TigerSoft News Service 10/9/2009

www.tigersoft.com

TigerSoft News Service 10/9/2009

www.tigersoft.com

Other Free Tiger Blogs - http://www.tigersoft.com/Tiger-Blogs/index.htm

Trading The United Kingdom Stock Market with TigerSoft and

Peerless Stock Market Timing: 2000-2009

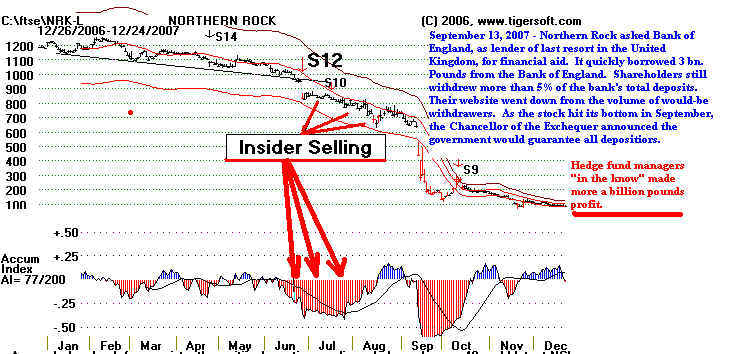

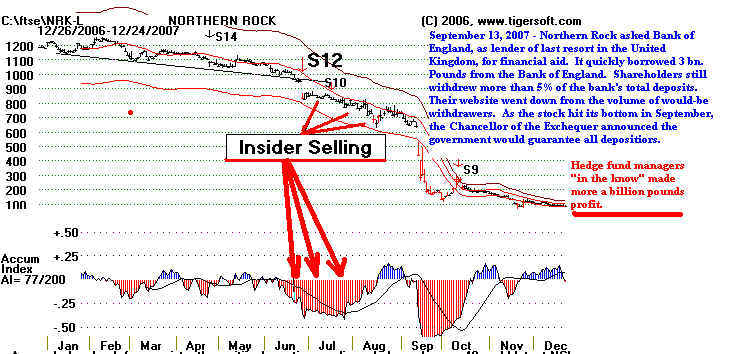

British Northern Rock's Crash Made

Insiders A Billion Pounds

10/16/2009 Some examples of Red Buys and Sells,

CLosing Power trend-Breaks, S9s and

automatic intenral strength readings.

See also our

report on this topic in 2006.

by William Schmidt, Ph.D.

===================================================================

Buy

and Holding Is Dangerous See All The Peerless Real-Time

Signals: 1981-2009

Tiger Software - Helping Investors

since 1981 Make Your Retirement Grow

Suggestions:

Peerless Stock Market Timing: 1928-1966

Track

Record of Major Peerless Signals

Earlier Peerless-DJIA charts

7 Paths To Making 25+%/Yr. Using

TigerSoft

Index Options

FOREX trading

Investing Longer-Term

Mutual Funds

Speculative Stocks

Swing Trading

Day Trading

Stock Options

Commodity Trading

Research on Individual Stocks upon Request: Composite Seasonality Graph

of Any Stock for $125. Example of

historical research NEM - Newmont Mining. Order Here.

Trading The United

Kingdom Stock Market

with TigerSoft and Peerless Stock Market Timing:

2000-2009

Peerless is the easiest and most important approach to successfully

timing the British

stock market. Peerless signals are obtained from charting the

DJIA. It has been carefully,

painstakingly, back-tested to 1929 and earlier. The world's

markets are integrated as never

before. The Peerless signals obtained from charting the DJIA can

be super-imposed on

all financial vehicles. They have worked well with the indexes of

all the countries of the world.

They work especially well with the London Stock Exchange's FTSE-100.

