We have you with us, still. Great.

We have you with us, still. Great. Part III BUYING ON WEAKNESS and

SELLING SHORT on STRENGTH

Using Tiger's Closing Power To Clinch

Automatic Buy B8s, B9s and Sell S8s and S9s.

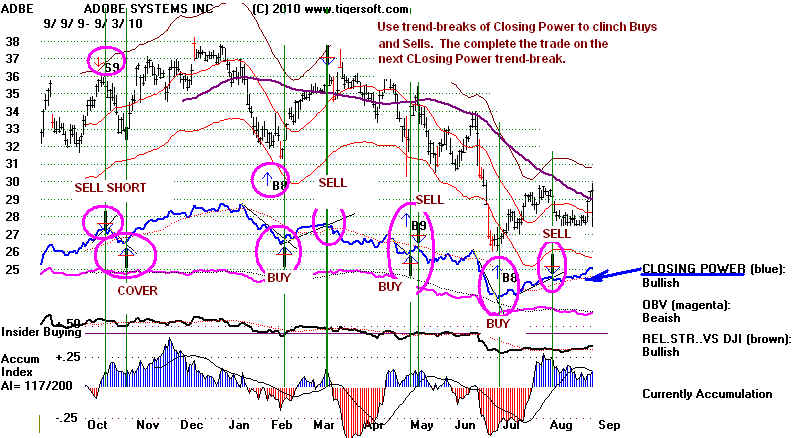

After one of these signals, watch for a trend-break in the CLosing Power. After a

Sell signal, a break in the Closing Power uptrend tells you to sell or sell short. Professionals

are switching to the sell side. A decline is probable. Vice verse, after a Buy signal,

a break in the Closing Power downtrend tells you to buy. Professionals have turned

bullish and a rally is very likely, Working with professionals will help you as much

as anything we offer, other than major Peerless Sells that warn of a bear market/

Draw the CP trendlines with TigerSoft rubber band lines. Place the

vertical lines with arrows with TigerSoft. Then see what the percent

gains are with TigerSoft.

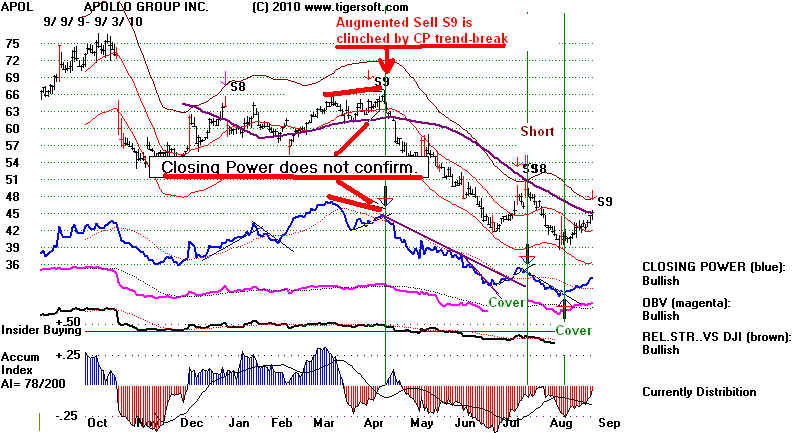

Watch for Closing Power Non-Confirmations

of new highs.

A new price high that is not matched by a Closing Power new high

is a bearish con-confirmation. Closing Power trend-breaks after such a

non-confirmation (NC) are bearish and should be used to sell or sell short.

The presence of an S8 or S9 Sell signal makes the sell more emphatic.

A new low by prices (even a minor one) that is not matched by a Closing Power

new low is a bearish con-confirmation. Closing Power trend-breaks after such a

non-confirmation (NC) are bearish and should be used to sell or sell short. The

presence of a B8 or B9 Buy signal makes the buy more emphatic.

Again use Trading Tiger's Pro-Closing Power Trends,

but look for positive non-confirmations by Accumulation

Index and Unusual Strengh by Closing Power.

