|

==== THIS IS A PERFECT TIME TO TRADE GOLD STOCKS WITH

TIGERSOFT ======

See TigerSoft Introduction http://tigersoft.com/--3--/Explanation/index.html

===================================================================================

THE MONETARY FIX,

INCOME INEQUALITY IN THE US

AND THE BEST

GOLD STOCKS TO BUY AND TRADE

3% INTEREST RATES BOOST GOLD

The dramatic Federal Reserve Rate cuts are doing exactly what they are really intended to

do, help

"financials" make

more money, boost their depressed stock prices and avert a need for a Federal bailout

of a major bank, like Northern Rock

in the UK last year. The drop in interest rates puts strong downward

pressure on the Dollar.

Higher interest rates prevail overseas. So, hot money moves away from the US.

Americans on fixed incomes should

investigate the returns they can get from overseas utilities.

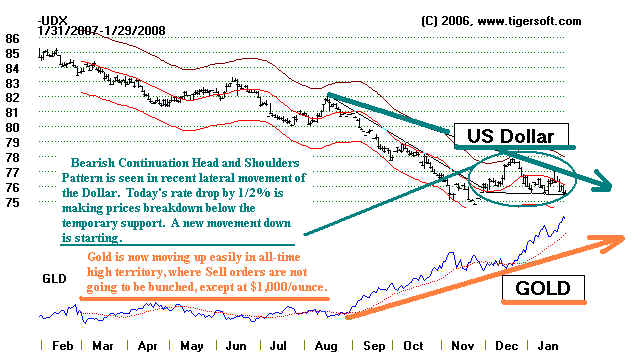

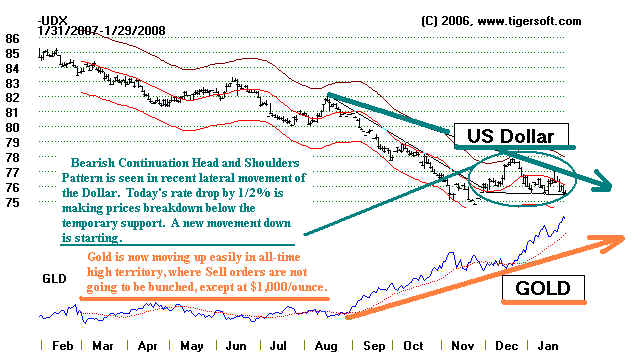

The Dollar Index is flirting with making

a new all-time low The Dollar Index is flirting with making

a new all-time low

against a basket of foreign currencies.

Gold is making more record new highs. Gold is a haven for those

concerned about currency volatility.

Since its upturn in 2002,

it has provided a positive return, unlike real

interest rates (annual interest minus

inflation) and it provides safety to those who have read about the collapse

of currencies. I have written about

the collapse of the German

Mark in the 1920s and the Argentina's Peso

in 2002. Yes, it most certainly

could happen here.

-------- As

The Dollar Goes Down, Gold Rises Inversely

--------------

-----------------------

GOLD ETF MAKES NEW HIGHS -----------------------------

----------------- SILVER

ETF MAKES NEW HIGHS -----------------------

I believe that before the precious metals' markets uptrend finally ends, Silver will rise

spectacularly

as it did in early 1980.

Then in tripled, from $15 to $50/ounce. While there are limits on the number

of futures' contracts an

individual trader can buy, thereby preventing some like the Hunt Brothers from

"cornering" the

silver market to run in the shorts, the existence of Exchange Traded funds makes the

buying of gold and silver an

easy commodity to speculate in. And most extreme markets end in "bubbles

of wild speculation".

The metals market have not begin to approach the wild final phase.

================= Gold

Stocks Index (XAU) ===================================

Should you buy Gold or Gold Stocks? Gold is less volatile. The two have tracked each

other

quite closely. You can use a

relative strength tool like Tiger's, RSQ - Relative Strength Quotient -

and plot the quotient of GLD

(gold bullion) divided by the XAU Index of Gold and Silver stocks.

It will show you uptrends and

downtrends. Draw trendlines to capture these swings. But also notice

the floor of support of the

RSQ for XAU/GLD at current levels. This makes Gold Stocks attractive

now, it seems to me. I

will take up the matter of finding the right gold and silver stocks further below.

But first I want to raise

questions about the very suitability of the Fed's monetary as a solution for

the coming recession.

========= Rate Cuts Won't Fix What Is Broken

about The US Economy =========

INCOME INEQUALITY IS BIGGEST THREAT

TO THE AMERICAN ECONOMY

The US Dollar's previous low was set in 1974 as Nixon

resigned. Some might see this as a sign that

things can only get better.