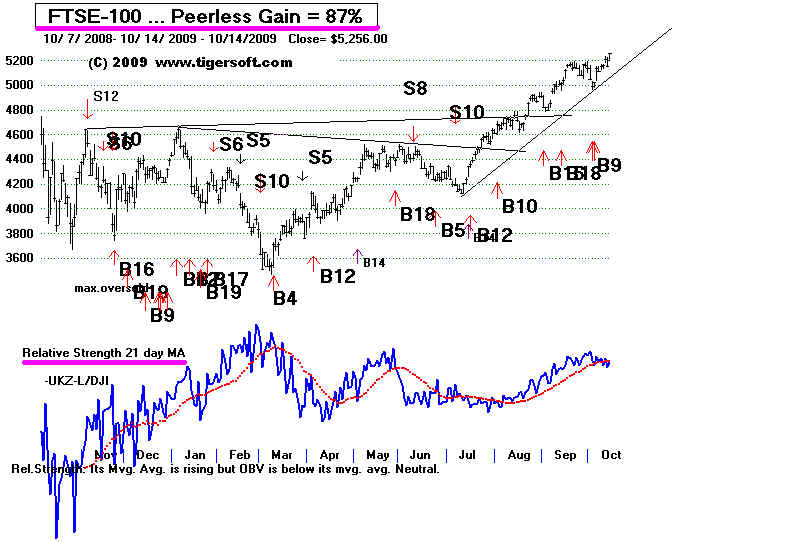

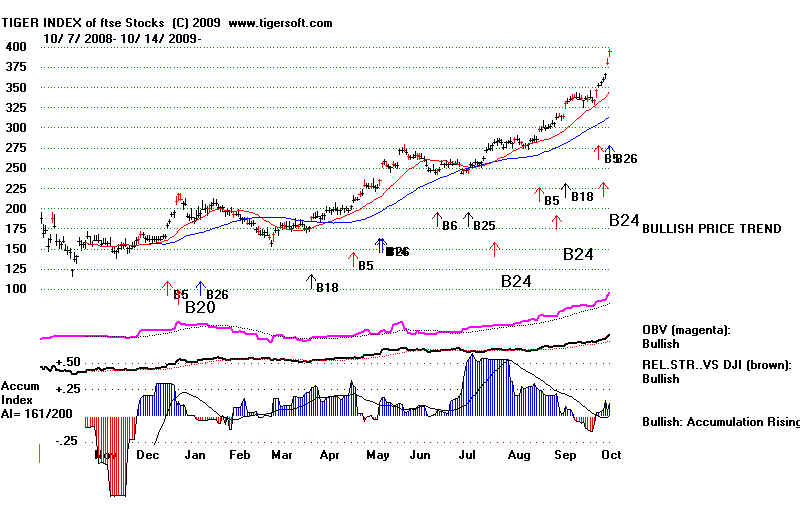

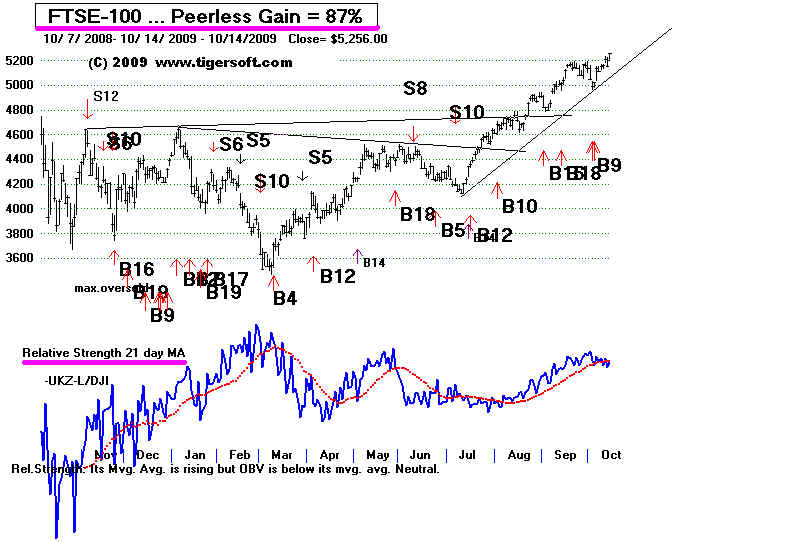

Below is the chart for 2008-2009 of the FTSE-100 with the Peerless

signals superimposed.

The gains are computed by the software in this way. It assumes

that a trader would buy at

the opening the day after a Peerless "Buy" and he/she would

sell at the opening on the

day after the next Peerless "Sell". Round-tip

commissions of $40 are assumed and $10,000

is started with.

