last rev. December 29, 2014

last rev. December 29, 2014

Here we want to walk you through the basics of

TigerSoft. We start with

the

most obvious and worth through to the more advanced steps. You will

also

see find links here to more detailed studies on each topic. The sections

here

are entitled:

1. Always Begin by Determining How Safe The General Market Is.

Use Peerless, Seasonality and On-Going Hotline Studies.

2. Basics of Technical Analysis

Price Bands,

Overbought/Oversold

Stochastic Indicators

RSI Indicator

Commodity Channel Index

3. TigerSoft's Contributions to Technical Analysis:

Price Bands

Optimized Red Buys and Sells

Accumulation Index

Relative Strength Quotient

Intermediate-Term Relative Strength

Split-Volume

Opening Power

Closing Power

Tiger Day Traders' Tool

Red Price Bars

Numbered Technical Signals

4. Percent Change

First-out-of-Gate

Momentum

Streaking up/down

5. Support and Resistance

6. Trading Range Dynamics

7. Trending Stocks and Markets.

8. Broken Support becomes Resistance

9. Broken Resistance becomes Support

10. Well-tested Trendlines of Support and Resistance

11. Bullish Breakouts and Pullbacks before Continuation of Up Trend

12. Bearish Breakdowns and Pullbacks before Continuation of Down Trend

13. False Breakouts.

14. Well-Tested Uptrendlines

15. Well-Tested Downtrendlines

16. Bullish Price Gaps and Red High Volume

17. Bearish Price Gaps and Red High Volume

18. Classic Price Patterns

Broadening Tops

Head and Shoulders

Inverted Head and Shoulders

Line Formations (usually low-priced and thinly traded stocks)

Horizontal Breakouts and Ascending Triangles

Horizontal Breakdowns and Descending Triangles

Bullish Flag Pattern Breakout

Bearish Flag and Pennant Pattern Breakdown

Triangle Breakouts

Triangle Breakdowns

Bearish Rising Wedge Patterns

Bullish Falling Wedge Patterns

19, Internal Strength Indicators' Confirmations,

Non-confirmations, Divergences

1. Accumulation - IP21

2. Closing Power

3. Both-Up and Both-Down

4. OBV Pct.

5. Asynchronicity (Moves against DJI trend.)

6. Symmetry (Moves with DJI trend.)

.

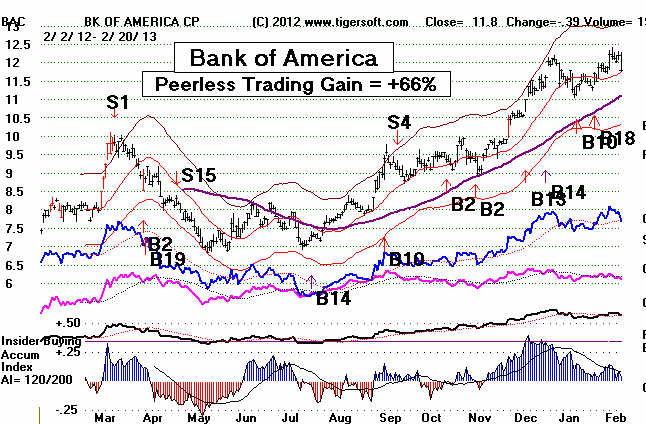

Peerless

Stock Market Timing: 1915-2015

Peerless helps us correctly judge the direction and

safety of the general market.

This

is immensely important because most stocks rise in a bull market

and

also even in a small 5%-10% advance by the DJI. With the

added

confidence that comes from knowing Peerless will probably

tell

us when the DJI is going to fall more than 10%, we not only

can

sleep better, relax and let a stock run more, we can also use more

leverage. Since 1945, there have only been 23 cases where Peerless

failed to call a DJI top which was followed by a 6% or more decline.

There

was only one instance where the DJI fell 9%.

Peerless uses bands, divergences and seasonality.

