Tiger Software - Bill's Blog

9/27/2007 -- The Fed and

The Stock Market --

Tiger Software - Bill's Blog

9/27/2007 -- The Fed and

The Stock Market -- |

Daily

Blog - Tiger Software Fed Keeps Injecting Billions into Market Despite Dollar's Weakness Stocks To Buy When Fed Inflates CARTOONS to CRY BY.. ======================================= |

|

Tiger

Software - Helping Investors since 1981 Suggestions: Peerless Stock Market Timing: 1928-1966 Track Record of Major Peerless Signals Earlier Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using TigerSoft Index Options FOREX trading Investing Longer-Term Mutual Funds Speculative Stocks Swing Trading Day Trading Stock Options Commodity Trading |

Fed Keeps Injecting Billions into

Market  STOCKS to Buy When Fed INFLATES

STOCKS to Buy When Fed INFLATES

Econ text books tell us that the Fed, from time to time, typically

buys billions of dollars worth

of

securities from major banks, pumping extra cash into the banking system, which the banks

are

obliged to

repurchase at a later date. But which they can then loan out, if they wish, so

long as

they meet

their own reserve requirements.. Supposedly, the Fed does injects money in this way

when an

economic slow-down threatens. It reverses this operations when it considers

inflation

is too

great a risk.

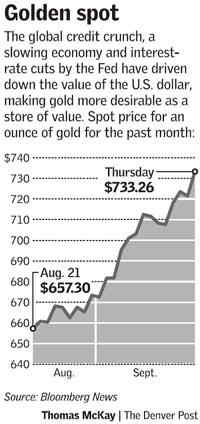

Now we have a situation when Oil is running to new highs,

foreigners are starting to sell US

Treasury

securities on balance and Gold is rising, because it is trusted more than the Dollar.

Most text

books would say these are signs of inflation. Yet

the Fed is hewing an expansionary

monetary

policy, the exact opposite of what ECON text books might suggest is a normal

course of

action. It is doing this, at great risk to those on fixed incomes, to save

bankers

and

brokerages from the consequences of their lax loan policies of the last few years. Examples

are easy to

find. Think back just two years ago when you could buy a house or a condo for NO

MONEY DOWN!

This was a shell game. It was reminiscent of the 10% margin

requirements that

produced

the 1929 Crash and the Great Depression.

Things are not what they seem. Article

I, Section 8, Clause 5, of the United States Constitution provides

that Congress

shall have the power to coin money and regulate the value thereof and of any foreign

coins.

But that is not

the case. The Federal Reserve Act of 1913 has given that power to a semi-private

corporation,

registered in the

State of Delaware - the Federal Reserve Bank. At the time of its creation, the

Federal

Reserve started

printing a new currency, Federal Reserve notes, which were backed by gold. Now it is

only "good

faith" which backs the greenbacks.

In 1936, Congress became concerned and a bill was initiated to "to abolish the

practice of creating bank

deposits by

private groups upon fractional

reserves". The Congress wanted to withdraw from the banks the

right to issue

credit on fractional reserves, and leave the banks the right to issue credit on account of

actual

deposits,

which means that permanent money will be loaned not bank manufactured money. Money could

not be

created out of

nothing. The law was not passed. It was too much an affront to entrenched

banking

interests.

It is said that JFK wanted to end the whole Federal Reserve system. Kennedy

recognized before

he was slain -

the original deal in 1913 creating the Federal Reserve Bank had a simple back-out clause.

The bank

investors loaned the United States Government $1 billion to create its charter. The

back-out clause

still exists for

the United States to buy out the system for that $1 billion. (See: http://sonic.net/sentinel/naij2.html )

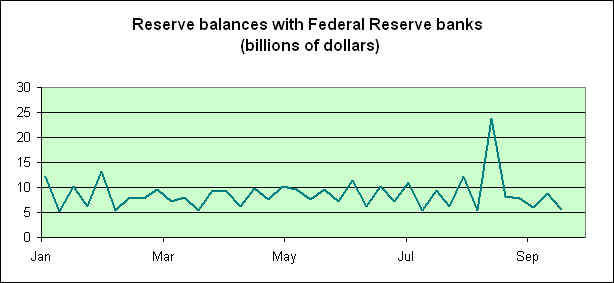

True to his word, Fed Chairman Ben

"Helicopter"<1> Bernanke has been busy printing

money

and increasing the

money supply. Beginning August 9, the Fed aggressively

used repos to add new

reserves. Until

today, the zenith of these operations was the week of August 9-15. The new

number is $38 billion!

Clearly they are worried about a run on the banks! Banks have loaned

too much money that is

not being paid back!

Since August 8th, the Fed

has injected some 200 billion dollars into the financial system. The

distressed US mortgage

market is just the tip of the ice berg, I suggest. American consumers are tapped

out. The Fed

typically tries to prevent a bear market until the next President takes office, especially

if

it he belongs to a

party other than the political party which appointed him. See my lengthy study of

the politics behinds

Fed Discount rate changes between 1955 and 2007.

http://www.tigersoft.com/Tiger-Blogs/8-18-2003/index.htm

Source: http://209.85.165.104/search?q=cache:uTxBODOOudoJ:www.econbrowser.com/archives/2007/09/money_creation.html+added+reserves+Fed&hl=en&ct=clnk&cd=6&gl=us&client=firefox-a

)

2007

September

27 - The Federal Reserve added 38 billion

dollars in temporary reserves to the US money markets

Thursday in four separate operations to ease tight credit conditions.

