|

Charts of Presidential Election Years: 1944 to 2004: Early Weakness

Followed

by

A Limited Rally And Then An End of Year Partisan Rally.

For

a long time, I have said that big declines are avoided in a Presidential

Election

year, especially after the first quarter. We now see why this is true.

Politicians

are

much more heedful of Wall Street and Main Street. They do what they can

to

avoid a big drop so as not to become political targets because of a weak stock

market.

These forces are clearly at work now. It takes a while for monetary policies

to

impact Main Street. They often have a substantial effect on stock prices. We

have

never

seen a 3/4% rate cut in a Presidential Election year. It should bolster the market

a

lot unless economic conditions and business confidence have already passed the

point

of no return, as was true in 2001 and 2002.

It

may be said that the Fed panicked last Tuesday morning when they

saw

the severe drops overseas on the Friday and Monday. If so, the discovery that

a

single rogue French trader may have caused their panic, may lead them not

to

cut rates again this week. If they do cut rates again, it may well be taken as a

sign

that

the number of bad loans may be much larger than outsiders realize. It may

mean

they

want to help banks return to profitability to avoid a bail out of some very big banks,

as

happened in the UK with Northern Rock Bank.

My

own feeling is that they will only cut rates again if the DJI falls another 10%.

And

that will bring a typical Presidential Election year rally nearer the end of the

first

quarter.

Arthur

Merrill studied the market in Presidential Election years, from 1886 to 1980. The

median

probability

for any given month being up was 56%. 55% of Januarys in Presidential Election years

rise.

Februarys

are worse. They are up 47% of the time. March features an advance by the close

and is

up

71% of the time. April and May are each up only 47% of the time. June is up

51% of the time..

Julys

rise 59% of the time, August advance 67% of the time. But Septembers fall.

They rise only 41%

of

the time. The probabilities of a monthly advance are 69%, 69% and 59% for October,

November

and

December, respectively.

Below

are the charts since 1940 of Presidential Election years. First quarter declines

occurred

in 12

cases: 1940, 1944, 1948, 1952, 1956, 1960, 1968, 1980, 1984, 1988, 1992, 2000 and 2004.

The

exceptions

were 1964, 1972, 1976 and 1996. So, on this basis the odds are 3:1 for a significant

decline

in the first quarter. Of course, we have already seen that for January. But

will the market go

down

more. A decline to May and June is most typical. If we count count the number

of times bottoms

occurred

in subsequent months, we see the number are:

late

January-February: 1948, 1956 (trading bounce), 1988

March

1968, 2000

April 1944, 1952, 1960 (trading bounce), 1980, 1992

May

- 1940, 1956, 2004 (trading bounce)

June

July

- 1984

Over

and over, we see interest rates are not raised until late in a Presidential Election year,

unless

a Republican Fed Chairman wishes to sabotage chances for re-election of a Democrat

or

vice verse. See the cases of this in 1956, 1980 and 2000. The Feds delay in 1992 may

have

cost the first Bush re-election. Lowering interest rates by the Fed in 2008 helps

Republicans

avoid

going into the Presidential Election saddled by a recession. In 1972, the Fed sat on

its

hands

in 1972, despite rising commodity prices. After the Election, they started raising rates.

(Source:

http://minneapolisfed.org/research/data/us/disc.cfm

)