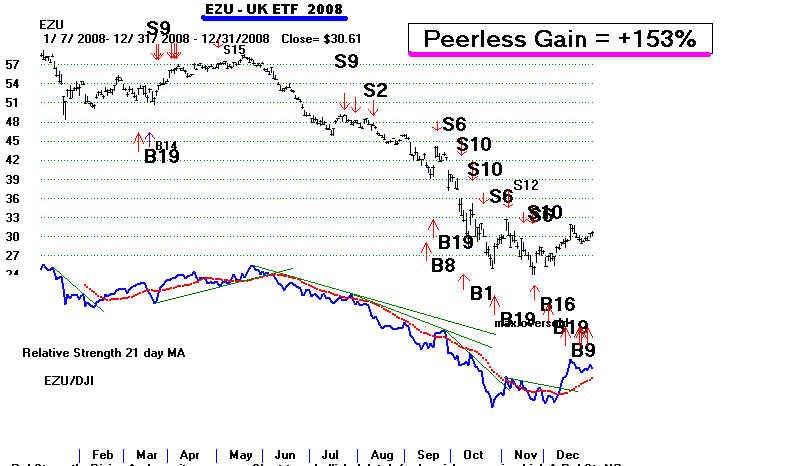

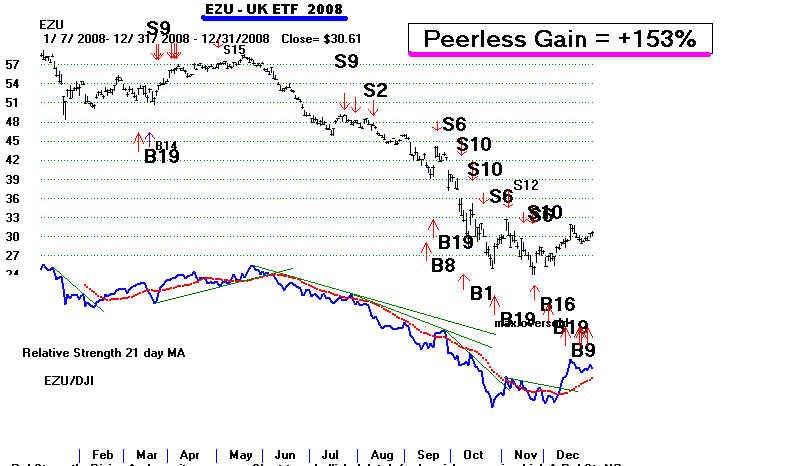

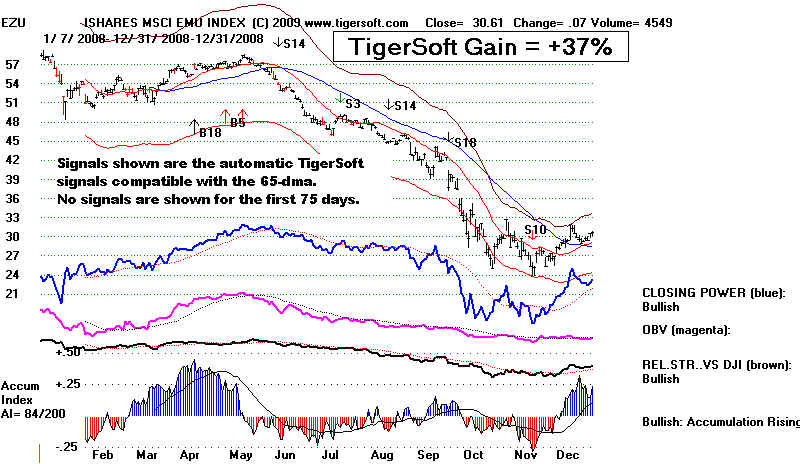

It can be easily shown how powerful Peerless is historically. One

way is to take the Exchange

Traded Fund, EWU, that represents British stocks and superimpose the Peerless

signals on

these charts. Here is the chart of EZU for 2008. Including short sales,

trades taken the day

after a reversing Peerless signal would have gained a trader 153%. It

should be noted that

EZU fell much more sharply than the FTSE-100 did from June to November.

The FTSE's

gains were "only" +105% using Peerless for longs and short

positions. On the EZU, the gains

amounted to +28% in this weak market. The short sales gained +56%.