September

9 The Fed added $5 billion

of temporary reserves to the banking system through 2-day

repurchase agreements.

September

6 Fed injects 31.25 billion

dollars into markets. The

Federal Reserve added 31.25 billion

dollars in temporary reserves to the US money markets Thursday in three different

operations, the latest move to keep credit markets from drying up. The New York Fed

added 7.0 billion dollars in 14-day repurchase agreements, 16 billion in seven-day

repurchase agreements and 8.25 billion in one-day repos.

August 27 Federal Reserve Bends the Rules for Citibank and Bank of America

One of the central tenets of banking regulation is that banks with federally insured

deposits should never be over-exposed to brokerage subsidiaries; indeed, for decades

financial institutions were legally required to keep the two units completely separate.

"In a clear sign that the credit crunch is still affecting the nation’s largest

financial

institutions, the Federal Reserve agreed this week to bend key banking regulations

to help out Citigroup and Bank of America." The regulations in

question effectively

limit a bank’s funding exposure to an affiliate to 10% of the bank’s capital.

But the

Fed has allowed Citibank and Bank of America to blow through that level. Citigroup

and Bank of America are able to lend up to $25 billion apiece under this exemption,

according to the Fed. If Citibank used the full amount, “that represents about 30%

of Citibank’s total regulatory capital, which is no small exemption,” says

Charlie

Peabody, banks analyst at Portales Partners.

(Source: www.crooksandliars.com/2007/08/27/federal-reserve-bends-the-rules-for-citibank-and-bank-of-america/

)

August 11

"The Federal Reserve injected $38 billion into the system in three increments

Friday, its

biggest one-day infusion since September 2001. The Fed sought to reassure investors by

releasing a statement before financial markets opened, saying it would provide as much

extra money as needed to hold its benchmark overnight interest rate at about 5.25

percent"

(Source: http://www.washingtonpost.com/wp-dyn/content/article/2007/08/10/AR2007081000689.html

)

------------------------------------------------------------------------------------------------------------------------------

<1> Bernanke wrote that he would have dropped greenbacks

from an airplane in the millions in the

early 1930's,

rather than follow the tight monetary policies of the times that he blames for lengthening

and,

possibly, even

starting the Great Depression.

WHAT TO DO WHEN

FED INFLATES US DOLLAR?

Tiger makes it easy to trade this market in these circumstances. We know the Fed's

printing money debases the dollar. So we are long those vehicles and stocks that rise in an era of

a sliding dollar. International American companies like those in the DJI do well because so much

of their earnings comes from overseas. And in the DJI-30 group, we always buy the highest

Accumulation stocks. Now those are XOM and MCD. Both are at their highs. Next we

buy gold. That is at its highs. We buy oil. Oil stocks and Gold stocks are making new highs

together. Lastly we buy foreign ETFs, especially China and foreign telecomms. These groups

of stocks are the best...

http://www.denverpost.com/business/ci_6952943

OUR CURRENT BUY LIST (Charts are shown below)

EURO

http://www.tigersoft.com/Tiger-Blogs/7-12-2007/index.htm

XOM and MCD in DJI-30

http://www.tigersoft.com/Tiger-Blogs/6-15-2007/index.htm

Gold and GOLD Stocks - XAU is up 25% in last month!

http://www.tigersoft.com/Tiger-Blogs/9-19-2007/index.html

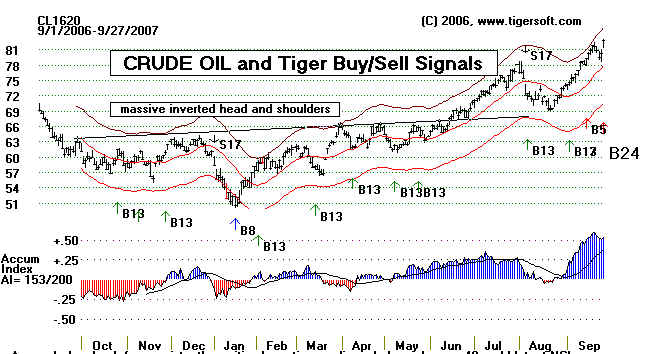

Crude Oil and strongest high Accumulation Oil Stocks

http://www.tigersoft.com/Tiger-Blogs/7-23-2007/index.htm

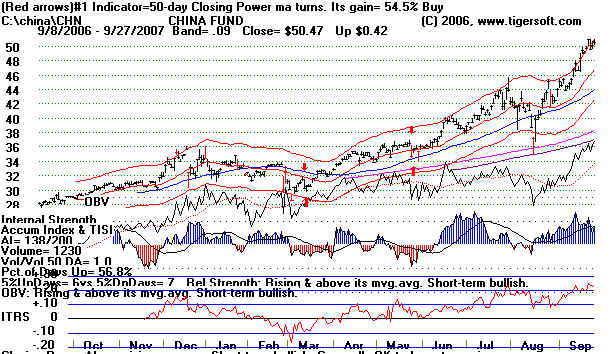

CHN (China Fund), LVS (Las Vegas Sands - Macao casino is big.)

http://tigersoft.com/--3--/Best-stock-now-from-Tiger.htm

Foreign ETFs

http://www.tigersoft.com/Tiger-Blogs/6-18-2007/index.htm

Foreign Telecomms