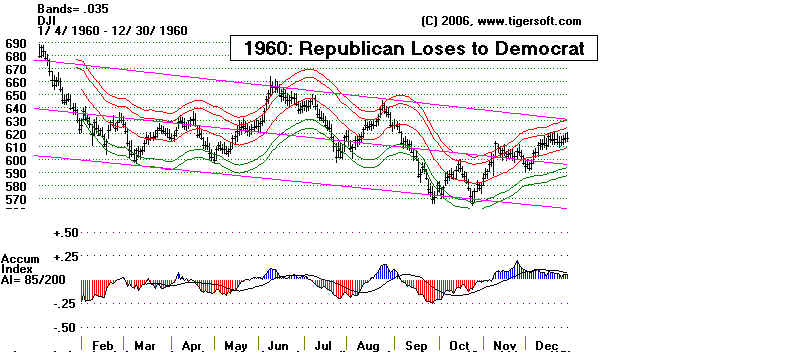

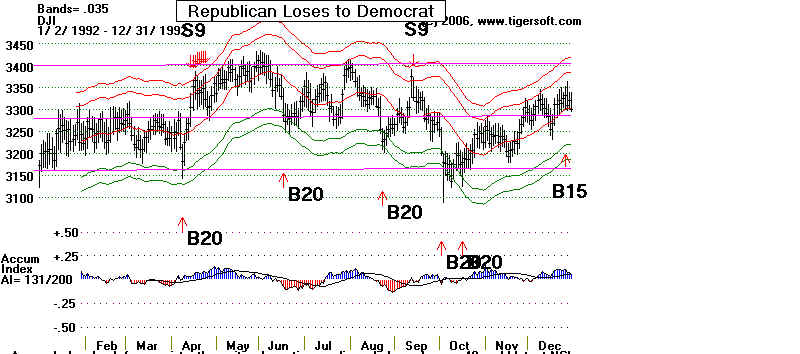

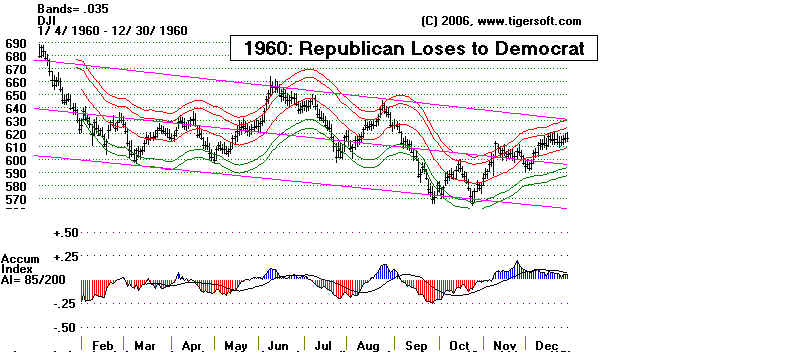

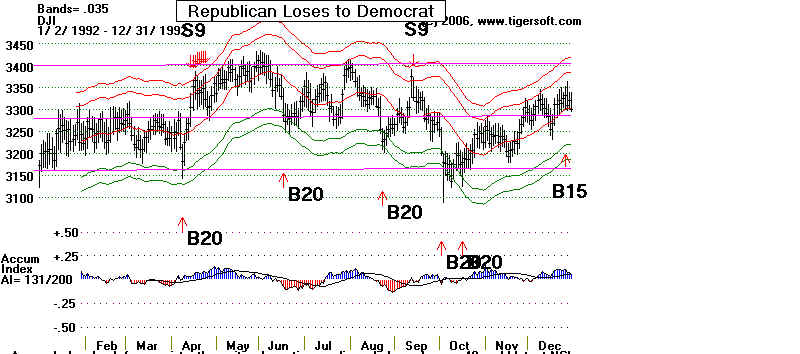

The

market tends to be weaker in a Presidential Election year when a Democrat is going to

take

away the White House from a Republican. See 1960 and 1992 below. 1976 may be viewed

as

an exception, because Republicans were tarred with Nixon's resignation.

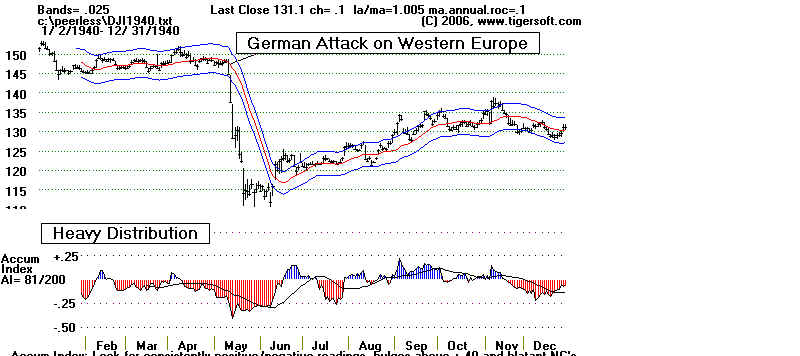

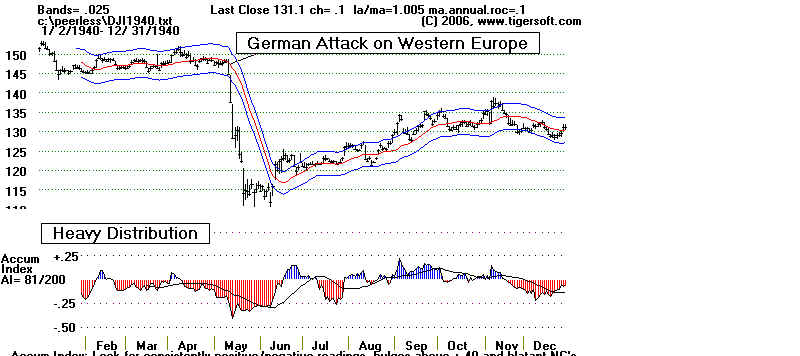

--------------------------------------------- 1940

--------------------------------------------------------------------------------------

-------------------------------------------- 1944

-------------------------------------------------------------------------------------

------------------------------------------- 1948

--------------------------------------------------------------------------------------

Discount rate was raised from 1.0% to 1.25% on 1/12/48. Hence the early decline.