You can readily see how well the stocks in a Tiger stocks directory

behave or confirm to the Peerless Buys and Sells. Use the commands:

Peercomm + Charts-2013 + Runs/Setups + Compute Peerless Gains for

All Stocks

Below see the Peerless reversing Buys and Sells

applied to the 37 stocks

and

major market ETFs in c:\DJI-30

Peerless Signals and Trading Gains Starting with $10000 -------------------------------------------------------------------------------------- Directory=C:\dji-30 11/ 6/ 12- 11/ 18/ 13 Number of Symbols= 37 Symbol $10000. Biggest-- Gains/Losses 5% Stops- 10% Stops ------ becomes Paper---- ------------ triggered triggered ------ ------- Loss Pct ============================================================================ AXP Long 15393 3 4 AXP Short 10893 4.2 3 BA Long 16613 5.1 4 1 BA Short 9193 11 3 2 1 CAT Long 9858 14.9 3 1 1 1 CAT Short 10965 1.9 3 CSCO Long 11729 9.7 3 1 1 CSCO Short 11047 3 2 1 CVX Long 12238 3.2 4 CVX Short 11154 3 3 DD Long 13235 2.3 4 DD Short 9829 10.8 2 1 1 1 DIA Long 12678 1.8 4 DIA Short 10591 3.4 3 DIS Long 14755 1.4 4 DIS Short 10747 7 2 1 1 FAS Long 21824 7.4 4 2 FAS Short 11446 9.4 3 3 GE Long 12481 3.9 4 GE Short 9885 5.2 2 1 1 GS Long 14120 4.1 4 GS Short 11142 4.2 3 HD Long 13576 2.7 4 HD Short 10751 5.5 2 1 1 IBM Long 10271 6.2 3 1 1 IBM Short 10835 4.6 3 INTC Long 12861 6.4 3 1 1 INTC Short 11047 5 3 1 IWM Long 12631 3.1 4 IWM Short 9931 3.1 2 1 JNJ Long 13214 3.3 3 1 JNJ Short 9939 5.1 2 1 1 JPM Long 13633 4 4 JPM Short 10963 2.6 3 KO Long 12250 1.3 4 KO Short 11256 2.5 3 MCD Long 11627 1.5 4 MCD Short 10665 2.4 2 1 MDY Long 12515 2.8 4 MDY Short 10060 3.1 2 1 MMM Long 13788 1.5 4 MMM Short 10000 3.8 2 1 MRK Long 12104 7.6 3 1 1 MRK Short 10507 2.3 2 1 MSFT Long 14570 3.9 4 MSFT Short 10604 4.5 2 1 NKE Long 14066 2.6 4 NKE Short 9324 12.3 1 2 2 1 PFE Long 12273 2.8 4 PFE Short 9806 7.5 1 2 2 PG Long 12649 7.2 3 1 1 PG Short 10286 4 2 1 QQQ Long 12381 3 4 QQQ Short 9959 2.7 1 2 SPY Long 12705 2 4 SPY Short 10312 2.9 3 T Long 11006 4.8 4 T Short 10638 3 3 TNA Long 20136 9.4 4 2 TNA Short 10121 9.7 2 1 3 TRV Long 13039 2.2 4 TRV Short 10755 6 2 1 1 UNH Long 12363 8 3 1 2 UNH Short 9427 8.1 1 2 1 UTX Long 13182 2.7 4 UTX Short 10098 7.7 2 1 2 V Long 13229 4.4 4 V Short 10189 8.5 1 2 1 VZ Long 11334 6.7 2 2 1 VZ Short 9913 5.6 1 2 2 WMT Long 12196 2.2 4 WMT Short 10618 3.5 3 XOM Long 11959 2.9 4 XOM Short 10954 2.4 3 |

Market Timing and Seasonality

Peerless gives us a good feel for where we are at

each stage in the stock

market's typical cycle. It lets us see how seasonality plays a big role.

So,

all things being equal, buying in late November and selling in May

has a

long history of succeeding. At the same time, we have to be ready

for

January pivots-down as well as January take-offs.