TIMING THE UK MARKET WITH TIGERSOFT

If you don't have the Peerless programs, you can add them after getting the

TigerSoft programs. In that

case you will want to learn to use the TigerSoft internal strength indicators and

the Tiger signals (as opposed

to the Peerless signals.) This is should be easy if you apply what we can

teach you, right from this

website. To time the UK markets, use either the FTSE, EWU (the Exchanged

Traded Fund) or build an

index of the stocks we provide.

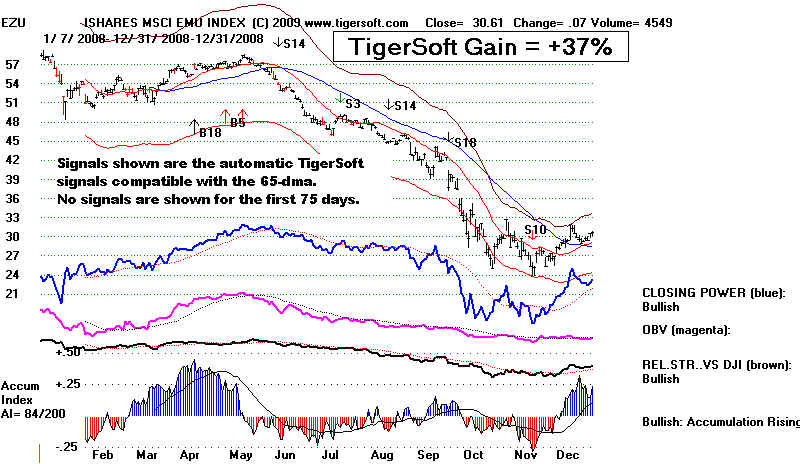

Look first at how readily the weakness of 2008 was predicted by the internal weakness in

EWU. We prefer

to use EZU because the FTSE-100 data does not come with the volume for either its stocks

or the whole

London Stock Exchange. You can see the classic Sell produced when EZU dropped below its

falling 50-day

mvg.avg. with the Tiger Accumulation index negative and the Tiger Closing Power falling.

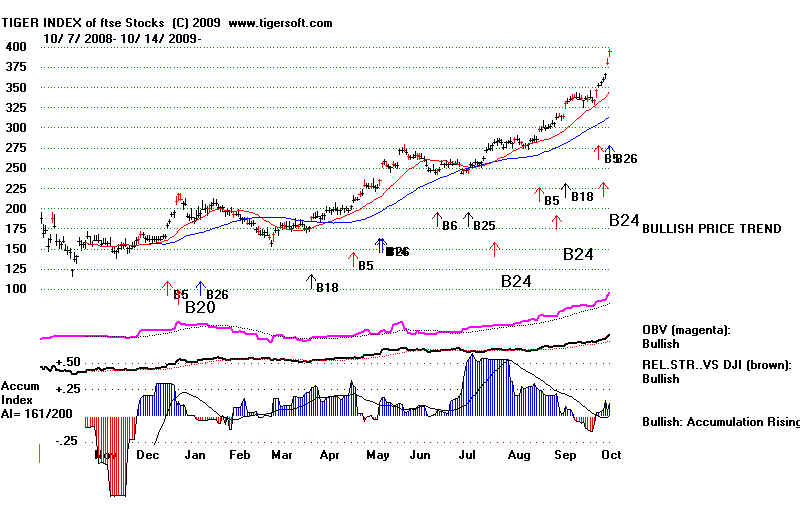

Build Your Own Indexes and

Study Their Internals

TigerSoft lets you build indexes of groups of stocks. Below is the TigerSoft

chart of the 99 British stocks

we now provide. (More will be added on request and as time permits).

All the internal strength indicators

were positive as the index moved bullishly higher and higher above its 65-day ma.

Notice the very

bullish jump of Accumulation in July. This proved quite prescient, as prices

shot up steeply soon afterwards.

