TigerSoft News Service 10/9/2009

www.tigersoft.com

TigerSoft News Service 10/9/2009

www.tigersoft.com

Other

Free Tiger Blogs - http://www.tigersoft.com/Tiger-Blogs/index.htm

WORLD

BULL MARKET ROLLS ON

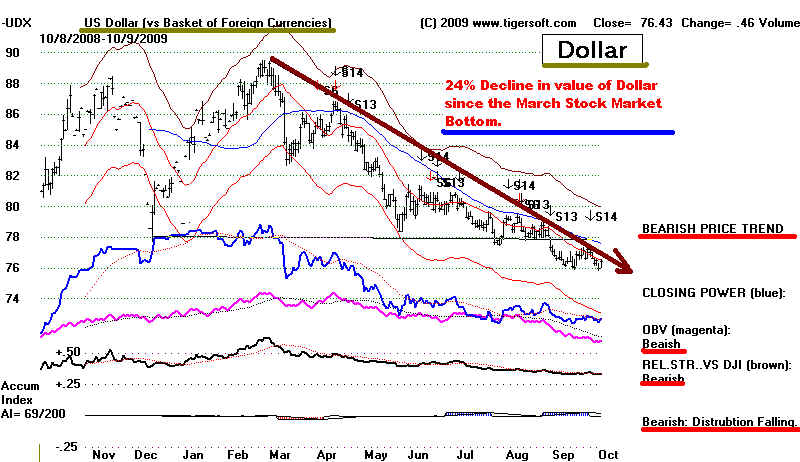

---- The Weak US Dollar Is The Fuel ---

Only a part of the huge rally since March can be

explained away as being a bear market bounce in an

extremly oversold market. There is much more happening

than that. This has been a very broad advance, affecting

nearly all equities around the world.

Peerless and TigerSoft have had no trouble since March in

advising traders and investors to play the rally

aggressively on the long side and avoid the short side.

Foreigners should consider using our Peerless Stock

Market Timing Software to better time the trading of

their country's stocks.

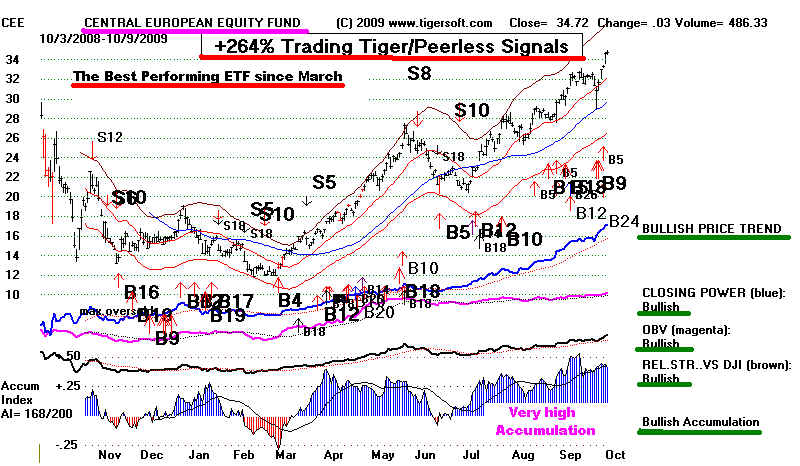

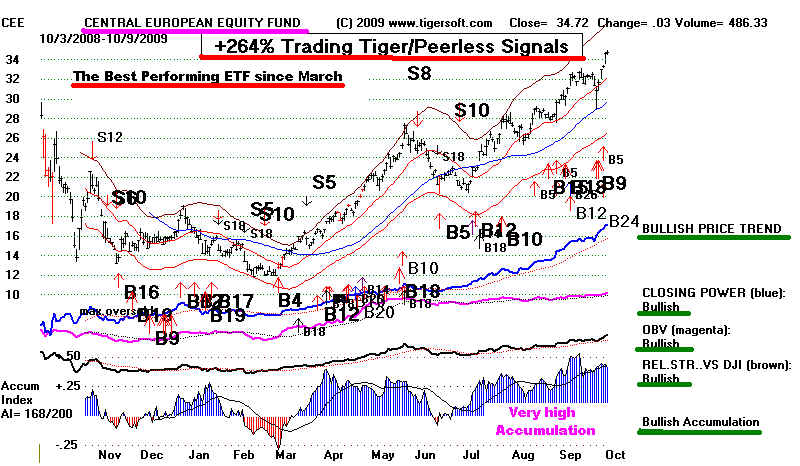

The outlook is still quite good. Non-US stocks, gold stocks

and technology stocks are the leaders. 25 of the 65 foreign

ETFs we track were up more than 100%. Central European

Equity Fund was up the most, +190%, in this period.

