TIGERSOFT's Day Traders' Tool Is for You.

TigerSoft Insider Trading Software

with Data

TigerSoft Insider Trading Software

with Data

www.tigersoft.com

----------------------------------------------------------------------------------------------------------------------------------------------------

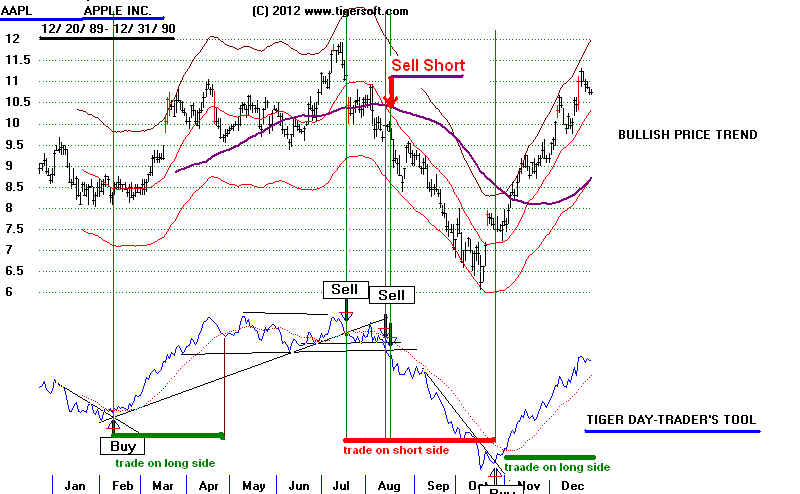

Trade The Trend of The Tiger Day Traders' Tool

When you look at a stock to day trade, you want to see if there is more upside

or downside potential in it. Our Day Traders' tool shows you this.

When the Tiger Day Traders' Tool is declining, you will want to fade the opening

with short sales. When it is rising, there is more upside potential, so consider

going long, not short. Below you will some charts of AAPL (Apple). Simply

draw "rubber band" lines through its lows to see if there is a well-tested

rising uptrend for the Day Traders' Tool. Oppositely draw "rubber band" lines

through its highs to show the falling Day Traders' downtrend. Day traders should

mostly trade in the direction of the Day Traders' Tool's trend, even though its trend

can sometimes be different from the stock's own intermediate-term price trend.

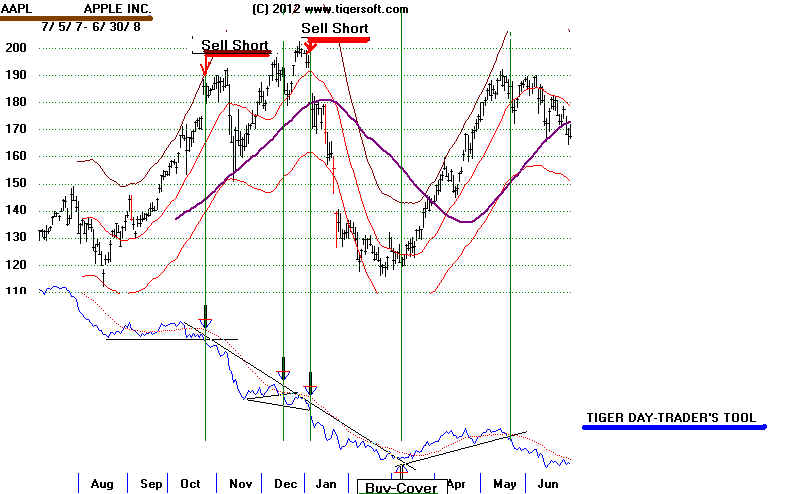

Major Sells from The Day Traders' Tool

Breakdowns by this indicator below its well-tested horizontal support are usually

quite bearish generally. Short sales are usually warranted, especially when the

the Tiger Closing Power breaks its uptrend and/or when there is red Distribution shown

by the Tiger Accumulation Index.

APPLE 2007-2008

APPLE 2008

Day Traders, We Can Show You A Lot of Other Ways

To Make Money.

Optimized, Automatic Trading Range Buys and Sells.

We have an extraordinary amount of original research to impart to you.

It is condensed in the materials we use for Day Trading Seminars. Ask for a

copy when you get the Full TigerSoft Package.

At the simplest level, we suggest you subscribe to our HOTLINE.

$350, amd take advantage of the market's likely moves, using the

latest research we do. You would do well to get Peerless Stock Market

Timing: 1915-2012

We suggest getting our enite package, books, all software

and Elite Stock Professional Service (ESP). This includes the Hotline,

Research Bullish and Bearish Special Situations and daily data for a year.

At the very least, start using TigerSoft $295. It has the tools you need

to know to best trade any given stock, index, currency or commodity.

You will see how very valuable our TigerSoft Accumulation Index

and Closing Power are. And you will find the automatic Buy and Sell

signals extremely helpful.

These signals are based on a system shown at the top line of the chart.

They gained 433.2% this past year in the case of CityGroup (C).!

It tells you whether you should be BUYING

or SELLING short at the opening.

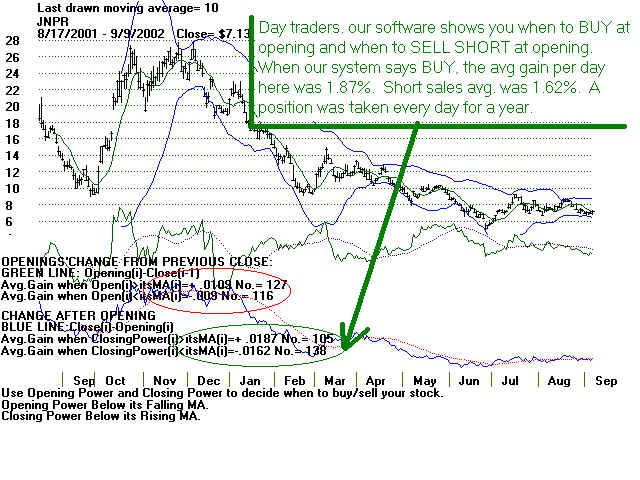

Take JNPR for example. See its chart below..

Assuming that the day trades are entered at the opening and closed at the close

the avg gain on Longs was 1.87% per day on 105 days when the key condition

we will show you prevails.

Short selling on the designated days at the opening produced an avg. gain of

1.62% per day on 128 days.

The software also tell you when it is safe to hold a position overnight and

when it isn't safe. We will explain this to you when you get the software.

These amazing tools are only available with Tigersoft. And the results shown

here with JNPR are typical for a volatile stock..

Interestingly, the best times to hold a stock long is when Tiger's Opening Power (TM) and

Closing Power are both rising. This condition we call "BOTH UP". This is another

condition that our programs flag each night from any universe of up to 1,000 stocks

and display in spreadsheets of key values for any stock..

Price Objectives to close out day-trades.

For day traders who want take profits not at the end of each day, our software gives

you an estimate of the next day's high or low based on the stock's volatility.

Another unique chart is the one which shows you when next day high's are moving further

away from the previous day's close and when they are not bringing much of a move.

Similarly, short sellers will want to pick stocks whose daily lows are tending further and

further away from each previous day's close.

Each of the above mentioned tools is only available with Tigersoft. There are many

other unique features. TIGERSOFT has long had a reputation of being an industry leader.

Use it and stay ahead of your competition. Call 858-273-5900 for more information.