Peerless is apolitical. It does not ask who is in the White House or whether

expansionary or deflationary policies are being pursued by the Fed, by

President and the Congress. But we should understand how these policies

affect the stock market. This is one of the jobs of our Tiger Hotline,

which

tries to penetrate the smoke and mirrors of Washington for your advantage.

Until the Peerless books are done, it

is best studied through the Hotline and by

viewing the studies of signals at www.tigersoft.com/PeerInst-2012.

One book will

be a

history of the DJI since 1915 with technical comments on the market using

the

NYSED A/D Line and the price charts of the DJI. The second book will

be an

elaborate discussion of the Peerless Buy and Sell signals.

Tiger

technical analysis can be understood by mastering a set of basic

concepts. They can be studied one by one, It is hoped that more links

and

additonal studies with be provided on a continuing

basis.

Basics of Technical Analysis

Prices

Tiger Price Bands

Overbought and Oversold

Stochastic Indicators

RSI Indicator

Commodity Channel Index

Internal Strength

Indicators

Introduction to Finding Explosive

Super Stocks

TigerSoft's Contribution to Technical Analysis

http://www.tigersoftware.com/2012-Explo/2012-EXPLO/Introduction/index.htm

Applied Example

12/27/2014 Gold/Silver Stocks:

Closing Power, Accumulation Index and Candle Stick Charts

http://www.tigersoftware.com/DL/index.html

Pct Change - 1-year

Pct Change - 21 day: First-Out-of-The-Gate at Start

of New Bull Market

Pct

Change - 50-day

Pct

Change - 200 day

Pct

Change over Specified Time.

Pct

Change - 1-day

Momentum: Increasing and Decreasing

Momentum Indicator MVMxxyy

Momentum Indicator PVPxx

Streaking

Support and Resistance

Trading Ranges

Trending Markets

Broken Support Becomes Resistance

Broken Resistance Becomes Support

Well-Tested

Breakdowns below Well Tested Support (Bearish)

Breakouts above Well-Tested Resistance (Bullish)

Bullish

Breakouts

False

Breakouts

Price

Trends and Well-Tested Trendlines

Price

Gaps Upward and Red High Volume (Bullish)

Price

Breakdown Gaps Down and Red High Volume (Bearish)

Red

Price Bars using TigerSoft

Price Patterns

Broadening Top (Bearish)

Head and Shoulders (Bearish)

Inverted Head and Shoulders (Bullish)

Line

Formation Breakouts (Bullish)

Horizontal Breakouts (Bullish)

Horizontal Breakdowns (Bearish)

Flag

Breakouts (Bullish)

Ascending Triangle with Flat Top (Bullish)

Descending Triangle with Flat Bottom (bearish)

Flag

and Pennant Breakdowns (Bearish)

Triangle Breakouts (Bullish)

Triangle Breakdowns (Bearish)

Rising Wedge Patterns (Bearish)

Falling Wedge Patterns (Bullish)

Internal Strength Indicators

Tiger Accumulation Index

Tiger Closing Power

Sell on non-confirmation of new price high and then trend-break

Tiger Opening Power

Both Up Condition

Both Down Condition

Tiger Relative Strength RSQ

TIger Relative Strength ITRS-50

Tiger Day Traders Tool

OBV

OBV-PCT

Asynchronicity Index (with direction of daily DJI move)

Symmetry Index (against direction of daily DJI move.)

It may

help to read the rest of this page as a whole, in place of looking

at each

item above.

1) Support

and Resistance

A stock or index will often recover several or more times from approximately

the same price

leve or support-line. It also often will fall back from the same

price level or

resistance-line. The tests of the line are often suprisingly exact

and close.

There can be small differences here, but the important thing is to

watch for a

successful test of this price level. When it succeeds, traders quickly

make prices

reverse. Big institutions will tend to place orders to buy or sell

in a concentrated

way. A good number of buy orders concentrated at a

given price level

often brings new confidence to that market. Similarly, when

prices fail

repeatedly to get past a certain level, we should assume that there

is big money

selling and confidence in the stock or the market will thus be hurt.