But the Dollar decline will eat up those on fixed incomes as import prices rise.

And with so many

manufacturing jobs already gone overseas, it is not clear how much more the US

will export. Watch to

see if the interest on your bank and credit loans do, in fact, go down. So, cuts in

interest rates and a lower

Dollar are not even a trade-off. They won't increase exports and they will

encourage hot capital

(including US savings) to leave the US.

They are being set out as an economic stimulus. In reality, they only help shore up the US

stock markets

until the Presidential

Election is over. Next year, all bets will be off. The basic problems remain

untouched by monetary

(interest rate) palliatives. Bush's $2 trillion blunder - the Iraq war - continues

on and on. For what?

To help him save face. Because he is stubborn. Because he wants his

cronies

to get all they can while

they can and leave the US Federal Deficit so over-drawn, there will be little

a new White House can do,

except to cut spending when they come into office. If they tax the wealthy,

they will only ensure a

deeper bear market with all the attendant political risks. The truth is Bush's was

has benefited only the

zero-bid and hugely wasteful military industrial complex and those who are content

that hatred for the US is

spreading so that more military spending will be justified.

The rate cut does very little to help bring back the millions and millions of white collar

and manufacturing

US jobs that have been outsouced

for the sake of higher multinational profits. Though productivity is rising,

real wages have been declining

since 1973, and the trend is now worsening.

"During the 17 years after 1973, real wages declined to 86 percent in 1995 and

recovered

to only 92 percent of real wages in

2000 during the "economic boom" of the late 1990s. "If 'free trade' had

been a better policy. . . their

real wages in 2000 should have been significantly more than 175 percent of 1973

--not a reduction," http://www.nikutai-to-kageboushi.com/uspovrty.html

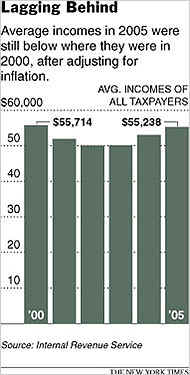

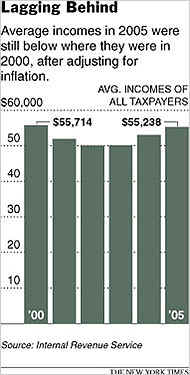

"Americans earned a smaller average income in 2005 than in 2000, the fifth

consecutive year that

they had to make ends meet with less

money than at the peak of the last economic expansion."

Real income growth here was

calculated using BLS data measures Real income growth here was

calculated using BLS data measures

of CPI. It’s even worse than this in

reality, as we have long demonstrated that CPI does not accurately

measure inflation. So the true, after

inflation, "Real Income," is actually far, far worse. Perhaps

this explains

why 2/3rds of the people interviewed in a WSJ/NBC survey

believe that we are either in a recession or will

be within a year.

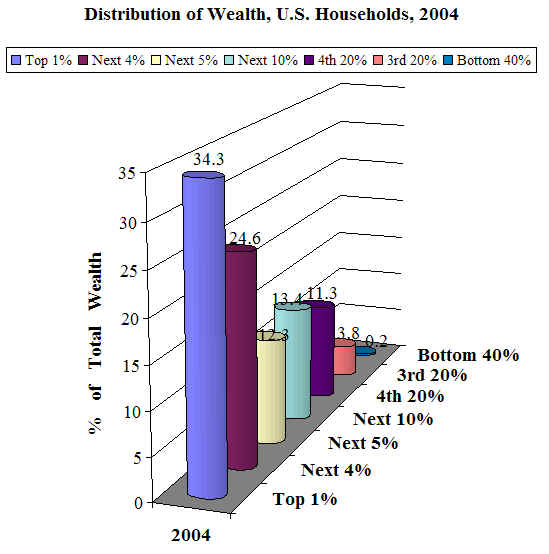

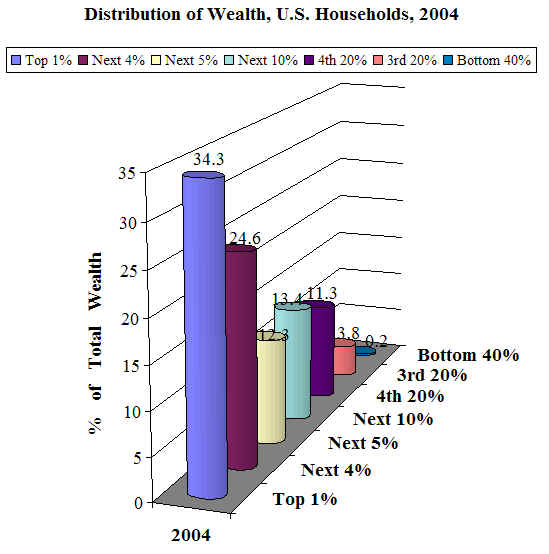

Also, it is no secret:that income growth has been concentrated in the highest few

percentile:

