TIGERSOFT and Stochastic Indicators

(c) 2013 www.tigersoft.com All rights

strictly reserve

Stochastic oscillators show how far a stock is

between its, say, 20-day low and

20-day high. This is the fast-(red) K-Line.

If the stock's range for the last 20 days is 15 to 20, and the stock

is at 19, then the K-Stochastic's value is 80. At 16, the K-Stochastic

value here would be 20.

We smooth the K-Line with a 3-day mvg.avg and get the blue "slow" stochastic.

Selling Options Is An Option.

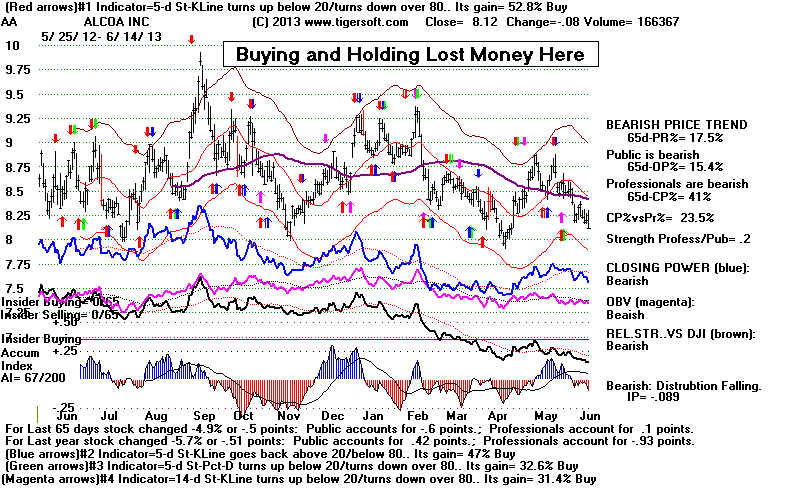

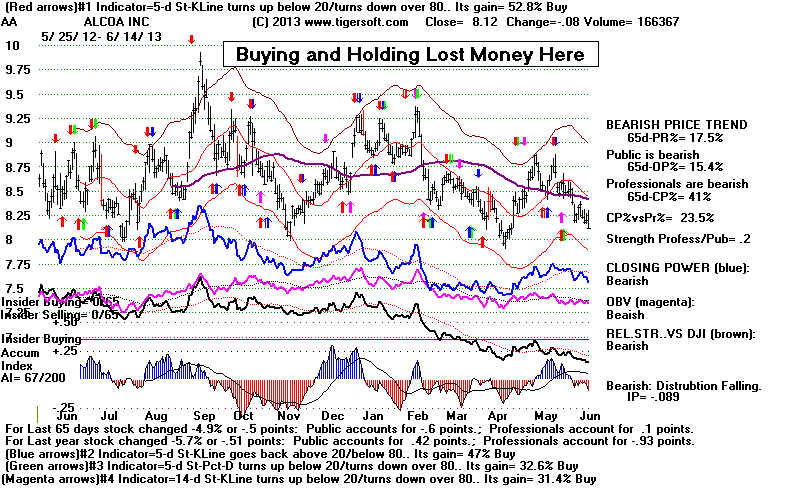

Many times a stock is stuck in neutral. Using the red

automatic signals based on short

term stochastics can turn this situation around and make it profitable. Options

could

be written very profitably here. Sometimes, it is more profitable to trade on the next

day's

opening can actually be more profitable. That was true below by 5%. In this

situation, there

was no paper loss bigger than 9.8%. There were 21 qinning trades and 7 losses.