We spot the best of these ETFs and any group of stocks

using our Tiger Power Ranker and noting how strong the

TigerSoft's Accumulation Index and Closing Power are.

CEF's Closing Power is #1 in Closing Power. Its AI/200

score is 168. Only two other funds have this high an AI/200

score, but their Closing Power rank in much lower.

Both Peerless and TigerSoft Remain

Bullish

by William Schmidt, Ph.D.

Buy and Holding Is Dangerous See All The Peerless Real-Time

Signals: 1981-2009

Tiger Software - Helping Investors since 1981

Make Your Retirement Grow

Suggestions:

Peerless

Stock Market Timing: 1928-1966

Track Record

of Major Peerless Signals

Earlier Peerless-DJIA charts

7 Paths To Making 25+%/Yr. Using

TigerSoft

Index Options

FOREX trading

Investing Longer-Term

Mutual Funds

Speculative Stocks

Swing Trading

Day Trading

Stock Options

Commodity Trading

Research on Individual Stocks upon Request: Composite Seasonality Graph

of Any Stock for $125. Example of

historical research NEM - Newmont Mining. Order Here.

WORLD BULL MARKET ROLLS ON

Look at the

huge gains in foreign ETFs since the March

bottom. Below we rank these ETFs for their 150 day

performance since March 9th.

NON-US ETFS Days back= 150

3/9/2009 - 10/9/2009

Rank Symbol Name Price Pct.Gain %over 50dma Accumulation Closing Pwer Up%

--------- ----------------------------------- ------------ ----------- ------------ ------------ ----------------