"The growth in total incomes was

concentrated among those making more than $1 million. The number of such

taxpayers grew by more than 26 percent, to

303,817 in 2005, from 239,685 in 2000. "These individuals, who

constitute less than a quarter of 1 percent of

all taxpayers, reaped almost 47 percent of the total income gains

in 2005, compared with 2000. People with

incomes of more than a million dollars also received 62 percent of the

savings from the reduced tax rates on long-term

capital gains and dividends that President Bush signed into law in

2003, according to a separate analysis by

Citizens for Tax Justice, a group that points out policies that it says

favor the rich. The group’s

calculations showed that 28 percent of the investment tax cut savings went to just

11,433 of the 134 million taxpayers, those who

made $10 million or more, saving them almost $1.9 million each.

Over all, this small number of wealthy

Americans saved $21.7 billion in taxes on their investment income as a

result of the tax-cut law." (Source:

http://bigpicture.typepad.com/comments/2007/08/real-income-fai.html

)

By all measures, poverty is dramatically on the rise. Sickness and suffering are on the

rise, too, because

health insurance is pricing itself beyond

the reach of 40 million Americans. And millions more can afford only

very high deductibles, $5,000 a year, and

so avoid going to doctors for basic tests. Math and science education

suffer; because college education is made

more and more impossibly expensive. Tuition is 36 times higher now

than when I went to school in the 1960s.

Meanwhile,

the greed and insider trading of corporate CEOs knows no bound. But Federal trade

and

government deficits are now so big, there

is no money to rebuild American infrastructure and provide unemployed

American workers decent jobs. So,

most Americans go deeper and deeper in debt and work longer and longer

hours. When their equity in their

house goes to zero, they walk away from it. That's what CEO and business

schools teach. So, I can't see how

lowering interest rates will help much, except in the short run.

The

income inequality in the US is the greatest its been since the 1920's. It is also

the greatest

threat to the American economy and

American Democracy. The Keynesians were correct. Under consumption

led to the Great Depression, not mixed up

monetary policies, as Friedman and his pupil Ben Bernacke would

have us believe. With many credit

markets receiving emmergency bail-out remedies, we should, I think, go

back over the records of FDR's Federal Reserve Chairman, Marriner Eccles. In the late 1920s, before

the Crash, Eccles gave speeches to other

bankers in which he warned about the dangers inherent in the

then widening gap of wealth. He was

laughed at!

"We

sustained high levels of employment in that period with the aid of an exceptional

expansion

of debt outside of the banking

system. This debt was provided by the large growth of business savings as well as

savings by individuals, particularly in

the upper-income groups where taxes were relatively low. Private debt outside

of the banking system increased about

fifty per cent. This debt, which was at high interest rates, largely took the

form of mortgage debt on housing,

office, and hotel structures, consumer installment debt, brokers' loans, and

foreign debt. The

stimulation to spending by debt-creation of this sort was short-lived and could not be

counted on to sustain high levels of

employment for long periods of time. Had there been a better

distribution of the current income from

the national product -- in other words, had there been less savings

by business and the higher-income groups

and more income in the lower groups -- we should have had far

greater stability in our economy.

Had the six billion dollars, for instance, that were loaned by corporations and

wealthy individuals for stock-market

speculation been distributed to the public as lower prices or higher wages and

with less profits to the corporations and

the well-to-do, it would have prevented or greatly moderated the economic

collapse that began at the end of

1929.".

( http://www.tpmcafe.com/discussiontables/economics_table/2007/dec/03/income_inequality_caused_depression_marriner_eccles#comment

)

Politicians

Have Learned Little from The 1920s

"The Roaring Twenties were an era dominated by Republican presidents: Warren Harding

(1920-1923),

Calvin Coolidge (1923-1929) and Herbert

Hoover (1929-1933). Under their conservative economic philosophy

of laissez-faire ("leave it

alone"), markets were allowed to operate without government interference. Taxes and

regulation were slashed dramatically,

monopolies were allowed to form, and inequality of wealth and income

reached record levels. The country was on

the conservative's preferred gold standard, and the Federal Reserve

was not allowed to significantly change

the money supply.