Trading a Trading Range Stock

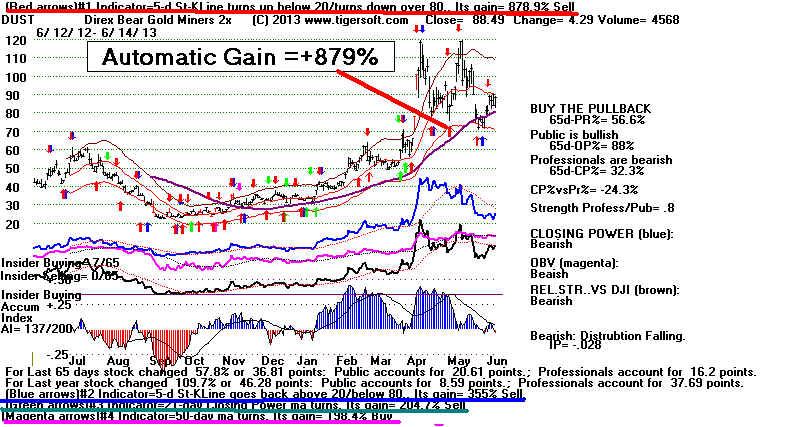

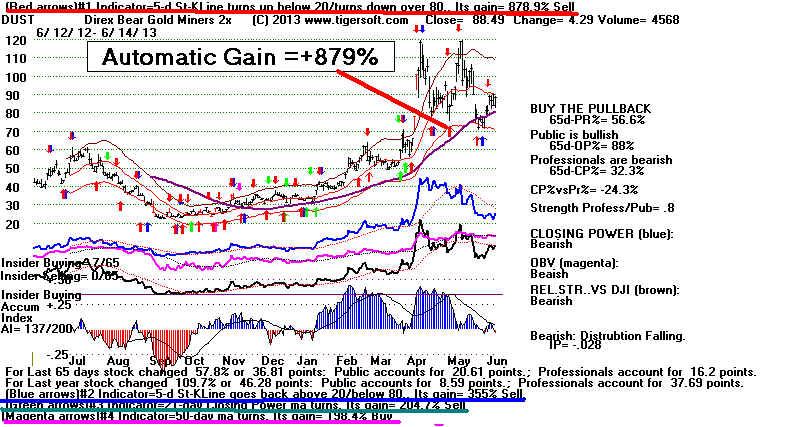

DUST Case Study

With the leveraged ETF DUST (short on mining stocks), a simple 5-day Stochastic system

all by itself gained 872.7%. Using the next day's opening to trade would have gained

+804%. There would have been 25 winning trades and 13 losing trades.

Unfortunately,

the biggest paper losses were very sizeable: 37.6% on long trades and 32.2%

on short trades. It is necessary to understand the limitations as well as the

strengths of TigerSoft's aututmatic Buys and Sells. There are many steps

Tiger users can take to avoid such big paper losses. This study shows

how find these very profitable trading situations and also how to limit paper losses.

Detailed DUST Case Study

http://tigersoft.com/Automatic-Signals/DUST-CaseStudy/index.htm

The Best of The Best

When a frequency

distribution is done of the various best Tiger automatic systems, we

consistently find that 5-day Stochastics generally occur 3 times more than chance

would

allow. With NASDAQ-100 stocks 29% of all the stocks trade best with one of the 5

different 5-day Stochastics. Among the Stochastic systems, two occur more than

4x more

than chance would suggest. See the separate study of The Frequency of the

5-day Stochastics

Being The Best Trading Systen from 1990-2013. It reaches the same

conclusion but it does show there is considerable variation in their frequencies

from year to year. Even so these 2 Stochastic-5 systems still out performed chance

in

the worst years, 1995-1999, 2003 and 2008-2009.

See http://www.tigersoft.com/Automatic-Signals/IntroAS.htm

Our

optimized signals readily tell you which length stochastic, a 5-day, 14-day,

20-day, 50-day or 90-day Stochastic works best given the data

you are looking

at

for the last year. As long as, prices do not abruptly change their behavior,

this

gives you knowledge you can use which otherwise would take a long time

to

discover by your own testing. TigerSoft in this way also tells yoo whether you

will

want to use a simple crossing of 20 and 80 for buys and sells, respectively, or

that

you will want to use a turning up below 20 or a turning down above 80 or

that

you shuld probably use the K-Line crossing the Pct-D. If you prefer,

a

different length Stochastic, clear the signals using

PEERCOMM + Charts-2013 + Daily Stocks + Symbol

+ Operations + Restore Simple Bar CHart +

Signals

(2) + Stochastic + 8 (for example)

You

can improve your trading's results by waiting for the Stochastic to fail to confirm

a

price high or low. In the chart below, we see that the blue Stochastic is the best

trading system. Instead of taking all the automatic red signals, one might want to

be more

selective and buy or sell short when the blue Stochastic fails to make a confirming

price

high or low.