1 CEE CENTRAL EUROPEAN EQUITY FUND 34.72 190% 17% 168 63%

2 TRF TEMPLETON RUSSIA FUND 19.72 181% 7.1% 106 51%

3 IF INDONESIA FUND 10.3 167% 10.5% 138 48%

4 RSX MKT VCTR RUSSIA S 30.25 152% 20% 148 55%

5 INP IPATH ETNS LINKED 60.18 149% 9.2% 139 51%

6 EWO ISHARES MSCI AUSTRIA INDEX 22.58 137% 11.3% 144 56%

7 IIF MORGAN STANLEY INDIA D 21.57 124% 7% 114 52%

8 IFN INDIA FUND 29.42 123% 4.2% 170 50%

9 EWA ISHARES MSCI AUSTRALIA INDEX 23.37 122% 12.4% 124 54%

10 EWZ ISHARES MSCI BRAZIL INDEX 72.12 118% 14.9% 159 56%

11 SGF SINGAPORE FUND 12.49 117% 5.1% 131 52%

12 TAO CLAYMORE/ALPHASHA 18.67 117% 4.4% 114 45%

13 EWI ISHARES MSCI ITALY INDEX 20.78 115% 7.9% 165 51%

14 HAO CLAYMORE/ALPHASHA 24.47 112% 3.4% 88 44%

15 KEF KOREA EQUITY FUND 8.97 112% 7.9% 170 50%

16 EWY ISHARES SOUTH KOREA INDEX 46.62 111% 6.4% 151 56%

17 EWW ISHARES MSCI MEXICO INDEX 45.88 110% 5.7% 147 54%

18 GRR ASIA TIGERS FUNDS 18.86 110% 5.4% 139 48%

19 BKF ISHARES MSCI BRIC 43.91 109% 9.9% 102 51%

20 EPP ISHARES PACIFIC EX-JAPAN IND 41.61 107% 9.6% 169 57%

21 EWS ISHARES MSCI SINGAPORE INDEX 10.81 105% 3.3% 94 50%

22 MXF MEXICO FUND 21.4 105% 3.7% 154 57%

23 EWP ISHARES MSCI SPAIN INDEX 50.22 104% 5.1% 168 57%

24 ILF ISHARES S&P LATIN AMERICA-40 45.05 102% 11.1% 165 56%

25 VWO Vanguard Emerg Mkts Stocks 39.83 101% 8.1% 181 50%

26 EWK ISHARES MSCI BELGIUM INDEX 13.29 97% 8.8% 158 57%

27 EWD ISHARES MSCI SWEDEN INDEX 23.07 96% 1% 169 54%

28 EWN ISHARES MSCI NETHERLANDS 20.56 96% 8.9% 134 57%

29 EZA ISHARES SOUTH AFRICA INDEX 55.89 95% 5.8% 165 57%

30 DGS WISDOMTREE Emerg MKT 41.33 94% 6.7% 121 48%

31 PGJ PowerShares Dragon China 23.66 93% 2.6% 145 50%

32 EEM ISHARES EMERGING MARKETS 39.85 92% 7.2% 161 52%

33 GMF ST SP EM AS PAC E 71.58 91% 6.3% 164 54%

34 GCH GREATER CHINA FUND 12.79 90% 4.5% 147 47%

35 EWC ISHARES MSCI CANADA INDEX 26.11 89% 6.4% 152 44%

