TigerSoft News Service www.tigersoft.com

TigerSoft News Service www.tigersoft.com

TigerSoft News Service www.tigersoft.com

TigerSoft News Service www.tigersoft.com

RECENT TIGERSOFT HOTLINE

HEADLINES

and PEERLESS SIGNALS

6/16/2010 - DJIA = 10409

Peerless Signal = Sell S9/S12

See also

PEERLESS DJIA SIGNALS and CHARTS

SPY: 1993-2010

|

Tiger Software Helping Investors since 1981 Make Your Retirement Grow Suggestions: Peerless Stock Market Timing: 1928-1966 Track Record of Major Peerless Signals Earlier Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using TigerSoft Index Options FOREX trading Investing Longer-Term Mutual Funds Speculative Stocks Swing Trading Day Trading Stock Options Commodity Trading |

6/29/2010

Recent Headlines from

Peerless/TIGERSOFT Hotlines:

6/21/2010

"PEERLESS SELL S9/S12 OPERATIVE.

Shorting the DIA or SPY Now Seems Reasonable.

The DJIA opened up 120, tagged the resistance

of the falling 65-dma and then went

into a steady decline for the rest of the

day. Significantly, this broke the recent uptrend

of the Closing Power for the DIA.

SPY, QQQQ, MDY and IWM. That the DJI has also

tagged the 10600 objective set out based by the

DJIA's head and shoulder's right shoulder

potential apex means I can recommend

shorting the DIA or SPY."

6/17/2010

"The DJI and other averages may

go a little higher to reach their apex of right shoulders

symmetrical to their left

shoulders... But a re-test of 9800 seems indicated by the S9/S12

from Peerless on the

DJIA."

6/16/2010

"NEW PEERLESS SELL S9/S12 TODAY. A DJIA DECLINE BACK BELOW

10000

SEEMS MOST LIKELY."

6/15/2010

"Peerless Remains

on A Buy. DJIA-10500 Is A Reasonable Target, although a

retreat with good

breadth would be constructive tomorrow. Sometimes the market's

own chart patterns

dictate price action. That seems to be true now. Symmetry is

more common than

asymmetry in the pattern unfolding. The DJIA is tracing out a

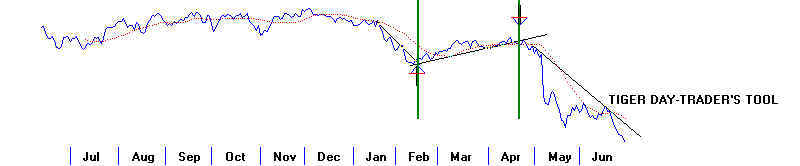

head and shoulders

pattern by advancing now upwards towards a right shoulder apex.

If a symmetrical head

and shoulders pattern does unfold, we should see a peak near

10600 (Intra-Day)

"

6/11/2010

"Until

the DJIA breaks out above 10750 (the apex of its right shoulder) or breaks

down below

the 9750 (neckline), we probably should use trading range tools.

The best

tools are the trends of the CLosing Power, the A/D Lines of different groups

of stocks

and the 5-day Stochastic. In this hotline, see that each of these tools now are

short-term

bullish."

6/10/2010

"Today

brought another Peerless Buy B14... DJIA ...Resistance at 10700

6/3/2010

"A Rally to 10500-10700 on the DJIA Is As Much As Seems Likely Now."

6/2/2010

"Only

The Peerless Buys Give Us Some Hope That The Key Support

at 9800 Will Hold...Short drilling stocks. Hold them short while their

Closing Powers Are Declining.

5/28/2010

"9800 Is Still Likely Support."

5/27/2010

"Relief Rally Under Way... Today brought a Peerless Buy B14..."

5/26/2010

"9800-10000 Is Key Support. The ETF's CLosing Powers Are Bullishly

Rising. That Suggests A Rally of 3%-5%."

5/24/2010

"We got short-term Buys today as the Closing Power downtrend-lines were

violated for the DIAI. SPY and QQQQ...This is a short-term Buy. A 3%-4% rally

would be typical here. "

5/23/2010

"Tiger's Closing Power and The NYSE A/D Line Are Still in Downtrends.

Wait

until these downtrendlines are broken to Buy. Shorter Term traders

should use Closing Power downtrend breaks...BP's eforts to stop the flow

of oil will (likely) fail... Our (Stocks') Hotline is short (BP and) considerably more

than

we are long."

5/21/2010

"Breaks in (the NYSE).. down-trendline after the DJI is down 9% offer an

extremely reliable way to call a bottom. "

5/20/2010

"9800-10000 is the most likely support area."

5/19/2010

"The DJI most likely needs to test its best support near 10000. There are

lots

of cases of broad 10% trading ranges after a big advance. Wait for the TigerSoft

Closing Power's current downtrend to end and be broken to buy."

5/17/2010

"Wait for the TigerSoft Closing Power's current downtrend to end and be

broken to buy. Professionals Are Still Selling To The Public."

5/14/2010

"Wait for the TigerSoft Closing Power to break its downtrend for the QQQQ,

SPY and DIA"

5/13/2010

"Having reached price

resistance, a retreat by the DJIA, NASDAQ, QQQQ

and SPY has now started. The

broken neckline in a head and shoulders

pattern and a falling 21-day ma both act as resistance levels. When they

overlap, they reinforce each other and resistance is more likely to

cause a reversal. Now that we have tested such resistance, a decline has

started."

5/6/2010

"NEW BUYS BUY B5 and BUY B17" (but) "the extreme downside

volatility

we saw today alone should make us nervous. With the DJIA now at a year-long

price uptrend, we should be careful...I would prefer to see the TigerSoft Closing

Power to break its downtrend, before going 100% long. "

5/4/2010

"Tthe completed head and shoulders patterns and Falling Closing Powers

are distinctly Bearish. SPY Head and Shoulders

Patterns: 1983-2010:

4/30/2010

"Bearishly, the major market ETFs' CLosing Powers' steep uptrend-lines are

being broken. They show developing head and shoulders patterns. But the

necklines have not been violated. If that happens, "duck and cover"