12, DJI fell below lower band.

1/10/1983 1.052

.741 105 56 .002

4 .118 S12 on 1/6/83

Decline to lower band.

1/6/1984

1.022 .152 34

28 -.035 -1 -.154 S12, DJI

fell below lower band.

2/13/1985 1.019

.629 317 18

.086 19 -.147 No Sell Decline to lower 2% band.

1/7/1986

1.022 .645 164

43 .095 13 .105 No Sell Decline to lower 2% band.

4/7/1987

1.019 .529

-5 -3 .15

6 .267 S9 Decline

to lower band.

1/7/1988

1.048 1.466 280 5

.22 25 .417 No Sell. Decline to lower band.

2/7/1989

1.031 .807 181 41

.156 30 .156 No

Sell. Decline to lower band.

1/3/1990

1.027 .270 36

-15 .08 -4

-.093 S4/S15. DJI fell below lower band.

3/6/1991

1.029 .831 263

-42 .102 31 .101 No Sell Decline to lower 2% band.

3/3/1992

1.009 .244 17

16 .408

-7 -.033 No Sell Decline

to lower 2% band.

2/5/1993

1.044 .627 233 15

.115 20 .425 No

Sell Decline to lower 2% band.

>1/31/1994

1.028 .692 150

17 .195 11

.450 S4.. DJI fell below lower band.

1995 No peaks and declines to

Lower Band during first 6 months of year.

3/18/1996 1.021

.283 -25

52 .139 -19 .048

S1 Decline to lower band.

3/10/1997 1.018

.526 173 36 .127

17 .133 S9. DJI fell below lower band.

4/21/1998 1.024

.37 13 -11 .045 -7

.056 S15 Decline to lower band.

1/8/1999

1.058 .806 48

25 .090 10

.231 No Sell. Decline

to lower 2% band.

1/14/2000 1.03

.522 90

27 -.058

-28 .433 S4/S12/S15 DJI fell below lower band.

(1/3/2001 1.025

.639 335 28 .022

-19 .215 S12.

Decline to lower 2% band)

2/2/2001

1.016 -.091 290 -88 .041

-15 -.076 S9.

DJI fell below lower band.

(1/4/2002 1.024

.435 269 -20 .040

0 .291 No Sell. Decline to lower band.

3/13/2002 1.044 1.042

375 -53 .117

53 .236 Premature S9. DJI fell below lower band.

1/14/2003 1.033 .424

217 21 .098

-12 .039 S12. DJI fell below lower band.

2/11/2004 1.017 .285

246 22 .093

-6 .134

S9/S15. DJI fell below lower band.

3/4/2005 1.017

.381 251 40

.093 -15 .14

S15. DJI fell below lower band.

5/10/2006 1.025

.527 117 6

.091 -10 .334

S9. DJI fell below lower band.

2/20/2007 1.013

.208 385 -26

.063 44 .309 Premature S9.

Decline to lower band.

2008 No rallies to

upper band until May 2008.

1/2/2009

1.045 .850 495 18

.058 61 -.004

S12. DJI fell below lower band.

>1/19/2010

1.017 .321 429

37 .078

16 .357 Early S9. DJI fell below lower band.

2/18/2011 1.023

.56 456

8 .238 36 .490 No Sell. Decline to lower band.

3/15/2012 1.022

.344 196 67 .071

5 .236 S1/S15.

Decline to lower band.

====================================================================================

OLDER HOTLINES

====================================================================================

1/14/2013 Peerless Remains on A Buy B14

Peerless remains

on a Buy. Without a Peerless Sell signal or a head/shoulders top,

the odds are

against a decline to the lower band. Given AAPL's huge capitalization,

I would expect a

re-test of the DJI's 21-day ma about 2% lower if AAPL closes below

its 500 support,

which seems likely tomorrow. (Its Closing Power is still falling).

It may be a

surprise but, historically, sizeable AAPL weakness relative to the DJI

has not been

bearish for the general market. There were many times in the past

when AAPL fell

33% or more in a general market that continued to rise:

1983, 1985, 1991,

1992, 1993, 1995, 1996 and 1997.

1/14/2013

Key Values: DJI 13507 +19 la/ma=1.017

21droc = .235 P= +328

Pch= +328

IP21 = +.135 V = --10 Opct = -.048

DIA is being drawn back to its 136-136.5 old highs' resistance.

Its Closign Power is rising and its IP21 is quite respectably positive.

It typically is the strongest index at the end of a run. It is the "last

man standing", if you will. Today it rose despite the NASDAQ's weakness,

owing to AAPL's 3% decline.