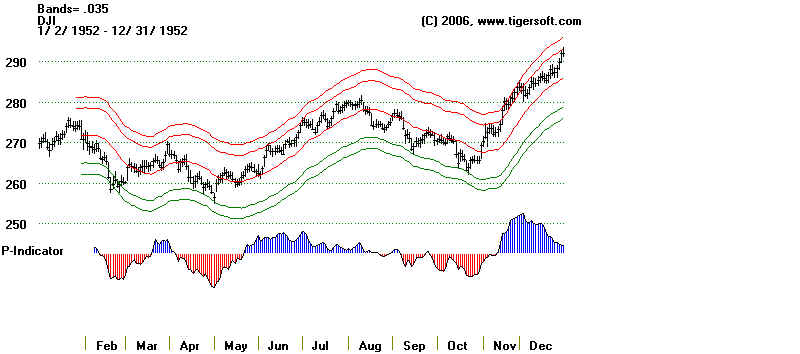

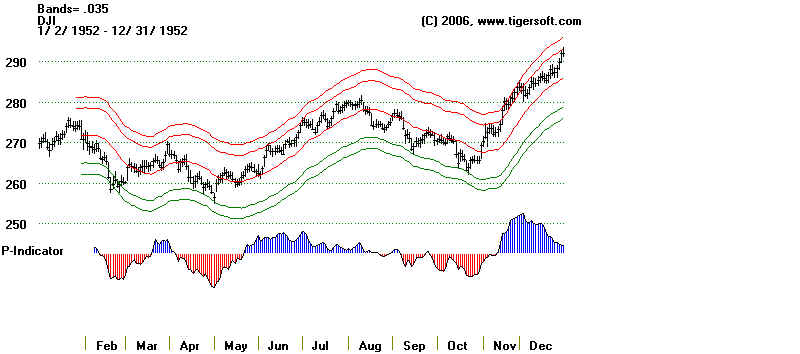

------------------------------------------- 1952

--------------------------------------------------------------------------------------

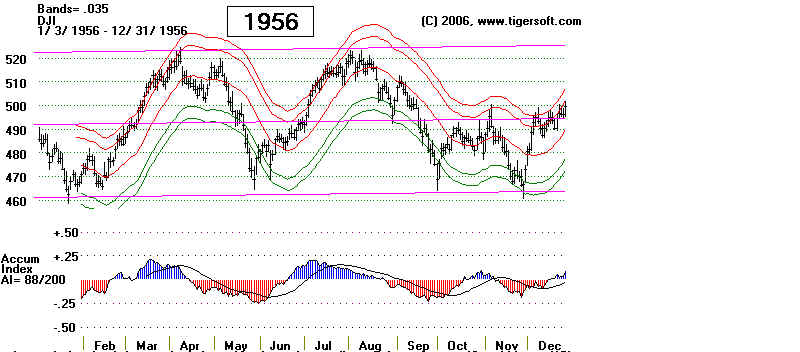

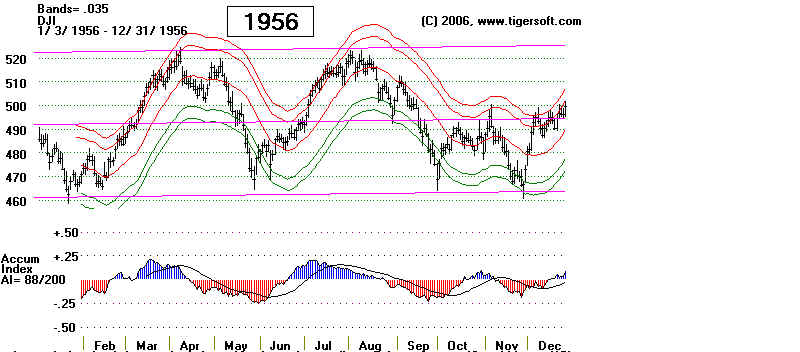

------------------------------------------- 1956

--------------------------------------------------------------------------------------

Democrat Fed raised Discount rate from 2.25% to 2.5%

on 4/13/56. This brought an immediate sell-off.