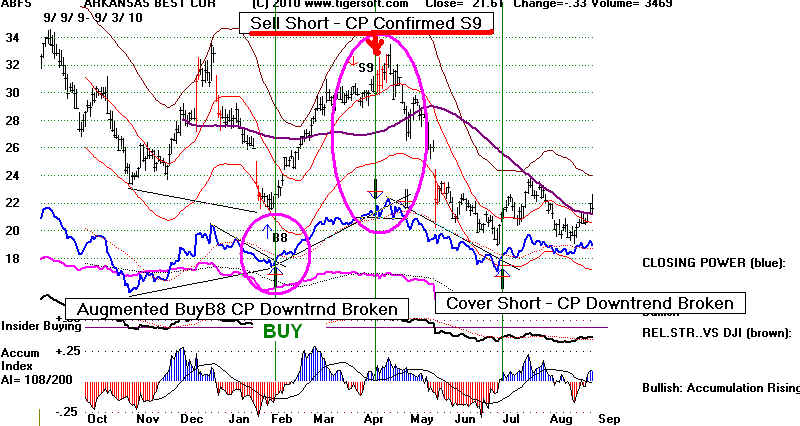

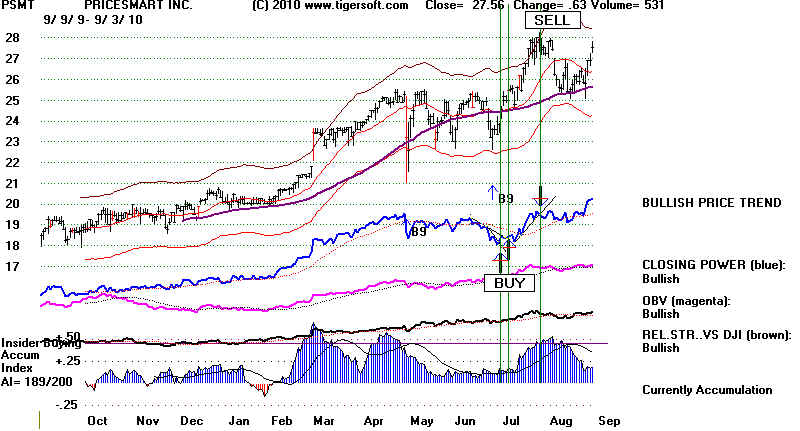

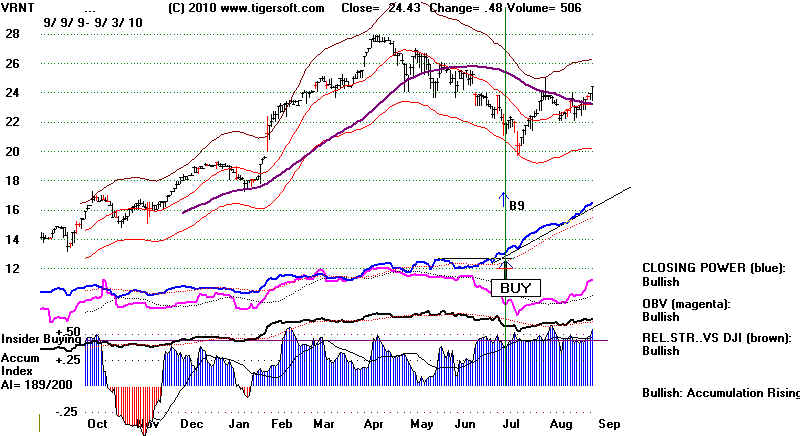

(A) Buy on Unconfirmed New Lows and Sell When CP Uptrend is Violated.