A well-tested

support line is more likely to succeed in reversing prices when

parallel to it is

a resistance line. The DIA shows a well-defined trading

range in 2013.

Horizontal Support at a 3x tested line drawn through lows

at same price

approximately is considered to be "well-tested". Similarly,

horizontal

resistance at a 3x tested line drawn through highs at about

the same price or

at at a resistance line is said to be "well-tested."

So, we should

watch for well-tested (=>3X) successful support and resistance.

Support and

resistance that is well-tested can also occur on a trend-line and

at a particular

moving average. They can form price channels as shown below

in DD in 2013.

Professionals watch these trendlines. They are the ones

that make them

work. So, a well-tested support lines tend to show

Professional

buying. Similarly, a well-tested resistance line usually

shows

Professional selling. Accordingly, successful tests of a well-tested

uptrendlines that

go back over a few months should be used for buying.

Short-term support lines are much less reliable. They are more likely

to be penetrated,

as when a short-term support is broken in a head/shoulders

pattern.

They are more likely to be penetrated to the upside when

a brief

resistance line is drawn in an uptrend. Here are two examples,

but look below

under chart patterns to see more.

We use the hooks

upward by the blue Closing Power to decide when to buy.

The same thing

works in reverse for short sellers.

When the 65-dma becomes

well-tested as support, we want to buy on

what appear to be

successful tests of it. In particular, we watch the blue

Tiger Closing Power to

hook back up. This shows that Professionals

are net buyers again

and are aggressively buying.

2) Bearish Breakdowns

But support

and resistance will sometimes finally fail and the failures

can lead to

rapid and deep declines. This was abundantly true in the

1987

October Crash, 2001 or 2008.

Individual stocks can break below well-tested support even in a rising market,

but

they are more likely to be mining stocks like SSRI below, currencies like the

Japanese Yen or bond funds early in 2013.

There can

be "false" breakdowns below support and "false" breakouts

above

resistace. Prices should be required to close below the support

line and close above the resistance level by 1% or more. In addition, we

will want

to see confirmation by our Tiger internal strength indicators of the

breakdown

andbreakout. More on this below.

When key

support fails, the broken support level usually becomes resistance

on the next

rally. Traders should sell short on breakdowns and also when

the next

rally fails at the expected resistance of the broken support level.

In the next two charts, see the Tiger Index of Bond

Funds for 2012 and 2013.

The

breakdown below key support was considered so significant I wrote a blog

about it.

Though after the breakdown, there was a pullback to the point of

breakdown,

this acted as resistance and the Index soon down sharply.

Commonly a

break in well-tested support usually gives way to a declin

A break in

well-tested support that occurs on red high high volume and

a price gap

is more likely to decline very steeply. See how CAT broke

below its

well-tested 65-dma.

The

severity of a decline on a price-breakdown below support is most often

a function

technically of how over-extended prices are and how serious is the

underlying

technical weakness. NEM was very over-extended and showed heavy

distribution at the top. Its Accumulation Index had turned negative. The Tiger

Sell S9

warns of this.