"The fact that the Great Depression began in 1929, then, on the Republicans' watch,

is a great

embarrassment to conservative economists.

Many try to blame the worsening of the Depression on Hoover,

for supposedly betraying the laissez-faire

ideology." (Or the Federal Reserve for not dropping interest rates.)

But much more importantly, the economy

was clearly turning downward even before Hoover took office in 1929.

Entire sectors of the economy were

depressed throughout the decade, like agriculture, energy and mining. Even the

two industries with the most spectacular

growth -- construction and automobile manufacturing -- were contracting

in the year before the stock market crash

of 1929. About 600 banks a year were failing. Half the American people

lived at or below the minimum subsistence

level. By the time the stock market crashed, there was a major glut of

goods on the market, with inventories

three times their normal size."

"A depression, Keynes believed, is an especially severe recession in which people

hoard money no

matter how much the central bank tries to

expand the money supply. In that case, he suggested that government

should do what the people were not: start

spending. He called this "priming the pump" of the economy. Indeed,

most economists believe that only massive

U.S. defense spending in preparation for World War II cured the

Great Depression."

(Source: http://www.huppi.com/kangaroo/Causes.htm

)

With the Dollar falling, rich Americans are smart enough to know to buy overseas precious

metal stocks

and get higher real interest rates by sending

their money overseas.

(Source: http://www.faculty.fairfield.edu/faculty/hodgson/Courses/so11/stratification/income&wealth.htm

)

For historical trends in distribution of wealth

see:

http://sociology.ucsc.edu/whorulesamerica/power/wealth.html

Comparisons among Countries

Wealth Owned by Top Ten Percent

US 70%

France 61%

Sweden 59%

UK 56%

Canada 53%

Norway 51%

Germany 44%

Finland 42%

|

What Gold Stocks Should You Buy?

Past trends do tend to continue in the stock market. If you had bought the top best

performing

five stocks of 2006, you would have

gained about 37.4% for the last 12 months. If you had bought

the next five best, you would have

gained 29.5%. If you had bought the five highest

Tiger Accumulation

Index stocks, you would have gained

50.8%. Buying the top 5 Power-Ranked (which is

a 3-6 months'

out tool, you would have gained 13.7%.

Interestingly, if you had bought the next highest 5 Power-Ranked

stocks, you would have gained 54.7% for

the last 12 months.

So what are the highest Accumulated Gold Stocks now.

Top 10

Accumulation Index

12/29/2008

====================

AZS

174

17.81

GLD

167

91.15

IAU

159

91.19

GOLD 156

46.72

MVG

144 13.50

What

are the best performing Gold stocks for the last year?