If the Tiger Accumumulation (at the bottom of the chart) is Positive on

the new price low, we typically see a Buy B9. This is a positive non-

confirmation (PNC). It is bullish. If the the Tiger Closing Power also

does not make a new low with prices on their new lows, the situation

is that much more bullish. We look for bullish Closing Power divergences

between prices and Closing Power. They often preceed a take-over

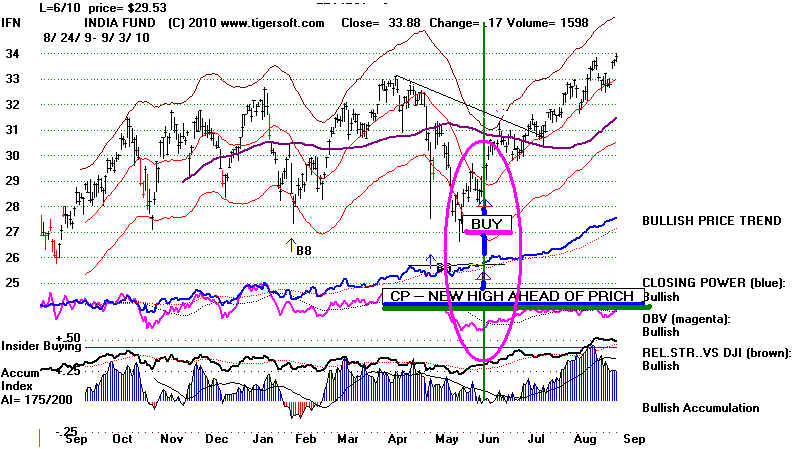

bid for example. Searching for the cases where Closing Powers make

new highs ahead of price is a particularly productive Tiger screen.

McAfee Take Over - Bullish Price versus Closing Power Divergence

INDIA ETF - BULLISH - Closing Power Makes a New High Ahead of Price.

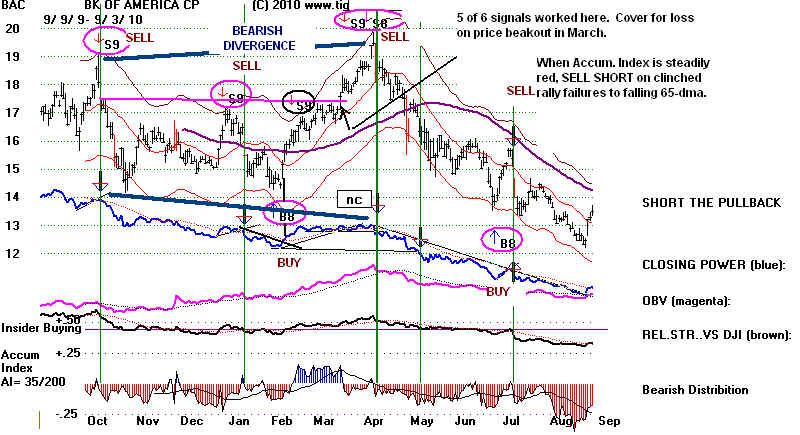

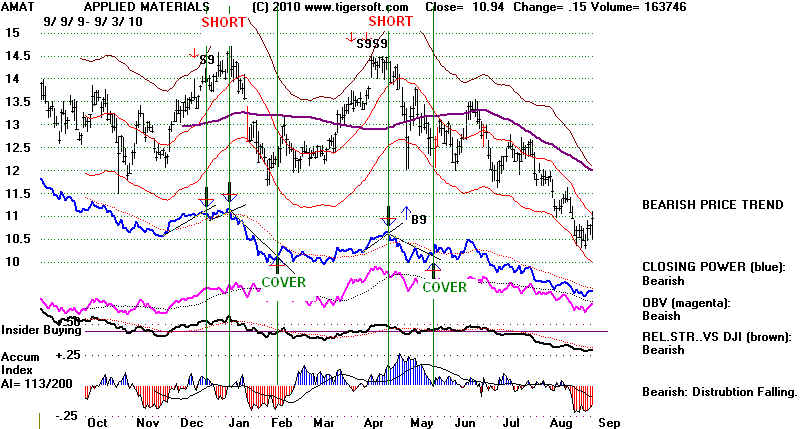

(B) Sell Short on Unconfirmed New Highs and Cover When CP Uptrend is Violated.

It is much more bearish if the Tiger Accumumulation is Negative on the new

price high (Sell S9) and/or the Tiger Closing Power does not make a new

high with prices making new highs. This is a CP "NC" (non-confirmation).

S9s with CP NCs are fairly rare. They are bearish.

We offer a bearish screening of stocks where Closing Powers are making

new lows ahead of price. When the CLosing Power breaks its minor uptrends,

it is a new point to sell short. We cover rhese shorts when the CLosing Power moves up above its downtrend.