36 EZU ISHARES MSCI EMU INDEX 38.57 89% 6.9% 142 55%

37 JFC JARDINE CHINA REGION FUND 13.55 89% 5.2% 141 54%

38 TFC TAIWAN GRR CHINA 5.95 88% 8.3% 165 53%

39 FEZ FRESCO DOW JONES EURO-50 41.81 87% 5.6% 136 53%

40 VGK Vanguard European Stocks 49.83 86% 4.6% 160 56%

41 GXC STRK SPDR S&P CH 69.76 84% 4% 139 49%

42 CHN CHINA FUND 25.99 82% 11.1% 181 50%

43 FXI iShares FTSE/Xinhua China-25 42.89 81% 3.7% 151 52%

44 MF MALAYSIA FUND 7.68 81% 115 52%

45 EWQ IShares MSCI France 26.07 80% 6.4% 165 57%

46 IEV ISHARES S&P EUROPE 350 FUND 38.61 80% 4.4% 158 56%

47 EWH ISHARES MSCI HONG KONG INDEX 15.74 79% 3.7% 164 51%

48 EWG ISHARES MSCI GERMANY INDEX 22.47 76% 6% 157 53%

49 EWT ISHARES MSCI TAIWAN INDEX 12.34 75% 6.9% 140 55%

50 TF THAI CAPITAL FUND 10.32 74% 11.4% 169 52%

51 EKH HOLDRS EUROPE 2001 60.81 73% 4.8% 151 21%

52 EWU ISHARES MSCI UK INDEX 15.45 71% 1.7% 184 54%

53 IXN ISHARES S&P GLOBAL TECH 52.52 69% 3.9% 157 52%

54 EWL ISHARES MSCI SWITZERLAND 21.65 66% 4.3% 157 57%

55 CH CHILE FUND 16.34 65% 4.3% 156 49%

56 TWN TAIWAN FUND 14.05 65% 8.3% 180 56%

57 VPL Vanguard Pacific Stock VIPERs 52.92 65% 3.1% 171 52%

58 EWM ISHARES MSCI MALAYSIA INDEX 10.64 59% 6.2% 162 54%

59 BZF BRAZIL FUND 26.53 45% 5.5% 91 48%

60 ITF ISHARES S&P-TOPIX 150 42.89 45% -.7% 132 52%

61 EWJ ISHARES MSCI JAPAN INDEX 9.95 44% -.8% 149 52%

62 PWJ PS DYN MIDCAP GR 16.33 43% 5.6% 151 53%

63 JOF JAPAN OTC EQUITY FUND 7.75 41% -1.8% 157 57%

64 IXP ISHARES S&P GLOBAL TELECOMM 53.15 36% 1.4% 119 49%

65 CAF MORGAN STANLEY CH 33.43 25% 2.5% 131 50%

|

Both Peerless and TigerSoft Remain

Bullish

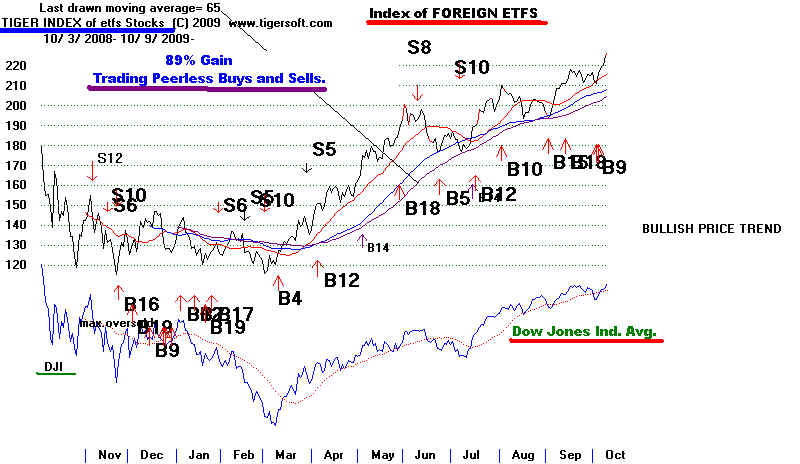

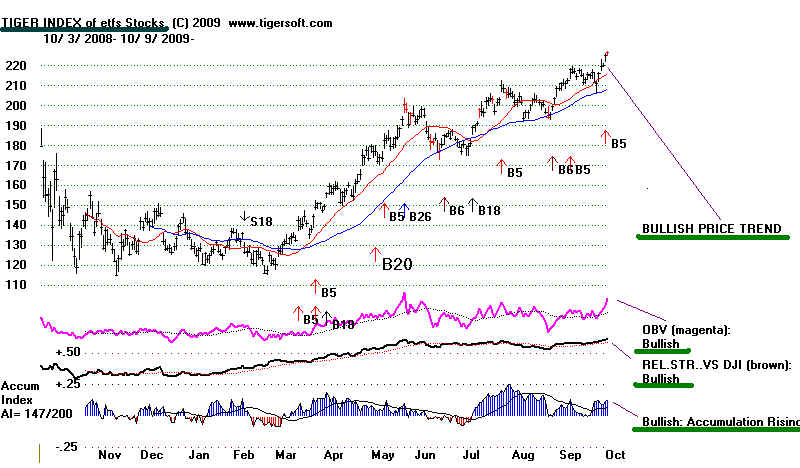

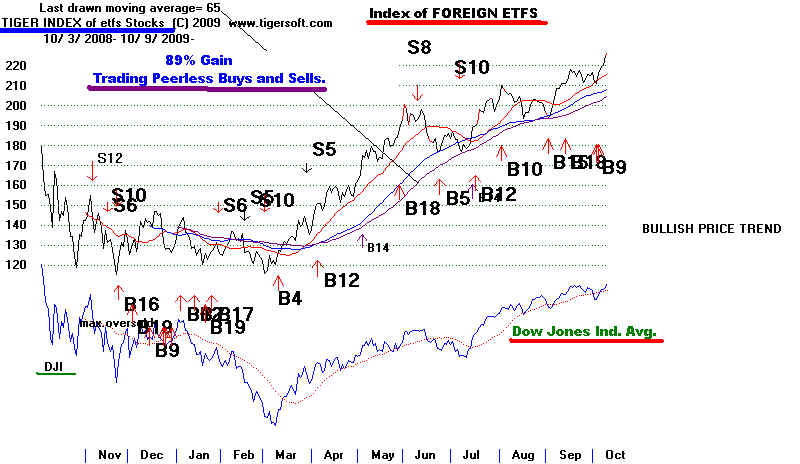

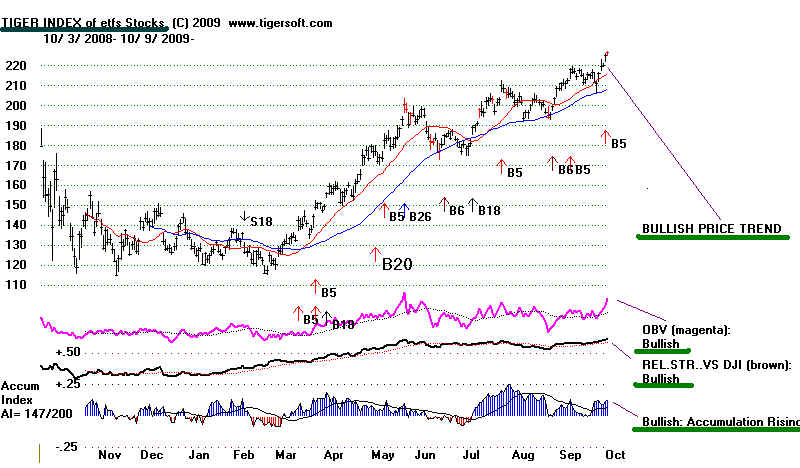

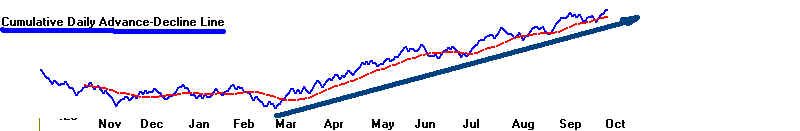

Below is the TigerSoft Index of foreign ETFs.