------------------------------------------- 1960

--------------------------------------------------------------------------------------

Federal Reserve lowered Discount Rate from 4/0% to

3.5% on June 10th. This brought a rally

for a month. On August 15th, they lowered rates to 3.0%.

The stock market still declined.

Richard Nixon angrily claimed that the Fed deliberately delayed cutting

rates to help a Democrat

win.

------------------------------------------- 1964

-------------------------------------------------------------------------------------

Fed raised rates on November 30th from

4.0% to 4.5%. This was too late to effect

the Presidential Election.

------------------------------------------ 1968

-------------------------------------------------------------------------------------

The Fed

raised the Discount Rate from 4.5% to 5.0% on March 15th. A month

later they raised the rates to 5.5%. On

August 16th, rates were lowered to 5.25%.

1968 was a year of wild speculation in

low-priced stocks.

------------------------------------------ 1972

-------------------------------------------------------------------------------------

In November and December 1971, under

pressure from Richard Nixon, the FED lowered

rates from 5.0% to 4.5%, despite the widespread talk by the

Nixon Administration that

prices should be stabilized.

----------------------------------------- 1976

--------------------------------------------------------------------------------------

On January 19, 1976, the Fed

lowered the Discount rate from 6.0% to 5.5%. After the

election, the rates were lowered to 5.25% on November 26.

That brought a year-end rally.

----------------------------------------- 1980

-------------------------------------------------------------------------------------

The Fed raised

rates (sabotaging Jimmy Carter's Presidential Election hopes) from 12.0%

to 13%. That was on February 15th.

The stock market immediately declined. On May 29th,

they lowered the rates from 13.0% to 12.0%.

That sent the DJI to new highs. On June 13th,

rates were lowered to 11.0% and on July 28th,

they lowered them again to 10.0%. Then rates

were taken back up by a percent on September

26th, November 17th and December 12th.

----------------------------------------- 1984

-------------------------------------------------------------------------------------

The Fed raised rates

from 8.5% to 9.0% on April 9th. That sent the market down again.

In November and December rates were

lowered in half steps to 8.0%.

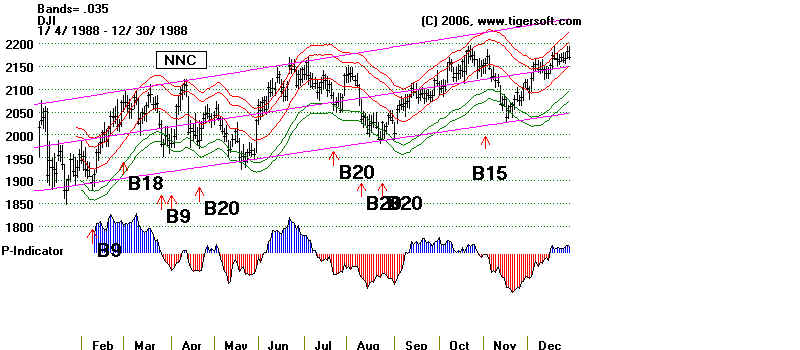

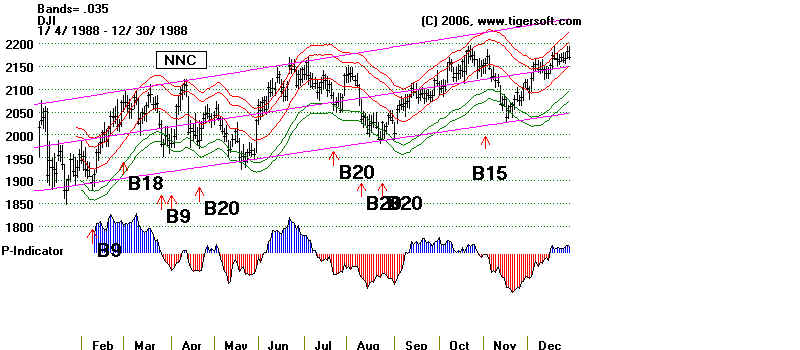

----------------------------------------- 1988

-------------------------------------------------------------------------------------

The Fed raised the Discount

Rate from 6.0% to 6.5% on September 8th, too late to

affect the Presidential Election.

----------------------------------------- 1992

-------------------------------------------------------------------------------------

On July 2nd, 1992, too late to help

the first President Bush be re-elected, the Fed lowered

rates from 3.5% to 3.0%. This may have cost him the

election.

----------------------------------------- 1996

-------------------------------------------------------------------------------------

On January 31th, the Fed

lowered the Discount Rate from 5.25% to 5.0%. By then

President Clinton had proven he was a good

friend to Greenspan and Wall Street. He had

re-appointed him and the stock market was

booming.