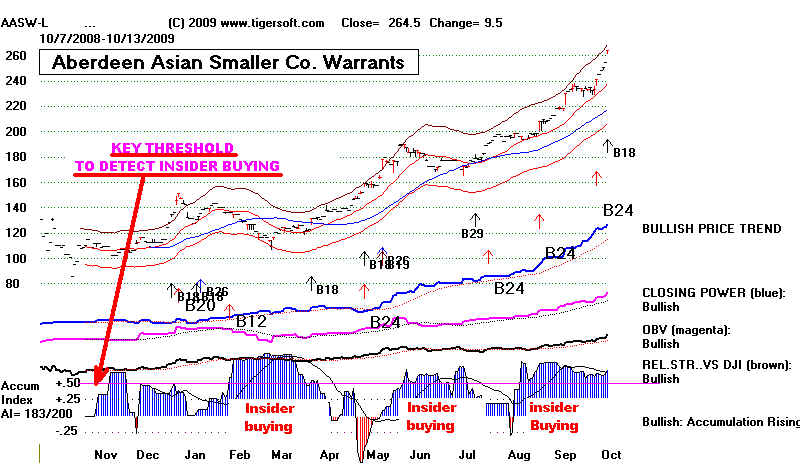

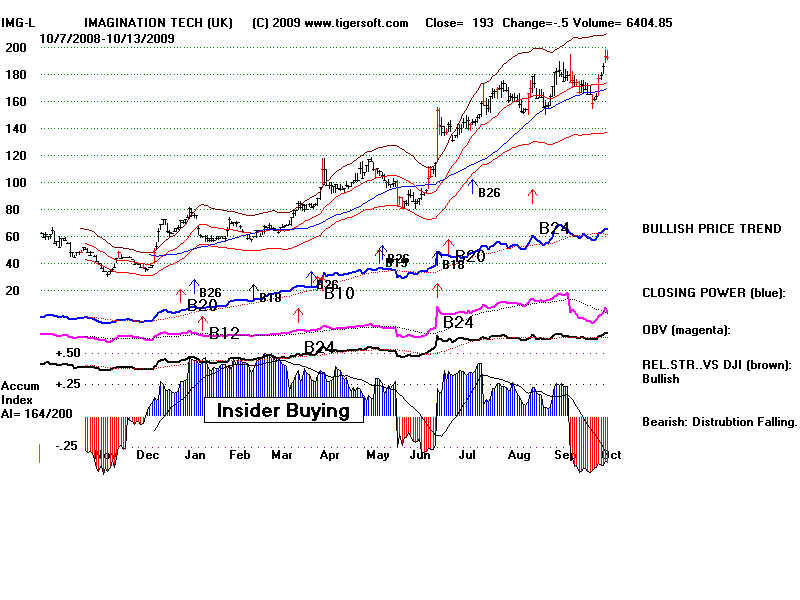

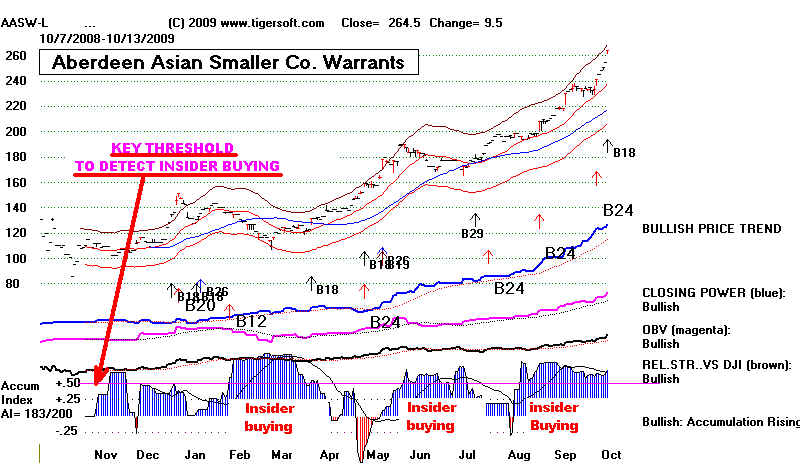

FINDING

BRITISH EXPLOSIVE SUPER STOCKS

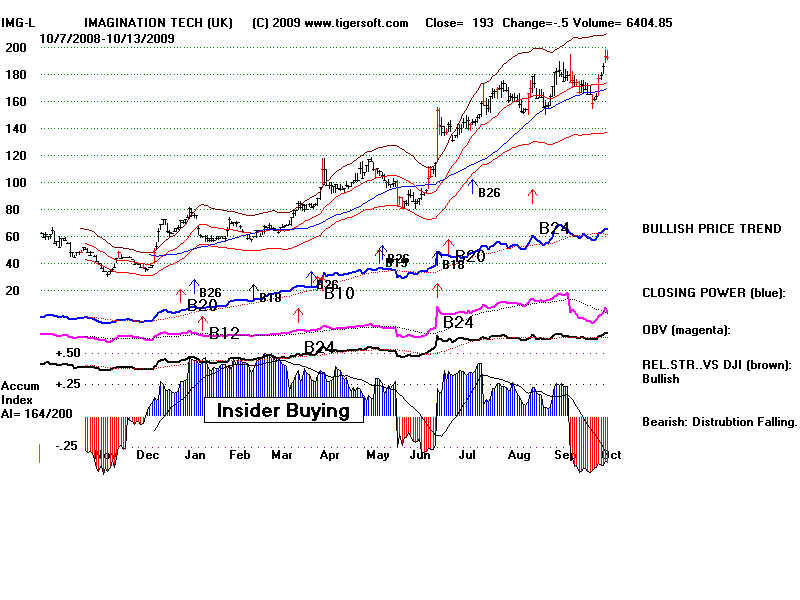

We have learned that watching for insider buying, which we

detect when the Tiger Accumulation

Index bulges past +.50 and the stock subsequently ,makes a new

high, is the best way to make money when

the overall market looks bullish. This is as true for UK

stocks as it is for American stocks. Insiders

always find a way to exploit their better information about a

company.