Stochastic Buys and Sells only work periodically. We can study the

Stochastic-5's

success over time and see this. Thus, only in 6 of the 20 years since 1993 was the

Stochastic-5-K-line the best of the 50-60 different trading systems that TigerSoft

automatically searches through as it puts a graph on your computer.

See http://www.tigersoft.com/Automatic-Signals/SPY-1993-2013/Index.html

As we have seen in the discussion of Overbought and OverSold conditions, a number

of factors help us know when a Stochastic buy signal will likely work and when it is

more likely to succeed. Stochastic's should not be used to fight strong

momentum,

fresh price breakouts/breakdowns, head/shoulders patterns, price gaps on high

volume.

Consider the case of LTS below. Shorting it because of the new red Stochastic Sell

signal

is not consistent with what is recommended here. The momentum is too strong.

The Accumulation Index is positive, rising and shows previous bulges at 3-4 months

intervals. Someone thinks enough of this stock to buy it regularly. They

probably

intend to push it higher because they know a bullish story is going to be released

at higher prices. It is just below the top of its price channel, but breakouts above

the top of a price channel are common late in a bull market. And the stock is

thinly traded. These are the type of stocks market makers love to push up if

you take short position that they can run in. Sure enough, on 11/6/2013 the stock

jumps up to 257 intra-day, making a short sale at 2.00 problematic.

We can list factors that will help make a Stochastic work:

Use the Stochastic Buys when:

1) the stock is in an uptrend based on the direction of the 65-dma,

2) the stock is at support in a trading range,

3) the stock shows heavy blue Accumulation.

4) the stock's Closing Power is behaving more strongly than prices.

5) Peerless is on a general market Buy signal,

6) Seasonality is Bullish,

7) the Stochastic Indicator itself fails to confirm a price

low.

8) the Optimized Stochastic is a 5-day K-Line.

Use the Stochastic Sells when:

1) the stock is in a price downtrend based on the direction of the 65-dma,

2) the stock is at resistance in a trading range,

3) the stock shows heavy red Distribution.

4) the stock's Closing Power is behaving more weakly than prices.

5) Peerless is on a general market Sell signal,

6) Seasonality is Bearish,

7) the Stochastic Indicator itself fails to confirm a price

high,.

8) the Optimized Stochastic is a 5-day K-Line.

Traders, Use The 5-Day Stochastic

Our studies repeatedly show that the most commonly occurring best mechanical

Tiger system out of the 50-60 that TigerSoft automatically examines as you

place a chart on the screen, are the ones based on the red 5-day Stochastic,

especially the K-Line. We like the 5-day Stochastic so much that we build a

directory of stocks each night to download where the Stochastic-5 is the best

trading system. If you then run the Folder Optimization Program

Peercomm + Older Charting + Run/Setups + Run Best Indicators

All Stocks + Y

Then find the very best stocks traded with the 5-day stochastic by using:

Peercomm + Charts-2013 + Tiger Selection + #1 Indicators' Results/Status

A display appears which shows you the stocks most profitably traded with a

Stochastic-5. It looks like this:

Stock Best Performing Indicator

Gain Status Close Chnage AI/200 IP21

IPvsTISI

(yearly)

-----------------------------------------------------------------------------------------------------------------------------------

ACAT 5-day St.KLine turns up below 20/ 172.6% Sell

52.23 -1.49 154

,297 AR

turns down below 80

ACOR 5-day Pct-D turns up below 20/

172.6% Buy 32.6

.269 139

-.129 AF

turns down below 80

AMRI 5-day St.KLine turns up below 20/ 282.5% Sell

13.93 .65

129 ,239 AR

turns down below 80

We often use a trendbreak in our Tiger Closing Power to "clinch" a Stochastic

Buy or Sell. In the chart below a red down arrow appears in November. Instead

of taking that as an immediate point to go short, especially with the 65-dma rising,

we suggest waiting for the blue TigerSoft Closing Power to break its uptrend.

Additional TigerSoft studies of Stochastics:

www.tigersoftware.com/TigerBlogs/1-20-2010/index.html

http://www.tigersoft.com/Automatic-Signals/IntroAS.htm