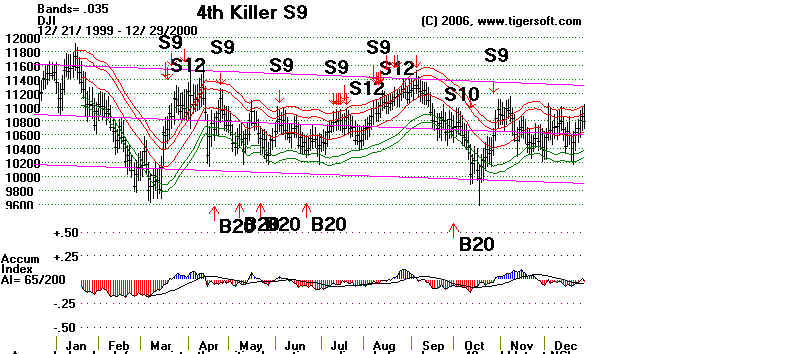

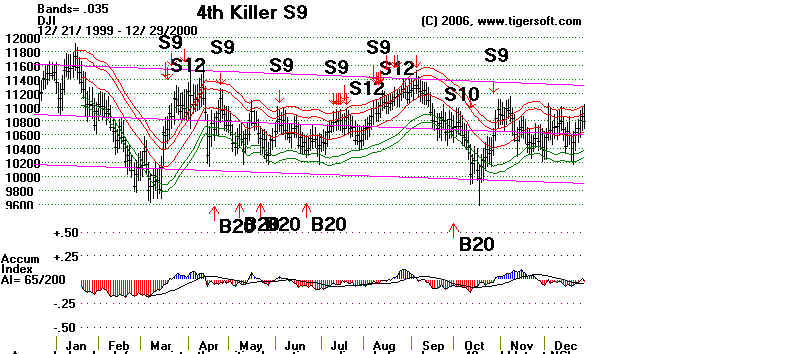

----------------------------------------- 2000

-------------------------------------------------------------------------------------

The Fed raised rates from 5.0% to 6.0% in

2000 between February 3rd and May 18th.

This was designed to cool the over-heated stock market and

probably, not incidentally,

help make the Democrats lose the Presidential Election.

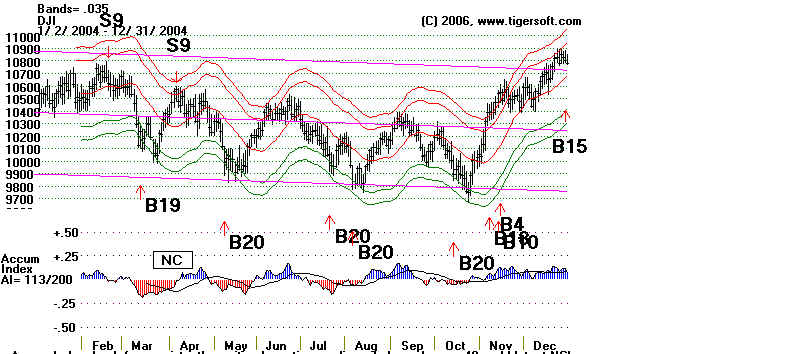

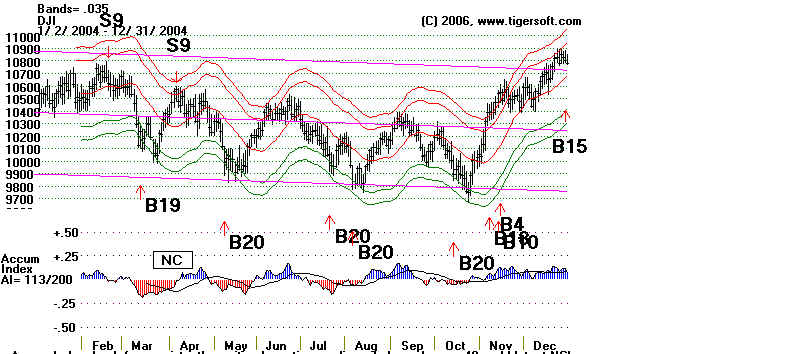

----------------------------------------- 2004

-------------------------------------------------------------------------------------

The Fed raised

rates from the low 2.0% of 2003 to 2.25% on June 39th. On August 10th

the rates were raised to 2.5%. 1/4%

raises were also instituted in September, November

and December. Notice how the rates

were not cut until late in the Presidential Election year.

"

|