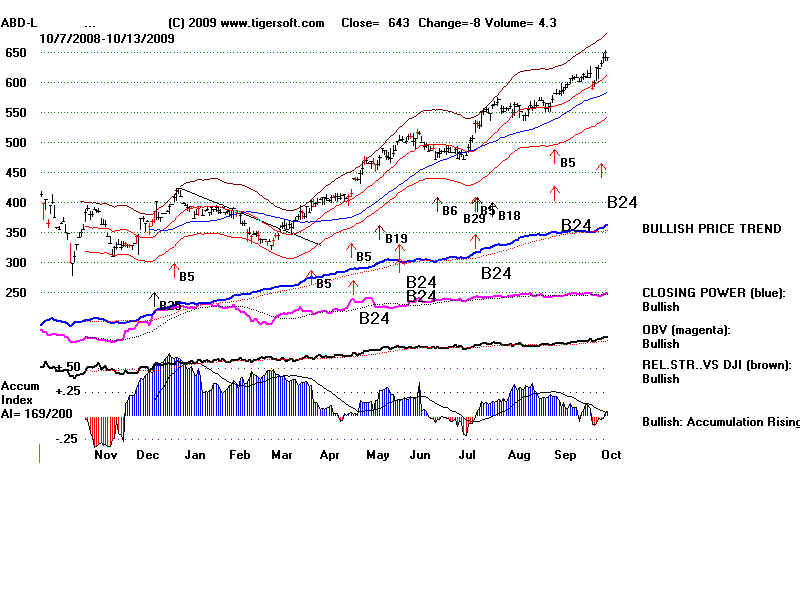

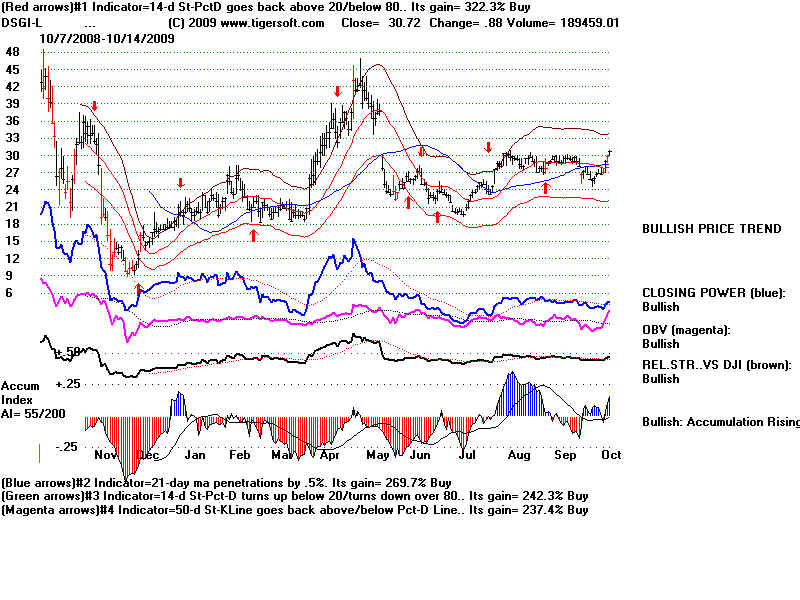

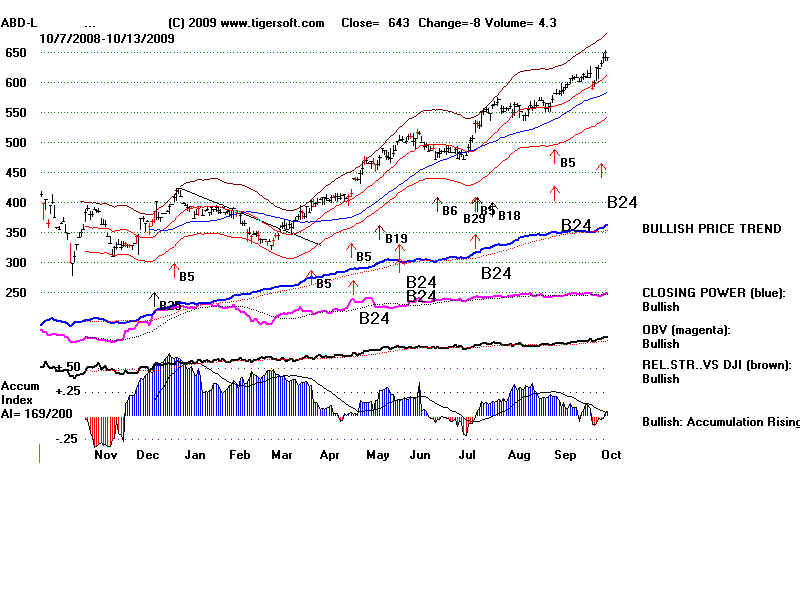

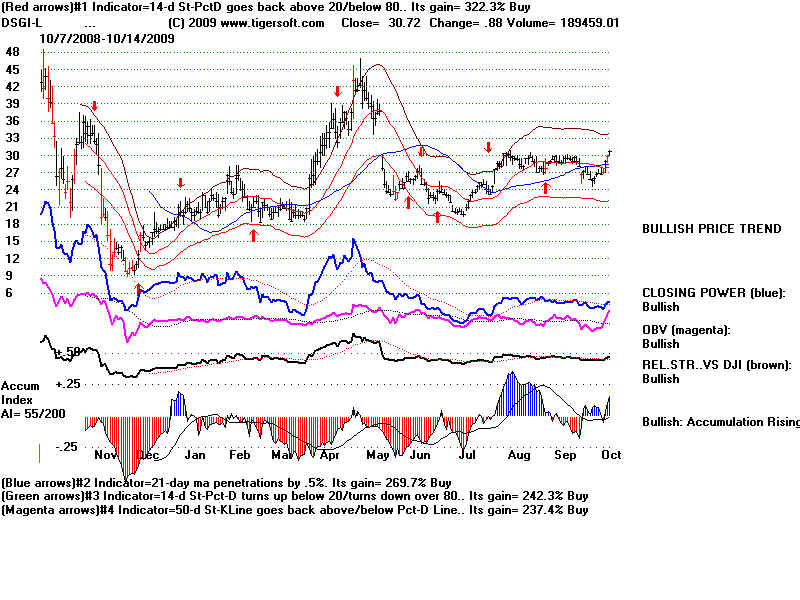

AUTOMATIC OPTIMIZED BUYS AND SELLS

TigerSoft's charts automatically show the best trading

system(s) for the last year out of 60 candidate

systems. These often reflect the character of the

stock and the personally types that gravitate to and

control particular stocks. Of course, the conditions

change from time to time. But short-term traders

will especially like this feature of TigerSoft because of

how profitable it often is, even after a year

using a particularly favored system. Below is an example.

Once again, what is true about trading

stocks is true about trading stocks in the UK and

universally,

TigerSoft News Service 10/9/2009

www.tigersoft.com

TigerSoft News Service 10/9/2009

www.tigersoft.com