The

uptrend is clear. A new high was just made. The OBV,

Relative Strength and Accumulation Indicators are all

rated "Bullish" and the last signals are TigerSoft

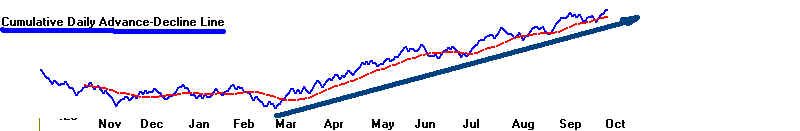

and Peerless Buys. An Advance-Decline Line for the

65 foreign ETFs in our ETFS.exe data download is also

uptrending and has confirmed the lastest recent new high.

This is a relatively volatile ETFf, but the combined

Peerless and TigerSoft signals' gain trading it is +269%.

TIGER

INDEX of FOREGN ETFS

Up

80% since March Bottom

A

False Rally?

I know many who read this believe

that the rally in

the US stock market owes to the trillions of dollars

provided US banks by both the Bush and Obama

Administrations and the Federal Reserve under their

protector, Ben Bernanke. The rally is therefore phony and

therefore expected to be ephermal. The first part may

be true. Main Street certainly got no bailout like

Wall Street did. And real unemployment is very high.

More than 15% in Michigan. If this is not a damn

disgrace both for capitalism and for our political "leaders".

than such words mean nothing.

But the second part - that the rally will be

short-lived

has not been true. Nowhere has this been more true in

the 500%, 1000% and even 2000% record gains in some

stocks since March. I have written about this Stealthy bull

market elsewhere. The momentum is clearly up. Rallies

have been shallow, thus giving nervous traders few chances

to buy on pullbacks. Bears, who have been caught in the

uptrend are being gradually squeezed.

What's most important is that the world markets are

now also booming. It is very hard to stop such momentum.

This world-wide momentum cannot be quickly and

simply explained away, as being merely the result of

a bubble created by bank bailouts and trillions of Dollars

in almost no interest loans for US banks by the Federal

Reserve.

I can understand and accept the proposition that US

banks are using the trillions the Fed has given them

to buy Treasury securities and some US stocks. But it

seems unlikely that they are buying overseas stocks and

pushing up foreign equities like we now see.

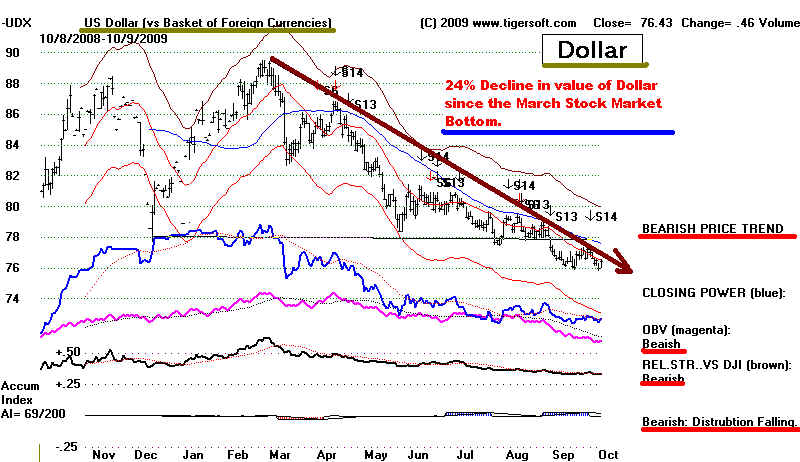

But much can be explained as a deliberate

pursuit of non-US investments in an era of a weak

US Dollar. Since the March 2009 stock market bottom,

the Dollar has fallen 24%.

TigerSoft News Service 10/9/2009

www.tigersoft.com

TigerSoft News Service 10/9/2009

www.tigersoft.com