1/14/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM

S&P OEX NYSE

Value Line

DJIA-Peerless GLD

SLV Crude Oil Foods EURO Dollar 10-Year Rates

Tiger -Bonds Big Banks IBB-BioTechs Military Home-Building Stocks

- Key Stocks AAPL ADBE GOOG AMZN EBAY

Biotechs: AMGN ALXN CELG GILD

REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM and F

---> 203 -14 MAXCP stocks Bullish

MAXCP Stocks (1/14/2013) BULLish plurality

---> 36 +4

MINCP stocks Bearish MINCP Stocks (1/14/2013)

--->

76 (+12) New Highs on NASDAQ

5 new lows. BULLish plurality

--->

128 (-8) New Highs on NYSE

1 new lows. BULLish plurality

====================================================================================

OLD HOTLINES

====================================================================================

1/11/2013 Peerless Remains on A Buy B14

There are many high Accumulation

breakouts. Transports, Autos, biotechs, housing-related stocks

and food commodity users are advancing as

Sugar and other commodities slip downward

and the Chinese, Europeon and Developing

Countries' economies improve.

The stock market doubts that the House

Republicans will succeed in forcing a debt

reduction- government stoppage next

month. If a true crisis of "financial confidence"

was about to occur because the national

debts were reaching a dangerous threshold,

one might expect the Dollar to be in a

dive and Gold to be rising powerfully. They are

clearly not. The Dollar is not the

Argentine Peso or Weimar Germany's D-Mark. This

will not prevent FOX and CNN from trying

to scare investors. It will leave stocks in

strong hands. And that is bullish.

As long as the Closing Powers for

SPY and QQQ are rising, as long as the NYSE A/D Line

is rising and as long as AAPL does not

break its 500 support, I believe the DJI and

general market will move higher.

"Sneaky" bear markets are very few. First, there must

either some pronounced internal

weakness or, at least, a head/shoulders pattern showing

that something unexpectedly bearish is

about to happen.

AAPL's troubles? Right now, money

coming out of AAPL is probably being reinvested in

lots of much smaller companies. The

broad-based Value Line and NYSE are making

new 12 month highs.

Of more concern is the speed with which

the Japanese Yen is falling. Japanese

imports may become very cheap in the near

futures. If you are a car-buyer that

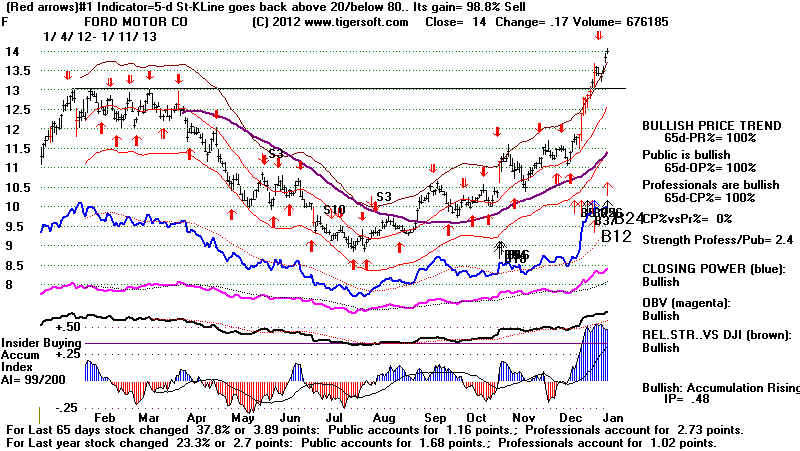

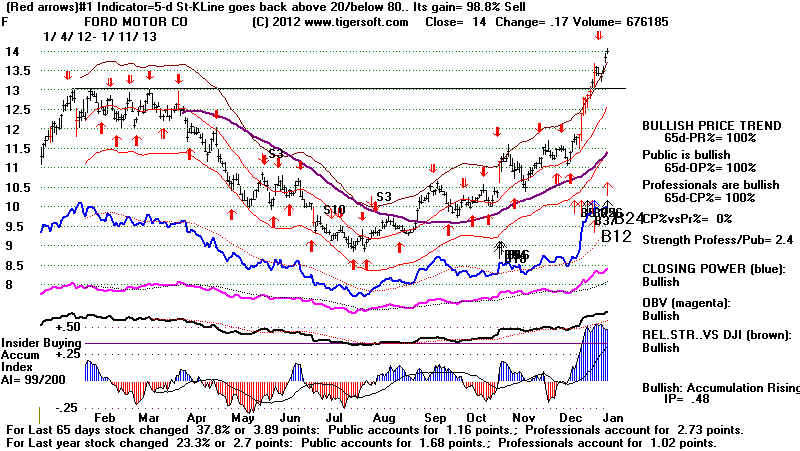

could help. Ford, meantime, is

bursting out to new highs. The fall-out from the

falling Yen will have to be watched.

