|

Who Will Be Proven Right?

The

Monetarists or The Keynesians?

Part 2. (See Part 1 - http://www.tigersoft.com/Tiger-Blogs/Jan-29-2008/index.html

)

versus

versus

Ben Bernacke

John M. Keynes

Can A Severe

Recession Be Avoided?

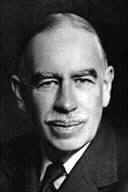

Bernacke's cuts of interest rates have been breath-taking. We see very few times in

history when

rates were cut as fast.

People forget that it was the raising of

rates by Fed Chairman Greenspan that

started the awful 2000-2003 bear

market.. He chose to fight stock market speculation in the same way the

Fed had done in 1928 and 1929,

raising interest rates rather than increasing margin requirements. When the

stock market did crash in 2001 and

2002, Greenspan dropped the Discount rates from 6.0% in small 1/2%

and 1/4% steps from 2001 until

November 7, 2002. One has to ask if he had acted more forcefully, more

quickly could the longest bear

market since the Great Depression have been shortened and ameliorated.

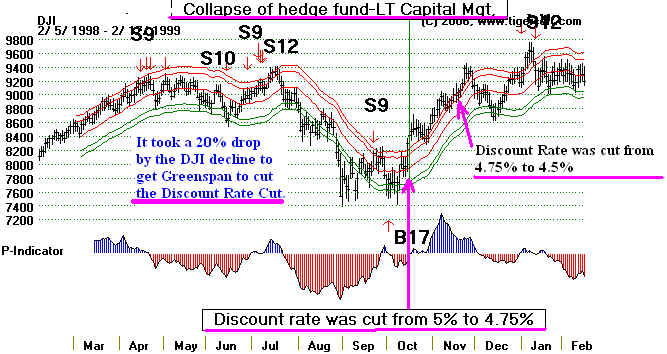

Greenspan was always cautious.

He instituted no Discount Rate cut after the 1987 Crash, though the Fed

Funds' rate was dropped.. And

he was late in reacting to the 20% decline in 1998 in the aftermath of

of the collapse of the LT-Hedge

Fund. Bernacks clearly is more aggressive than Greenspan. Bernacke's

academic interest at Princeton was

centered around the monetary mistakes of the Great Depression.

|

DID GREENSPAN CAUSE

THE CRASH OF 2001-2003?

Discount

Rate

| 11/19/98 to 08/24/99 |

4.50 |

|

| 08/25/99 to 11/17/99 |

4.75 |

|

| 11/18/99 to 02/02/00 |

5.00 |

|

| 02/03/00 to 03/20/00 |

5.25 |

|

| 03/21/00 to 05/17/00 |

5.50 |

|

| 05/18/00 to 01/03/01 |

6.00 |

|

|

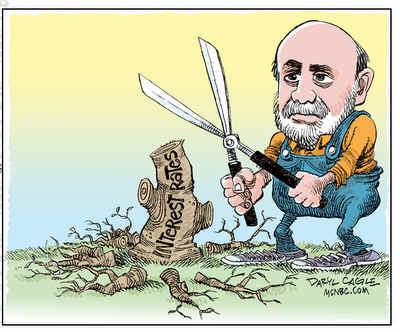

Bernacke clearly is much more aggressive than Greenspan. We

might want to study his

Essays on the Great Depression.

Essays on the Great Depression.

|

Recent

Discount Rate

Cuts

| 06/29/06 to 08/16/07 |

6.25 |

0 |

| 08/17/07 to 09/17/07 |

5.75 |

0 |

| 09/18/07 to 10/31/07 |

5.25 |

0 |

| 11/01/07 to 12/11/07 |

5.00 |

0 |

| 12/12/07 to 01/21/08 |

4.75 |

0 |

| 01/22/08 to 01/30/08 |

4.00 |

0 |

| 01/31/08 to present |

3.50 |

0 |

|

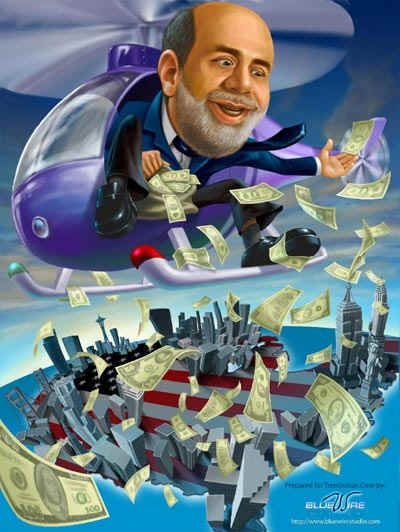

(Cartoon's source: http://politicalhumor.about.com/od/politicalcartoons/ig/Political-Cartoons/Bernanke-s-Brew.htm

)

Ben Bernacke has followed in the foot-steps of Milton Friedman in believing that business

cycles can be smoothed by timely raising and lower of interest rates. When business

conditions

weaken it is the job of the Federal Reserve to increase the supply of money in the US

economy.

Both

argue that the Great Depression was a direct result of mistaken monetary policies and that

the

inflation of the 1970s resulted because President Nixon wrongly tried to use wage and

price

controls to control inflation.

Bernacke's lecture in March 2004 makes clear his concern that the Fed be a primary agent

in the battle to avoid another great Depression. He begins by contrasting the

severity of the

Great Depression and the deepest post World War II recession. "During the major

contraction phase

of the Depression, between 1929 and 1933, real output in the United States fell nearly 30

percent.

