Welcome,

Welcome,

TIGERSOFT -

VERY SIMPLE...

VERY

PROFITABLE ...

A QUICK DEMONSTRATION.

Part II Trading Tiger's Pro-Closing Power Trends:

Buy on Tests of Key Support and Sell When

CP Uptrend is Violated.

Welcome,

Welcome,

TigerSoft thanks you for visiting. We have had

nearly 30 years to test and

develop for you the simplest

and most profitable stock trading software offered anywhere.

See if you don't see this

from the discussion and demonstration on this page.

Let's

assume you had to $10,000 to invest at the start of 2010. Here's how

Tiger helps you using just

the Introductory TigerSoft program. We want to find stocks

to buy and then sell, using

our simple rules.

Take

any group of stocks you like OR, better, work with the ones we have

prescreened for high

Accumulation and and insider buying which are offered each

night on our Tiger

Stock Data Page.

#1 Go

through the Tiger charts looking for stocks with recent big bulges of blue

Accumulation:

1. The Tiger Accumulation Index bulge should rise up to the black

horizontal line labelled "Insider Trading".

2. The AI bulge should have occurred in the past 3 months.

3. The purple 65-day ma must be rising. It is best if the 65-day ma has just

turned up or its rate of climb is increasing.

4. The blue Tiger Closing Power should be in general uptrend.

#2

Buy on a retreat by the stock close to or below the rising 65-day ma kust after

the blue Tiger Closing Power breaks its minor downtrend to the upside..

#3

Traders should simply sell when the uptrend line of the Tiger Closing Power

breaks its

downtrend.

To find

these stocks, just hit the down-arrow key to chart the next stock.

Here we

will simply work with the stocks that begin with the letter "A".

As

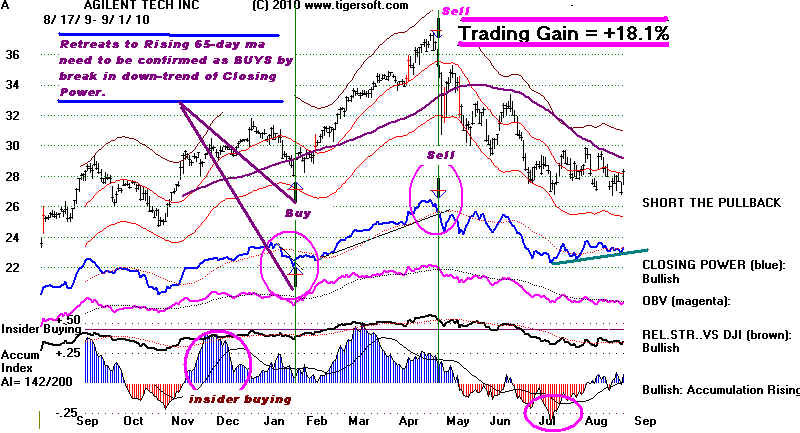

you should be able to see, the first chart belongs to A - Agilent Tech.

Agilent shows a bulge of insider buying in late

November 2009 that pushes the Tiger

Accumulation Index up to the key level showing insider buying. Below is its chart.

The

arrows we have placed on the chart show where these simple rules

would

have produced a Buy and the subsequent Sell. After placing the

Buy

and Sell arrows on the screen, the Tiger program shows you what happens

to

$10,000, assuming the trade is taken at the next day's opening and commissions

amount to $40 for a round-trip trade (Buy and Sell). The result was a gain of

$1810

if $10,000 had been invested. The software has paid for itself and 5x over.

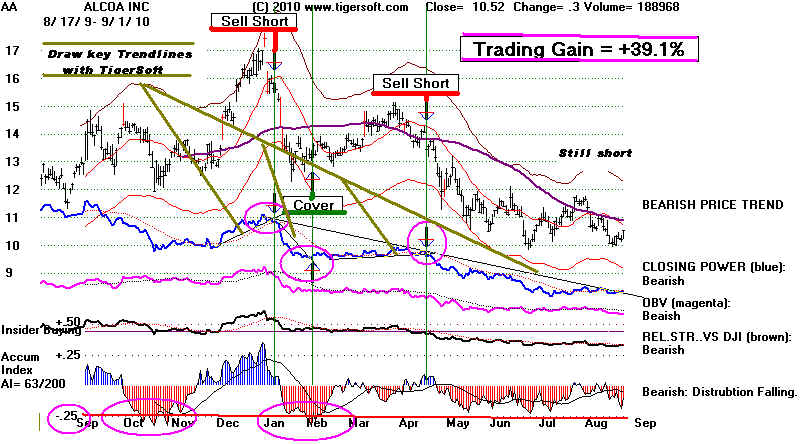

The next stock AA does not show this pattern of insider buying. See it below.

AA does illustrate how we find short sales. The only difference in reverse is that

the Accumulation Index need only fall below -.25. After that we wait for a

pullback to the falling 65-dma and then a break in the temporarily rising Blue

Closing Power to sell short. We cover the short sale when the Blue Closing

Power breaks its downtrend. See the two place where a short sale would

have been appropriate.

The

next stocks to show such a bulge in the Tiger Accumulation Index are

AAR (a preferred stock that pays a divividend, too), low-priced ABIO. ABR and

ACF See their charts below. When you get handy with this section's rules,

see the next section - Part II - Buying on Unconfirmed New Lows and

Selling

Short on Unconfirmed New Highs. Then for Part III, Read

about TigerSoft's

Explosive Super Stocks

AAR

ABR - Arbor Realty - Two trades.

ACF

Here the bulge of Accum occurs as stock turns up from 65-dma.

This is more

immediately bullish. We have to chase a little but when this

happens.

BUY

SELL