1/11/2013 Key Values: DJI

13488 +17 la/ma=1.017 21droc = .216 P=

+324 Pch= -46

IP21 = +.109 V

= --4 Opct = -.129

SPY - Blue Closing Power Is Rising.

1/11/2013 To Key Index and Stock Charts

DIA SPY QQQ IWM S&P OEX NYSE Value Line

DJIA-Peerless

TigerDJI TigerSPY Tiger-QQQ GLD SLV Crude Oil Foods

Dollar 10-Year Rates

Tiger -Bonds

Big

Banks IBB-BioTechs

Military Home-Building Stocks

- Key Stocks AAPL

ADBE GOOG

AMZN EBAY Biotechs: AMGN

GILD REGN

and 6 highest priced DJI stocks: IBM CAT CVX MCD MMM and XOM

plus JPM

GS NEM

---> 217 -25 MAXCP stocks Bullish MAXCP Stocks (1/11/2013) BULLish plurality

---> 32 +5

MINCP stocks Bearish MINCP Stocks (1/11/2013)

--->

64 (-31) New Highs on NASDAQ

6 new lows. BULLish plurality

--->

136 (-49) New Highs on NYSE

2 new lows. BULLish plurality

===================================================================================

EARLIER HOTLINES

===================================================================================

1/10/2013 Peerless

Remains on A Buy B14

1/10/2013 Key Values: DJI 13471 +81 la/ma=1.016 21droc = .271 P= +369 Pch= +20

IP21 = +.095 V = -+12 Opct = -.129

The SPY and DIA Closing Powers,

NYSE A/D Line, DJI-AI and DJI-PI are all in rising trends.

It looks like the DJI wants to rally and test

the resistance at 13600. AAPL is still weak, but

the big biotechs rallied convincingly again

today. The broad based Value Line made a new

high today as did the NYSE. The SP-500

has made a 12-month closing high. It still

must get past 1275 is surpass its highest

intra-day trading for the last year.

At this point, I see no reason why the market

cannot continue to advance. The prevailing

tendency is for a post Presidential Election

year rally to move higher when a Democrat

is in the White House in office since 1936 AND

Peerless is on a Buy in January.

We should expect to see a Peerless Sell signal

at the next top and one or more significant

non-confirmations (NCs) at this top, including

an A/D Line NC.

In all 6 cases when a Democrat was in the White

House, the market rallied at least

until March 9th. In 4 of the 6 cases, the

first "top" was in May. See Table 1:

The study I started a few nights ago about

about the length of bull market cycle's is finished.

I show it below in Table 2:. The main conclusion is that the

typical bull market lasts 53 months from

the bottom of a major DJI decline before

peaking and then starting another major (+20% decline).

As the DJI

bottomed in March 2009, we might normally expect the bull market to continue

until peaking in August 2013. But be

careful. While 53 months is the average length

of a bull market, there are big variations.

Only 6 of the 16 cycles show bull market

rallies that actually last between 48 and 63

months. 6 last less than 38 months. 4 last

more than 76 months.

How Will We Spot The Next Major Peak?

1929, 1973, 2000

and 2007 Are The Ideal Types of A Perfect Top

While there are a few cases (December 1969 or

August 1987) of very big bear markets

starting from what might seem like more

independent and isolated non-confirmations

and single Peerless Sell signals, more of the

extreme declines start from peaks showing

multiple Negative Non-Confirmations by the P-I,

IP21 and V-I. They also show an

A/D Line that has fallen far behind the false

final advance of the DJI. They display

multiple Peerless Sells at the final top and

multiple sets of Sells in the previous 6-8

months. And they show either a price

break-down below well-tested support about 10% below the

recent peaks (examples: 1973, 1987, 2000-2001,

2007-2008) OR they easy-to-spot

Head/Shoulders patterns (examples: 1946,

1961-1962 and 1990).

What helped me most, as I began the

research on Peerless in 1981 was looking at the

January 1973 top. It showed multiple

negative non-confirmations at the peak.

The DJI and the "nifty-fifty"

insututional favorites had run up the market superficially.

But most stocks were declining. The NYSE

A/D Line had been downtrending since

mid 1972. Below is the Peerless chart for

the January top of 1972. Interestingly,

Barrons' cover headlined for all the

world to see that the DJI was headed for 1200

with Richard Nixon re-elected and business safe

again from Democrat regulations

and increased corporation taxes. Years

later, I saw how similar the top in 1929

was to the top in early 1973 technically and

how its prospects were portrayed by

the pundits of the time.

The internals of the market are clearly much

stronger now than at those tops shown

below. Eventually, I would expect the key