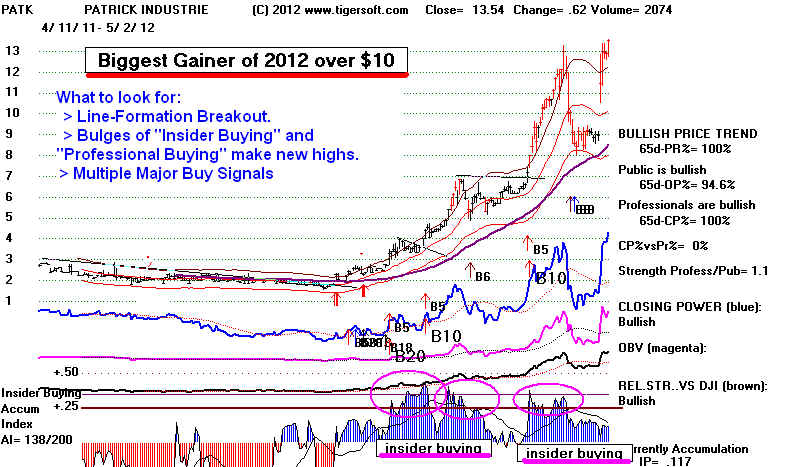

3) Bullish Breakouts

Broken

well-tested resistance most often leads to much higher prices. The

minimum

upside target then is the height of the pattern added to the point of

breakout

from the pattern. However, when Peerless is on a new Buy signal

and the

stocks shows bullish internals, as discussed below, the stock will

usually go

much higher. It is usually best to hold the first such breakouts

in a new

intermediate up-turn tightly, at least until they violate their 65-day ma.

When

well-tested resistance fails, the broken resistance level usually becomes

support

on the next rally. But do not count on a decline soon after the first

few

breakouts

whicxh will give you a convenient entry point. Too often in the

best

stocks, there are no such pull-backs.

So traders

should buy on breakouts when:

1) Peerless is on a new Buy;

2) the price breakout takes prices clearly above well-tested resistance;

3) there is a price gap;

4) there is red high volume;

5) the Accumulation Index is or has recently bulged above +.375;

6) the Closing Power makes a new high to confirm the breakout;

7) the Relative Strength Quotient Line makes a new high.

8) the Tiger program puts major Buy signals on the screen:

B10 - major conformed breakout.

B12 - IP21>.45 and ITRS (relative strength) >.30

B20 - Take-off velocity has been achieved.

B24 - there has previously been a bulge of IP21>.45

Every bull market shows

dozens or even hundreds of explosive

super stocks like this.

The biggest percent moves are usually made in

low priced stocks, like

SFEG. It prices have been multiplied by 100. You

can see this easily

enough. Run the Power Ranker against the stocks

making new highs.

Then view the stock up the most for 250 days.

From Tiger screen

choose Ranking Results + 250-day Pct Change.

Most of them have these

characteristics early-on in their moves.

More examples: 1990-2006 2007 2007-2008 2008-2009 2010 2011

See http://www.tigersoft.com/Tigers-Original-Indicators/index.html

4) Price Trends and Well-Tested Trendlines

Uptrends can be

defined by their uptrend-support-line. Prices must have bounced

up from it at

least 3 times for it to be considered "well-tested". Successful

tests of a

well-defined up-trendline themselves show careful professional buying.

A price channel

may be said to have formed when there is a resistance line

that is roughly

parallel to the support line.

Downtrends are

defined by their falling resistance line. Prices must have fallen

off the

downtrendline 3x for it to be considered well-tested. Successful

tests of a

well-defined down-trendline themselves show careful professional

selling.

5) Price Patterns

Bearish Head/Shoulders Reversal Patterns

These bearish H/S

patterns can occur in any market environment. A close

below the neckline and

also the 65-dma completes the pattern and

increases the chances

for a significant decline. Markedly lower

Accumulation on the

right shoulder adds to the bearishness, as does

a price gap down on red

high volume. Compare the outcome of the

completed

head/shoulders pattern in VLO (below) during the 2013

bull market with

head/shoulders patterns at the start of general bear

markets in 1987(AA), 1990(LOW),

1998 (CL), 2000 (CSC),

2002 (GR)

and 2008 (HOT). It is a fact

that these patterns cannot be searched

for by the computer.

This means you will have to be on the alert for

them. One way to

save time is to look only a the stocks that have

fallen below their

65-dma and then note the ones that have just

completed a

head/shoulders pattern. While this bring a short sale

a little late, the

subsequent decline is usually ample enough to

make unimportant the

lateness of the short sale.

Examples

See DJIA Head/shoulders

patterns

SPY Head/shoulders

patterns

Bullish Inverted Head and Shoulders Reversal

Patterns

These

inverted head/shoulders patterns usually have less symmetry

then

regular head/shoulders do. The necklines sometimes are less precise.