Top 5 Percent Change

Last 250 Days

1/31/2007

====================

SA

103%

24.77

GOLD 98%

46.72

MVG 98%

13.50

ABX

79% 53.23

KGC

65% 21.97

Second Five Power Ranked

1/29/2007

====================

GOLD 359

46.72

GLD 348

91.15

RIC 325

3.3

GDX 311

50.7

GG

264

37.72

-------- HISTORICAL STUDY ------------------------------------

12/26/2006

Top 10 Percent Change

250 Days

12/28/2005 to 12/26/2006

1/29.2007 Pct Change

====================

=======

========

AZK +112%

3.13

4.10

+31.0%

AEM +106%

40.41

62.73

+55.2%

SSRI +98%

30.26

34.93

+15.4%

AUY +92%

12.65

16.27

+28.6%

SLW +83%

10.42

16.31

+56.5%

HL +76%

7.32

9.45

+29.1%

MFN +51%

8.20

11.50

+40.2%

GOLD +39%

22.77

46.72 +105.2%

CEF +38%

9.23

12.01 +30.1%

GRS +37%

16.07

6.91 -56.8%

Top 10 Accumulation Index

12/28/2005 to 12/26/2006

1/29/2007 Pct Change

====================

=======

========

AUY 161

12.65

16.27

+28.6%

AZS 153

12.15

17.81 +46.6%

GLD 136

61.98

91.15 +47.1%

GBN 136

1.63

3.01 +84.7%

IAU 127

62.05

91.19 +47.0%

Top 10 Power Ranked

12/28/2005 to 12/26/2006

1/29/2007

Pct Change

====================

=======

========

AUY 278

12.65

16.27 +28.6%

AZS 235

12.15

17.81 +46.6%

XAU 165

139.34

187.36 +34.5%

GRS 163

16.07

6.91 -56.8%

SSRI 156

30.26

34.93 +15.4%

HL 135

7.32

9.45 +29.1%

GLD 92

61.98

91.15 +47.1%

AEM 83

40.41

62.73 +55.2%

GOLD 80

22.77

46.72 +105.2%

GG 62

27.52

37.72 +37.1%

Pct. Gains Using Optimized

Trading System when Stochastic

Is Best System, 12/26/2006

======================

Long & Short Buy Next Day's Opening

Sell Next Day's Opening

----------

--------------

--------------------------

ABX

71.5% 40.1%

AEM

206%

77.2%

AU

87.8% 33.6%

AZK

146.4%

139.5%

CEF

91.5%

51.4%

GBN

77.3%

47.4%

GDX

76.2%

31.4%

GFI

85.5%

33.6%

GLD

52.4%

25.1%

GOLD

126.7%

73.1%

HL

251.9% 130.5%

IAG

112.3%

52.0%

KGC

84.3%

30.6%

MFN

236.6%

85.1%

NEM

75.8%

28.4%

SIL

121.3%

30.5%

SLW

159.7%

61.2%

SSRI

124.1%

78.2%

XAU

11.3%

57.0%

Top 10 Percent Change

Last 250 Days

1/31/2007

====================

SA

103%

24.77

GOLD 98%

46.72

MVG 98%

13.50

ABX

79% 53.23

KGC

65% 21.97

GBN

61% 3.01

AEM

55% 62.73

SLW

51% 16.31

AZS

47%

17.81

GLD

40%

91.15

Top 10 Accumulation Index

12/29/2008

====================

AZS

174

17.81

GLD

167

91.15

IAU

159

91.19

GOLD 156

46.72

MVG

144 13.50

Top 10 Power Ranked

1/29/2007

====================

AZS 174

17.81

IAU

159 91.19

XAU 398

187.36

AZK 364

4.1

GBN 360

46.72

GOLD 359

46.72

GLD 348

91.15

RIC 325

3.3

GDX 311

50.7

GG

264

37.72

==================================================================================

WHAT

GOLD AND SILVER STOCKS SHOULD YOU TRADE

WITH TIGERSOFT'S BUYS AND SELLS?

TigerSoft's Red Buys and Sells will help you trade

the volatility and trading ranges that

Presidential Election

years usually produce. Here are the gold

and silver stocks

that have traded best for the last two year.

Often the trading

gains are much moe than Buying and Holding.

By way of

illustration, look at the effectiveness of SLW's

buys and sells.

Stocks to trade using TigerSoft tools. Come

back here and I will post more examples.

See http://tigersoft.com/--3--/Explanation/index.html

Pct. Gains Using Optimized

Trading System when Stochastic

Is Best System, 1/28/2006

======================

Long & Short Buy Next Day's Opening

Sell Next Day's Opening

----------

--------------

--------------------------

ABX

93.7% 99.6%

AEM

232.9% 105.4%

AU

181.3% 56.9%

AUY

157.1% 86.1%

AZS

186.4% 115.5%

CDE

104.5% 50.3%

GDX

98.3% 46.4%

GFI

66.0% 19.2%

GG

92.0% 70.7%|

HL

140.4% 58.1%

IAG

126.1% 76.3%

KGC

253.5%

106.7%

MFN

111.9%

36.5%

PAAS

129%

58.6%

SLW

190.5% 131.4%

SSRI

130%

64.8%

SWC

136.4%

57.6%

XAU

85.7% 55.2%

Pct. Gains Using Optimized

Trading System when Stochastic

Is Best System,

12/26/2006

======================

Long & Short Buy Next Day's Opening

Sell Next Day's Opening

----------

--------------

--------------------------

ABX

71.5% 40.1%

AEM

206%

77.2%

AU

87.8% 33.6%

AZK

146.4%

139.5%

CEF

91.5%

51.4%

GBN

77.3%

47.4%

GDX

76.2%

31.4%

GFI

85.5%

33.6%

GLD

52.4%

25.1%

GOLD

126.7%

73.1%

HL

251.9% 130.5%

IAG

112.3%

52.0%

KGC

84.3%

30.6%

MFN

236.6%

85.1%

NEM

75.8%

28.4%

SIL

121.3%

30.5%

SLW

159.7%

61.2%

SSRI

124.1%

78.2%

XAU

11.3%

57.0%

|

The Dollar Index is flirting with making

a new all-time low

The Dollar Index is flirting with making

a new all-time low

Real income growth here was

calculated using BLS data measures

Real income growth here was

calculated using BLS data measures