During the same period, according to retrospective studies, the unemployment rate rose

from about

3 percent to nearly 25 percent, and many of those lucky enough to have a job were able to

work

only part-time. For comparison, between 1973 and 1975, in what was perhaps the most severe

U.S.

recession of the World War II era, real output fell 3.4 percent and the unemployment rate

rose from

about 4 percent to about 9 percent." Unlike in the 1970's, prices fell by 10%

in the 1930s. Money

supply decreased by one-third between 1929 and 1933. He praises the book by Friedman

and

Schwartz, A Monetary History of the United States, 1867-1960 (1963) for pointing out a

series of

mistakes by the Federal Reserve in the period 1929 to 1933.

1. The first mistake was the Fed's raising the Discount Rate in 1928 to curb excessive

stock

speculation. The Fed should have dealt with stock speculation differently (Raising

the margin

requirements would have been a better policy choice.) since the economy itself was slowing

down

in

1928. The Fed had lowered rates from 7.0%, starting on 5/10/21, in steps to 3.5% on

9/13/1927.

It

then raised the rates until 2/28/30, four months after the Crash. It sat on its hands

after 9/12/30,

when

the DJI was at 241.20

Date Discount Rate

DJI

9/13/27 3.5%

194.70

2/27/28 4.0%

192.10

4/25/28 4.5%

208.90

5/14/29 5.0%

320.80

9/13/29

381.20

2/8/30 4.5%

271.10

4/15/30 4.0%

293.30

9/12/30 3.5%

241.20

Fed did nothing for the next 3 1/2 years!

--------------------- DJI 1931

-----------------------------------------------------------------------------------------------------

---------------------------- DJI 1932

-----------------------------------------------------------------------------

7/28/32

41.20

2/27/33

50.20

3/16/34 3.0%

102.70

1/8/35 2.5%

105.00

5/14/35 2.0%

114.20

8/24/37 1.5%

182.40

11/23/37

115.80

9/12/39

155.90

3/28/42 1.0%

100.00

4/29/42

94.70

(Source: http://minneapolisfed.org/research/data/us/disc.cfm

)

2. In 1931 and 1932, the Fed chose to protect the Dollar against foreign exchange

speculators

by

rising interest rates, instead of doing all they could to take steps to prevent the

growing number of

bank

failures in the US. There was no Depositors' Insurance. That would have helped a lot

to stem

the

tide of runs on banks. "The Federal Reserve had the power at least to ameliorate the

problems

of

the banks. For example, the Fed could have been more aggressive in lending cash to banks

(taking

their

loans and other investments as collateral), or it could have simply put more cash in

circulation.

Either action would have made it easier for banks to obtain the cash necessary to pay off

depositors,

which

might have stopped bank runs before they resulted in bank closings and failures.

3. Many of the Fed Governors viewed the "Depression as the inevitable and necessary

purging

of

financial excesses built up during the 1920's".

4. Some Governors did not understand that "even though nominal

interest rates were very low,

the

ongoing deflation meant that the real cost of borrowing was very high because any loans

would have

to be

repaid in dollars of much greater value."

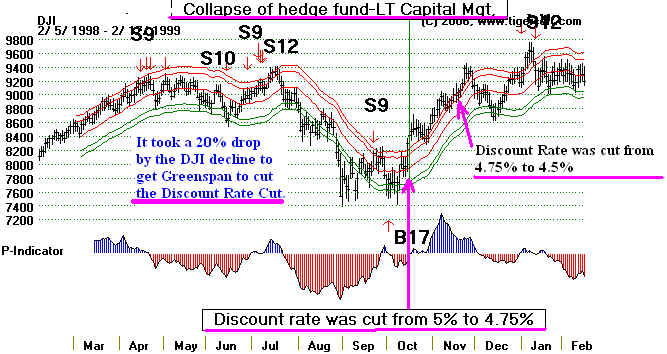

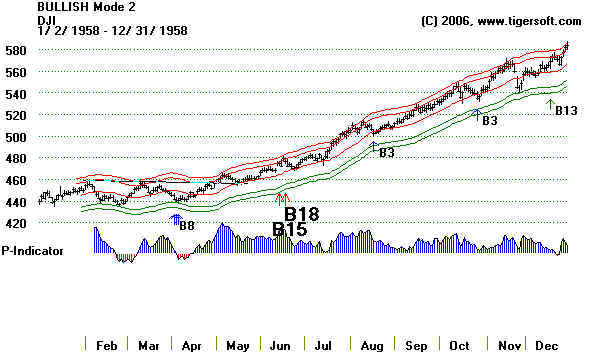

The Closest Historical Parallel to 2008 Is 1958

if We Are Considering Rapid Cuts in

Interest Rates.

This Produced A 52% Gain from Its Lows in

21 Months.

Background: The DJI had run up strongly, nearly 100%, from 255.50 on

September 1954 to

521.10 in April

1956. In 1956, a Presidential Election year, ir then went sidewise with two steep

drops in the

Presidential Election year of 1956. But from mid-July 2007, with the DJI at 520, the

market

started turning down.

On October 4th, 1957, the Soviet Union successfully launched Sputnik, the

world's first

artificial satellite. The USSR was seen as ahead of the US in the Space Race.

The US

had announced its own

plan to put up a space satellite in July 1955, but did not succeed until January

31, 1958.

---------------------------------- DJI 1957

-------------------------------------------------------------

.

.

On 11/22/57 the Discount Rate was dropped from 3.5% to 3.0% It was then

lowered

in three steps to

1.75% by 4/18/58. On 11/22/57 the DJI was at 442.70. On 4/18/58,

it was at 449.30.

It peaked on 8/3/59 at 678.10, a rise of 50.9%.

This was a 50% reduction

in the FED

DISCOUNT rate cut in 4 months.

Next

- The Limits of the FED's Power:

Criticisms of A Monetarism.....

|

versus

versus