Still, you

will see the basic outlines of the pattern, I hope, in these examples

from the

bottom in early 2009.

Bearish Rising

Wedge Patterns and Bullish Falling Wedge Patterns

Triangle Pattern

-Bullish Breakouts and Bearish Breakdowns

TRANGLE BREAKDOWNS

TRANGLE BREAKOUTS

Bullish

Flags and Flat-Topped Consolidation patterns. "They beckon for a

breakout".

Trading Ranges

whose Prices may ultimately breakout out or breakdown.

Read also some of

the classics on Technical Analysis or goggle price chart patterns

2) Price Bands

Our bands automatically bracket about 93% of a stock's movements.

Very often the

bands bring reversals because they capture the stock's

over-bought and

oversolf conditions. Reversals are most likely at

the bands when

there are internal strength indicator divergences or

non-confirmations

are the upper or lower band. Peerless Sell S9 signals,

for example,

occur when the DJI reaches the upper band but the P-Indicator

is negative.

Sell S12s in Peerless register the fact that the Accumulation

Index for the DJI

is negative even as prices have reached the upper band.

With stocks, we

can place a Tiger Sell S9 on a chart. These show the

the stock's

Accumulation Index is negative with prices at the upper band.,

3) Price Breakouts occur when prices close above a well-tested

resistance line.

Price Breakdowns occur

when prices close below a well-tested support line.

Band Breakouts are

similar. Warning - do not trust

automatic Optimized

Stochastic sell signals on such breakouts.

The stocks are showing abnormal

strength or weakness.

4) We use our internal strength indicators to judge the likely

direction and power

of the moves from these patterns. This is

the analysis of divergences and

confirmations. Breakouts may be confirmed or unconfirmed by other indicators

or indexes making similar highs or lows at the

same time.

5) Momentum - Speed and Direction of the 21-day mvg avg (one

month),

65-day ma (one quarter), 52-week ma (one year using weekly charts).

6) Typical Over-Bought

Condition occurs when prices reach

automatically

drawn upper band above 21-dma.

Other indicators show this differently

Stochastic - above 80

CCI - above 200

RSI - above 80

Typical Over-Sold

Condition occurs when price reach

automatically drawn lower band

below 21-dma.

Other indicators show this differently

Stochastic - above 20

CCI - above -200

RSI - below -20

7) Tiger Accumulation

Index measures Institutional Buying and

Selling.

Steadily positive Accumulation tends to show

there will more new highs or a

price breakout. Steadily negative

Accumulation (red Distribution) suggests

a breakdown or more new lows.

8) High readings from Tiger Accumulation Index above +.375 may show Insider

Buying.

Bulges of Accumulation, especially above +.50

are signs that insiders are preparing

for a big advance in the stock, assuming

general market conditions allow it.

But these stocks on their dips when the Closing

Power hooks up.

9) Extremely High Readings

from Tiger Accumulation Index above

+.45

show intense Insider Buying and our studies

show this is a key factor

occurring in 70% to 80% of the best performing

stocks each year.

10) Closing Power measures daily net Professional Buying and Selling.

This is

very important - Please see our internet-book on subject.

http://tigersoftware.com/2012-EXPLO/ClosingPower/1-Cover/index.html

Start off

by trading IWM - the Russell-2000. It is highly liquid. Volatile.

It has

leveraged ETFs if you like. It is not so easily manipulated and

the Closing

Power trend-changes have worked well over the years.

Closing Power Trend Changes

Applied to IWM and IBB: 2000-2013

11) Optimized Red signals

are best used when a stock is very over-extended

and there is a new Red Buy after a long

decline or a Red Sell after a long

advance.

The 5-day Stochastic also work extremely

well for limited periods of

time, especially in flat trading ranges.

If the trend is strongly up, the

Sells will be terrible, but the Buys can

be usually be be used.

work welli